Sify reports Revenues of INR 6451 Million for First Quarter of FY 2021-22

30 July 2021 - 7:37PM

PERFORMANCE HIGHLIGHTS:

- Revenue

for the quarter was INR 6451 Million, a growth of 23% over the same

quarter last year.

- EBITDA

for the quarter was INR 1454 Million, an increase of 26% over the

same quarter last year.

- Profit

before tax for the quarter was INR 440 Million, an increase of 65%

over the same quarter last year.

- Profit

after tax for the quarter was INR 329 Million, an increase of 91%

over the same quarter last year.

- CAPEX

during the quarter was INR 917 Million.

- Cash

balance at the end of the quarter was INR 3515

Million.

MANAGEMENT

COMMENTARYMr. Raju Vegesna, Chairman,

said, “Lessons learned from dealing with the first wave of the

pandemic have stood us in good stead as we continue to provide

mission-critical ICT services in a challenging environment. India

has quickly bounced back from the second with Enterprises slowly

returning to at-office business. Mid-sized business, which bore the

brunt of the pandemic, are becoming more active in the market for

automation solutions. Sify is proud to have played a small role in

helping Indian Enterprises to sustain their operations and become

more resilient.

This year, critical requirements like the

National data policy and continued remote access will push security

to the top of the priority list for Enterprises. This is also

expected to accelerate the interest in data center space on a

pan-India basis.”

Mr. Kamal Nath, CEO, said,

“With industries and people steadily returning to work,

digitalization decisions are being accelerated. The trends of the

previous quarters continue to be relevant, resulting in sustained

interest in our Cloud@core portfolio of services. Work from

anywhere, migration to hosted DC and hybrid cloud platform,

strengthening of disaster recovery plans to enable business

continuity, application modernization – all these market trends are

reflected in our current customer engagements.

Data Center colocation business is one of the

fastest growing segments in India. It is led by Hyperscale Cloud

Providers, followed by Enterprises and supporting

telecommunications players. We expect this to drive our future

growth, alongside Cloud, Network and Digital services

business.”

Mr. M P Vijay Kumar, CFO, said,

“The operating performance has been stable. We continue to invest

in expansion of our data centers, network connectivity and digital

services. We will stay focused on our cost efficiency and liquidity

management, given that the economic recovery is still regaining

lost ground due to the pandemic.

Cash balance at the end of the quarter was INR

3515 Million.”

| FINANCIAL HIGHLIGHTS |

|

|

|

|

| |

|

|

|

|

|

Unaudited Consolidated Income Statement as per

IFRS |

|

|

|

| (In

INR millions) |

|

|

|

|

|

|

Quarter ended |

Quarter ended |

Quarter ended |

Year ended |

|

Description |

June |

June |

March |

March |

|

|

2021 |

2020 |

2021 |

2021 |

|

|

|

|

|

(Audited) |

|

|

|

|

|

|

|

Revenue |

6,451 |

|

5,259 |

|

6,860 |

|

24,320 |

|

|

Cost of Revenues |

(3,906 |

) |

(3,103 |

) |

(4,016 |

) |

(14,703 |

) |

|

Selling, General and Administrative Expenses |

(1,091 |

) |

(1,003 |

) |

(1,391 |

) |

(4,532 |

) |

|

|

|

|

|

|

|

EBITDA |

1,454 |

|

1,153 |

|

1,453 |

|

5,085 |

|

|

|

|

|

|

|

|

Depreciation and Amortisation expense |

(802 |

) |

(658 |

) |

(801 |

) |

(2,836 |

) |

|

Net Finance Expenses |

(227 |

) |

(236 |

) |

(195 |

) |

(790 |

) |

|

Other Income (including exchange gain) |

17 |

|

15 |

|

63 |

|

156 |

|

|

Other Expenses (including exchange loss) |

(2 |

) |

(8 |

) |

- |

|

(15 |

) |

|

|

|

|

|

|

|

Profit before tax |

440 |

|

266 |

|

520 |

|

1,600 |

|

|

Current Tax |

(118 |

) |

(101 |

) |

(250 |

) |

(672 |

) |

|

Deferred Tax |

7 |

|

7 |

|

581 |

|

604 |

|

|

Profit for the period |

329 |

|

172 |

|

851 |

|

1,532 |

|

|

|

|

|

|

|

|

Profit attributable to: |

|

|

|

|

|

Reconciliation with Non-GAAP measure |

|

|

|

|

|

Profit for the period |

329 |

|

172 |

|

851 |

|

1,532 |

|

|

Add: |

|

|

|

|

|

Depreciation and Amortisation expense |

802 |

|

658 |

|

801 |

|

2,836 |

|

|

Net Finance Expenses |

227 |

|

236 |

|

195 |

|

790 |

|

|

Other Expenses (including exchange loss) |

2 |

|

8 |

|

- |

|

15 |

|

|

Current Tax |

118 |

|

101 |

|

250 |

|

672 |

|

|

Less: |

|

|

|

|

|

Deferred Tax |

(7 |

) |

(7 |

) |

(581 |

) |

(604 |

) |

|

Other Income (including exchange gain) |

(17 |

) |

(15 |

) |

(63 |

) |

(156 |

) |

|

EBITDA |

1,454 |

|

1,153 |

|

1,453 |

|

5,085 |

|

|

|

|

|

|

|

| |

|

|

|

|

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/f285746f-3ec6-4a4e-8808-39e0f1ab2974

BUSINESS HIGHLIGHTS

-

Revenue from Data Center centric IT Services grew 45% against the

same quarter last year.

-

Segment-wise, revenue from Data Center Services grew 38%, Cloud and

Managed Services grew 24%, Applications Integration Services grew

153% and Technology Integration Services grew 20%.

-

Revenue from Network centric Services grew by 3% over the same

quarter last year.

-

Segment-wise, revenue from Data Connectivity Services grew 7% while

revenue from the Voice business fell by 14%.

|

GROWTH DRIVERS

The pandemic has accelerated the primary growth

drivers in the market for cloud adoption, led by digital

initiatives and transformation. This trend is triggering movement

of workloads from on-premise Data Centers to Hyperscale Public

Cloud and hosted Private Cloud in varied degrees, based on the

digital objectives of Enterprises. This results in transformation

of the traditional network architecture and transformation at the

edge which connects the end user. The need for digital services

like analytics, data lakes, IoT, etc are shifting the focus toward

adoption of Hybrid and Public Cloud vs Private Cloud. Collectively,

these trends are generating opportunities for full scale Cloud, DC

and Network service providers with digital services skills.

KEY WINS

A summary of the major categories of customers who are signing

up with Sify include:

- Customers choosing Sify for

migration of their on-premise data center to multi-cloud platforms

like Cloudinfinit, AWS, Azure and Oracle. They also often entrust

Sify with management and security.

- Customers choosing Sify as their DC

Hosting partner as they embrace hybrid cloud strategy.

- Customers choosing Sify as their

multi-service Digital Transformation partner.

- Customers choosing Sify as their

Network Transformation and Management partner as they migrate to

Cloud-ready networks.

A consolidated summary of the key highlights

during the quarter is noted below:

Data Center centric IT Services

highlights include:

- A subsidiary of one of the oldest

Indian MNCs contracted to migrate their on-premise DC to AWS Cloud,

while another subsidiary contracted to migrate their SAP Workload

to AWS Cloud.

- A couple of startups, among them a

gaming company and an OTT platform provider, signed up to migrate

to a global CDN platform.

- A nodal agency implementing payment

related activities for the Central bank migrated to Sify Data

Center.

- A major paint manufacturer and a

digital transformation startup focused on the financial sector

contracted to move from their on-premise DC to Sify DC.

- One of the country’s largest

Private banks and a prominent Public sector finance institution

contracted Sify to commission Private Cloud at their Data

Center.

- A State data center contracted to

augment their Data Center and deploy non-IT services.

- A Public sector bank migrated to

Sify DC as part of their consolidation and expansion exercise.

- Sify’s Cloud-based backend supply

chain integration platform signed a prominent player in retail and

another in healthcare, an online education platform, a financial

services company and multiple non-banking financial companies.

- Multi-year contracts for building

and augmenting Security Operations Center came from two Public

Services Insurance majors.

- A Regional bank signed up to

implement Digital certification for the universal ID and a private

bank signed up for managed services.

- Sify was accredited as an

Independent Software Vendor for WhatsApp for Business.

Network centric services highlights

include:

- Sify added 53 new Network Services

customers in the quarter.

- One of the largest Private banks in

the country contracted to connect their network to Near line

Disaster Recovery.

- A Private scheduled bank signed up

for network consolidation and a large cooperative bank signed up to

connect a few hundred locations.

- A global retail major and a generic

pharmaceutical multinational contracted with Sify for managed and

secure SD-WAN services.

- A Fortune Global 500 consulting

major signed up for Cloud based collaboration services.

- One of the country’s oldest MNCs

contracted Sify to commission their Network Operation Center.

- A social media major and a global

OTT platform signed up for network nodes and connectivity

expansion.

- Sify invested in upgradation of the

core backbone to 100G to support the next phase of growth and also

in fresh capacity in key cities.

About Sify Technologies

A Fortune India 500 company, Sify Technologies

is India’s most comprehensive ICT service & solution provider.

With Cloud at the core of our solutions portfolio, Sify is focussed

on the changing ICT requirements of the emerging Digital economy

and the resultant demands from large, mid and small-sized

businesses.

Sify’s infrastructure comprising

state-of-the-art Data Centers, the largest MPLS network,

partnership with global technology majors and deep expertise in

business transformation solutions modelled on the cloud, make it

the first choice of start-ups, SMEs and even large Enterprises on

the verge of a revamp.

More than 10000 businesses across multiple

verticals have taken advantage of our unassailable trinity of Data

Centers, Networks and Security services and conduct their business

seamlessly from more than 1600 cities in India. Internationally,

Sify has presence across North America, the United Kingdom and

Singapore.

Sify, www.sify.com, Sify Technologies and

www.sifytechnologies.com are registered trademarks of Sify

Technologies Limited.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. The forward-looking statements

contained herein are subject to risks and uncertainties that could

cause actual results to differ materially from those reflected in

the forward-looking statements. Sify undertakes no duty to update

any forward-looking statements.

For a discussion of the risks associated with

Sify’s business, please see the discussion under the caption “Risk

Factors” in the company’s Annual Report on Form 20-F for the year

ended March 31, 2021, which has been filed with the United States

Securities and Exchange Commission and is available by accessing

the database maintained by the SEC at www.sec.gov, and Sify’s other

reports filed with the SEC.

For further information, please contact:

|

Sify Technologies LimitedMr. Praveen

KrishnaInvestor Relations & Public Relations+91

9840926523praveen.krishna@sifycorp.com |

20:20 Media Nikhila Kesavan+91

9840124036nikhila.kesavan@2020msl.com |

Grayling Investor RelationsShiwei

Yin+1-646-284-9474Shiwei.Yin@grayling.com |

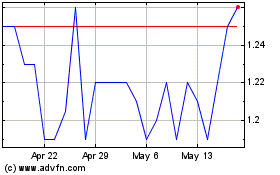

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From Oct 2024 to Nov 2024

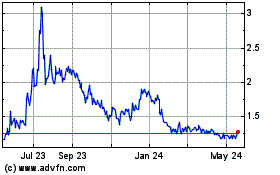

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From Nov 2023 to Nov 2024