Sight Sciences, Inc. (Nasdaq: SGHT) ("Sight Sciences" or the

"Company"), an eyecare technology company focused on developing and

commercializing innovative, interventional technologies that

elevate the standard of care, today reported financial results for

the third quarter ended September 30, 2024, and updated its

adjusted operating expenses guidance for full year 2024.

Third Quarter 2024 Financial and Business

Highlights

- Generated total revenue of $20.2

million, an increase of 1% compared to the same period in the prior

year.

- Generated positive cash flow of

$0.4 million, a substantial improvement compared to $10.0 million

cash used in the third quarter of 2023, reflecting continued

operational discipline and significant working capital

improvements. Cash used in the nine months ended September 30, 2024

was $19.6 million compared to $40.5 million in the same period in

the prior year.

- Five Medicare Administrative

Contractors (“MACs”), each individually published final local

coverage determinations and related final local coverage articles

(collectively, the “Final LCDs”) regarding Micro-Invasive Glaucoma

Surgery (“MIGS”). The Final LCDs confirm Medicare coverage for

phacoemulsification / intraocular lens placement procedures (each,

a “cataract surgery”) performed with a single MIGS procedure,

including both canaloplasty and goniotomy procedures. Accordingly,

Medicare coverage for canaloplasty and goniotomy procedures will

continue in the states administered by these MACs. The anticipated

effective date of the Final LCDs is November 17, 2024.

Management Commentary

"In the third quarter, our Surgical Glaucoma

revenue improved slightly but our recovery did not meet our growth

expectations, while our Dry Eye revenue outperformed our

expectations ahead of our price increase, which was a testament to

the importance of TearCare in the treatment paradigm for dry eye

patients,” said Paul Badawi, co-founder and Chief Executive Officer

of Sight Sciences. “The LCDs that will be effective later this

month will provide clarity with continued Medicare coverage for

cataract surgery procedures performed with a single MIGS procedure

and restrictions on multiple MIGS procedures performed in a single

surgery. Surgical glaucoma reimbursement coverage clarity coupled

with the continued optimization of our commercial organization and

strategy position us for stronger performance and predictability.

With our procedurally comprehensive OMNI technology, and an

increasing interventional surgeon mindset, we remain confident in

the growth trajectory for OMNI in both combination cataract and

standalone use cases in 2025 and beyond.”

“We also remain focused on establishing

equitable market access for TearCare and are working towards

positive coverage policies and payment schedules in 2025,” Paul

Badawi continued. “We believe these developments help lay the

foundation to establish Sight Sciences as a leading interventional

eye care company and position us for growth in 2025 and

beyond.”

Third Quarter 2024 Financial

ResultsRevenue for the third quarter of 2024 was $20.2

million, an increase of 1% compared to the same period in the prior

year. Surgical Glaucoma revenue was $18.6 million, an increase of

1% compared to the same period in the prior year. This increase was

primarily driven by higher account utilization, which increased by

3% versus the same period in the prior year. Dry Eye revenue was

$1.5 million, a decrease of 4% from the same period in the prior

year, but ahead of expectations for segment revenue during the

period. The expected decline was primarily due to fewer new

accounts and related SmartHub® sales, which was a result of the

Company’s focus on achieving market access for TearCare

procedures.

Gross profit for the third quarter of 2024 was

$16.9 million compared to $17.3 million in the same period in the

prior year. Gross margin for the third quarter of 2024 was 84%,

compared to 87% in the same period in the prior year, as expected

due to higher overhead costs per unit in the current period as a

result of lower production volumes in both segments. Surgical

Glaucoma gross margin in the third quarter of 2024 declined to 87%,

compared to 89% in the same period in the prior year. Dry Eye gross

margin in the third quarter of 2024 declined to 48%, from 57% in

the same period in the prior year.

Total operating expenses were $28.1 million in

the third quarter of 2024, representing an 8% decrease compared to

$30.7 million in the same period in the prior year, which reflects

improved operating expense leverage compared to the same period in

the prior year. The decrease was primarily due to lower legal

expenses in the comparative periods. Research and development

expenses were $4.7 million in the third quarter of 2024 compared to

$4.2 million in the same period in the prior year, representing a

12% increase. Selling, general, and administrative expenses were

$23.4 million in the third quarter of 2024, compared to $26.5

million in the same period in the prior year, representing a 12%

decrease. Adjusted operating expenses1,2 were $23.8 million in the

third quarter of 2024, down from $26.8 million in the same period

in the prior year, representing an 11% decrease.

Net loss was $11.1 million ($0.22 per share) in

the third quarter of 2024, compared to $13.0 million ($0.27 per

share) in the same period in the prior year.

Cash and cash equivalents totaled $118.6 million

and total long-term debt was $35.0 million (before debt discount

and amortized debt issuance costs) as of September 30, 2024,

compared to $118.2 million and $35.0 million, respectively, as of

June 30, 2024. Cash generated in the third quarter of 2024 totaled

$0.4 million, compared to $10.0 million of cash used in the same

period in the prior year, reflecting continued operational

discipline and a substantial improvement in working capital.

2024 Financial GuidanceSight

Sciences maintains its revenue guidance expectations for full year

2024 of approximately $81.0 million to $83.0 million.

The Company continues to expect double-digit

Surgical Glaucoma revenue growth in the fourth quarter of 2024

compared to the same period in the prior year as it regains

commercial momentum and expands utilization and its customer base.

However, the Company also acknowledges headwinds to growth in the

total number of MIGS devices used in MIGS procedures due to the

Final LCDs’ limitations on multiple MIGS used in a single surgery

effective mid-quarter, and the slower than expected recovery in

Surgical Glaucoma utilization and active accounts experienced in

the third quarter of 2024.

The Company expects Dry Eye revenue for the

fourth quarter 2024 to be less than $0.5 million. Dry Eye revenue

is still expected to decrease following the implementation of an

increase in dry eye pricing effective October 1, 2024, which is

expected to have a significant negative impact on cash-pay

procedure volumes in the fourth quarter of 2024, before the Company

expects a return to growth in 2025 with market access wins.

The Company revises its guidance expectations

for adjusted operating expenses1,3 for full year 2024 to

approximately $104.0 million to $106.0 million from $107.0 million

to $109.0 million previously reported, representing a decrease of

approximately 4% to 6% compared to 2023.

The Company's full year 2024 financial guidance

is forward-looking in nature, reflecting management’s expectations

as of November 7, 2024, and is subject to significant risks and

uncertainties that limit its ability to accurately forecast

results. This outlook assumes no meaningful changes to the

Company's business prospects or risks and uncertainties identified

by management that could impact future results, which include, but

are not limited to: changes to coverage decisions or reimbursement

rates for our products, pricing pressure or loss of market share

resulting from the evolving competitive landscape; and disruptions

to or increased costs associated with our supply chain, including

as a result of having a limited number of suppliers.

1 “Adjusted operating expenses” is a financial

measure not prepared in accordance with the generally accepted

accounting principles in the United States (“GAAP,” and such

measure, a “non-GAAP financial measure”), and is calculated as

operating expenses less stock-based compensation expense,

depreciation and amortization, and restructuring costs. Please see

the “Non-GAAP Financial Measures” section below for additional

information.2 A reconciliation of the non-GAAP financial measures

to the most directly comparable GAAP financial measures has been

provided in the table titled "Non-GAAP to GAAP Reconciliation"

attached to this press release.3 Consistent with Securities and

Exchange Commission regulations, the Company has not provided a

reconciliation of forward-looking non-GAAP financial measures to

the most directly comparable GAAP financial measures in reliance on

the “unreasonable efforts” exception set forth in the applicable

regulations, because there is substantial uncertainty associated

with predicting any future adjustments that may be made to the

Company’s GAAP financial measures in calculating the non-GAAP

financial measures.

Non-GAAP Financial Measures

Certain non-GAAP financial measures, including

adjusted operating expenses, are presented in this press release to

provide information that may assist investors in understanding the

Company's financial and operating results. The Company believes

these non-GAAP financial measures are important performance

indicators because they exclude items that are unrelated to, and

may not be indicative of, the Company's core financial and

operating results. These non-GAAP financial measures, as

calculated, may not necessarily be comparable to similarly titled

measures of other companies and may not be appropriate measures for

comparing the performance of other companies relative to the

Company. These non-GAAP financial measures are not intended to

represent, and should not be considered to be more meaningful

measures than, or alternatives to, measures of operating

performance as determined in accordance with GAAP. To the extent

the Company utilizes such non-GAAP financial measures in the

future, it expects to calculate them using a consistent method from

period to period.

Conference Call Sight Sciences'

management team will host a conference call today, November 7,

2024, beginning at 1:30 p.m. Pacific Time / 4:30 p.m. Eastern Time.

Investors interested in listening to the conference call may do so

by accessing a live and archived webcast of the event at

www.sightsciences.com, on the Investors page in the News &

Events section.

About Sight SciencesSight

Sciences is an eyecare technology company focused on developing and

commercializing innovative and interventional solutions intended to

transform care and improve patients’ lives. Using minimally

invasive or non-invasive approaches to target the underlying causes

of the world’s most prevalent eye diseases, Sight Sciences seeks to

create more effective treatment paradigms that enhance patient care

and supplant conventional outdated approaches. The Company’s OMNI®

Surgical System is an implant-free glaucoma surgery technology (i)

indicated in the United States to reduce intraocular pressure in

adult patients with primary open-angle glaucoma; and (ii) CE Marked

for the catheterization and transluminal viscodilation of Schlemm’s

canal and cutting of the trabecular meshwork to reduce intraocular

pressure in adult patients with open-angle glaucoma. Glaucoma is

the world’s leading cause of irreversible blindness. The SION®

Surgical Instrument is a bladeless, manually operated device used

in ophthalmic surgical procedures to excise trabecular meshwork.

The Company’s TearCare® System is 510(k) cleared in the United

States for the application of localized heat therapy in adult

patients with evaporative dry eye disease due to meibomian gland

dysfunction (“MGD”), enabling clearance of gland obstructions by

physicians to address the leading cause of dry eye disease. Visit

www.sightsciences.com for more information.

Sight Sciences, TearCare, SmartHub and SmartLids

are trademarks of Sight Sciences registered in the United States.

OMNI and SION are trademarks of Sight Sciences registered in the

United States, European Union and other territories.

© 2024 Sight Sciences. All rights reserved.

Forward-Looking StatementsThis

press release, together with other statements and information

publicly disseminated by the Company, contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The Company intends

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with these safe harbor

provisions. Any statements made in this press release or during the

earnings call that are not statements of historical fact, including

statements about our beliefs and expectations, are forward-looking

statements and should be evaluated as such. Forward-looking

statements include, but are not limited to, statements concerning

our clinical and market access progress; our ability to support

expanded use cases for our products and reengage existing

customers; the impact of our dry eye pricing strategy; our ability

to achieve our 2024 revenue guidance and updated adjusted operating

expenses guidance; our ability to achieve Surgical Glaucoma revenue

growth in the fourth quarter of 2024; our estimated Dry Eye revenue

and growth prospects in the segment in 2025; the impact of the

adoption of the Final LCDs on our growth; and optimization of our

commercial organization to help drive stronger performance and

predictability.

These statements often include words such as

"anticipate," "expect," “suggests,” “plan,” “believe,” “intend,”

“estimates,” “targets,” “projects,” “should,” “could,” “would,”

“may,” “will,” “forecast” and other similar expressions. We base

these forward-looking statements on our current expectations, plans

and assumptions we have made in light of our experience in the

industry, as well as our perceptions of historical trends, current

conditions, expected future developments and other factors we

believe are appropriate under the circumstances at such time.

Although we believe these forward-looking statements are based on

reasonable assumptions at the time they are made, you should be

aware that many factors could affect our business, results of

operations and financial condition and could cause actual results

to differ materially from those expressed in the forward-looking

statements. These statements are not guarantees of future

performance or results. These forward-looking statements are

subject to and involve numerous risks, uncertainties and

assumptions, including those discussed under the caption “Risk

Factors” in our filings with the U.S. Securities and Exchange

Commission, as may be updated from time to time in subsequent

filings, and you should not place undue reliance on these

statements. These cautionary statements are made only as of the

date of this press release. We undertake no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law.

Investor contact:Philip TaylorGilmartin

Group415.937.5406Investor.Relations@Sightsciences.com

Media contact:

pr@SightSciences.com

SIGHT SCIENCES,

INC.Condensed Consolidated Balance Sheets

(Unaudited)(in thousands, except share and per

share data)

|

|

|

September 30, |

|

|

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

118,564 |

|

|

$ |

138,129 |

|

|

Accounts receivable, net of allowance for credit losses of $824 and

$1,186 at September 30, 2024 and December 31, 2023,

respectively |

|

|

12,929 |

|

|

|

14,289 |

|

|

Inventory, net |

|

|

6,091 |

|

|

|

7,849 |

|

|

Prepaid expenses and other current assets |

|

|

2,885 |

|

|

|

2,604 |

|

|

Total current assets |

|

|

140,469 |

|

|

|

162,871 |

|

| Property and equipment, net |

|

|

1,448 |

|

|

|

1,640 |

|

| Operating lease right-of-use

assets |

|

|

1,100 |

|

|

|

1,458 |

|

| Other noncurrent assets |

|

|

580 |

|

|

|

682 |

|

|

Total assets |

|

$ |

143,597 |

|

|

$ |

166,651 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,297 |

|

|

$ |

1,731 |

|

|

Accrued compensation |

|

|

7,889 |

|

|

|

4,528 |

|

|

Accrued and other current liabilities |

|

|

4,613 |

|

|

|

3,774 |

|

|

Current portion - long-term debt, net |

|

|

— |

|

|

|

2,219 |

|

|

Total current liabilities |

|

|

13,799 |

|

|

|

12,252 |

|

| |

|

|

|

|

|

|

| Long-term debt, net |

|

|

34,152 |

|

|

|

31,708 |

|

| Other noncurrent liabilities |

|

|

689 |

|

|

|

2,476 |

|

|

Total liabilities |

|

|

48,640 |

|

|

|

46,436 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock, par value $0.001 per share; 10,000,000 shares

authorized; no shares issued and outstanding as of September 30,

2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

|

Common stock, par value $0.001 per share; 200,000,000 shares

authorized; 50,398,148 and 49,131,363 shares issued and outstanding

as of September 30, 2024 and December 31, 2023, respectively |

|

|

50 |

|

|

|

49 |

|

|

Additional paid-in-capital |

|

|

429,358 |

|

|

|

414,956 |

|

|

Accumulated deficit |

|

|

(334,451 |

) |

|

|

(294,790 |

) |

|

Total stockholders’ equity |

|

|

94,957 |

|

|

|

120,215 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

143,597 |

|

|

$ |

166,651 |

|

SIGHT SCIENCES,

INC.Condensed Consolidated Statements of

Operations and Comprehensive Loss (Unaudited)(in

thousands, except share and per share data)

|

|

|

Three Months Ended September

30, |

|

|

Nine Months Ended September

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$ |

20,157 |

|

|

$ |

20,009 |

|

|

$ |

60,792 |

|

|

$ |

62,305 |

|

| Cost of goods sold |

|

|

3,250 |

|

|

|

2,677 |

|

|

|

9,068 |

|

|

|

9,105 |

|

|

Gross profit |

|

|

16,907 |

|

|

|

17,332 |

|

|

|

51,724 |

|

|

|

53,200 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

4,746 |

|

|

|

4,239 |

|

|

|

13,698 |

|

|

|

14,129 |

|

|

Selling, general and administrative |

|

|

23,390 |

|

|

|

26,504 |

|

|

|

76,629 |

|

|

|

85,235 |

|

|

Total operating expenses |

|

|

28,136 |

|

|

|

30,743 |

|

|

|

90,327 |

|

|

|

99,364 |

|

| Loss from operations |

|

|

(11,229 |

) |

|

|

(13,411 |

) |

|

|

(38,603 |

) |

|

|

(46,164 |

) |

| Investment income |

|

|

1,454 |

|

|

|

1,897 |

|

|

|

4,628 |

|

|

|

5,499 |

|

| Interest expense |

|

|

(1,151 |

) |

|

|

(1,432 |

) |

|

|

(3,501 |

) |

|

|

(4,057 |

) |

| Loss on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

(1,962 |

) |

|

|

— |

|

| Other income (expense), net |

|

|

26 |

|

|

|

(11 |

) |

|

|

(25 |

) |

|

|

(34 |

) |

| Loss before income taxes |

|

|

(10,900 |

) |

|

|

(12,957 |

) |

|

|

(39,463 |

) |

|

|

(44,756 |

) |

| Provision for income taxes |

|

|

166 |

|

|

|

78 |

|

|

|

198 |

|

|

|

100 |

|

| Net loss and comprehensive

loss |

|

$ |

(11,066 |

) |

|

$ |

(13,035 |

) |

|

$ |

(39,661 |

) |

|

$ |

(44,856 |

) |

| Net loss per share attributable

to common stockholders, basic and diluted |

|

$ |

(0.22 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.79 |

) |

|

$ |

(0.92 |

) |

| Weighted-average shares used in

computing net loss per share attributable to common stockholders,

basic and diluted |

|

|

50,340,603 |

|

|

|

48,671,049 |

|

|

|

49,911,655 |

|

|

|

48,538,517 |

|

SIGHT SCIENCES,

INC.Gross Margin Disaggregation

(Unaudited)(in thousands)

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Surgical Glaucoma |

|

$ |

18,632 |

|

|

$ |

18,425 |

|

|

$ |

57,132 |

|

|

$ |

57,158 |

|

|

|

Dry Eye |

|

|

1,525 |

|

|

|

1,584 |

|

|

|

3,660 |

|

|

|

5,147 |

|

|

|

Total |

|

|

20,157 |

|

|

|

20,009 |

|

|

|

60,792 |

|

|

|

62,305 |

|

|

| Cost of goods

sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Surgical Glaucoma |

|

|

2,453 |

|

|

|

2,002 |

|

|

|

7,084 |

|

|

|

6,808 |

|

|

|

Dry Eye |

|

|

797 |

|

|

|

675 |

|

|

|

1,984 |

|

|

|

2,297 |

|

|

|

Total |

|

|

3,250 |

|

|

|

2,677 |

|

|

|

9,068 |

|

|

|

9,105 |

|

|

| Gross

profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Surgical Glaucoma |

|

|

16,179 |

|

|

|

16,423 |

|

|

|

50,048 |

|

|

|

50,350 |

|

|

|

Dry Eye |

|

|

728 |

|

|

|

909 |

|

|

|

1,676 |

|

|

|

2,850 |

|

|

|

Total |

|

|

16,907 |

|

|

|

17,332 |

|

|

|

51,724 |

|

|

|

53,200 |

|

|

| Gross

margin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Surgical Glaucoma |

|

|

86.8 |

% |

|

|

89.1 |

% |

|

|

87.6 |

% |

|

|

88.1 |

% |

|

|

Dry Eye |

|

|

47.7 |

% |

|

|

57.4 |

% |

|

|

45.8 |

% |

|

|

55.4 |

% |

|

|

Total |

|

|

83.9 |

% |

|

|

86.6 |

% |

|

|

85.1 |

% |

|

|

85.4 |

% |

|

SIGHT SCIENCES,

INC.Non-GAAP to GAAP Reconciliation

(Unaudited)(in thousands)

| |

|

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

|

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| Operating

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses |

|

$ |

28,136 |

|

|

$ |

30,743 |

|

|

$ |

90,327 |

|

|

$ |

99,364 |

|

|

|

Less: Stock-based Compensation |

|

|

(4,225 |

) |

|

|

(3,779 |

) |

|

|

(12,848 |

) |

|

|

(10,915 |

) |

|

|

Less: Depreciation and Amortization |

|

|

(158 |

) |

|

|

(160 |

) |

|

|

(536 |

) |

|

|

(455 |

) |

|

|

Less: Restructuring Costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Adjusted Operating Expenses(4) |

|

|

23,753 |

|

|

|

26,804 |

|

|

|

76,943 |

|

|

|

87,994 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 Please see the section titled "Non-GAAP Financial Measures"

for additional information.

SIGHT SCIENCES,

INC.Supplemental Financial Measures

(Unaudited)

|

|

|

Three Months Ended September

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Surgical Glaucoma active customers (5) |

|

|

1,107 |

|

|

|

1,108 |

|

| Dry Eye lid treatment units sold

(6) |

|

|

5,379 |

|

|

|

5,090 |

|

| Dry Eye active customers (7) |

|

|

296 |

|

|

|

318 |

|

| |

|

|

|

|

|

|

|

|

5 “Surgical Glaucoma active customers” means the number of

customers who ordered the OMNI® Surgical System or the SION®

Surgical Instrument during the three months ended September 30,

2024 and 2023.6 “Dry Eye lid treatment units sold” means the

quantity of TearCare® SmartLids® sold during the three months ended

September 30, 2024 and 2023.7 “Dry Eye active customers” means the

number of customers who ordered lid treatment units during the

three months ended September 30, 2024 and 2023.

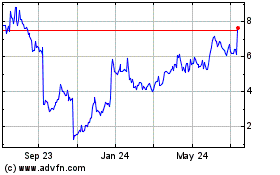

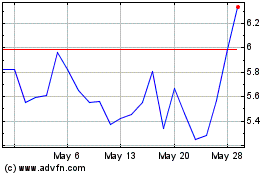

Sight Sciences (NASDAQ:SGHT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sight Sciences (NASDAQ:SGHT)

Historical Stock Chart

From Dec 2023 to Dec 2024