Homes With Low Natural Disaster Risk Are Rising in Value Faster Than Homes With High Risk for the First Time in Over a Decade

21 November 2024 - 12:00AM

Business Wire

Redfin reports that this year marked the first

time since 2010 that low-risk homes across three major climate

categories—heat, fire and flood—gained value faster than high-risk

homes. That may be a sign Americans are growing more responsive to

natural disasters.

(NASDAQ: RDFN) — For the first time since 2010, homes facing low

risk from natural disasters are rising in value faster than homes

facing high risk, according to a new report from Redfin

(redfin.com), the technology-powered real estate brokerage.

- The total value of U.S. homes facing low risk of extreme

heat is up 7% year over year to $17.7 trillion. The

total value of homes facing high risk of extreme heat is up

6.3% to $29.7 trillion.

- The total value of homes facing low flood risk is up

6.7% year over year to $40.2 trillion. The total value of

homes facing high flood risk is up 6% to $7.2

trillion.

- The total value of homes facing low fire risk is up

6.6% year over year to $39 trillion. The total value of

homes facing high fire risk is up 6.4% to $8.4

trillion.

While these differences are small, they are notable because this

year marked the first time since 2010 that low-risk homes across

all three categories—heat, flood and fire—rose in value faster than

high-risk homes.

Low-risk homes across all three risk categories have been

gaining value faster than high-risk homes since February 2024. This

is the first time Redfin is reporting the trend.

“The fact that this is happening across risk types—and thus,

across the country—is some of the best evidence we have that

climate change is impacting people’s homebuying decisions,” said

Redfin Senior Economist Elijah de la Campa. “With climate

catastrophes becoming increasingly frequent and calamitous, many

people have decided they don’t want to live in risky areas. And

with insurance costs skyrocketing, many risky areas that were once

affordable have become prohibitively expensive. The reality of

climate change is setting in and it’s causing a reckoning; people

are putting disaster risk higher on their list of considerations

when looking for a home.”

Recent shifts in where Americans are choosing to live also

indicate that people may be growing more responsive to climate

risk. In California, high-fire-risk areas saw more people leave

than move in last year—a reversal from the prior year.

Additionally, a Redfin-commissioned survey conducted by Ipsos in

October found that nearly one-third of young adults say Hurricane

Helene made them reconsider where they want to live in the

future.

One reason the value of low-risk homes is rising faster than the

value of high-risk homes is that Florida and Texas—which both face

high natural disaster risk—have seen among the slowest home value

growth in the nation over the last year. In some areas, including

hurricane-prone parts of Florida, that’s likely due to natural

disaster risk itself. But it’s also because the rising cost of

other things, like insurance and property taxes, has hurt demand.

Additionally, Florida and Texas are building more homes than

anywhere else in the country, putting a lid on value growth.

While climate risk has become a top consideration for some house

hunters, that’s certainly not the case for everyone. There are

still more people moving into than out of disaster-prone America as

a whole, which is one reason home values in disaster-prone areas

continue to climb.

Home Values in High-Risk Areas Are Still Up More Than 60%

Since Before the Pandemic

The value of both high- and low-risk homes is up substantially

from before the pandemic—largely due to the 2020-2021 homebuying

frenzy—but it’s up most for high-risk homes:

- The total value of homes facing high risk of extreme

heat is up 62.5% from before the pandemic. The total

value of homes facing low risk of extreme heat is up 53.2%.

- The total value of homes facing high flood risk is up

60.3% from before the pandemic. The total value of homes

facing low risk is up 58.7%.

- The total value of homes facing high fire risk is up

67.8% from before the pandemic. The total value of

homes facing low fire risk is up 57.2%.

The value of the U.S. housing market skyrocketed during the

pandemic as fierce homebuying demand—driven by record-low mortgage

rates—caused buyers to bid up values. Some of the fiercest

competition occurred in the Sun Belt, as the region’s relatively

affordable housing attracted hordes of homebuyers from more

expensive states. But the Sun Belt is home to many places prone to

flooding, extreme heat and/or fires, including Florida, Arizona and

Texas.

Home values in disaster-prone areas continue to rise in part

because there’s still demand for homes in these areas. Some people

relocate to disaster-prone areas because many of those areas are

relatively affordable.

Home values in both risky and non-risky areas also continue to

rise because the mortgage rate lock-in effect has exacerbated

America’s shortage of homes for sale, putting upward pressure on

values.

This is based on a Redfin analysis of climate-risk scores from

First Street and Redfin Estimates for roughly 93 million U.S.

residential properties as of June 2024. Year-ago values represent

June 2023, and pre-pandemic values represent June 2019. This data

is subject to revision. Roughly 58 million U.S. homes face high

heat risk, while roughly 15 million face high fire risk and roughly

13 million face high flood risk. Please note that some homes face

more than one type of risk.

To view the full report, including charts and more details on

methodology, please visit:

https://www.redfin.com/news/home-values-climate-risk-2024/

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate

company. We help people find a place to live with brokerage,

rentals, lending, and title insurance services. We run the

country's #1 real estate brokerage site. Our customers can save

thousands in fees while working with a top agent. Our home-buying

customers see homes first with on-demand tours, and our lending and

title services help them close quickly. Our rentals business

empowers millions nationwide to find apartments and houses for

rent. Since launching in 2006, we've saved customers more than $1.6

billion in commissions. We serve approximately 100 markets across

the U.S. and Canada and employ over 4,000 people.

Redfin’s subsidiaries and affiliated brands include: Bay Equity

Home Loans®, Rent.™, Apartment Guide®, Title Forward® and

WalkScore®.

For more information or to contact a local Redfin real estate

agent, visit www.redfin.com. To learn about housing market trends

and download data, visit the Redfin Data Center. To be added to

Redfin's press release distribution list, email press@redfin.com.

To view Redfin's press center, click here.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120421442/en/

Contact Redfin Redfin Journalist Services: Isabelle Novak

press@redfin.com

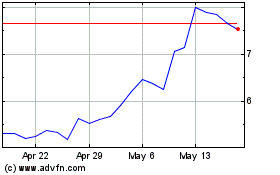

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Jan 2024 to Jan 2025