Sutro Biopharma, Inc. (Sutro or the Company) (NASDAQ: STRO), a

clinical-stage oncology company pioneering site-specific and

novel-format antibody drug conjugates (ADCs), today reported its

financial results for the second quarter of 2023, its recent

business highlights, and a preview of select anticipated

milestones.

“We are delighted with the initiation of the REFRaME study, a

pivotal Phase 2/3 trial for patients with platinum-resistant

ovarian cancer. The oral presentation at ASCO has generated

significant interest of luvelta within the medical community,

providing momentum for patient enrollment into REFRaME across our

global sites," said Bill Newell, Sutro’s Chief Executive Officer.

“Our financial position has been bolstered by the Blackstone

royalty agreement, which helps to extend our cash runway into the

first half of 2025. We remain committed to our pipeline progress

and eagerly anticipate sharing updated data from the Phase 1

STRO-002-GM1 study in the second half of this year for ovarian and

endometrial cancers."

Recent Business

Highlights and

Select Anticipated

Milestones

STRO-002, International Nonproprietary Name, “luveltamab

tazevibulin,” abbreviated as “luvelta”, FolRα-Targeting

ADC: Luveltamab tazevibulin (luvelta) is being studied in

the clinic globally for patients with ovarian and endometrial

cancers.

- Data from the Phase 1 dose-expansion

study for luvelta in ovarian cancer were featured as an oral

presentation at the 2023 American Society of Clinical Oncology

(ASCO 2023) Annual Meeting in Chicago, IL in June 2023. Consistent

with data reported in January 2023, luvelta demonstrated

substantial clinical benefit in FolRα-selected patients, defined by

a Tumor Proportion Score (TPS) of >25%, irrespective of staining

intensity, in which the data collected has shown to represent

approximately 80% of the advanced ovarian cancer patient

population. Additionally, Sutro expects to release updated data

from the Phase 1 STRO-002-GM1 study in patients with ovarian cancer

in the second half of 2023.

- In June 2023, Sutro announced the

initiation of REFRaME, a Phase 2/3 registration-directed study for

patients with platinum-resistant ovarian cancer. Patient dosing has

begun, and global sites have been activated, with additional sites

expected this year. Once results are analyzed on ~110 patents with

demonstrated high or unmet need, Sutro plans to apply for

accelerated approval based on overall response rate (ORR) as the

primary endpoint. At the end of the trial, full approval may be

pursued based on progression-free survival (PFS) as the primary

endpoint, comparing results from the luvelta arm and the standard

of care arm.

- Patients with CBFA2T3::GLIS2 (CBF/GLIS;

RAM phenotype) AML, a highly refractory and uniformly fatal subtype

of acute myeloid leukemia found exclusively in infants and young

children, were treated with luvelta under compassionate use. During

the 64th American Society of Hematology Annual Meeting and

Exposition (ASH 2022), an oral presentation was given by Soheil

Meshinchi, M.D., Ph.D. summarizing preliminary results from

compassionate use of luvelta in this rare indication, suggesting

that luvelta was well tolerated as a monotherapy agent and in

combination with standard cancer therapies. Sutro plans to initiate

a pivotal, or registration-enabling protocol to pursue registration

in this high unmet need, vastly underserved patient

population.

- Additional ongoing clinical studies for

luvelta include a combination study with bevacizumab for patients

with advanced ovarian cancer and a dose-expansion study for

patients with endometrial cancer. Sutro will present data from the

Phase 1 dose expansion of luveltamab tazevibulin for patients with

endometrial cancers as a Mini Oral Session at the European Society

for Medical Oncology (ESMO) Congress 2023 to be held October 20-24,

2023 in Madrid, Spain.Title: Luveltamab

Tazevibulin (STRO-002), an anti-Folate Receptor Alpha (FolRα)

Antibody Drug Conjugate (ADC), Demonstrates Clinical Activity in

Recurrent/Progressive Epithelial Endometrial Cancer (EEC):

STRO-002-GM1 Phase 1 Dose ExpansionSession: Mini

Oral Session 1 - Gynecological cancersDate &

Time: Sunday, October 22, 2023, 10:15am-11:45am CEST

- Translational work is ongoing to

support an Investigational New Drug (IND) application for the

initiation of a non-small cell lung cancer (NSCLC) study, for which

submission is planned in 2023.

STRO-001, CD74-Targeting ADC: The Phase 1 study

for patients with B-cell malignancies has been completed in global

sites ex-Greater China and clinical studies in Greater China have

been initiated.

- Sutro has completed the Phase 1

dose-escalation study in patients with non-Hodgkin’s lymphoma (NHL)

and multiple myeloma (MM), after reaching a maximum tolerated dose

(MTD). Sutro plans to leverage the clinical data produced by its

partner BioNova Pharma (BioNova) in Greater China to make future

prioritization decisions regarding further clinical

development.

- BioNova is advancing clinical

development of BN301 (STRO-001) for patients with hematological

malignancies in Greater China. In February 2023, BioNova announced

that the first patient had been dosed in the Phase 1 clinical study

of BN301 for the treatment of advanced non-Hodgkin’s lymphoma

(NHL).

Additional Pipeline Development: STRO-003, a

ROR1-targeting ADC and STRO-004, a tissue factor-targeting ADC have

INDs planned for Q1 2024 and Q1 2025, respectively.

- STRO-003, a novel, next-generation ADC

that has been designed to target ROR1, features eight precisely

placed β-Glucuronidase-cleavable linkers attached to

next-generation exatecan warheads, which, when released, inhibit

topoisomerase-1 (TOPO-1) and cause DNA disruption.

- Expanded preclinical data for STRO-003

was presented at the American Association for Cancer Research

(AACR) Annual Meeting in April 2023, demonstrating potent

anti-tumor activity and immune-modulating properties, suggesting

that STRO-003 may have the potential to augment checkpoint blockade

therapy.

- STRO-003 has demonstrated, in NSCLC and

breast cancer patient-derived xenograft models, strong cell-killing

activity in low and heterogeneous ROR1-expressing tumors. STRO-003

has also exhibited promising tolerability in preclinical studies

involving rodents and non-human primates, with potentially reduced

lung toxicity relative to other TOPO-1 inhibiting ADCs.

Collaboration Updates: Sutro continues to seek

to maximize the value of its proprietary cell-free platform by

working with partners on programs in multiple disease spaces and

geographies and has generated from collaborators an aggregate of

approximately $772 million in payments through June 30, 2023,

including equity investments.

- In June 2023, Sutro announced a royalty

monetization agreement with Blackstone Life Sciences, an affiliate

of Blackstone, under which Sutro received $140 million upfront and

is eligible to receive up to an additional $250 million in future

milestone payments in exchange for the 4% royalty, or revenue

interest, in potential future sales of Vaxcyte’s products. This

transaction with Blackstone provides non-dilutive capital to Sutro

for continued pipeline advancement. Sutro retains the right to

discover and develop vaccines for the treatment or prophylaxis of

any disease that is not caused by an infectious pathogen, including

cancer.

- In December 2022, Sutro and Vaxcyte

expanded upon a nearly decade-long relationship through a new

agreement, under which Vaxcyte acquired an option to access

expanded rights to develop and manufacture cell-free extract, among

other rights, and includes a $22.5 million upfront payment and,

upon exercise of the option, up to an additional $135 million in

option exercise and contingent payments.

- Sutro’s collaboration with Astellas on

the discovery of immunostimulatory antibody-drug conjugates (iADCs)

for three targets is ongoing, for which Sutro receives financial

support for its research efforts, potential milestone payments and

royalties, and has an option to co-develop and co-commercialize

product candidates in the U.S.

- Sutro is manufacturing initial drug

supply for its partners including for Merck’s MK-1484, currently in

Phase 1 as monotherapy and in combination with pembrolizumab in

advanced or metastatic solid tumors. Sutro is providing clinical

drug supply to BioNova for clinical studies for BN301 (STRO-001) in

Greater China. Sutro is currently supporting Tasly

Biopharmaceuticals (Tasly) for their IND filing and the initiation

of clinical development activities in Greater China for STRO-002

and will provide initial clinical drug supply.

Corporate Updates: Sutro continues to

strengthen its Research team.

- Gang Yin, Ph.D., has been promoted to

Vice President, Platform and Process Sciences, and will continue to

lead protein biochemistry efforts and serve as a key interface with

other Sutro teams working on its cell-free technology and

platform.

- Alice Yam, Ph.D., has been promoted to

Vice President, Drug Discovery, and will lead pharmacology efforts

and continue to provide leadership for pre-clinical efforts on

Sutro’s emerging product development candidates.

Second Quarter 2023 Financial

Highlights

Cash, Cash Equivalents and Marketable SecuritiesAs of June 30,

2023, Sutro had cash, cash equivalents and marketable securities of

$358.3 million, as compared to $251.5 million as of March 31, 2023,

and approximately 0.7 million shares of Vaxcyte common stock with a

fair value of $33.3 million, which together provide a projected

cash runway into the first half of 2025, based on current business

plans and assumptions.

Unrealized Gain from Increase in Value of Vaxcyte Common

StockThe non-operating, unrealized gain of $8.3 million in the

quarter ended June 30, 2023 was due to the increase since March 31,

2023 in the estimated fair value of Sutro’s holdings of Vaxcyte

common stock. Vaxcyte common stock held by Sutro will be remeasured

at fair value based on the closing price of Vaxcyte’s common stock

on the last trading day of each reporting period, with any

non-operating, unrealized gains and losses recorded in Sutro’s

statements of operations.

RevenueRevenue was $10.4 million for the quarter ended June 30,

2023, as compared to $28.1 million for the same period in 2022,

with the 2023 amount related principally to the Astellas, Merck and

BMS collaborations. Future collaboration and license

revenue under existing agreements, and from any additional

collaboration and license partners, will fluctuate as a result of

the amount and timing of revenue recognition of upfront,

milestones, and other agreement payments.

Operating ExpensesTotal operating expenses for the quarter ended

June 30, 2023 were $56.6 million, as compared to $47.5 million for

the same period in 2022. The second quarter 2023 amount includes

non-cash expenses for stock-based compensation of $6.7 million and

depreciation and amortization of $1.7 million, as compared to $6.7

million and $1.4 million, respectively, in the comparable 2022

period. Total operating expenses for the quarter ended June 30,

2023 were comprised of research and development expenses of $41.6

million and general and administrative expenses of $15.0 million,

which are expected to increase in the remainder of 2023 as Sutro’s

internal product candidates advance in clinical development and

additional general and administrative expenses are incurred as a

public company.

Royalty Monetization AgreementAs related to the royalty

monetization agreement between Sutro and an affiliate of Blackstone

Life Sciences, Sutro received in June 2023 a $140.0 million

upfront payment and is eligible to receive up to an additional

$250.0 million in future milestone payments. Sutro recorded the

$140.0 million upfront payment from Blackstone as a deferred

royalty obligation related to the sale of future royalties on the

Company's condensed Balance Sheets as of June 30, 2023. Due to the

Company's ongoing manufacturing obligations, the Company accounted

for the proceeds as imputed debt and will recognize future non-cash

royalty revenues. Non-cash interest expense will be recognized over

the estimated life of the royalty term arrangement using the

effective interest method based on the imputed interest rate

derived from estimated amounts and timing of future royalty

payments to be received from Vaxcyte. As part of the sale, Sutro

incurred approximately $3.8 million in transaction costs, which are

being amortized over the estimated life of the royalty term

arrangement using the effective interest method. As future

royalties are earned from Vaxcyte by Blackstone, the balance of the

deferred royalty obligation will be amortized over the estimated

life of the royalty term arrangement.

About Sutro Biopharma

Sutro Biopharma, Inc., is a clinical-stage company developing

next-generation cancer therapeutics, principally antibody-drug

conjugates (ADCs), designed for greater potency, tolerability and

improved safety. Sutro’s cell-free technology, XpressCF®, enables

the design and manufacture of homogeneous product candidates with

precise and empirically-demonstrated positioning of linker-payloads

and consistent drug antibody ratio (DAR). Sutro’s platform has

produced six clinical stage candidates to date, including two

wholly-owned ADCs—luveltamab tazevibulin, or luvelta, a folate

receptor alpha (FolRα)-targeting ADC in clinical studies for

ovarian and endometrial cancers, as well as STRO-001, a

CD74-targeting ADC in clinical studies for B-cell malignancies. In

addition, the Company has a robust pipeline of preclinical and

discovery stage candidates including STRO-003, a ROR1-targeting

ADC, and STRO-004, a tissue factor-targeting ADC. Sutro has also

entered into high-value collaborations with industry partners,

including Astellas and Merck (MSD outside of the United States and

Canada); and Sutro’s platform technology enabled the formation of

Vaxcyte. Sutro is headquartered in South San Francisco. For more

information, follow Sutro on Twitter, @Sutrobio, or visit

www.sutrobio.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including, but not

limited to, anticipated preclinical and clinical development

activities, timing of announcements of clinical results, trial

initiation, and regulatory filings, potential benefits of luvelta

and the Company’s other product candidates and platform, potential

future milestone and royalty payments, and potential market

opportunities for luvelta and the Company’s other product

candidates. All statements other than statements of historical fact

are statements that could be deemed forward-looking statements.

Although the Company believes that the expectations reflected in

such forward-looking statements are reasonable, the Company cannot

guarantee future events, results, actions, levels of activity,

performance or achievements, and the timing and results of

biotechnology development and potential regulatory approval is

inherently uncertain. Forward-looking statements are subject to

risks and uncertainties that may cause the Company’s actual

activities or results to differ significantly from those expressed

in any forward-looking statement, including risks and uncertainties

related to the Company’s ability to advance its product candidates,

the receipt and timing of potential regulatory designations,

approvals and commercialization of product candidates and the

Company’s ability to successfully leverage Fast Track designation,

the market size for the Company’s product candidates to be smaller

than anticipated, the impact of the COVID-19 pandemic on the

Company’s business, clinical trial sites, supply chain and

manufacturing facilities, the Company’s ability to maintain and

recognize the benefits of certain designations received by product

candidates, the timing and results of preclinical and clinical

trials, the Company’s ability to fund development activities and

achieve development goals, the Company’s ability to protect

intellectual property, the value of the Company’s holdings of

Vaxcyte common stock, and the Company’s commercial collaborations

with third parties and other risks and uncertainties described

under the heading “Risk Factors” in documents the Company files

from time to time with the Securities and Exchange Commission.

These forward-looking statements speak only as of the date of this

press release, and the Company undertakes no obligation to revise

or update any forward-looking statements to reflect events or

circumstances after the date hereof.

Investor & Media ContactAnnie J. Chang

Sutro Biopharma (650)

801-5728

ajchang@sutrobio.com

Sutro Biopharma,

Inc.Selected Statements of Operations Financial

Data(Unaudited)(In thousands,

except share and per share amounts)

|

|

|

Three Months Ended |

Six Months Ended |

|

|

|

|

June 30, |

June 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenues |

|

$ |

10,412 |

|

|

$ |

28,096 |

|

|

$ |

23,086 |

|

|

$ |

33,993 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

41,592 |

|

|

|

32,332 |

|

|

|

80,991 |

|

|

|

62,322 |

|

|

General and administrative |

|

|

14,999 |

|

|

|

15,143 |

|

|

|

30,511 |

|

|

|

30,182 |

|

| Total operating expenses |

|

|

56,591 |

|

|

|

47,475 |

|

|

|

111,502 |

|

|

|

92,504 |

|

| Loss from operations |

|

|

(46,179 |

) |

|

|

(19,379 |

) |

|

|

(88,416 |

) |

|

|

(58,511 |

) |

| Interest income |

|

|

2,842 |

|

|

|

197 |

|

|

|

5,402 |

|

|

|

313 |

|

| Unrealized gain (loss) on

equity securities |

|

|

8,321 |

|

|

|

(3,736 |

) |

|

|

1,329 |

|

|

|

(3,173 |

) |

| Non-cash interest expense

related to the sale of future royalties |

|

|

(442 |

) |

|

|

- |

|

|

|

(442 |

) |

|

|

- |

|

| Interest and other income

(expense), net |

|

|

(2,915 |

) |

|

|

(594 |

) |

|

|

(5,901 |

) |

|

|

(1,251 |

) |

| Loss before provision for

income taxes |

|

|

(38,373 |

) |

|

|

(23,512 |

) |

|

|

(88,028 |

) |

|

|

(62,622 |

) |

| Provision for income

taxes |

|

|

151 |

|

|

|

2,500 |

|

|

|

546 |

|

|

|

2,500 |

|

| Net loss |

|

$ |

(38,524 |

) |

|

$ |

(26,012 |

) |

|

$ |

(88,574 |

) |

|

$ |

(65,122 |

) |

| Net loss per share, basic and

diluted |

|

$ |

(0.64 |

) |

|

$ |

(0.55 |

) |

|

$ |

(1.49 |

) |

|

$ |

(1.39 |

) |

| Weighted-average shares used

in computing basic and diluted loss per share |

|

|

60,339,475 |

|

|

|

46,957,196 |

|

|

|

59,535,918 |

|

|

|

46,729,663 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sutro Biopharma,

Inc.Selected Balance Sheets Financial

Data (Unaudited)(In

thousands)

|

|

|

June

30,2023(1) |

|

|

December

31,2022(2) |

|

|

Assets |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

|

$ |

358,293 |

|

|

$ |

302,344 |

|

|

Investment in equity securities |

|

|

33,349 |

|

|

|

32,020 |

|

|

Accounts receivable |

|

|

9,999 |

|

|

|

7,122 |

|

|

Property and equipment, net |

|

|

23,636 |

|

|

|

24,621 |

|

|

Operating lease right-of-use assets |

|

|

25,138 |

|

|

|

26,443 |

|

|

Other assets |

|

|

14,484 |

|

|

|

14,394 |

|

| Total

Assets |

|

$ |

464,899 |

|

|

$ |

406,944 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other liabilities |

|

$ |

32,958 |

|

|

$ |

32,822 |

|

|

Deferred revenue |

|

|

97,916 |

|

|

|

106,644 |

|

|

Operating lease liability |

|

|

32,460 |

|

|

|

34,159 |

|

|

Debt |

|

|

10,197 |

|

|

|

16,271 |

|

|

Deferred royalty obligation related to the sale of future

royalties |

|

|

136,653 |

|

|

|

- |

|

| Total liabilities |

|

|

310,184 |

|

|

|

189,896 |

|

| Total stockholders’

equity |

|

|

154,715 |

|

|

|

217,048 |

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

464,899 |

|

|

$ |

406,944 |

|

(1) The condensed balance sheet as of June 30, 2023 was

derived from the unaudited financial statements included in the

Company's Quarterly Report on Form 10-Q for the quarter ended June

30, 2023, filed with the Securities and Exchange Commission on

August 10, 2023.

(2) The condensed balance sheet as of December 31, 2022 was

derived from the audited financial statements included in the

Company's Annual Report on Form 10-K for the year ended December

31, 2022, filed with the Securities and Exchange Commission on

March 30, 2023.

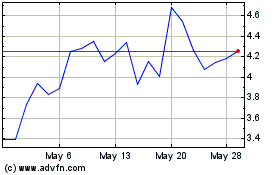

Sutro Biopharma (NASDAQ:STRO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sutro Biopharma (NASDAQ:STRO)

Historical Stock Chart

From Feb 2024 to Feb 2025