0001434621false00014346212025-03-052025-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 5, 2025

LendingTree, Inc.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34063 | | 26-2414818 |

| (State or other jurisdiction | | (Commission | | (IRS Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | | | | |

| 1415 Vantage Park Dr., Suite 700, | Charlotte | NC | | 28203 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (704) 541-5351

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

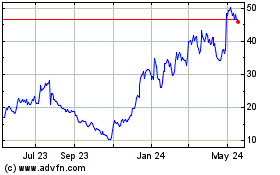

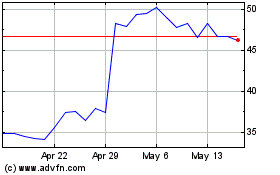

| Common Stock, $0.01 par value per share | | TREE | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On March 5, 2025, LendingTree, Inc. (the “Registrant”) announced financial results for the quarter and year ended December 31, 2024. A copy of the related press release is furnished as Exhibit 99.1 and a copy of the related Shareholder Letter is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

The information contained in this Current Report shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: March 5, 2025 | |

| | |

| | LENDINGTREE, INC. |

| | |

| | |

| | By: | /s/ Jason Bengel |

| | | Jason Bengel |

| | | Chief Financial Officer |

Exhibit 99.1

LENDINGTREE REPORTS FOURTH QUARTER 2024 RESULTS

Above Forecast Results Driven by Revenue Growth Across All Three Business Segments

•Consolidated revenue of $261.5 million

•GAAP net income of $7.5 million or $0.55 per diluted share

•Variable marketing margin of $86.7 million

•Adjusted EBITDA of $32.2 million

•Adjusted net income per share of $1.16

CHARLOTTE, NC - March 5, 2025 - LendingTree, Inc. (NASDAQ: TREE), operator of LendingTree.com, the nation's leading online financial services marketplace, today announced results for the quarter ended December 31, 2024. The Company has posted a shareholder letter on its investor relations website at investors.lendingtree.com.

"We are thrilled to report the company's fourth quarter performance was well above the high end of our guidance range, showcasing the strength of our diversification,” said Doug Lebda, Chairman and CEO. "Our Insurance business delivered another outstanding quarter with revenue growth of 188% compared to the prior year period. Looking forward, we expect another solid year of AEBITDA growth in 2025 on continued revenue strength and operating expense discipline."

Scott Peyree, President and COO, commented, "Our business has returned to broad-based growth. The exceptional Q4 performance in Insurance was powered by record revenue along with a four-percentage point sequential increase in segment margin. Our Home and Consumer segments grew revenue 35% and 12% YoY, respectively, in the quarter as well. We forecast continued revenue growth across all three of our segments in 2025. The team's focus on operational excellence has generated multiple small wins that combine to create a stronger growth profile for the company. We are energized for the year ahead."

Jason Bengel, CFO, added, "Our financial profile improved materially in 2024 with net leverage ending the year at 3.5x, a decline from 5.3x at year-end 2023. Our forecast anticipates further improvement in our leverage profile this year, which we intend to utilize to lower our cost of capital and improve free cashflow conversion for shareholders. We have also made steady progress managing the fixed costs of the business. Expense discipline is a core focus for the company. We anticipate the forecasted level of operating expense can drive scalable revenue growth going forward."

Fourth Quarter 2024 Business Highlights

•Home segment revenue of $34.0 million increased 35% over fourth quarter 2023 and produced segment profit of $11.7 million, a 44% increase over the same period.

•Consumer segment revenue of $55.6 million increased 12% over fourth quarter 2023.

◦Within Consumer, personal loans revenue of $26.5 million increased 21% over prior year while Small Business revenue increased 45% in the period.

•Insurance segment revenue of $171.7 million increased 188% from fourth quarter 2023 and translated into segment profit of $48.0 million, an increase of 90% over the same period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LendingTree Summary Financial Metrics |

| (In millions, except per share amounts) |

| | | | | | | | | | | |

| Three Months Ended December 31, | | Y/Y | | | Three Months Ended September 30, | | Q/Q | |

| 2024 | | 2023 | | % Change | | | 2024 | | % Change | |

| | | | | | | | | | | |

| Total revenue | $ | 261.5 | | | $ | 134.4 | | | 95 | % | | | $ | 260.8 | | | — | % | |

| | | | | | | | | | | |

| Income (loss) before income taxes | $ | 9.1 | | | $ | 13.1 | | | (31) | % | | | (57.5) | | | 116 | % | |

| Income tax expense | (1.6) | | | (0.4) | | | 300 | % | | | (0.5) | | | 220 | % | |

| Net income (loss) | $ | 7.5 | | | $ | 12.7 | | | (41) | % | | | $ | (58.0) | | | 113 | % | |

| Net income (loss) % of revenue | 3 | % | | 9 | % | | | | | (22) | % | | | |

| | | | | | | | | | | |

| Income (loss) per share | | | | | | | | | | | |

| Basic | $ | 0.56 | | | $ | 0.98 | | | | | | $ | (4.34) | | | | |

| Diluted | $ | 0.55 | | | $ | 0.98 | | | | | | $ | (4.34) | | | | |

| | | | | | | | | | | |

| Variable marketing margin | | | | | | | | | | | |

| Total revenue | $ | 261.5 | | | $ | 134.4 | | | 95 | % | | | $ | 260.8 | | | — | % | |

Variable marketing expense (1) (2) | $ | (174.8) | | | $ | (73.8) | | | 137 | % | | | $ | (183.6) | | | (5) | % | |

Variable marketing margin (2) | $ | 86.7 | | | $ | 60.6 | | | 43 | % | | | $ | 77.2 | | | 12 | % | |

Variable marketing margin % of revenue (2) | 33 | % | | 45 | % | | | | | 30 | % | | | |

| | | | | | | | | | | |

Adjusted EBITDA (2) | $ | 32.2 | | | $ | 15.5 | | | 108 | % | | | $ | 26.9 | | | 20 | % | |

Adjusted EBITDA % of revenue (2) | 12 | % | | 12 | % | | | | | 10 | % | | | |

| | | | | | | | | | | |

Adjusted net income (2) | $ | 15.8 | | | $ | 3.6 | | | 339 | % | | | $ | 10.9 | | | 45 | % | |

| | | | | | | | | | | |

Adjusted net income per share (2) | $ | 1.16 | | | $ | 0.28 | | | 314 | % | | | $ | 0.80 | | | 45 | % | |

| | | | | | | | | | | |

| | | | | |

| (1) | Represents the portion of selling and marketing expense attributable to variable costs paid for advertising, direct marketing and related expenses. Excludes overhead, fixed costs and personnel-related expenses. |

| (2) | Variable marketing expense, variable marketing margin, variable marketing margin % of revenue, adjusted EBITDA, adjusted EBITDA % of revenue, adjusted net income and adjusted net income per share are non-GAAP measures. Please see "LendingTree's Reconciliation of Non-GAAP Measures to GAAP" and "LendingTree's Principles of Financial Reporting" below for more information. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LendingTree Segment Results |

| (In millions) |

| | | | | | | | | | | |

| Three Months Ended December 31, | | Y/Y | | | Three Months Ended September 30, | | Q/Q | |

| 2024 | | 2023 | | % Change | | | 2024 | | % Change | |

Home (1) | | | | | | | | | | | |

| Revenue | $ | 34.0 | | | $ | 25.1 | | | 35 | % | | | $ | 32.2 | | | 6 | % | |

| Segment profit | $ | 11.7 | | | $ | 8.1 | | | 44 | % | | | $ | 9.3 | | | 26 | % | |

| Segment profit % of revenue | 34 | % | | 32 | % | | | | | 29 | % | | | |

| | | | | | | | | | | |

Consumer (2) | | | | | | | | | | | |

| Revenue | $ | 55.6 | | | $ | 49.5 | | | 12 | % | | | $ | 59.5 | | | (7) | % | |

| Segment profit | $ | 28.2 | | | $ | 28.9 | | | (2) | % | | | $ | 28.0 | | | 1 | % | |

| Segment profit % of revenue | 51 | % | | 58 | % | | | | | 47 | % | | | |

| | | | | | | | | | | |

Insurance (3) | | | | | | | | | | | |

| Revenue | $ | 171.7 | | | $ | 59.6 | | | 188 | % | | | $ | 169.1 | | | 2 | % | |

| Segment profit | $ | 48.0 | | | $ | 25.2 | | | 90 | % | | | $ | 41.4 | | | 16 | % | |

| Segment profit % of revenue | 28 | % | | 42 | % | | | | | 24 | % | | | |

| | | | | | | | | | | |

Other (4) | | | | | | | | | | | |

| Revenue | $ | 0.2 | | | $ | 0.1 | | | 100 | % | | | $ | — | | | — | % | |

| (Loss) profit | $ | — | | | $ | (0.1) | | | (100) | % | | | $ | — | | | — | % | |

| | | | | | | | | | | |

| Total revenue | $ | 261.5 | | | $ | 134.4 | | | 95 | % | | | $ | 260.8 | | | — | % | |

| | | | | | | | | | | |

| Total segment profit | $ | 87.9 | | | $ | 62.2 | | | 41 | % | | | $ | 78.6 | | | 12 | % | |

Brand marketing expense (5) | $ | (1.2) | | | $ | (1.6) | | | (25) | % | | | $ | (1.4) | | | (14) | % | |

| Variable marketing margin | $ | 86.7 | | | $ | 60.6 | | | 43 | % | | | $ | 77.2 | | | 12 | % | |

| Variable marketing margin % of revenue | 33 | % | | 45 | % | | | | | 30 | % | | | |

| | | | | | | | | | | |

| | | | | |

| (1) | The Home segment includes the following products: purchase mortgage, refinance mortgage, and home equity loans. |

| (2) | The Consumer segment includes the following products: credit cards, personal loans, small business loans, student loans, auto loans, deposit accounts, and debt settlement. |

| (3) | The Insurance segment consists of insurance quote products and sales of insurance policies. |

| (4) | The Other category includes marketing revenue and related expenses not allocated to a specific segment. |

| (5) | Brand marketing expense represents the portion of selling and marketing expense attributable to variable costs paid for advertising, direct marketing and related expenses that are not assignable to the segments' products. This measure excludes overhead, fixed costs and personnel-related expenses. |

Financial Outlook

Today we are issuing our outlook for the first-quarter and full-year 2025.

For first-quarter 2025:

▪Revenue: $241 - $248 million

▪Variable Marketing Margin: $75 - $79 million

▪Adjusted EBITDA: $25 - $27 million

For full-year 2025:

▪Revenue is anticipated to be in the range of $985 - $1,025 million, an increase of 9% to 14% compared to 2024.

▪Variable Marketing Margin is expected to be in the range of $319 - $336 million, representing growth of 5% to 10% over last year.

▪Adjusted EBITDA is anticipated to be in the range of $116 - $126 million, an increase of 11% to 21% from 2024.

Our full-year 2025 outlook assumes double-digit revenue growth in both the Home and Consumer segments, with more modest Insurance segment growth following a record year.

LendingTree is not able to provide a reconciliation of projected variable marketing margin or adjusted EBITDA to the most directly comparable expected GAAP results due to the unknown effect, timing and potential significance of the effects of legal matters and tax considerations. Expenses associated with legal matters and tax consequences have in the past, and may in the future, significantly affect GAAP results in a particular period.

Quarterly Conference Call

A conference call to discuss LendingTree's fourth-quarter 2024 financial results will be webcast live today, March 5, 2025 at 5:00 PM Eastern Time (ET). The live webcast is open to the public and will be available on LendingTree's investor relations website at investors.lendingtree.com. Following completion of the call, a recorded replay of the webcast will be available on LendingTree's investor relations website.

LENDINGTREE'S RECONCILIATION OF NON-GAAP MEASURES TO GAAP

Variable Marketing Expense

Below is a reconciliation of selling and marketing expense, the most directly comparable GAAP measure, to variable marketing expense. See "Lending Tree's Principles of Financial Reporting" for further discussion of the Company's use of this non-GAAP measure.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | |

| | December 31,

2024 | September 30,

2024 | December 31,

2023 | | December 31,

2024 | December 31,

2023 | | | |

| (in thousands) | | | |

| Selling and marketing expense | $ | 185,858 | | $ | 193,542 | | $ | 83,168 | | | $ | 635,963 | | $ | 433,588 | | | | |

Non-variable selling and marketing expense (1) | (11,084) | | (9,976) | | (9,407) | | | (40,055) | | (42,031) | | | | |

| | | | | | | | | |

| Variable marketing expense | $ | 174,774 | | $ | 183,566 | | $ | 73,761 | | | $ | 595,908 | | $ | 391,557 | | | | |

| | | | | |

| (1) | | Represents the portion of selling and marketing expense not attributable to variable costs paid for advertising, direct marketing and related expenses. Includes overhead, fixed costs and personnel-related expenses. |

| |

LENDINGTREE'S RECONCILIATION OF NON-GAAP MEASURES TO GAAP

Variable Marketing Margin

Below is a reconciliation of net income (loss), the most directly comparable GAAP measure, to variable marketing margin and net income (loss) % of revenue to variable marketing margin % of revenue. See "LendingTree's Principles of Financial Reporting" for further discussion of the Company's use of these non-GAAP measures.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | |

| | December 31,

2024 | September 30,

2024 | December 31,

2023 | | December 31,

2024 | December 31,

2023 | | | |

| (in thousands, except percentages) | | | |

| Net income (loss) | $ | 7,506 | | $ | (57,978) | | $ | 12,719 | | | $ | (41,704) | | $ | (122,404) | | | | |

| Net income (loss) % of revenue | 3 | % | (22) | % | 9 | % | | (5) | % | (18) | % | | | |

| | | | | | | | | |

| Adjustments to reconcile to variable marketing margin: | | | | | | | | | |

| Cost of revenue | 9,744 | | 9,372 | | 8,126 | | | 36,072 | | 38,758 | | | | |

| | | | | | | | | |

Non-variable selling and marketing expense (1) | 11,084 | | 9,976 | | 9,407 | | | 40,055 | | 42,031 | | | | |

| General and administrative expense | 29,111 | | 26,680 | | 25,477 | | | 108,705 | | 117,700 | | | | |

| Product development | 12,937 | | 11,190 | | 11,101 | | | 46,358 | | 47,197 | | | | |

| Depreciation | 4,448 | | 4,584 | | 4,831 | | | 18,300 | | 19,070 | | | | |

| Amortization of intangibles | 1,467 | | 1,466 | | 1,682 | | | 5,889 | | 7,694 | | | | |

| Goodwill impairment | — | | — | | — | | | — | | 38,600 | | | | |

| | | | | | | | | |

| Restructuring and severance | 10 | | 273 | | 151 | | | 508 | | 10,118 | | | | |

| Litigation settlements and contingencies | 6 | | 3,762 | | 38 | | | 3,797 | | 388 | | | | |

| Interest expense (income), net | 9,950 | | 10,060 | | (10,693) | | | 27,849 | | (21,685) | | | | |

| Other (income) expense | (1,143) | | 57,391 | | (2,644) | | | 54,162 | | 105,993 | | | | |

| Income tax expense (benefit) | 1,628 | | 447 | | 397 | | | 4,320 | | (2,515) | | | | |

| Variable marketing margin | $ | 86,748 | | $ | 77,223 | | $ | 60,592 | | | $ | 304,311 | | $ | 280,945 | | | | |

| Variable marketing margin % of revenue | 33 | % | 30 | % | 45 | % | | 34 | % | 42 | % | | | |

| | | | | |

| |

| (1) | | Represents the portion of selling and marketing expense not attributable to variable costs paid for advertising, direct marketing and related expenses. Includes overhead, fixed costs and personnel-related expenses. |

LENDINGTREE'S RECONCILIATION OF NON-GAAP MEASURES TO GAAP

Adjusted EBITDA

Below is a reconciliation of net income (loss), the most directly comparable GAAP measure, to adjusted EBITDA and net income (loss) % of revenue to adjusted EBITDA % of revenue. See "LendingTree's Principles of Financial Reporting" for further discussion of the Company's use of these non-GAAP measures.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended | | |

| | December 31,

2024 | September 30,

2024 | December 31,

2023 | | December 31,

2024 | December 31,

2023 | | | |

| (in thousands, except percentages) | | | |

| Net income (loss) | $ | 7,506 | | $ | (57,978) | | $ | 12,719 | | | $ | (41,704) | | $ | (122,404) | | | | |

| Net income (loss) % of revenue | 3 | % | (22) | % | 9 | % | | (5) | % | (18) | % | | | |

| Adjustments to reconcile to adjusted EBITDA: | | | | | | | | | |

| Amortization of intangibles | 1,467 | | 1,466 | | 1,682 | | | 5,889 | | 7,694 | | | | |

| Depreciation | 4,448 | | 4,584 | | 4,831 | | | 18,300 | | 19,070 | | | | |

| Restructuring and severance | 10 | | 273 | | 151 | | | 508 | | 10,118 | | | | |

| Loss on impairments and disposal of assets | 1,797 | | 6 | | 182 | | | 2,584 | | 5,437 | | | | |

| Loss on impairment of investments | — | | 58,376 | | — | | | 58,376 | | 114,504 | | | | |

| Goodwill impairment | — | | — | | — | | | — | | 38,600 | | | | |

| Non-cash compensation | 6,494 | | 6,859 | | 8,177 | | | 28,579 | | 37,176 | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Acquisition expense | — | | — | | — | | | — | | (5) | | | | |

| Litigation settlements and contingencies | 6 | | 3,762 | | 38 | | | 3,797 | | 388 | | | | |

| Interest expense (income), net | 9,950 | | 10,060 | | (10,693) | | | 27,849 | | (21,685) | | | | |

| Dividend income | (1,144) | | (982) | | (2,021) | | | (4,385) | | (7,888) | | | | |

| Income tax expense (benefit) | 1,628 | | 447 | | 397 | | | 4,320 | | (2,515) | | | | |

| Adjusted EBITDA | $ | 32,162 | | $ | 26,873 | | $ | 15,463 | | | $ | 104,113 | | $ | 78,490 | | | | |

| Adjusted EBITDA % of revenue | 12 | % | 10 | % | 12 | % | | 12 | % | 12 | % | | | |

LENDINGTREE'S RECONCILIATION OF NON-GAAP MEASURES TO GAAP

Adjusted Net Income

Below is a reconciliation of net income (loss), the most directly comparable GAAP measure, to adjusted net income and net income (loss) per diluted share to adjusted net income per share. See "LendingTree's Principles of Financial Reporting" for further discussion of the Company's use of these non-GAAP measures.

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| | December 31,

2024 | September 30,

2024 | December 31,

2023 | | December 31,

2024 | December 31,

2023 |

| (in thousands, except per share amounts) |

| Net income (loss) | $ | 7,506 | | $ | (57,978) | | $ | 12,719 | | | $ | (41,704) | | $ | (122,404) | |

| Adjustments to reconcile to adjusted net income: | | | | | | |

| Restructuring and severance | 10 | | 273 | | 151 | | | 508 | | 10,118 | |

| Goodwill impairment | — | | — | | — | | | — | | 38,600 | |

| Loss on impairments and disposal of assets | 1,797 | | 6 | | 182 | | | 2,584 | | 5,437 | |

| Loss on impairment of investments | — | | 58,376 | | — | | | 58,376 | | 114,504 | |

| Non-cash compensation | 6,494 | | 6,859 | | 8,177 | | | 28,579 | | 37,176 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Acquisition expense | — | | — | | — | | | — | | (5) | |

| Litigation settlements and contingencies | 6 | | 3,762 | | 38 | | | 3,797 | | 388 | |

| Gain on extinguishment of debt | — | | (416) | | (17,665) | | | (9,035) | | (48,562) | |

| | | | | | |

| Income tax benefit from adjusted items | — | | — | | — | | | — | | (5,764) | |

| | | | | | |

| | | | | | |

| Adjusted net income | $ | 15,813 | | $ | 10,882 | | $ | 3,602 | | | $ | 43,105 | | $ | 29,488 | |

| Interest on convertible notes, net of tax | — | | — | | — | | | 1,871 | | — | |

| Adjusted net income attributable to shareholders | $ | 15,813 | | $ | 10,882 | | $ | 3,602 | | | $ | 44,976 | | $ | 29,488 | |

| | | | | | |

| Net income (loss) per diluted share | $ | 0.55 | | $ | (4.34) | | $ | 0.98 | | | $ | (3.14) | | $ | (9.46) | |

| Adjustments to reconcile net income (loss) to adjusted net income | 0.61 | | 5.16 | | (0.70) | | | 6.39 | | 11.74 | |

| Adjustments to reconcile effect of dilutive securities | — | | (0.02) | | — | | | (0.06) | | — | |

| Adjusted net income per share | $ | 1.16 | | $ | 0.80 | | $ | 0.28 | | | $ | 3.19 | | $ | 2.28 | |

| | | | | | |

| Adjusted weighted average diluted shares outstanding | 13,591 | | 13,555 | | 13,020 | | | 14,121 | | 12,957 | |

| Effect of dilutive securities | — | | 206 | | — | | | 235 | | 16 | |

| Effect of dilutive convertible notes | — | | — | | — | | | 617 | | — | |

| Weighted average diluted shares outstanding | 13,591 | | 13,349 | | 13,020 | | | 13,269 | | 12,941 | |

| Effect of dilutive securities | 224 | | — | | 12 | | | — | | — | |

| Weighted average basic shares outstanding | 13,367 | | 13,349 | | 13,008 | | | 13,269 | | 12,941 | |

LENDINGTREE’S PRINCIPLES OF FINANCIAL REPORTING

LendingTree reports the following non-GAAP measures as supplemental to GAAP:

•Variable marketing expense

•Variable marketing margin

•Variable marketing margin % of revenue

•Earnings Before Interest, Taxes, Depreciation and Amortization, as adjusted for certain items discussed below ("Adjusted EBITDA")

•Adjusted EBITDA % of revenue

•Adjusted net income

•Adjusted net income per share

Variable marketing expense, variable marketing margin and variable marketing margin % of revenue are related measures of the effectiveness of the Company's marketing efforts. Variable marketing expense represents the portion of selling and marketing expense attributable to variable costs paid for advertising, direct marketing, and related expenses, and excludes overhead, fixed costs, and personnel-related expenses. Variable marketing margin is a measure of the efficiency of the Company’s operating model, measuring revenue after subtracting variable marketing expense. The Company’s operating model is highly sensitive to the amount and efficiency of variable marketing expenditures, and the Company’s proprietary systems are able to make rapidly changing decisions concerning the deployment of variable marketing expenditures (primarily but not exclusively online and mobile advertising placement) based on proprietary and sophisticated analytics.

Adjusted EBITDA and adjusted EBITDA % of revenue are primary metrics by which LendingTree evaluates the operating performance of its businesses, on which its marketing expenditures and internal budgets are based and, in the case of adjusted EBITDA, by which management and many employees are compensated in most years.

Adjusted net income and adjusted net income per share supplement GAAP net income and GAAP net income per diluted share by enabling investors to make period to period comparisons of those components of the most directly comparable GAAP measures that management believes better reflect the underlying financial performance of the Company’s business operations during particular financial reporting periods. Adjusted net income and adjusted net income per share exclude certain amounts, such as non-cash compensation, non-cash asset impairment charges, gain/loss on disposal of assets, gain/loss on investments, restructuring and severance, litigation settlements and contingencies, acquisition and disposition income or expenses including with respect to changes in fair value of contingent consideration, gain/loss on extinguishment of debt, contributions to the LendingTree Foundation, one-time items which are recognized and recorded under GAAP in particular periods but which might be viewed as not necessarily coinciding with the underlying business operations for the periods in which they are so recognized and recorded, the effects to income taxes of the aforementioned adjustments, any excess tax benefit or expense associated with stock-based compensation recorded in net income in conjunction with FASB pronouncement ASU 2016-09, and income tax (benefit) expense from a full valuation allowance. LendingTree believes that adjusted net income and adjusted net income per share are useful financial indicators that provide a different view of the financial performance of the Company than adjusted EBITDA (the primary metric by which LendingTree evaluates the operating performance of its businesses) and the GAAP measures of net income and GAAP net income per diluted share.

These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. LendingTree provides and encourages investors to examine the reconciling adjustments between the GAAP and non-GAAP measures set forth above.

Definition of LendingTree's Non-GAAP Measures

Variable marketing margin is defined as revenue less variable marketing expense. Variable marketing expense is defined as the expense attributable to variable costs paid for advertising, direct marketing and related expenses, and excluding overhead, fixed costs and personnel-related expenses. The majority of these variable advertising costs are expressly intended to drive traffic to our websites and these variable advertising costs are included in selling and marketing expense on the Company's consolidated statements of operations and consolidated income.

EBITDA is defined as net income excluding interest, income taxes, amortization of intangibles and depreciation.

Adjusted EBITDA is defined as EBITDA excluding (1) non-cash compensation expense, (2) non-cash impairment charges, (3) gain/loss on disposal of assets, (4) gain/loss on investments, (5) restructuring and severance expenses, (6) litigation settlements and contingencies, (7) acquisitions and dispositions income or expense (including with respect to changes in fair value of contingent consideration), (8) contributions to the LendingTree Foundation,(9) dividend income, and (10) one-time items.

Adjusted net income is defined as net income (loss) excluding (1) non-cash compensation expense, (2) non-cash impairment charges, (3) gain/loss on disposal of assets, (4) gain/loss on investments, (5) restructuring and severance expenses, (6) litigation settlements and contingencies, (7) acquisitions and dispositions income or expense (including with respect to changes in fair value of contingent consideration), (8) gain/loss on extinguishment of debt, (9) contributions to the LendingTree Foundation, (10) one-time items, (11) the effects to income taxes of the aforementioned adjustments, (12) any excess tax benefit or expense associated with stock-based compensation recorded in net income in conjunction with FASB pronouncement ASU 2016-09, and (13) income tax (benefit) expense from a full valuation allowance.

Adjusted net income per share is defined as adjusted net income divided by the adjusted weighted average diluted shares outstanding. For periods which the Company reports GAAP loss, the effects of potentially dilutive securities are excluded from the calculation of net loss per diluted share because their inclusion would have been anti-dilutive. In periods where the Company reports GAAP loss but reports positive non-GAAP adjusted net income, the effects of potentially dilutive securities are included in the denominator for calculating adjusted net income per share if their inclusion would be dilutive.

LendingTree endeavors to compensate for the limitations of these non-GAAP measures by also providing the comparable GAAP measures with equal or greater prominence and descriptions of the reconciling items, including quantifying such items, to derive the non-GAAP measures. These non-GAAP measures may not be comparable to similarly titled measures used by other companies.

One-Time Items

Adjusted EBITDA and adjusted net income are adjusted for one-time items, if applicable. Items are considered one-time in nature if they are non-recurring, infrequent or unusual, and have not occurred in the past two years or are not expected to recur in the next two years, in accordance with SEC rules. For the periods presented in this report, there are no adjustments for one-time items.

Non-Cash Expenses That Are Excluded From LendingTree's Adjusted EBITDA and Adjusted Net Income

Non-cash compensation expense consists principally of expense associated with the grants of restricted stock, restricted stock units and stock options. These expenses are not paid in cash and LendingTree includes the related shares in its calculations of fully diluted shares outstanding. Upon settlement of restricted stock units, exercise of certain stock options or vesting of restricted stock awards, the awards may be settled on a net basis, with LendingTree remitting the required tax withholding amounts from its current funds. Cash expenditures for employer payroll taxes on non-cash compensation are included within adjusted EBITDA and adjusted net income.

Amortization of intangibles are non-cash expenses relating primarily to acquisitions. At the time of an acquisition, the intangible assets of the acquired company, such as purchase agreements, technology and customer relationships, are valued and amortized over their estimated lives. Amortization of intangibles are only excluded from adjusted EBITDA.

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

The matters contained in the discussion above may be considered to be “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. Those statements include statements regarding the intent, belief or current expectations or anticipations of LendingTree and members of our management team. Factors currently known to management that could cause actual results to differ materially from those in forward-looking statements include the following: adverse conditions in the primary and secondary mortgage markets and in the economy, particularly interest rates and inflation; default rates on loans, particularly unsecured loans; demand by investors for unsecured personal loans; the effect of such demand on interest rates for personal loans and consumer demand for personal loans; seasonality of results; potential liabilities to secondary market purchasers; changes in the Company's relationships with network partners, including dependence on certain key network partners; breaches of network security or the misappropriation or misuse of personal consumer information; failure to provide competitive service; failure to maintain brand recognition; ability to attract and retain consumers in a cost-effective manner; the effects of potential acquisitions of other businesses, including the ability to integrate them successfully with LendingTree’s existing operations; accounting rules related to excess tax benefits or expenses on stock-based compensation that could materially affect earnings in future periods; ability to develop new products and services and enhance existing ones; competition; effects of changing laws, rules or regulations on our business model; allegations of failure to comply with existing or changing laws, rules or regulations, or to obtain and maintain required licenses; failure of network partners or other affiliated parties to comply with regulatory requirements; failure to maintain the integrity of systems and infrastructure; liabilities as a result of privacy regulations; failure to adequately protect intellectual property rights or allegations of infringement of intellectual property rights; and changes in management. These and additional factors to be considered are set forth under “Risk Factors” in our Annual Report on Form 10-K for the period ended December 31, 2023, in our Quarterly Report on Form 10-Q for the period ended September 30, 2024, and in our other filings with the Securities and Exchange Commission. LendingTree undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results or expectations.

About LendingTree, Inc.

LendingTree, Inc. is the parent of LendingTree, LLC and several companies owned by LendingTree, LLC (collectively, "LendingTree" or the "Company").

LendingTree is one of the nation's largest, most experienced online financial platforms, created to give consumers the power to win financially. LendingTree provides customers with access to the best offers on loans, credit cards, insurance and more through its network of approximately 430 financial partners. Since its founding, LendingTree has helped millions of customers obtain financing, save money, and improve their financial and credit health in their personal journeys. With a portfolio of innovative products and tools and personalized financial recommendations, LendingTree helps customers achieve everyday financial wins.

LendingTree, Inc. is headquartered in Charlotte, NC. For more information, please visit www.lendingtree.com.

Investor Relations:

investors@lendingtree.com

Media Relations:

press@lendingtree.com

Exhibit 99.2

March 5, 2025

Fellow Shareholders:

We are delighted to report 2024 AEBITDA grew 33% to $104 million, driven by 8% VMD growth and ongoing operating expense discipline. Importantly, we have momentum and an improved financial position entering the new year, with all three of our reportable segments achieving YoY revenue growth in Q4. Quarterly revenue of $262 million, VMD of $87 million and $32 million of AEBITDA all topped our forecast. Insurance again led the way with revenue up 188% from the prior year, and the Consumer segment also grew despite a still restrictive underwriting environment. The strong performance is reflective of the team's disciplined focus and the benefits gained from our operational excellence initiatives.

Our Insurance business had a record year, with revenue of $549 million and $159 million of segment profit growing 120% and 54%, respectively, from 2023. Insurance carriers substantially increased spend with us throughout 2024 after gaining increased confidence in the profitability of their underwriting results. Margin was subsequently pressured for much of the year as media costs rose rapidly in response. However, in Q4 the segment's profit margin notably increased by four points sequentially as this trend abated.

In 2025 we expect insurers will continue to enjoy strong underwriting profitability as they optimize policy rates and marketing costs to capture share in a competitive market. This should lead to increased consumer shopping traffic that will benefit our business. We remain focused on growing our share of the market and refining our marketing strategies as media costs stabilize to drive continued growth in the segment profitability this year.

Our Consumer segment performance strengthened throughout the year as well, with Q4 revenue up 12% from the prior year period. Exceptional execution in our small business vertical along with a second consecutive quarter of YoY growth in personal loan revenue indicate we are taking share from peers. Home finished the year with accelerating demand for home equity loans in our marketplace, driving segment revenue up 35% YoY and 5% sequentially in what is typically a seasonally weaker quarter. We are optimistic the positive trends in both the Consumer and Home segments will continue this year.

The company spent a significant portion of 2024 preparing to comply with the one-to-one consent requirement issued by the FCC, which was scheduled to go into effect on January 27, 2025. We are pleased that the court case with the 11th Circuit Court of Appeals resulted in the rule being vacated. As a result, we do not expect this topic to be revisited by the FCC in the future.

The sustained improvement in our financial results has lowered our net leverage to 3.5x at year-end, down from 5.3x at the end of 2023. Based on the 2025 financial outlook issued today, we expect net leverage to

continue to steadily decline going forward. As our credit metrics improve, we will evaluate opportunities to enhance the efficiency of our capital structure, reduce our interest expense, and improve free cashflow generation for our shareholders.

A summary of our fourth quarter results and future outlook follow below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Summary Consolidated Financials |

| (millions, except per share amounts) | | 2024 | | 2023 | | | Y/Y | |

| | Q4 | | | Q3 | | Q2 | | Q1 | | Q4 | | | % Change | |

| | | | | | | | | | | | | | | |

| Total revenue | | $ | 261.5 | | | | $ | 260.8 | | | $ | 210.1 | | | $ | 167.8 | | | $ | 134.4 | | | | 95 | % | |

| | | | | | | | | | | | | | | |

| Income (loss) before income taxes | | $ | 9.1 | | | | $ | (57.5) | | | $ | 9.4 | | | $ | 1.6 | | | $ | 13.1 | | | | (31) | % | |

| Income tax expense | | $ | (1.6) | | | | $ | (0.5) | | | $ | (1.6) | | | $ | (0.6) | | | $ | (0.4) | | | | 300 | % | |

| Net income (loss) | | $ | 7.5 | | | | $ | (58.0) | | | $ | 7.8 | | | $ | 1.0 | | | $ | 12.7 | | | | (41) | % | |

| Net income (loss) % of revenue | | 3 | % | | | (22) | % | | 4 | % | | 1 | % | | 9 | % | | | | |

| | | | | | | | | | | | | | | |

| Income (loss) per share | | | | | | | | | | | | | | | |

| Basic | | $ | 0.56 | | | | $ | (4.34) | | | $ | 0.58 | | | $ | 0.08 | | | $ | 0.98 | | | | | |

| Diluted | | $ | 0.55 | | | | $ | (4.34) | | | $ | 0.58 | | | $ | 0.08 | | | $ | 0.98 | | | | | |

| | | | | | | | | | | | | | | |

| Variable marketing margin | | | | | | | | | | | | | | | |

| Total revenue | | $ | 261.5 | | | | $ | 260.8 | | | $ | 210.1 | | | $ | 167.8 | | | $ | 134.4 | | | | 95 | % | |

Variable marketing expense (1) (2) | | $ | (174.8) | | | | $ | (183.6) | | | $ | (139.2) | | | $ | (98.4) | | | $ | (73.8) | | | | 137 | % | |

Variable marketing margin (2) | | $ | 86.7 | | | | $ | 77.2 | | | $ | 70.9 | | | $ | 69.4 | | | $ | 60.6 | | | | 43 | % | |

Variable marketing margin % of revenue (2) | | 33 | % | | | 30 | % | | 34 | % | | 41 | % | | 45 | % | | | | |

| | | | | | | | | | | | | | | |

Adjusted EBITDA (2) | | $ | 32.2 | | | | $ | 26.9 | | | $ | 23.5 | | | $ | 21.6 | | | $ | 15.5 | | | | 108 | % | |

Adjusted EBITDA % of revenue (2) | | 12 | % | | | 10 | % | | 11 | % | | 13 | % | | 12 | % | | | | |

| | | | | | | | | | | | | | | |

Adjusted net income(2) | | $ | 15.8 | | | | $ | 10.9 | | | $ | 7.2 | | | $ | 9.2 | | | $ | 3.6 | | | | 339 | % | |

| | | | | | | | | | | | | | | |

Adjusted net income per share (2) | | $ | 1.16 | | | | $ | 0.80 | | | $ | 0.54 | | | $ | 0.70 | | | $ | 0.28 | | | | 314 | % | |

| | | | | | | | | | | | | | | |

| | | | | |

| (1) | Represents the portion of selling and marketing expense attributable to variable costs paid for advertising, direct marketing and related expenses. Excludes overhead, fixed costs and personnel-related expenses. |

| (2) | Variable marketing expense, variable marketing margin, variable marketing margin % of revenue, adjusted EBITDA, adjusted EBITDA % of revenue, adjusted net income and adjusted net income per share are non-GAAP measures. Please see "LendingTree's Reconciliation of Non-GAAP Measures to GAAP" and "LendingTree's Principles of Financial Reporting" below for more information. |

Q4 2024 Consolidated Results

Consolidated revenue of $261.5 million increased 95% over prior year, led by a 188% increase in Insurance segment revenue, 35% growth in Home, and 12% improvement in Consumer segment revenue.

On a GAAP basis, net income was $7.5 million, or $0.55 per diluted share, this compares to a net income of $12.7 million, or $0.98 per diluted share in the prior-year period.

Variable Marketing Margin of $86.7 million, representing a 33% margin, was 43% above the prior year. The Insurance segment drove most of this improvement growing 90% YoY, while the Home segment also contributed with 44% growth.

Adjusted EBITDA was $32.2 million.

Adjusted net income of $15.8 million translates to $1.16 per share.

Segment Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(millions)

| | 2024 | | 2023 | | | Y/Y | |

| | Q4 | | | Q3 | | Q2 | | Q1 | | Q4 | | | % Change | |

Home (1) | | | | | | | | | | | | | | | |

| Revenue | | $ | 34.0 | | | | $ | 32.2 | | | $ | 32.2 | | | $ | 30.4 | | | $ | 25.1 | | | | 35 | % | |

| Segment profit | | $ | 11.7 | | | | $ | 9.3 | | | $ | 9.3 | | | $ | 9.6 | | | $ | 8.1 | | | | 44 | % | |

| Segment profit % of revenue | | 34 | % | | | 29 | % | | 29 | % | | 32 | % | | 32 | % | | | | |

| | | | | | | | | | | | | | | |

Consumer (2) | | | | | | | | | | | | | | | |

| Revenue | | $ | 55.6 | | | | $ | 59.5 | | | $ | 55.9 | | | $ | 51.5 | | | $ | 49.5 | | | | 12 | % | |

| Segment profit | | $ | 28.2 | | | | $ | 28.0 | | | $ | 26.9 | | | $ | 27.4 | | | $ | 28.9 | | | | (2) | % | |

| Segment profit % of revenue | | 51 | % | | | 47 | % | | 48 | % | | 53 | % | | 58 | % | | | | |

| | | | | | | | | | | | | | | |

Insurance (3) | | | | | | | | | | | | | | | |

| Revenue | | $ | 171.7 | | | | $ | 169.1 | | | $ | 122.1 | | | $ | 85.9 | | | $ | 59.6 | | | | 188 | % | |

| Segment profit | | $ | 48.0 | | | | $ | 41.4 | | | $ | 36.4 | | | $ | 33.4 | | | $ | 25.2 | | | | 90 | % | |

| Segment profit % of revenue | | 28 | % | | | 24 | % | | 30 | % | | 39 | % | | 42 | % | | | | |

| | | | | | | | | | | | | | | |

Other Category (4) | | | | | | | | | | | | | | | |

| Revenue | | $ | 0.2 | | | | $ | — | | | $ | — | | | $ | — | | | $ | 0.1 | | | | 100 | % | |

| Loss | | $ | — | | | | $ | — | | | $ | (0.1) | | | $ | — | | | $ | (0.1) | | | | (100) | % | |

| | | | | | | | | | | | | | | |

| Total | | | | | | | | | | | | | | | |

| Revenue | | $ | 261.5 | | | | $ | 260.8 | | | $ | 210.1 | | | $ | 167.8 | | | $ | 134.4 | | | | 95 | % | |

| Segment profit | | $ | 87.9 | | | | $ | 78.6 | | | $ | 72.5 | | | $ | 70.5 | | | $ | 62.2 | | | | 41 | % | |

| Segment profit % of revenue | | 34 | % | | | 30 | % | | 35 | % | | 42 | % | | 46 | % | | | | |

| | | | | | | | | | | | | | | |

Brand marketing expense (5) | | $ | (1.2) | | | | $ | (1.4) | | | $ | (1.6) | | | $ | (1.1) | | | $ | (1.6) | | | | (25) | % | |

| | | | | | | | | | | | | | | |

| Variable marketing margin | | $ | 86.7 | | | | $ | 77.2 | | | $ | 70.9 | | | $ | 69.4 | | | $ | 60.6 | | | | 43 | % | |

| Variable marketing margin % of revenue | | 33 | % | | | 30 | % | | 34 | % | | 41 | % | | 45 | % | | | | |

| | | | | | | | | | | | | | | |

| | | | | |

| (1) | The Home segment includes the following products: purchase mortgage, refinance mortgage, and home equity loans. |

| (2) | The Consumer segment includes the following products: credit cards, personal loans, small business loans, student loans, auto loans, deposit accounts, and debt settlement. |

| (3) | The Insurance segment consists of insurance quote products and sales of insurance policies. |

| (4) | The Other category primarily includes marketing revenue and related expenses not allocated to a specific segment. |

| (5) | Brand marketing expense represents the portion of selling and marketing expense attributable to variable costs paid for advertising, direct marketing and related expenses that are not assignable to the segments' products. This measure excludes overhead, fixed costs and personnel-related expenses. |

Home

Home segment revenue of $34.0 million increased 35% in Q4 compared to the prior year period, as our Home Equity offering grew revenue by 48%. Consumer demand for home equity loans broadly increased throughout the year. Leveraging our large network of lenders against this increased demand, along with notable growth in the number of lenders offering home equity loans, has improved unit economics in the business. Many of our partners have also improved their processes to more efficiently complete customers' loan applications and move those apps to close.

Longer-term rates have remained stable at rates higher than most existing first mortgages. As a result, second lien products have become an attractively priced source of capital for homeowners. According to CoreLogic, homeowners with a mortgage in the U.S. have $17.5 trillion of equity as of 3Q24, a 2.5% increase from the year prior. We expect further growth in our home equity business this year as home values continue to hover near record levels.

The Mortgage Bankers Association forecasts total mortgage originations will increase by 16% in 2025, although Q1 is expected to remain weak and below 4Q24 levels. The forecast calls for total loan originations of $2.1 trillion, with purchase loans accounting for 69% of the total. During this prolonged trough in mortgage origination activity, we have partnered closely with a number of our lending partners through our mortgage innovation lab to improve the consumer experience and test new features to retain our leading market position when the next growth phase begins.

Consumer

In Q4 our Consumer revenue grew 12% YoY due to gains in our small business and personal loan offerings. Lenders have broadly increased their appetite for new loan originations as consumer credit performance stabilized last year. We have strategically increased our marketing spend to position the business for wallet share gains with these lenders as we enter the new year. Segment profit thus declined 2% in the quarter from last year, generating a segment margin of 51%, down from a record 58% margin in the year ago period.

Personal loan revenue of $26.5 million increased 21% YoY, and we expect continued healthy growth in the business this year. The leading consumer use case for a personal loan is the refinancing of higher-cost credit card debt. Current total revolving consumer debt of $1.38 trillion is at a record high, and interest expense on that debt has increased along with the rise in short-term interest rates. Many of our lender partners have publicly stated their intention to meaningfully grow their originations this year. We remain in a solid competitive position to grow with them.

Small business revenue grew 45% in Q4 compared to the prior year period. Lenders in our network have increased new loan originations with us as credit performance has broadly improved. We responded to this growth in partner demand by investing in our concierge sales team and targeted marketing campaigns. Our concierge sales members create a single-point of contact with us for small business owners, assisting in procuring the best loan offer, collecting documentation required for loan applications and troubleshooting any issues as they arise. Our investment in this team helped drive a material increase in approval rates for our customers, and allows us to capture lender volume bonus and renewal revenue streams.

Insurance

Our Insurance segment continued its strong growth cadence with revenue increasing 188% YoY and segment profit up 90% YoY. Carriers increased their marketing spend with us steadily throughout the year as positive underwriting results created an increased demand for new customers. This trend continued in the fourth quarter. The exceptional level of demand from carriers, however, also pressured advertising costs for the industry, which resulted in declines in our segment profit margin into the third quarter. We indicated in our Q3 earnings announcement we believed segment profit margin had bottomed, and that has indeed been the case. In Q4 we continued to optimize our search marketing campaigns and broadened our use of additional marketing channels, resulting in a four percentage point increase in segment margin sequentially.

Balance Sheet & Capital Management

The company ended the year levered 3.5x on a net basis, down from 5.3x at the close of 2023. We maintain $107 million of cash on hand and $50 million remains undrawn on our Apollo term loan. Our available liquidity will allow us to comfortably retire the remaining $115 million of convertible notes due to mature in July of this year.

We have made steady progress improving the strength of our balance sheet while avoiding the issuance of dilutive equity or equity-linked capital. Based on our forecast, leverage should continue to decline steadily from the current level. Reducing our outstanding debt balance will remain a primary use of excess cash. As our credit metrics continue to improve we will evaluate opportunities to enhance the efficiency of our capital structure, reduce our interest expense and improve free cashflow generation for shareholders.

Financial Outlook*

Today we are issuing our outlook for the first-quarter and full-year 2025.

First-quarter 2025:

▪Revenue: $241 - $248 million

▪Variable Marketing Margin: $75 - $79 million

▪Adjusted EBITDA: $25 - $27 million

Full-year 2025:

▪Revenue is anticipated to be in the range of $985 million - $1,025 million, an increase of 9% to 14% compared to 2024.

▪Variable Marketing Margin is expected to be in the range of $319 - $336 million, representing growth of 5% to 10% over last year.

▪Adjusted EBITDA is anticipated to be in the range of $116 - $126 million, an increase of 11% to 21% from 2024.

Our full-year 2025 outlook assumes double-digit revenue growth in both the Home and Consumer segments, with more modest Insurance segment growth following a record year.

*LendingTree is not able to provide a reconciliation of projected variable marketing margin or adjusted EBITDA to the most directly comparable expected GAAP results due to the unknown effect, timing and potential significance of the effects of legal matters and tax considerations. Expenses associated with legal matters and tax considerations have in the past, and may in the future, significantly affect GAAP results in a particular period.

Conclusion

Our business has good momentum as we begin the new year, with all three of our reportable segments growing revenue on a year over year basis in the fourth quarter. The team is focused on increasing wallet share with our network lending and insurance partners while also improving operating efficiency, with a laser focus on variable marketing unit economics and fixed costs. Our outlook for solid AEBITDA growth will further improve our leverage profile, which should allow us to reduce our interest expense over time and increase free cashflow for shareholders.

Thank you for your continued support.

Sincerely,

Doug Lebda, Chairman & CEO

Jason Bengel, CFO

| | | | | |

Investor Relations: investors@lendingtree.com | Media Relations: press@lendingtree.com |

LENDINGTREE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (in thousands, except per share amounts) |

| Revenue | $ | 261,522 | | | $ | 134,353 | | | $ | 900,219 | | | $ | 672,502 | |

| Costs and expenses: | | | | | | | |

Cost of revenue (exclusive of depreciation and amortization shown separately below) (1) | 9,744 | | | 8,126 | | | 36,072 | | | 38,758 | |

Selling and marketing expense (1) | 185,858 | | | 83,168 | | | 635,963 | | | 433,588 | |

General and administrative expense (1) | 29,111 | | | 25,477 | | | 108,705 | | | 117,700 | |

Product development (1) | 12,937 | | | 11,101 | | | 46,358 | | | 47,197 | |

| Depreciation | 4,448 | | | 4,831 | | | 18,300 | | | 19,070 | |

| Amortization of intangibles | 1,467 | | | 1,682 | | | 5,889 | | | 7,694 | |

| Goodwill impairment | — | | | — | | | — | | | 38,600 | |

| | | | | | | |

| Restructuring and severance | 10 | | | 151 | | | 508 | | | 10,118 | |

| Litigation settlements and contingencies | 6 | | | 38 | | | 3,797 | | | 388 | |

| Total costs and expenses | 243,581 | | | 134,574 | | | 855,592 | | | 713,113 | |

| Operating income (loss) | 17,941 | | | (221) | | | 44,627 | | | (40,611) | |

| Other (expense) income, net: | | | | | | | |

| Interest (expense) income, net | (9,950) | | | 10,693 | | | (27,849) | | | 21,685 | |

| Other income (expense) | 1,143 | | | 2,644 | | | (54,162) | | | (105,993) | |

| Income (loss) before income taxes | 9,134 | | | 13,116 | | | (37,384) | | | (124,919) | |

| Income tax (expense) benefit | (1,628) | | | (397) | | | (4,320) | | | 2,515 | |

| | | | | | | |

| | | | | | | |

| Net income (loss) and comprehensive income (loss) | $ | 7,506 | | | $ | 12,719 | | | $ | (41,704) | | | $ | (122,404) | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 13,367 | | | 13,008 | | | 13,269 | | | 12,941 | |

| Diluted | 13,591 | | | 13,020 | | | 13,269 | | | 12,941 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income (loss) per share: | | | | | | | |

| Basic | $ | 0.56 | | | $ | 0.98 | | | $ | (3.14) | | | $ | (9.46) | |

| Diluted | $ | 0.55 | | | $ | 0.98 | | | $ | (3.14) | | | $ | (9.46) | |

| | | | | | | |

(1) Amounts include non-cash compensation, as follows: | | | | | | | |

| Cost of revenue | $ | 66 | | | $ | 85 | | | $ | 297 | | | $ | 396 | |

| Selling and marketing expense | 737 | | | 1,060 | | | 3,303 | | | 5,267 | |

| General and administrative expense | 4,676 | | | 5,459 | | | 20,478 | | | 25,180 | |

| Product development | 1,015 | | | 1,573 | | | 4,501 | | | 6,333 | |

| Restructuring and severance | — | | | 178 | | | — | | | 2,506 | |

LENDINGTREE, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| | December 31,

2024 | | December 31,

2023 |

| | (in thousands, except par value and share amounts) |

| ASSETS: | | | |

| Cash and cash equivalents | $ | 106,594 | | | $ | 112,051 | |

| Restricted cash and cash equivalents | — | | | 5 | |

| Accounts receivable, net | 97,790 | | | 54,954 | |

| Prepaid and other current assets | 34,078 | | | 29,472 | |

| | | |

| | | |

| Total current assets | 238,462 | | | 196,482 | |

| Property and equipment, net | 42,780 | | | 50,481 | |

| Operating lease right-of-use assets | 52,557 | | | 57,222 | |

| Goodwill | 381,539 | | | 381,539 | |

| Intangible assets, net | 43,283 | | | 50,620 | |

| | | |

| Equity investments | 1,700 | | | 60,076 | |

| Other non-current assets | 7,353 | | | 6,339 | |

| | | |

| Total assets | $ | 767,674 | | | $ | 802,759 | |

| | | |

| LIABILITIES: | | | |

| Current portion of long-term debt | $ | 124,931 | | | $ | 3,125 | |

| Accounts payable, trade | 8,360 | | | 1,960 | |

| Accrued expenses and other current liabilities | 107,185 | | | 70,544 | |

| | | |

| | | |

| | | |

| Total current liabilities | 240,476 | | | 75,629 | |

| Long-term debt | 344,124 | | | 525,617 | |

| Operating lease liabilities | 69,238 | | | 75,023 | |

| | | |

| Deferred income tax liabilities | 4,884 | | | 2,091 | |

| Other non-current liabilities | 131 | | | 267 | |

| Total liabilities | 658,853 | | | 678,627 | |

| | | |

| SHAREHOLDERS' EQUITY: | | | |

Preferred stock $.01 par value; 5,000,000 shares authorized; none issued or outstanding | — | | | — | |

Common stock $.01 par value; 50,000,000 shares authorized; 16,746,556 and 16,396,911 shares issued, respectively, and 13,391,090 and 13,041,445 shares outstanding, respectively | 167 | | | 164 | |

| Additional paid-in capital | 1,254,239 | | | 1,227,849 | |

| Accumulated deficit | (879,407) | | | (837,703) | |

Treasury stock; 3,355,466 and 3,355,466 shares, respectively | (266,178) | | | (266,178) | |

| Total shareholders' equity | 108,821 | | | 124,132 | |

| Total liabilities and shareholders' equity | $ | 767,674 | | | $ | 802,759 | |

LENDINGTREE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| | Year Ended December 31, |

| | 2024 | 2023 | 2022 |

| | (in thousands) |

| Cash flows from operating activities: | | | |

| Net loss and comprehensive loss | $ | (41,704) | | $ | (122,404) | | $ | (187,952) | |

| | | |

| | | |

| Adjustments to reconcile net loss to net cash provided by operating activities | | | |

| Loss on impairments and disposal of assets | 2,584 | | 5,437 | | 6,590 | |

| | | |

| Amortization of intangibles | 5,889 | | 7,694 | | 25,306 | |

| Depreciation | 18,300 | | 19,070 | | 20,095 | |

| | | |

| Non-cash compensation expense | 28,579 | | 39,682 | | 59,624 | |

| Deferred income taxes | 2,793 | | (4,692) | | 132,666 | |

| | | |

| Loss (gain) on investments | 58,376 | | 114,504 | | — | |

| Loss on impairment of goodwill | — | | 38,600 | | — | |

| Bad debt expense | 171 | | 1,752 | | 4,101 | |

| Amortization of debt issuance costs | 2,168 | | 3,137 | | 6,432 | |

| | | |

| Amortization of debt discount | 331 | | — | | 1,475 | |

| Gain on settlement of convertible debt | (9,035) | | (48,562) | | — | |

| Reduction in carrying amount of ROU asset, offset by change in operating lease liabilities | (2,839) | | (4,404) | | (1,547) | |

| Changes in current assets and liabilities: | | | |

| Accounts receivable | (43,007) | | 27,706 | | 9,143 | |

| Prepaid and other current assets | (4,747) | | (2,977) | | (4,313) | |

| Accounts payable, accrued expenses and other current liabilities | 44,581 | | (5,541) | | (28,418) | |

| | | |

| Income taxes receivable | 96 | | (140) | | 214 | |

| Other, net | (278) | | (1,291) | | (449) | |

| Net cash provided by operating activities | 62,258 | | 67,571 | | 42,967 | |

| Cash flows from investing activities | | | |

| Capital expenditures | (11,220) | | (12,528) | | (11,443) | |

| | | |

| | | |

| Purchase of equity investment | — | | — | | (16,440) | |

| | | |

| | | |

| | | |

| Other investing activities | 2 | | 50 | | 7 | |

| Net cash used in investing activities | (11,218) | | (12,478) | | (27,876) | |

| Cash flows from financing activities | | | |

| Payments related to net-share settlement of stock-based compensation, net of proceeds from exercise of stock options | (2,186) | | (1,088) | | (3,411) | |

| Purchase of treasury stock | — | | — | | (43,009) | |

| Proceeds from term loan | 125,000 | | — | | 250,000 | |

| Repayment of term loan | (12,500) | | (1,875) | | (1,250) | |

| Repurchases of 0.50% Convertible Senior Notes | (158,839) | | (237,464) | | — | |

| Repayment of 0.625% Convertible Senior Notes | — | | — | | (169,659) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Payment of debt issuance costs | (4,300) | | (1,580) | | (135) | |

| | | |

| Payment of original issue discount on term loan | (3,125) | | — | | — | |

| | | |

| | | |

| Other financing activities | (552) | | 1 | | — | |

| Net cash (used in) provided by financing activities | (56,502) | | (242,006) | | 32,536 | |

| | | |

| | | |

| | | |

| | | |

| Net (decrease) increase in cash, cash equivalents, restricted cash and restricted cash equivalents | (5,462) | | (186,913) | | 47,627 | |

| Cash, cash equivalents, restricted cash, and restricted cash equivalents at beginning of period | 112,056 | | 298,969 | | 251,342 | |

| Cash, cash equivalents, restricted cash, and restricted cash equivalents at end of period | $ | 106,594 | | $ | 112,056 | | $ | 298,969 | |

LENDINGTREE'S RECONCILIATION OF NON-GAAP MEASURES TO GAAP

Variable Marketing Expense

Below is a reconciliation of selling and marketing expense, the most directly comparable GAAP measure, to variable marketing expense. See "Lending Tree's Principles of Financial Reporting" for further discussion of the Company's use of this non-GAAP measure.

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| | December 31,

2024 | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | | | |

| (in thousands) | | | |

| Selling and marketing expense | $ | 185,858 | | $ | 193,542 | | $ | 148,387 | | $ | 108,176 | | $ | 83,168 | | | | |

Non-variable selling and marketing expense (1) | (11,084) | | (9,976) | | (9,140) | | (9,855) | | (9,407) | | | | |

| Variable marketing expense | $ | 174,774 | | $ | 183,566 | | $ | 139,247 | | $ | 98,321 | | $ | 73,761 | | | | |

| | | | | |

| (1) | | Represents the portion of selling and marketing expense not attributable to variable costs paid for advertising, direct marketing and related expenses. Includes overhead, fixed costs and personnel-related expenses. |

LENDINGTREE'S RECONCILIATION OF NON-GAAP MEASURES TO GAAP

Variable Marketing Margin

Below is a reconciliation of net income (loss), the most directly comparable GAAP measure, to variable marketing margin and net income (loss) % of revenue to variable marketing margin % of revenue. See "LendingTree's Principles of Financial Reporting" for further discussion of the Company's use of these non-GAAP measures.

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| | December 31,

2024 | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | | | |

| (in thousands, except percentages) | | | |

| Net income (loss) | $ | 7,506 | | $ | (57,978) | | $ | 7,752 | | $ | 1,016 | | $ | 12,719 | | | | |

| Net income (loss) % of revenue | 3 | % | (22) | % | 4 | % | 1 | % | 9 | % | | | |

| | | | | | | | |

| Adjustments to reconcile to variable marketing margin: | | | | | | | | |

| Cost of revenue | 9,744 | | 9,372 | | 8,411 | | 8,545 | | 8,126 | | | | |

| | | | | | | | |

Non-variable selling and marketing expense (1) | 11,084 | | 9,976 | | 9,140 | | 9,855 | | 9,407 | | | | |

| General and administrative expense | 29,111 | | 26,680 | | 27,118 | | 25,796 | | 25,477 | | | | |

| Product development | 12,937 | | 11,190 | | 10,374 | | 11,857 | | 11,101 | | | | |

| Depreciation | 4,448 | | 4,584 | | 4,601 | | 4,667 | | 4,831 | | | | |

| Amortization of intangibles | 1,467 | | 1,466 | | 1,467 | | 1,489 | | 1,682 | | | | |

| | | | | | | | |

| | | | | | | | |

| Restructuring and severance | 10 | | 273 | | 202 | | 23 | | 151 | | | | |

| Litigation settlements and contingencies | 6 | | 3,762 | | (7) | | 36 | | 38 | | | | |

| Interest expense (income), net | 9,950 | | 10,060 | | 1,201 | | 6,638 | | (10,693) | | | | |

| Other (income) expense | (1,143) | | 57,391 | | (1,052) | | (1,034) | | (2,644) | | | | |

| Income tax expense | 1,628 | | 447 | | 1,686 | | 559 | | 397 | | | | |

| Variable marketing margin | $ | 86,748 | | $ | 77,223 | | $ | 70,893 | | $ | 69,447 | | $ | 60,592 | | | | |

| Variable marketing margin % of revenue | 33 | % | 30 | % | 34 | % | 41 | % | 45 | % | | | |

| | | | | |

| (1) | | Represents the portion of selling and marketing expense not attributable to variable costs paid for advertising, direct marketing and related expenses. Includes overhead, fixed costs and personnel-related expenses. |

LENDINGTREE'S RECONCILIATION OF NON-GAAP MEASURES TO GAAP

Adjusted EBITDA

Below is a reconciliation of net income (loss), the most directly comparable GAAP measure, to adjusted EBITDA and net income (loss) % of revenue to adjusted EBITDA % of revenue. See "LendingTree's Principles of Financial Reporting" for further discussion of the Company's use of these non-GAAP measures.

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| | December 31,

2024 | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | | | |

| (in thousands, except percentages) | | | |

| Net income (loss) | $ | 7,506 | | $ | (57,978) | | $ | 7,752 | | $ | 1,016 | | $ | 12,719 | | | | |

| Net income (loss) % of revenue | 3 | % | (22) | % | 4 | % | 1 | % | 9 | % | | | |

| Adjustments to reconcile to adjusted EBITDA: | | | | | | | | |

| Amortization of intangibles | 1,467 | | 1,466 | | 1,467 | | 1,489 | | 1,682 | | | | |

| Depreciation | 4,448 | | 4,584 | | 4,601 | | 4,667 | | 4,831 | | | | |

| Restructuring and severance | 10 | | 273 | | 202 | | 23 | | 151 | | | | |

| Loss on impairments and disposal of assets | 1,797 | | 6 | | 413 | | 368 | | 182 | | | | |

| Loss on impairment of investments | — | | 58,376 | | — | | — | | — | | | | |

| | | | | | | | |

| Non-cash compensation | 6,494 | | 6,859 | | 7,437 | | 7,789 | | 8,177 | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Litigation settlements and contingencies | 6 | | 3,762 | | (7) | | 36 | | 38 | | | | |

| Interest expense (income), net | 9,950 | | 10,060 | | 1,201 | | 6,638 | | (10,693) | | | | |

| Dividend income | (1,144) | | (982) | | (1,225) | | (1,034) | | (2,021) | | | | |

| Income tax expense | 1,628 | | 447 | | 1,686 | | 559 | | 397 | | | | |

| Adjusted EBITDA | $ | 32,162 | | $ | 26,873 | | $ | 23,527 | | $ | 21,551 | | $ | 15,463 | | | | |

| Adjusted EBITDA % of revenue | 12 | % | 10 | % | 11 | % | 13 | % | 12 | % | | | |

LENDINGTREE'S RECONCILIATION OF NON-GAAP MEASURES TO GAAP

Adjusted Net Income

Below is a reconciliation of net income (loss), the most directly comparable GAAP measure, to adjusted net income and net income (loss) per diluted share to adjusted net income per share. See "LendingTree's Principles of Financial Reporting" for further discussion of the Company's use of these non-GAAP measures.

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| | December 31,

2024 | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 |

| (in thousands, except per share amounts) |

| Net income (loss) | $ | 7,506 | | $ | (57,978) | | $ | 7,752 | | $ | 1,016 | | $ | 12,719 | |

| Adjustments to reconcile to adjusted net income: | | | | | |

| Restructuring and severance | 10 | | 273 | | 202 | | 23 | | 151 | |

| | | | | |

| Loss on impairments and disposal of assets | 1,797 | | 6 | | 413 | | 368 | | 182 | |

| Loss on impairment of investments | — | | 58,376 | | — | | — | | — | |

| Non-cash compensation | 6,494 | | 6,859 | | 7,437 | | 7,789 | | 8,177 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Litigation settlements and contingencies | 6 | | 3,762 | | (7) | | 36 | | 38 | |

| Gain on extinguishment of debt | — | | (416) | | (8,619) | | — | | (17,665) | |

| | | | | |

| | | | | |

| | | | | |

| Adjusted net income | $ | 15,813 | | $ | 10,882 | | $ | 7,178 | | $ | 9,232 | | $ | 3,602 | |

| | | | | |

| Net income (loss) per diluted share | $ | 0.55 | | $ | (4.34) | | $ | 0.58 | | $ | 0.08 | | $ | 0.98 | |

| Adjustments to reconcile net income (loss) to adjusted net income | 0.61 | | 5.16 | | (0.04) | | 0.62 | | (0.70) | |

| Adjustments to reconcile effect of dilutive securities | — | | (0.02) | | — | | — | | — | |

| Adjusted net income per share | $ | 1.16 | | $ | 0.80 | | $ | 0.54 | | $ | 0.70 | | $ | 0.28 | |

| | | | | |

| Adjusted weighted average diluted shares outstanding | 13,591 | | 13,555 | | 13,407 | | 13,276 | | 13,020 | |

| Effect of dilutive securities | — | | 206 | | — | | — | | — | |

| Weighted average diluted shares outstanding | 13,591 | | 13,349 | | 13,407 | | 13,276 | | 13,020 | |

| Effect of dilutive securities | 224 | | — | | 150 | | 176 | | 12 | |

| Weighted average basic shares outstanding | 13,367 | | 13,349 | | 13,257 | | 13,100 | | 13,008 | |

LENDINGTREE’S PRINCIPLES OF FINANCIAL REPORTING

LendingTree reports the following non-GAAP measures as supplemental to GAAP:

•Variable marketing expense

•Variable marketing margin

•Variable marketing margin % of revenue

•Earnings Before Interest, Taxes, Depreciation and Amortization, as adjusted for certain items discussed below ("Adjusted EBITDA")

•Adjusted EBITDA % of revenue

•Adjusted net income

•Adjusted net income per share

Variable marketing expense, variable marketing margin and variable marketing margin % of revenue are related measures of the effectiveness of the Company's marketing efforts. Variable marketing expense represents the portion of selling and marketing expense attributable to variable costs paid for advertising, direct marketing, and related expenses, and excludes overhead, fixed costs, and personnel-related expenses. Variable marketing margin is a measure of the efficiency of the Company’s operating model, measuring revenue after subtracting variable marketing expense. The Company’s operating model is highly sensitive to the amount and efficiency of variable marketing expenditures, and the Company’s proprietary systems are able to make rapidly changing decisions concerning the deployment of variable marketing expenditures (primarily but not exclusively online and mobile advertising placement) based on proprietary and sophisticated analytics.

Adjusted EBITDA and adjusted EBITDA % of revenue are primary metrics by which LendingTree evaluates the operating performance of its businesses, on which its marketing expenditures and internal budgets are based and, in the case of adjusted EBITDA, by which management and many employees are compensated in most years.

Adjusted net income and adjusted net income per share supplement GAAP net income and GAAP net income per diluted share by enabling investors to make period to period comparisons of those components of the most directly comparable GAAP measures that management believes better reflect the underlying financial performance of the Company’s business operations during particular financial reporting periods. Adjusted net income and adjusted net income per share exclude certain amounts, such as non-cash compensation, non-cash asset impairment charges, gain/loss on disposal of assets, gain/loss on investments, restructuring and severance, litigation settlements and contingencies, acquisition and disposition income or expenses including with respect to changes in fair value of contingent consideration, gain/loss on extinguishment of debt, contributions to the LendingTree Foundation, one-time items which are recognized and recorded under GAAP in particular periods but which might be viewed as not necessarily coinciding with the underlying business operations for the periods in which they are so recognized and recorded, the effects to income taxes of the aforementioned adjustments, any excess tax benefit or expense associated with stock-based compensation recorded in net income in conjunction with FASB pronouncement ASU 2016-09, and income tax (benefit) expense from a full valuation allowance. LendingTree believes that adjusted net income and adjusted net income per share are useful financial indicators that provide a different view of the financial performance of the Company than adjusted EBITDA (the primary metric by which LendingTree evaluates the operating performance of its businesses) and the GAAP measures of net income and GAAP net income per diluted share.

These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. LendingTree provides and encourages investors to examine the reconciling adjustments between the GAAP and non-GAAP measures set forth above.

Definition of LendingTree's Non-GAAP Measures

Variable marketing margin is defined as revenue less variable marketing expense. Variable marketing expense is defined as the expense attributable to variable costs paid for advertising, direct marketing and related expenses, and excluding overhead, fixed costs and personnel-related expenses. The majority of these variable advertising costs are expressly intended to drive traffic to our websites and these variable advertising costs are included in selling and marketing expense on the Company's consolidated statements of operations and consolidated income.

EBITDA is defined as net income excluding interest, income taxes, amortization of intangibles and depreciation.

Adjusted EBITDA is defined as EBITDA excluding (1) non-cash compensation expense, (2) non-cash impairment charges, (3) gain/loss on disposal of assets, (4) gain/loss on investments, (5) restructuring and severance expenses, (6) litigation settlements and contingencies, (7) acquisitions and dispositions income or expense (including with respect to changes in fair value of contingent consideration), (8) contributions to the LendingTree Foundation, (9) dividend income, and (10) one-time items.

Adjusted net income is defined as net income (loss) excluding (1) non-cash compensation expense, (2) non-cash impairment charges, (3) gain/loss on disposal of assets, (4) gain/loss on investments, (5) restructuring and severance expenses, (6) litigation settlements and contingencies, (7) acquisitions and dispositions income or expense (including with respect to changes in fair value of contingent consideration), (8) gain/loss on extinguishment of debt, (9) contributions to the LendingTree Foundation, (10) one-time items, (11) the effects to income taxes of the aforementioned adjustments, (12) any excess tax benefit or expense associated with stock-based compensation recorded in net income in conjunction with FASB pronouncement ASU 2016-09, and (13) income tax (benefit) expense from a full valuation allowance.

Adjusted net income per share is defined as adjusted net income divided by the adjusted weighted average diluted shares outstanding. For periods which the Company reports GAAP loss, the effects of potentially dilutive securities are excluded from the calculation of net loss per diluted share because their inclusion would have been anti-dilutive. In periods where the Company reports GAAP loss but reports positive non-GAAP adjusted net income, the effects of potentially dilutive securities are included in the denominator for calculating adjusted net income per share if their inclusion would be dilutive.

LendingTree endeavors to compensate for the limitations of these non-GAAP measures by also providing the comparable GAAP measures with equal or greater prominence and descriptions of the reconciling items, including quantifying such items, to derive the non-GAAP measures. These non-GAAP measures may not be comparable to similarly titled measures used by other companies.

One-Time Items

Adjusted EBITDA and adjusted net income are adjusted for one-time items, if applicable. Items are considered one-time in nature if they are non-recurring, infrequent or unusual, and have not occurred in the past two years or are not expected to recur in the next two years, in accordance with SEC rules. For the periods presented in this report, there are no adjustments for one-time items.

Non-Cash Expenses That Are Excluded From LendingTree's Adjusted EBITDA and Adjusted Net Income