As filed with the Securities and Exchange Commission

on August 27, 2024

Registration No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TWIN

VEE POWERCATS CO.

(Exact name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

33-0505269 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

3101 S. U.S. Highway 1

Fort Pierce, Florida 34982

(772) 429-2525

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Joseph C. Visconti

Chief Executive Officer

Twin Vee PowerCats Co.

3101 S. U.S. Highway 1

Fort Pierce, Florida 34982

(772) 429-2525

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies

to: |

Leslie

Marlow, Esq.

Hank Gracin, Esq.

Patrick Egan, Esq.

Blank Rome LLP

1271 Avenue of the Americas

New

York, New York 10020

(212) 885-5000 |

Glenn

Sonoda, Esq.

General

Counsel

Forza X1, Inc.

3101 S. U.S. Highway 1

Fort Pierce, Florida 34982

(772) 429-2525 |

Approximate date of commencement of proposed sale

to the public: As soon as practicable after this Registration Statement becomes effective and the satisfaction or waiver of all other

conditions to the closing of the merger of Forza X1, Inc. and the Registrant as described in the Agreement and Plan of Merger dated as

of August [●], 2024.

If

the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance

with General Instruction G, check the following box. ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company, or emerging growth company. See

the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer |

☐ |

Accelerated

filer |

☐ |

Non-accelerated

filer ☒ |

|

Smaller reporting

company ☒ |

| |

|

|

|

|

|

Emerging growth company

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to us ethe extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7 (a)(2)(B) of the Securities Act. ☐

If applicable, place an X in the box to designate

the appropriate rule provision relied upon in conducting this transaction:

Exchange Act

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ☐

Exchange Act

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ☐

The registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in this Joint Proxy

Statement/Prospectus is not complete and may be changed. We may not issue these securities until the registration statement filed with

the Securities and Exchange Commission is effective. This Joint Proxy Statement/Prospectus is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST

27, 2024

JOINT PROXY STATEMENT/PROSPECTUS

YOUR VOTE IS VERY IMPORTANT

To the Stockholders of Twin Vee PowerCats Co. and Forza X1, Inc.:

Twin Vee PowerCats Co., a Delaware corporation (“Twin

Vee”), Twin Vee Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Twin Vee (“Merger Sub”), and

Forza X1, Inc., a Delaware corporation (“Forza”), have entered into a merger agreement dated August 12, 2024 (the “Merger

Agreement”), which transaction is referred to as the “Merger”, pursuant to which Forza will merge with and into Merger

Sub and become a wholly owned subsidiary of Twin Vee. Forza is a minority-owned subsidiary of Twin Vee. Twin Vee and Forza believe that

the Merger will enhance stockholder value for both Twin Vee and Forza stockholders by (i) providing a method by which the Twin Vee stockholders

can more directly share in the growth of Forza and (ii) generating substantial cost savings and bolstering business efficiencies, including

elimination of duplicate administrative functions. Before the Merger can be completed, the stockholders of Twin Vee and Forza must provide

various approvals. Twin Vee stockholders will vote to, among other things, approve the issuance of shares of its common stock, par value

$0.001 per share (the “Twin Vee Common Stock”) to the Forza stockholders as set forth in the Merger Agreement at an annual

meeting of Twin Vee stockholders to be held on _____, 2024. Forza stockholders will vote to approve and adopt the Merger Agreement and

the other transactions and matters described below at an annual meeting of Forza stockholders to be held on ______, 2024. Twin Vee, in

its capacity as a principal stockholder of Forza, has agreed to vote the shares of common stock, par value $0.001 per share, of Forza

(the “Forza Common Stock”) held by it for the approval and adoption of the Merger only if a majority of the other stockholders

of Forza present in person or by proxy at the Forza Annual Meeting vote to approve and adopt the Merger.

At the closing of the Merger, the holders of Forza Common Stock will receive

0.611666275 shares of Twin Vee Common Stock (the “Exchange Ratio”) in exchange for each share of Forza Common Stock that they

own on the effective date of the Merger for a maximum of 5,355,000 shares of Twin Vee Common Stock (no fractional shares of Twin Vee Common

Stock will be issued) and the 7,000,000 shares of Forza Common Stock held by Twin Vee will be cancelled. After the Merger, Twin Vee will

have 14,875,000 shares of Twin Vee Common Stock outstanding. The Exchange Ratio was negotiated so that the pre-closing stockholders of

each of Twin Vee and Forza would beneficially own approximately 64% and 36%, respectively of the outstanding shares of Twin Vee Common

Stock following the closing of the Merger and not counting for purposes of the computation any outstanding options to purchase shares

of Forza Common Stock or any outstanding warrants to purchase shares of Forza Common Stock. Accordingly, at the closing of the Merger:

(i) each outstanding share of Forza Common Stock (other than shares held by Twin Vee) will be converted into 0.611666275 of a share

of Twin Vee Common Stock, (ii) each outstanding stock option exercisable for shares of Forza Common Stock that is outstanding at

the effective time of the Merger (the “Effective Time”), whether vested or unvested, will be assumed by Twin Vee and converted

into a stock option to purchase the number of shares of Twin Vee Common Stock that the holder would have received if such holder had exercised

such stock option to purchase shares of Forza Common Stock prior to the Merger and exchanged such shares for shares of Twin Vee Common

Stock in accordance with the Exchange Ratio, (iii) each outstanding warrant to purchase shares of Forza Common Stock will be assumed by

Twin Vee and converted into a warrant to purchase the number of shares of Twin Vee Common Stock that the holder would have received if

such holder had exercised such warrant to purchase shares of Forza Common Stock prior to the Merger and exchanged such shares for shares

of Twin Vee Common Stock in accordance with the Exchange Ratio, and (iv) the 7,000,000 shares of Forza Common Stock held by Twin Vee will

be cancelled. For a more complete description of the Exchange Ratio, see the section titled “The Merger Agreement—Exchange

Ratio” in this Joint Proxy Statement/Prospectus.

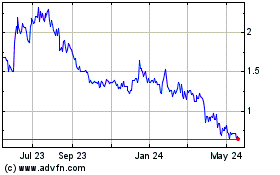

Twin Vee Common Stock is currently listed on the Nasdaq Capital Market

(the “Nasdaq”), under the symbol “VEEE.” Prior to the closing of the Merger, Twin Vee intends to file with Nasdaq

a notification form for the listing of additional shares with respect to the shares of Twin Vee Common Stock to be issued to the Forza

stockholders in the Merger so that these shares will be listed on the Nasdaq following the Merger. After the closing of the Merger, the

combined company is expected to trade on Nasdaq under the symbol “VEEE”. On August [●], 2024, the most recent practicable

trading day prior to the printing of this Joint Proxy Statement/Prospectus, the closing price of Twin Vee Common Stock was $[●]

per share. The market price of the Twin Vee Common Stock may fluctuate before the completion of the Merger, therefore, you are urged to

obtain current market quotations for Twin Vee Common Stock. Twin Vee expects to issue a maximum of 5,355,000 shares of Twin Vee Common

Stock in the Merger upon completion of the Merger. No fractional shares of Twin Vee Common Stock will be issued to any stockholder of

Forza upon completion of the Merger. The holder of shares of Forza Common Stock who would otherwise be entitled to a fraction of Twin

Vee Common Stock (after aggregating all fractional shares of Twin Vee Common Stock that otherwise would be received by such holder), will,

in lieu of such fraction of a share, be rounded down to the nearest whole share. We anticipate that the closing of the Merger will occur

not later than three business days following the affirmative vote of Twin Vee stockholders and Forza stockholders.

Forza Common Stock is currently listed on Nasdaq under

the symbol “FRZA.” On August [●], 2024, the most recent practicable trading day prior to the printing of this Joint

Proxy Statement/Prospectus, the closing price of Forza Common Stock was $[●] per share. The market price of the Forza Common Stock

may fluctuate before the completion of the Merger, therefore, you are urged to obtain current market quotations for Forza Common Stock.

If the Merger is completed, Forza Common Stock will be delisted from Nasdaq and there will no longer be a trading market for Forza Common

Stock as of such date. In addition, promptly following the closing of the Merger, Forza Common Stock will be deregistered under the Exchange

Act and Forza will no longer file periodic reports with the Securities and Exchange Commission (the “SEC”).

Twin Vee is asking stockholders of Twin Vee to

approve the issuance of the shares of Twin Vee Common Stock to the Forza stockholders as set forth in the Merger Agreement (the

“Stock Issuance Proposal”) at the annual meeting of Twin Vee stockholders to take place on_______, 2024 (the “Twin

Vee Annual Meeting”), at 10:00 a.m. Eastern Time, at the offices of Twin Vee, 3101 S. U.S. Highway 1, Fort Pierce, Florida. At

the Twin Vee Annual Meeting, Twin Vee stockholders will also be asked to vote on the Twin Vee director nominees, to ratify the

appointment of Grassi & Co., CPAs, P.C. as Twin Vee’s independent registered public accounting firm for its fiscal year

ending on December 31, 2024, to approve an amendment to Twin Vee’s Certificate of Incorporation, at the discretion of the

Board of Directors of Twin Vee (the “Twin Vee Board of Directors”), to effect a reverse stock split (the “Twin Vee

Reverse Stock Split”) with respect to the issued and outstanding shares of Twin Vee Common Stock (the “Twin Vee Reverse

Stock Split Proposal”), to approve an amendment to the Twin Vee PowerCats Co. Amended and Restated 2021 Stock Incentive Plan

(the “Twin Vee 2021 Plan”) to increase the number of shares of Twin Vee Common Stock available for issuance under the

Twin Vee 2021 Plan by 1,000,000 shares to 3,171,800 shares (the “Plan Increase Proposal”); and approval to adjourn the

meeting if necessary to continue to solicit votes in favor of the Stock Issuance Proposal, Plan Increase Proposal and/or the Twin

Vee Reverse Stock Split Proposal.

Forza is asking stockholders of Forza to adopt and

approve the Merger Agreement and the Merger (the “Merger Proposal”) at an annual meeting of Forza stockholders to take place

on _______, 2024 (the “Forza Annual Meeting”), at 10:30 a.m. Eastern Time, at the offices of Forza, 3101 S. U.S. Highway 1,

Fort Pierce, Florida 34982. At the Forza Annual Meeting, Forza stockholders will also be asked to vote on the Forza director nominees,

to ratify the appointment of Grassi & Co., CPAs, P.C. as Forza’s independent registered public accounting firm for its fiscal

year ending on December 31, 2024, to approve an amendment to Forza’s Amended and Restated Certificate of Incorporation, at the discretion

of the Board of Directors of Forza (the “Forza Board of Directors”), to effect a reverse stock split (the “Forza Reverse

Stock Split”) with respect to the issued and outstanding shares of Forza Common Stock (the “Forza Reverse Stock Split Proposal”),

and approval to adjourn the meeting if necessary to continue to solicit votes in favor of the Merger Proposal and/or the Forza Reverse

Stock Split Proposal. If the Merger is effected, all of the Forza board members, other than Joseph Visconti, will resign as members of

the Forza Board of Directors and the Forza Reverse Stock Split will be abandoned.

After careful consideration, the Twin Vee Board of Directors and Forza Board

of Directors have unanimously approved the Merger Agreement and the respective proposals referred to above, and each of the Twin Vee Board

of Directors and Forza Boards of Directors has determined that it is advisable to enter into the Merger. The Twin Vee Board of Directors

recommends that Twin Vee stockholders vote “FOR” the respective proposals described in the accompanying Joint Proxy

Statement/Prospectus. The Merger cannot be completed unless Twin Vee stockholders approve the issuance of the shares of Twin Vee Common

Stock to the Forza stockholders as set forth in the Merger Agreement (the “Stock Issuance Proposal”) and Forza stockholders

adopt and approve the Merger and the Merger Agreement (the “Merger Proposal”).

PLEASE GIVE ALL OF THE DETAILED INFORMATION ON

TWIN VEE, FORZA AND THE MERGER CONTAINED IN THE JOINT PROXY STATEMENT/PROSPECTUS YOUR CAREFUL ATTENTION, ESPECIALLY THE DISCUSSION IN

THE SECTION ENTITLED “RISK FACTORS” IN THIS JOINT PROXY STATEMENT/PROSPECTUS.

Neither the Securities and Exchange Commission

nor any state securities regulators has approved or disapproved the Twin Vee Common Stock to be issued under this Joint Proxy Statement/Prospectus

or passed upon the adequacy or accuracy of this Joint Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

This Joint Proxy Statement/Prospectus is not an

offer to sell Twin Vee Common Stock and Twin Vee is not soliciting an offer to buy Forza Common Stock in any state where the offer or

sale is not permitted.

On behalf of the Twin Vee Board of Directors and the

Forza Board of Directors, we thank you for your support.

| Joseph C.

Visconti |

Daniel Norton

|

| Chief Executive

Officer |

President |

| Twin Vee PowerCats Co. |

Forza X1, Inc. |

Joint Proxy Statement/Prospectus dated August [●],

2024 and to be mailed on or around August [●], 2024.

Please also see “Where You Can Find More Information”.

ADDITIONAL INFORMATION

Stockholders may also consult Twin Vee’s or

Forza’s websites for more information concerning the Merger described in this Joint Proxy Statement/Prospectus and each of the parties

thereto. Twin Vee’s website is www.twinvee.com and Forza’s website is www.forzax1.com. Information included on these websites

is not incorporated by reference into this Joint Proxy Statement/Prospectus.

This Joint Proxy Statement/Prospectus is dated August

[●], 2024 and is first being mailed to the stockholders of Forza and the stockholders of Twin Vee on or about August [●],

2024.

Twin Vee PowerCats Co.

3101 S. U.S. Highway 1

Fort Pierce, Florida 34982

(772) 429-2525

Forza X1, Inc..

3101 S. U.S. Highway 1

Fort Pierce, Florida 34982

(772) 429-2525

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS OF

TWIN VEE POWERCATS CO.

TO BE HELD ON _________, 2024

To the Stockholders of Twin Vee PowerCats Co. (“Twin

Vee”):

The annual meeting of stockholders of Twin Vee (the

“Twin Vee Annual Meeting”), a Delaware corporation, will be held on _________, 2024, at 10:00 a.m., Eastern Time, at the offices

Twin Vee, 3101 S. U.S. Highway 1, Fort Pierce, Florida 34982, for the following purposes:

1. To

consider and vote upon a proposal to approve the issuance of shares of Twin Vee Common Stock pursuant to the Agreement and Plan of Merger,

dated as of August 12, 2024, by and between Twin Vee, Twin Vee Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of

Twin Vee, and Forza X1, Inc. (the “Merger Agreement”), which transaction is referred to as the “Merger,” as described

in the attached Joint Proxy Statement/Prospectus, a copy of which is attached as Annex A to the Joint Proxy Statement/Prospectus

(the “Stock Issuance Proposal”);

2. To elect the two (2) nominees

for Class III director named in the accompanying Joint Proxy Statement/Prospectus to the Board of Directors of Twin Vee (the “Twin

Vee Board of Directors”), each to serve a three-year term expiring at the 2027 Annual Meeting of Stockholders and until such director’s

successor is duly elected and qualified (provided, however, that if the Merger is completed, the Twin Vee Board of Directors will be reconstituted

as provided in the Merger Agreement);

3. To ratify the appointment of

Grassi & Co., CPAs, P.C. as Twin Vee’s independent registered public accounting firm for its fiscal year ending on December

31, 2024;

4. To consider and vote upon a

proposal to approve an amendment to Twin Vee’s Certificate of Incorporation, in substantially the form attached to the accompanying

Joint Proxy Statement/Prospectus as Annex B, at the discretion of the Twin Vee Board of Directors of to effect a reverse stock

split with respect to the issued and outstanding shares of Twin Vee Common Stock, at a ratio of 1-for-2 to 1-for-20, with the ratio within

such range to be determined at the discretion of the Twin Vee Board of Directors and included in a public announcement, subject to the

authority of the Twin Vee Board of Directors to abandon such amendment (the “Twin Vee Reverse Stock Split Proposal”);

5. To consider and vote upon a proposal to approve an amendment to the Twin Vee

PowerCats Co. Amended and Restated 2021 Stock Incentive Plan (the “Twin Vee 2021 Plan”), in substantially the form attached

to the accompanying Joint Proxy Statement/Prospectus as Annex D, to increase the number of shares of Twin Vee Common Stock available

for issuance under the Twin Vee 2021 Plan by 1,000,000 shares to 3,171,800 shares (the “Plan Increase Proposal”);

6. To consider and vote upon a

proposal to adjourn the Twin Vee Annual Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not

sufficient votes in favor of the Stock Issuance Proposal, the Twin Vee Reverse Stock Split Proposal and/or the Plan Increase Proposal;

and

7. To transact such other business

as may properly come before the Twin Vee Annual Meeting or any adjournment or postponement thereof.

The Twin Vee Board of Directors has fixed August [●],

2024 as the record date (the “Twin Vee Record Date”) for the determination of stockholders entitled to notice of, and to vote

at, the Twin Vee Annual Meeting and any adjournment or postponement thereof. Only stockholders of record at the close of business on the

Twin Vee Record Date are entitled to notice of, and to vote at, the Twin Vee Annual Meeting. Only stockholders or their proxy holders

and Twin Vee guests may attend the meeting. A list of stockholders entitled to vote will be made available at the Twin Vee Annual Meeting

and will be available at the offices of Twin Vee, 3101 S. U.S. Highway 1, Fort Pierce, Florida 34982 for ten days before the meeting.

At the close of business on the Twin Vee Record Date, there were 9,520,000 shares of Twin Vee Common Stock outstanding and entitled to

vote.

| August [●], 2024 |

Joseph C. Visconti, Chief Executive Officer |

Your vote is important.

You are urged to attend the Twin Vee Annual Meeting

in person, but if you are unable to do so, the Twin Vee Board of Directors would appreciate you submitting a proxy to have your shares

votes as promptly as possible by using the internet or by returning by mail the enclosed proxy card, dated and signed.

Twin Vee PowerCats Co.

3101 S. U.S. Highway 1

Fort Pierce, Florida 34982

(772) 429-2525

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS OF

FORZA X1, INC.

TO BE HELD ON _________, 2024

To the Stockholders of Forza X1, Inc. (“Forza”):

The annual meeting of stockholders of Forza (the “Forza

Annual Meeting”), a Delaware corporation, will be held on _________, 2024, at 10:30 a.m., Eastern Time, at the offices of Forza,

3101 S. U.S. Highway 1, Fort Pierce, Florida 34982, for the following purposes:

1. To

consider and vote upon a proposal to adopt and approve the Agreement and Plan of Merger, dated as of August 12, 2024, by and between Twin

Vee PowerCats Co., Twin Vee Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Twin Vee, and Forza (the “Merger

Agreement”), which transaction is referred to as the “Merger,” as described in the attached Joint Proxy Statement/Prospectus,

a copy of which is attached as Annex A to the Joint Proxy Statement/Prospectus (the “Merger Proposal”)

2. To elect the one (1) nominee

for Class II director named in the accompanying Joint Proxy Statement/Prospectus to the Board of Directors of Forza (the “Forza

Board of Directors”), to serve a three-year term expiring at the 2027 Annual Meeting of Stockholders and until such director’s

successor is duly elected and qualified (provided, however, if the Merger is effected, all of the Forza board members, other than Joseph

Visconti, will resign as members of the Forza Board of Directors);

3. To ratify the appointment of

Grassi & Co., CPAs, P.C. as Forza’s independent registered public accounting firm for its fiscal year ending on December 31,

2024;

4. To consider and vote upon a

proposal to approve an amendment to Forza’s Amended and Restated Certificate of Incorporation, in substantially the form attached

to the accompanying proxy statement as Annex B-1, at the discretion of the Forza Board of Directors, to effect a reverse stock

split (the “Forza Reverse Stock Split”) with respect to the issued and outstanding shares of Forza Common Stock, including

stock held by Forza as treasury shares, at a ratio of 1-for-2 to 1-for-20, with the ratio within such range to be determined at the discretion

of the Forza Board of Directors and included in a public announcement, subject to the authority of the Forza Board of Directors to abandon

such amendment (the “Forza Reverse Stock Split Proposal”) (If the Merger is effected, the Forza Reverse Stock Split will be

abandoned);

5. To consider and vote upon an

adjournment of the meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor

of the Merger Proposal and/or the Forza Reverse Stock Split Proposal; and

6. To transact such other business

as may properly come before the meeting or any adjournment or postponement thereof.

The Forza Board of Directors has fixed August [●],

2024 as the record date (the “Forza Record Date”) for the determination of stockholders entitled to notice of, and to vote

at, the Forza Annual Meeting and any adjournment or postponement thereof. Only stockholders of record at the close of business on the

Forza Record Date are entitled to notice of, and to vote at, the Forza Annual Meeting. Only stockholders or their proxy holders and Forza

guests may attend the meeting. A list of stockholders entitled to vote will be made available at the Forza Annual Meeting and will be

available at the offices of Forza, 3101 S. U.S. Highway 1, Fort Pierce, Florida 34982, for ten days before the meeting. At the close of

business on the Forza Record Date, there were 15,754,774 shares of Forza Common Stock outstanding and entitled to vote.

| |

Joseph

Visconti, Interim Chief Executive Officer |

August

[●], 2024

|

|

Your vote is important.

You are urged to attend the Forza Annual Meeting

in person, but if you are unable to do so, the Forza Board of Directors would appreciate you submitting a proxy to have your shares votes

as promptly as possible by using the internet or the designated toll-free telephone number or by returning by mail the enclosed proxy

card, dated and signed.

Forza X1, Inc.

3101 S. U.S. Highway 1

Fort Pierce, Florida 34982

(772) 429-2525

ABOUT THIS JOINT PROXY

STATEMENT/PROSPECTUS

This Joint Proxy Statement/Prospectus,

which forms part of a registration statement on Form S-4 filed with the SEC by Twin Vee (File No. 333-[●]), constitutes a prospectus

of Twin Vee under Section 5 of the Securities Act of 1933, as amended (the “Securities Act”), with respect to the shares of

Twin Vee Common Stock to be issued pursuant to the Merger Agreement, as described in this Joint Proxy Statement/Prospectus. This document

also constitutes a notice of meeting and a proxy statement under Section 14(a) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), with respect to the Twin Vee Annual Meeting, at which Twin Vee stockholders will be asked to consider and

vote on, among other matters, a proposal to approve the issuance of shares of Twin Vee Common Stock pursuant to the Merger Agreement.

This document also serves as a notice of meeting and a proxy statement with respect to the Forza Annual Meeting, at which Forza stockholders

will be asked to consider and vote on, among other matters, a proposal to adopt the Merger and Merger Agreement.

No one has been authorized

to provide you with information that is different from that contained in, or incorporated by reference into, this Joint Proxy Statement/Prospectus.

This Joint Proxy Statement/Prospectus is dated August [●], 2024. The information contained in this Joint Proxy Statement/Prospectus

is accurate only as of that date or, in the case of information in a document incorporated by reference, as of the date of such document,

unless the information specifically indicates that another date applies.

This Joint Proxy Statement/Prospectus

does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, or the solicitation of a proxy, in any jurisdiction

in which or from any person to whom it is unlawful to make any such offer or solicitation in such jurisdiction.

The information concerning

Twin Vee contained in this Joint Proxy Statement/Prospectus has been provided by Twin Vee, and the information concerning Forza contained

in this Joint Proxy Statement/Prospectus has been provided by Forza.

TABLE OF CONTENTS

| Forum Selection |

|

143 |

| Anti-Takeover

Provisions |

|

144 |

| Limitations

on Liability and Indemnification of Twin Vee’s Officers and Directors |

|

145 |

| Dissenters’

Rights of Appraisal and Payment |

|

145 |

| Stockholders’

Derivative Actions |

|

146 |

| Transfer

Agent and Registrar |

|

146 |

| Trading

Symbol and Market |

|

146 |

| DESCRIPTION

OF FORZA CAPITAL STOCK |

|

147 |

DESCRIPTION OF SECURITIES REGISTERED PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED |

|

147 |

| General |

|

147 |

| Common

Stock |

|

147 |

| Forum

Selection |

|

147 |

| Anti-Takeover

Provisions |

|

148 |

| Limitations

on Liability and Indemnification of Forza’s Officers and Directors |

|

149 |

| Dissenters’

Rights of Appraisal and Payment |

|

149 |

| Stockholders’

Derivative Actions |

|

149 |

| Transfer

Agent and Registrar |

|

150 |

| Trading

Symbol and Market |

|

150 |

| COMPARISON

OF RIGHTS OF HOLDERS OF TWIN VEE COMMON STOCK AND FORZA X1, INC. COMMON STOCK |

|

150 |

| TWIN

VEE ANNUAL MEETING PROPOSALS |

|

161 |

| TWIN

VEE PROPOSAL NO. 1 - APPROVAL OF THE ISSUANCE OF SHARES OF TWIN VEE COMMON STOCK PURSUANT TO THE TERMS OF THE MERGER AGREEMENT |

|

161 |

| TWIN

VEE PROPOSAL NO. 2 - TWIN VEE ELECTION OF DIRECTORS PROPOSAL |

|

162 |

| TWIN

VEE PROPOSAL NO. 3 - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

163 |

| TWIN

VEE PROPOSAL NO. 4 - ADOPTION AND APPROVAL OF THE TWIN VEE REVERSE STOCK SPLIT PROPOSAL |

|

166 |

| TWIN

VEE PROPOSAL NO. 5 - AMENDMENT TO THE TWIN VEE POWERCATS CO. 2021 STOCK INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES AUTHORIZED

FOR ISSUANCE THEREUNDER BY 1,000,000 SHARES TO 3,171,800 SHARES |

|

177 |

| TWIN

VEE PROPOSAL NO. 6 - ADJOURNMENT OF THE TWIN VEE ANNUAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT

VOTES IN FAVOR OF TWIN VEE PROPOSAL NO. 3, TWIN VEE PROPOSAL NO. 4 AND/OR TWIN VEE PROPOSAL NO. 5 |

|

187 |

| FORZA

ANNUAL MEETING PROPOSALS |

|

188 |

| FORZA

PROPOSAL NO. 1 - APPROVAL OF THE MERGER AND THE MERGER AGREEMENT |

|

188 |

| FORZA

PROPOSAL NO. 2 - ELECTION OF DIRECTORS |

|

189 |

| FORZA

PROPOSAL NO. 3 - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

190 |

| FORZA

PROPOSAL NO. 4 - ADOPTION AND APPROVAL OF THE FORZA REVERSE STOCK SPLIT PROPOSAL |

|

193 |

| FORZA

PROPOSAL NO. 5 - ADJOURNMENT OF THE FORZA ANNUAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE INSUFFICIENT VOTES

IN FAVOR OF PROPOSAL NO. 3 AND/OR PROPOSAL NO. 4 |

|

204 |

| CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS |

|

205 |

| Twin

Vee |

|

205 |

| Indemnification |

|

206 |

| Twin

Vee’s Policy Regarding Related Party Transactions |

|

207 |

| Director

Independence |

|

207 |

| Forza |

|

207 |

| Indemnification |

|

208 |

| Assignment

of Assets Agreement; Assignment of Intellectual Property |

|

208 |

| Assignment

of Land Contract |

|

209 |

| Transition

Services Agreement |

|

209 |

| Forza’s

Policy Regarding Related Party Transactions |

|

209 |

| Director

Independence |

|

210 |

| CONFLICTS

OF INTEREST |

|

210 |

| HOUSEHOLDING

OF PROXY MATERIALS |

|

210 |

| OTHER

MATTERS |

|

210 |

| APPRAISAL

RIGHTS |

|

210 |

| FUTURE

TWIN VEE STOCKHOLDER PROPOSALS |

|

211 |

| FUTURE

FORZA STOCKHOLDER PROPOSALS |

|

211 |

| LEGAL

MATTERS |

|

212 |

| EXPERTS |

|

212 |

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE |

|

212 |

PROSPECTUS SUMMARY

This summary highlights

selected information from this Joint Proxy Statement/Prospectus and may not contain all of the information that is important to you. To

better understand the Merger, the proposals being considered at the Twin Vee Annual Meeting and the Forza Annual Meeting, you should read

this entire Joint Proxy Statement/Prospectus carefully, including the Merger Agreement and the other annexes to which you are referred

to herein. For more information, please see the section titled “Where You Can Find More Information.”

The Parties

Twin Vee PowerCats Co.

3101 S. US-1

Ft. Pierce, Florida 34982

Twin Vee is a designer, manufacturer

and marketer of recreational and commercial power boats. Twin Vee believes it has been an innovator in the recreational and commercial

power catamaran industry. Twin Vee currently has 13 gas-powered models in production ranging in size from its 20-foot mono hull, single

engine, center console to its newly designed 40-foot offshore 400 GFX catamaran, quad engines. While Twin Vee’s twin-hull catamaran

running surface, known as a symmetrical catamaran hull design, adds to the Twin Vee ride quality by reducing drag, increasing fuel efficiency,

and offering users a stable riding boat, its new mono hull line addresses the largest portion of the overall market.

Twin Vee has organized its business into three operating segments: (i) its gas-powered

boat segment which manufactures and distributes gas-powered boats under the Twin Vee and AquaSport names; (ii) its electric-powered boat

segment which is developing fully electric boats, through its publicly minority owned subsidiary, Forza; and (iii) its franchise segment

which is developing a franchise business model.

Twin Vee’s gas-powered boats allow consumers

to use them for a wide range of recreational activities including fishing, diving and water skiing and commercial activities including

transportation, eco tours, fishing and diving expeditions. Twin Vee believes that the performance, quality and value of its boats positions

it to achieve its goal of increasing Twin Vee’s market share and expanding the power catamaran boating market. Twin Vee currently

primarily sells its boats through a current network of 23 independent boat dealers in 37 locations across North America and the Caribbean

who resell Twin Vee’s boats to the end user Twin Vee and AquaSport customers. Twin Vee continues recruiting efforts for high quality

boat dealers and seek to establish new dealers and distributors domestically and internationally to distribute its boats as it grows its

production and introduce new models. Twin Vee’s gas-powered boats are currently outfitted with gas-powered outboard combustion engines.

During the first half of 2024, Twin Vee experienced

a significant reduction in demand for its products, as has been experienced throughout the boating industry. Total units sold in the quarter

were 32 compared to 54 in the first quarter of 2023, a 41% reduction, in line with the 41% reduction in revenue over the same period.

Twin Vee’s objectives have been to add new, larger boat models including a new line of GFX2 models, expand its dealers and distribution

network, and increase unit production to fulfill its customer and dealer orders. Twin Vee has also added its monohull line, shipping its

first model of the monohull, the 22-foot, in February of 2023. The combination of fewer but larger Twin Vee units combined with the new

monohull models resulted in a flat average selling price in the first quarter of 2024 compared to the prior year quarter.

Due to the growing demand for sustainable, environmentally

friendly electric and alternative fuel commercial and recreational vehicles, Forza, is designing and developing a line of electric-powered

boats. Forza’s electric boats are being designed as fully integrated electric boats including the hull, outboard motor and control

system. To date, Forza has built-out and tested multiple Forza company units, including: three offshore-style catamarans, two bay boat-style

catamarans, one deck boat and three 22-foot center console (F22) monohulls.

Twin Vee is a Delaware corporation headquartered

in Fort Pierce, Florida. Twin Vee Common Stock is traded on the Nasdaq Capital Market under the symbol “VEEE.”

For additional information

regarding Twin Vee, please refer to its Annual Report on Form 10-K for the year ended December 31, 2023 (the “Twin

Vee 2023 Annual Report”), as filed with the SEC and incorporated by reference into this Joint Proxy Statement/Prospectus, as well

as Twin Vee’s other filings with the SEC. For more information, please see the section titled “Where You Can Find More

Information.”

Forza X1, Inc.

3101 S. US-1

Ft. Pierce, Florida 34982

Forza was founded with a

mission to inspire the adoption of sustainable recreational boating by producing stylish electric sport boats designed

to offer a cleaner, quieter, and more efficient alternative to traditional gasoline-powered boats. Forza has been focused on the

creation, implementation and sale of electric boats utilizing its electric vehicle (“EV”) technology to control and power

its boats and proprietary outboard electric motor.

Forza has not completed the

development of its electric boats or electric outboard motor. Three different protypes of the electric boat have been built. Forza has

completed the design phase of its outboard motor and it is now in the prototype phase.

Approximately 44.4% of

the outstanding Forza Common Stock is owned by Twin Vee.

Industry Trends

The past year has seen a marked deceleration in the

global demand for recreational marine vehicles, influenced heavily by economic uncertainties and shifting consumer priorities. This slowdown

reflects broader trends affecting the recreational vehicle industries at large, including electric vehicles (EVs). Notably, the global

shift towards EV adoption has been much slower than initially anticipated. Several leading automotive manufacturers have adjusted their

strategies, accordingly, including halting the construction of dedicated EV factories.

The slower-than-expected adoption rates have led to

cautious consumer spending and investment in EV technology, directly impacting the electric boat market. Specifically, the electric boat

segment has experienced even more sluggish growth than the automotive sector. In addition, while Forza’s electric boats are still

in the development stage, many of the larger players in the boat industry, such as Mercury Marine, have completed their development efforts

and have brought their electric outboard motors to market.

Despite these challenges, Twin Vee and Forza have

managed to sustain operations through strategic adjustments, including cost management and a focus on strategic partnerships. Twin Vee

and Forza have each implemented measures that have reduced cash burn and conserved cash reserves while seeking to leverage its technological

advancements through strategic collaborations and partnerships to enhance shareholder value. Twin Vee and Forza have responded to the

industry challenges by tightening its financial reins to mitigate the impacts of reduced demand with a view toward long-term sustainability.

Forza is enacting the following key measures:

| |

1. |

Capital

Expenditure Reduction: With the exception of Forza’s new facility, capital expenditures have been significantly curtailed,

focusing only on essential maintenance and strategically critical projects. Non-essential development has been postponed or re-evaluated

based on stringent ROI analyses. |

| |

2. |

Workforce

Optimization: Although a difficult decision, Forza has optimized Forza’s workforce to align with current production needs and

financial realities. This includes a temporary freeze on hiring and, regrettably, reductions in areas where the workload has decreased.

These measures are designed to preserve as many jobs as possible while maintaining financial viability. |

| |

3. |

Expense

Management: Forza is scrutinizing all expenses, from administrative to marketing, ensuring that only those that are essential and

offer clear value are maintained or increased. This has also involved renegotiating contracts and seeking better terms from suppliers

to reduce costs without compromising quality. |

Twin Vee Merger Sub, Inc.

3101 S. US-1

Ft. Pierce, Florida 34982

Twin Vee Merger Sub, Inc., a Delaware corporation

(“Merger Sub”), is a wholly owned subsidiary of Twin Vee and was formed on August 12, 2024 solely for the purposes of carrying

out the Merger.

Overview of the Merger Agreement and Agreements

Related to the Merger Agreement

The Merger Agreement

If the Merger is consummated,

Merger Sub will merge with and into Forza with Forza surviving the Merger as a wholly owned subsidiary of the combined company. A copy

of the Merger Agreement is attached as Annex A to this Joint Proxy Statement/Prospectus and is incorporated herein by reference.

Twin Vee and Forza encourage you to read the entire merger agreement carefully because it is the principal document governing the merger.

We currently expect that the Merger will be completed during the fourth quarter of 2024. However, we cannot predict the actual timing

of the completion of the Merger.

Merger Consideration

Subject to the terms and conditions of the Merger Agreement, if the Merger is completed,

at the Effective Time (i) each outstanding share of Forza Common Stock (other than shares held by Twin Vee) will be converted into

the right to receive 0.611666275 shares of Twin Vee Common Stock (the “Exchange Ratio”), (ii) each outstanding stock

option exercisable for shares of Forza Common Stock that is outstanding at the Effective Time, whether vested or unvested, will be assumed

by Twin Vee and converted into a stock option to purchase the number of shares of Twin Vee Common Stock that the holder would have received

if such holder had exercised such stock option for shares of Forza Common Stock prior to the Merger and exchanged such shares for Twin

Vee Common Stock in accordance with the Exchange Ratio, (iii) each outstanding warrant to purchase shares of Forza Common Stock will be

assumed by Twin Vee and converted into a warrant to purchase the number of shares of Twin Vee Common Stock that the holder would have

received if such holder had exercised such warrant for shares of Forza Common Stock prior to the Merger and exchanged such shares for

Twin Vee Common Stock in accordance with the Exchange Ratio, subject to adjustment for any reverse stock split, and (iv) the 7,000,000

shares of Forza Common Stock held by Twin Vee will be cancelled.

Under the Exchange Ratio formula in the Merger Agreement, as of immediately after

the Merger as provided for in the Merger Agreement, the pre-closing Forza stockholders (other than Twin Vee) are expected to own approximately

36% of the Post-Closing Shares, and the stockholders of Twin Vee as of immediately prior to the Merger are expected to own approximately

64% of the aggregate number of Post-Closing Shares, as defined below. The 7,000,000 shares of Forza Common Stock held by Twin Vee will

be cancelled. The Exchange Ratio formula in the Merger Agreement was negotiated so that the pre-closing stockholders of each

of Twin Vee and Forza (excluding Twin Vee as a Forza stockholder) would beneficially own approximately 64% and 36% of the aggregate number

of shares of common stock of the combined company outstanding immediately following the Effective Time (the “Post-Closing Shares”),

subject to (i) not counting for purposes of the computation any outstanding options to purchase shares of Twin Vee Common Stock or

any outstanding options to purchase shares of Forza Common Stock or (ii) any warrants to purchase Twin Vee Common Stock or any warrants

to purchase Forza Common Stock. Accordingly, any outstanding options or warrants to purchase shares of Twin Vee Common Stock and Forza

Common Stock were not reflected in the computation of the Exchange Ratio. On a fully diluted basis, taking into all outstanding warrants

and options the pre-closing Forza stockholders are expected to own approximately 34.3% of the outstanding securities of Twin Vee after

the Merger, and the stockholders of Twin Vee are expected to own approximately 65.3% of the aggregate number of the outstanding securities

of Twin Vee after the Merger. The Exchange Ratio has been fixed. For a more complete description of the Exchange Ratio, see the section

titled “The Merger Agreement—Exchange Ratio” in this Joint Proxy Statement/Prospectus.

The Merger Agreement does

not include a price-based termination right, and there will be no adjustment to the total number of shares of Twin Vee Common Stock that

Forza securityholders will be entitled to receive for changes in the market price of Twin Vee Common Stock or Forza Common Stock. Accordingly,

the market value of the shares of Twin Vee Common Stock issued pursuant to the Merger Agreement will depend on the market value of the

shares of Twin Vee Common Stock at the time the Merger closes and could vary significantly from the market value on the date of this Joint

Proxy Statement/Prospectus. On [●], 2024, the last trading day before the date of this Joint Proxy Statement/Prospectus, the closing

sale price of Twin Vee Common Stock was $[●] per share and the closing price of Forza Common Stock was $[●] per share.

Treatment of Twin Vee Stock Options

All options to purchase shares

of Twin Vee Common Stock will remain outstanding immediately after the Effective Time in accordance with their terms. The number of shares

of Twin Vee Common Stock underlying such options and the exercise prices for such options will be appropriately adjusted to reflect the

Twin Vee Reverse Stock Split, assuming the approval of the Twin Vee Reverse Stock Split Proposal by Twin Vee’s stockholders at the

Twin Vee Annual Meeting and if thereafter consummated at the discretion of Twin Vee Board of Directors. The terms governing options to

purchase shares of Twin Vee Common Stock will remain in full force and effect following the closing of the Merger.

Treatment of Forza Stock Options

At the Effective Time, each option

to purchase shares of Forza Common Stock that are outstanding and unexercised immediately prior to the Effective Time, whether or not

vested, issued under the Forza 2022 Plan shall be assumed by Twin Vee and converted into an option to purchase shares of Twin Vee Common

Stock. Twin Vee will assume the Forza 2022 Plan and each such option in accordance with the terms of the Forza 2022 Plan and the terms

of the stock option agreement by which such option is evidenced. From and after the Effective Time, each option to purchase shares of

Forza Common Stock assumed by Twin Vee may be exercised for such number of shares of Twin Vee Common Stock as is determined by multiplying

the number of shares of Forza Common Stock that were subject to such option by the Exchange Ratio, and rounding the resulting number down

to the nearest whole number of shares of Twin Vee Common Stock. The per share exercise price of the converted option to purchase shares

of Twin Vee Common Stock will be determined by dividing the existing per share exercise price of the option to purchase shares of Forza

Common Stock by the Exchange Ratio, and rounding to the resulting exercise price up to the nearest whole cent. Any restrictions on the

exercise of any option to purchase shares of Forza Common Stock assumed by Twin Vee will continue following the conversion, and the term,

exercisability, vesting schedule and other provisions of such option will generally remain unchanged; provided, that any options to purchase

shares of Forza Common Stock assumed by Twin Vee may be subject to adjustment to reflect changes in Twin Vee’s capitalization after

the Effective Time and that the Twin Vee Board of Directors or a committee thereof will succeed to the authority and responsibility of

the Forza Board of Directors or a committee thereof with respect to each assumed option to purchase shares of Forza Common Stock.

Treatment of Twin Vee Warrants

All warrants to purchase

shares of Twin Vee Common Swill remain outstanding and unexercised immediately after the Effective Time in accordance with their terms.

The number of shares of Twin Vee Common Stock underlying such warrants and the exercise prices for such warrants will be appropriately

adjusted to reflect the Twin Vee Reverse Stock Split, assuming the approval of the Twin Vee Reverse Stock Split Proposal by Twin Vee’s

stockholders at the Twin Vee Annual Meeting and if thereafter consummated at the discretion of Twin Vee Board of Directors. The terms

governing warrants to purchase shares of Twin Vee Common Stock will remain in full force and effect following the closing of the Merger.

Treatment of Forza

Warrants

At the Effective Time, each warrant

to purchase shares of Forza Common Stock that is outstanding and unexercised immediately prior to the Effective Time, shall be assumed

by Twin Vee and converted into a warrant to purchase shares of Twin Vee Common Stock. Twin Vee will assume the warrants in accordance

with the terms of the warrant agreement by which such warrant is evidenced. From and after the Effective Time, each warrant to purchase

shares of Forza Common Stock assumed by Twin Vee may be exercised for such number of shares of Twin Vee Common Stock as is determined

by multiplying the number of shares of Forza Common Stock that were subject to such warrant by the Exchange Ratio, and rounding the resulting

number down to the nearest whole number of shares of Twin Vee Common Stock. The per share exercise price of the converted warrant will

be determined by dividing the existing per share exercise price of the warrant to purchase shares of Forza Common Stock by the Exchange

Ratio, and rounding to the resulting exercise price up to the nearest whole cent. Any restrictions on the exercise of any warrant to purchase

shares of Forza Common stock assumed by Twin Vee will continue following the conversion, and the term, exercisability, and other provisions

of such warrant will generally remain unchanged.

The closing of the Merger

will occur no later than the second business day after the last of the conditions to the Merger has been satisfied or waived, or at another

time as Twin Vee and Forza agree. Twin Vee and Forza anticipate that the closing of the Merger will occur promptly after the Twin Vee

Annual Meeting and Forza Annual Meeting. However, because the Merger is subject to a number of conditions, neither Twin Vee nor Forza

can predict exactly when the closing will occur or if it will occur at all.

Risks Relating to the Merger

In evaluating the adoption of the Merger Agreement

or the issuance of shares of Twin Vee Common Stock in the Merger, you should carefully read this Joint Proxy Statement/Prospectus and

especially consider the factors discussed in the section titled “Risk Factors,” for a description of risks relating to the

Merger, the combined company’s businesses, and Twin Vee Common Stock.

Both Twin Vee and Forza are

subject to various risks associated with their businesses and their industries. In addition, the Merger, including the possibility that

the Merger may not be completed, poses a number of risks to each company and its respective stockholders, including the following risks:

| |

● |

All

of Forza’s executive officers and all but one of its directors serve on both the Twin Vee Board of Directors and Forza Board of

Directors and therefore have conflicts of interest that may influence them to support or approve the Merger without regard to your interests.

In addition, the one director who does not sit on both the Twin Vee Board of Directors and Forza Board of Directors is expected to serve

as a director of the combined company and therefore may also have a conflict of interest. |

| |

● |

The Exchange

Ratio is not adjustable based on the market price of Twin Vee Common Stock or the Forza Common Stock so the Merger consideration at the

closing may have a greater or lesser value than it had at the time the Merger Agreement was signed. |

| |

● |

The combined

company’s stock price is expected to be volatile, and the market price of its common stock may drop following the Merger. |

| |

● |

The market

price of the combined company’s common stock may decline as a result of the Merger. |

| |

● |

The combined

company may not experience the anticipated strategic benefits of the Merger. |

| |

● |

If the

conditions to the Merger are not met, the Merger will not occur. |

| |

● |

Twin

Vee and Forza will incur substantial expenses related to this transaction whether or not the Merger is completed. |

| |

● |

Twin

Vee will assume all of Forza’s outstanding liabilities if the Merger is completed. |

| |

● |

The pro

forma financial statements are presented for illustrative purposes only and may not be an indication of the combined company’s

financial condition or results of operations following the Merger. |

| |

● |

Although

Houlihan’s opinion was given to Twin Vee’s Board of Directors on August 6, 2024, it does not reflect any changes in market

and economic circumstances after August 6, 2024. |

| |

● |

Although

InteleK’s opinion was given to Forza’s Board of Directors on August 9, 2024, it does not reflect any changes in market and

economic circumstances after August 9, 2024. |

| |

● |

The issuance

of the Merger consideration is subject to approval by the stockholders of Twin Vee and the Merger and Merger Agreement are subject to

approval by the Forza stockholders, including a majority of the stockholders excluding Twin Vee. |

| |

● |

Twin

Vee’s business and stock price may be adversely affected if the acquisition of Forza is not completed. |

These risks and other risks are discussed in greater

detail under the section titled “Risk Factors” and in the documents incorporated by reference in this Joint Proxy Statement/Prospectus.

Twin Vee and Forza both encourage you to read and consider all of these risks carefully.

Reasons for the Merger

Twin Vee and Forza are proposing

the Merger because, among other things, it is believed that the Merger will enhance stockholder value for both Twin Vee and Forza stockholders

(i) by providing a method by which the Twin Vee stockholders can more directly share in the growth of Forza and (ii) due to the cost savings

expected to be realized. For a discussion of Twin Vee’s reasons for the Merger, please see the sections entitled “The Merger

Transaction—Recommendation of the Twin Vee Board of Directors and its Reasons for the Merger” and “The Merger

Transaction—Recommendation of the Forza Board of Directors and its Reasons for the Merger”.

Twin Vee Reasons for the Merger

In reaching its unanimous

decision to approve the Merger Agreement and the transactions contemplated thereby, the Twin Vee Board of Directors considered a

number of factors, including, among others, the following:

| ● |

the

belief that the combination of the businesses of Twin Vee and Forza would create more value for Twin Vee stockholders in the long term

due to cost reductions of a combined company than as separate companies |

| |

|

| ● |

the potential

cost savings synergies derived from the Merger, including the reduced fees resulting from Forza no longer being a stand-alone public

company which reduction is estimated to be approximately $700,000 and includes reduced legal and accounting fees and proxy

solicitation fees as well as the reduced Nasdaq listing fees; |

| |

● |

the

historical and current information concerning Twin Vee’s and Forza’s business,

financial performance, financial condition, including Twin Vee’s and Forza’s

cash position, operations, management and competitive position, the prospects of Twin Vee

and Forza separately and combined, and the nature of the boating industry generally, including

financial projections of Twin Vee and Forza under various scenarios and their short-and long-term

strategic objectives;

|

| |

● |

the

opinion of Twin Vee’s financial advisor, dated August 6, 2024, to the special committee of

the Twin Vee Board of Directors (the “Twin Vee Special Committee”) that, as of such date

and based on and subject to the assumptions, limitations, qualifications and other matters set forth

in the opinion, the exchange ratio of 0.611666275 shares of Twin Vee Common Stock to be issued in

exchange for each share of Forza Common Stock pursuant to the Merger Agreement was fair to Twin Vee

stockholders from a financial point of view;

|

| |

● |

current

financial market conditions and historical market prices, volatility and trading information with respect to Forza Common Stock and

Twin Vee Common Stock; |

| |

|

|

| |

● |

that

the Merger would provide existing Twin Vee stockholders a significant opportunity to directly participate in the potential growth

of the combined company following the Merger; |

| |

|

|

| |

● |

the

terms and conditions of the Merger Agreement and associated transactions, including the relative percentage ownership of Twin Vee

securityholders and Forza securityholders immediately following the closing of the Merger, the reasonableness of the fees and

expenses related to the Merger and the likelihood that the Merger will be completed; |

| |

|

|

| |

● |

the

fact that the Exchange Ratio, as defined in the Merger Agreement, is fixed and will not fluctuate based upon changes in the stock

prices of Twin Vee or Forza prior to the completion of the Merger; and |

| |

|

|

| |

● |

the

belief that the terms and conditions of the Merger Agreement, including the parties’ mutual representations and warranties,

covenants, deal protection provisions and closing conditions, are reasonable for a transaction of this nature. |

The Twin Vee Board of Directors considered the potential

risks of the Merger, including, but not limited to, the following:

| |

● |

the

risks, challenges and costs inherent in combining the two companies and the expenses to be incurred in connection with the Merger,

including the possibility that delays or difficulties in completing the integration could adversely affect the combined company’s

operating results and preclude the achievement of some benefits anticipated from the Merger; |

| |

● |

the

possible volatility, at least in the short term, of the trading price of Twin Vee Common Stock resulting from the Merger announcement; |

| |

● |

the

risk of diverting management’s attention from other strategic priorities to implement Merger integration efforts; |

| |

● |

the

risk that the Merger might not be consummated in a timely manner, or that the Merger might not be consummated at all; |

| |

● |

the

fact that certain of the directors and executive officers of Twin Vee may have conflicts of interest in connection with the Merger,

as they may receive certain benefits that are different from, and in addition to, those of the other stockholders of Twin Vee; |

| |

● |

that,

while the Merger is expected to be completed, there can be no assurance that all conditions to the parties’

obligations to complete the Merger will be satisfied, and as a result, it is possible that the Merger may

not be completed, even if the issuance of the Merger consideration is approved by the stockholders of Twin

Vee;

|

| |

|

|

| |

● |

the

risk to Twin Vee’s business, operations and financial results in the event that the Merger is not consummated; and |

| |

● |

various

other applicable risks associated with the combined company and the Merger, including those described in the

section of this Joint Proxy Statement/Prospectus entitled “Risk Factors”.

|

Forza Reasons for the

Merger

In reaching its unanimous

decision to approve the Merger Agreement and the transactions contemplated thereby, the Forza Board of Directors considered a number

of factors, including, among others, the following:

| |

● |

the strategic rationale for the Merger and the potential benefits of the contemplated transaction; |

| |

● |

that the Merger was superior to the strategic alternatives available to Forza, including continuing as a stand-alone company or attempting to sell Forza to a third-party acquirer, or liquidating, each of which the Forza Board of Directors viewed as less favorable to Forza stockholders than the Merger; |

| |

|

|

| |

● |

the potential business, operational and financial synergies that may be realized over time by the combined company following the Merger; |

| |

|

|

| |

● |

the lack of a viable market for Forza’s designed product for the foreseeable future; |

| |

|

|

| |

● |

the opinion of Forza’s financial advisor, dated August 7, 2024, to the special committee of the Forza Board of Directors (the “Forza Special Committee”) that, as of such date and based on and subject to the assumptions, limitations, qualifications and other matters set forth in the opinion, the exchange ratio of 0.611666275 shares of Twin Vee Common Stock to be issued in exchange for each share of Forza Common Stock pursuant to the Merger Agreement was fair to Forza stockholders from a financial point of view; |

| |

|

|

| |

● |

current and historical information concerning Forza’s and Twin Vee’s respective businesses, business plans, operations, management, financial performance and conditions, technology, operations, prospects and competitive position, before and after giving effect to the merger and the merger’s potential effect on stockholder value; |

| |

● |

its knowledge of the business, operations, financial condition and earnings of Twin Vee; |

| |

|

|

| |

● |

the ability to be a stockholder of a company generating revenue, given that Forza, to date, has not yet generated revenue from the sale of its boats; |

| |

● |

the likelihood that the Merger will be completed; |

| |

● |

current financial market conditions and historical market prices, volatility and trading information with respect to Forza Common Stock and Twin Vee Common Stock; |

| |

● |

the terms of the Merger Agreement, including the parties’ representations, warranties and covenants, and the conditions to their respective obligations; |

| |

|

|

| |

● |

the consideration to be received by Forza stockholders in the Merger, including the form of such consideration, which enables Forza’s stockholders to continue to have a substantial equity interest in the combined company following the Merger, as well as the fact that the shares of Twin Vee Common Stock to be received by Forza’s stockholders are intended to be received in a tax-free exchange; and |

| |

|

|

| |

● |

that the Merger should qualify as a reorganization within the meaning of Section 368(a) of the Code and that Forza’s stockholders generally should not recognize gain or loss for U.S. federal income tax purposes upon the exchange of their shares of Forza Common Stock for shares of Twin Vee Common Stock in connection with the Merger. |

The Forza Board of Directors considered the potential

risks of the Merger, including, but not limited to, the following:

| |

● |

the possibility that the Merger might not be completed whether as a result of the failure to satisfy conditions to the closing of the Merger, including the failure to secure the required approvals from Forza and Twin Vee stockholders, or as a result of the termination of the merger agreement by Forza or Twin Vee in certain specified circumstances and the potential effects of the public announcement and pendency of the Merger on management attention; |

| |

|

|

| |

● |

the effect of a public announcement of the transactions on Forza’s operations, stock price and employees, the potential disruption to Forza and Twin Vee and their businesses as a result of the announcement and pendency of the Merger and the potential adverse effects on the financial results of Forza and Twin Vee as a result of that disruption and the continued operations of the core business of Forza and Twin Vee during the period between the signing of the Merger Agreement and the completion of the Merger; |

| |

● |

the fact that the executive officers and all but one of Forza’s directors may have interests in the Merger that are different from, or in addition to, those of Forza’s other stockholders, including the matters described under the section entitled “Chapter One—The Merger—The Merger Transaction—Interests of Forza Directors and Executive Officers in the Merger”, and the risk that these different interests might influence their decisions with respect to the Merger; |

| |

● |

that, while the Merger is expected to be completed, there can be no assurance that all conditions to the parties’ obligations to complete the Merger will be satisfied, and as a result, it is possible that the Merger may not be completed, even if the issuance of the shares of Twin Vee Common Stock to Forza stockholders pursuant to the Merger Agreement is approved by the stockholders of Twin Vee; |

| |

● |

the risk of not realizing all of the anticipated strategic benefits between Forza and Twin Vee and the risk that other anticipated benefits might not be realized;

|

| |

|

|

| |

● |

the risk that the Merger may not be consummated in a timely manner or that the Merger may not be consummated at all, including the impact on Forza’s ability to effect the Forza Reverse Stock split if necessary in time to maintain compliance with the Nasdaq continued listing requirements; |

| |

|

|

| |

● |

Forza’s inability to solicit competing acquisition proposals; |

| |

● |

the substantial costs to be incurred in connection with the Merger, including the costs of integrating the operations of Forza and Twin Vee and the transaction expenses arising from the Merger; and various other applicable risks associated with the combined company and the Merger, including the risks described in the section titled “Risk Factors;” and |

| |

|

|

| |

● |

the other risks of the type and nature described under “Risk Factors” of this Joint Proxy Statement/Prospectus |

For more information on the Twin Vee Board of Directors’

reasons for the transaction, see the section titled “The Merger Transaction— Recommendation of the Twin Vee Board of Directors

and its Reasons for the Merger.”

For more information on the Forza Board of Directors’

reasons for the transaction, see the section titled “The Merger Transaction—Recommendation of the Forza Board of Directors

and its Reasons for the Merger.”

Opinion of the Financial Advisor to the

Twin Vee Board of Directors

The Twin Vee Board of Directors

engaged Houlihan Capital, LLC (“Houlihan”) to provide financial advisory and investment banking services in connection with

the Twin Vee Board of Directors’ consideration and evaluation of certain potential strategic alternatives. On August 6, 2024, Houlihan

delivered its oral opinion to the Twin Vee Board of Directors, which opinion was confirmed in writing on the same date, that, as of the

date of such opinion, and based upon and subject to the assumptions made, procedures followed, matters considered, limitations of the

review undertaken, qualifications contained and other matters set forth in its written opinion, as of July 31, 2024, the Exchange Ratio

to be paid by Twin Vee in the Merger pursuant to the Merger Agreement was fair, from a financial point of view, to Twin Vee’s stockholders.

The full text of Houlihan’s

written opinion, which sets forth the assumptions made, procedures followed, matters considered, limitations of the review undertaken,

qualifications contained and other matters set forth therein, is attached as Annex C-1 to this joint proxy statement/prospectus

and is incorporated herein by reference. Twin Vee urges you to carefully read the Houlihan opinion, together with the description of such

opinion included elsewhere in this Joint Proxy Statement/Prospectus, in its entirety, under the heading ”The Merger Transaction—Opinion

of the Financial Advisor to the Twin Vee Board of Directors” starting on page 47] of this Joint Proxy Statement/Prospectus.

Houlihan provided its opinion to the Twin Vee Board of Directors (in their capacity as such) for its information and assistance in connection

with its consideration of the financial terms of the Merger and it may not be used for any other purpose. Houlihan’s opinion addressed

solely the fairness, from a financial point of view, of the Exchange Ratio to be paid by Twin Vee in the Merger pursuant to the Merger

Agreement, to Forza’s stockholders. Houlihan’s opinion does not compare the relative merits of the Merger with any other alternative

transactions or business strategies which may have been available to Twin Vee and does not address the underlying business decision of

the Twin Vee Board of Directors or Twin Vee to proceed with or effect the Merger. Houlihan’s opinion does not constitute a recommendation

to the Twin Vee Board of Directors as to how the Twin Vee Board of Directors should vote on the issuance of the Twin Vee Common Stock

to Forza stockholders pursuant to the Merger Agreement or to any stockholder of Twin Vee or Forza as to how any such stockholder should

vote at any stockholders’ meeting at which the any of the transactions contemplated by the Merger Agreement, or the Merger Agreement

itself, is considered, or whether or not any stockholder of Twin Vee or Forza should enter into a voting, shareholders’, or affiliates’

agreement with respect to the Merger, or take any other actions in connection with the Merger or otherwise. For a more complete discussion

of Houlihan’s opinion, see the section titled “The Merger Transaction—Opinion of the Financial Advisor to the Twin

Vee Board of Directors.”

Opinion of the Financial

Advisor to the Forza Board of Directors

Forza

engaged InteleK Business Valuations & Advisory (“InteleK”), to provide financial advisory and investment banking services

in connection with the Forza Special Committee’s and Forza Board of Directors’ consideration and evaluation of certain potential

strategic alternatives. On August 9, 2024, InteleK delivered its oral opinion to the Forza Board of Directors, which opinion was confirmed

in writing on the same date, that, as of the date of such opinion, and based upon and subject to the assumptions made, procedures followed,

matters considered, limitations of the review undertaken, qualifications contained and other matters set forth in its written opinion,

as of August 7, 2024, the Exchange Ratio to be paid by Twin Vee in the Merger pursuant to the Merger Agreement was fair, from a financial

point of view, to Forza’s stockholders.

The full text of InteleK’s written opinion, which sets forth the assumptions

made, procedures followed, matters considered, limitations of the review undertaken, qualifications contained and other matters set forth

therein, is attached as Annex C-2 to this Joint Proxy Statement/Prospectus and is incorporated herein by reference.

Forza urges you to carefully read the InteleK opinion, together with the description of such opinion included elsewhere in this joint

proxy statement/prospectus, in its entirety, under the heading ”The Merger Transaction—Opinion of the Financial Advisor

to the Forza Board of Directors” starting on page 52 of this Joint Proxy Statement/Prospectus. InteleK provided its opinion

to the Forza Board of Directors (in their capacity as such) for its information and assistance in connection with its consideration of

the financial terms of the Merger and it may not be used for any other purpose. InteleK’s opinion addressed solely the fairness,

from a financial point of view, of the Exchange Ratio to be paid by Twin Vee in the Merger pursuant to the Merger Agreement, to Forza.

InteleK’s opinion does not compare the relative merits of the Merger with any other alternative transactions or business strategies

which may have been available to Forza and does not address the underlying business decision of the Forza Special Committee, the Forza

Board of Directors or Forza to proceed with or effect the Merger. InteleK’s opinion does not constitute a recommendation to the

Forza Board of Directors as to how the Forza Board of Directors should vote on the Merger or to any stockholder of Twin Vee or Forza as

to how any such stockholder should vote at any stockholders’ meeting at which the Merger is considered. For a more complete discussion

of InteleK’s opinion, see the section titled “The Merger Transaction—Opinion of the Financial Advisor to the Forza

Board of Directors.”

Conditions to the Closing of the Merger

Twin Vee and Forza are required to complete the Merger

only if certain customary conditions are satisfied or waived, including, but not limited to:

|

● |

approval

of the Merger and the Merger Agreement by stockholders holding a majority of the outstanding shares of Forza Common Stock at the

Forza Annual Meeting (which approval shall include a majority of the shares present in person or by proxy at the Forza Annual Meeting

excluding shares held by Twin Vee); |

| |

● |

approval

of the issuance by Twin Vee of the shares of common stock pursuant to the Merger Agreement to the Forza stockholders by stockholders

holding a majority of the shares present in person or by proxy at the Twin Vee Annual Meeting; |

| |

● |

no

court, administrative agency, commission, governmental or regulatory authority, has enacted, enforced or entered

any statute, rule, regulation, or other order which is in effect and which has the effect of making the Merger

illegal or otherwise prohibiting the consummation of the Merger;

|

| |

|

|

| |

● |

the

registration statement on Form S-4, of which this Joint Proxy Statement/Prospectus is a part, must have been declared effective by

the SEC in accordance with the Securities Act and must not be subject to any stop order suspending the effectiveness of the registration

statement on Form S-4 and no similar proceeding in respect to the Joint Proxy Statement/Prospectus will have been initiated or threatened