Form NT 10-K - Notification of inability to timely file Form 10-K 405, 10-K, 10-KSB 405, 10-KSB, 10-KT, or 10-KT405

31 December 2024 - 8:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

(Check One): ☒ Form 10-K ☐

Form 20-F ☐ Form 11-K ☐ Form 10-Q ☐ Form 10-D ☐ Form N-CEN ☐ Form N-CSR

For Period Ended: September 30, 2024

☐ Transition Report on Form 10-K

☐ Transition Report on Form 20-F

☐ Transition Report on Form 11-K

☐ Transition Report on Form 10-K

For the Transition Period Ended: _____________________________________

Read Instructions (on back page) Before Preparing

Form. Please Print or Type.

NOTHING IN THIS FORM SHALL BE CONSTRUED TO IMPLY

THAT THE COMMISSION HAS VERIFIED

ANY INFORMATION CONTAINED HEREIN.

If the notification relates to a portion of the

filing checked above, identify the Item(s) to which the notification relates:

PART I -- REGISTRANT INFORMATION

| Full Name of Registrant: |

Richtech Robotics Inc. |

| Former Name if Applicable: |

N/A |

Address of Principal Executive Office

(Street and Number): |

4175 Cameron St Ste 1 |

| City,

State and Zip Code: |

Las Vegas, NV 89103 |

PART II - RULES 12b-25(b) AND (c)

If the subject report could not be filed without

unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed (Check box

if appropriate)

| |

(a) |

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| ☒ |

(b) |

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| |

(c) |

The accountant's statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III -- NARRATIVE

State below in reasonable detail why Forms 10-K,

20-F, 11-K, 10-Q, 10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

The Registrant is unable to file its

Form 10-K for the year ended September 30, 2024 within the prescribed time period without unreasonable effort or expense because the Registrant’s

accounting staff needs additional time to prepare the financial statements for the period ended September 30, 2024 and the Registrant’s

independent registered public accounting firm will need additional time to complete its audit of such financial statements. The Registrant

anticipates that it will file its Form 10-K within the fifteen-day grace period provided by Rule 12b-25 of the Securities Exchange Act

of 1934, as amended.

PART IV -- OTHER INFORMATION

(1) Name and telephone number of person to contact

in regard to this notification:

| Zhenqiang (Michael) Huang |

|

866 |

|

236-3835 |

| (Name) |

|

(Area Code) |

|

(Telephone Number) |

(2) Have all other periodic reports required under

Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12

months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s).

☒ Yes ☐ No

(3) Is it anticipated that any significant change

in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included

in the subject report or portion thereof?

☒ Yes ☐

No

If so, attach an explanation of the anticipated

change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be

made.

We expect to report an approximately

52% decrease in revenue, to approximately $4,240 thousand for the fiscal year ended September 30, 2024 (“FY 2024”), compared

to $8,759 thousand for the fiscal year ended September 30, 2023 (“FY 2023”). This decline is primarily attributed to the company’s

strategic transition from a traditional sales model to a RaaS leasing model, with over $5 million in leasing agreements signed during

FY 2024. Gross profit is expected to decrease by 45% to approximately $2,720 thousand in FY 2024, compared to $6,015 thousand in FY 2023.

Gross margin is expected to decline to approximately 64% in FY 2024, down from 69% in FY 2023.

Total operating expenses are expected

to increase to approximately $9,793 thousand in FY 2024, compared to $5,726 thousand in FY 2023. Our net loss is projected to increase

significantly to approximately $8,140 thousand, compared to $339 thousand in FY 2023. This expected increase in net loss is primarily

driven by higher professional service fees associated with financing activities and compliance costs as a public company.

The foregoing financial information

is unaudited, and may be subject to change, and actual results may vary when reported on the Company’s Form 10-K.

| |

Richtech Robotics Inc. |

|

| |

(Name of Registrant as Specified in Charter) |

|

has caused this notification to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date: December 30, 2024 |

By: |

/s/ Zhenqiang Huang |

| |

|

Zhenqiang Huang |

| |

|

Chief Financial Officer |

3

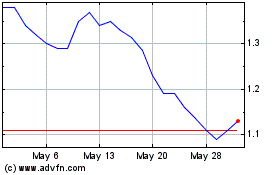

Richtech Robotics (NASDAQ:RR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Richtech Robotics (NASDAQ:RR)

Historical Stock Chart

From Jan 2024 to Jan 2025