false

0000081955

0000081955

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): August 6, 2024

RAND

CAPITAL CORPORATION

(Exact

Name of Registrant as Specified in Its Charter)

| New

York |

|

814-00235 |

|

16-0961359 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

1405

Rand Building, Buffalo, NY 14203

(Address

of Principal Executive Offices) (Zip Code)

(716)

853-0802

(Registrant’s

Telephone Number, Including Area Code)

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.10 par value |

|

RAND |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

August 6, 2024, Rand Capital Corporation (the “Company”) issued a press release announcing its results for the second quarter

ended June 30, 2024. A copy of the release is furnished with this report as Exhibit 99.1 and is incorporated by reference into this Item

2.02.

The

information contained in this report under Item 2.02 is being furnished and shall not be deemed filed for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section.

The information contained in this report under Item 2.02 shall not be incorporated by reference into any registration statement or other

document filed pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific

reference in such filing.

Item

7.01. Regulation FD Disclosure.

The

Company has updated its earnings conference call slide presentation for the second quarter ended June 30, 2024, and will make it available

on the Company’s website at www.randcapital.com, under “Investors”. The slide presentation will be referenced during

the Company’s earnings conference call. The information found on, or otherwise accessible through, the Company’s website

is not incorporated by reference herein.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

Exhibit

Number |

|

Description

of Exhibit |

| 99.1 |

|

Press Release, dated August 6, 2024. |

| 104 |

|

Cover

Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

RAND

CAPITAL CORPORATION |

| |

|

|

| Date:

August 6, 2024 |

|

|

| |

|

|

| |

By:

|

/s/

Margaret Brechtel |

| |

Name:

|

Margaret Brechtel |

| |

Title: |

Chief Financial Officer |

Exhibit

99.1

|

NEWS

RELEASE |

| 14 Lafayette Square, Suite 1405 ● Buffalo, New York 14203 |

FOR

IMMEDIATE RELEASE

Rand

Capital Reports 18% Increase in Total Investment Income

for

Second Quarter 2024

| ● | Total

investment income increased 18% to $2.1 million for the quarter compared with the second

quarter last year driven by strong growth in interest income from an expanded portfolio of

debt investments |

| ● | Net

asset value per share (“NAV”) was $26.56 at June 30, 2024, up 11% from March

31, 2024 and up 13% from year-end 2023 |

| ● | Capitalized

on market conditions with the sale of certain BDC holdings that resulted in a realized gain

of $1.3 million |

| ● | Reduced

debt balance $2.0 million during the quarter and repaid an additional $2.3 million subsequent

to quarter-end |

| ● | Portfolio

company SciAps expected to be acquired in 2024 after definitive purchase agreement signed |

| ● | Announced

a quarterly dividend of $0.29 per share for third quarter 2024 |

BUFFALO,

NY, August 6, 2024 – Rand Capital Corporation (Nasdaq: RAND) (“Rand” or the “Company”), a business

development company providing alternative financing for lower middle market companies, announced its results for the second quarter ended

June 30, 2024.

Daniel

P. Penberthy, President and Chief Executive Officer of Rand, commented, “We are consistent and persistent in the execution of our

strategy, driving strong growth in total investment income through prudent and strategic investments in income-generating debt instruments.

During the quarter, our efforts to optimize the portfolio, including selective exits, generated capital that we advantageously deployed

to improve our balance sheet. This positions us well for future growth opportunities. Additionally, we look forward to leveraging the

capital expected from the pending sale of our portfolio investment company, SciAps, which we had previously announced and is expected

to close later this year.

“Looking

ahead, our plan is to continue scaling our business through new investments and also reinvesting in high-potential existing portfolio

companies. Our goal is to focus on new debt investments in smaller opportunities, replicating our past successes in helping these companies

grow. We believe this will cultivate a robust and steady income stream, strengthening our ability to increase cash dividends over the

long term.”

Second

Quarter Highlights (compared with the prior-year period unless otherwise noted)

| ● | Total

investment income grew $321,000, or 18%, to $2.1 million, which reflected a 35% increase

in interest from portfolio companies, partially offset by lower dividend and fee income. |

| ● | Total

expenses were $2.7 million compared with $1.3 million in last year’s second quarter.

The change largely reflects a $1.2 million increase in capital gains incentive fees to the

Company’s external investment adviser. The increase in total expenses also reflects

$393,000 in interest expense from the senior revolving credit facility compared with $259,000

for the second quarter of 2023. |

Rand Capital Reports 18% Increase in Total Investment Income for Second Quarter 2024 August 6, 2024 Page 2 of 7 |

| ● | Adjusted

expenses, which exclude capital gains incentive fees and is a non-GAAP financial measure,

were $1.0 million compared with $816,000 in the second quarter of 2023. See the attached

description of this non-GAAP financial measure and reconciliation table for adjusted expenses. |

| ● | Net

investment loss was $517,000, or $0.20 per share, compared with net investment income of

$493,000, or $0.19 per share, in the second quarter of 2023. Adjusted net investment income

per share, a non-GAAP financial measure, which excludes the capital gains incentive fee accrual

expense, was $0.44 per share, up 16% from $0.38 per share in last year’s second quarter.

See the attached description of this non-GAAP financial measure and reconciliation table

for adjusted net investment income per share. |

Portfolio

and Investment Activity

As

of June 30, 2024, Rand’s portfolio included investments with a fair value of $87.1 million across 26 portfolio

businesses. This was an increase of $9.9 million, or 13%, from December 31, 2023, and reflected new and follow-on investments and

valuation adjustments in multiple portfolio companies, partially offset by stock sales and other portfolio company loan repayments.

At June 30, 2024, Rand’s portfolio was comprised of approximately 66% in debt investments, 32% in equity investments in

private companies, and 2% in publicly traded equities of other BDCs. The annualized weighted average yield of debt investments,

which includes PIK interest, was 13.8% at June 30, 2024, compared with 13.6% at the end of 2023.

Second

quarter 2024:

| ● | Funded

a follow-on equity investment of $108,000 in Food Service Supply Holdco LLC (FSS). Rand’s

total debt and equity investment in FSS had a fair value of $7.5 million at quarter-end. |

| ● | Sold

shares in three publicly traded BDCs for total proceeds of $3.3 million, which included a

realized gain of $1.3 million. |

| ● | Received

$740,000 principal loan repayment from Pressure Pro, Inc. |

| ● | Realized

a gain of $397,000 from a partial asset sale of a Tilson affiliated company. |

| ● | At

quarter-end, Rand’s total debt and equity investment in SciAps had a fair value of

$10.8 million. |

| ● | Exited

remaining equity investment in KNOA Software. |

Liquidity

and Capital Resources

Cash

was $2.3 million at June 30, 2024. The Company also held shares valued at approximately $1.3 million in other publicly traded

BDCs, which are available for future operational and liquidity needs.

During

the quarter, Rand reduced its outstanding borrowings by $2.0 million, leaving a balance of $17.2 million on its existing

$25.0 million senior secured revolving credit facility at June 30, 2024. The outstanding borrowings carried an interest rate of 8.8%

at quarter-end. Subsequent to quarter-end, Rand repaid an additional $2.3 million on its outstanding borrowings.

The

Company did not repurchase any outstanding common stock during the second quarter of 2024.

Dividends

On

May 8, 2024, Rand declared its regular quarterly cash dividend distribution of $0.29 per share, which was paid during the second quarter

to shareholders of record as of May 31, 2024.

On

July 31, 2024, Rand declared its regular quarterly cash dividend distribution of $0.29 per share. The cash dividend will be distributed

on or about September 13, 2024, to shareholders of record as of August 30, 2024.

Rand Capital Reports 18% Increase in Total Investment Income for Second Quarter 2024 August 6, 2024 Page 3 of 7 |

Webcast

and Conference Call

Rand

will host a conference call and webcast on Tuesday August 6, 2024, at 1:30 p.m. Eastern Time, to review its financial results. The review

will be accompanied by a slide presentation, which will be available on Rand’s website at www.randcapital.com in the “Investor

Relations” section. Rand’s conference call can be accessed by calling (201) 689-8263. Alternatively, the webcast can be monitored

on Rand’s website at www.randcapital.com under “Investor Relations” where the replay will also be available.

A

telephonic replay will be available from 5:30 p.m. ET on the day of the call through Tuesday, August 20, 2024. To listen to the archived

call, dial (412) 317-6671 and enter replay pin number 13747031. A transcript of the call will also be posted once available.

ABOUT

RAND CAPITAL

Rand

Capital (Nasdaq: RAND) is an externally managed business development company (BDC). The Company’s investment objective is to maximize

total return to its shareholders with current income and capital appreciation by focusing its debt and related equity investments in

privately-held, lower middle market companies with committed and experienced managements in a broad variety of industries. Rand invests

in businesses that have sustainable, differentiated and market-proven products, revenue of more than $10 million and EBITDA in excess

of $1.5 million. The Company’s investment activities are managed by its external investment adviser, Rand Capital Management, LLC.

Additional information can be found at the Company’s website where it regularly posts information: www.randcapital.com.

Safe

Harbor Statement

This

press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than historical facts, including but not limited

to statements regarding the strategy of the Company and its outlook; statements regarding pending sale of portfolio company SciAps and

the timing for the expected closing of such transaction; statements regarding the implementation of the Company’s strategy and

the growth of its dividend; and any assumptions underlying any of the foregoing, are forward-looking statements. Forward-looking statements

concern future circumstances and results and other statements that are not historical facts and are sometimes identified by the words

“may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,”

“seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,” “believe,”

“could,” “project,” “predict,” “continue,” “target” or other similar words

or expressions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove to be incorrect,

actual results may vary materially from those indicated or anticipated by such forward-looking statements. The inclusion of such statements

should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could

cause actual results to differ materially from such plans, estimates or expectations include, among others, (1) evolving legal, regulatory

and tax regimes; (2) changes in general economic and/or industry specific conditions; and (3) other risk factors as detailed from time

to time in Rand’s reports filed with the Securities and Exchange Commission (“SEC”), including Rand’s annual

report on Form 10-K for the year ended December 31, 2023, quarterly reports on Form 10-Q, and other documents filed with the SEC. Consequently,

such forward-looking statements should be regarded as Rand’s current plans, estimates and beliefs. Except as required by applicable

law, Rand assumes no obligation to update the forward-looking information contained in this release.

Contacts:

| Company: |

|

Investors:

|

| Daniel

P. Penberthy |

|

Deborah

K. Pawlowski / Craig P. Mychajluk |

| President

and CEO |

|

Kei

Advisors LLC |

| 716.853.0802 |

|

716-843-3908

/ 716-843-3832 |

| dpenberthy@randcapital.com |

|

dpawlowski@keiadvisors.com

/ cmychajluk@keiadvisors.com |

FINANCIAL

TABLES FOLLOW

Rand Capital Reports 18% Increase in Total Investment Income for Second Quarter 2024 August 6, 2024 Page 4 of 7 |

Rand

Capital Corporation and Subsidiaries

Consolidated

Statements of Financial Position

| | |

June

30, 2024 (Unaudited) | | |

December 31, 2023 | |

| ASSETS | |

| | | |

| | |

| Investments at fair value: | |

| | | |

| | |

| Control investments (cost of $5,721,856 and $5,272,770, respectively) | |

$ | 4,598,046 | | |

$ | 4,148,960 | |

| Affiliate investments (cost of $45,250,676 and $45,720,974, respectively) | |

| 61,779,019 | | |

| 53,499,372 | |

| Non-Control/Non-Affiliate investments (cost of $22,449,599 and $17,371,862, respectively) | |

| 20,693,902 | | |

| 19,477,380 | |

| Total investments, at fair value (cost of $73,422,131 and $68,365,606, respectively) | |

| 87,070,967 | | |

| 77,125,712 | |

| Cash | |

| 2,293,226 | | |

| 3,295,321 | |

| Interest receivable | |

| 516,617 | | |

| 244,600 | |

| Prepaid income taxes | |

| 149,863 | | |

| 127,869 | |

| Deferred tax asset, net | |

| 174,053 | | |

| 39,179 | |

| Other assets | |

| 584,343 | | |

| 189,301 | |

| Total assets | |

$ | 90,789,069 | | |

$ | 81,021,982 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (NET ASSETS) | |

| | | |

| | |

| Liabilities: | |

| | | |

| | |

| Due to investment adviser | |

$ | 322,672 | | |

$ | 979,297 | |

| Accounts payable and accrued expenses | |

| 108,358 | | |

| 145,516 | |

| Line of credit | |

| 17,200,000 | | |

| 16,250,000 | |

| Capital gains incentive fees | |

| 4,033,000 | | |

| 2,279,700 | |

| Deferred revenue | |

| 566,423 | | |

| 552,256 | |

| Total liabilities | |

| 22,230,453 | | |

| 20,206,769 | |

| Stockholders’ equity (net assets): | |

| | | |

| | |

| Common stock, $0.10 par; shares authorized 100,000,000; shares issued: 2,648,916; shares outstanding: 2,581,021 at 6/30/24 and 12/31/23 | |

| 264,892 | | |

| 264,892 | |

| Capital in excess of par value | |

| 55,801,170 | | |

| 55,801,170 | |

| Treasury stock, at cost: 67,895 shares at 6/30/24 and 12/31/23 | |

| (1,566,605 | ) | |

| (1,566,605 | ) |

| Total distributable earnings | |

| 14,059,159 | | |

| 6,315,756 | |

| Total stockholders’ equity (net assets) (per share – 6/30/24: $26.56; 12/31/23: $23.56) | |

| 68,558,616 | | |

| 60,815,213 | |

| Total liabilities and stockholders’ equity (net assets) | |

$ | 90,789,069 | | |

$ | 81,021,982 | |

Rand Capital Reports 18% Increase in Total Investment Income for Second Quarter 2024 August 6, 2024 Page 5 of 7 |

Rand

Capital Corporation and Subsidiaries

Consolidated

Statements of Operations

(Unaudited)

| | |

Three months ended June 30, 2024 | | |

Three months ended June 30, 2023 | | |

Six months ended June 30, 2024 | | |

Six months ended June 30, 2023 | |

| Investment income: | |

| | | |

| | | |

| | | |

| | |

| Interest from portfolio companies: | |

| | | |

| | | |

| | | |

| | |

| Control investments | |

$ | 198,885 | | |

$ | 179,922 | | |

$ | 386,368 | | |

$ | 330,838 | |

| Affiliate investments | |

| 1,192,116 | | |

| 941,201 | | |

| 2,358,201 | | |

| 1,729,022 | |

| Non-Control/Non-Affiliate Investments | |

| 604,226 | | |

| 352,417 | | |

| 1,064,306 | | |

| 710,583 | |

| Total interest from portfolio companies | |

| 1,995,227 | | |

| 1,473,540 | | |

| 3,808,875 | | |

| 2,770,443 | |

| Interest from other investments: | |

| | | |

| | | |

| | | |

| | |

| Non-Control/Non-Affiliate Investments | |

| 144 | | |

| 104 | | |

| 2,058 | | |

| 236 | |

| Total interest from other investments | |

| 144 | | |

| 104 | | |

| 2,058 | | |

| 236 | |

| Dividend and other investment income: | |

| | | |

| | | |

| | | |

| | |

| Affiliate investments | |

| 13,125 | | |

| 59,677 | | |

| 26,250 | | |

| 406,825 | |

| Non-Control/Non-Affiliate Investments | |

| 60,050 | | |

| 132,920 | | |

| 198,760 | | |

| 260,515 | |

| Total dividend and other investment income | |

| 73,175 | | |

| 192,597 | | |

| 225,010 | | |

| 667,340 | |

| Fee income: | |

| | | |

| | | |

| | | |

| | |

| Control investments | |

| 4,516 | | |

| 4,311 | | |

| 9,032 | | |

| 8,211 | |

| Affiliate investments | |

| 54,815 | | |

| 138,902 | | |

| 128,535 | | |

| 206,744 | |

| Non-Control/Non-Affiliate Investments | |

| 8,272 | | |

| 5,978 | | |

| 29,858 | | |

| 13,956 | |

| Total fee income | |

| 67,603 | | |

| 149,191 | | |

| 167,425 | | |

| 228,911 | |

| Total investment income | |

| 2,136,149 | | |

| 1,815,432 | | |

| 4,203,368 | | |

| 3,666,930 | |

| Expenses: | |

| | | |

| | | |

| | | |

| | |

| Base management fee | |

| 322,672 | | |

| 255,867 | | |

| 625,267 | | |

| 501,260 | |

| Capital gains incentive fees | |

| 1,641,000 | | |

| 491,000 | | |

| 1,753,300 | | |

| 782,000 | |

| Interest expense | |

| 393,172 | | |

| 258,912 | | |

| 783,192 | | |

| 417,312 | |

| Professional fees | |

| 91,460 | | |

| 100,307 | | |

| 323,767 | | |

| 271,282 | |

| Stockholders and office operating | |

| 82,667 | | |

| 85,080 | | |

| 151,695 | | |

| 149,384 | |

| Directors’ fees | |

| 66,550 | | |

| 67,391 | | |

| 130,400 | | |

| 131,241 | |

| Administrative fees | |

| 40,000 | | |

| 37,250 | | |

| 78,167 | | |

| 74,500 | |

| Insurance | |

| 10,380 | | |

| 10,380 | | |

| 23,424 | | |

| 23,340 | |

| Corporate development | |

| 4,881 | | |

| 554 | | |

| 10,426 | | |

| 4,267 | |

| Total expenses | |

| 2,652,782 | | |

| 1,306,741 | | |

| 3,879,638 | | |

| 2,354,586 | |

| Net investment (loss) income before income taxes: | |

| (516,633 | ) | |

| 508,691 | | |

| 323,730 | | |

| 1,312,344 | |

| Income taxes, including excise tax expense | |

| 562 | | |

| 16,061 | | |

| 1,340 | | |

| 104,798 | |

| Net investment (loss) income | |

| (517,195 | ) | |

| 492,630 | | |

| 322,390 | | |

| 1,207,546 | |

| Net realized gain on sales and dispositions of investments: | |

| | | |

| | | |

| | | |

| | |

| Affiliate investments | |

| (831,891 | ) | |

| 2,537,765 | | |

| (831,891 | ) | |

| 2,596,094 | |

| Non-Control/Non-Affiliate Investments | |

| 1,259,999 | | |

| 1,280,482 | | |

| 4,710,091 | | |

| 1,275,541 | |

| Net realized gain on sales and dispositions of investments, before income taxes | |

| 428,108 | | |

| 3,818,247 | | |

| 3,878,200 | | |

| 3,871,635 | |

| Income tax expense | |

| — | | |

| 338,158 | | |

| — | | |

| 338,158 | |

| Net realized gain on sales and dispositions of investments | |

| 428,108 | | |

| 3,480,089 | | |

| 3,878,200 | | |

| 3,533,477 | |

| Net change in unrealized appreciation/depreciation on investments: | |

| | | |

| | | |

| | | |

| | |

| Affiliate investments | |

| 8,849,945 | | |

| (886,698 | ) | |

| 8,749,945 | | |

| (886,698 | ) |

| Non-Control/Non-Affiliate Investments | |

| (1,070,919 | ) | |

| (480,572 | ) | |

| (3,861,215 | ) | |

| 921,401 | |

| Change in unrealized appreciation/depreciation before income taxes | |

| 7,779,026 | | |

| (1,367,270 | ) | |

| 4,888,730 | | |

| 34,703 | |

| Deferred income tax benefit | |

| (47,834 | ) | |

| (66,441 | ) | |

| (47,834 | ) | |

| (66,441 | ) |

| Net change in unrealized appreciation/depreciation on investments | |

| 7,826,860 | | |

| (1,300,829 | ) | |

| 4,936,564 | | |

| 101,144 | |

| Net realized and unrealized gain on investments | |

| 8,254,968 | | |

| 2,179,260 | | |

| 8,814,764 | | |

| 3,634,621 | |

| Net increase in net assets from operations | |

$ | 7,737,773 | | |

$ | 2,671,890 | | |

$ | 9,137,154 | | |

$ | 4,842,167 | |

| Weighted average shares outstanding | |

| 2,581,021 | | |

| 2,581,021 | | |

| 2,581,021 | | |

| 2,581,021 | |

| Basic and diluted net increase in net assets from operations per share | |

$ | 3.00 | | |

$ | 1.04 | | |

$ | 3.54 | | |

$ | 1.88 | |

Rand Capital Reports 18% Increase in Total Investment Income for Second Quarter 2024 August 6, 2024 Page 6 of 7 |

Rand

Capital Corporation and Subsidiaries

Consolidated

Statements of Changes in Net Assets

(Unaudited)

| | |

Three months ended June 30, 2024 | | |

Three months ended June 30, 2023 | | |

Six months ended June 30, 2024 | | |

Six months ended June 30, 2023 | |

| Net assets at beginning of period | |

$ | 61,569,339 | | |

$ | 59,375,393 | | |

$ | 60,815,213 | | |

$ | 57,721,320 | |

| Net investment (loss) income | |

| (517,195 | ) | |

| 492,630 | | |

| 322,390 | | |

| 1,207,546 | |

| Net realized gain on sales and dispositions of investments | |

| 428,108 | | |

| 3,480,089 | | |

| 3,878,200 | | |

| 3,533,477 | |

| Net change in unrealized appreciation/depreciation on investments | |

| 7,826,860 | | |

| (1,300,829 | ) | |

| 4,936,564 | | |

| 101,144 | |

| Net increase in net assets from operations | |

| 7,737,773 | | |

| 2,671,890 | | |

| 9,137,154 | | |

| 4,842,167 | |

| Declaration of dividend | |

| (748,496 | ) | |

| (645,255 | ) | |

| (1,393,751 | ) | |

| (1,161,459 | ) |

| Net assets at end of period | |

$ | 68,558,616 | | |

$ | 61,402,028 | | |

$ | 68,558,616 | | |

$ | 61,402,028 | |

Rand Capital Reports 18% Increase in Total Investment Income for Second Quarter 2024 August 6, 2024 Page 7 of 7 |

Rand

Capital Corporation and Subsidiaries

Reconciliation

of GAAP Total Expense to Non-GAAP Adjusted Expenses

(Unaudited)

In

addition to reporting total expenses, which is a U.S. generally accepted accounting principle (“GAAP”) financial measure,

Rand presents adjusted expenses, which is a non-GAAP financial measure. Adjusted expenses is defined

as GAAP total expenses removing the effect of any expenses for capital gains incentive fees accrual. GAAP total expenses is the most

directly comparable GAAP financial measure. Rand believes that adjusted expenses provides useful information to investors regarding financial

performance because it is a method the Company uses to measure its financial and business trends related to its results of operations.

The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared

in accordance with GAAP.

| | |

Three months ended June 30, 2024 | | |

Three months ended June 30, 2023 | | |

Six months ended June 30, 2024 | | |

Six months ended June 30, 2023 | |

| | |

| | |

| | |

| | |

| |

| Total expenses | |

$ | 2,652,782 | | |

$ | 1,306,741 | | |

$ | 3,879,638 | | |

$ | 2,354,586 | |

| Exclude expenses for capital gains incentive fees | |

| 1,641,000 | | |

| 491,000 | | |

| 1,753,300 | | |

| 782,000 | |

| Adjusted total expenses | |

$ | 1,011,782 | | |

$ | 815,741 | | |

$ | 2,126,338 | | |

$ | 1,572,586 | |

Reconciliation

of GAAP Net Investment (Loss) Income per Share to

Adjusted

Net Investment Income per Share

(Unaudited)

In

addition to reporting Net Investment (Loss) Income per Share, which is a GAAP financial measure, the Company presents Adjusted

Net Investment Income per Share, which is a non-GAAP financial measure. Adjusted Net Investment Income per Share is defined as GAAP Net

Investment (Loss) Income per Share removing the effect of any expenses for capital gains incentive fees. GAAP Net Investment (Loss) Income

per Share is the most directly comparable GAAP financial measure. Rand believes that Adjusted Net Investment Income per Share provides

useful information to investors regarding financial performance because it is a method the Company uses to measure its financial and

business trends related to its results of operations. The presentation of this additional information is not meant to be considered in

isolation or as a substitute for financial results prepared in accordance with GAAP.

| | |

Three months ended June 30, 2024 | | |

Three months ended June 30, 2023 | | |

Six months ended June 30, 2024 | | |

Six months ended June 30, 2023 | |

| | |

| | |

| | |

| | |

| |

| Net investment (loss) income per share | |

$ | (0.20 | ) | |

$ | 0.19 | | |

$ | 0.12 | | |

$ | 0.47 | |

| Exclude expenses for capital gains incentive fees per share | |

| 0.64 | | |

| 0.19 | | |

| 0.68 | | |

| 0.30 | |

| Adjusted net investment income per share | |

$ | 0.44 | | |

$ | 0.38 | | |

$ | 0.80 | | |

$ | 0.77 | |

###

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

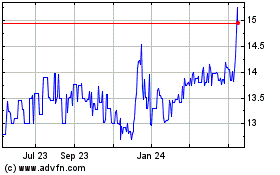

Rand Capital (NASDAQ:RAND)

Historical Stock Chart

From Nov 2024 to Dec 2024

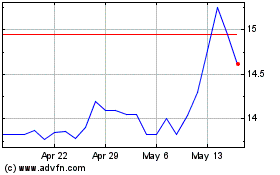

Rand Capital (NASDAQ:RAND)

Historical Stock Chart

From Dec 2023 to Dec 2024