StoneX Group Inc. (the “Company”; NASDAQ: SNEX), a global financial

services network that connects companies, organizations, traders

and investors to the global market ecosystem through a unique blend

of digital platforms, end-to-end clearing and execution services,

high touch service and deep expertise, today announced its

financial results for the fiscal year 2025 first quarter ended

December 31, 2024. In addition and as discussed further below,

on February 5, 2024, the Company’s Board of Directors approved a

three-for-two split of the Company’s common stock.

Sean O’Connor, the Company’s Executive Vice-Chairman of the

Board, stated, “We achieved another record quarterly result,

building on momentum realized through fiscal 2024, reporting net

income of $85.1 million, a 23% increase over the prior year

quarter, diluted EPS of $2.54, and a 19.5% return on equity for the

first fiscal quarter of 2025. We experienced continued strong

client engagement with increased volumes across all operating

segments and products despite relatively low volatility.”

StoneX Group Inc. Summary Financials

Consolidated financial statements for the Company will be

included in our Quarterly Report on Form 10-Q to be filed with the

Securities and Exchange Commission (the “SEC”). Upon filing, the

Quarterly Report on Form 10-Q will also be made available on the

Company’s website at www.stonex.com.

| |

Three Months Ended December 31, |

|

(Unaudited) (in millions, except share and per share

amounts) |

|

2024 |

|

|

|

2023 |

|

|

% Change |

| Revenues: |

|

|

|

|

|

|

Sales of physical commodities |

$ |

27,051.1 |

|

|

$ |

18,820.9 |

|

|

44% |

|

Principal gains, net |

|

308.9 |

|

|

|

293.8 |

|

|

5% |

|

Commission and clearing fees |

|

149.3 |

|

|

|

129.7 |

|

|

15% |

|

Consulting, management, and account fees |

|

47.8 |

|

|

|

38.5 |

|

|

24% |

|

Interest income |

|

378.2 |

|

|

|

290.1 |

|

|

30% |

| Total revenues |

|

27,935.3 |

|

|

|

19,573.0 |

|

|

43% |

|

Cost of sales of physical commodities |

|

26,991.0 |

|

|

|

18,788.8 |

|

|

44% |

| Operating revenues |

|

944.3 |

|

|

|

784.2 |

|

|

20% |

|

Transaction-based clearing expenses |

|

86.5 |

|

|

|

74.3 |

|

|

16% |

|

Introducing broker commissions |

|

44.3 |

|

|

|

39.1 |

|

|

13% |

|

Interest expense |

|

306.2 |

|

|

|

236.0 |

|

|

30% |

|

Interest expense on corporate funding |

|

15.2 |

|

|

|

13.2 |

|

|

15% |

| Net operating revenues |

|

492.1 |

|

|

|

421.6 |

|

|

17% |

| Compensation and other

expenses: |

|

|

|

|

|

|

Variable compensation and benefits |

|

133.3 |

|

|

|

121.9 |

|

|

9% |

|

Fixed compensation and benefits |

|

119.2 |

|

|

|

96.2 |

|

|

24% |

|

Trading systems and market information |

|

20.0 |

|

|

|

18.7 |

|

|

7% |

|

Professional fees |

|

19.0 |

|

|

|

15.7 |

|

|

21% |

|

Non-trading technology and support |

|

19.7 |

|

|

|

16.9 |

|

|

17% |

|

Occupancy and equipment rental |

|

13.0 |

|

|

|

7.7 |

|

|

69% |

|

Selling and marketing |

|

12.0 |

|

|

|

11.7 |

|

|

3% |

|

Travel and business development |

|

8.4 |

|

|

|

7.1 |

|

|

18% |

|

Communications |

|

2.1 |

|

|

|

2.2 |

|

|

(5)% |

|

Depreciation and amortization |

|

15.7 |

|

|

|

11.2 |

|

|

40% |

|

Bad debts (recoveries), net |

|

1.8 |

|

|

|

(0.3 |

) |

|

n/m |

|

Other |

|

16.7 |

|

|

|

16.9 |

|

|

(1)% |

| Total compensation and other

expenses |

|

380.9 |

|

|

|

325.9 |

|

|

17% |

|

Other gains |

|

5.7 |

|

|

|

— |

|

|

n/m |

| Income before tax |

|

116.9 |

|

|

|

95.7 |

|

|

22% |

|

Income tax expense |

|

31.8 |

|

|

|

26.6 |

|

|

20% |

| Net income |

$ |

85.1 |

|

|

$ |

69.1 |

|

|

23% |

| Earnings per share:(1) |

|

|

|

|

|

|

Basic |

$ |

2.66 |

|

|

$ |

2.20 |

|

|

21% |

|

Diluted |

$ |

2.54 |

|

|

$ |

2.13 |

|

|

19% |

| Weighted-average number of

common shares outstanding:(1) |

|

|

|

|

|

|

Basic |

|

30,976,042 |

|

|

|

30,233,107 |

|

|

2% |

|

Diluted |

|

32,444,772 |

|

|

|

31,274,307 |

|

|

4% |

| |

|

|

|

|

|

| Return on equity

(“ROE”)(1) |

|

19.5 |

% |

|

|

19.3 |

% |

|

|

| ROE on tangible book

value(1) |

|

20.5 |

% |

|

|

20.5 |

% |

|

|

| n/m = not

meaningful to present as a percentage |

|

(1 |

) |

The Company calculates ROE on stated book value based on net income

divided by average stockholders’ equity. For the calculation of ROE

on tangible book value, the amount of goodwill and intangibles, net

is excluded from stockholders’ equity. |

|

|

|

|

The following table presents our consolidated operating revenues

by segment for the periods indicated.

| |

Three Months Ended December 31, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

|

% Change |

| Segment operating

revenues represented by: |

|

|

|

|

|

|

Commercial |

$ |

232.3 |

|

|

$ |

198.4 |

|

|

17% |

|

Institutional |

|

539.6 |

|

|

|

435.7 |

|

|

24% |

|

Self-Directed/Retail |

|

124.1 |

|

|

|

92.5 |

|

|

34% |

|

Payments |

|

58.1 |

|

|

|

60.6 |

|

|

(4)% |

|

Corporate |

|

11.1 |

|

|

|

9.2 |

|

|

21% |

|

Eliminations |

|

(20.9 |

) |

|

|

(12.2 |

) |

|

71% |

| Operating revenues |

$ |

944.3 |

|

|

$ |

784.2 |

|

|

20% |

| |

|

|

|

|

|

|

|

|

|

The following table presents our consolidated income by segment

for the periods indicated.

| |

Three Months Ended December 31, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

|

% Change |

| Segment income

represented by: |

|

|

|

|

|

|

Commercial |

$ |

102.2 |

|

|

$ |

87.2 |

|

|

17% |

|

Institutional |

|

78.1 |

|

|

|

65.2 |

|

|

20% |

|

Self-Directed/Retail |

|

56.9 |

|

|

|

28.7 |

|

|

98% |

|

Payments |

|

34.1 |

|

|

|

35.0 |

|

|

(3)% |

| Total segment income |

$ |

271.3 |

|

|

$ |

216.1 |

|

|

26% |

| Reconciliation of segment

income to income before tax: |

|

|

|

|

|

| Segment income |

$ |

271.3 |

|

|

$ |

216.1 |

|

|

26% |

|

Net operating loss within Corporate(1) |

|

(21.1 |

) |

|

|

(15.6 |

) |

|

35% |

|

Overhead costs and expenses |

|

(133.3 |

) |

|

|

(104.8 |

) |

|

27% |

| Income before tax |

$ |

116.9 |

|

|

$ |

95.7 |

|

|

22% |

|

(1 |

) |

Includes interest expense on corporate funding. |

|

|

|

|

Key Operating Metrics

The tables below present operating revenues disaggregated across

the key products we provide to our clients and select operating

data and metrics used by management in evaluating our performance,

for the periods indicated.

| |

Three Months Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

% Change |

| Operating Revenues (in

millions): |

|

|

|

|

|

|

Listed derivatives |

$ |

111.8 |

|

|

$ |

109.2 |

|

|

2% |

|

Over-the-counter (“OTC”) derivatives |

|

36.6 |

|

|

|

44.5 |

|

|

(18)% |

|

Securities |

|

401.8 |

|

|

|

316.2 |

|

|

27% |

|

FX/Contracts for difference (“CFD”) contracts |

|

98.6 |

|

|

|

74.6 |

|

|

32% |

|

Payments |

|

56.8 |

|

|

|

59.4 |

|

|

(4)% |

|

Physical contracts |

|

92.6 |

|

|

|

51.4 |

|

|

80% |

|

Interest/fees earned on client balances |

|

107.6 |

|

|

|

98.4 |

|

|

9% |

|

Other |

|

48.3 |

|

|

|

33.5 |

|

|

44% |

|

Corporate |

|

11.1 |

|

|

|

9.2 |

|

|

21% |

|

Eliminations |

|

(20.9 |

) |

|

|

(12.2 |

) |

|

71% |

| |

$ |

944.3 |

|

|

$ |

784.2 |

|

|

20% |

| Volumes and Other

Select Data: |

|

|

|

|

|

|

Listed derivatives (contracts, 000’s) |

|

53,180 |

|

|

|

50,759 |

|

|

5% |

|

Listed derivatives, average rate per contract (“RPC”)(1) |

$ |

2.03 |

|

|

$ |

2.03 |

|

|

—% |

|

Average client equity - listed derivatives (millions) |

$ |

6,620 |

|

|

$ |

6,170 |

|

|

7% |

|

OTC derivatives (contracts, 000’s) |

|

859 |

|

|

|

814 |

|

|

6% |

|

OTC derivatives, average RPC |

$ |

42.84 |

|

|

$ |

54.92 |

|

|

(22)% |

|

Securities average daily volume (“ADV”) (millions) |

$ |

8,733 |

|

|

$ |

6,224 |

|

|

40% |

|

Securities rate per million (“RPM”)(2) |

$ |

237 |

|

|

$ |

295 |

|

|

(20)% |

|

Average money market/FDIC sweep client balances (millions) |

$ |

1,197 |

|

|

$ |

1,060 |

|

|

13% |

|

FX/CFD contracts ADV (millions) |

$ |

11,685 |

|

|

$ |

10,917 |

|

|

7% |

|

FX/CFD contracts RPM |

$ |

133 |

|

|

$ |

109 |

|

|

22% |

|

Payments ADV (millions) |

$ |

84 |

|

|

$ |

75 |

|

|

12% |

|

Payments RPM |

$ |

10,414 |

|

|

$ |

12,557 |

|

|

(17)% |

|

(1 |

) |

Give-up fee revenues, related

to contract execution for clients of other FCMs, as well as cash

and voice brokerage revenues are excluded from the calculation of

listed derivatives, average rate per contract. |

|

(2 |

) |

Interest expense associated

with our fixed income activities is deducted from operating

revenues in the calculation of Securities RPM while interest income

related to securities lending is excluded. |

|

|

|

|

Interest expense

| |

Three Months Ended December 31, |

|

(in millions) |

|

2024 |

|

|

2023 |

|

% Change |

| Interest expense attributable

to: |

|

|

|

|

|

|

Trading activities: |

|

|

|

|

|

|

Institutional dealer in fixed income securities |

$ |

223.6 |

|

$ |

172.1 |

|

30% |

|

Securities borrowing |

|

22.0 |

|

|

14.6 |

|

51% |

|

Client balances on deposit |

|

33.8 |

|

|

36.3 |

|

(7)% |

|

Short-term financing facilities of subsidiaries and other direct

interest of operating segments |

|

26.8 |

|

|

13.0 |

|

106% |

| |

|

306.2 |

|

|

236.0 |

|

30% |

|

Corporate funding |

|

15.2 |

|

|

13.2 |

|

15% |

| Total interest expense |

$ |

321.4 |

|

$ |

249.2 |

|

29% |

| |

|

|

|

|

|

|

|

Increased interest expense attributable to trading activities

principally resulted from an increase in our fixed income,

securities borrowing, and physical business activities. The

increase in interest expense for the three months ended December

31, 2024 attributable to corporate funding was principally due to

an increase in the aggregate amount of senior secured notes

outstanding, related to the March 1, 2024 issuance of our 7.875%

Senior Secured Notes due 2031 (the “Notes due 2031”), effectively

replacing our 8.625% Senior Secured Notes due 2025 (“the Notes due

2025”). This increase was partially offset by lower average

borrowings on our revolving credit facility.

Variable vs. Fixed ExpensesThe table below sets

forth our variable expenses and non-variable expenses as a

percentage of total non-interest expenses for the periods

indicated.

| |

Three Months Ended December 31, |

|

(in millions) |

|

2024 |

|

% ofTotal |

|

|

2023 |

|

|

% ofTotal |

|

Variable compensation and benefits |

$ |

133.3 |

|

26% |

|

$ |

121.9 |

|

|

28% |

| Transaction-based clearing

expenses |

|

86.5 |

|

17% |

|

|

74.3 |

|

|

17% |

| Introducing broker

commissions |

|

44.3 |

|

9% |

|

|

39.1 |

|

|

9% |

|

Total variable expenses |

|

264.1 |

|

52% |

|

|

235.3 |

|

|

54% |

| Fixed compensation and

benefits |

|

119.2 |

|

23% |

|

|

96.2 |

|

|

22% |

| Other fixed expenses |

|

126.6 |

|

25% |

|

|

108.1 |

|

|

24% |

| Bad debts (recoveries), net |

|

1.8 |

|

—% |

|

|

(0.3 |

) |

|

—% |

|

Total non-variable expenses |

|

247.6 |

|

48% |

|

|

204.0 |

|

|

46% |

| Total non-interest expenses |

$ |

511.7 |

|

100% |

|

$ |

439.3 |

|

|

100% |

| |

|

|

|

|

|

|

|

|

|

|

Other Gains, net

The results of the three months ended December 31, 2024 included

nonrecurring gains of $5.7 million resulting from proceeds received

from class action settlements.

Segment Results

Our business activities are managed through four operating

segments, including Commercial, Institutional, Self-Directed/Retail

and Payments.

The tables below present the financial performance, a

disaggregation of operating revenues, and select operating data and

metrics used by management in evaluating the performance of our

segments, for the periods indicated. Additional information on the

performance of our segments will be included in our Quarterly

Report on Form 10-Q to be filed with the SEC.

Commercial

| |

Three Months Ended December 31, |

|

(in millions) |

|

2024 |

|

|

2023 |

|

|

% Change |

| Revenues: |

|

|

|

|

|

|

Sales of physical commodities |

$ |

27,033.7 |

|

$ |

18,809.5 |

|

|

44% |

|

Principal gains, net |

|

67.2 |

|

|

77.1 |

|

|

(13)% |

|

Commission and clearing fees |

|

48.7 |

|

|

44.3 |

|

|

10% |

|

Consulting, management and account fees |

|

6.5 |

|

|

5.8 |

|

|

12% |

|

Interest income |

|

52.9 |

|

|

41.3 |

|

|

28% |

| Total revenues |

|

27,209.0 |

|

|

18,978.0 |

|

|

43% |

|

Cost of sales of physical commodities |

|

26,976.7 |

|

|

18,779.6 |

|

|

44% |

| Operating revenues |

|

232.3 |

|

|

198.4 |

|

|

17% |

|

Transaction-based clearing expenses |

|

17.6 |

|

|

15.8 |

|

|

11% |

|

Introducing broker commissions |

|

11.3 |

|

|

10.4 |

|

|

9% |

|

Interest expense |

|

14.2 |

|

|

8.8 |

|

|

61% |

| Net operating revenues |

|

189.2 |

|

|

163.4 |

|

|

16% |

|

Variable compensation and benefits |

|

43.5 |

|

|

37.0 |

|

|

18% |

| Net contribution |

|

145.7 |

|

|

126.4 |

|

|

15% |

|

Fixed compensation and benefits |

|

17.0 |

|

|

15.5 |

|

|

10% |

|

Other fixed expenses |

|

25.3 |

|

|

23.8 |

|

|

6% |

|

Bad debts (recoveries), net |

|

1.2 |

|

|

(0.1 |

) |

|

n/m |

| Non-variable direct expenses |

|

43.5 |

|

|

39.2 |

|

|

11% |

| Segment income |

|

102.2 |

|

|

87.2 |

|

|

17% |

|

Allocation of overhead costs |

|

9.7 |

|

|

8.8 |

|

|

10% |

| Segment income, less allocation

of overhead costs |

$ |

92.5 |

|

$ |

78.4 |

|

|

18% |

| |

Three Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

% Change |

| Operating Revenues (in

millions): |

|

|

|

|

|

|

Listed derivatives |

$ |

62.2 |

|

$ |

59.4 |

|

5% |

|

OTC derivatives |

|

36.6 |

|

|

44.5 |

|

(18)% |

|

Physical contracts |

|

90.1 |

|

|

50.6 |

|

78% |

|

Interest/fees earned on client balances |

|

36.6 |

|

|

37.2 |

|

(2)% |

|

Other |

|

6.8 |

|

|

6.7 |

|

1% |

| |

$ |

232.3 |

|

$ |

198.4 |

|

17% |

| |

|

|

|

|

|

| Volumes and

Other Select Data: |

|

|

|

Listed derivatives (contracts, 000’s) |

|

10,608 |

|

|

9,523 |

|

11% |

|

Listed derivatives, average RPC (1) |

$ |

5.67 |

|

$ |

5.95 |

|

(5)% |

|

Average client equity - listed derivatives (millions) |

$ |

1,727 |

|

$ |

1,700 |

|

2% |

|

OTC derivatives (contracts, 000’s) |

|

859 |

|

|

814 |

|

5% |

|

OTC derivatives, average RPC |

$ |

42.84 |

|

$ |

54.92 |

|

(22)% |

|

(1 |

) |

Give-up fee revenues, related to contract execution for clients of

other FCMs, as well as cash and voice brokerage revenues are

excluded from the calculation of listed derivatives, average

RPC. |

|

|

|

|

Institutional

| |

Three Months Ended December 31, |

|

(in millions) |

|

2024 |

|

|

2023 |

|

|

% Change |

| Revenues: |

|

|

|

|

|

|

Sales of physical commodities |

$ |

— |

|

$ |

— |

|

|

—% |

|

Principal gains, net |

|

108.6 |

|

|

103.2 |

|

|

5% |

|

Commission and clearing fees |

|

85.7 |

|

|

73.3 |

|

|

17% |

|

Consulting, management and account fees |

|

20.3 |

|

|

17.3 |

|

|

17% |

|

Interest income |

|

325.0 |

|

|

241.9 |

|

|

34% |

| Total revenues |

|

539.6 |

|

|

435.7 |

|

|

24% |

|

Cost of sales of physical commodities |

|

— |

|

|

— |

|

|

—% |

| Operating revenues |

|

539.6 |

|

|

435.7 |

|

|

24% |

|

Transaction-based clearing expenses |

|

63.0 |

|

|

52.9 |

|

|

19% |

|

Introducing broker commissions |

|

8.1 |

|

|

7.7 |

|

|

5% |

|

Interest expense |

|

294.5 |

|

|

226.5 |

|

|

30% |

| Net operating revenues |

|

174.0 |

|

|

148.6 |

|

|

17% |

|

Variable compensation and benefits |

|

56.2 |

|

|

48.4 |

|

|

16% |

| Net contribution |

|

117.8 |

|

|

100.2 |

|

|

18% |

|

Fixed compensation and benefits |

|

18.6 |

|

|

16.4 |

|

|

13% |

|

Other fixed expenses |

|

22.4 |

|

|

19.0 |

|

|

18% |

|

Bad debts (recoveries), net |

|

— |

|

|

(0.4 |

) |

|

(100)% |

| Non-variable direct expenses |

|

41.0 |

|

|

35.0 |

|

|

17% |

| Other gain |

|

1.3 |

|

|

— |

|

|

n/m |

| Segment income |

$ |

78.1 |

|

$ |

65.2 |

|

|

20% |

|

Allocation of overhead costs |

|

14.8 |

|

|

12.8 |

|

|

16% |

| Segment income, less allocation

of overhead costs |

$ |

63.3 |

|

$ |

52.4 |

|

|

21% |

| |

Three Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

% Change |

| Operating Revenues (in

millions): |

|

|

|

|

|

|

Listed derivatives |

$ |

49.6 |

|

$ |

49.8 |

|

—% |

|

Securities |

|

373.5 |

|

|

293.6 |

|

27% |

|

FX contracts |

|

9.6 |

|

|

8.0 |

|

20% |

|

Interest/fees earned on client balances |

|

70.3 |

|

|

60.5 |

|

16% |

|

Other |

|

36.6 |

|

|

23.8 |

|

54% |

| |

$ |

539.6 |

|

$ |

435.7 |

|

24% |

| |

|

|

|

|

|

| Volumes and Other Select

Data: |

|

|

|

|

|

|

Listed derivatives (contracts, 000’s) |

|

42,572 |

|

|

41,236 |

|

3% |

|

Listed derivatives, average RPC (1) |

$ |

1.12 |

|

$ |

1.12 |

|

—% |

|

Average client equity - listed derivatives (millions) |

$ |

4,893 |

|

$ |

4,470 |

|

9% |

|

Securities ADV (millions) |

$ |

8,733 |

|

$ |

6,224 |

|

40% |

|

Securities RPM (2) |

$ |

237 |

|

$ |

295 |

|

(20)% |

|

Average money market/FDIC sweep client balances (millions) |

$ |

1,197 |

|

$ |

1,060 |

|

13% |

|

FX contracts ADV (millions) |

$ |

4,082 |

|

$ |

3,970 |

|

3% |

|

FX contracts RPM |

$ |

36 |

|

$ |

34 |

|

6% |

|

(1 |

) |

Give-up fee revenues, related to contract execution for clients of

other FCMs, revenues are excluded from the calculation of listed

derivatives, average RPC. |

|

(2 |

) |

Interest expense associated

with our fixed income activities is deducted from operating

revenues in the calculation of Securities RPM, while interest

income related to securities lending is excluded. |

|

|

|

|

Self-Directed/Retail

| |

Three Months Ended December 31, |

|

(in millions) |

|

2024 |

|

|

2023 |

|

% Change |

| Revenues: |

|

|

|

|

|

|

Sales of physical commodities |

$ |

17.4 |

|

$ |

11.4 |

|

53% |

|

Principal gains, net |

|

79.5 |

|

|

55.6 |

|

43% |

|

Commission and clearing fees |

|

13.5 |

|

|

11.2 |

|

21% |

|

Consulting, management and account fees |

|

19.3 |

|

|

14.1 |

|

37% |

|

Interest income |

|

8.7 |

|

|

9.4 |

|

(7)% |

| Total revenues |

|

138.4 |

|

|

101.7 |

|

36% |

|

Cost of sales of physical commodities |

|

14.3 |

|

|

9.2 |

|

55% |

| Operating revenues |

|

124.1 |

|

|

92.5 |

|

34% |

|

Transaction-based clearing expenses |

|

3.4 |

|

|

3.5 |

|

(3)% |

|

Introducing broker commissions |

|

24.0 |

|

|

20.4 |

|

18% |

|

Interest expense |

|

2.1 |

|

|

1.6 |

|

31% |

| Net operating revenues |

|

94.6 |

|

|

67.0 |

|

41% |

|

Variable compensation and benefits |

|

3.0 |

|

|

4.4 |

|

(32)% |

| Net contribution |

|

91.6 |

|

|

62.6 |

|

46% |

|

Fixed compensation and benefits |

|

9.4 |

|

|

10.3 |

|

(9)% |

|

Other fixed expenses |

|

29.2 |

|

|

23.5 |

|

24% |

|

Bad debts, net of recoveries |

|

0.5 |

|

|

0.1 |

|

400% |

| Non-variable direct expenses |

|

39.1 |

|

|

33.9 |

|

15% |

| Other gain |

|

4.4 |

|

|

— |

|

n/m |

| Segment income |

|

56.9 |

|

|

28.7 |

|

98% |

|

Allocation of overhead costs |

|

12.6 |

|

|

11.5 |

|

10% |

| Segment income, less allocation

of overhead costs |

$ |

44.3 |

|

$ |

17.2 |

|

158% |

| |

Three Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

% Change |

| Operating Revenues (in

millions): |

|

|

|

|

|

|

Securities |

$ |

28.3 |

|

$ |

22.6 |

|

25% |

|

FX/CFD contracts |

|

89.0 |

|

|

66.6 |

|

34% |

|

Physical contracts |

|

2.5 |

|

|

0.8 |

|

213% |

|

Interest/fees earned on client balances |

|

0.7 |

|

|

0.7 |

|

—% |

|

Other |

|

3.6 |

|

|

1.8 |

|

100% |

| |

$ |

124.1 |

|

$ |

92.5 |

|

34% |

| |

|

|

|

|

|

| Volumes and

Other Select Data: |

|

|

|

FX/CFD contracts ADV (millions) |

$ |

7,603 |

|

$ |

6,948 |

|

9% |

|

FX/CFD contracts RPM |

$ |

185 |

|

$ |

151 |

|

23% |

Payments

| |

Three Months Ended December 31, |

|

(in millions) |

|

2024 |

|

|

2023 |

|

% Change |

| Revenues: |

|

|

|

|

|

|

Sales of physical commodities |

$ |

— |

|

$ |

— |

|

—% |

|

Principal gains, net |

|

54.4 |

|

|

57.5 |

|

(5)% |

|

Commission and clearing fees |

|

1.8 |

|

|

1.5 |

|

20% |

|

Consulting, management, account fees |

|

1.3 |

|

|

0.9 |

|

44% |

|

Interest income |

|

0.6 |

|

|

0.7 |

|

(14)% |

| Total revenues |

|

58.1 |

|

|

60.6 |

|

(4)% |

|

Cost of sales of physical commodities |

|

— |

|

|

— |

|

—% |

| Operating revenues |

|

58.1 |

|

|

60.6 |

|

(4)% |

|

Transaction-based clearing expenses |

|

1.8 |

|

|

1.8 |

|

—% |

|

Introducing broker commissions |

|

0.9 |

|

|

0.6 |

|

50% |

|

Interest expense |

|

— |

|

|

— |

|

—% |

| Net operating revenues |

|

55.4 |

|

|

58.2 |

|

(5)% |

|

Variable compensation and benefits |

|

9.1 |

|

|

10.6 |

|

(14)% |

| Net contribution |

|

46.3 |

|

|

47.6 |

|

(3)% |

|

Fixed compensation and benefits |

|

6.6 |

|

|

7.3 |

|

(10)% |

|

Other fixed expenses |

|

5.5 |

|

|

5.2 |

|

6% |

|

Bad debts, net of recoveries |

|

0.1 |

|

|

0.1 |

|

—% |

| Total non-variable direct

expenses |

|

12.2 |

|

|

12.6 |

|

(3)% |

| Segment income |

|

34.1 |

|

|

35.0 |

|

(3)% |

|

Allocation of overhead costs |

|

5.6 |

|

|

5.1 |

|

10% |

| Segment income, less allocation

of overhead costs |

$ |

28.5 |

|

$ |

29.9 |

|

(5)% |

| |

Three Months Ended December 31, |

|

|

|

2024 |

|

|

2023 |

|

% Change |

| Operating Revenues (in

millions): |

|

|

|

|

|

|

Payments |

$ |

56.8 |

|

$ |

59.4 |

|

(4)% |

|

Other |

|

1.3 |

|

|

1.2 |

|

8% |

| |

$ |

58.1 |

|

$ |

60.6 |

|

(4)% |

| |

|

|

|

|

|

| Volumes and

Other Select Data: |

|

|

|

Payments ADV (millions) |

$ |

84 |

|

$ |

75 |

|

12% |

|

Payments RPM |

$ |

10,414 |

|

$ |

12,557 |

|

(17)% |

|

|

|

|

|

|

|

|

|

Overhead Costs and Expenses

We incur overhead costs and expenses, including certain shared

services such as information technology, accounting and treasury,

credit and risk, legal and compliance, and human resources and

other activities. The following table provides information

regarding overhead costs and expenses. The allocation of overhead

costs to operating segments includes costs associated with

compliance, technology, and credit and risk costs. The share of

allocated costs is based on resources consumed by the relevant

businesses. In addition, the allocation of human resources and

occupancy costs is principally based on employee costs within the

relevant businesses.

| |

Three Months Ended December 31, |

|

(in millions) |

|

2024 |

|

|

|

2023 |

|

|

% Change |

| Compensation and benefits: |

|

|

|

|

|

|

Variable compensation and benefits |

$ |

20.2 |

|

|

$ |

19.4 |

|

|

4% |

|

Fixed compensation and benefits |

|

61.0 |

|

|

|

40.6 |

|

|

50% |

| |

|

81.2 |

|

|

|

60.0 |

|

|

35% |

| Other expenses: |

|

|

|

|

|

|

Occupancy and equipment rental |

|

12.1 |

|

|

|

7.3 |

|

|

66% |

|

Non-trading technology and support |

|

15.3 |

|

|

|

13.0 |

|

|

18% |

|

Professional fees |

|

8.7 |

|

|

|

7.5 |

|

|

16% |

|

Depreciation and amortization |

|

6.4 |

|

|

|

5.5 |

|

|

16% |

|

Communications |

|

1.5 |

|

|

|

1.6 |

|

|

(6)% |

|

Selling and marketing |

|

0.9 |

|

|

|

1.3 |

|

|

(31)% |

|

Trading systems and market information |

|

1.6 |

|

|

|

1.7 |

|

|

(6)% |

|

Travel and business development |

|

2.6 |

|

|

|

1.7 |

|

|

53% |

|

Other |

|

3.0 |

|

|

|

5.2 |

|

|

(42)% |

| |

|

52.1 |

|

|

|

44.8 |

|

|

16% |

| Overhead costs and expenses |

|

133.3 |

|

|

|

104.8 |

|

|

27% |

|

Allocation of overhead costs |

|

(42.7 |

) |

|

|

(38.2 |

) |

|

12% |

| Overhead costs and expense, net

of allocation to operating segments |

$ |

90.6 |

|

|

$ |

66.6 |

|

|

36% |

| |

|

|

|

|

|

|

|

|

|

Balance Sheet Summary

The following table below provides a summary of asset, liability

and stockholders’ equity information for the periods indicated.

| (Unaudited) (in

millions, except for share and per share amounts) |

December 31, 2024 |

|

September 30, 2024 |

| Summary asset

information: |

|

|

|

|

Cash and cash equivalents |

$ |

1,398.2 |

|

$ |

1,269.0 |

|

Cash, securities and other assets segregated under federal and

other regulations |

$ |

3,156.6 |

|

$ |

2,841.2 |

|

Securities purchased under agreements to resell |

$ |

5,479.2 |

|

$ |

5,201.5 |

|

Securities borrowed |

$ |

2,120.7 |

|

$ |

1,662.3 |

|

Deposits with and receivables from broker-dealers, clearing

organizations and counterparties, net |

$ |

7,783.9 |

|

$ |

7,283.2 |

|

Receivables from clients, net and notes receivable, net |

$ |

1,096.3 |

|

$ |

1,013.1 |

|

Financial instruments owned, at fair value |

$ |

6,918.1 |

|

$ |

6,767.1 |

|

Physical commodities inventory, net |

$ |

861.4 |

|

$ |

681.1 |

|

Property and equipment, net |

$ |

145.1 |

|

$ |

143.1 |

|

Operating right of use assets |

$ |

159.7 |

|

$ |

157.0 |

|

Goodwill and intangible assets, net |

$ |

87.0 |

|

$ |

80.6 |

|

Other |

$ |

379.1 |

|

$ |

367.1 |

| |

|

|

|

| Summary liability and

stockholders’ equity information: |

|

|

|

|

Accounts payable and other accrued liabilities |

$ |

491.3 |

|

$ |

548.8 |

|

Operating lease liabilities |

$ |

198.6 |

|

$ |

195.9 |

|

Payables to clients |

$ |

11,338.2 |

|

$ |

10,345.9 |

|

Payables to broker-dealers, clearing organizations and

counterparties |

$ |

445.5 |

|

$ |

734.2 |

|

Payables to lenders under loans |

$ |

550.0 |

|

$ |

338.8 |

|

Senior secured borrowings, net |

$ |

543.3 |

|

$ |

543.1 |

|

Securities sold under agreements to repurchase |

$ |

8,872.9 |

|

$ |

8,581.3 |

|

Securities loaned |

$ |

1,826.5 |

|

$ |

1,615.9 |

|

Financial instruments sold, not yet purchased, at fair value |

$ |

3,541.6 |

|

$ |

2,853.3 |

|

Stockholders’ equity |

$ |

1,777.4 |

|

$ |

1,709.1 |

| |

|

|

|

| Common stock outstanding -

shares |

|

32,034,629 |

|

|

31,874,447 |

| Net asset value per share |

$ |

55.48 |

|

$ |

53.62 |

| |

|

|

|

|

|

Three-for-Two Stock Split

On February 5, 2025, the Company’s Board of Directors approved a

three-for-two split of its common stock to make stock ownership

more accessible to employees and investors. The stock split will be

effected as a stock dividend entitling each stockholder of record

to receive one additional share of common stock for every two

shares owned. Additional shares issued as a result of the stock

dividend will be distributed after close of trading on March 21,

2025, to stockholders of record at the close of business on March

11, 2025. Cash will be distributed in lieu of fractional shares

based on the opening price of a share of common stock on March 12,

2025. Trading is expected to begin on a stock split-adjusted basis

at market open on March 24, 2025. All share and per share amounts

contained herein have not been retroactively adjusted for this

subsequent stock split.

Conference Call & Web Cast

A conference call to discuss the Company’s financial results

will be held tomorrow, Thursday, February 6, 2025 at 9:00 a.m.

Eastern time. The call may also include discussion of Company

developments, and forward-looking and other material information

about business and financial matters. A live webcast of the

conference call as well as additional information to review during

the call will be made available in PDF form on-line on the

Company’s corporate web site at

https://register.vevent.com/register/BIe20141cf7fd043c89fde461964a3582e

approximately ten minutes prior to the start time. Participants may

preregister for the conference call here.

For those who cannot access the live broadcast, a replay of the

call will be available at https://www.stonex.com.

About StoneX Group Inc.

StoneX Group Inc., through its subsidiaries, operates a global

financial services network that connects companies, organizations,

traders and investors to the global market ecosystem through a

unique blend of digital platforms, end-to-end clearing and

execution services, high touch service and deep expertise. The

Company strives to be the one trusted partner to its clients,

providing its network, product and services to allow them to pursue

trading opportunities, manage their market risks, make investments

and improve their business performance. A Fortune-500 company

headquartered in New York City and listed on the Nasdaq Global

Select Market (NASDAQ:SNEX), StoneX Group Inc. and its more than

4,600 employees serve more than 54,000 commercial, institutional,

and payments clients, and more than 400,000 retail accounts, from

more than 80 offices spread across six continents. Further

information on the Company is available at

www.stonex.com.

Forward Looking Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, such as those pertaining to the Company’s financial

condition, results of operations, business strategy, financial

needs of the Company and the stock split. All statements other than

statements of current or historical fact contained in this press

release are forward-looking statements. The words “believe,”

“expect,” “anticipate,” “should,” “plan,” “will,” “may,” “could,”

“intend,” “estimate,” “predict,” “potential,” “continue” or the

negative of these terms and similar expressions, as they relate to

StoneX Group Inc., are intended to identify forward-looking

statements.

These forward-looking statements are largely based on current

expectations and projections about future events and financial

trends that may affect the financial condition, results of

operations, business strategy and financial needs of the Company.

These forward-looking statements involve known and unknown risks

and uncertainties, many of which are beyond the control of the

Company, including adverse changes in economic, political and

market conditions, including losses from our market-making and

trading activities arising from counterparty failures, the loss of

key personnel, the impact of increasing competition, the impact of

changes in government regulation, the possibility of liabilities

arising from violations of foreign, United States (“U.S.”) federal

and U.S. state securities laws, the impact of changes in technology

in the securities and commodities trading industries, and other

risks discussed in our filings with the SEC, including Part I, Item

1A of our Annual Report on Form 10-K for the year ended September

30, 2024. Although we believe that our forward-looking statements

are based upon reasonable assumptions regarding our business and

future market conditions, there can be no assurances that our

actual results will not differ materially from any results

expressed or implied by our forward-looking statements.

These forward-looking statements speak only as of the date of

this press release. StoneX Group Inc. undertakes no obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law. Accordingly, readers are cautioned not to place

undue reliance on these forward-looking statements. For these

statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995.

StoneX Group Inc.

Investor inquiries:

Kevin Murphy(212) 403 - 7296 kevin.murphy@stonex.com

SNEX-G

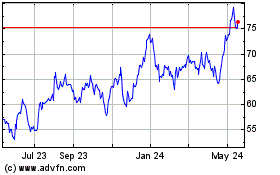

StoneX (NASDAQ:SNEX)

Historical Stock Chart

From Jan 2025 to Feb 2025

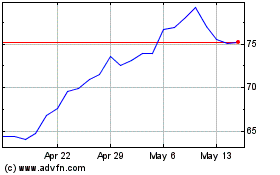

StoneX (NASDAQ:SNEX)

Historical Stock Chart

From Feb 2024 to Feb 2025