Visteon Releases Preliminary Fourth Quarter and Full Year 2004

Results 2004 Highlights VAN BUREN TOWNSHIP, Mich., Jan. 31

/PRNewswire-FirstCall/ -- Visteon Corporation (NYSE:VC) today

announced preliminary fourth quarter and full year results for

2004. For the fourth quarter 2004, Visteon reported revenue of $4.7

billion, up 5 percent compared with the same period in 2003. These

results were driven by a 35 percent increase in non-Ford revenue.

Non-Ford revenue for the quarter totaled a record $1.6 billion, up

more than 7 percentage points from the same period last year.

(Logo: http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGO )

For the full year 2004, revenue totaled $18.7 billion, up $1

billion compared to 2003, despite a $460 million decline in Ford

revenue. Full-year non-Ford revenue reached a record $5.7 billion,

up 36 percent over 2003. Full-year non-Ford revenue represented 30

percent of total revenue. "Our record non-Ford revenue growth in

2004 exceeded our expectations and serves as testament to the

innovative products customers are counting on us to deliver," said

Mike Johnston, president and chief executive officer. "Our new

business wins in 2004 continue to be in the growth products that

are core to our success - interiors, climate and electronics,

including lighting. We've strengthened our competitive position to

serve customers around the globe by opening and expanding technical

centers in every region. "We have implemented programs to reduce

headcount and costs in the United States, but material surcharges

and lower North American Ford production have put significant

pressure on our operating results. As we announced last September,

we are exploring strategic and structural changes to our U.S.

operations to achieve a sustainable and competitive business. We

are having constructive and ongoing discussions with Ford about

such changes." Visteon's results are preliminary because, during

the course of the year- end closing process, errors were discovered

in the company's accounting for certain retiree health care and

pension benefits, and income taxes. Management has made an initial

evaluation of the impact of these errors and has included

preliminary financial results reflecting these estimates. Because

of these errors, Visteon is, in consultation with its independent

registered public accounting firm, PricewaterhouseCoopers LLP,

reviewing prior reports filed with the Securities and Exchange

Commission to determine if any other adjustments or corrections are

necessary. Visteon has not identified any other necessary

adjustments at this time. Fourth Quarter 2004 During the fourth

quarter of 2004, Visteon changed the method of determining the cost

of production inventory for U.S. locations from the last- in,

first-out (LIFO) method to the first-in, first-out (FIFO) method.

Visteon believes the FIFO method of inventory costing will provide

more meaningful information to investors and conforms all

inventories to the same FIFO basis. In accordance with Accounting

Principles Board Opinion No. 20, "Accounting Changes", a change

from the LIFO method of inventory costing to another method is

considered a change in accounting principle that should be applied

by retroactively restating all prior periods. For the fourth

quarter 2004 Visteon reported a net loss of $115 million, or $0.92

per share. These results include $41 million of after-tax special

charges, or $0.33 per share, primarily related to costs associated

with a U.S. salaried employee voluntary termination incentive

program that will result in a reduction of approximately 400

employees by March 31, 2005. For the fourth quarter 2003, as

restated, Visteon reported a net loss of $829 million, or $6.60 per

share. These results included asset impairment write-downs, an

increase in deferred tax asset valuation allowances, and special

charges totaling $720 million after-tax, or $5.73 per share. Full

Year 2004 For the full year 2004, Visteon recorded a net loss of

$1.489 billion, or $11.88 per share. These results include non-cash

write-downs of $871 million for increased valuation allowances

against Visteon's deferred taxes, $314 million for asset impairment

write-downs, and $78 million for other special charges. In

aggregate these items totaled $1.263 billion after tax, or $10.08

per share. For the full year 2003, as restated, Visteon recorded a

net loss of $1.190 billion or $9.46 per share. These results

include the asset impairment write- downs, an increase in deferred

tax asset valuation allowances and other special charges. In

aggregate, after-tax, these items totaled $911 million, or $7.24

per share. For the full year 2004, cash flow from operations was

$427 million, a $57 million increase from 2003. Cash payments

related to capital expenditures were $836 million for the full year

2004, $43 million lower than 2003. At year end 2004, Visteon had

$752 million of cash and marketable securities, down $204 million

from the previous year end. 2005 Outlook Visteon is exploring

strategic and structural changes to its business in the United

States that would involve Ford and Visteon's legacy businesses.

Visteon is seeking a comprehensive agreement that could address a

number of items. The discussions with Ford have been constructive

and are ongoing. Because of the uncertainty surrounding future

market and economic conditions, combined with Visteon's ongoing

discussions with Ford, Visteon is not providing specific guidance

at this time. "In light of mounting challenges facing our business,

we are identifying actions to improve the company's cost structure

and cash position," said Johnston. "In addition to our strategic

and structural discussions with Ford, we are taking actions to

focus capital and engineering resources to growth areas only, and

minimize the impact of material surcharges." The Board of Directors

considers each quarter whether to declare a cash dividend, and has

declared and paid a cash dividend each quarter since its spin off

from Ford in 2000. In light of the uncertainty regarding future

market conditions, Visteon's current financial conditions and the

ongoing discussions with Ford, the Board intends to discuss its

options regarding the cash dividend at its regularly scheduled

February 9, 2005 meeting, including modification or suspension of

the dividend. Accounting Restatements Effective in January 2002,

Visteon amended its retiree health care benefits plan for certain

of its U.S. employees. Effective in January 2004, a Visteon wholly

owned subsidiary amended its retiree health care benefits plan for

its employees. These amendments changed the eligibility

requirements for participants in the plan. As a result of these

amendments, Visteon changed the expense attribution periods, which

eliminated cost accruals for younger employees and increased

accrual rates for older participating employees. Prior to these

amendments, Visteon accrued for the cost of the benefit from a

participating employee's date of hire, regardless of age. During

the course of preparing Visteon's 2004 financial statements, it was

determined that the requirement to properly communicate these

benefit changes to affected employees was not satisfied. Further,

analysis of the annual United Kingdom pension valuation identified

pension expense related to special termination benefits provided

under Visteon's European Plan for Growth were not fully recognized

in the company's previous financial statements. In addition to the

employee benefit matters described above, Visteon also corrected

the amount and timing of the recognition of certain tax adjustments

made during the periods. As the company expects to repatriate

earnings of foreign subsidiaries, adjustments were made to provide

for the tax effects of foreign currency movements against the U.S.

dollar. These adjustments impacted the timing of the recognition of

deferred tax asset valuation allowances in the fourth quarter of

2003 and the third quarter of 2004. Further, the company recognized

an additional valuation allowance for certain deferred tax assets

that had previously been misclassified and not considered in the

company's 2003 deferred tax assessment. As a result of these

errors, Visteon's management has recommended, and the Audit

Committee has approved, the review and preliminary restatement of

its financial statements for 2002, 2003 and the first three fiscal

quarters of 2004. The restatements presented in the accompanying

financial information include adjustments that had resulted from

the changes described above. The preliminary restatements and

adjustments reflected in the attached financial information are

being reviewed and could change. Accordingly, investors are

cautioned not to rely on the company's historical financial

statements for such periods. A preliminary summary of adjustments

identified, including related tax effects, is set forth in the

"Note to Financial Information." "Although the OPEB plan changes

were disclosed in our public filings, we did not properly

communicate these changes to employees who were affected,"

explained Jim Palmer, executive vice president and chief financial

officer. "Because of this lapse in communication, the action cannot

be considered effective and we are reversing the change. This is a

non-cash item and is unrelated to Ford's recent OPEB reserve

announcement. We are hopeful the review of this matter and other

identified issues will be concluded shortly, allowing for a timely

filing of our 2004 10-K." Visteon has concluded that the

deficiencies in internal controls that led to the errors constitute

a "material weakness," as defined by the Public Company Accounting

Oversight Board's Auditing Standard No. 2. Consequently, management

will be unable to conclude that Visteon's internal controls over

financial reporting are effective as of December 31, 2004.

Furthermore, Visteon expects that PricewaterhouseCoopers LLP will

issue an adverse opinion with respect to the company's internal

controls over financial reporting, which opinion will be included

in Visteon's 2004 Form 10-K. Quarterly Conference Call Scheduled at

10 a.m. EST Today A conference call will be hosted today, Monday,

January 31 at 10 a.m. EST to discuss Visteon's fourth quarter and

full year 2004 financial results in further detail, as well as

other related matters. To participate in the call, callers in the

U.S. should dial 888-452-7086 and callers outside of the U.S.

should dial 706-643-3752. Please call approximately 10 minutes

before the start of the conference. For a replay of the conference,

those in the U.S should dial 800-642-1687; outside the U.S.,

callers should dial 706-645-9291. The pass code to access the

replay is 1098115 (domestic and international). The replay will be

available for one week. Visteon will provide a broadcast of the

quarterly meeting for the general public via a live audio web cast.

The conference call, along with the financial results release,

presentation material and other supplemental information, can be

accessed through Visteon's web site at

http://www.visteon.com/earnings. Visteon Corporation is a leading

full-service supplier that delivers consumer-driven technology

solutions to automotive manufacturers worldwide and through

multiple channels within the global automotive aftermarket. Visteon

has about 70,000 employees and a global delivery system of more

than 200 technical, manufacturing, sales and service facilities

located in 25 countries. This press release contains

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward- looking

statements are not guarantees of future results and conditions but

rather are subject to various factors, risks and uncertainties that

could cause our actual results to differ materially from those

expressed in these forward-looking statements, including the

automotive vehicle production volumes and schedules of our

customers, and in particular Ford's North American vehicle

production volumes; the successful completion of our discussions

with Ford and, if successful, implementing structural changes that

result from those discussions; our successful execution of internal

performance plans and other cost-reduction and productivity

efforts; charges resulting from asset impairment reviews,

restructurings, employee reductions, acquisitions or dispositions;

our ability to offset or recover significant material surcharges;

the completion of the review of our prior period financial

statements referred to in this press release and any adjustments

that may result from such review; the effect of pension and other

post- employment benefit obligations; as well as those factors

identified in our filings with the SEC (including our Annual Report

on Form 10-K for the year- ended December 31, 2003). We assume no

obligation to update these forward- looking statements. Visteon

Corporation And Subsidiaries Supplemental DATA (Preliminary and

Unaudited) (in millions, except per share amounts) 2004

over/(under) 2004 Restated 2003 * Fourth Full Fourth Full Quarter

Year Quarter Year Sales Ford and affiliates $3,115 $13,015 $(174)

$(460) Other customers 1,580 5,676 410 1,491 Total sales $4,695

$18,691 $236 $1,031 Depreciation and amortization Depreciation $146

$580 $ -- $8 Amortization 24 102 (2) -- Total depreciation and

amortization $170 $682 $(2) $8 Selling, administrative and other

expenses $266 $994 $6 $(14) (Loss) before income taxes and minority

interests $(123) $(489) $496 $687 Net (loss) $(115) $(1,489) $714

$(299) Net (loss) per share Basic and Diluted $(0.92) $(11.88)

$5.68 $(2.42) Average shares outstanding Basic and diluted 125.3

125.3 (0.4) (0.5) Special charges (1)(2) Included in costs of sales

$(27) $(382) $(414) $(352) Included in selling, administrative and

other expenses (14) (14) -- (6) Total pre-tax special charges $(41)

$(396) $(414) $(358) Special charges above, after-tax $(41) $(392)

$(252) $(92) Deferred tax asset valuation allowance -- (871) (427)

444 Total after-tax special charges $(41) $(1,263) $(679) $352

Special charges per share, based on average diluted shares

outstanding above $(0.33) $(10.08) $(5.40) $2.84 Capital

expenditures(3) $274 $854 $36 $(25) Cash provided by operating

activities $200 $427 $(138) $57 Cash and borrowing (compared to

December 2003 year-end) Cash and marketable securities $752 $(204)

Borrowing 2,021 203 * See Note to Financial Information which

describes the restatement of previously reported financial

information. ------ 1 - Fourth Quarter 2004 amounts include $41

million ($41 million after- tax) related to restructuring and other

actions. Full Year 2004 amounts include $82 million ($78 million

after-tax) related to restructuring and other actions and $314

million ($314 million after- tax) related to fixed asset impairment

write-downs. 2 - Fourth Quarter 2003 restated amounts include $48

million ($33 million after-tax) related to restructuring and other

actions and $407 million ($260 million after-tax) related to

non-cash fixed asset impairment write-downs. Full Year 2003

restated amounts include $318 million ($205 million after-tax)

related to restructuring and other actions and $436 million ($279

million after-tax) related to fixed asset impairment write-downs. 3

- Includes amounts related to capital leases. Visteon Corporation

And Subsidiaries Consolidated Statement Of Operations (Preliminary

And Unaudited) For the Years Ended December 31, Fourth Quarter

Restated Restated Restated 2004 2003* 2002* 2004 2003* (in

millions, except per share amounts) Sales Ford and affiliates

$13,015 $13,475 $14,779 $3,115 $3,289 Other customers 5,676 4,185

3,616 1,580 1,170 Total sales 18,691 17,660 18,395 4,695 4,459

Costs and expense Costs of sales 18,135 17,806 17,612 4,535 4,812

Selling, administrative and other expenses 994 1,008 893 266 260

Total costs and expenses 19,129 18,814 18,505 4,801 5,072 Operating

(loss) (438) (1,154) (110) (106) (613) Interest income 19 17 23 5 4

Bond extinguishment costs 11 -- -- -- -- Interest expense 104 94

103 29 23 Net interest expense (96) (77) (80) (24) (19) Equity in

net income of affiliated companies 45 55 44 7 13 (Loss) before

income taxes, minority interests and change in accounting (489)

(1,176) (146) (123) (619) Provision (benefit) for income taxes 965

(15) (69) (15) 201 (Loss) before minority interests and change in

accounting (1,454) (1,161) (77) (108) (820) Minority interests in

net income of subsidiaries 35 29 28 7 9 (Loss) before change in

accounting (1,489) (1,190) (105) (115) (829) Cumulative effect of

change in accounting, net of tax -- -- (265) -- -- Net (Loss)

$(1,489) $(1,190) $(370) $(115) $(829) Basic and diluted (Loss) per

share Before cumulative effect of change in accounting $ (11.88)

$(9.46) $(0.82) $(0.92) $(6.60) Cumulative effect of change in

accounting -- -- (2.07) -- -- Basic and diluted $(11.88) $(9.46)

$(2.89) $(0.92) $(6.60) Cash dividends per share $0.24 $0.24 $0.24

$0.06 $0.06 * See Note to Financial Information which describes the

restatement of previously reported financial information. Visteon

Corporation And Subsidiaries Consolidated Balance Sheet

(Preliminary And Unaudited) December 31, Restated 2004 2003* (in

millions) Assets Cash and cash equivalents $752 $953 Marketable

securities -- 3 Total cash and marketable securities 752 956

Accounts receivable - Ford and affiliates 1,276 1,198 Accounts

receivable - other customers 1,263 1,164 Total receivables 2,539

2,362 Inventories 889 852 Deferred income taxes 51 163 Prepaid

expenses and other current assets 231 160 Total current assets

4,462 4,493 Equity in net assets of affiliated companies 227 215

Net property 5,319 5,369 Deferred income taxes 132 700 Other assets

203 270 Total assets $10,343 $11,047 Liabilities and Stockholders'

Equity Trade payables $2,403 $2,270 Accrued liabilities 893 929

Income taxes payable 34 27 Debt payable within one year 508 351

Total current liabilities 3,838 3,577 Long-term debt 1,513 1,467

Postretirement benefits other than pensions 636 513 Postretirement

benefits payable to Ford 2,135 2,090 Deferred income taxes 296 3

Other liabilities 1,491 1,505 Total liabilities 9,909 9,155

Stockholders' equity Capital stock Preferred stock, par value

$1.00, 50 million shares authorized, none outstanding -- -- Common

stock, par value $1.00, 500 million shares authorized, 131 million

shares issued, 130 million and 131 million shares outstanding,

respectively 131 131 Capital in excess of par value of stock 3,365

3,358 Accumulated other comprehensive (loss) 8 (53) Other (26) (19)

Earnings retained for use in business (accumulated deficit) (3,044)

(1,525) Total stockholders' equity 434 1,892 Total liabilities and

stockholders' equity $10,343 $11,047 * See Note to Financial

Information which describes the restatement of previously reported

financial information. Visteon Corporation And Subsidiaries

Consolidated Statement Of Cash Flows (Preliminary And Unaudited)

For the Years Ended December 31, Restated Restated 2004 2003* 2002*

(in millions) Cash and cash equivalents at January 1 $953 $1,204

$1,024 Cash flows provided by operating activities 427 370 1,101

Cash flows from investing activities Capital expenditures (836)

(879) (723) Acquisitions and investments in joint ventures, net --

(4) -- Purchases of securities -- (48) (508) Sales and maturities

of securities 11 118 588 Other 34 25 36 Net cash used in investing

activities (791) (788) (607) Cash flows from financing activities

Commercial paper (repayments) issuances, net (81) (85) (194) Other

short-term debt, net (20) 55 45 Proceeds from issuance of other

debt, net of issuance costs 576 238 115 Principal payments on other

debt (32) (121) (245) Repurchase of unsecured debt securities (269)

-- -- Purchase of treasury stock (11) (5) (24) Cash dividends (31)

(31) (31) Other, including book overdrafts 3 77 (4) Net cash

provided by (used in) financing activities 135 128 (338) Effect of

exchange rate changes on cash 28 39 24 Net (decrease) increase in

cash and cash equivalents (201) (251) 180 Cash and cash equivalents

at December 31 $752 $953 $1,204 * See Note to Financial Information

which describes the restatement of previously reported financial

information. Visteon Corporation And Subsidiaries NOTE TO FINANCIAL

INFORMATION The following table summarizes the anticipated

adjustments to the previously reported financial information

announced by Visteon. These adjustments impacted previously

reported costs of sales, selling, general and other expenses and

income tax expense on the statement of operations. Full Fourth Full

First Nine Year Quarter Year Months 2002 2003 2003 2004 (in

millions) Net (loss), as originally reported $ (352) $ (863) $

(1,213) $ (1,299) Accounting for change in inventory costing

methodology (pre-tax)(1) (9) 3 3 -- Accounting corrections for

postretirement health care costs and pension costs (pre-tax)(2)

(20) (11) (29) (28) Tax impact of above (3) 11 18 25 -- Accounting

correction for taxes (4) -- 32 32 (39) Accounting correction for

taxes (5) -- (8) (8) (8) Net (loss), as restated $ (370) $ (829) $

(1,190) $ (1,374) Net (loss) per share - basic and diluted As

originally reported $ (2.75) $ (6.87) $ (9.65) $ (10.37) As

restated $ (2.89) $ (6.60) $ (9.46) $ (10.97) ------ 1 - During the

fourth quarter of 2004, Visteon changed the method of determining

the cost of production inventory for U.S. locations from the last-

in, first-out ("LIFO") method to the first-in, first-out ("FIFO")

method. Visteon believes the FIFO method of inventory costing

provides more meaningful information to investors and conforms all

inventories to the same FIFO basis. In accordance with Accounting

Principles Board Opinion No. 20, "Accounting Changes", a change

from the LIFO method of inventory costing to another method is

considered a change in accounting principle that should be applied

by retroactively restating all prior periods. 2 - Includes

accounting corrections for U.S. postretirement life and health care

costs to reverse the cumulative expense reductions that had been

recorded from plan amendments which changed eligibility

requirements for the retiree health care benefits for participating

employees. As a result of these amendments, Visteon changed the

expense attribution periods, which eliminated cost accruals for

younger employees and increased the accrual rate for older

participating employees. It was determined that the requirement of

Statement of Financial Accounting Standards No. 106 to properly

communicate these benefit changes to affected employees was not

satisfied and that such expense reductions should not have been

recorded. Further, based on an analysis of the annual United

Kingdom pension actuarial valuation, amounts also include $5

million for the full year 2003 and fourth quarter of 2003 and $4

million for the first nine months of 2004 related to special

termination benefits provided under Visteon's European Plan for

Growth which were not fully recognized in Visteon's previous

financial statements. 3 - Represents the deferred tax benefit of

the pre-tax expense adjustments, net of any valuation allowances.

The fourth quarter and full year 2003 amounts include $17 million

to adjust the valuation allowance for the cumulative impact on

deferred tax assets of the pre-tax adjustments. 4 - Represents an

adjustment to provide U.S. deferred taxes for the impact of

currency fluctuations on retained earnings of non-U.S. subsidiaries

and the related adjustments to the required deferred tax asset

valuation allowances in the fourth quarter of 2003 and the third

quarter of 2004. Visteon expects to repatriate earnings of non-U.S.

subsidiaries and must provide for the expected U.S. tax impact of

the assumed future repatriation, including the impact of currency

fluctuations. These amounts were originally provided for in the

second quarter of 2004 in conjunction with Visteon's completion of

a full analysis and assessment of the Other Comprehensive Income

balances, including the pre-spin periods. This adjustment was

recorded to fully recognize the tax amounts as they arose in prior

periods and to account for the related impact on the deferred tax

asset valuation allowances recorded in the fourth quarter of 2003

and the third quarter of 2004. 5 - Represents accounting

corrections to adjust the valuation allowance recorded against

Visteon's deferred tax assets. The fourth quarter and full year

2003 adjustment relates to certain foreign deferred tax assets that

had been previously misclassified. The adjustment for the first

nine months of 2004 relates to the impact of changes in foreign

currency exchange rates on Visteon's U.S. deferred tax liabilities

for withholding taxes on unremitted foreign earnings.

http://www.newscom.com/cgi-bin/prnh/20001201/DEF008LOGODATASOURCE:

Visteon Corporation CONTACT: Media: Kimberly A. Welch, Corporate

Communications, +1-734-710-5593, or , Analyst: Derek Fiebig,

+1-734-710-5800, or Web site: http://www.visteon.com/

http://www.visteon.com/earnings

Copyright

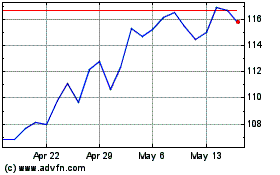

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jun 2024 to Jul 2024

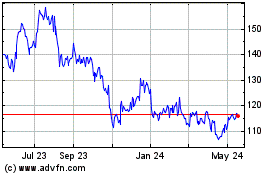

Visteon (NASDAQ:VC)

Historical Stock Chart

From Jul 2023 to Jul 2024