Verb Technology Company, Inc. (Nasdaq:

VERB)

("VERB" or the "Company"), the company behind MARKET.live, the

innovative multi-vendor, multi-presenter livestream social shopping

platform, announces that the Company closed a $3 million preferred

stock financing. The preferred stock is non-convertible into the

Company’s common shares and as such is non-dilutive to current

stockholders.

“I am pleased to announce that we have successfully closed a $3

million financing, uniquely structured and extremely advantageous

to the Company and its shareholders,” states Rory J. Cutaia, VERB

CEO. “This financing positions the Company extremely well to

execute our growth strategies as we begin 2024 and represents a

meaningful enhancement to shareholder equity as will be reflected

on our year-end balance sheet.”

On December 29, 2023, the Company entered into a securities

purchase agreement (the “Securities Purchase Agreement”) with an

existing family office investor pursuant to which the Company sold

and the investor purchased 3,000 shares of the Company’s newly

designated non-convertible Series C Preferred Stock (the “Preferred

Shares”) for a total purchase price of $3,000,000. The Preferred

Shares have a 10% stated annual dividend, no voting rights, and a

face value of $1,300 per share. The sale of the Preferred Shares

was consummated on December 29, 2023.

The Company intends to use the proceeds to drive its

MARKET.live, livestream social shopping platform and for general

corporate purposes. The Securities Purchase Agreement contains

customary representations and warranties from the Company and the

investor.

The sale of the Series C Preferred Stock pursuant to the

Securities Purchase Agreement has not been registered under the

Securities Act of 1933, as amended (the “Securities Act”), in

reliance on the exemption from registration provided by Section

4(a)(2) of the Securities Act and certain rules and regulations

promulgated thereunder. This description of the Securities Purchase

Agreement is only a summary and is qualified in its entirety by

reference to the full text of the Securities Purchase Agreement

attached as Exhibit 10.1 to the Company’s Form 8-K filed on January

4, 2024.

In connection with the transaction, on December 28, 2023, the

Company filed a certificate of designation of preferences and

rights (the “Certificate of Designation”) of Series C Preferred

Stock with the Secretary of State of Nevada, designating 5,000

shares of preferred stock, par value $0.0001 of the Company, as

Series C Preferred Stock. Each share of Series C Preferred Stock

shall have a stated face value of $1,300.00 (“Stated Value”).

The Series C Preferred Stock is not convertible into common

shares of capital stock of the Company and as such is non-dilutive

to current stockholders.

Each share of Series C Preferred Stock shall accrue a rate of

return on the Stated Value at the rate of 10% per year, compounded

annually to the extent not paid as set forth in the Certificate of

Designation, and to be determined pro rata for any factional year

periods (the “Preferred Return”). The Preferred Return shall accrue

on each share of Series C Preferred Stock from the date of its

issuance, and may be paid in additional shares of Series C

Preferred Stock, based on the Stated Value, or in cash, as

determined by the Company, as set forth in the Certificate of

Designation.

Subject to the terms and conditions set forth in the Certificate

of Designation, at any time the Company may elect, in the sole

discretion of the Board of Directors, to redeem all, but not less

than all, of the Series C Preferred Stock then issued and

outstanding from all of the Series C Preferred Stock Holders (a

“Corporation Optional Redemption”) by paying to the applicable

Series C Preferred Stock Holders an amount in cash equal to the

Series C Preferred Liquidation Amount (as defined in the

Certificate of Designation) then applicable to such shares of

Series C Preferred Stock being redeemed in the Corporation Optional

Conversion (the “Redemption Price”).

The Series C Preferred Stock confers no voting rights on

holders, except with respect to matters that materially and

adversely affect the voting powers, rights or preferences of the

Series C Preferred Stock or as otherwise required by applicable

law.

This description of the Certificate of Designation is only a

summary and is qualified in its entirety by reference to the full

text of the form of the Certificate of Designation attached as

Exhibit 3.1 to the Company’s Form 8-K filed on January 4, 2024.

About VERBVerb Technology Company, Inc.

(Nasdaq: VERB), is a market leader in interactive video-based sales

applications. The Company’s MARKET.live platform is a multi-vendor,

multi-presenter, livestream social shopping destination at the

forefront of the convergence of ecommerce and entertainment, where

hundreds of retailers, brands, creators and influencers can

monetize their base of fans and followers across social media

channels. The Company is headquartered in Las Vegas, NV and

operates creator studios in Los Alamitos, California and

Philadelphia, PA.

Follow VERB AND MARKET.LIVE here:

TikTok:

https://www.tiktok.com/@market.live_official

Facebook:

https://www.facebook.com/market.liveofficial

Instagram:

https://www.instagram.com/market.liveofficial/

LinkedIn:

https://www.linkedin.com/company/verb-tech/

YouTube:

https://www.youtube.com/@market.liveofficial

FORWARD-LOOKING STATEMENTSThis communication contains

"forward-looking statements" as that term is defined in the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements involve risks and uncertainties and include, without

limitation, any statement that may predict, forecast, indicate or

imply future results, performance or achievements, and may contain

words such as "anticipate," "expect," "project," "plan," or words

or phrases with similar meaning. Forward-looking statements are

based on current expectations, forecasts and assumptions that

involve risks and uncertainties. If any of these risks or

uncertainties materialize, or if any of our assumptions prove

incorrect, our actual results could differ materially from the

results expressed or implied by these forward-looking statements.

Investors are referred to our filings with the Securities and

Exchange Commission, including our Annual Reports on Form 10-K and

Quarterly Reports on Form 10-Q, for additional information

regarding the risks and uncertainties that may cause actual results

to differ materially from those expressed in any forward-looking

statement. All forward-looking statements in this press release are

based on information available to us as of the date hereof, and we

do not assume any obligation to update the forward-looking

statements provided to reflect events that occur or circumstances

that exist after the date on which they were made, except as

required by law.

Investor Relations:investors@verb.tech

Media Contact:info@verb.tech

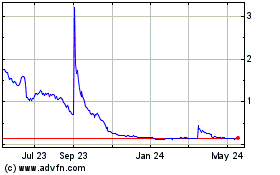

Verb Technology (NASDAQ:VERB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Verb Technology (NASDAQ:VERB)

Historical Stock Chart

From Jan 2024 to Jan 2025