0001590877false00015908772024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 06, 2024 |

REGENXBIO Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37553 |

47-1851754 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

9804 Medical Center Drive |

|

Rockville, Maryland |

|

20850 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (240) 552-8181 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

RGNX |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 6, 2024, REGENXBIO Inc. (the “Company”) issued a press release regarding its results of operations and financial condition for the quarter ended September 30, 2024. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8‑K and is incorporated by reference herein.

The information in Item 2.02 of this Current Report on Form 8‑K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

REGENXBIO INC. |

|

|

|

|

Date: |

November 6, 2024 |

By: |

/s/ Patrick J. Christmas II |

|

|

|

Patrick J. Christmas II

Executive Vice President, Chief Legal Officer

|

REGENXBIO Reports Third Quarter 2024 Financial Results and Recent Operational Updates

•Advancement in Phase I/II AFFINITY DUCHENNE® trial of RGX-202 for Duchenne Muscular Dystrophy; pivotal trial initiation and first functional data expected this month

•BLA submission for RGX-121 initiated and expected to complete in Q1 2025

•Positive Phase II data support bilateral administration of subretinal ABBV-RGX-314; data consistent with that from multiple previous studies demonstrating favorable safety and efficacy profile

•End-of-Phase II meeting for ABBV-RGX-314 in diabetic retinopathy accelerated to Q4 2024 to support global pivotal program initiation in H1 2025

•Conference call today at 4:30 p.m. ET

ROCKVILLE, Md., Nov 6, 2024 /PRNewswire/ -- REGENXBIO Inc. (Nasdaq: RGNX) today reported financial results and recent operational highlights for the third quarter ended September 30, 2024.

“It has been a turning point year for REGENXBIO, as we are on the cusp of advancing AFFINITY DUCHENNE® to pivotal phase, completing our first BLA for MPS II and entering pivotal phase in a second indication within our global eyecare collaboration with AbbVie,” said Curran M. Simpson, President and Chief Executive Officer of REGENXBIO. “The rapid progress we are making in RGX-202, which continues to demonstrate its potential to be a best-in-class gene therapy for Duchenne, is highly encouraging, and the near-term filing of our BLA for RGX-121 represents a major milestone for the patient community in need of a treatment to address both the neurocognitive and systemic effects of MPS II. The recent fellow eye data presented at the American Academy of Ophthalmology meeting demonstrate the potential of ABBV-RGX-314 to preserve vision long-term for patients with wet AMD as a one-time treatment for both eyes. Each of these programs represent one-time treatments with the potential to transform the trajectory and management of disease for patients in need of new and better options, and we look forward to continued momentum and important milestones in the last quarter of the year.”

PROGRAM HIGHLIGHTS AND MILESTONES

Neuromuscular Disease: RGX-202 is a potential best-in-class gene therapy designed to deliver a differentiated, novel microdystrophin gene for improved function and outcomes for patients living with Duchenne.

•In the Phase I/II AFFINITY DUCHENNE trial of RGX-202, the last patient has been dosed in the dose level 2 (pivotal dose) expansion cohort for ages 4-11 and the first patient has been dosed in the cohort for ages 1-3. Patients with Duchenne under 4 years old have no access to gene therapy, and REGENXBIO is the only gene therapy sponsor recruiting patients in this age group in the U.S.

•A clinical trials application (CTA) for RGX-202 has been authorized by Health Canada. REGENXBIO expects to initiate sites in Canada in H1 2025.

•REGENXBIO plans to share a full program update this month, including pivotal trial design and plans for accelerated approval, as well as initial strength and functional assessment data for both dose levels of the AFFINITY DUCHENNE trial.

Retinal Disease: ABBV-RGX‑314, being developed in collaboration with AbbVie, is potentially the first-in-class treatment for wet age-related macular degeneration (wet AMD) and diabetic retinopathy (DR).

ABBV-RGX-314 for Treatment of DR (Suprachoroidal Delivery)

•Based on positive interim results to date from the Phase II ALTITUDE® trial, AbbVie and REGENXBIO have accelerated a planned End-of-Phase II meeting with the U.S. Food and Drug

Administration (FDA) expected this quarter. The Company expects to initiate the first global pivotal trial in H1 2025.

•The ALTITUDE trial is enrolling a new cohort of patients with center-involved diabetic macular edema (DME). DME is a vision-threatening complication of DR; an estimated 34 million people globally have DME. Patients will receive a one-time, in-office injection of ABBV-RGX-314 at dose level 4 (1.5x10e12 GC/eye) with short course prophylactic steroid eye drops.

ABBV-RGX-314 for the Treatment of Wet AMD (Subretinal Delivery)

•Enrollment is on track in the ATMOSPHERE® and ASCENT™ pivotal trials and these trials are expected to support global regulatory submissions with the FDA and European Medicines Agency in H1 2026.

•Positive data from the Phase II fellow eye sub-study evaluating the subretinal delivery of ABBV-RGX-314 in patients with bilateral wet AMD were recently presented at the American Academy of Ophthalmology annual meeting. As of September 11, 2024, ABBV-RGX-314 was well tolerated in the treated fellow eye, with no drug-related serious adverse events and no cases of intraocular inflammation observed. At nine months post-administration, patients saw a 97% reduction in anti-VEGF treatment burden and sustained vision and anatomy. These results support the potential of ABBV-RGX-314 to treat bilateral disease at an expected commercial launch.

ABBV-RGX-314 for the Treatment of Wet AMD (Suprachoroidal Delivery)

•Based on a favorable safety profile and to evaluate dose levels for a planned pivotal program, the Phase II AAVIATE® trial is enrolling a new cohort to evaluate ABBV-RGX-314 at dose level 4 (1.5x10e12 GC/eye). Patients in this cohort will also receive short course prophylactic steroid eye drops. At dose level 3, patients receiving ABBV-RGX-314 demonstrated an 80% reduction in annualized injection rate, with 50% of patients remaining injection-free at six months. Patients also demonstrated stable Best Corrected Visual Acuity and central retinal thickness.

Neurodegenerative Disease: RGX-121 is a potential first-in-class treatment for MPS II.

•REGENXBIO initiated a rolling BLA submission for RGX-121 using the accelerated approval pathway in Q3 2024. The BLA submission is expected to be complete in Q1 2025.

•RGX-121 is on track to be the potential first gene therapy and one-time treatment approved for MPS II. Approval of RGX-121 could result in receipt of a Priority Review Voucher in 2025.

FINANCIAL RESULTS

Cash Position: Cash, cash equivalents and marketable securities were $278.6 million as of September 30, 2024, compared to $314.1 million as of December 31, 2023. The decrease was primarily driven by cash used to fund operating activities during the nine months ended September 30, 2024, and was partially offset by $131.1 million of aggregate net proceeds received from the follow-on public offering of the Company’s common stock and pre-funded warrants completed in March 2024.

Revenues: Revenues were $24.2 million for the three months ended September 30, 2024, compared to $28.9 million for the three months ended September 30, 2023. The decrease was primarily attributable to Zolgensma royalty revenues, which decreased from $28.4 million for the third quarter of 2023 to $23.9 million for the third quarter of 2024.

Research and Development Expenses: Research and development expenses were $54.4 million for the three months ended September 30, 2024, compared to $58.2 million for the three months ended September 30, 2023. The decrease was largely driven by lower personnel-related costs and early-stage research and development activities, and was partially offset by increases in clinical trial expenses for ABBV-RGX-314 and RGX-202.

General and Administrative Expenses: General and administrative expenses were $19.4 million for the three months ended September 30, 2024, compared to $23.1 million for the three months ended September 30, 2023. The decrease was primarily attributable to expenses for professional services and other corporate overhead costs.

Net Loss: Net loss was $59.6 million, or $1.17 basic and diluted net loss per share, for the three months ended September 30, 2024, compared to a net loss of $61.9 million, or $1.41 basic and diluted net loss per share, for the three months ended September 30, 2023.

FINANCIAL GUIDANCE

REGENXBIO expects its balance in cash, cash equivalents and marketable securities of $278.6 million as of September 30, 2024 to fund its operations into 2026. This cash runway guidance is based on the Company’s current operational plans and excludes the impact of any material payments that may potentially be received from partners or licensees upon the achievement of development or regulatory milestones, or upon the approval or commercialization of product candidates.

CONFERENCE CALL

In connection with this announcement, REGENXBIO will host a conference call and webcast at 4:30 p.m. ET. Listeners can register for the webcast via this link. Analysts wishing to participate in the question and answer session should use this link. A replay of the webcast will be available via the company’s investor website approximately two hours after the call’s conclusion. Those who plan on participating are advised to join 15 minutes prior to the start time.

ABOUT REGENXBIO Inc.

REGENXBIO is a leading clinical-stage biotechnology company seeking to improve lives through the curative potential of gene therapy. Since its founding in 2009, REGENXBIO has pioneered the development of AAV Therapeutics, an innovative class of gene therapy medicines. REGENXBIO is advancing a pipeline of AAV Therapeutics for rare and retinal diseases, including RGX-202 for the treatment of Duchenne, ABBV-RGX-314 for the treatment of wet AMD and diabetic retinopathy, being developed in collaboration with AbbVie, and RGX-121 for the treatment of MPS II. Thousands of patients have been treated with REGENXBIO’s AAV Therapeutic platform, including Novartis’ ZOLGENSMA® for children with spinal muscular atrophy. Designed to be one-time treatments, AAV Therapeutics have the potential to change the way healthcare is delivered for millions of people. For more information, please visit www.regenxbio.com.

FORWARD-LOOKING STATEMENTS

This press release includes "forward-looking statements," within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements express a belief, expectation or intention and are generally accompanied by words that convey projected future events or outcomes such as "believe," "may," "will," "estimate," "continue," "anticipate," "assume," "design," "intend," "expect," "could," "plan," "potential," "predict," "seek," "should," "would" or by variations of such words or by similar expressions. The forward-looking statements include statements relating to, among other things, REGENXBIO's future operations, clinical trials, costs and cash flow. REGENXBIO has based these forward-looking statements on its current expectations and assumptions and analyses made by REGENXBIO in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors REGENXBIO believes are appropriate under the circumstances. However, whether actual results and developments will conform with REGENXBIO's expectations and predictions is subject to a number of risks and uncertainties, including the timing of enrollment, commencement and completion and the success of clinical trials conducted by REGENXBIO, its licensees and its partners, the timing of commencement and completion and the success of preclinical studies conducted by REGENXBIO and its development partners, the timing or likelihood of payments from AbbVie, the monetization of any priority review voucher, the timely development and launch of new products, the ability to obtain and maintain regulatory approval of product candidates, the ability to obtain and maintain intellectual property protection for product candidates and technology, trends and challenges in the business and markets in which REGENXBIO operates, the size and growth of potential markets for product candidates and the ability to serve those markets, the rate and degree of acceptance of product candidates, and other factors, many of which are beyond the control of REGENXBIO. Refer to the "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of REGENXBIO's Annual Report on Form 10-K for the year ended December 31, 2023, and comparable

"risk factors" sections of REGENXBIO's Quarterly Reports on Form 10-Q and other filings, which have been filed with the U.S. Securities and Exchange Commission (SEC) and are available on the SEC's website at WWW.SEC.GOV. All of the forward-looking statements made in this press release are expressly qualified by the cautionary statements contained or referred to herein. The actual results or developments anticipated may not be realized or, even if substantially realized, they may not have the expected consequences to or effects on REGENXBIO or its businesses or operations. Such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Readers are cautioned not to rely too heavily on the forward-looking statements contained in this press release. These forward-looking statements speak only as of the date of this press release. Except as required by law, REGENXBIO does not undertake any obligation, and specifically declines any obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Zolgensma® is a registered trademark of Novartis AG. All other trademarks referenced herein are registered trademarks of REGENXBIO.

REGENXBIO INC.

CONSOLIDATED BALANCE SHEETS

(unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

56,617 |

|

|

$ |

34,522 |

|

Marketable securities |

|

|

198,843 |

|

|

|

240,736 |

|

Accounts receivable, net |

|

|

23,604 |

|

|

|

24,790 |

|

Prepaid expenses |

|

|

11,002 |

|

|

|

14,520 |

|

Other current assets |

|

|

23,330 |

|

|

|

20,403 |

|

Total current assets |

|

|

313,396 |

|

|

|

334,971 |

|

Marketable securities |

|

|

23,108 |

|

|

|

38,871 |

|

Accounts receivable |

|

|

404 |

|

|

|

701 |

|

Property and equipment, net |

|

|

120,551 |

|

|

|

132,103 |

|

Operating lease right-of-use assets |

|

|

55,293 |

|

|

|

60,487 |

|

Restricted cash |

|

|

2,030 |

|

|

|

2,030 |

|

Other assets |

|

|

4,332 |

|

|

|

4,807 |

|

Total assets |

|

$ |

519,114 |

|

|

$ |

573,970 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

19,522 |

|

|

$ |

22,786 |

|

Accrued expenses and other current liabilities |

|

|

48,642 |

|

|

|

49,703 |

|

Deferred revenue |

|

|

144 |

|

|

|

148 |

|

Operating lease liabilities |

|

|

7,720 |

|

|

|

7,068 |

|

Liability related to sale of future royalties |

|

|

26,697 |

|

|

|

50,567 |

|

Total current liabilities |

|

|

102,725 |

|

|

|

130,272 |

|

Operating lease liabilities |

|

|

76,342 |

|

|

|

82,222 |

|

Liability related to sale of future royalties |

|

|

35,052 |

|

|

|

43,485 |

|

Other liabilities |

|

|

3,579 |

|

|

|

6,249 |

|

Total liabilities |

|

|

217,698 |

|

|

|

262,228 |

|

Stockholders’ equity |

|

|

|

|

|

|

Preferred stock; no shares issued and outstanding

at September 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

Common stock; 49,534 and 44,046 shares issued

and outstanding at September 30, 2024 and

December 31, 2023, respectively |

|

|

5 |

|

|

|

4 |

|

Additional paid-in capital |

|

|

1,182,956 |

|

|

|

1,021,214 |

|

Accumulated other comprehensive loss |

|

|

(582 |

) |

|

|

(4,429 |

) |

Accumulated deficit |

|

|

(880,963 |

) |

|

|

(705,047 |

) |

Total stockholders’ equity |

|

|

301,416 |

|

|

|

311,742 |

|

Total liabilities and stockholders’ equity |

|

$ |

519,114 |

|

|

$ |

573,970 |

|

REGENXBIO INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(unaudited)

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months |

|

|

Nine Months |

|

|

Ended September 30, |

|

|

Ended September 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

License and royalty revenue |

$ |

24,197 |

|

|

$ |

28,914 |

|

|

$ |

62,114 |

|

|

$ |

68,029 |

|

Total revenues |

|

24,197 |

|

|

|

28,914 |

|

|

|

62,114 |

|

|

|

68,029 |

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

12,387 |

|

|

|

12,388 |

|

|

|

27,249 |

|

|

|

25,975 |

|

Research and development |

|

54,429 |

|

|

|

58,183 |

|

|

|

158,142 |

|

|

|

176,585 |

|

General and administrative |

|

19,422 |

|

|

|

23,083 |

|

|

|

56,568 |

|

|

|

69,415 |

|

Impairment of long-lived assets |

|

— |

|

|

|

— |

|

|

|

2,101 |

|

|

|

— |

|

Other operating expenses |

|

37 |

|

|

|

220 |

|

|

|

32 |

|

|

|

279 |

|

Total operating expenses |

|

86,275 |

|

|

|

93,874 |

|

|

|

244,092 |

|

|

|

272,254 |

|

Loss from operations |

|

(62,078 |

) |

|

|

(64,960 |

) |

|

|

(181,978 |

) |

|

|

(204,225 |

) |

Other Income (Expense) |

|

|

|

|

|

|

|

|

|

|

|

Interest income from licensing |

|

25 |

|

|

|

56 |

|

|

|

91 |

|

|

|

166 |

|

Investment income |

|

3,276 |

|

|

|

4,660 |

|

|

|

9,213 |

|

|

|

8,953 |

|

Interest expense |

|

(820 |

) |

|

|

(1,624 |

) |

|

|

(3,242 |

) |

|

|

(5,499 |

) |

Total other income |

|

2,481 |

|

|

|

3,092 |

|

|

|

6,062 |

|

|

|

3,620 |

|

Net loss |

$ |

(59,597 |

) |

|

$ |

(61,868 |

) |

|

$ |

(175,916 |

) |

|

$ |

(200,605 |

) |

Other Comprehensive Income |

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on available-for-sale securities, net |

|

1,684 |

|

|

|

2,685 |

|

|

|

3,847 |

|

|

|

7,988 |

|

Total other comprehensive income |

|

1,684 |

|

|

|

2,685 |

|

|

|

3,847 |

|

|

|

7,988 |

|

Comprehensive loss |

$ |

(57,913 |

) |

|

$ |

(59,183 |

) |

|

$ |

(172,069 |

) |

|

$ |

(192,617 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

$ |

(1.17 |

) |

|

$ |

(1.41 |

) |

|

$ |

(3.59 |

) |

|

$ |

(4.60 |

) |

Weighted-average common shares outstanding, basic and diluted |

|

50,800 |

|

|

|

43,945 |

|

|

|

49,051 |

|

|

|

43,644 |

|

###

CONTACTS:

Dana Cormack

Corporate Communications

Dcormack@regenxbio.com

George E. MacDougall

Investor Relations

IR@regenxbio.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

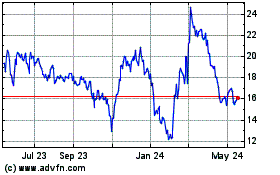

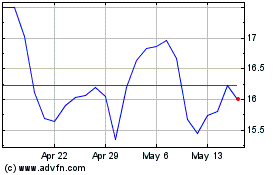

REGENXBIO (NASDAQ:RGNX)

Historical Stock Chart

From Feb 2025 to Mar 2025

REGENXBIO (NASDAQ:RGNX)

Historical Stock Chart

From Mar 2024 to Mar 2025