0001689731FALSE00016897312024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________

FORM 8-K

___________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 27, 2024

___________________________

Southern States Bancshares, Inc.

(Exact Name of Registrant as Specified in its Charter)

___________________________

| | | | | | | | |

Alabama | 001-40727 | 26-2518085 |

(State or Other Jurisdiction of Incorporation) | (Commission

File Number) | (IRS Employer Identification No.) |

| 615 Quintard Ave. | | |

Anniston, AL | | 36201 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (256) 241-1092

Securities registered pursuant to Section 12(b) of the Act:

___________________________

| | | | | | | | |

| Title of each class | Trading Symbols(s) | Name of exchange on which registered |

| Common Stock, $5.00 par value | SSBK | The NASDAQ Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Agreement and Plan of Merger

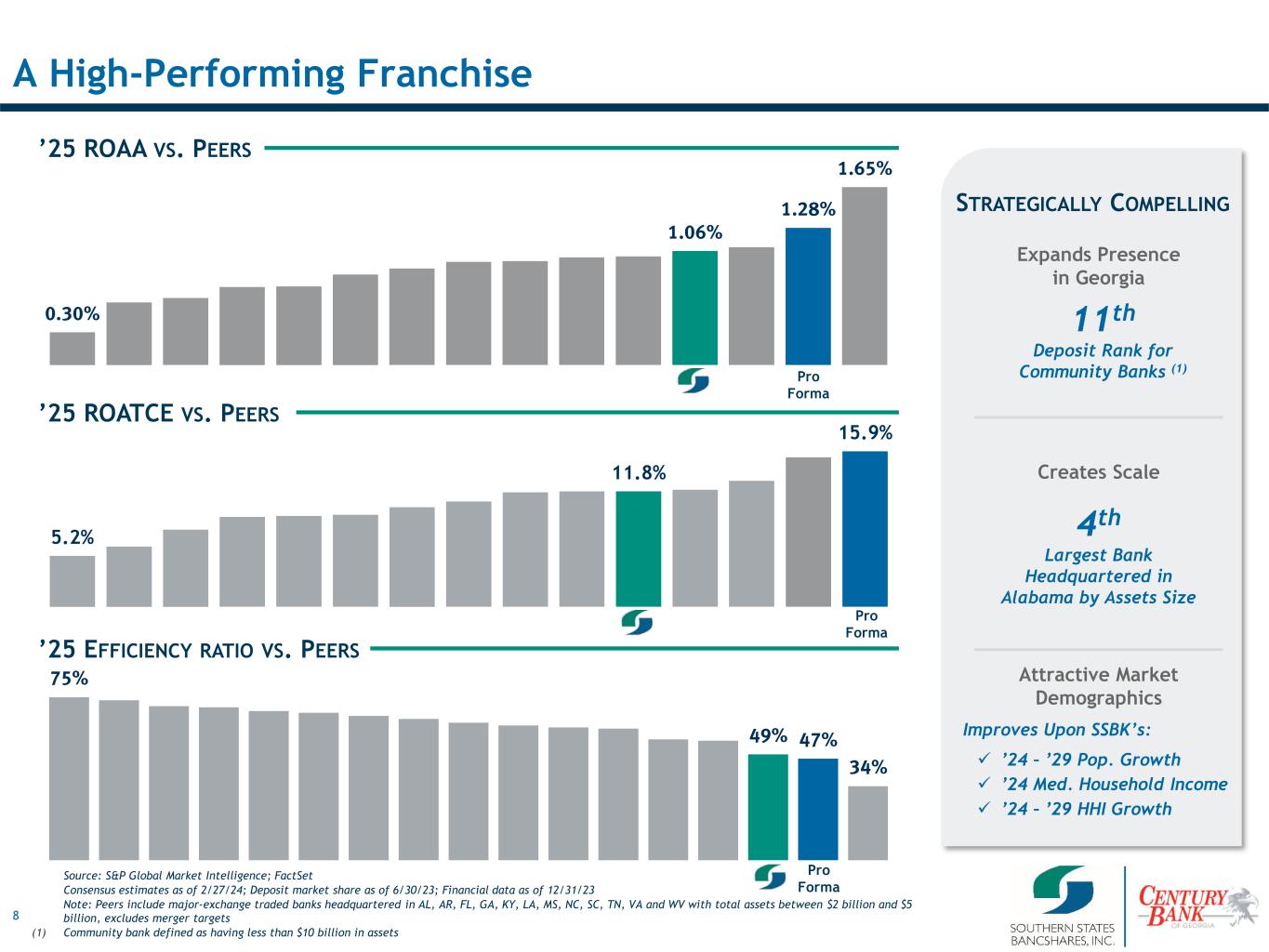

On February 27, 2024, Southern States Bancshares, Inc. (“Southern States Bancshares”), the parent company of Southern States Bank (“Southern States Bank”), and CBB Bancorp (“CBB Bancorp”), the parent company of Century Bank of Georgia (“Century Bank”), entered into an Agreement and Plan of Merger (the “Agreement”), pursuant to which: (i) CBB Bancorp will, subject to the terms and conditions set forth in the Agreement, merge with and into Southern States Bancshares (the “Corporate Merger”), with Southern States Bancshares as the surviving corporation in the Corporate Merger and (ii) subsequent to the Corporate Merger, Century Bank will merge with and into Southern States Bank (the “Bank Merger,” and together with the Corporate Merger, the “Merger”) with Southern States Bank as the surviving banking corporation in the Bank Merger.

Under the terms and subject to the conditions of the Agreement, upon the consummation of the Corporate Merger (the “Effective Date”), holders of CBB Bancorp will have the right to elect to receive either 1.550 shares of Southern States Bancshares common stock or $45.63 in cash for each share of CBB Bancorp common stock they hold. Shareholder elections for cash are subject to proration such that no more than 10% of the shares outstanding of CBB Bancorp common stock will receive the cash consideration. At the Effective Date, all options to purchase CBB Bancorp common stock under the CBB Bancorp amended and restated stock option and incentive plan, whether vested or unvested, will be cancelled and extinguished and exchanged into the right to receive cash equal to the product of the number of shares underlying the option by the excess, if any, of $45.63 over the exercise price of the option.

The Agreement contains customary representations and warranties and covenants by Southern States Bancshares and CBB Bancorp, including, among others, covenants relating to (1) the conduct of each party’s business during the period prior to the consummation of the Merger, (2) CBB Bancorp’s obligations to facilitate CBB Bancorp’s shareholders’ consideration of, and voting upon, the Agreement and the Merger at a meeting of shareholders held for that purpose, (3) the recommendation by the CBB Bancorp board of directors in favor of approval of the Agreement and the Merger, and (4) CBB Bancorp’s non-solicitation obligations relating to alternative business combination transactions. The Agreement further provides that Richard E. Drews, Jr. will join the board of directors of Southern States Bancshares and board of directors of Southern States Bank on the Effective Date.

Each party’s obligation to consummate the Merger is subject to customary closing conditions, including, among others, (1) approval of the Agreement and the Merger by CBB Bancorp shareholders, (2) receipt of required regulatory approvals without the imposition of a condition that, in the reasonable good faith judgment of the board of directors of Southern States Bancshares or the board of directors of CBB Bancorp, would so materially adversely impact the economic benefits of the transaction as contemplated by this Agreement so as to render inadvisable the consummation of the Merger, and receipt of all other requisite consents or approvals, (3) the absence of any law or order preventing or prohibiting the consummation of the transactions contemplated by the Agreement (including the Merger), (4) the effectiveness of the registration statement for the Southern States Bancshares common stock to be issued in the Corporate Merger, (5) receipt by Southern States Bancshares of opinion to the effect that the Corporate Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended, (6) subject to certain exceptions, the accuracy of the representations and warranties of the other party, (7) the performance in all material respects by the other party of its obligations under the Agreement, and (8) the absence of any material adverse effect with respect to the other party.

CBB Bancorp’s obligation to consummate the Merger is also subject to their receipt from Performance Trust Capital Partners, of an opinion, from a financial point of view, of the fairness of the consideration under the Corporate Merger to be received by the stockholders of CBB Bancorp. The obligation of Southern States Bancshares to consummate the Merger is additionally subject to the delivery of non-competition and non-disclosure agreements from all members of the CBB Bancorp board of directors and a condition that the number of shares as to which CBB Bancorp stockholders have exercised dissenters’ rights does not exceed seven and one-half percent of the outstanding CBB Bancorp common stock.

The Agreement contains certain termination rights for both Southern States Bancshares and CBB Bancorp and further provides that a termination fee of $1.2 million will be payable by CBB Bancorp to Southern States Bancshares upon termination of the Agreement under certain specified circumstances.

The representations, warranties and covenants of each party set forth in the Agreement were made only for purposes of the Agreement and as of specific dates, and were and are solely for the benefit of the parties to the Agreement, may be subject to limitations agreed upon by the parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the parties that differ from those applicable to investors. Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made or at any other time, and investors should not rely on them or any descriptions of them as statements of facts or conditions of Southern States Bancshares, CBB Bancorp, or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures. In addition, such representations and warranties (1) will not survive consummation of the Merger, unless otherwise specified therein, and (2) were made only as of the date of the Agreement or such other date as is specified in the Agreement. Accordingly, the Agreement is included with this filing only to provide investors with information regarding the terms of the Agreement, and not to provide investors with any other factual information regarding Southern States Bancshares, CBB Bancorp, their respective affiliates, or their respective businesses. The Agreement should not be read alone, but should instead be read in conjunction with the other information regarding Southern States Bancshares, CBB Bancorp, their respective affiliates or their respective businesses, the Agreement, and the Merger that will be contained in, or incorporated by reference into, the Registration Statement on Form S-4 that will include a proxy statement of CBB Bancorp and a prospectus of Southern States Bancshares, as well as in the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings by Southern States Bancshares with the Securities and Exchange Commission (the “SEC”) from time to time.

The foregoing description of the Agreement and the Merger does not purport to be complete and is qualified in its entirety by reference to the full text of the Agreement, which is filed as Exhibit 2.1 to this Current Report on Form 8-K (this “Report”) and is incorporated herein by reference.

Support Agreements

In connection with the Agreement, Southern States Bancshares entered into a support agreement with each director of CBB Bancorp who owns shares of CBB Bancorp common stock, a form of which is attached hereto as Exhibit 10.1 (the “Support Agreements”). The CBB Bancorp directors that are party to the Support Agreements beneficially own in the aggregate approximately 29.9% of the outstanding shares of CBB Bancorp common stock. The Support Agreements require, among other things, that the party thereto vote all of his or her shares of CBB Bancorp common stock in favor of the Merger and the other transactions contemplated by the Agreement and to refrain from transfers of any such shares of CBB Bancorp common stock prior to the Effective Date.

The foregoing description of the Support Agreements does not purport to be complete and is qualified in its entirety by reference to the form of Support Agreement, which is attached as Exhibit 10.1 to this Report, and incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On February 28, 2024, Southern States Bancshares and CBB Bancorp issued a joint press release announcing the signing of the Agreement. On February 28, 2024, Southern States Bancshares and CBB Bancorp also issued a presentation and CBB Bancorp issued a separate press release describing certain aspects of the Merger. The press releases and presentation are attached to this Current Report on Form 8-K as Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3, respectively, which are incorporated herein by reference.

The information contained in Item 7.01, including Exhibit 99.1, Exhibit 99.2 and Exhibit 99.3 furnished herewith, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section, nor shall it be deemed incorporated by reference into any registration statement or other documents pursuant to the Securities Act of 1933, as amended (the “Securities Act”), or into any filing or other document pursuant to the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Important Information and Where to Find It

This Report does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed acquisition by Southern States Bancshares of CBB Bancorp. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

In connection with the proposed transaction, Southern States Bancshares will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement of CBB Bancorp and a prospectus of Southern States Bancshares (the “Proxy Statement/Prospectus”), and Southern States Bancshares may file with the SEC other relevant documents concerning the proposed Merger. The definitive Proxy Statement/Prospectus will be mailed to shareholders of CBB Bancorp. SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BY SOUTHERN STATES BANCSHARES, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT SOUTHERN STATES BANCSHARES, CBB BANCORP, AND THE PROPOSED TRANSACTION.

Free copies of the Proxy Statement/Prospectus, as well as other filings containing information about Southern States Bancshares, may be obtained at the SEC’s website (http://www.sec.gov) when they are filed by Southern States Bancshares. You will also be able to obtain these documents, when they are filed, free of charge, from Southern States Bancshares at https://ir.southernstatesbank.net/ under the heading “Financials & Filings.” Copies of the Proxy Statement/Prospectus can also be obtained, when it becomes available, free of charge, by directing a request to Southern States Bancshares, Lynn Joyce at 100 Office Park Drive, Birmingham, Alabama 35223, telephone 205-820-8065, or by directing a request to CBB Bancorp, Richard E. Drews, Jr. at 215 East Main Street, Cartersville, GA, telephone 770-387-1922.

Participants in the Solicitation

This Report is not a solicitation of a proxy from any security holder of Southern States Bancshares or CBB Bancorp. However, Southern States Bancshares or CBB Bancorp and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of CBB Bancorp in respect of the proposed Merger. Information about Southern States Bancshares’ directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 14, 2023 and other documents filed by Southern States Bancshares with the SEC. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus and other relevant materials to be filed with the SEC when they become available. Free copies of this document may be obtained as described in the preceding paragraph.

Forward-Looking Statements

This Report contains estimates, predictions, opinions, projections and other “forward-looking statements” as that phrase is defined in the Private Securities Litigation Reform Act of 1995. Such statements include, without limitation, statements relating to the impact Southern States Bancshares and CBB Bancorp expect the Merger to have on the combined entities operations, financial condition, and financial results, and Southern States Bancshares’ expectations about its ability to successfully integrate the combined businesses and the amount of cost savings and other benefits Southern States Bancshares expects to realize as a result of the

Merger. Forward-looking statements also include, without limitation, predictions or expectations of future business or financial performance as well as its goals and objectives for future operations, financial and business trends, business prospects, and management’s outlook or expectations for earnings, revenues, expenses, capital levels, liquidity levels, asset quality or other future financial or business performance, strategies or expectations, and are subject to risks and uncertainties. These statements often, but not always, are preceded by, are followed by or otherwise include the words such as “may,” “can,” “should,” “could,” “to be,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “likely,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “target,” “project,” “would” and “outlook,” or the negative version of those words or other similar words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about the banking industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. This may be especially true given recent events and trends in the banking industry and interest rate volatility. Although Southern States Bancshares and CBB Bancorp believe that the expectations reflected in such forward-looking statements are reasonable as of the dates made, they cannot give any assurance that such expectations will prove correct and actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Such risks and uncertainties include, but are not limited to, the possibility that the proposed Merger does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; the delay in or failure to close for any other reason; the outcome of any legal proceedings that may be instituted against Southern States Bancshares or CBB Bancorp; the occurrence of any event, change or other circumstance that could give rise to the right of one or both parties to terminate the Agreement; the risk that the businesses of Southern States Bancshares and CBB Bancorp will not be integrated successfully; the possibility that the cost savings and any synergies or other anticipated benefits from the proposed Merger may not be fully realized or may take longer to realize than expected; disruption from the proposed Merger making it more difficult to maintain relationships with employees, customers or other parties with whom Southern States Bancshares or CBB Bancorp have business relationships; diversion of management time on Merger-related issues; risks relating to the potential dilutive effect of the shares of Southern States Bancshares common stock to be issued in the proposed Merger; the reaction to the proposed Merger of the companies’ customers, employees and counterparties; and other factors, many of which are beyond the control of Southern States Bancshares and CBB Bancorp. For additional information, refer to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Southern States Bancshares’ Annual Report on Form 10-K for the year ended December 31, 2022 and any updates to those risk factors set forth in Southern States Bancshares’ Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings, which have been filed by Southern States Bancshares with the SEC and are available on the SEC’s website at www.sec.gov. You should not place undue reliance on any such forward-looking statements. All forward-looking statements, expressed or implied, included herein are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Any forward-looking statement speaks only as of the date on which it is made, and Southern States Bancshares and CCB Bancorp do not undertake any obligation to publicly update or revise any forward-looking statement, whether written or oral, and whether as a result of new information, future developments or otherwise, except as specifically required by law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 2.1* | | |

| 10.1 | | |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

| * | | Schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule will be furnished supplementally to the SEC upon request; provided, however, that the parties may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any document so furnished. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: February 28, 2024 | SOUTHERN STATES BANCSHARES, INC. |

| | |

| By: | /s/ Lynn Joyce |

| Name: | Lynn Joyce |

| Title: | Senior Executive Vice President and Chief Financial Officer |

Execution Version

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

by and between

SOUTHERN STATES BANCSHARES, INC.

and

CBB BANCORP

dated as of

February 27, 2024

TABLE OF CONTENTS

Caption Page

Exhibits:

Exhibit A – Bank Merger Agreement

Exhibit B – Claims Letter

Exhibit C – Support Agreement

Exhibit D – Director Non-Competition and Non-Disclosure Agreement

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (the “Agreement”) is made and entered into as of this the 27th day of February, 2024, by and between SOUTHERN STATES BANCSHARES, INC., an Alabama corporation (“SSB”), and CBB BANCORP, a Georgia corporation (“CBB”).

WITNESSETH

WHEREAS, SSB operates as a bank holding company for its wholly owned subsidiary, Southern States Bank (“Southern States Bank”), an Alabama banking corporation, with its principal office in Anniston, Alabama; and

WHEREAS, CBB operates as a bank holding company for its wholly owned subsidiary, Century Bank of Georgia, a Georgia banking corporation (“Century Bank”), with its principal office in Cartersville, Georgia; and

WHEREAS, the board of directors of CBB has (i) approved this Agreement and declared this Agreement and the transactions contemplated hereby, including the Merger (as defined herein), advisable and in the best interests of CBB and its stockholders, (ii) authorized and approved the execution, delivery and performance by CBB of this Agreement and the consummation of the transactions contemplated hereby, subject to the terms and conditions herein, and (iii) resolved and agreed to recommend approval of this Agreement by the stockholders of CBB entitled to vote; and

WHEREAS, the board of directors of SSB has (i) approved this Agreement and declared this Agreement and the transactions contemplated hereby, including the Merger, advisable and in the best interests of SSB and its stockholders, (ii) authorized and approved the execution, delivery and performance by SSB of this Agreement and the consummation of the transactions contemplated hereby, subject to the terms and conditions herein, and (iii) approved the issuance of shares of SSB Common Stock in connection with the Merger;

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the Parties hereto agree as follows:

Article 1

NAME

1.1Name. The name of the corporation resulting from the Merger shall be “Southern States Bancshares, Inc.”

1.2Definitions. Article 14 contains a list of all terms used in the Agreement, and the definitions for such terms, or the Sections where the terms are defined, are provided.

Article 2

MERGER — TERMS AND CONDITIONS

2.1 Applicable Law. Upon the terms and subject to the conditions of this Agreement, on the Effective Date, CBB shall be merged (the “Merger”) with and into SSB with SSB as the surviving corporation (herein referred to as the “Resulting Corporation” whenever reference is made to it as of the time of Merger or thereafter).

2.2 Corporate Existence. On the Effective Date, the corporate existence of CBB shall, as provided in the ABCL and the GBCC, be merged into and continued in SSB, as provided in the ABCL and the GBCC, as the Resulting Corporation in the Merger. The Resulting Corporation shall then be deemed to be the same corporation as CBB and SSB. The offices and facilities of CBB and of SSB shall become the offices and facilities of the Resulting Corporation. All rights, privileges, powers, franchises and interests of CBB and SSB, respectively, in and to every type of property (real, personal and mixed) and choses in action shall be transferred to and vested in the Resulting Corporation by virtue of the Merger without any deed or other transfer. All liabilities, obligations, and indebtedness of every kind and description of CBB and SSB, respectively, as of the Effective Date shall be transferred to and assumed by the Resulting Corporation by virtue of the Merger without any separate assignment, assumption, or other transfer. The Resulting Corporation on the Effective Date, and without any order or other action on the part of any court or otherwise, shall hold and enjoy all rights of property, franchises and interests, including appointments, designations and nominations and all other rights and interests as trustee, executor, administrator, transfer agent and registrar of stocks and bonds, guardian of estates, assignee, and receiver and in every other fiduciary capacity and in every agency, and capacity, in the same manner and to the same extent as such rights, franchises and interests were held or enjoyed by CBB and SSB, respectively, immediately before the Effective Date.

2.3 Articles of Incorporation and Bylaws. On the Effective Date, following the Merger, the articles of incorporation and bylaws of the Resulting Corporation shall be the articles of incorporation and bylaws of SSB as they existed immediately before the Effective Date.

2.4 Resulting Corporation’s Board. The board of directors of the Resulting Corporation on the Effective Date shall consist of the board of directors of SSB plus the New SSB Director as set forth in Section 6.1(f), and such director shall hold office or continue to hold office until his successor is duly elected and qualified, or his earlier death, resignation or removal subject to Section 6.1(f).

2.5 Stockholder Approval. This Agreement shall be submitted to the stockholders of CBB at a special meeting of stockholders (the “Stockholders Meeting”) to be held as promptly as practicable consistent with the satisfaction of the conditions set forth in this Agreement. Upon approval by the requisite vote of the stockholders of CBB, as required by the GBCC, the Merger shall become effective as soon as practicable thereafter in the manner provided in Section 2.7, subject to the provisions of Section 8.2.

2.6 Further Acts. If, at any time after the Effective Date, the Resulting Corporation shall consider or be advised that any further assignments or assurances in law or any other acts are necessary or desirable (i) to vest, perfect, confirm or record, in the Resulting Corporation, title to and possession of any property or right of CBB as a result of the Merger, or (ii) otherwise to carry out the purposes of this Agreement, the proper officers and directors of the Resulting Corporation are fully authorized in the name of CBB or SSB to execute and deliver all such proper deeds, assignments and assurances in law and to do all acts necessary or proper to vest, perfect or confirm title to, and possession of, such property or rights in the Resulting Corporation and otherwise to carry out the purposes of this Agreement.

2.7 Effective Date and Closing. Subject to the terms of all requirements of Law and the conditions specified in this Agreement, the Merger shall become effective on the date and time specified in the Statement of Merger to be filed with the Secretary of State of the State of Alabama (such time being herein called the “Effective Date”) and any required filing under the GBCC. Assuming all other conditions stated in this Agreement have been or will be satisfied (or waived) as of the Closing, the Closing shall take place at the offices of SSB, in Anniston,

Alabama, at 5:00 p.m. as to the Merger on a date specified by SSB (and reasonably acceptable to CBB) (such date, the “Closing Date”) that shall be as soon as reasonably practicable, after the later to occur of the Stockholders Meeting or receipt of all required regulatory approvals under Section 8.2, and the expiration of any applicable waiting periods, or at such other place and time, and in such manner, that the Parties may mutually agree.

2.8 Subsidiary Bank Merger. As soon as practicable after completion of the Merger, Century Bank will merge with and into Southern States Bank (herein referred to as the “Resulting Bank” whenever reference is made to it as of the time of the Merger or thereafter) substantially in accordance with the terms of the Bank Merger Agreement set forth as Exhibit A hereto (the “Subsidiary Bank Merger”). CBB will cooperate with SSB, including the call of any special meetings of the board of directors of Century Bank and the filing of any regulatory applications, in the execution and filing of appropriate documentation relating to such merger. The Bank Merger Agreement shall provide that the board of directors of the Resulting Bank shall consist of the members of Southern States Bank as of the effective date of the Subsidiary Bank Merger plus the New SSB Director.

Article 3

MERGER CONSIDERATION; EXCHANGE PROCEDURES

3.1 Merger Consideration. Subject to the provisions of this Agreement, at the Effective Date, automatically by virtue of the Merger and without any action on the part of the Parties or any shareholder of CBB:

(a)Each share of SSB Common Stock that is issued and outstanding immediately prior to the Effective Date shall remain issued and outstanding following the Effective Date and shall be unchanged by the Merger.

(b)Each share of CBB Common Stock owned directly by SSB, CBB, or any of their respective wholly owned Subsidiaries (other than shares in trust accounts, managed accounts, and the like for the benefit of customers or shares held as collateral for outstanding debt previously contracted) immediately prior to the Effective Date shall be cancelled and retired at the Effective Date without any conversion thereof, and no payment shall be made with respect thereto (the “CBB Cancelled Shares”).

(c)Notwithstanding anything in this Agreement to the contrary, all shares of CBB Common Stock that are issued and outstanding immediately prior to the Effective Date and which are held by a shareholder who did not vote in favor of the Merger (or consent thereto in writing) and who is entitled to demand and properly demands the fair value of such shares pursuant to, and who complies in all respects with, the provisions of Title 13 of the GBCC, shall not be converted into or be exchangeable for the right to receive the Merger Consideration (the “Dissenting Shares”), but instead the holder of such Dissenting Shares (hereinafter called a “Dissenting Shareholder”) shall be entitled to payment of the fair value of such shares in accordance with the applicable provisions of the GBCC (and at the Effective Date, such Dissenting Shares shall no longer be outstanding and shall automatically be cancelled and shall cease to exist and such holder shall cease to have any rights with respect thereto, except the rights provided for pursuant to the applicable provisions of the GBCC and this Section 3.1(c)), unless and until such Dissenting Shareholder shall have failed to perfect such holder’s right to receive, or shall have effectively withdrawn, revoked, waived or lost rights to demand or receive, the fair value of such shares of CBB Common Stock under the applicable provisions of the GBCC. If any Dissenting Shareholder shall fail to perfect or effectively withdraw, revoke, waive or lose such Holder’s dissenter’s rights under the applicable provisions of the GBCC, each such Dissenting Share shall be deemed to have been converted into and to have become exchangeable

for the right to receive the Stock Consideration (as defined below), without any interest thereon, in accordance with the applicable provisions of this Agreement. CBB shall give SSB (i) prompt notice of any written notices to exercise dissenters’ rights in respect of any shares of CBB Common Stock, attempted withdrawals of such notices and any other instruments served pursuant to the GBCC and received by CBB relating to dissenters’ rights and (ii) the opportunity to participate in negotiations and proceedings with respect to demands for fair value under the GBCC. CBB shall not, except with the prior written consent of SSB, voluntarily make any payment with respect to, or settle, or offer or agree to settle, any such demand for payment. Any portion of the Merger Consideration made available to the Exchange Agent pursuant to this Article 3 to pay for shares of CBB Common Stock for which dissenters’ rights have been perfected shall be returned to SSB upon demand.

(d)Subject to Section 3.1(c), Section 3.3 regarding proration and Section 3.6 regarding fractional shares, each share of CBB Common Stock (excluding Dissenting Shares and CBB Cancelled Shares) issued and outstanding at the Effective Date shall cease to be outstanding and shall be converted, in accordance with the terms of this Article 3, into and exchanged for the right to receive either of the following forms of consideration (the “Merger Consideration”):

(i)for each one (1) share of CBB Common Stock the right to receive from SSB 1.550 shares of SSB Common Stock (the “Exchange Ratio”), validly issued, fully paid and nonassessable (the “Stock Consideration”); or

(ii)for each one (1) share of CBB Common Stock with respect to which a Cash Election (as defined herein) has been validly made and not revoked pursuant to Section 3.3 (the “Cash Election Shares”), the right to receive in cash from SSB an amount equal to $45.63 (the “Cash Consideration”); and

(iii)unless a Cash Election for shares of CBB Common Stock has been validly made and not revoked, the shares of CBB Common Stock will receive the Stock Consideration.

Subject to Sections 3.2 and 3.3 below, no more than ten percent (10%) of the shares of CBB Common Stock outstanding at the Effective Date shall receive the Cash Consideration (the “Maximum Cash Consideration”).

(e)If, between the date hereof and the Effective Date, the outstanding shares of CBB Common Stock or SSB Common Stock shall have been increased, decreased, changed into or exchanged for a different number or kind of shares or securities as a result of a reorganization, stock dividend, stock split, reverse stock split or similar change in capitalization, appropriate and proportionate adjustments shall be made to the Exchange Ratio and Cash Consideration. For purposes of clarity, the Exchange Ratio and Cash Consideration are based on the number of outstanding shares of CBB Common Stock set forth in Section 5.2 and any change to such number of outstanding shares will result in an appropriate adjustment to the Exchange Ratio and Cash Consideration.

3.2 Election Procedures.

(a)Prior to the Effective Date, SSB shall appoint an exchange agent (the “Exchange Agent”), which is acceptable to CBB in its reasonable discretion, for the payment and exchange of the Merger Consideration.

(b)Holders of record of CBB Common Stock have the right to submit an Election Form (defined below) to convert the number of shares of CBB Common Stock held by such Holder into the right to receive the Cash Consideration (a “Cash Election”). Such Election Form must cover all shares of CBB Common Stock held of record by such Holder and is subject to Section 3.3.

(c)An election form (“Election Form”), together with a Letter of Transmittal (as defined in Section 3.8), shall be mailed no less than twenty (20) Business Days prior to the Election Deadline (as defined below) or on such earlier date as SSB and CBB shall mutually agree (the “Mailing Date”) to each Holder of record of CBB Common Stock as of five (5) Business Days prior to the Mailing Date. Holders of record of shares of CBB Common Stock who hold such shares as nominees, trustees or in other representative capacities (a “Record Holder”) may submit multiple Election Forms, provided that each such Election Form covers all the shares of CBB Common Stock held by each Record Holder for a particular beneficial owner. Any shares owned by a Holder who has not, as of the Election Deadline, made an election by submission to the Exchange Agent of an effective, properly completed Election Form shall receive the Stock Consideration. The Exchange Agent shall make available one or more Election Forms as may reasonably be requested in writing from time to time by all Persons who become holders (or beneficial owners) of CBB Common Stock between the record date for the initial mailing of Election Forms and the close of business on the Business Day prior to the Election Deadline, and CBB shall provide to the Exchange Agent all information reasonably necessary for it to perform as specified herein.

(d)The term “Election Deadline”, as used below, shall mean 5:00 p.m., Eastern time, on the date of the CBB Meeting. An election shall have been properly made only if the Exchange Agent shall have actually received a properly completed Election Form by the Election Deadline accompanied by one or more Certificates (or customary affidavits and indemnification regarding the loss or destruction of such certificates) representing all the shares of CBB Common Stock covered by such Election Form. Any Election Form may be revoked or changed by the Person submitting such Election Form to the Exchange Agent by written notice to the Exchange Agent only if such notice of revocation or change is actually received by the Exchange Agent at or prior to the Election Deadline. Shares of CBB Common Stock held by holders who acquired such shares subsequent to the Election Deadline will be designated non-election shares (“Non-Election Shares”). In addition, if a Holder of CBB Common Stock either (1) does not submit a properly completed Election Form in a timely fashion or (2) revokes its Election Form prior to the Election Deadline and fails to file a new properly completed Election Form before the deadline, such shares shall be designated Non-Election Shares. Non-Election Shares will receive Stock Consideration. Subject to the terms of this Agreement and of the Election Form, the Exchange Agent shall have discretion to determine whether any election, revocation or change has been properly or timely made and to disregard immaterial defects in the Election Forms, and any good faith decisions of the Exchange Agent regarding such matters shall be binding and conclusive. Neither SSB nor the Exchange Agent shall be under any obligation to notify any Person of any defect in an Election Form.

3.3 Proration.

(a)Notwithstanding any other provision contained in this Agreement, the maximum number of shares of CBB Common Stock that may be converted into Cash Consideration (which, for this purpose, shall be deemed to include the Dissenting Shares determined as of the Effective Date) shall not exceed the Maximum Cash Consideration. All other shares of CBB Common Stock (other than CBB Cancelled Shares and Dissenting Shares) shall be converted into the right to receive the Stock Consideration.

(b)Within five (5) Business Days after the Effective Date, SSB shall cause the Exchange Agent to effect the allocation among the Holders of the rights to receive the Cash Consideration or the Stock Consideration such that if the aggregate number of shares of CBB Common Stock with respect to which Cash Elections shall have been validly made and not revoked (which, for this purpose, shall be deemed to include the Dissenting Shares determined as of the Effective Date) exceeds the Maximum Cash Consideration, then the Cash Consideration shall be prorated as set forth in this Section 3.3(b). The manner and basis of prorating the shares of CBB Common Stock into shares of SSB Common Stock or cash are as follows:

(1)If more than 10% of the shares of CBB Common Stock outstanding at the Effective Date would otherwise be converted into cash (including shares held by Holders who have properly exercised their right to dissent as set forth above) the Holders of CBB Common Stock electing cash will receive a combination of cash and SSB Common Stock with the cash to be prorated on the basis of the number of shares of CBB Common Stock as to which proper Cash Elections have been made so that the maximum amount of shares of CBB Common Stock to receive cash shall not exceed 10%.

(2)If less than 10% of the shares of CBB Common Stock outstanding at the Effective Date have elected cash so that less than 10% of such shares shall be converted into and exchanged for cash (including shares held by Holders who have properly exercised their right to dissent as set forth above) cash shall be distributed to those stockholders electing cash and SSB Common Stock shall be distributed to the remainder of stockholders of CBB as set forth in Section 3.1(d)(i) above.

3.4 CBB Stock-Option Awards. At the Effective Date, each option granted by CBB to purchase shares of CBB Common Stock under the CBB Bancorp Amended and Restated 2009 Stock Option and Incentive Plan (the “CBB Stock Plan”), whether vested or unvested, that is outstanding and unexercised immediately prior to the Effective Date (a “CBB Option”) shall be canceled and extinguished at the Effective Date and automatically exchanged into the right to receive an amount of cash (without interest) equal to the product of (i) the aggregate number of shares of CBB Common Stock issuable upon exercise of such CBB Option multiplied by (ii) the excess, if any, of (A) the Cash Consideration over (B) the per-share exercise price of such CBB Option, payable through the payroll of CBB or its Affiliates (less applicable Tax withholdings) as promptly as practicable following the Effective Date. CBB will be entitled to deduct and withhold such amounts as may be required to be deducted and withheld under the Code and any applicable state or local Tax laws as allowed under the CBB Stock Plan and the applicable grant agreement.

3.5 Rights as Shareholders; Stock Transfers. At the Effective Date, all shares of CBB Common Stock, when converted in accordance with Section 3.1, shall no longer be outstanding and shall automatically be cancelled and retired and shall cease to exist, and each Certificate or Book-Entry Share previously evidencing such shares shall thereafter represent only the right to receive for each such share of CBB Common Stock, the Merger Consideration and any cash in lieu of fractional shares of SSB Common Stock in accordance with this Article 3. Shares of SSB Common Stock to be issued shall be issued in Book-Entry form only. At the Effective Date, holders of CBB Common Stock shall cease to be, and shall have no rights as, shareholders of CBB, other than the right to receive the Merger Consideration and cash in lieu of fractional shares of SSB Common Stock as provided under this Article 3. At the Effective Date, the stock transfer books of CBB shall be closed, and there shall be no registration of transfers on the stock transfer books of CBB of shares of CBB Common Stock.

3.6 Fractional Shares. Notwithstanding any other provision hereof, no fractional shares of SSB Common Stock and no certificates or scrip therefor, or other evidence of ownership thereof, will be issued in the Merger. In lieu thereof, SSB shall pay or cause to be paid to each Holder of a fractional share of SSB Common Stock, rounded to the nearest one hundredth of a share, an amount of cash (without interest and rounded to the nearest whole cent) determined by multiplying the fractional share interest in SSB Common Stock to which such Holder would otherwise be entitled by the Cash Consideration.

3.7 Plan of Reorganization. It is intended that the Merger and the Bank Merger shall each qualify as a “reorganization” within the meaning of Section 368(a) of the Code, and that this Agreement shall constitute a “plan of reorganization” within the meaning of Treasury Regulation Section 1.368-2(g) for each of the Merger and the Bank Merger.

3.8 Exchange Procedures. As promptly as practicable after the Effective Date, the Exchange Agent will mail or otherwise cause to be delivered to each Holder appropriate and customary transmittal materials, which shall specify that delivery shall be effected, and risk of loss and title to the Certificates or Book-Entry Shares (if any) representing CBB Common Stock shall pass, only upon delivery of the Certificates or Book-Entry Shares to the Exchange Agent, as well as instructions for use in effecting the surrender of the Certificates or Book-Entry Shares in exchange for the Merger Consideration (including cash in lieu of fractional shares) as provided for in this Agreement (the “Letter of Transmittal”).

3.9 Deposit and Delivery of Merger Consideration.

(a)Prior to the Effective Date, SSB shall (i) notify the Exchange Agent the number of shares of SSB Common Stock and cash sufficient to deliver the Merger Consideration (together with, to the extent then determinable, any cash payable in lieu of fractional shares pursuant to Section 3.6, and if applicable, cash in an aggregate amount sufficient to make the appropriate payment to the Holders of Dissenting Shares) (collectively, the “Exchange Fund”), and (ii) instruct the Exchange Agent to pay such Merger Consideration and cash in lieu of fractional shares in accordance with this Agreement as promptly as practicable after the Effective Date and conditioned upon receipt of a properly completed Letter of Transmittal. The Stock Consideration shall be issued and recorded as Book-Entry Shares. The Exchange Agent and SSB, as the case may be, shall not be obligated to deliver the Merger Consideration to a Holder to which such Holder would otherwise be entitled as a result of the Merger until such Holder surrenders the Certificates or Book Entry Shares representing the shares of CBB Common Stock for exchange as provided in this Article 3, or an appropriate affidavit of loss and indemnity agreement and/or a bond in such amount as may be reasonably required in each case by SSB or the Exchange Agent.

(b)Any portion of the Exchange Fund that remains unclaimed by the shareholders of CBB for one year after the Effective Date (as well as any interest or proceeds from any investment thereof) shall be delivered by the Exchange Agent to SSB. Any Holder who has not theretofore complied with this Section 3.9 shall thereafter look only to SSB for the Merger Consideration, any cash in lieu of fractional shares of CBB Common Stock to be issued or paid in consideration therefor, and any dividends or distributions to which such Holder is entitled in respect of each share of CBB Common Stock such Holder held immediately prior to the Effective Date, as determined pursuant to this Agreement, in each case without any interest thereon. If outstanding Certificates or Book-Entry Shares for shares of CBB Common Stock are not surrendered or the payment for them is not claimed prior to the date on which such shares of SSB Common Stock or cash would otherwise escheat to or become the property of any Governmental Authority, the unclaimed items shall, to the extent permitted by the law of abandoned property and any other applicable Law, become the property of SSB (and to the

extent not in its possession shall be delivered to it), free and clear of all claims or interest of any Person previously entitled to such property. Neither the Exchange Agent nor any Party shall be liable to any Holder represented by any Certificate or Book-Entry Share for any amounts delivered to a public official pursuant to applicable abandoned property, escheat, or similar Laws. SSB and the Exchange Agent shall be entitled to rely upon the stock transfer books of CBB to establish the identity of those Persons entitled to receive the Merger Consideration specified in this Agreement, which books shall be conclusive with respect thereto. In the event of a dispute with respect to ownership of any shares of CBB Common Stock represented by any Certificate or Book-Entry Share, SSB and the Exchange Agent shall be entitled to tender to the custody of any court of competent jurisdiction any Merger Consideration represented by such Certificate or Book-Entry Share and file legal proceedings interpleading all parties to such dispute, and will thereafter be relieved with respect to any claims thereto.

(c)SSB or the Exchange Agent, as applicable, shall be entitled to deduct and withhold from any amounts otherwise payable pursuant to this Agreement to any Holder such amounts as SSB is required to deduct and withhold under applicable Law. Any amounts so deducted and withheld shall be remitted to the appropriate Governmental Authority and shall be treated for all purposes of this Agreement as having been paid to the Holder in respect of which such deduction and withholding was made by SSB or the Exchange Agent, as applicable.

3.10 Rights of Certificate Holders after the Effective Date.

(a)All shares of SSB Common Stock to be issued pursuant to the Merger shall be deemed issued and outstanding as of the Effective Date and if ever a dividend or other distribution is declared by SSB in respect of the SSB Common Stock, the record date for which is at or after the Effective Date, that declaration shall include dividends or other distributions in respect of all shares of SSB Common Stock issuable pursuant to this Agreement. No dividends or other distributions in respect of the SSB Common Stock shall be paid to any Holder of any unsurrendered Certificate or Book-Entry Share until such Certificate or Book-Entry Share is surrendered for exchange in accordance with this Article 3. Subject to the effect of applicable Laws, following surrender of any such Certificate or Book-Entry Share, there shall be issued to the Holder whole shares of SSB Common Stock in Book-Entry form and the Holder shall be paid, without interest, (i) at the time of such surrender, the dividends or other distributions with a record date after the Effective Date theretofore payable with respect to such whole shares of SSB Common Stock and not paid and (ii) at the appropriate payment date, the dividends or other distributions payable with respect to such whole shares of SSB Common Stock with a record date after the Date with a payment date subsequent to surrender.

(b)In the event of a transfer of ownership of a Certificate representing CBB Common Stock that is not registered in the stock transfer records of CBB, the proper amount of cash and/or shares of SSB Common Stock shall be paid or issued in exchange therefor to a person other than the person in whose name the Certificate so surrendered is registered if the Certificate formerly representing such CBB Common Stock shall be properly endorsed or otherwise be in proper form for transfer and the person requesting such payment or issuance shall pay any transfer or other similar Taxes required by reason of the payment or issuance to a person other than the registered Holder of the Certificate or establish to the satisfaction of SSB that the Tax has been paid or is not applicable.

Article 4

REPRESENTATIONS AND WARRANTIES OF SSB

Except as disclosed and set forth in the disclosure letter delivered by SSB to CBB prior to the execution of this Agreement (the “SSB Disclosure Letter”) (which sets forth, among other

things, items the disclosure of which is necessary or appropriate either in response to an express disclosure requirement contained in a provision hereof or as an exception to one or more representations or warranties contained in this Article 4, or to one or more of SSB’s covenants contained herein (provided that the mere inclusion of an item in the SSB Disclosure Letter as an exception to a representation or warranty shall not be deemed an admission that such item represents a material exception or material fact, event or circumstance or that such item has had or would have a Material Adverse Effect)), and subject to current filings made by SSB with the SEC, SSB represents, warrants and covenants to and with CBB as follows:

4.1 Organization.

(a)SSB is a corporation and Southern States Bank is an Alabama banking corporation, each duly organized, validly existing and in good standing under the Laws of the State of Alabama. Each of SSB and Southern States Bank has the necessary corporate powers to carry on its business as presently conducted and is qualified to do business in every jurisdiction in which the character and location of the Assets owned by it or the nature of the business transacted by it requires qualification or in which the failure to qualify could, individually or in the aggregate, have a Material Adverse Effect.

(b)SSB has no direct Subsidiaries other than Southern States Bank, and there are no Subsidiaries of Southern States Bank. SSB owns all of the issued and outstanding capital stock of Southern States Bank free and clear of any liens, claims or encumbrances of any kind. All of the issued and outstanding shares of capital stock of Southern States Bank have been validly issued and are fully paid and non-assessable.

4.2 Capital Stock.

(a)The authorized capital stock of SSB consists of 30,000,000 shares of voting common stock, $5.00 par value per share (the “SSB Common Stock”), of which as of December 31, 2023, 8,841,349 shares were validly issued and outstanding, fully paid and nonassessable and are not subject to preemptive rights, 5,000,000 shares of nonvoting common stock $5.00 par value per share, of which as of December 31, 2023, no shares were issued and outstanding, and 325,715 shares subject to options. The shares of SSB Common Stock to be issued in the Merger are duly authorized and, when so issued, will be validly issued and outstanding, fully paid and nonassessable.

(b)The authorized capital stock of each Subsidiary of SSB is validly issued, fully paid and nonassessable, and each Subsidiary is wholly owned, directly or indirectly, by SSB.

4.3 Financial Statements; Taxes.

(a)SSB has previously delivered or made available to CBB copies of (i) the audited consolidated financial statements of SSB for the years ending December 31, 2022, 2021 and 2020, accompanied by the unqualified audit reports of Mauldin & Jenkins and (ii) unaudited interim financial statements (including the related notes and schedules thereto) of SSB and each of its Subsidiaries for the nine months ended September 30, 2023 (the “Latest Balance Sheet Date”). All such financial statements are in all material respects in accordance with the books and records of SSB and have been prepared except as noted therein in accordance with GAAP applied on a consistent basis throughout the periods indicated, all as more particularly set forth in the notes to such statements. Each of the consolidated balance sheets presents fairly as of its date the consolidated financial condition of SSB and its Subsidiaries. Except as and to the extent reflected or reserved against it in such balance sheets (including the notes thereto), neither SSB

nor Southern States Bank had, as of the dates of such balance sheets, any material Liabilities or obligations (absolute or contingent) of a nature customarily reflected in a balance sheet or the notes thereto. The statements of consolidated income, stockholders’ equity and changes in consolidated financial position present fairly the results of operations and changes in financial position of SSB and its Subsidiaries for the periods indicated. The foregoing representations, insofar as they relate to any unaudited interim financial statements of SSB that may be presented to CBB, are subject in all cases to normal recurring year-end adjustments and the omission of footnote disclosure. All journal entries have been appropriately made in the books and records of SSB.

(b)All income and other material Tax returns required to be filed by or on behalf of SSB have been timely filed (or requests for extensions therefor have been timely made and have not expired), and all returns filed are complete and accurate in all material respects. All Taxes shown on these returns to be due and all additional assessments received have been paid unless appropriately reflected as a Liability on the balance sheet. The amounts recorded for Taxes on the balance sheets provided under Section 4.3(a)(i) are, to the Knowledge of SSB, sufficient in all material respects for the payment of all unpaid federal, state, county, local, foreign or other Taxes (including any interest or penalties) of SSB accrued for or applicable to the period ended on the dates thereof, and all years and periods prior thereto and for which SSB may at such dates have been liable in its own right or as transferee of the Assets of, or as successor to, any other corporation or other party. No audit, examination or investigation is presently being conducted or, to the Knowledge of SSB, threatened by any taxing authority which is likely to result in a material Tax Liability, no material unpaid Tax deficiencies or additional Tax liabilities have been proposed by any governmental representative and no agreements for extension of time for the assessment of any material amount of Tax have been entered into by or on behalf of SSB other than extensions obtained in the ordinary course of business.

(c)Each SSB Company has withheld from its employees (and timely paid to the appropriate government entity) proper and accurate amounts for all periods in material compliance with all Tax withholding provisions of applicable federal, state, foreign and local Laws (including without limitation, income, social security and employment Tax withholding for all types of compensation). Each SSB Company is in compliance with, and its records contain all information and documents (including properly completed IRS Forms W-9) necessary to comply with, all applicable information reporting and Tax withholding requirements under federal, state and local Tax Laws, and such records identify with specificity all accounts subject to backup withholding under Section 3406 of the Code.

4.4 No Conflict with Other Instrument. The consummation of the transactions contemplated by this Agreement will not result in a breach of or constitute a Default (without regard to the giving of notice or the passage of time) under any material Contract, indenture, mortgage, deed of trust or other material agreement or instrument to which SSB or any of its Subsidiaries is a party or by which they or their Assets may be bound; will not conflict with any provision of the articles of incorporation or bylaws of SSB or the articles of incorporation or bylaws of any of its Subsidiaries; and will not violate any provision of any Law, regulation, judgment or decree binding on them or any of their Assets.

4.5 Absence of Material Adverse Effect. Since the Latest Balance Sheet Date, there have been no events, changes or occurrences which have had or are reasonably likely to have, individually or in the aggregate, a Material Adverse Effect on SSB.

4.6 Approval of Agreement.

(a) The board of directors of SSB has approved this Agreement and the transactions contemplated by it and has authorized the execution and delivery by SSB of this Agreement. This Agreement constitutes the legal, valid and binding obligation of SSB, enforceable against it in accordance with its terms. SSB has full power, authority and legal right to enter into this Agreement and to consummate the transactions contemplated by this Agreement. SSB has no Knowledge of any fact or circumstance under which the appropriate regulatory approvals required by Section 8.2 will not be granted without the imposition of material conditions or material delays.

(b) No Consent, Permit, notice, or filing of or with any governmental entity is required to be obtained or made by SSB or its Subsidiaries in connection with the execution, delivery, and performance by SSB of this Agreement or the consummation by it and its Subsidiaries of the transactions contemplated hereby, except for: (i) the filing of Statement of Merger with the Secretary of State of the State of Alabama; (ii) the filing with the SEC of the Form S-4 pursuant to Section 7.3 and the SEC’s declaration of its effectiveness under the 1933 Act, and (iii) the filing of such reports under the 1934 Act as may be required in connection with this Agreement, the Merger, and Merger Consideration, and the other transactions contemplated by this Agreement; (iii) such filings, Permits, Consents, if any, as may be required under applicable state securities or “blue sky” Laws and the securities Laws of any foreign country; (iv) the approvals described in Section 8.2; and (v) such other Consents which if not obtained or made would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect on SSB.

4.7 Subsidiaries. Each Subsidiary of SSB has been duly incorporated and is validly existing as a corporation in good standing under the Laws of the jurisdiction of its incorporation and each Subsidiary has been duly qualified as a foreign corporation to transact business and is in good standing under the Laws of each other jurisdiction in which it owns or leases properties, or conducts any business so as to require such qualification and in which the failure to be duly qualified could have a Material Adverse Effect upon SSB and its Subsidiaries considered as one enterprise; and Southern States Bank has its deposits fully insured by the FDIC to the extent provided by the Federal Deposit Insurance Act.

4.8 Litigation. Except as disclosed in or reserved for in SSB’s financial statements, there is no Litigation (whether or not purportedly on behalf of SSB) pending or, to the Knowledge of SSB, threatened against or affecting any SSB Company (nor does SSB have Knowledge of any facts which are likely to give rise to any such Litigation) at law or in equity, or before or by any governmental department, commission, board, bureau, agency or instrumentality, domestic or foreign, or before any arbitrator of any kind, which involves the possibility of any judgment or Liability not fully covered by insurance in excess of a reasonable deductible amount or which may have a Material Adverse Effect on SSB, and no SSB Company is in Default with respect to any judgment, order, writ, injunction, decree, award, rule or regulation of any court, arbitrator or governmental department, commission, board, bureau, agency or instrumentality, which Default would have a Material Adverse Effect on SSB. To the Knowledge of SSB, each SSB Company has complied in all material respects with all material applicable Laws and regulations including those imposing Taxes, of any applicable jurisdiction and of all states, municipalities, other political subdivisions and Agencies, in respect of the ownership of its properties and the conduct of its business, which, if not complied with, would have a Material Adverse Effect on SSB.

4.9 Compliance. SSB and its Subsidiaries, in the conduct of their businesses. are, to the Knowledge of SSB, in material compliance with all material federal, state or local Laws applicable to their or the conduct of their businesses.

4.10 Proxy Statement. SSB shall provide information to be used by CBB in its Proxy Statement at the time of the CBB Stockholders Meeting. Such information provided by SSB will not contain an untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading.

4.11 SEC Filings. SSB has filed timely all registration statements, prospectuses, schedules, forms, statements, proxy materials and reports (including, in each case, all exhibits and documents incorporated by reference) required to be filed or furnished by it with or to the SEC (collectively, the “SEC Documents”). As of their respective filing dates or, if amended or superseded by a subsequent filing prior to the date hereof, as of the date of the last such amendment or superseding filing (and, in the case of registration statements and proxy statements, on the dates of effectiveness and the dates of mailing or use, respectively), each of the SEC Documents complied as to form in all material respects with the applicable requirements of the 1933 Act, the 1934 Act, and the Sarbanes-Oxley Act of 2002, and the rules and regulations of the SEC thereunder applicable to such SEC Documents. None of the SEC Documents, including any financial statements, schedules, or exhibits included or incorporated by reference therein at the time they were filed (or, if amended or superseded by a subsequent filing prior to the date hereof, as of the date of the last such amendment or superseding filing), contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading. To the Knowledge of SSB, none of the SEC Documents is the subject of ongoing SEC review or outstanding SEC investigation and there are no outstanding or unresolved comments received from the SEC with respect to any of the SEC Documents. No Subsidiary of SSB is required to file or furnish any forms, reports, or other documents with the SEC.

4.12 Absence of Regulatory Communications; Filings. Neither SSB nor any of its Subsidiaries is subject to, or has received during the past twelve (12) months, any written communication directed specifically to it from any Agency to which it is subject or pursuant to which such Agency has imposed or has indicated it may impose any material restrictions on the operations of it or the business conducted by it or in which such Agency has raised a material question concerning the condition, financial or otherwise, of such company. All reports, records, registrations, statements, notices and other documents or information required to be filed by SSB and Southern States Bank with any Agency have been duly and timely filed and, to the Knowledge of SSB, all information and data contained in such reports, records or other documents are true, accurate, correct and complete in all material respects.

4.13 Loans; Adequacy of Allowance for Credit Losses.

(a)ACL. All allowances for credit losses shown on the most recent financial statements furnished by SSB have been calculated in accordance with GAAP and prudent and customary banking practices and are adequate in all material respects to reflect the risk inherent in the loans of Southern States Bank. SSB has no Knowledge of any fact which is likely to require a future material increase in the provision for loan losses or a material decrease in the credit loss allowance reflected in such financial statements.

(b)Validity. Each loan reflected as an Asset on the financial statements of SSB is the legal, valid and binding obligation of the obligor of each loan, enforceable in

accordance with its terms subject to the effect of bankruptcy, insolvency, reorganization, moratorium, or other similar laws relating to creditors’ rights generally and to general equitable principles and complies with all Laws to which it is subject. SSB does not have in its portfolio any loan exceeding its legal lending limit, or any loan to any insider in violation of Regulation O and SSB has no known significant delinquent, substandard, doubtful, loss, nonperforming or problem loans. Each outstanding loan (including loans held for resale to investors) was solicited and originated, and is and has been administered and, where applicable, serviced, and the relevant loan files are being maintained, in all material respects in accordance with the relevant notes or other credit or security documents, the written underwriting standards of Southern States Bank (and, in the case of loans held for resale to investors, the underwriting standards, if any, of the applicable investors) and with all applicable federal, state and local laws, regulations and rules. None of the agreements pursuant to which Southern States Bank has sold loans or pools of loans or participations in loans or pools of loans contains any obligation to repurchase such loans or interests therein solely on account of a payment default by the obligor on any such loan.

4.14 Fair Housing Act, Home Mortgage Disclosure Act and Equal Credit Opportunity Act and Flood Disaster Protection Act. Southern States Bank is in compliance in all material respects with the Fair Housing Act (42 U.S.C. § 3601 et seq.), the Home Mortgage Disclosure Act (12 U.S.C. § 2801 et seq.), the Equal Credit Opportunity Act (15 U.S.C. § 1691 et seq.), and the Flood Disaster Protection Act (42 USC § 4002, et seq.), and all regulations promulgated thereunder. Southern States Bank has not received any written notices of any violation of such acts or any of the regulations promulgated thereunder, and it has not received any written notice of any, and to the Knowledge of SSB, there is no, threatened administrative inquiry, proceeding or investigation with respect to its compliance with such laws.

4.15 Bank Secrecy Act, Foreign Corrupt Practices Act and U.S.A. Patriot Act. Southern States Bank is in material compliance with the Bank Secrecy Act (12 U.S.C. §§ 1730(d) and 1829(b)), the United States Foreign Corrupt Practices Act and the International Money Laundering Abatement and Anti-Terrorist Financing Act, otherwise known as the U.S.A. Patriot Act, and all regulations promulgated thereunder.

4.16 Disclosure. No representation or warranty, or any statement or certificate furnished or to be furnished to CBB by SSB, contains or will contain any untrue statement of a material fact, or omits or will omit to state a material fact necessary to make the statements contained in this Agreement or in any such statement or certificate not misleading.

4.17 Community Reinvestment Act Compliance. Southern States Bank is an insured depository institution and has complied in all material respects with the Community Reinvestment Act of 1977 (“CRA”) and the rules and regulations thereunder, and has a composite CRA rating of not less than “satisfactory.”

4.18 Title and Related Matters. SSB has good and marketable title to all the properties, interest in properties and Assets, real and personal, that are material to the business of SSB, reflected in the most recent balance sheet referred to in Section 4.3(a)(i), or acquired after the date of such balance sheet (except properties, interests and Assets sold or otherwise disposed of since such date, in the ordinary course of business and consistent with past practice), free and clear of all mortgages, Liens, pledges, charges or encumbrances except (i) mortgages and other encumbrances referred to in the notes to such balance sheet, (ii) Liens for current Taxes not yet due and payable and (iii) such imperfections of title and easements as do not materially detract from or interfere with the present use of the properties subject thereto or affected thereby, or otherwise materially impair present business operations at such properties. To the Knowledge of SSB, the material structures and equipment of each SSB Company comply in all material respects with the requirements of all applicable Laws. SSB is not aware of any defects,

irregularities or problems with any of its computer hardware or software which renders such hardware or software unable to satisfactorily perform the tasks and functions to be performed by them in the business of any SSB Company

4.19 Material Contract Defaults. No SSB Company is in Default in any material respect under the terms of any material Contract, agreement, lease or other commitment which is or may be material to the business, operations, properties or Assets, or the condition, financial or otherwise, of such company and, to the Knowledge of SSB, there is no event which, with notice or lapse of time, or both, may be or become an event of Default under any such material Contract, agreement, lease or other commitment in respect of which adequate steps have not been taken to prevent such a Default from occurring.

4.20 Insurance. Each SSB Company has in effect insurance coverage and bonds with reputable insurers which, in respect to amounts, types and risks insured, management of SSB reasonably believes to be adequate for the type of business conducted by such company. No SSB Company is liable for any material retroactive premium adjustment. All insurance policies and bonds are valid, enforceable and in full force and effect, and no SSB Company has received any notice of any material premium increase or cancellation with respect to any of its insurance policies or bonds. Within the last three years, no SSB Company has been refused any insurance coverage which it has sought or applied for, and it has no reason to believe that existing insurance coverage cannot be renewed as and when the same shall expire, upon terms and conditions as favorable as those presently in effect, other than possible increases in premiums that do not result from any extraordinary loss experience. All policies of insurance presently held or policies containing substantially equivalent coverage will be outstanding and in full force with respect to each SSB Company at all times from the date hereof to the Effective Date.

4.21 Registration Statement. At the time the Registration Statement becomes effective, at the time of the mailing of the Proxy Statement, at the time of use of other proxy material, and at the time of the Stockholders’ Meeting, the Registration Statement, including the Proxy Statement which shall constitute a part thereof, will comply in all material respects with the requirements of the 1933 Act and the rules and regulations thereunder, will not contain an untrue statement of a material fact or omit to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading; provided, however, that the representations and warranties in this subsection shall not apply to statements in or omissions from the Proxy Statement made in reliance upon and in conformity with information furnished in writing to SSB by CBB or any of its representatives expressly for use in the Proxy Statement regarding the business of CBB, its operations, Assets and capital.

4.22 Agreements with Regulatory Agencies. Neither SSB nor any of its Subsidiaries is subject to any cease-and-desist, consent order, or other order or enforcement action issued by, or is a party to any written agreement, consent agreement, or memorandum of understanding with, or is a party to any commitment letter or similar undertaking to, or is subject to any order or directive by, or has been ordered to pay any civil money penalty by, or has been, during the preceding five (5) years, a recipient of any supervisory letter from, or, during the preceding five (5) years, has adopted any policies, procedures or board resolutions at the request or suggestion of any Agency or other Governmental Authority that currently restricts in any material respect the conduct of its business or that in any material manner relates to its capital adequacy, its ability to pay dividends, its credit or risk management policies, its management or its business, other than those of general application that apply to similarly situated bank holding companies or their subsidiaries, whether or not set forth in the SSB Disclosure Letter (an “SSB Regulatory Agreement”), nor has or any of its Subsidiaries been advised, during the preceding five (5) years,

by any Agency or other Governmental Authority that it is considering issuing, initiating, ordering, or requesting any such SSB Regulatory Agreement. There are no refunds or restitutions required to be paid as a result of any criticism of any Agency or body cited in any examination report of SSB or any of its Subsidiaries as a result of an examination by any Agency or body, or set forth in any accountant’s or auditor’s report to SSB or any of its Subsidiaries.

4.23 Broker. All negotiations relative to this Agreement and the transactions contemplated by this Agreement have been carried on by SSB directly with CBB and without the intervention of any other person, either as a result of any act of SSB, or otherwise, in such manner as to give rise to any valid claim against SSB for a finder’s fee, brokerage commission or other like payment except for any such arrangement between SSB and Keefe, Bruyette & Woods.

4.24 Approval Delays. To the knowledge of SSB, there is no reason why the granting of any of the required regulatory approvals under Section 8.2 would be denied or unduly delayed.

4.25 No Shareholder Approval. No vote or consent of any of the holders of SSB’s capital stock is required by Law or stock purchase agreement for SSB to enter into this Agreement and to consummate the Merger.

4.26 No Additional Representations.

(a) Except for the representations and warranties made by SSB in this Article 4, neither SSB nor any other Person makes any express or implied representation or warranty with respect to SSB or its Subsidiaries or their respective businesses, operations, assets, liabilities, conditions (financial or otherwise) or prospects, and SSB hereby disclaims any such other representations or warranties.