Sutro Biopharma, Inc. (Sutro or the Company) (NASDAQ: STRO), a

clinical-stage oncology company pioneering site-specific and

novel-format antibody drug conjugates (ADCs), today reported its

financial results for the third quarter of 2024 and its recent

business highlights.

With its lead program, luveltamab tazevibulin (luvelta), Sutro

recently initiated a registrational trial for a rare form of

pediatric leukemia, a clinical trial for non-small cell lung cancer

(NSCLC), and presented expansion data in combination with

bevacizumab. The randomized portion of Sutro’s registrational trial

for patients with advanced ovarian cancer is underway. Sutro

expects to provide an update following alignment with the U.S. Food

& Drug Administration (FDA) on the selected dose for the

pivotal portion of this trial around the end of the year.

Recognizing the potential patient benefit and commercial

opportunity for luvelta, Sutro engaged Lazard to assist in its

efforts to identify a partner for luvelta who can provide financial

resources and expertise for the multi-indication development and

commercialization of luvelta.

Additionally, Sutro showcased at a recent Research Forum a

portfolio of emerging next-generation ADCs, made possible by our

unique cell-free platform, which are expected to drive value

creation beyond luvelta. During the event, Sutro announced three

planned IND filings over the next three years for wholly owned

programs, including STRO-004, a tissue-factor targeting ADC,

featuring a DAR8 exatecan payload and site-specific linker design,

which is expected to enter the clinic next year.

Recent Business

Highlights and

Select Anticipated

Milestones

Luveltamab Tazevibulin (luvelta), FRα-Targeting ADC

Franchise:

- Sutro presented updated data from the

Phase 1b study of luvelta in combination with bevacizumab for

patients with ovarian cancer in a poster presentation at the

European Society for Medical Oncology (ESMO) Congress 2024,

demonstrating a 56% response rate at the recommended Phase 2 dose

of luvelta (4.3 mg/kg) for this study. An expansion study of this

combination is ongoing, with data expected in the first half of

2025.

- Part 2 (randomized portion) of the

Phase 3 trial, REFRαME-O1, for treatment of platinum-resistant

ovarian cancer (PROC), is ongoing.

- REFRαME-P1, a registration-enabling

trial for pediatric patients with CBFA2T3::GLIS2 (CBF/GLIS; RAM

phenotype) AML, is underway.

- A Phase 2 trial for the treatment of

NSCLC is underway, with initial data expected in 2025.

Additional Pipeline Development and Collaboration

Updates:

- In October 2024, Sutro hosted a

Research Forum highlighting next-generation ADC innovation and

near-term pipeline milestones, including:

- STRO-004, a tissue factor-targeting

ADC, which features a drug-antibody-ratio (DAR) of eight exatecan

payloads and site-specific linker design, demonstrated greater

anti-tumor activity and lower toxicities than a tissue factor

benchmark ADC in preclinical models. Sutro anticipates filing an

IND for STRO-004 in the second half of 2025.

- Dual-payload ADCs (ADC2) provide

therapeutic benefits compared to standard ADCs, including potential

to overcome tumor resistance mechanisms, and show increased

anti-tumor activity and desirable properties in preclinical

models.

- iADCs provide a novel mechanism of

action, bridging innate and adaptive immunity to enable broad

protection in a single molecule, and show increased and durable

anti-tumor activity in a preclinical model compared to standalone

ADCs or immune-stimulating antibody conjugates.

- Sutro’s proprietary and partnered

preclinical ADC portfolio has potential across a broad range of

tumor types and the Company plans to deliver three INDs over the

next three years.

- Sutro continues to seek to maximize the

value of its proprietary cell-free platform by working with

partners on programs in multiple disease spaces and geographies and

has generated from collaborators an aggregate of approximately $975

million in payments through September 30, 2024, including equity

investments.

Upcoming Events: Sutro plans to participate in

three upcoming investor conferences. Webcasts of the presentations

will be accessible through the News & Events page of the

Investor Relations section of the Company’s website at

www.sutrobio.com. Archived replays will be available for at least

30 days after the events.

- Jefferies London Healthcare Conference,

November 19-21, 2024, in London

- The Citizens JMP Hematology and

Oncology Summit, December 2, 2024, Virtual

- Piper Sandler 36th Annual Healthcare

Conference, December 3-5, 2024, in New York

Third Quarter 2024 Financial

Highlights

Cash, Cash Equivalents and Marketable Securities As of September

30, 2024, Sutro had $388.3 million in cash, cash equivalents and

marketable securities.

Realized Gain on Sale of Vaxcyte Common StockIncluded in

non-operating interest and other income (expense), net, on the

Statement of Operations for the nine months ended September 30,

2024 was a realized gain of $32.1 million from the sale of

approximately 0.7 million shares of Vaxcyte common stock, with net

proceeds of approximately $74.0 million. As of September 30, 2024,

Sutro does not hold any shares of Vaxcyte common stock.

RevenueRevenue was $8.5 million for the quarter ended September

30, 2024, as compared to $16.9 million for the same period in 2023,

with the 2024 amount related principally to the Astellas

collaboration and the Vaxcyte agreement. Future collaboration and

license revenue under existing agreements, and from any additional

collaboration and license partners, will fluctuate as a result of

the amount and timing of revenue recognition of upfront,

milestones, and other agreement payments.

Operating ExpensesTotal operating expenses for the quarter ended

September 30, 2024 were $76.4 million, as compared to $60.9 million

for the same period in 2023. The 2024 quarter includes non-cash

expenses for stock-based compensation of $6.5 million and

depreciation and amortization of $1.8 million, as compared to $6.0

million and $1.7 million, respectively, in the comparable 2023

period. Total operating expenses for the quarter ended September

30, 2024 were comprised of research and development expenses of

$62.1 million and general and administrative expenses of $14.3

million.

About Sutro BiopharmaSutro Biopharma, Inc., is

a clinical-stage company relentlessly focused on the discovery and

development of precisely designed cancer therapeutics, to transform

what science can do for patients. Sutro’s fit-for-purpose

technology, including cell-free XpressCF®, provides the opportunity

for broader patient benefit and an improved patient experience.

Sutro has multiple clinical stage candidates, including luveltamab

tazevibulin, or luvelta, a registrational-stage folate receptor

alpha (FolRα)-targeting ADC in clinical studies. A robust pipeline,

coupled with high-value collaborations and industry partnerships,

validates Sutro’s continuous product innovation. Sutro is

headquartered in South San Francisco. For more information, follow

Sutro on social media @Sutrobio, or visit www.sutrobio.com.

Forward-Looking Statements This press release

contains forward-looking statements within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995, including, but not limited to, anticipated preclinical and

clinical development activities, including enrollment and site

activation; timing of announcements of clinical results, trial

initiation, and regulatory filings; outcome of discussions with

regulatory authorities; potential benefits of luvelta and the

Company’s other product candidates and platform; potential business

development and partnering transactions; potential market

opportunities for luvelta and the Company’s other product

candidates; and the Company’s expected cash runway. All statements

other than statements of historical fact are statements that could

be deemed forward-looking statements. Although the Company believes

that the expectations reflected in such forward-looking statements

are reasonable, the Company cannot guarantee future events,

results, actions, levels of activity, performance or achievements,

and the timing and results of biotechnology development and

potential regulatory approval is inherently uncertain.

Forward-looking statements are subject to risks and uncertainties

that may cause the Company’s actual activities or results to differ

significantly from those expressed in any forward-looking

statement, including risks and uncertainties related to the

Company’s ability to advance its product candidates, the receipt

and timing of potential regulatory designations, approvals and

commercialization of product candidates and the Company’s ability

to successfully leverage Fast Track designation, the market size

for the Company’s product candidates to be smaller than

anticipated, clinical trial sites, supply chain and manufacturing

facilities, the Company’s ability to maintain and recognize the

benefits of certain designations received by product candidates,

the timing and results of preclinical and clinical trials, the

Company’s ability to fund development activities and achieve

development goals, the Company’s ability to protect intellectual

property, and the Company’s commercial collaborations with third

parties and other risks and uncertainties described under the

heading “Risk Factors” in documents the Company files from time to

time with the Securities and Exchange Commission. These

forward-looking statements speak only as of the date of this press

release, and the Company undertakes no obligation to revise or

update any forward-looking statements to reflect events or

circumstances after the date hereof.

|

Sutro Biopharma, Inc.Selected Statements

of Operations Financial

Data(Unaudited)(In thousands,

except share and per share amounts) |

|

|

|

|

|

|

Three Months Ended |

Nine Months Ended |

|

|

|

September 30, |

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

$ |

8,520 |

|

|

$ |

16,924 |

|

|

$ |

47,234 |

|

|

$ |

40,010 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

62,108 |

|

|

|

45,669 |

|

|

|

181,006 |

|

|

|

126,660 |

|

|

General and administrative |

|

14,331 |

|

|

|

15,269 |

|

|

|

39,423 |

|

|

|

45,780 |

|

| Total operating expenses |

|

76,439 |

|

|

|

60,938 |

|

|

|

220,429 |

|

|

|

172,440 |

|

| Loss from operations |

|

(67,919 |

) |

|

|

(44,014 |

) |

|

|

(173,195 |

) |

|

|

(132,430 |

) |

| Interest income |

|

4,875 |

|

|

|

4,550 |

|

|

|

13,882 |

|

|

|

9,952 |

|

| Unrealized gain on equity

securities |

|

- |

|

|

|

694 |

|

|

|

- |

|

|

|

2,023 |

|

| Non-cash interest expense related

to thesale of future royalties |

|

(7,910 |

) |

|

|

(5,936 |

) |

|

|

(22,380 |

) |

|

|

(6,378 |

) |

| Interest and other income

(expense), net |

|

22,167 |

|

|

|

(2,739 |

) |

|

|

26,683 |

|

|

|

(8,640 |

) |

| Loss before provision for income

taxes |

|

(48,787 |

) |

|

|

(47,445 |

) |

|

|

(155,010 |

) |

|

|

(135,473 |

) |

| Provision for income taxes |

|

- |

|

|

|

1,839 |

|

|

|

8 |

|

|

|

2,385 |

|

| Net loss |

$ |

(48,787 |

) |

|

$ |

(49,284 |

) |

|

$ |

(155,018 |

) |

|

$ |

(137,858 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.59 |

) |

|

$ |

(0.81 |

) |

|

$ |

(2.07 |

) |

|

$ |

(2.30 |

) |

| Weighted-average shares used in

computingbasic and diluted loss per share |

|

82,043,671 |

|

|

|

60,599,025 |

|

|

|

74,934,737 |

|

|

|

59,894,181 |

|

|

Sutro Biopharma, Inc.Selected Balance

Sheets Financial

Data(Unaudited)(In

thousands) |

|

|

|

|

September

30,2024(1) |

|

|

December

31,2023(2) |

|

|

Assets |

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

$ |

388,254 |

|

|

$ |

333,681 |

|

|

Investment in equity securities |

|

- |

|

|

|

41,937 |

|

|

Accounts receivable |

|

6,655 |

|

|

|

36,078 |

|

|

Property and equipment, net |

|

18,997 |

|

|

|

21,940 |

|

|

Operating lease right-of-use assets |

|

19,027 |

|

|

|

22,815 |

|

|

Other assets |

|

18,899 |

|

|

|

14,285 |

|

| Total

Assets |

$ |

451,832 |

|

|

$ |

470,736 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other liabilities |

$ |

53,222 |

|

|

$ |

64,293 |

|

|

Deferred revenue |

|

90,559 |

|

|

|

74,045 |

|

|

Operating lease liability |

|

24,864 |

|

|

|

29,574 |

|

| Debt |

|

- |

|

|

|

4,061 |

|

| Deferred royalty obligation

related to the sale of future royalties |

|

171,967 |

|

|

|

149,114 |

|

| Total liabilities |

|

340,612 |

|

|

|

321,087 |

|

| Total stockholders’

equity |

|

111,220 |

|

|

|

149,649 |

|

| Total Liabilities and

Stockholders’ Equity |

$ |

451,832 |

|

|

$ |

470,736 |

|

(1) The condensed balance sheet as of September 30, 2024

was derived from the unaudited financial statements included in the

Company's Quarterly Report on Form 10-Q for the quarter ended

September 30, 2024, filed with the Securities and Exchange

Commission on November 13, 2024.

(2) The condensed balance sheet as of December 31, 2023 was

derived from the unaudited financial statements included in the

Company's Annual Report on Form 10-K for the year ended December

31, 2023, filed with the Securities and Exchange Commission on

March 25, 2024.

Contact

Emily White

Sutro Biopharma

(650) 823-7681

ewhite@sutrobio.com

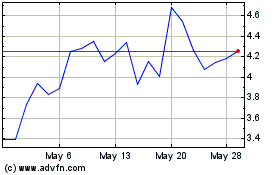

Sutro Biopharma (NASDAQ:STRO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sutro Biopharma (NASDAQ:STRO)

Historical Stock Chart

From Dec 2023 to Dec 2024