UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of September 2022

Commission File Number 001-41385

Visionary Education Technology Holdings Group

Inc.

(Translation of registrant’s name into English)

200 Town Centre Blvd.

Suite 408A

Markham, Ontario, Canada L3R 8G5

905-739-0593

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only

permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

Entry into a Material Definitive Agreement.

Visionary Education Technology Holdings Group

Inc. (the “Company”) entered into an Amended and Restated Securities Purchase Agreement (the “SPA”) as of September

19, 2022, with an accredited investor (the “Purchaser”), to issue and sell to the Purchaser a senior secured convertible note

of the Company in the principal amount of $1.5 million (the “Note”), and a Series A Warrant and a Series B Warrant to purchase

additional common shares of the Company (the Series A Warrant and the Series B Warrant are collectively referred to as the “Warrants”).

The Company issued the Note and the Warrants as

of September 19, 2022. The Note is subject to an original issue discount of 10%, and is convertible, in whole and in part, from time to

time at the option of the Purchaser commencing March 19, 2023 into the Company’s common shares at a conversion price equal to the

lower of (i) $4.00, and (ii) the greater of (x) the Floor Price then in effect and (y) 85% of the lowest trading price of our common shares

during the 15 consecutive trading day period preceding the delivery of the conversion notice. Pursuant to the original issue discount,

the Purchaser paid $1,350,000 for the Note and related Warrants, less certain fees, and expenses payable by the Company. The Note may

not be converted to the extent that the number of common shares owned by the Purchaser and its affiliates will exceed 4.99% of the issued

and outstanding shares of the Company at the time of conversion.

The Note matures on September 19, 2023, or earlier

under certain conditions set forth in the SPA. The Note accrues interest at the greater of (x) the sum of the prime rate plus four and

a half percent (4.5%) per annum and (y) nine percent (9%) per annum, provided that, subject to certain conditions set forth in the SPA,

the Company may elect to pay such interest in common shares. The Note ranks senior to all present and future Company indebtedness, subject

to certain permitted senior indebtedness (including real estate mortgages). The Company has the right to redeem all, but not less than

all, of the outstanding balance under the Note at a 20% premium to the greater of the balance of the Note and the number of common shares

into which the Note can then be converted.

The Company’s obligations under the Note,

the SPA, the Warrants and other transaction documents are secured by (i) the grant of a first priority lien by the Company and its subsidiaries

upon substantially all of the personal and real property of the Company and its subsidiaries pursuant to a security agreement between

the Company, its subsidiaries and the Purchaser (the “Security Agreement”) and (ii) by a pledge of 3,620,378 shares held by

our principal shareholder, director, and executive director, Fan Zhou (the “Pledge Agreement"). The Company’s obligations

under the Note are also subject to a guaranty by the Company and its subsidiaries (the “Guaranty”).

Under the SPA, the Purchaser has customary preemptive

rights to participate in any future financing by the Company and the Company agreed to certain restrictions on changes in its capital

structure, including the Company’s agreement to certain restrictions on the issuance of additional equity securities so long as

the Purchaser owns any Securities (as defined in the SPA), or to engage in any Dilutive Issuances (as defined in the Note) so long as

the Note or any Warrants are outstanding.

The Company delivered to Purchaser the Warrants

registered in the name of the Purchaser. The Series A Warrant grants the Purchaser the right to purchase 1,279,357 common shares at an

exercise price of $4.00 per share until September 19, 2032. The Series B Warrant grants the Purchaser the right, from March 19, 2023 until

September 19, 2032, to purchase 1,944,445 common shares at an exercise price equal to lower of (i) $3.60 and (ii) the greater of (x) the

Floor Price (as defined in the Note) and (y) 75% of the lowest volume weighted average price of the Company’s common shares during

the 15 consecutive trading day period preceding the delivery of the exercise notice. The Warrants may not be exercised to the extent that

the number of common shares owned by the Purchaser and its affiliates will exceed 4.99% of the issued and outstanding shares of the Company.

The Company is required to use its best efforts

to file, as soon as practicable, a registration statement on the appropriate form providing for the resale by the Purchaser of the common

shares issuable upon exercise of the Warrants and conversion of the Note, including interest on the Note through the first anniversary

of the Closing Date. The Company is also required to use its best efforts to cause such registration statement to become effective and

to always maintain the effectiveness of such registration statement until the Purchaser no longer owns any Warrants or Notes or common

shares issuable upon exercise or conversion thereof.

The foregoing description of the SPA, Note, Warrants,

Pledge Agreement, Registration Rights Agreement, Security Agreement, and Guaranty is a summary and is qualified in its entirety by reference

to the full text of these documents filed as Exhibits 10.1, 10.2, 10.3, 10.4, 10.5, 10.6, 10.7, and 10.8, respectively, to this Current

Report on Form 6-K and incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of Section 12

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto

duly authorized.

| |

VISIONARY EDUCATION TECHNOLOGY HOLDINGS GROUP INC. |

| |

|

| |

|

|

| Date: September 26, 2022 |

By: |

/s/ Guiping Xu |

| |

|

Guiping Xu |

| |

|

Chief Executive Officer |

EXHIBIT INDEX

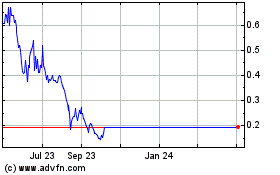

Visionary Education Tech... (NASDAQ:VEDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

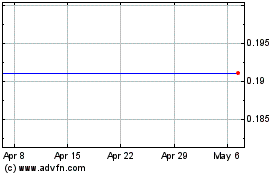

Visionary Education Tech... (NASDAQ:VEDU)

Historical Stock Chart

From Apr 2023 to Apr 2024