0001840574false00018405742024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 27, 2024

Verve Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-40489 |

82-4800132 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

201 Brookline Avenue, Suite 601 Boston, Massachusetts |

|

02215 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (617) 603-0070

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common stock, $0.001 par value per share |

|

VERV |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2024, Verve Therapeutics, Inc. (the “Company”) announced its financial results for the quarter and year ended December 31, 2023. The full text of the press release issued by the Company in connection with the announcement is being furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is furnished herewith:

99.1 Press Release issued by Verve Therapeutics, Inc. on February 27, 2024.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

VERVE THERAPEUTICS, INC. |

|

|

|

|

Date: February 27, 2024 |

|

By: |

/s/ Allison Dorval |

|

|

|

Name: Allison Dorval |

|

|

|

Title: Chief Financial Officer |

Exhibit 99.1

Verve Therapeutics Provides Pipeline Progress and Reports Fourth Quarter and Full Year 2023 Financial Results

Three Clinical Stage Programs Targeting PCSK9 and ANGPTL3 Expected in 2024

Announced First Human Proof-of-Concept Data for In Vivo Base Editing from Ongoing Heart-1 Phase 1b Clinical Trial of VERVE-101 in November 2023

Cash, Cash Equivalents and Marketable Securities of $624 Million with Cash Runway into Late 2026

BOSTON — Feb. 27, 2024 — Verve Therapeutics, a clinical-stage biotechnology company pioneering a new approach to the care of cardiovascular disease with single-course gene editing medicines, today reported pipeline updates and financial results for the fourth quarter and year ended December 31, 2023.

“2023 was a momentous year for Verve as we made significant strides towards our mission of protecting the world from cardiovascular disease. Our pipeline, including clinical, preclinical, and discovery programs, captures a robust set of targets with compelling human genetics validation in areas of high unmet need and significant market opportunities, including PCSK9, ANGPTL3, and LPA. We are incredibly proud of the accomplishments we’ve made to date, particularly with the Heart-1 clinical trial of VERVE-101 in patients with HeFH, which demonstrated the first proof-of-concept data for in vivo base editing in humans,” said Sekar Kathiresan, M.D., co-founder and chief executive officer of Verve Therapeutics. “Looking ahead in 2024, we expect to dose the first patient in the United States complete enrollment in the ongoing Phase 1b trial of VERVE-101, and provide a data update. We also expect to initiate the Heart-2 Phase 1b trial for VERVE-102 targeting PCSK9 in the first half of this year, followed by initiation of a Phase 1b trial for VERVE-201 targeting ANGPTL3 in the second half of the year. We are excited about the potential to have three in vivo gene editing programs in the clinic in 2024, supported by a substantial cash position that provides an estimated runway into late 2026, and a collaborator with expertise in cardiometabolic disease as well as late-stage development in Eli Lilly.”

Interim Data from Ongoing Heart-1 Phase 1b Clinical Trial Demonstrating First Human Proof-of-Concept for In Vivo Base Editing

VERVE-101, an in vivo base editing medicine delivered as a one-time intravenous infusion, is designed to inactivate the PCSK9 gene in liver cells, turning off liver production of PCSK9 protein and thereby durably reducing low-density lipoprotein cholesterol (LDL-C). VERVE-101 is being developed initially for the treatment of patients living with heterozygous familial hypercholesterolemia (HeFH), a life-threatening inherited disease characterized by lifelong elevations in blood LDL-C and accelerated atherosclerotic cardiovascular disease (ASCVD).

VERVE-101 is being evaluated in the Heart-1 Phase 1b clinical trial with endpoints of safety and tolerability as well as changes in blood PCSK9 protein and LDL-C levels.

In November 2023, Verve presented interim data from the ongoing Heart-1 trial of VERVE-101 in a late-breaking science presentation at the American Heart Association (AHA) Scientific Sessions highlighting first human proof-of-concept data for in vivo base editing. Treatment with VERVE-101 led to dose-dependent reductions of disease-causing LDL-C in patients living with HeFH. Time-averaged LDL-C reductions of up to 55% and blood PCSK9 protein reductions of up to 84% were observed after a single infusion of VERVE-101 at potentially therapeutic doses. These results suggest successful editing at the intended genomic target. Dose-dependent LDL-C reductions, a validated measure of clinical efficacy for this patient population, were observed one month after treatment at the 0.45 and 0.6 mg/kg dose cohorts, and the reduction was sustained out to six months for the single patient in the highest dose cohort. A review of the safety data of VERVE-101 by an independent data and safety monitoring board

supported the continued development of VERVE-101 in the Heart-1 trial, and the adverse events were consistent with expectations in the severe, advanced ASCVD patient population enrolled in the trial.

The Heart-1 trial is enrolling patients in the 0.45 and 0.6 mg/kg cohorts of the single ascending dose portion, and Verve expects to complete enrollment of the Heart-1 clinical trial in 2024. Verve plans to provide a data update from the Heart-1 clinical trial in the second half of 2024.

IND Clearance by U.S. FDA for VERVE-101

In October 2023, Verve announced the clearance of its Investigational New Drug (IND) Application for VERVE-101 in patients living with HeFH by the U.S. Food and Drug Administration (FDA). Supplementing the active trial sites in the United Kingdom and New Zealand, Verve is working to activate U.S. trial sites and to dose the first patient with VERVE-101 in the United States.

VERVE-102 On-Track for Clinical Trial Initiation in First Half of 2024

VERVE-102 is an in vivo base editing medicine that aims to inactivate the PCSK9 gene in a similar way to VERVE-101. VERVE-101 and VERVE-102 share an identical guide RNA targeting PCSK9 as well as similar messenger RNA expressing an adenine base editor; however, VERVE-102 is delivered using Verve's proprietary GalNAc-LNP delivery technology which can access liver cells using either the asialoglycoprotein receptor (ASGPR) or the low-density lipoprotein receptor (LDLR).

Verve plans to pursue a regulatory strategy initially outside the U.S. for the Heart-2 Phase 1b clinical trial. Verve expects to initiate the Heart-2 trial with VERVE-102 for patients with HeFH or premature coronary artery disease in the first half of 2024, subject to regulatory clearances. Following an evaluation of clinical data from the Heart-1 and the Heart-2 trials, Verve plans to initiate a randomized, placebo-controlled Phase 2 clinical trial of either VERVE-101 or VERVE-102 in 2025.

VERVE-201 On-Track for Clinical Trial Initiation in Second Half of 2024

VERVE-201, an in vivo base editing medicine delivered as a one-time intravenous infusion, is designed to inactivate the ANGPTL3 gene in liver cells, turning off liver production of blood ANGPTL3 protein and thereby durably reducing blood LDL-C and triglyceride-rich lipoproteins. For VERVE-201, Verve is utilizing its proprietary GalNAc-LNP delivery technology. VERVE-201 is being developed initially for the treatment of patients living with homozygous familial hypercholesterolemia (HoFH), a rare and often fatal inherited subtype of premature ASCVD characterized by extremely high blood LDL-C. VERVE-201 aims to reduce the heavy treatment burden associated with available therapies for HoFH, including the requirement for multiple oral, injectable, and intravenous infusions, often administered over decades. Verve also plans to evaluate VERVE-201 in ASCVD patients with refractory hypercholesterolemia, who have high LDL-C despite treatment with maximally-tolerated standard of care therapies.

Preclinical studies to support regulatory submissions for clinical development of VERVE-201 are ongoing. Verve plans to pursue a regulatory strategy initially outside the U.S. for the VERVE-201 Phase 1b clinical trial. Verve expects to initiate the VERVE-201 Phase 1b clinical trial in the second half of 2024, subject to regulatory clearances.

Corporate Update

In December 2023, Verve announced the closing of an underwritten public offering of 14,375,000 shares of its common stock at a public offering price of $10.00 per share. The total net proceeds of the public offering were approximately $134.7 million, after deducting underwriting discounts and commissions and offering expenses payable by Verve. Concurrently, the company announced the closing of its private placement of 2,296,317 shares of

its common stock to Eli Lilly and Company (Lilly), at a price per share equal to the public offering price. The total net proceeds of the private placement were approximately $23.0 million.

In October 2023, Verve announced the expansion of its relationship with Lilly, which was previously established in June 2023. Lilly acquired certain product rights from Beam Therapeutics to Verve’s cardiovascular in vivo gene editing programs targeting PCSK9 and ANGPTL3, as well as a third cardiovascular disease target. Under the collaboration agreement, Verve retains control of the development and commercialization of all collaboration products.

Fourth Quarter and Full Year 2023 Financial Results

Cash Position: Cash, cash equivalents and marketable securities were $624.0 million as of December 31, 2023, compared with $554.8 million as of December 31, 2022. Based on current operating plans, Verve expects its existing cash, cash equivalents and marketable securities will enable the company to fund its operating expenses and capital expenditure requirements into late 2026.

Collaboration Revenue: Collaboration revenue was $5.1 million for the quarter ended December 31, 2023, and $11.8 million for the year ended December 31, 2023 and related to research services performed under the collaboration agreement with Vertex Pharmaceuticals Incorporated (Vertex) and the Lp(a) collaboration with Lilly. Collaboration revenue was $1.0 million for the quarter ended December 31, 2022, and $1.9 million for the year ended December 31, 2022 and related to research services performed under the collaboration agreement with Vertex.

R&D Expenses: Research and development (R&D) expenses were $46.8 million for the quarter ended December 31, 2023, and $184.9 million for the year ended December 31, 2023, compared to $37.3 million for the quarter ended December 31, 2022, and $130.1 million for the year ended December 31, 2022.

G&A Expenses: General and administrative (G&A) expenses were $12.3 million for the quarter ended December 31, 2023, and $49.9 million for the year ended December 31, 2023, compared to $11.4 million for the quarter ended December 31, 2022, and $37.5 million for the year ended December 31, 2022.

Net Loss: Net loss was $48.4 million, or $0.69 basic and diluted net loss per share, for the quarter ended December 31, 2023, and $200.1 million, or $3.12 basic and diluted net loss per share, for the year ended December 31, 2023, compared to a net loss of $41.1 million, or $0.67 basic and diluted net loss per share, for the quarter ended December 31, 2022, and $157.4 million, or $2.91 basic and diluted net loss per share, for the year ended December 31, 2022.

About Verve Therapeutics

Verve Therapeutics, Inc. (Nasdaq: VERV) is a clinical-stage genetic medicines company pioneering a new approach to the care of cardiovascular disease, potentially transforming treatment from chronic management to single-course gene editing medicines. The company’s lead programs – VERVE-101, VERVE-102, and VERVE-201 – target genes that have been extensively validated as targets for lowering low-density lipoprotein cholesterol (LDL-C), a root cause of atherosclerotic cardiovascular disease (ASCVD). VERVE-101 and VERVE-102 are designed to permanently turn off the PCSK9 gene in the liver and are being developed initially for heterozygous familial hypercholesterolemia (HeFH) and ultimately to treat patients with established ASCVD who continue to be impacted by high LDL-C levels. VERVE-201 is designed to permanently turn off the ANGPTL3 gene in the liver and is initially being developed for homozygous familial hypercholesterolemia (HoFH) and for refractory hypercholesterolemia where patients still have high LDL-C despite treatment with maximally-tolerated standard of care therapies. For more information, please visit www.VerveTx.com.

Cautionary Note Regarding Forward Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve substantial risks and uncertainties, including statements regarding the company’s

ability to enroll patients in its ongoing Heart-1 trial and activate clinical trial sites, and begin dosing, in the United States; the timing and availability of clinical data from its Heart-1 trial; the regulatory strategy for VERVE-102 and VERVE-201; the receipt of regulatory clearances and expected timing of initiating the clinical trials of VERVE-102 and VERVE-201; its research and development plans; the potential advantages and therapeutic potential of the company’s programs; and the period over which the company believes that its existing cash, cash equivalents and marketable securities will be sufficient to fund its operating expenses. All statements, other than statements of historical facts, contained in this press release, including statements regarding the company’s strategy, future operations, future financial position, prospects, plans and objectives of management, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Any forward-looking statements are based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in, or implied by, such forward-looking statements. These risks and uncertainties include, but are not limited to, risks associated with the company’s limited operating history; the company’s ability to timely submit and receive approvals of regulatory applications for its product candidates; advance its product candidates in clinical trials; initiate, enroll and complete its ongoing and future clinical trials on the timeline expected or at all; correctly estimate the potential patient population and/or market for the company’s product candidates; replicate in clinical trials positive results found in preclinical studies and/or earlier-stage clinical trials of VERVE-101, VERVE-102, and VERVE-201; advance the development of its product candidates under the timelines it anticipates in current and future clinical trials; obtain, maintain or protect intellectual property rights related to its product candidates; manage expenses; and raise the substantial additional capital needed to achieve its business objectives. For a discussion of other risks and uncertainties, and other important factors, any of which could cause the company’s actual results to differ from those contained in the forward-looking statements, see the “Risk Factors” section, as well as discussions of potential risks, uncertainties and other important factors, in the company’s most recent filings with the Securities and Exchange Commission and in other filings that the company makes with the Securities and Exchange Commission in the future. In addition, the forward-looking statements included in this press release represent the company’s views as of the date hereof and should not be relied upon as representing the company’s views as of any date subsequent to the date hereof. The company anticipates that subsequent events and developments will cause the company’s views to change. However, while the company may elect to update these forward-looking statements at some point in the future, the company specifically disclaims any obligation to do so.

Investor Contact

Jen Robinson

Verve Therapeutics, Inc.

jrobinson@vervetx.com

Media Contact

Ashlea Kosikowski

1AB

ashlea@1abmedia.com

Verve Therapeutics, Inc.

Selected Condensed Consolidated Financial Information

(in thousands, except share and per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

December 31, |

|

|

Year ended

December 31, |

|

Condensed consolidated statements of operations |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration revenue |

|

$ |

5,143 |

|

|

$ |

1,012 |

|

|

$ |

11,758 |

|

|

$ |

1,941 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

46,811 |

|

|

|

37,283 |

|

|

|

184,946 |

|

|

|

130,095 |

|

General and administrative |

|

|

12,281 |

|

|

|

11,438 |

|

|

|

49,936 |

|

|

|

37,533 |

|

Total operating expenses |

|

|

59,092 |

|

|

|

48,721 |

|

|

|

234,882 |

|

|

|

167,628 |

|

Loss from operations |

|

|

(53,949 |

) |

|

|

(47,709 |

) |

|

|

(223,124 |

) |

|

|

(165,687 |

) |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Change in fair value of success payment liability |

|

|

(713 |

) |

|

|

2,177 |

|

|

|

165 |

|

|

|

1,486 |

|

Interest and other income, net |

|

|

6,341 |

|

|

|

4,501 |

|

|

|

23,166 |

|

|

|

6,867 |

|

Total other income, net |

|

|

5,628 |

|

|

|

6,678 |

|

|

|

23,331 |

|

|

|

8,353 |

|

Loss before provision for income taxes |

|

|

(48,321 |

) |

|

|

(41,031 |

) |

|

|

(199,793 |

) |

|

|

(157,334 |

) |

Provision for income taxes |

|

|

(32 |

) |

|

|

(53 |

) |

|

|

(275 |

) |

|

|

(53 |

) |

Net loss |

|

$ |

(48,353 |

) |

|

$ |

(41,084 |

) |

|

$ |

(200,068 |

) |

|

$ |

(157,387 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.69 |

) |

|

$ |

(0.67 |

) |

|

$ |

(3.12 |

) |

|

$ |

(2.91 |

) |

Weighted-average common shares used in net loss per share, basic and diluted |

|

|

69,671,255 |

|

|

|

61,464,731 |

|

|

|

64,175,137 |

|

|

|

54,023,653 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed consolidated balance sheet data |

|

December 31, 2023 |

|

|

December 31, 2022 |

|

Cash, cash equivalents and marketable securities |

|

$ |

623,950 |

|

|

$ |

554,808 |

|

Total assets |

|

$ |

752,688 |

|

|

$ |

679,223 |

|

Total liabilities |

|

$ |

153,186 |

|

|

$ |

128,291 |

|

Total stockholders' equity |

|

$ |

599,502 |

|

|

$ |

550,932 |

|

|

|

|

|

|

|

|

v3.24.0.1

Document And Entity Information

|

Feb. 27, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity Registrant Name |

Verve Therapeutics, Inc.

|

| Entity Central Index Key |

0001840574

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-40489

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-4800132

|

| Entity Address, Address Line One |

201 Brookline Avenue

|

| Entity Address, Address Line Two |

Suite 601

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02215

|

| City Area Code |

(617)

|

| Local Phone Number |

603-0070

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value per share

|

| Trading Symbol |

VERV

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

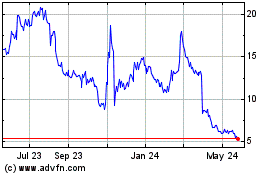

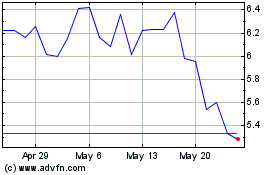

Verve Therapeutics (NASDAQ:VERV)

Historical Stock Chart

From Apr 2024 to May 2024

Verve Therapeutics (NASDAQ:VERV)

Historical Stock Chart

From May 2023 to May 2024