0001616533FALSE00016165332025-01-082025-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 8, 2025

PENGUIN SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

Commission File Number 001-38102

| | | | | |

| Cayman Islands | 98-1013909 |

(State or Other Jurisdiction of

Incorporation or Organization) | (I.R.S. Employer

Identification No.) |

| | | | | |

| c/o Walkers Corporate Limited | |

| 190 Elgin Avenue | |

| George Town, Grand Cayman | |

| Cayman Islands | KY1-9008 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (510) 623-1231

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Ordinary shares, $0.03 par value per share | PENG | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 8, 2025, Penguin Solutions, Inc. (the “Company”) issued a press release and will hold a conference call announcing its financial results for the first quarter of fiscal 2025. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K (this “Form 8-K”) and is incorporated herein by reference.

The Company refers to non-GAAP financial information in both the press release and on the conference call. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release.

The information furnished pursuant to Item 2.02 of this Form 8-K, including the information contained in Exhibit 99.1 of this Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit

No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: January 8, 2025 | Penguin Solutions, Inc. |

| By: | /s/ Nate Olmstead |

| | Nate Olmstead |

| | Senior Vice President and Chief Financial Officer |

| | (Principal Financial and Accounting Officer) |

Exhibit 99.1

Press Release

FOR IMMEDIATE RELEASE

PENGUIN SOLUTIONS REPORTS Q1 FISCAL 2025 FINANCIAL RESULTS

Revenue up by 24% vs. Q1 FY24, highlighted by 49% growth in Advanced Computing

Milpitas, Calif. – January 8, 2025 – Penguin Solutions, Inc. (“Penguin Solutions,” “we,” “us,” or the “Company”) (NASDAQ: PENG) today reported financial results for the first quarter of fiscal 2025.

First Quarter Fiscal 2025 Highlights

•Net sales of $341 million, up 24.4% versus the year-ago quarter

•GAAP gross margin of 28.7%, down 150 basis points versus the year-ago quarter

•Non-GAAP gross margin of 30.8%, down 250 basis points versus the year-ago quarter

•GAAP diluted EPS of $0.10 versus $(0.23) in the year-ago quarter

•Non-GAAP diluted EPS of $0.49 versus $0.24 in the year-ago quarter

“Our strong performance this quarter, highlighted by a 49% year-over-year increase in Advanced Computing revenue, reflects the continued execution of our strategy to support customers navigating the complexities of AI infrastructure implementation,” said Mark Adams, CEO of Penguin Solutions. “Our approach as a provider of differentiated hardware, software and managed services enables us to serve as a trusted advisor for our large enterprise customers. Based on our positive start to the year, we are pleased to affirm our outlook for the full fiscal year,” concluded Adams.

Quarterly Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | GAAP (1) | | Non-GAAP (2) |

| (in thousands, except per share amounts) | Q1 FY25 | | Q4 FY24 | | Q1 FY24 | | Q1 FY25 | | Q4 FY24 | | Q1 FY24 |

| Net sales: | | | | | | | | | | | |

| Advanced Computing | $ | 177,426 | | | $ | 149,355 | | | $ | 118,824 | | | $ | 177,426 | | | $ | 149,355 | | | $ | 118,824 | |

| Integrated Memory | 96,706 | | | 95,832 | | | 85,668 | | | 96,706 | | | 95,832 | | | 85,668 | |

| Optimized LED | 66,970 | | | 65,961 | | | 69,755 | | | 66,970 | | | 65,961 | | | 69,755 | |

| Total net sales | $ | 341,102 | | | $ | 311,148 | | | $ | 274,247 | | | $ | 341,102 | | | $ | 311,148 | | | $ | 274,247 | |

| | | | | | | | | | | |

| Gross profit | $ | 97,812 | | | $ | 87,086 | | | $ | 82,850 | | | $ | 105,122 | | | $ | 96,007 | | | $ | 91,277 | |

| Operating income | 17,356 | | | 8,791 | | | 1,305 | | | 40,918 | | | 33,739 | | | 26,679 | |

| Net income (loss) attributable to Penguin Solutions | 5,217 | | | (24,547) | | | (11,773) | | | 26,518 | | | 20,007 | | | 12,538 | |

| Diluted earnings (loss) per share | $ | 0.10 | | | $ | (0.46) | | | $ | (0.23) | | | $ | 0.49 | | | $ | 0.37 | | | $ | 0.24 | |

(1)GAAP represents U.S. Generally Accepted Accounting Principles.

(2)Non-GAAP represents GAAP excluding the impact of certain activities. Further information regarding the Company’s use of non-GAAP measures and reconciliations between GAAP and non-GAAP measures is included within this press release.

Business Outlook

As of January 8, 2025, Penguin Solutions is providing the following financial outlook for fiscal year 2025:

| | | | | | | | | | | | | | |

| | GAAP Outlook | Adjustments | Non-GAAP Outlook |

| Net sales | 15% YoY Growth +/- 5% | — | 15% YoY Growth +/- 5% |

| Gross margin | 30% +/- 1% | 2% | (A) | 32% +/- 1% |

| Operating expenses | $335 million +/- $15 million | ($60) million | (B)(C) | $275 million +/- $15 million |

| Diluted earnings per share | $0.10 +/- $0.20 | $1.40 | (A)(B)(C)(D) | $1.50 +/- $0.20 |

| Diluted shares | 56.3 million | — | 56.3 million |

| | | | | |

| Non-GAAP adjustments (in millions) | |

| (A) Share-based compensation and amortization of acquisition-related intangibles included in cost of sales | $ | 31 | |

| (B) Share-based compensation and amortization of acquisition-related intangibles included in R&D and SG&A | 48 | |

| (C) Other adjustments | 12 | |

| (D) Estimated income tax effects | (12) | |

| $ | 79 | |

First Quarter Fiscal 2025 Earnings Conference Call and Webcast Details

Penguin Solutions will hold a conference call and webcast to discuss the first quarter of fiscal 2025 results and related matters today, January 8, 2025, at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time). Interested parties may access the call by dialing +1-833-470-1428 in the United States or +1-929-526-1599 from international locations, using the access code 213238. The earnings presentation and a live webcast of the conference call can be accessed from the Company’s investor relations website (https://ir.penguinsolutions.com/investors/default.aspx) where they will remain available for approximately one year.

Use of Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements concerning or regarding future events and the future financial and operating performance of Penguin Solutions; statements regarding the extent and timing of and expectations regarding Penguin Solutions’ future revenues and expenses; statements regarding Penguin Solutions’ strategic transformation and priorities; statements regarding long-term effective tax rates; and statements regarding the business and financial outlook for the next fiscal year described under “Business Outlook” above.

These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipate,” “target,” “expect,” “estimate,” “intend,” “plan,” “goal,” “believe,” “could,” and other words of similar meaning. Forward-looking statements provide our current expectations or forecasts of future events, circumstances, results or aspirations and are subject to a number of significant risks, uncertainties and other factors, many of which are outside of our control, including but not limited to: global business and economic conditions and growth trends in technology industries (including trends and markets related to artificial intelligence), our customer markets and various geographic regions; uncertainties in the geopolitical environment; the ability to manage our cost structure; disruptions in our operations or supply chain as a result of global pandemics or otherwise; changes in trade regulations or adverse developments in international trade relations and agreements; changes in currency exchange rates; overall information technology spending; appropriations for government spending; the success of our strategic initiatives including our rebranding and related strategy, any potential collaborations and additional investments in new products and additional capacity; acquisitions of companies or technologies and the failure to successfully integrate and operate them or customers’ negative reactions to them; issues, delays or complications in integrating the operations of Stratus

Technologies; failure to achieve the intended benefits of the sale of SMART Brazil and its business; limitations on or changes in the availability of supply of materials and components; fluctuations in material costs; the temporary or volatile nature of pricing trends in memory or elsewhere; deterioration in customer relationships; our dependence on a select number of customers and the timing and volume of customer orders; production or manufacturing difficulties; competitive factors; technological changes; difficulties with, or delays in, the introduction of new products; slowing or contraction of growth in the memory market, LED market or other markets in which we participate; changes to applicable tax regimes or rates; changes to the valuation allowance for our deferred tax assets, including any potential inability to realize these assets in the future; prices for the end products of our customers; strikes or labor disputes; deterioration in or loss of relations with any of our limited number of key vendors; the inability to maintain or expand government business; and the continuing availability of borrowings under term loans and revolving lines of credit and our ability to raise capital through debt or equity financings.

These and other risks, uncertainties and factors are described in greater detail under the sections titled “Risk Factors,” “Critical Accounting Estimates,” “Results of Operations,” “Quantitative and Qualitative Disclosures About Market Risk” and “Liquidity and Capital Resources” contained in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and our other filings with the U.S. Securities and Exchange Commission. In addition, such risks, uncertainties and factors as outlined above and in such filings do not constitute all risks, uncertainties and factors that could cause our actual results to be materially different from such forward-looking statements. Accordingly, investors are cautioned not to place undue reliance on any forward-looking statements. Any forward-looking statements that we make in this press release speak only as of the date of this press release. Except as required by law, we do not undertake to update the forward-looking statements contained in this press release to reflect the impact of circumstances or events that may arise after the date that the forward-looking statements were made.

Statement Regarding Use of Non-GAAP Financial Measures

This press release and the accompanying tables contain the following non-GAAP financial measures: non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP effective tax rate, non-GAAP net income, non-GAAP weighted-average shares outstanding, non-GAAP diluted earnings per share and Adjusted EBITDA. Penguin Solutions management uses these non-GAAP measures to supplement Penguin Solutions’ financial results under GAAP. Management uses these measures to analyze its operations and make decisions as to future operational plans and believes that this supplemental non-GAAP information is useful to investors in analyzing and assessing the Company’s past and future operating performance. These non-GAAP measures exclude certain items, such as share-based compensation expense; amortization of acquisition-related intangible assets (consisting of amortization of developed technology, customer relationships and trademarks/trade names acquired in connection with business combinations); cost of sales-related restructuring; diligence, acquisition and integration expense; restructuring charges; impairment of goodwill; changes in the fair value of contingent consideration; gains (losses) from changes in foreign currency exchange rates; amortization of debt issuance costs; gain (loss) on extinguishment or prepayment of debt; other infrequent or unusual items and related tax effects and other tax adjustments. While amortization of acquisition-related intangible assets is excluded, the revenues from acquired companies are reflected in the Company’s non-GAAP measures and these intangible assets contribute to revenue generation. Management believes the presentation of operating results that exclude certain items provides useful supplemental information to investors and facilitates the analysis of the Company’s core operating results and comparison of operating results across reporting periods. Management also uses adjusted EBITDA, which represents GAAP net income (loss), adjusted for net interest expense; income tax provision (benefit); depreciation expense and amortization of intangible assets; share-based compensation expense; cost of sales-related restructuring; diligence, acquisition and integration expense; restructuring charges; loss on extinguishment of debt and other infrequent or unusual items.

In fiscal 2024, for our non-GAAP reporting, we began to utilize a long-term projected non-GAAP effective tax rate of 28%, which includes the tax impact of pre-tax non-GAAP adjustments and reflects currently available information as well as other factors and assumptions. While we expect to use this normalized non-GAAP effective tax rate through fiscal 2025, this long-term non-GAAP effective tax rate may be subject to change for a variety of reasons, including the rapidly evolving global tax environment, significant changes in our geographic earnings mix or changes to our strategy or business operations. Our GAAP effective tax rate can vary significantly from quarter

to quarter based on a variety of factors, including, but not limited to, discrete items which are recorded in the period they occur, the tax effects of certain items of income or expense, significant changes in our geographic earnings mix or changes to our strategy or business operations. We are unable to predict the timing and amounts of these items, which could significantly impact our GAAP effective tax rate, and therefore we are unable to reconcile our forward-looking non-GAAP effective tax rate measure to our GAAP effective tax rate.

Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP, as they exclude important information about Penguin Solutions’ financial results, as noted above. The presentation of these adjusted amounts varies from amounts presented in accordance with GAAP and therefore may not be comparable to amounts reported by other companies. In addition, adjusted EBITDA does not purport to represent cash flow provided by, or used for, operating activities in accordance with GAAP and should not be used as a measure of liquidity. Investors are encouraged to review the “Reconciliation of GAAP to Non-GAAP Measures” tables below.

About Penguin Solutions

The most exciting technological advancements are also the most challenging for companies to adopt. At Penguin Solutions, we support our customers in achieving their ambitions across our computing, memory, and LED lines of business. With our expert skills, experience, and partnerships, we turn our customers’ most complex challenges into compelling opportunities.

For more information, visit www.penguinsolutions.com.

Penguin Solutions, Inc.

Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | November 29,

2024 | | August 30,

2024 | | December 1,

2023 | | | | |

| Net sales: | | | | | | | | | |

| Advanced Computing | $ | 177,426 | | | $ | 149,355 | | | $ | 118,824 | | | | | |

| Integrated Memory | 96,706 | | | 95,832 | | | 85,668 | | | | | |

| Optimized LED | 66,970 | | | 65,961 | | | 69,755 | | | | | |

| Total net sales | 341,102 | | | 311,148 | | | 274,247 | | | | | |

| Cost of sales | 243,290 | | | 224,062 | | | 191,397 | | | | | |

| Gross profit | 97,812 | | | 87,086 | | | 82,850 | | | | | |

| | | | | | | | | |

| Operating expenses: | | | | | | | | | |

| Research and development | 19,811 | | | 19,941 | | | 21,389 | | | | | |

| Selling, general and administrative | 60,536 | | | 58,029 | | | 57,217 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other operating (income) expense | 109 | | | 325 | | | 2,939 | | | | | |

| Total operating expenses | 80,456 | | | 78,295 | | | 81,545 | | | | | |

| Operating income (loss) | 17,356 | | | 8,791 | | | 1,305 | | | | | |

| | | | | | | | | |

| Non-operating (income) expense: | | | | | | | | | |

| Interest expense, net | 4,396 | | | 5,403 | | | 9,559 | | | | | |

| Other non-operating (income) expense | 636 | | | 20,971 | | | (576) | | | | | |

| Total non-operating (income) expense | 5,032 | | | 26,374 | | | 8,983 | | | | | |

| Income (loss) before taxes | 12,324 | | | (17,583) | | | (7,678) | | | | | |

| | | | | | | | | |

| Income tax provision | 6,360 | | | 6,209 | | | 3,534 | | | | | |

| Net income (loss) from continuing operations | 5,964 | | | (23,792) | | | (11,212) | | | | | |

| Net loss from discontinued operations | — | | | — | | | (8,148) | | | | | |

| Net income (loss) | 5,964 | | | (23,792) | | | (19,360) | | | | | |

| Net income attributable to noncontrolling interest | 747 | | | 755 | | | 561 | | | | | |

| Net income (loss) attributable to Penguin Solutions | $ | 5,217 | | | $ | (24,547) | | | $ | (19,921) | | | | | |

| | | | | | | | | |

| Basic earnings (loss) per share: | | | | | | | | | |

| Continuing operations | $ | 0.10 | | | $ | (0.46) | | | $ | (0.23) | | | | | |

| Discontinued operations | — | | | — | | | (0.15) | | | | | |

| $ | 0.10 | | | $ | (0.46) | | | $ | (0.38) | | | | | |

| | | | | | | | | |

| Diluted earnings (loss) per share: | | | | | | | | | |

| Continuing operations | $ | 0.10 | | | $ | (0.46) | | | $ | (0.23) | | | | | |

| Discontinued operations | — | | | — | | | (0.15) | | | | | |

| $ | 0.10 | | | $ | (0.46) | | | $ | (0.38) | | | | | |

| | | | | | | | | |

| Shares used in per share calculations: | | | | | | | | | |

| Basic | 53,482 | | | 53,071 | | | 52,068 | | | | | |

| Diluted | 54,312 | | | 53,071 | | | 52,068 | | | | | |

Penguin Solutions, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(In thousands, except percentages)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | November 29,

2024 | | August 30,

2024 | | December 1,

2023 | | | | |

| GAAP gross profit | $ | 97,812 | | | $ | 87,086 | | | $ | 82,850 | | | | | |

| Share-based compensation expense | 1,643 | | | 1,847 | | | 1,815 | | | | | |

| Amortization of acquisition-related intangibles | 5,909 | | | 5,909 | | | 5,944 | | | | | |

| | | | | | | | | |

| Cost of sales-related restructuring | (42) | | | 865 | | | 668 | | | | | |

| Other | (200) | | | 300 | | | — | | | | | |

| Non-GAAP gross profit | $ | 105,122 | | | $ | 96,007 | | | $ | 91,277 | | | | | |

| | | | | | | | | | |

| GAAP gross margin | 28.7 | % | | 28.0 | % | | 30.2 | % | | | | |

| Effect of adjustments | 2.1 | % | | 2.9 | % | | 3.1 | % | | | | |

| Non-GAAP gross margin | 30.8 | % | | 30.9 | % | | 33.3 | % | | | | |

| | | | | | | | | |

| GAAP operating expenses | $ | 80,456 | | | $ | 78,295 | | | $ | 81,545 | | | | | |

| Share-based compensation expense | (9,888) | | | (8,512) | | | (9,155) | | | | | |

| Amortization of acquisition-related intangibles | (3,846) | | | (3,838) | | | (4,064) | | | | | |

| Diligence, acquisition and integration expense | (833) | | | (2,094) | | | (789) | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Restructuring charges | (109) | | | (325) | | | (2,939) | | | | | |

| Other | (1,576) | | | (1,258) | | | — | | | | | |

| Non-GAAP operating expenses | $ | 64,204 | | | $ | 62,268 | | | $ | 64,598 | | | | | |

| | | | | | | | | | |

| GAAP operating income | $ | 17,356 | | | $ | 8,791 | | | $ | 1,305 | | | | | |

| Share-based compensation expense | 11,531 | | | 10,359 | | | 10,970 | | | | | |

| Amortization of acquisition-related intangibles | 9,755 | | | 9,747 | | | 10,008 | | | | | |

| | | | | | | | | |

| Cost of sales-related restructuring | (42) | | | 865 | | | 668 | | | | | |

| Diligence, acquisition and integration expense | 833 | | | 2,094 | | | 789 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Restructuring charges | 109 | | | 325 | | | 2,939 | | | | | |

| Other | 1,376 | | | 1,558 | | | — | | | | | |

| Non-GAAP operating income | $ | 40,918 | | | $ | 33,739 | | | $ | 26,679 | | | | | |

Penguin Solutions, Inc.

Reconciliation of GAAP to Non-GAAP Measures

(In thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | November 29,

2024 | | August 30,

2024 | | December 1,

2023 | | | | |

| GAAP net income (loss) attributable to Penguin Solutions | $ | 5,217 | | | $ | (24,547) | | | $ | (11,773) | | | | | |

| Share-based compensation expense | 11,531 | | | 10,359 | | | 10,970 | | | | | |

| Amortization of acquisition-related intangibles | 9,755 | | | 9,747 | | | 10,008 | | | | | |

| | | | | | | | | |

| Cost of sales-related restructuring | (42) | | | 865 | | | 668 | | | | | |

| Diligence, acquisition and integration expense | 833 | | | 2,094 | | | 789 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Restructuring charges | 109 | | | 325 | | | 2,939 | | | | | |

| Amortization of debt issuance costs | 953 | | | 897 | | | 1,042 | | | | | |

| Loss (gain) on extinguishment or prepayment of debt | — | | | 21,646 | | | — | | | | | |

| Foreign currency (gains) losses | 1,028 | | | (1,072) | | | (546) | | | | | |

| Other | 1,376 | | | 1,558 | | | — | | | | | |

| Income tax effects | (4,242) | | | (1,865) | | | (1,559) | | | | | |

| Non-GAAP net income attributable to Penguin Solutions | $ | 26,518 | | | $ | 20,007 | | | $ | 12,538 | | | | | |

| | | | | | | | | |

| Weighted-average shares outstanding - Diluted: | | | | | | | | | |

| GAAP weighted-average shares outstanding | 54,312 | | | 53,071 | | | 52,068 | | | | | |

| Adjustment for dilutive securities and capped calls | — | | | 1,434 | | | 1,213 | | | | | |

| Non-GAAP weighted-average shares outstanding | 54,312 | | | 54,505 | | | 53,281 | | | | | |

| | | | | | | | | |

| Diluted earnings (loss) per share from continuing operations: | | | | | | | | | |

| GAAP diluted earnings (loss) per share | $ | 0.10 | | | $ | (0.46) | | | $ | (0.23) | | | | | |

| Effect of adjustments | 0.39 | | | 0.83 | | | 0.47 | | | | | |

| Non-GAAP diluted earnings per share | $ | 0.49 | | | $ | 0.37 | | | $ | 0.24 | | | | | |

| | | | | | | | | | |

| Net income (loss) attributable to Penguin Solutions | $ | 5,217 | | | $ | (24,547) | | | $ | (11,773) | | | | | |

| Interest expense, net | 4,396 | | | 5,403 | | | 9,559 | | | | | |

| Income tax provision (benefit) | 6,360 | | | 6,209 | | | 3,534 | | | | | |

| Depreciation expense and amortization of intangible assets | 14,961 | | | 15,381 | | | 17,654 | | | | | |

| Share-based compensation expense | 11,531 | | | 10,359 | | | 10,970 | | | | | |

| | | | | | | | | |

| Cost of sales-related restructuring | (42) | | | 865 | | | 668 | | | | | |

| Diligence, acquisition and integration expense | 833 | | | 2,094 | | | 789 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Restructuring charges | 109 | | | 325 | | | 2,939 | | | | | |

| Loss on extinguishment of debt | — | | | 21,646 | | | — | | | | | |

| Other | 1,376 | | | 1,558 | | | — | | | | | |

| Adjusted EBITDA | $ | 44,741 | | | $ | 39,293 | | | $ | 34,340 | | | | | |

Penguin Solutions, Inc.

Consolidated Balance Sheets

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| As of | November 29,

2024 | | August 30,

2024 |

| Assets | | | |

| Cash and cash equivalents | $ | 370,295 | | | $ | 383,147 | |

| Short-term investments | 23,430 | | | 6,337 | |

| Accounts receivable, net | 275,629 | | | 251,743 | |

| Inventories | 246,952 | | | 151,213 | |

| Other current assets | 79,273 | | | 75,264 | |

| | | |

| Total current assets | 995,579 | | | 867,704 | |

| Property and equipment, net | 100,239 | | | 106,548 | |

| Operating lease right-of-use assets | 58,317 | | | 60,349 | |

| Intangible assets, net | 111,926 | | | 121,454 | |

| Goodwill | 161,958 | | | 161,958 | |

| Deferred tax assets | 84,934 | | | 85,078 | |

| Other noncurrent assets | 70,062 | | | 71,415 | |

| | | |

| Total assets | $ | 1,583,015 | | | $ | 1,474,506 | |

| | | |

| Liabilities and Equity | | | |

| Accounts payable and accrued expenses | $ | 284,636 | | | $ | 219,090 | |

| | | |

| Deferred revenue | 41,326 | | | 63,954 | |

| | | |

| Other current liabilities | 100,924 | | | 44,552 | |

| | | |

| Total current liabilities | 426,886 | | | 327,596 | |

| Long-term debt | 658,070 | | | 657,347 | |

| Noncurrent operating lease liabilities | 58,611 | | | 60,542 | |

| | | |

| Other noncurrent liabilities | 30,499 | | | 29,813 | |

| | | |

| Total liabilities | 1,174,066 | | | 1,075,298 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Penguin Solutions shareholders’ equity: | | | |

| Preferred shares | — | | | — | |

| Ordinary shares | 1,832 | | | 1,807 | |

| Additional paid-in capital | 528,201 | | | 513,335 | |

| Retained earnings | 35,202 | | | 29,985 | |

| Treasury shares | (164,879) | | | (153,756) | |

| Accumulated other comprehensive income (loss) | 19 | | | 10 | |

| Total Penguin Solutions shareholders’ equity | 400,375 | | | 391,381 | |

| Noncontrolling interest in subsidiary | 8,574 | | | 7,827 | |

| Total equity | 408,949 | | | 399,208 | |

| Total liabilities and equity | $ | 1,583,015 | | | $ | 1,474,506 | |

Penguin Solutions, Inc.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| November 29,

2024 | | August 30,

2024 | | December 1,

2023 | | | | |

| Cash flows from operating activities | | | | | | | | | |

| Net income (loss) | $ | 5,964 | | | $ | (23,792) | | | $ | (19,360) | | | | | |

| Net loss from discontinued operations | — | | | — | | | (8,148) | | | | | |

| Net income (loss) from continuing operations | 5,964 | | | (23,792) | | | (11,212) | | | | | |

| Adjustments to reconcile net income (loss) from continuing operations to cash provided by (used for) operating activities | | | | | | | | | |

| Depreciation expense and amortization of intangible assets | 14,961 | | | 15,381 | | | 17,654 | | | | | |

| Amortization of debt issuance costs | 953 | | | 897 | | | 1,042 | | | | | |

| Share-based compensation expense | 11,531 | | | 10,359 | | | 10,970 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Loss on extinguishment or prepayment of debt | — | | | 21,646 | | | — | | | | | |

| Deferred income taxes, net | 211 | | | (7,396) | | | (282) | | | | | |

| Other | (712) | | | 83 | | | 664 | | | | | |

| Changes in operating assets and liabilities: | | | | | | | | | |

| Accounts receivable | (23,885) | | | (39,901) | | | 48,658 | | | | | |

| Inventories | (93,380) | | | 26,086 | | | (33,464) | | | | | |

| Other assets | 705 | | | 14,801 | | | 2,102 | | | | | |

| Accounts payable and accrued expenses and other liabilities | 97,471 | | | (30,320) | | | 23,581 | | | | | |

| | | | | | | | | |

| Net cash provided by (used for) operating activities from continuing operations | 13,819 | | | (12,156) | | | 59,713 | | | | | |

| Net cash used for operating activities from discontinued operations | — | | | — | | | (28,235) | | | | | |

| Net cash provided by (used for) operating activities | 13,819 | | | (12,156) | | | 31,478 | | | | | |

| | | | | | | | | |

| Cash flows from investing activities | | | | | | | | | |

| Capital expenditures and deposits on equipment | (1,836) | | | (5,795) | | | (4,648) | | | | | |

| | | | | | | | | |

| Proceeds from maturities of investment securities | 3,780 | | | 7,525 | | | 9,665 | | | | | |

| Purchases of held-to-maturity investment securities | (20,723) | | | — | | | (8,469) | | | | | |

| Purchases of non-marketable investments | — | | | (10,000) | | | — | | | | | |

| Other | (143) | | | (8) | | | (188) | | | | | |

| Net cash used for investing activities from continuing operations | (18,922) | | | (8,278) | | | (3,640) | | | | | |

| Net cash provided by investing activities from discontinued operations | — | | | — | | | 118,938 | | | | | |

| Net cash provided by (used for) investing activities | $ | (18,922) | | | $ | (8,278) | | | $ | 115,298 | | | | | |

Penguin Solutions, Inc.

Consolidated Statements of Cash Flows, Continued

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| November 29,

2024 | | August 30,

2024 | | December 1,

2023 | | | | |

| Cash flows from financing activities | | | | | | | | | |

| Repayments of debt | $ | — | | | $ | (224,703) | | | $ | (14,423) | | | | | |

| Payments to acquire ordinary shares | (11,123) | | | (3,318) | | | (13,130) | | | | | |

| | | | | | | | | |

| Net cash paid for settlement and purchase of capped calls | — | | | (16,300) | | | — | | | | | |

| Distribution to noncontrolling interest | — | | | — | | | (1,470) | | | | | |

| | | | | | | | | |

| Proceeds from debt | — | | | 192,694 | | | — | | | | | |

| Proceeds from issuance of ordinary shares | 3,360 | | | 1,745 | | | 3,455 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other | — | | | 2 | | | (582) | | | | | |

| Net cash used for financing activities from continuing operations | (7,763) | | | (49,880) | | | (26,150) | | | | | |

| Net cash used for financing activities from discontinued operations | — | | | — | | | (606) | | | | | |

| Net cash used for financing activities | (7,763) | | | (49,880) | | | (26,756) | | | | | |

| | | | | | | | | |

| Effect of changes in currency exchange rates | — | | | — | | | (1,025) | | | | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (12,866) | | | (70,314) | | | 118,995 | | | | | |

| Cash, cash equivalents and restricted cash at beginning of period | 383,477 | | | 453,791 | | | 410,064 | | | | | |

| Cash, cash equivalents and restricted cash at end of period | $ | 370,611 | | | $ | 383,477 | | | $ | 529,059 | | | | | |

| | | | | |

| Investor Contact: | PR Contact: |

| Suzanne Schmidt | Maureen O’Leary |

| Investor Relations | Director Communications |

| +1-510-360-8596 | 1-602-330-6846 |

ir@penguinsolutions.com | pr@penguinsolutions.com |

v3.24.4

Cover

|

Jan. 08, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 08, 2025

|

| Entity Registrant Name |

PENGUIN SOLUTIONS, INC.

|

| Entity File Number |

001-38102

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Tax Identification Number |

98-1013909

|

| Entity Address, Address Line One |

c/o Walkers Corporate Limited

|

| Entity Address, Address Line Two |

190 Elgin Avenue

|

| Entity Address, City or Town |

George Town, Grand Cayman

|

| Entity Address, Country |

KY

|

| Entity Address, Postal Zip Code |

KY1-9008

|

| City Area Code |

510

|

| Local Phone Number |

623-1231

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary shares, $0.03 par value per share

|

| Trading Symbol |

PENG

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001616533

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

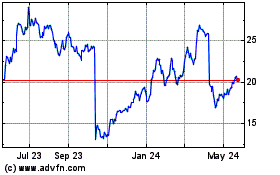

SMART Global (NASDAQ:SGH)

Historical Stock Chart

From Jan 2025 to Feb 2025

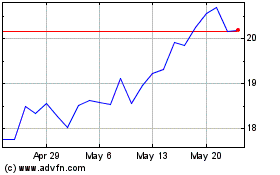

SMART Global (NASDAQ:SGH)

Historical Stock Chart

From Feb 2024 to Feb 2025