false000082441000008244102024-01-232024-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2024

SANDY SPRING BANCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | 000-19065 | 52-1532952 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

17801 Georgia Avenue, Olney, Maryland 20832

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (301) 774-6400

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

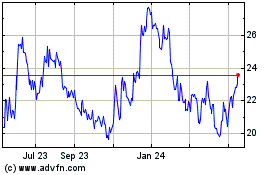

| Common Stock, par value $1.00 per share | SASR | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On January 23, 2024, Sandy Spring Bancorp, Inc. (the “Company”) issued a news release announcing its results of operations and financial condition for the quarter ended December 31, 2023. A copy of the news release is included as Exhibit 99.1 to this report.

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

The Company is providing supplemental information regarding its quarterly results and related matters. A copy of the supplemental information is included as Exhibit 99.2 to this report and will be posted on the Company’s website at www.sandyspringbank.com. The supplemental information is being furnished pursuant to Item 7.01 and, in accordance with General Instruction B.2 of Form 8-K, the information contained therein shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities under that Section. Furthermore, the information contained in Exhibit 99.2 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

| | | | | |

| Exhibits. |

| |

| Exhibit No. | Description |

| |

| Press release dated January 23, 2024 |

| |

| Supplemental Information dated January 23, 2024 |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SANDY SPRING BANCORP, INC. |

| | (Registrant) |

| |

Date: January 23, 2024 | By: | /s/ Daniel J. Schrider |

| | | Daniel J. Schrider |

| | | President and Chief Executive Officer |

FOR IMMEDIATE RELEASE

SANDY SPRING BANCORP REPORTS FOURTH QUARTER EARNINGS OF $26.1 MILLION

OLNEY, MARYLAND, January 23, 2024 — Sandy Spring Bancorp, Inc. (Nasdaq-SASR), the parent company of Sandy Spring Bank, reported net income of $26.1 million ($0.58 per diluted common share) for the quarter ended December 31, 2023, compared to net income of $20.7 million ($0.46 per diluted common share) for the third quarter of 2023 and $34.0 million ($0.76 per diluted common share) for the fourth quarter of 2022. The increase in the current quarter's net income compared to the linked quarter was a product of a lower provision for credit losses coupled with lower non-interest expense, partially offset by lower net interest income and non-interest income.

Current quarter's core earnings were $27.1 million ($0.60 per diluted common share), compared to $27.8 million ($0.62 per diluted common share) for the quarter ended September 30, 2023 and $35.3 million ($0.79 per diluted common share) for the quarter ended December 31, 2022. Core earnings exclude the after-tax impact of amortization of intangibles, investment securities gains or losses and other non-recurring or extraordinary items. The current quarter’s core earnings were positively affected by a lower provision for credit losses, which was offset by lower revenues and an increase in non-interest expense, after excluding the pension settlement expense from the prior quarter.

“Over the past year, we successfully grew core funding, improved liquidity and expanded our client base," said Daniel J. Schrider, Chairman, President and CEO of Sandy Spring Bank. "We also launched improved digital banking and online account opening platforms that give our clients more control in how they bank with us."

“While it was a challenging year given the rate environment and economic uncertainty, we are focused on building on this positive momentum in 2024 and continuing to stay close to our clients,” Schrider added.

Fourth Quarter Highlights

•Total assets at December 31, 2023 decreased by 1% to $14.0 billion compared to $14.1 billion at September 30, 2023.

•Total loans increased by $66.7 million or 1% to $11.4 billion at December 31, 2023 compared to $11.3 billion at September 30, 2023. During the current quarter, the Company reduced its concentration in the investor commercial real estate segment by $33.3 million, while AD&C and commercial business loans and lines increased $50.3 million and $50.2 million, respectively. The total mortgage loan portfolio remained relatively unchanged during this period.

•Deposits decreased $154.5 million or 1% to $11.0 billion at December 31, 2023 compared to $11.2 billion at September 30, 2023, as noninterest-bearing and interest-bearing deposits declined $99.7 million and $54.7 million, respectively. Decline within noninterest-bearing deposit categories was driven by lower balances in small business and title company commercial checking accounts. The decrease in interest-bearing deposits was due to a $253.1 million reduction in brokered time deposits, as the Company continued to reduce its reliance on wholesale funding sources, in addition to the $111.9 million decrease in money market accounts. These declines were partially offset by the $265.9 million growth in savings accounts.

•The ratio of non-performing loans to total loans was 0.81% at December 31, 2023 compared to 0.46% at September 30, 2023 and 0.35% at December 31, 2022. The current quarter's increase in non-performing loans was related to two large investor commercial real estate relationships within the custodial care and multifamily residential property industries. Net charge-off activity during the current quarter was insignificant.

•Total borrowings were unchanged across all categories at December 31, 2023 compared to the previous quarter.

•Net interest income for the fourth quarter of 2023 declined $3.4 million or 4% compared to the previous quarter and $24.9 million or 23% compared to the fourth quarter of 2022. During the recent quarter, the $3.2 million growth in interest income was more than offset by the $6.6 million increase in interest expense, a result of the competitive rates offered on deposits.

•The net interest margin was 2.45% for the fourth quarter of 2023 compared to 2.55% for the third quarter of 2023 and 3.26% for the fourth quarter of 2022. This decline in the net interest margin was the result of higher rates paid on interest-bearing liabilities, driven by higher market rates, competition for deposits, and customers' movement of excess funds out of noninterest-bearing into interest-bearing accounts, which outpaced the increase in the yield on interest-earning assets. Compared to the linked quarter, the rate paid on interest-bearing liabilities rose 25 basis points, while the yield on interest-earning assets increased 9 basis points, resulting in the quarterly margin compression of 10 basis points.

•Provision for credit losses directly attributable to the funded loan portfolio for the current quarter was a credit of $2.6 million compared to a charge of $3.2 million in the previous quarter and $7.9 million in the prior year quarter. The reduction in the provision during the current quarter was attributable to a change in the composition of the loan portfolio, a decline in the probability of an economic recession and updates to other qualitative adjustments used within the reserve calculation. These factors were partially offset by an individual reserve established on an investor commercial real estate loan designated as non-accrual during the current quarter coupled with a slight deterioration in other relevant economic factors in the most recent economic forecast. In addition, during the current quarter the Company reduced its reserve for unfunded commitments by $0.9 million, a result of higher utilization rates on lines of credit.

•Non-interest income for the fourth quarter of 2023 decreased by 5% or $0.8 million compared to the linked quarter and grew by 16% or $2.3 million compared to the prior year quarter. The quarter-over-quarter decrease was mainly driven by lower income from mortgage banking activities, due to lower sales volume, partially offset by greater BOLI income.

•Non-interest expense for the fourth quarter of 2023 decreased $5.3 million or 7% compared to the third quarter of 2023 and $2.8 million or 4% compared to the prior year quarter. The previous quarter included an $8.2 million in pension settlement expense related to the termination of the Company's pension plan. Excluding this item from the previous quarter, total non-interest expense increased by $2.8 million or 4% due to higher professional and consulting fees, marketing expense and other operating expenses.

•Return on average assets (“ROA”) for the quarter ended December 31, 2023 was 0.73% and return on average tangible common equity (“ROTCE”) was 9.26% compared to 0.58% and 7.42%, respectively, for the third quarter of 2023 and 0.98% and 12.91%, respectively, for the fourth quarter of 2022. On a non-GAAP basis, the current quarter's core ROA was 0.76% and core ROTCE was 9.26% compared to 0.78% and 9.51%, respectively, for the previous quarter and 1.02% and 13.02%, respectively, for the fourth quarter of 2022.

•The GAAP efficiency ratio was 68.33% for the fourth quarter of 2023, compared to 70.72% for the third quarter of 2023 and 53.23% for the fourth quarter of 2022. The non-GAAP efficiency ratio was 66.16% for the fourth quarter of 2023 compared to 60.91% for the third quarter of 2023 and 51.46% for the prior year quarter. The increase in non-GAAP efficiency ratio (reflecting a decrease in efficiency) in the current quarter compared to the previous quarter and the fourth quarter of the prior year was the result of declines in net revenue from the prior periods coupled with the growth in non-interest expense.

Balance Sheet and Credit Quality

Total assets were $14.0 billion at December 31, 2023, as compared to $14.1 billion at September 30, 2023. At December 31, 2023 total loans increased by $66.7 million or 1% to $11.4 billion compared to $11.3 billion at September 30, 2023. Commercial real estate and business loans increased $62.0 million quarter-over-quarter due to the $50.3 million and $50.2 million growth in the AD&C and commercial business loan and lines portfolios, respectively, partially offset by a $33.3 million decline in the investor commercial real estate loan portfolio. Quarter-over-quarter the total mortgage loan portfolio remained relatively unchanged.

Deposits decreased $154.5 million or 1% to $11.0 billion at December 31, 2023 compared to $11.2 billion at September 30, 2023. During this period noninterest-bearing and interest-bearing deposits declined $99.7 million and $54.7 million, respectively. The decline within noninterest-bearing deposit categories was primarily driven by $64.7 million and $54.4 million decrease in small business and title company commercial checking accounts, respectively. The decrease in interest-bearing deposits was due to a $253.1 million reduction in brokered time deposits, as the Company continued to reduce its reliance on wholesale funding sources during the current quarter, in addition to the $111.9 million decrease in money market accounts. These declines were partially offset by $265.9 million growth in savings accounts. Total deposits, excluding brokered deposits, increased by $85.5 million or 1% quarter-over-quarter and represented 92% of the total deposits as of December 31, 2023 compared to 90% at September 30,

2023, reflecting continued stability of the core deposit base. Due to the deposit decline experienced during the current quarter the loan to deposit ratio increased to 103% at December 31, 2023 from 101% at September 30, 2023. Total uninsured deposits at December 31, 2023 were approximately 34% of the total deposits.

At December 31, 2023, contingent liquidity, which consists of available FHLB borrowings, fed funds, funds through the Federal Reserve Bank's discount window and the Bank Term Funding Program, as well as excess cash and unpledged investment securities totaled $6.0 billion or 162% of uninsured deposits.

The tangible common equity ratio increased to 8.77% of tangible assets at December 31, 2023, compared to 8.42% at September 30, 2023. This increase reflected the impact of higher tangible common equity, a product of $10.8 million increase in net retained earnings and a $38.2 million decrease in unrealized losses on available-for-sale investment securities during the current quarter, while tangible assets decreased by $119.2 million.

At December 31, 2023, the Company had a total risk-based capital ratio of 14.92%, a common equity tier 1 risk-based capital ratio of 10.90%, a tier 1 risk-based capital ratio of 10.90%, and a tier 1 leverage ratio of 9.51%. All of these ratios remain well in excess of the mandated minimum regulatory requirements.

Non-performing loans include non-accrual loans and accruing loans 90 days or more past due. At December 31, 2023, non-performing loans totaled $91.8 million, compared to $51.8 million at September 30, 2023 and $39.4 million at December 31, 2022. Non-performing loans to total loans was 0.81% compared to 0.46%. These levels of non-performing loans compare to 0.35% at December 31, 2022. The current quarter's increase in non-performing loans was related to two large investor commercial real estate relationships within the custodial care and multifamily residential property industries. These two relationships accounted for $42.4 million of the total $47.9 million of loans placed on non-accrual during the quarter. Only the custodial care relationship required an individual reserve during the current quarter. An individual reserve was recorded earlier in the year on the multifamily residential property relationship. Total net recoveries for the current quarter amounted to $0.1 million compared to net charge-offs of $0.1 million for the third quarter of 2023 and $0.1 million of net recoveries for the fourth quarter of 2022.

At December 31, 2023, the allowance for credit losses was $120.9 million or 1.06% of outstanding loans and 132% of non-performing loans, compared to $123.4 million or 1.09% of outstanding loans and 238% of non-performing loans at the end of the previous quarter and $136.2 million or 1.20% of outstanding loans and 346% of non-performing loans at the end of the fourth quarter of 2022. The decrease in the allowance for the current quarter compared to the previous quarter mainly reflects a change in the composition of the loan portfolio, a decline in the probability of an economic recession and updates to other qualitative adjustments, partially offset by an individual reserve established on the previously discussed investor commercial real estate loan designated as non-accrual during the current quarter coupled with a slight deterioration in other relevant economic factors in the most recent economic forecast.

Income Statement Review

Quarterly Results

Net income was $26.1 million ($0.58 per diluted common share) for the three months ended December 31, 2023 compared to $20.7 million ($0.46 per diluted common share) for the three months ended September 30, 2023 and $34.0 million ($0.76 per diluted common share) for the prior year quarter. The current quarter's core earnings were $27.1 million ($0.60 per diluted common share), compared to $27.8 million ($0.62 per diluted common share) for the previous quarter and $35.3 million ($0.79 per diluted common share) for the quarter ended December 31, 2022. The increase in the current quarter's net income compared to the previous quarter, which included a one-time pension settlement expense of $8.2 million, was a result of lower provision for credit losses partially offset by declines in both net interest income and non-interest income.

Net interest income for the fourth quarter of 2023 decreased $3.4 million or 4% compared to the previous quarter and $24.9 million or 23% compared to the fourth quarter of 2022. Both quarterly and year-over-year decreases in net interest income were driven by higher interest expense, a result of higher funding costs, which outpaced growth in interest income. The rising interest rate environment was primarily responsible for a $20.3 million year-over-year increase in interest income. This growth in interest income was more than offset by the $45.3 million year-over-year growth in interest expense as funding costs have also risen in response to the rising rate environment and significant competition for deposits. Interest income growth occurred in all categories of commercial loans and, to a lesser degree, in residential mortgage loans, and consumer loans.

The net interest margin was 2.45% for the fourth quarter of 2023 compared to 2.55% for the third quarter of 2023 and 3.26% for the fourth quarter of 2022. The contraction of the net interest margin for the current quarter reflects the higher rate paid on interest-bearing liabilities, which outpaced the increase in the yield on interest-earning assets. The overall rate and yield increases

were driven by the multiple federal funds rate increases that occurred over the preceding twelve months, competition for deposits in the market, and customer movement of excess funds out of noninterest-bearing accounts into higher yielding products. As compared to the prior year quarter, the yield on interest-earning assets increased 49 basis points while the rate paid on interest-bearing liabilities rose 169 basis points, resulting in net interest margin compression of 81 basis points.

The total provision for credit losses was a credit of $3.4 million for the fourth quarter of 2023 compared to a charge of $2.4 million for the previous quarter and $10.8 million for the fourth quarter of 2022. The provision for credit losses directly attributable to the funded loan portfolio was a credit of $2.6 million for the current quarter compared to a charge of $3.2 million for the third quarter of 2023 and the prior year quarter’s provision of $7.9 million. The current quarter's provision is mainly a reflection of change in the composition of the loan portfolio, a decline in the probability of an economic recession and updates to other qualitative adjustments, partially offset by an increase in individual reserves driven by one large investor commercial real estate relationship along with a slight deterioration in other relevant economic factors.

Non-interest income for the fourth quarter of 2023 decreased by 5% or $0.8 million compared to the linked quarter and grew by 16% or $2.3 million compared to the prior year quarter. The current quarter's decrease in non-interest income as compared to the previous quarter was mainly driven by lower income from mortgage banking activities, due to lower sales volume, partially offset by an increase in BOLI income.

Non-interest expense for the fourth quarter of 2023 decreased $5.3 million or 7% compared to the third quarter of 2023 and increased $2.8 million or 4% compared to the fourth quarter of 2022. The previous quarter included $8.2 million of pension settlement expense related to the termination of the Company's pension plan. Excluding this item from the previous quarter, total non-interest expense increased by $2.8 million or 4% driven by a cumulative effect of higher professional and consulting fees, marketing expense and other operating expenses, partially offset by lower salaries and employee benefits.

For the fourth quarter of 2023, the GAAP efficiency ratio was 68.33% compared to 70.72% for the third quarter of 2023 and 53.23% for the fourth quarter of 2022. The GAAP efficiency ratio rose from the prior year quarter primarily as a result of the 19% decrease in GAAP revenue in combination with the 4% increase in GAAP non-interest expense. The non-GAAP efficiency ratio was 66.16% for the current quarter as compared to 60.91% for the third quarter of 2023 and 51.46% for the fourth quarter of 2022. The increase in the non-GAAP efficiency ratio (reflecting a decrease in efficiency) from the fourth quarter of the prior year to the current year quarter was primarily the result of the 19% decline in non-GAAP revenue, while non-GAAP expenses increased 4%.

ROA for the quarter ended December 31, 2023 was 0.73% and ROTCE was 9.26% compared to 0.58% and 7.42%, respectively, for the third quarter of 2023 and 0.98% and 12.91%, respectively, for the fourth quarter of 2022. On a non-GAAP basis, the current quarter's core ROA was 0.76% and core ROTCE was 9.26% compared to 0.78% and 9.51% for the third quarter of 2023 and 1.02% and 13.02%, respectively, for the fourth quarter of 2022.

Year-to-Date Results

The Company recorded net income of $122.8 million for the year ended December 31, 2023 compared to net income of $166.3 million for the same period in the prior year. Core earnings were $134.3 million for the year ended December 31, 2023 compared to $160.3 million for the same period in the prior year. Year-to-date net income declined as a result of the gain recognized on the sale of the Company's insurance segment during the prior year in combination with the decrease in net interest income and higher non-interest expense, partially offset by lower provision for credit losses.

For the year ended December 31, 2023, net interest income decreased $72.5 million compared to the prior year as a result of the $214.3 million increase in interest expense, partially offset by the $141.9 million increase in interest income. The increase in interest expense was driven by the interest expense on deposits, primarily associated with money market and time deposit accounts and, to a lesser degree, FHLB and Federal Reserve Bank borrowings. The net interest margin declined to 2.67% for the year ended December 31, 2023, compared to 3.44% for the prior year, primarily as a result of higher funding costs due to the rising interest rate environment and market competition for deposits during the period.

The provision for credit losses for the year ended December 31, 2023 amounted to a credit of $17.6 million as compared to a charge of $34.4 million for 2022. The credit to the provision for the year ended December 31, 2023 was a reflection of the improving regional forecasted unemployment rate, observed during the first half of the current year, and the declining probability of economic recession, partially offset by higher individual reserves on our non-accrual loans during the year.

For the year ended December 31, 2023, non-interest income decreased 23% to $67.1 million compared to $87.0 million for 2022. During the prior year, the Company realized a $16.5 million gain on the sale of its insurance segment. Excluding the gain, non-interest income decreased 5% or $3.4 million, driven by a $2.9 million decrease in insurance commissions, a $2.6 million

decrease in bank card fees and a $0.6 million decrease in income from mortgage banking activities. Insurance commission income declined due to the disposition of the Company's insurance business during the second quarter of the prior year. Fees from bank cards declined as a result of regulatory restrictions on transaction fees effective in the second half of the prior year. The decline in income from mortgage banking activities is the result of the rising interest rate environment, which continues to dampen home sales and refinancing activity. These decreases in non-interest income year-over-year were partially offset by a $1.1 million increase in BOLI mortality-related income and the $0.9 million increase in wealth management income.

Non-interest expense increased 7% to $275.1 million for the year ended December 31, 2023, compared to $257.3 million for 2022. Current year expense included pension settlement expense of $8.2 million and severance expense of $1.9 million, while the prior year included contingent earn-out expense associated with the 2020 acquisition of Rembert Pendleton Jackson of $1.2 million and merger, acquisition and disposal expense of $1.1 million. Excluding these items, non-interest expense increased by $10.0 million or 4% in the current year over the prior year. The drivers of the increase in non-interest expense were a $8.8 million increase in professional fees, a $4.7 million increase in FDIC expense, and a $1.7 million increase in software amortization expense. Excluding the pension settlement expense, total salaries and benefits expense declined by $6.5 million from the prior year period, predominantly due to a reduction in performance-based compensation. Year-over-year increases in both professional fees and software amortization expense were mainly associated with the Company's investments in technology and software projects. The increase in FDIC insurance expense was a result of an increase in the assessment rate for all banks that became effective in 2023.

For the year ended December 31, 2023, the GAAP efficiency ratio was 65.24% compared to 50.05% for the same period in 2022. The non-GAAP efficiency ratio for the current year was 60.99% compared to the 49.66% for the prior year. The growth in the current year’s GAAP and non-GAAP efficiency ratios compared to the prior year, indicating a decline in efficiency, was the result of the declines in GAAP and non-GAAP revenues combined with the growth in GAAP and non-GAAP non-interest expenses.

Explanation of Non-GAAP Financial Measures

This news release contains financial information and performance measures determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). The Company’s management believes that the supplemental non-GAAP information provides a better comparison of period-to-period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. Non-GAAP measures used in this release consist of the following:

•Tangible common equity and related measures are non-GAAP measures that exclude the impact of goodwill and other intangible assets.

•The non-GAAP efficiency ratio excludes amortization of intangible assets, investment securities gains/(losses), merger, acquisition and disposal expense, gain on disposal of assets, pension settlement expense, severance expense and contingent payment expense, and includes tax-equivalent income.

•Core earnings and the related measures of core earnings per diluted common share, core return on average assets and core return on average tangible common equity reflect net income exclusive of amortization of intangible assets, pension settlement expense, investment securities gains/(losses) and other non-recurring or extraordinary items, on a net of tax basis.

•Pre-tax pre-provision net income excludes income tax expense and the provision (credit) for credit losses.

These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Please refer to the non-GAAP Reconciliation tables included with this release for a reconciliation of these non-GAAP measures to the most directly comparable GAAP measure.

Conference Call

The Company’s management will host a conference call to discuss its fourth quarter results today at 2:00 p.m. (ET). A live Webcast of the conference call is available through the Investor Relations section of the Sandy Spring Website at www.sandyspringbank.com. Participants may call 1-833-470-1428. Please use the following access code: 125369. Visitors to the Website are advised to log on 10 minutes ahead of the scheduled start of the call. An internet-based replay will be available on the website until February 6, 2024. A replay of the teleconference will be available through the same time period by calling 1-866-813-9403 under conference call number 801362.

About Sandy Spring Bancorp, Inc.

Sandy Spring Bancorp, Inc., headquartered in Olney, Maryland, is the holding company for Sandy Spring Bank, a premier community bank in the Greater Washington, D.C. region. With over 50 locations, the bank offers a broad range of commercial and retail banking, mortgage, private banking, and trust services throughout Maryland, Virginia, and Washington, D.C. Through its subsidiaries, Rembert Pendleton Jackson and West Financial Services, Inc., Sandy Spring Bank also offers a comprehensive menu of wealth management services.

Category: Webcast

Source: Sandy Spring Bancorp, Inc.

Code: SASR-E

For additional information or questions, please contact:

Daniel J. Schrider, Chair, President & Chief Executive Officer, or

Philip J. Mantua, E.V.P. & Chief Financial Officer

Sandy Spring Bancorp

17801 Georgia Avenue

Olney, Maryland 20832

1-800-399-5919

Email: DSchrider@sandyspringbank.com

PMantua@sandyspringbank.com

Website: www.sandyspringbank.com

Media Contact:

Jen Schell, Senior Vice President

301-570-8331

jschell@sandyspringbank.com

Forward-Looking Statements

Sandy Spring Bancorp’s forward-looking statements are subject to significant risks and uncertainties that may cause actual results to differ materially from those in such statements. These risks and uncertainties include, but are not limited to, the risks identified in our quarterly and annual reports and the following: changes in general business and economic conditions nationally or in the markets that we serve; changes in consumer and business confidence, investor sentiment, or consumer spending or savings behavior; changes in the level of inflation; changes in the demand for loans, deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected; the impact of the interest rate environment on our business, financial condition and results of operations; the impact of compliance with changes in laws, regulations and regulatory interpretations, including changes in income taxes; changes in credit ratings assigned to us or our subsidiaries; the ability to realize benefits and cost savings from, and limit any unexpected liabilities associated with, any business combinations; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the impact of changes in accounting policies, including the introduction of new accounting standards; the impact of judicial or regulatory proceedings; the impact of fiscal and governmental policies of the United States federal government; the impact of health emergencies, epidemics or pandemics; the effects of climate change; and the impact of natural disasters, extreme weather events, military conflict, terrorism or other geopolitical events. Sandy Spring Bancorp provides greater detail regarding some of these factors in its Form 10-K for the year ended December 31, 2022 and its Form 10-Q for the quarter ended September 30, 2023, including in the Risk Factors section of those reports, and in its other SEC reports. Sandy Spring Bancorp’s forward-looking statements may also be subject to other risks and uncertainties, including those that it may discuss elsewhere in this news release or in its filings with the SEC, accessible on the SEC’s Web site at www.sec.gov.

Sandy Spring Bancorp, Inc. and Subsidiaries

FINANCIAL HIGHLIGHTS - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | %

Change | | Year Ended

December 31, | | %

Change |

(Dollars in thousands, except per share data) | | 2023 | | 2022 | | | 2023 | | 2022 | |

| Results of operations: | | | | | | | | | | | | |

| Net interest income | | $ | 81,696 | | $ | 106,643 | | (23) | % | | $ | 354,550 | | $ | 427,004 | | (17) | % |

| Provision/ (credit) for credit losses | | (3,445) | | 10,801 | | N/M | | (17,561) | | 34,372 | | N/M |

| Non-interest income | | 16,560 | | 14,297 | | 16 | | | 67,078 | | 87,019 | | (23) | |

| Non-interest expense | | 67,142 | | 64,375 | | 4 | | | 275,054 | | 257,293 | | 7 | |

| Income before income tax expense | | 34,559 | | 45,764 | | (24) | | | 164,135 | | 222,358 | | (26) | |

| Net income | | 26,100 | | 33,980 | | (23) | | | 122,844 | | 166,299 | | (26) | |

| | | | | | | | | | | | |

| Net income attributable to common shareholders | | $ | 26,066 | | $ | 33,866 | | (23) | | | $ | 122,621 | | $ | 165,618 | | (26) | |

Pre-tax pre-provision net income (1) | | $ | 31,114 | | $ | 56,565 | | (45) | | | $ | 146,574 | | $ | 256,730 | | (43) | |

| | | | | | | | | | | | |

| Return on average assets | | 0.73 | % | | 0.98 | % | | | | 0.87 | % | | 1.26 | % | | |

| Return on average common equity | | 6.70 | % | | 9.23 | % | | | | 8.04 | % | | 11.23 | % | | |

Return on average tangible common equity (1) | | 9.26 | % | | 12.91 | % | | | | 11.06 | % | | 15.64 | % | | |

| Net interest margin | | 2.45 | % | | 3.26 | % | | | | 2.67 | % | | 3.44 | % | | |

Efficiency ratio - GAAP basis (2) | | 68.33 | % | | 53.23 | % | | | | 65.24 | % | | 50.05 | % | | |

Efficiency ratio - Non-GAAP basis (2) | | 66.16 | % | | 51.46 | % | | | | 60.99 | % | | 49.66 | % | | |

| | | | | | | | | | | | |

Per share data: | | | | | | | | | | | | |

| Basic net income per common share | | $ | 0.58 | | $ | 0.76 | | (24) | % | | $ | 2.74 | | $ | 3.69 | | (26) | % |

| Diluted net income per common share | | $ | 0.58 | | $ | 0.76 | | (23) | | | $ | 2.73 | | $ | 3.68 | | (26) | |

| Weighted average diluted common shares | | 45,009,574 | | 44,828,827 | | — | | | 44,947,263 | | 45,039,022 | | — | |

| Dividends declared per share | | $ | 0.34 | | $ | 0.34 | | — | | | $ | 1.36 | | $ | 1.36 | | — | |

| Book value per common share | | $ | 35.36 | | $ | 33.23 | | 6 | | | $ | 35.36 | | $ | 33.23 | | 6 | |

Tangible book value per common share (1) | | $ | 26.64 | | $ | 24.64 | | 8 | | | $ | 26.64 | | $ | 24.64 | | 8 | |

| Outstanding common shares | | 44,913,561 | | 44,657,054 | | 1 | | | 44,913,561 | | 44,657,054 | | 1 | |

| | | | | | | | | | | | |

Financial condition at period-end: | | | | | | | | | | | | |

| Investment securities | | $ | 1,414,453 | | $ | 1,543,208 | | (8) | % | | $ | 1,414,453 | | $ | 1,543,208 | | (8) | % |

| Loans | | 11,366,989 | | 11,396,706 | | — | | | 11,366,989 | | 11,396,706 | | — | |

| | | | | | | | | | | | |

| Assets | | 14,028,172 | | 13,833,119 | | 1 | | | 14,028,172 | | 13,833,119 | | 1 | |

| Deposits | | 10,996,538 | | 10,953,421 | | — | | | 10,996,538 | | 10,953,421 | | — | |

| | | | | | | | | | | | |

| Stockholders' equity | | 1,588,142 | | 1,483,768 | | 7 | | | 1,588,142 | | 1,483,768 | | 7 | |

| | | | | | | | | | | | |

| Capital ratios: | | | | | | | | | | | | |

Tier 1 leverage (3) | | 9.51 | % | | 9.33 | % | | | | 9.51 | % | | 9.33 | % | | |

Common equity tier 1 capital to risk-weighted assets (3) | | 10.90 | % | | 10.23 | % | | | | 10.90 | % | | 10.23 | % | | |

Tier 1 capital to risk-weighted assets (3) | | 10.90 | % | | 10.23 | % | | | | 10.90 | % | | 10.23 | % | | |

Total regulatory capital to risk-weighted assets (3) | | 14.92 | % | | 14.20 | % | | | | 14.92 | % | | 14.20 | % | | |

Tangible common equity to tangible assets (4) | | 8.77 | % | | 8.18 | % | | | | 8.77 | % | | 8.18 | % | | |

| Average equity to average assets | | 10.97 | % | | 10.61 | % | | | | 10.87 | % | | 11.20 | % | | |

| | | | | | | | | | | | |

| Credit quality ratios: | | | | | | | | | | | | |

| Allowance for credit losses to loans | | 1.06 | % | | 1.20 | % | | | | 1.06 | % | | 1.20 | % | | |

| Non-performing loans to total loans | | 0.81 | % | | 0.35 | % | | | | 0.81 | % | | 0.35 | % | | |

| Non-performing assets to total assets | | 0.65 | % | | 0.29 | % | | | | 0.65 | % | | 0.29 | % | | |

| Allowance for credit losses to non-performing loans | | 131.59 | % | | 346.15 | % | | | | 131.59 | % | | 346.15 | % | | |

Annualized net charge-offs/ (recoveries) to average loans (5) | | — | % | | — | % | | | | 0.01 | % | | — | % | | |

N/M - not meaningful

(1)Represents a non-GAAP measure.

(2)The efficiency ratio - GAAP basis is non-interest expense divided by net interest income plus non-interest income from the Condensed Consolidated Statements of Income. The traditional efficiency ratio - Non-GAAP basis excludes intangible asset amortization, merger, acquisition and disposal expense, severance expense, pension settlement expense and contingent payment expense from non-interest expense; and investment securities gains/ (losses) and gain on disposal of assets from non-interest income; and adds the tax-equivalent adjustment to net interest income. See the Reconciliation Table included with these Financial Highlights.

(3)Estimated ratio at December 31, 2023.

(4)The tangible common equity to tangible assets ratio is a non-GAAP ratio that divides assets excluding goodwill and other intangible assets into stockholders' equity after deducting goodwill and other intangible assets. See the Reconciliation Table included with these Financial Highlights.

(5)Calculation utilizes average loans, excluding residential mortgage loans held-for-sale.

Sandy Spring Bancorp, Inc. and Subsidiaries

RECONCILIATION TABLE - UNAUDITED (CONTINUED)

OPERATING EARNINGS - METRICS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| (Dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Core earnings (non-GAAP): | | | | | | | | |

| Net income (GAAP) | | $ | 26,100 | | $ | 33,980 | | $ | 122,844 | | $ | 166,299 |

Plus/ (less) non-GAAP adjustments (net of tax)(1): | | | | | | | | |

| Merger, acquisition and disposal expense | | — | | — | | — | | 796 |

| Amortization of intangible assets | | 1,047 | | 1,049 | | 3,898 | | 4,333 |

| | | | | | | | |

| Severance expense | | — | | — | | 1,445 | | — |

| Pension settlement expense | | — | | — | | 6,088 | | — |

| Gain on disposal of assets | | — | | — | | — | | (12,309) |

| Investment securities losses | | — | | 293 | | — | | 257 |

| Contingent payment expense | | — | | — | | 27 | | 929 |

| Core earnings (Non-GAAP) | | $ | 27,147 | | $ | 35,322 | | $ | 134,302 | | $ | 160,305 |

| | | | | | | | |

Core earnings per diluted common share (non-GAAP): | | | | | | | | |

| Weighted average common shares outstanding - diluted (GAAP) | | 45,009,574 | | 44,828,827 | | 44,947,263 | | 45,039,022 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Earnings per diluted common share (GAAP) | | $ | 0.58 | | $ | 0.76 | | $ | 2.73 | | $ | 3.68 |

| Core earnings per diluted common share (non-GAAP) | | $ | 0.60 | | $ | 0.79 | | $ | 2.99 | | $ | 3.56 |

| | | | | | | | |

| Core return on average assets (non-GAAP): | | | | | | | | |

| Average assets (GAAP) | | $ | 14,090,423 | | $ | 13,769,472 | | $ | 14,055,645 | | $ | 13,218,824 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Return on average assets (GAAP) | | 0.73 | % | | 0.98 | % | | 0.87 | % | | 1.26 | % |

| Core return on average assets (non-GAAP) | | 0.76 | % | | 1.02 | % | | 0.96 | % | | 1.21 | % |

| | | | | | | | |

| Return/ Core return on average tangible common equity (non-GAAP): | | | | | | | | |

| Net Income (GAAP) | | $ | 26,100 | | $ | 33,980 | | $ | 122,844 | | $ | 166,299 |

| Plus: Amortization of intangible assets (net of tax) | | 1,047 | | 1,049 | | 3,898 | | 4,333 |

| Net income before amortization of intangible assets | | $ | 27,147 | | $ | 35,029 | | $ | 126,742 | | $ | 170,632 |

| | | | | | | | |

| Average total stockholders' equity (GAAP) | | $ | 1,546,312 | | $ | 1,460,254 | | $ | 1,528,242 | | $ | 1,480,198 |

| Average goodwill | | (363,436) | | (363,436) | | (363,436) | | (366,244) |

| Average other intangible assets, net | | (20,162) | | (20,739) | | (18,596) | | (23,009) |

| Average tangible common equity (non-GAAP) | | $ | 1,162,714 | | $ | 1,076,079 | | $ | 1,146,210 | | $ | 1,090,945 |

| | | | | | | | |

Return on average tangible common equity (non-GAAP) | | 9.26 | % | | 12.91 | % | | 11.06 | % | | 15.64 | % |

| Core return on average tangible common equity (non-GAAP) | | 9.26 | % | | 13.02 | % | | 11.72 | % | | 14.69 | % |

(1) Tax adjustments have been determined using the combined marginal federal and state rate of 25.37% and 25.47% for 2023 and 2022, respectively.

Sandy Spring Bancorp, Inc. and Subsidiaries

RECONCILIATION TABLE - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| (Dollars in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

| Pre-tax pre-provision net income: | | | | | | | | |

| Net income (GAAP) | | $ | 26,100 | | $ | 33,980 | | $ | 122,844 | | $ | 166,299 |

| Plus/ (less) non-GAAP adjustments: | | | | | | | | |

| Income tax expense | | 8,459 | | 11,784 | | 41,291 | | 56,059 |

| Provision/ (credit) for credit losses | | (3,445) | | 10,801 | | (17,561) | | 34,372 |

| Pre-tax pre-provision net income (non-GAAP) | | $ | 31,114 | | $ | 56,565 | | $ | 146,574 | | $ | 256,730 |

| | | | | | | | |

Efficiency ratio (GAAP): | | | | | | | | |

| Non-interest expense | | $ | 67,142 | | $ | 64,375 | | $ | 275,054 | | $ | 257,293 |

| | | | | | | | |

| Net interest income plus non-interest income | | $ | 98,256 | | $ | 120,940 | | $ | 421,628 | | $ | 514,023 |

| | | | | | | | |

| Efficiency ratio (GAAP) | | 68.33% | | 53.23 | % | | 65.24 | % | | 50.05 | % |

| | | | | | | | |

| Efficiency ratio (Non-GAAP): | | | | | | | | |

| Non-interest expense | | $ | 67,142 | | $ | 64,375 | | $ | 275,054 | | $ | 257,293 |

| Less non-GAAP adjustments: | | | | | | | | |

| Amortization of intangible assets | | 1,403 | | 1,408 | | 5,223 | | 5,814 |

| | | | | | | | |

| Merger, acquisition and disposal expense | | — | | — | | — | | 1,068 |

| Severance expense | | — | | — | | 1,939 | | — |

| Pension settlement expense | | — | | — | | 8,157 | | — |

| Contingent payment expense | | — | | — | | 36 | | 1,247 |

| Non-interest expense - as adjusted | | $ | 65,739 | | $ | 62,967 | | $ | 259,699 | | $ | 249,164 |

| | | | | | | | |

Net interest income plus non-interest income | | $ | 98,256 | | $ | 120,940 | | $ | 421,628 | | $ | 514,023 |

| Plus non-GAAP adjustment: | | | | | | | | |

| Tax-equivalent income | | 1,113 | | 1,032 | | 4,157 | | 3,841 |

| Less/ (plus) non-GAAP adjustment: | | | | | | | | |

| Investment securities gains/ (losses) | | — | | (393) | | — | | (345) |

| Gain on disposal of assets | | — | | — | | — | | 16,516 |

| Net interest income plus non-interest income - as adjusted | | $ | 99,369 | | $ | 122,365 | | $ | 425,785 | | $ | 501,693 |

| | | | | | | | |

Efficiency ratio (Non-GAAP) | | 66.16% | | 51.46 | % | | 60.99 | % | | 49.66 | % |

| | | | | | | | |

| Tangible common equity ratio: | | | | | | | | |

| Total stockholders' equity | | $ | 1,588,142 | | $ | 1,483,768 | | $ | 1,588,142 | | $ | 1,483,768 |

| Goodwill | | (363,436) | | (363,436) | | (363,436) | | (363,436) |

| Other intangible assets, net | | (28,301) | | (19,855) | | (28,301) | | (19,855) |

| Tangible common equity | | $ | 1,196,405 | | $ | 1,100,477 | | $ | 1,196,405 | | $ | 1,100,477 |

| | | | | | | | |

Total assets | | $ | 14,028,172 | | $ | 13,833,119 | | $ | 14,028,172 | | $ | 13,833,119 |

| Goodwill | | (363,436) | | (363,436) | | (363,436) | | (363,436) |

| Other intangible assets, net | | (28,301) | | (19,855) | | (28,301) | | (19,855) |

| Tangible assets | | $ | 13,636,435 | | $ | 13,449,828 | | $ | 13,636,435 | | $ | 13,449,828 |

| | | | | | | | |

Tangible common equity ratio | | 8.77% | | 8.18 | % | | 8.77 | % | | 8.18 | % |

| | | | | | | | |

| Outstanding common shares | | 44,913,561 | | 44,657,054 | | 44,913,561 | | 44,657,054 |

| Tangible book value per common share | | $ | 26.64 | | $ | 24.64 | | $ | 26.64 | | $ | 24.64 |

Sandy Spring Bancorp, Inc. and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF CONDITION - UNAUDITED

| | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | December 31,

2023 | | December 31,

2022 | | |

Assets | | | | | | |

| Cash and due from banks | | $ | 82,257 | | | $ | 88,152 | | | |

| Federal funds sold | | 245 | | | 193 | | | |

| Interest-bearing deposits with banks | | 463,396 | | | 103,887 | | | |

| Cash and cash equivalents | | 545,898 | | | 192,232 | | | |

| Residential mortgage loans held for sale (at fair value) | | 10,836 | | | 11,706 | | | |

Investments held-to-maturity (fair values of $200,411 and $220,123 at December 31, 2023 and December 31, 2022, respectively) | | 236,165 | | | 259,452 | | | |

| Investments available-for-sale (at fair value) | | 1,102,681 | | | 1,214,538 | | | |

| Other investments, at cost | | 75,607 | | | 69,218 | | | |

| Total loans | | 11,366,989 | | | 11,396,706 | | | |

| Less: allowance for credit losses - loans | | (120,865) | | | (136,242) | | | |

| Net loans | | 11,246,124 | | | 11,260,464 | | | |

| Premises and equipment, net | | 59,490 | | | 67,070 | | | |

| Other real estate owned | | — | | | 645 | | | |

| Accrued interest receivable | | 46,583 | | | 41,172 | | | |

| Goodwill | | 363,436 | | | 363,436 | | | |

| Other intangible assets, net | | 28,301 | | | 19,855 | | | |

| Other assets | | 313,051 | | | 333,331 | | | |

| Total assets | | $ | 14,028,172 | | | $ | 13,833,119 | | | |

| | | | | | |

Liabilities | | | | | | |

Noninterest-bearing deposits | | $ | 2,914,161 | | | $ | 3,673,300 | | | |

| Interest-bearing deposits | | 8,082,377 | | | 7,280,121 | | | |

| Total deposits | | 10,996,538 | | | 10,953,421 | | | |

| Securities sold under retail repurchase agreements | | 75,032 | | | 61,967 | | | |

| Federal funds purchased | | — | | | 260,000 | | | |

| Federal Reserve Bank borrowings | | 300,000 | | | — | | | |

| Advances from FHLB | | 550,000 | | | 550,000 | | | |

| Subordinated debt | | 370,803 | | | 370,205 | | | |

| Total borrowings | | 1,295,835 | | | 1,242,172 | | | |

| Accrued interest payable and other liabilities | | 147,657 | | | 153,758 | | | |

| Total liabilities | | 12,440,030 | | | 12,349,351 | | | |

| | | | | | |

Stockholders' equity | | | | | | |

Common stock -- par value $1.00; shares authorized 100,000,000; shares issued and outstanding 44,913,561 and 44,657,054 at December 31, 2023 and December 31, 2022, respectively | | 44,914 | | | 44,657 | | | |

| Additional paid in capital | | 742,243 | | | 734,273 | | | |

| Retained earnings | | 898,316 | | | 836,789 | | | |

| Accumulated other comprehensive loss | | (97,331) | | | (131,951) | | | |

| Total stockholders' equity | | 1,588,142 | | | 1,483,768 | | | |

| Total liabilities and stockholders' equity | | $ | 14,028,172 | | | $ | 13,833,119 | | | |

Sandy Spring Bancorp, Inc. and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF INCOME - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| (Dollars in thousands, except per share data) | | 2023 | | 2022 | | 2023 | | 2022 |

| Interest income: | | | | | | | | |

| Interest and fees on loans | | $ | 148,655 | | | $ | 135,079 | | | $ | 579,960 | | | $ | 462,121 | |

| Interest on loans held for sale | | 199 | | | 234 | | | 896 | | | 738 | |

| Interest on deposits with banks | | 8,456 | | | 1,427 | | | 22,435 | | | 2,672 | |

| Interest and dividend income on investment securities: | | | | | | | | |

| Taxable | | 6,454 | | | 6,047 | | | 26,992 | | | 20,519 | |

| Tax-advantaged | | 1,848 | | | 2,509 | | | 7,224 | | | 9,609 | |

| Interest on federal funds sold | | 4 | | | 4 | | | 17 | | | 8 | |

| Total interest income | | 165,616 | | | 145,300 | | | 637,524 | | | 495,667 | |

| Interest expense: | | | | | | | | |

| Interest on deposits | | 69,813 | | | 28,276 | | | 225,028 | | | 43,854 | |

Interest on retail repurchase agreements and federal funds purchased | | 4,075 | | | 1,697 | | | 14,452 | | | 2,929 | |

| Interest on advances from FHLB | | 6,086 | | | 4,759 | | | 27,709 | | | 7,825 | |

| Interest on subordinated debt | | 3,946 | | | 3,925 | | | 15,785 | | | 14,055 | |

| Total interest expense | | 83,920 | | | 38,657 | | | 282,974 | | | 68,663 | |

| Net interest income | | 81,696 | | | 106,643 | | | 354,550 | | | 427,004 | |

| Provision/ (credit) for credit losses | | (3,445) | | | 10,801 | | | (17,561) | | | 34,372 | |

| Net interest income after provision/ (credit) for credit losses | | 85,141 | | | 95,842 | | | 372,111 | | | 392,632 | |

| Non-interest income: | | | | | | | | |

| Investment securities gains/ (losses) | | — | | | (393) | | | — | | | (345) | |

| Gain on disposal of assets | | — | | | — | | | — | | | 16,516 | |

| Service charges on deposit accounts | | 2,749 | | | 2,419 | | | 10,447 | | | 9,803 | |

| Mortgage banking activities | | 792 | | | 783 | | | 5,536 | | | 6,130 | |

| Wealth management income | | 9,219 | | | 8,472 | | | 36,633 | | | 35,774 | |

| Insurance agency commissions | | — | | | — | | | — | | | 2,927 | |

| Income from bank owned life insurance | | 1,207 | | | 950 | | | 4,210 | | | 3,141 | |

| Bank card fees | | 454 | | | 463 | | | 1,769 | | | 4,379 | |

| Other income | | 2,139 | | | 1,603 | | | 8,483 | | | 8,694 | |

| Total non-interest income | | 16,560 | | | 14,297 | | | 67,078 | | | 87,019 | |

| Non-interest expense: | | | | | | | | |

| Salaries and employee benefits | | 35,482 | | | 39,455 | | | 160,192 | | | 158,504 | |

| Occupancy expense of premises | | 4,558 | | | 4,728 | | | 18,778 | | | 19,255 | |

| Equipment expenses | | 3,987 | | | 3,859 | | | 15,675 | | | 14,779 | |

| Marketing | | 1,242 | | | 1,354 | | | 5,103 | | | 5,197 | |

| Outside data services | | 3,000 | | | 2,707 | | | 11,186 | | | 10,199 | |

| FDIC insurance | | 2,615 | | | 1,462 | | | 9,461 | | | 4,792 | |

| Amortization of intangible assets | | 1,403 | | | 1,408 | | | 5,223 | | | 5,814 | |

| Merger, acquisition and disposal expense | | — | | | — | | | — | | | 1,068 | |

| Professional fees and services | | 5,628 | | | 2,573 | | | 17,982 | | | 9,169 | |

| Other expenses | | 9,227 | | | 6,829 | | | 31,454 | | | 28,516 | |

| Total non-interest expense | | 67,142 | | | 64,375 | | | 275,054 | | | 257,293 | |

| Income before income tax expense | | 34,559 | | | 45,764 | | | 164,135 | | | 222,358 | |

| Income tax expense | | 8,459 | | | 11,784 | | | 41,291 | | | 56,059 | |

| Net income | | $ | 26,100 | | | $ | 33,980 | | | $ | 122,844 | | | $ | 166,299 | |

| | | | | | | | |

| Net income per share amounts: | | | | | | | | |

| Basic net income per common share | | $ | 0.58 | | | $ | 0.76 | | | $ | 2.74 | | | $ | 3.69 | |

| Diluted net income per common share | | $ | 0.58 | | | $ | 0.76 | | | $ | 2.73 | | | $ | 3.68 | |

| Dividends declared per share | | $ | 0.34 | | | $ | 0.34 | | | $ | 1.36 | | | $ | 1.36 | |

Sandy Spring Bancorp, Inc. and Subsidiaries

HISTORICAL TRENDS - QUARTERLY FINANCIAL DATA - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| (Dollars in thousands, except per share data) | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 |

| Profitability for the quarter: | | | | | | | | | | | | | | | | |

Tax-equivalent interest income | | $ | 166,729 | | $ | 163,479 | | $ | 159,156 | | $ | 152,317 | | $ | 146,332 | | $ | 131,373 | | $ | 114,901 | | $ | 106,902 |

Interest expense | | 83,920 | | 77,330 | | 67,679 | | 54,045 | | 38,657 | | 17,462 | | 7,959 | | 4,585 |

| Tax-equivalent net interest income | | 82,809 | | 86,149 | | 91,477 | | 98,272 | | 107,675 | | 113,911 | | 106,942 | | 102,317 |

Tax-equivalent adjustment | | 1,113 | | 1,068 | | 1,006 | | 970 | | 1,032 | | 951 | | 992 | | 866 |

| Provision/ (credit) for credit losses | | (3,445) | | 2,365 | | 5,055 | | (21,536) | | 10,801 | | 18,890 | | 3,046 | | 1,635 |

Non-interest income | | 16,560 | | 17,391 | | 17,176 | | 15,951 | | 14,297 | | 16,882 | | 35,245 | | 20,595 |

Non-interest expense | | 67,142 | | 72,471 | | 69,136 | | 66,305 | | 64,375 | | 65,780 | | 64,991 | | 62,147 |

| Income before income tax expense | | 34,559 | | 27,636 | | 33,456 | | 68,484 | | 45,764 | | 45,172 | | 73,158 | | 58,264 |

| Income tax expense | | 8,459 | | 6,890 | | 8,711 | | 17,231 | | 11,784 | | 11,588 | | 18,358 | | 14,329 |

| Net income | | $ | 26,100 | | $ | 20,746 | | $ | 24,745 | | $ | 51,253 | | $ | 33,980 | | $ | 33,584 | | $ | 54,800 | | $ | 43,935 |

| GAAP financial performance: | | | | | | | | | | | | | | | | |

| Return on average assets | | 0.73 | % | | 0.58 | % | | 0.70 | % | | 1.49 | % | | 0.98 | % | | 0.99 | % | | 1.69 | % | | 1.42 | % |

| Return on average common equity | | 6.70 | % | | 5.35 | % | | 6.46 | % | | 13.93 | % | | 9.23 | % | | 8.96 | % | | 14.97 | % | | 11.83 | % |

| Return on average tangible common equity | | 9.26 | % | | 7.42 | % | | 8.93 | % | | 19.10 | % | | 12.91 | % | | 12.49 | % | | 20.83 | % | | 16.45 | % |

| Net interest margin | | 2.45 | % | | 2.55 | % | | 2.73 | % | | 2.99 | % | | 3.26 | % | | 3.53 | % | | 3.49 | % | | 3.49 | % |

| Efficiency ratio - GAAP basis | | 68.33 | % | | 70.72 | % | | 64.22 | % | | 58.55 | % | | 53.23 | % | | 50.66 | % | | 46.03 | % | | 50.92 | % |

| Non-GAAP financial performance: | | | | | | | | | | | | | | | | |

| Pre-tax pre-provision net income | | $ | 31,114 | | $ | 30,001 | | $ | 38,511 | | $ | 46,948 | | $ | 56,565 | | $ | 64,062 | | $ | 76,204 | | $ | 59,899 |

| Core after-tax earnings | | $ | 27,147 | | $ | 27,766 | | $ | 27,136 | | $ | 52,253 | | $ | 35,322 | | $ | 35,695 | | $ | 44,238 | | $ | 45,050 |

| Core return on average assets | | 0.76 | % | | 0.78 | % | | 0.77 | % | | 1.52 | % | | 1.02 | % | | 1.05 | % | | 1.37 | % | | 1.45 | % |

| Core return on average common equity | | 6.97 | % | | 7.16 | % | | 7.09 | % | | 14.20 | % | | 9.60 | % | | 9.53 | % | | 12.09 | % | | 12.13 | % |

| Core return on average tangible common equity | | 9.26 | % | | 9.51 | % | | 9.43 | % | | 19.11 | % | | 13.02 | % | | 12.86 | % | | 16.49 | % | | 16.45 | % |

| Core earnings per diluted common share | | $ | 0.60 | | $ | 0.62 | | $ | 0.60 | | $ | 1.16 | | $ | 0.79 | | $ | 0.80 | | $ | 0.98 | | $ | 0.99 |

| Efficiency ratio - Non-GAAP basis | | 66.16 | % | | 60.91 | % | | 60.68 | % | | 56.87 | % | | 51.46 | % | | 48.18 | % | | 49.79 | % | | 49.34 | % |

| Per share data: | | | | | | | | | | | | |

| Net income attributable to common shareholders | | $ | 26,066 | | $ | 20,719 | | $ | 24,712 | | $ | 51,084 | | $ | 33,866 | | $ | 33,470 | | $ | 54,606 | | $ | 43,667 |

| Basic net income per common share | | $ | 0.58 | | $ | 0.46 | | $ | 0.55 | | $ | 1.14 | | $ | 0.76 | | $ | 0.75 | | $ | 1.21 | | $ | 0.97 |

| Diluted net income per common share | | $ | 0.58 | | $ | 0.46 | | $ | 0.55 | | $ | 1.14 | | $ | 0.76 | | $ | 0.75 | | $ | 1.21 | | $ | 0.96 |

| Weighted average diluted common shares | | 45,009,574 | | 44,960,455 | | 44,888,759 | | 44,872,582 | | 44,828,827 | | 44,780,560 | | 45,111,693 | | 45,333,292 |

| Dividends declared per share | | $ | 0.34 | | $ | 0.34 | | $ | 0.34 | | $ | 0.34 | | $ | 0.34 | | $ | 0.34 | | $ | 0.34 | | $ | 0.34 |

| Non-interest income: | | | | | | | | | | | | | | | | |

| Securities gains/ (losses) | | $ | — | | $ | — | | $ | — | | $ | — | | $ | (393) | | $ | 2 | | $ | 38 | | $ | 8 |

| Gain/ (loss) on disposal of assets | | — | | — | | — | | — | | — | | (183) | | 16,699 | | — |

| Service charges on deposit accounts | | 2,749 | | 2,704 | | 2,606 | | 2,388 | | 2,419 | | 2,591 | | 2,467 | | 2,326 |

| Mortgage banking activities | | 792 | | 1,682 | | 1,817 | | 1,245 | | 783 | | 1,566 | | 1,483 | | 2,298 |

| Wealth management income | | 9,219 | | 9,391 | | 9,031 | | 8,992 | | 8,472 | | 8,867 | | 9,098 | | 9,337 |

| Insurance agency commissions | | — | | — | | — | | — | | — | | — | | 812 | | 2,115 |

| Income from bank owned life insurance | | 1,207 | | 845 | | 1,251 | | 907 | | 950 | | 693 | | 703 | | 795 |

| Bank card fees | | 454 | | 450 | | 447 | | 418 | | 463 | | 438 | | 1,810 | | 1,668 |

| Other income | | 2,139 | | 2,319 | | 2,024 | | 2,001 | | 1,603 | | 2,908 | | 2,135 | | 2,048 |

| Total non-interest income | | $ | 16,560 | | $ | 17,391 | | $ | 17,176 | | $ | 15,951 | | $ | 14,297 | | $ | 16,882 | | $ | 35,245 | | $ | 20,595 |

| Non-interest expense: | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | $ | 35,482 | | $ | 44,853 | | $ | 40,931 | | $ | 38,926 | | $ | 39,455 | | $ | 40,126 | | $ | 39,550 | | $ | 39,373 |

| Occupancy expense of premises | | 4,558 | | 4,609 | | 4,764 | | 4,847 | | 4,728 | | 4,759 | | 4,734 | | 5,034 |

| Equipment expenses | | 3,987 | | 3,811 | | 3,760 | | 4,117 | | 3,859 | | 3,825 | | 3,559 | | 3,536 |

| Marketing | | 1,242 | | 729 | | 1,589 | | 1,543 | | 1,354 | | 1,370 | | 1,280 | | 1,193 |

| Outside data services | | 3,000 | | 2,819 | | 2,853 | | 2,514 | | 2,707 | | 2,509 | | 2,564 | | 2,419 |

| FDIC insurance | | 2,615 | | 2,333 | | 2,375 | | 2,138 | | 1,462 | | 1,268 | | 1,078 | | 984 |

| Amortization of intangible assets | | 1,403 | | 1,245 | | 1,269 | | 1,306 | | 1,408 | | 1,432 | | 1,466 | | 1,508 |

| Merger, acquisition and disposal expense | | — | | — | | — | | — | | — | | 1 | | 1,067 | | — |

| Professional fees and services | | 5,628 | | 4,509 | | 4,161 | | 3,684 | | 2,573 | | 2,207 | | 2,372 | | 2,017 |

| Other expenses | | 9,227 | | 7,563 | | 7,434 | | 7,230 | | 6,829 | | 8,283 | | 7,321 | | 6,083 |

| Total non-interest expense | | $ | 67,142 | | $ | 72,471 | | $ | 69,136 | | $ | 66,305 | | $ | 64,375 | | $ | 65,780 | | $ | 64,991 | | $ | 62,147 |

Sandy Spring Bancorp, Inc. and Subsidiaries

HISTORICAL TRENDS - QUARTERLY FINANCIAL DATA - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| (Dollars in thousands, except per share data) | | Q4 | | Q3 | | Q2 | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 |

| Balance sheets at quarter end: | | | | | | | | | | | | | | |

| Commercial investor real estate loans | | $ | 5,104,425 | | $ | 5,137,694 | | $ | 5,131,210 | | $ | 5,167,456 | | $ | 5,130,094 | | $ | 5,066,843 | | $ | 4,761,658 | | $ | 4,388,275 |

| Commercial owner-occupied real estate loans | | 1,755,235 | | 1,760,384 | | 1,770,135 | | 1,769,928 | | 1,775,037 | | 1,743,724 | | 1,767,326 | | 1,692,253 |

| Commercial AD&C loans | | 988,967 | | 938,673 | | 1,045,742 | | 1,046,665 | | 1,090,028 | | 1,143,783 | | 1,094,528 | | 1,089,331 |

| Commercial business loans | | 1,504,880 | | 1,454,709 | | 1,423,614 | | 1,437,478 | | 1,455,885 | | 1,393,634 | | 1,353,380 | | 1,349,602 |

| Residential mortgage loans | | 1,474,521 | | 1,432,051 | | 1,385,743 | | 1,328,524 | | 1,287,933 | | 1,218,552 | | 1,147,577 | | 1,000,697 |

| Residential construction loans | | 121,419 | | 160,345 | | 190,690 | | 223,456 | | 224,772 | | 229,243 | | 235,486 | | 204,259 |

| Consumer loans | | 417,542 | | 416,436 | | 422,505 | | 421,734 | | 432,957 | | 423,034 | | 426,335 | | 419,911 |

| Total loans | | 11,366,989 | | 11,300,292 | | 11,369,639 | | 11,395,241 | | 11,396,706 | | 11,218,813 | | 10,786,290 | | 10,144,328 |

| Allowance for credit losses - loans | | (120,865) | | (123,360) | | (120,287) | | (117,613) | | (136,242) | | (128,268) | | (113,670) | | (110,588) |

| Loans held for sale | | 10,836 | | 19,235 | | 21,476 | | 16,262 | | 11,706 | | 11,469 | | 23,610 | | 17,537 |

| Investment securities | | 1,414,453 | | 1,392,078 | | 1,463,554 | | 1,528,336 | | 1,543,208 | | 1,587,279 | | 1,595,424 | | 1,586,441 |

| | | | | | | | | | | | | | | | |

| Total assets | | 14,028,172 | | 14,135,085 | | 13,994,545 | | 14,129,007 | | 13,833,119 | | 13,765,597 | | 13,303,009 | | 12,967,416 |

| Noninterest-bearing demand deposits | | 2,914,161 | | 3,013,905 | | 3,079,896 | | 3,228,678 | | 3,673,300 | | 3,993,480 | | 4,129,440 | | 4,039,797 |

| Total deposits | | 10,996,538 | | 11,151,012 | | 10,958,922 | | 11,075,991 | | 10,953,421 | | 10,749,486 | | 10,969,461 | | 10,852,794 |

| Customer repurchase agreements | | 75,032 | | 66,581 | | 74,510 | | 47,627 | | 61,967 | | 91,287 | | 110,744 | | 130,784 |

| | | | | | | | | | | | | | | | |

| Total stockholders' equity | | 1,588,142 | | 1,537,914 | | 1,539,032 | | 1,536,865 | | 1,483,768 | | 1,451,862 | | 1,477,169 | | 1,488,910 |

| Quarterly average balance sheets: | | | | | | | | | | | | | | |

| Commercial investor real estate loans | | $ | 5,125,028 | | $ | 5,125,459 | | $ | 5,146,632 | | $ | 5,136,204 | | $ | 5,082,697 | | $ | 4,898,683 | | $ | 4,512,937 | | $ | 4,220,246 |

| Commercial owner-occupied real estate loans | | 1,755,048 | | 1,769,717 | | 1,773,039 | | 1,769,680 | | 1,753,351 | | 1,755,891 | | 1,727,325 | | 1,683,557 |

| Commercial AD&C loans | | 960,646 | | 995,682 | | 1,057,205 | | 1,082,791 | | 1,136,780 | | 1,115,531 | | 1,096,369 | | 1,102,660 |

| Commercial business loans | | 1,433,035 | | 1,442,518 | | 1,441,489 | | 1,444,588 | | 1,373,565 | | 1,327,218 | | 1,334,350 | | 1,372,755 |

| Residential mortgage loans | | 1,451,614 | | 1,406,929 | | 1,353,809 | | 1,307,761 | | 1,251,829 | | 1,177,664 | | 1,070,836 | | 964,056 |

| Residential construction loans | | 142,325 | | 174,204 | | 211,590 | | 223,313 | | 231,318 | | 235,123 | | 221,031 | | 197,366 |

| Consumer loans | | 419,299 | | 421,189 | | 423,306 | | 424,122 | | 426,134 | | 422,963 | | 421,022 | | 424,859 |

| Total loans | | 11,286,995 | | 11,335,698 | | 11,407,070 | | 11,388,459 | | 11,255,674 | | 10,933,073 | | 10,383,870 | | 9,965,499 |

| Loans held for sale | | 10,132 | | 13,714 | | 17,480 | | 8,324 | | 10,901 | | 15,211 | | 12,744 | | 17,594 |

| Investment securities | | 1,544,173 | | 1,589,342 | | 1,639,324 | | 1,679,593 | | 1,717,455 | | 1,734,036 | | 1,686,181 | | 1,617,615 |

| Interest-earning assets | | 13,462,583 | | 13,444,117 | | 13,423,589 | | 13,316,165 | | 13,134,234 | | 12,833,758 | | 12,283,834 | | 11,859,803 |

| Total assets | | 14,090,423 | | 14,086,342 | | 14,094,653 | | 13,949,276 | | 13,769,472 | | 13,521,595 | | 12,991,692 | | 12,576,089 |

| Noninterest-bearing demand deposits | | 2,958,254 | | 3,041,101 | | 3,137,971 | | 3,480,433 | | 3,833,275 | | 3,995,702 | | 4,001,762 | | 3,758,732 |

| Total deposits | | 11,089,587 | | 11,076,724 | | 10,928,038 | | 11,049,991 | | 11,025,843 | | 10,740,999 | | 10,829,221 | | 10,542,029 |

| Customer repurchase agreements | | 66,622 | | 67,298 | | 58,382 | | 60,626 | | 74,797 | | 104,742 | | 122,728 | | 131,487 |

| Total interest-bearing liabilities | | 9,418,666 | | 9,332,617 | | 9,257,652 | | 8,806,720 | | 8,310,278 | | 7,892,230 | | 7,377,045 | | 7,163,641 |

| Total stockholders' equity | | 1,546,312 | | 1,538,553 | | 1,535,465 | | 1,491,929 | | 1,460,254 | | 1,486,427 | | 1,468,036 | | 1,506,516 |

| Financial measures: | | | | | | | | | | | | | | | | |

| Average equity to average assets | | 10.97 | % | | 10.92 | % | | 10.89 | % | | 10.70 | % | | 10.61 | % | | 10.99 | % | | 11.30 | % | | 11.98 | % |

| Average investment securities to average earning assets | | 11.47 | % | | 11.82 | % | | 12.21 | % | | 12.61 | % | | 13.08 | % | | 13.51 | % | | 13.73 | % | | 13.64 | % |

| Average loans to average earning assets | | 83.84 | % | | 84.32 | % | | 84.98 | % | | 85.52 | % | | 85.70 | % | | 85.19 | % | | 84.53 | % | | 84.03 | % |

| Loans to assets | | 81.03 | % | | 79.94 | % | | 81.24 | % | | 80.65 | % | | 82.39 | % | | 81.50 | % | | 81.08 | % | | 78.23 | % |

| Loans to deposits | | 103.37 | % | | 101.34 | % | | 103.75 | % | | 102.88 | % | | 104.05 | % | | 104.37 | % | | 98.33 | % | | 93.47 | % |

| Assets under management | | $ | 5,999,520 | | $ | 5,536,499 | | $ | 5,742,888 | | $ | 5,477,560 | | $ | 5,255,306 | | $ | 4,969,092 | | $ | 5,171,321 | | $ | 5,793,787 |

| Capital measures: | | | | | | | | | | | | | | | | |

Tier 1 leverage (1) | | 9.51 | % | | 9.50 | % | | 9.42 | % | | 9.44 | % | | 9.33 | % | | 9.33 | % | | 9.53 | % | | 9.66 | % |

Common equity tier 1 capital to risk-weighted assets (1) | | 10.90 | % | | 10.83 | % | | 10.65 | % | | 10.53 | % | | 10.23 | % | | 10.18 | % | | 10.42 | % | | 10.78 | % |

Tier 1 capital to risk-weighted assets (1) | | 10.90 | % | | 10.83 | % | | 10.65 | % | | 10.53 | % | | 10.23 | % | | 10.18 | % | | 10.42 | % | | 10.78 | % |

Total regulatory capital to risk-weighted assets (1) | | 14.92 | % | | 14.85 | % | | 14.60 | % | | 14.43 | % | | 14.20 | % | | 14.15 | % | | 14.46 | % | | 15.02 | % |

| Book value per common share | | $ | 35.36 | | $ | 34.26 | | $ | 34.31 | | $ | 34.37 | | $ | 33.23 | | $ | 32.52 | | $ | 33.10 | | $ | 32.97 |

Outstanding common shares | | 44,913,561 | | 44,895,158 | | 44,862,369 | | 44,712,497 | | 44,657,054 | | 44,644,269 | | 44,629,697 | | 45,162,908 |

(1) Estimated ratio at December 31, 2023.

Sandy Spring Bancorp, Inc. and Subsidiaries

LOAN PORTFOLIO QUALITY DETAIL - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2022 |

| (Dollars in thousands) | | December 31, | | September 30, | | June 30, | | March 31, | | December 31, | | September 30, | | June 30, | | March 31, |

| Non-performing assets: | | | | | | | | | | | | | | | | |

| Loans 90 days past due: | | | | | | | | | | | | | | | | |

| Commercial real estate: | | | | | | | | | | | | | | | | |

| Commercial investor real estate | | $ | — | | | $ | — | | | $ | — | | | $ | 215 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Commercial owner-occupied real estate | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Commercial AD&C | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Commercial business | | 20 | | | 415 | | | 29 | | | 3,002 | | | 1,002 | | | 1,966 | | | — | | | — | |

| Residential real estate: | | | | | | | | | | | | | | | | |

| Residential mortgage | | 342 | | | — | | | 692 | | | 352 | | | — | | | 167 | | | 353 | | | 296 | |

| Residential construction | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Consumer | | — | | | — | | | — | | | — | | | — | | | 34 | | | — | | | — | |

Total loans 90 days past due | | 362 | | | 415 | | | 721 | | | 3,569 | | | 1,002 | | | 2,167 | | | 353 | | | 296 | |

| Non-accrual loans: | | | | | | | | | | | | | | | | |

| Commercial real estate: | | | | | | | | | | | | | | | | |

| Commercial investor real estate | | 58,658 | | | 20,108 | | | 20,381 | | | 15,451 | | | 9,943 | | | 14,038 | | | 11,245 | | | 11,743 | |

| Commercial owner-occupied real estate | | 4,640 | | | 4,744 | | | 4,846 | | | 4,949 | | | 5,019 | | | 6,294 | | | 7,869 | | | 8,083 | |

| Commercial AD&C | | 1,259 | | | 1,422 | | | 569 | | | — | | | — | | | — | | | 1,353 | | | 1,081 | |

| Commercial business | | 10,051 | | | 9,671 | | | 9,393 | | | 9,443 | | | 7,322 | | | 7,198 | | | 7,542 | | | 8,357 | |

| Residential real estate: | | | | | | | | | | | | | | | | |

| Residential mortgage | | 12,332 | | | 10,766 | | | 10,153 | | | 8,935 | | | 7,439 | | | 7,514 | | | 7,305 | | | 8,148 | |

| Residential construction | | 443 | | | 449 | | | — | | | — | | | — | | | — | | | 1 | | | 51 | |

| Consumer | | 4,102 | | | 4,187 | | | 3,396 | | | 4,900 | | | 5,059 | | | 5,173 | | | 5,692 | | | 6,406 | |

| Total non-accrual loans | | 91,485 | | | 51,347 | | | 48,738 | | | 43,678 | | | 34,782 | | | 40,217 | | | 41,007 | | | 43,869 | |

Total restructured loans - accruing (1) | | — | | | — | | | — | | | — | | | 3,575 | | | 2,077 | | | 2,119 | | | 2,161 | |

| Total non-performing loans | | 91,847 | | | 51,762 | | | 49,459 | | | 47,247 | | | 39,359 | | | 44,461 | | | 43,479 | | | 46,326 | |

| Other assets and other real estate owned (OREO) | | — | | | 261 | | | 611 | | | 645 | | | 645 | | | 739 | | | 739 | | | 1,034 | |

| Total non-performing assets | | $ | 91,847 | | | $ | 52,023 | | | $ | 50,070 | | | $ | 47,892 | | | $ | 40,004 | | | $ | 45,200 | | | $ | 44,218 | | | $ | 47,360 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Quarter Ended, |

(Dollars in thousands) | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 | | March 31,

2022 |

| Analysis of non-accrual loan activity: | | | | | | | | | | | | | | | | |

| Balance at beginning of period | | $ | 51,347 | | $ | 48,738 | | $ | 43,678 | | $ | 34,782 | | $ | 40,217 | | $ | 41,007 | | $ | 43,869 | | $ | 46,086 |

| | | | | | | | | | | | | | | | |

Non-accrual balances transferred to OREO | | — | | — | | — | | — | | — | | — | | — | | — |

| Non-accrual balances charged-off | | — | | (183) | | (2,049) | | (126) | | (22) | | (197) | | (376) | | (265) |

| Net payments or draws | | (7,619) | | (1,545) | | (1,654) | | (10,212) | | (9,535) | | (3,509) | | (3,234) | | (2,787) |

| Loans placed on non-accrual | | 47,920 | | 4,967 | | 9,276 | | 19,714 | | 5,467 | | 4,212 | | 948 | | 1,503 |

| Non-accrual loans brought current | | (163) | | (630) | | (513) | | (480) | | (1,345) | | (1,296) | | (200) | | (668) |

| Balance at end of period | | $ | 91,485 | | $ | 51,347 | | $ | 48,738 | | $ | 43,678 | | $ | 34,782 | | $ | 40,217 | | $ | 41,007 | | $ | 43,869 |

| | | | | | | | | | | | | | | | |

Analysis of allowance for credit losses - loans: | | | | | | | | | | | | | | | | |

| Balance at beginning of period | | $ | 123,360 | | $ | 120,287 | | $ | 117,613 | | $ | 136,242 | | $ | 128,268 | | $ | 113,670 | | $ | 110,588 | | $ | 109,145 |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Provision/ (credit) for credit losses - loans | | (2,574) | | 3,171 | | 4,454 | | (18,945) | | 7,907 | | 14,092 | | 3,046 | | 1,635 |

| Less loans charged-off, net of recoveries: | | | | | | | | | | | | | | | | |

| Commercial real estate: | | | | | | | | | | | | | | | | |

| Commercial investor real estate | | (3) | | (3) | | (14) | | (5) | | (1) | | — | | (300) | | (19) |

| Commercial owner-occupied real estate | | (27) | | (25) | | (27) | | (26) | | (27) | | (10) | | (12) | | — |

| Commercial AD&C | | — | | — | | — | | — | | — | | — | | — | | — |

| Commercial business | | (105) | | 15 | | 363 | | (127) | | (13) | | (512) | | 331 | | 111 |

| Residential real estate: | | | | | | | | | | | | | | | | |

| Residential mortgage | | (6) | | (4) | | 35 | | 21 | | (50) | | (8) | | (9) | | 120 |

| Residential construction | | — | | — | | — | | — | | — | | (3) | | (5) | | — |

| Consumer | | 62 | | 115 | | 1,423 | | (179) | | 24 | | 27 | | (41) | | (20) |

| Net charge-offs/ (recoveries) | | (79) | | 98 | | 1,780 | | (316) | | (67) | | (506) | | (36) | | 192 |

| Balance at the end of period | | $ | 120,865 | | $ | 123,360 | | $ | 120,287 | | $ | 117,613 | | $ | 136,242 | | $ | 128,268 | | $ | 113,670 | | $ | 110,588 |

| | | | | | | | | | | | | | | | |

| Asset quality ratios: | | | | | | | | | | | | | | | | |

| Non-performing loans to total loans | | 0.81 | % | | 0.46 | % | | 0.44 | % | | 0.41 | % | | 0.35 | % | | 0.40 | % | | 0.40 | % | | 0.46 | % |

| Non-performing assets to total assets | | 0.65 | % | | 0.37 | % | | 0.36 | % | | 0.34 | % | | 0.29 | % | | 0.33 | % | | 0.33 | % | | 0.37 | % |

| Allowance for credit losses to loans | | 1.06 | % | | 1.09 | % | | 1.06 | % | | 1.03 | % | | 1.20 | % | | 1.14 | % | | 1.05 | % | | 1.09 | % |

| Allowance for credit losses to non-performing loans | | 131.59 | % | | 238.32 | % | | 243.21 | % | | 248.93 | % | | 346.15 | % | | 288.50 | % | | 261.44 | % | | 238.72 | % |

| Annualized net charge-offs/ (recoveries) to average loans | | — | % | | — | % | | 0.06 | % | | (0.01) | % | | — | % | | (0.02) | % | | — | % | | 0.01 | % |

(1) Effective January 1, 2023, the Company adopted ASU 2022-02, which eliminated the accounting and recognition of troubled debt restructurings ("TDRs").

Sandy Spring Bancorp, Inc. and Subsidiaries

CONSOLIDATED AVERAGE BALANCES, YIELDS AND RATES - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, |

| | 2023 | | 2022 |

| (Dollars in thousands and tax-equivalent) | | Average Balances | | Interest (1) | | Annualized Average Yield/Rate | | Average Balances | | Interest (1) | | Annualized Average Yield/Rate |

| Assets | | | | | | | | | | | | |

Commercial investor real estate loans | | $ | 5,125,028 | | | $ | 60,909 | | | 4.72 | % | | $ | 5,082,697 | | | $ | 56,353 | | | 4.40 | % |

| Commercial owner-occupied real estate loans | | 1,755,048 | | | 21,011 | | | 4.75 | | | 1,753,351 | | | 20,433 | | | 4.62 | |

| Commercial AD&C loans | | 960,646 | | | 20,510 | | | 8.47 | | | 1,136,780 | | | 18,868 | | | 6.59 | |

| Commercial business loans | | 1,433,035 | | | 23,822 | | | 6.60 | | | 1,373,565 | | | 20,395 | | | 5.89 | |

| Total commercial loans | | 9,273,757 | | | 126,252 | | | 5.40 | | | 9,346,393 | | | 116,049 | | | 4.93 | |

| Residential mortgage loans | | 1,451,614 | | | 12,984 | | | 3.58 | | | 1,251,829 | | | 10,919 | | | 3.49 | |

| Residential construction loans | | 142,325 | | | 1,515 | | | 4.22 | | | 231,318 | | | 1,851 | | | 3.17 | |

| Consumer loans | | 419,299 | | | 8,543 | | | 8.08 | | | 426,134 | | | 6,775 | | | 6.31 | |

| Total residential and consumer loans | | 2,013,238 | | | 23,042 | | | 4.56 | | | 1,909,281 | | | 19,545 | | | 4.08 | |

Total loans (2) | | 11,286,995 | | | 149,294 | | | 5.25 | | | 11,255,674 | | | 135,594 | | | 4.78 | |

| Loans held for sale | | 10,132 | | | 199 | | | 7.86 | | | 10,901 | | | 234 | | | 8.58 | |

| Taxable securities | | 1,193,408 | | | 6,454 | | | 2.16 | | | 1,243,089 | | | 6,047 | | | 1.95 | |

| Tax-advantaged securities | | 350,765 | | | 2,322 | | | 2.64 | | | 474,366 | | | 3,026 | | | 2.55 | |

Total investment securities (3) | | 1,544,173 | | | 8,776 | | | 2.27 | | | 1,717,455 | | | 9,073 | | | 2.11 | |

| Interest-bearing deposits with banks | | 621,007 | | | 8,456 | | | 5.40 | | | 149,651 | | | 1,427 | | | 3.78 | |

| Federal funds sold | | 276 | | | 4 | | | 5.43 | | | 553 | | | 4 | | | 2.97 | |

| Total interest-earning assets | | 13,462,583 | | | 166,729 | | | 4.92 | | | 13,134,234 | | | 146,332 | | | 4.43 | |

| | | | | | | | | | | | |

Less: allowance for credit losses - loans | | (121,851) | | | | | | | (127,404) | | | | | |

| Cash and due from banks | | 89,143 | | | | | | | 94,840 | | | | | |

| Premises and equipment, net | | 69,162 | | | | | | | 65,958 | | | | | |