0001347178FALSE00013471782025-02-132025-02-130001347178us-gaap:CommonStockMember2025-02-132025-02-130001347178vnda:SeriesAJuniorParticipatingPreferredStockPurchaseRightMember2025-02-132025-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2025

VANDA PHARMACEUTICALS INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34186 | | 03-0491827 |

| (State or other jurisdiction of incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

2200 Pennsylvania Avenue NW

Suite 300E

Washington, DC 20037

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (202) 734-3400

| | |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | VNDA | The Nasdaq Global Market |

| Series A Junior Participating Preferred Stock Purchase Right, par value $0.001 per share | - | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | | | | |

| Item 2.02. | | Results of Operations and Financial Condition. |

On February 13, 2025, Vanda Pharmaceuticals Inc. (“Vanda”) issued a press release and is holding a conference call regarding its results of operations and financial condition for the quarter and full year ended December 31, 2024 (the “Earnings Call”). The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Various statements to be made during the Earnings Call are “forward-looking statements” under the securities laws, including, but not limited to, statements regarding Vanda’s commercial products, plans and opportunities, as well as statements about Vanda’s products in development and the related clinical development and regulatory timelines and commercial potential for such products. Words such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “project,” “target,” “goal,” “likely,” “will,” “would,” and “could,” or the negative of these terms and similar expressions or words, identify forward-looking statements. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Forward-looking statements are based upon current expectations and assumptions that involve risks, changes in circumstances and uncertainties.

Important factors that could cause actual results to differ materially from those reflected in Vanda’s forward-looking statements include, among others, Vanda’s assumptions regarding the strength of its business in the U.S. and Vanda’s ability to complete the clinical development of, and obtain regulatory approval for, the products in its pipeline. Therefore, no assurance can be given that the actual results or developments anticipated by Vanda will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Vanda. Forward-looking statements made during the Earnings Call should be evaluated together with the various risks and uncertainties that affect Vanda’s business and market, particularly those identified in the “Cautionary Note Regarding Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Vanda’s most recent Annual Report on Form 10-K, as updated by Vanda’s subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the U.S. Securities and Exchange Commission, which are available at www.sec.gov.

All written and verbal forward-looking statements attributable to Vanda or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. The information contained in this Current Report on Form 8-K is intended to be considered in the context of Vanda’s filings with the SEC and other public announcements that Vanda makes, by press release or otherwise, from time to time. Vanda cautions investors not to rely too heavily on the forward-looking statements Vanda makes or that are made on its behalf. The information conveyed on the Earnings Call will be provided only as of the date thereof, and Vanda undertakes no obligation, and specifically declines any obligation, to update or revise publicly any forward-looking statements made during the Earnings Call after the date thereof, whether as a result of new information, future events or otherwise, except as required by law.

The information in Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| | | | | | | | |

| Item 9.01. | | Financial Statements and Exhibits. |

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Dated: | February 13, 2025 | | VANDA PHARMACEUTICALS INC. |

| | | | |

| | | By: | | /s/ Timothy Williams |

| | | Name: | | Timothy Williams |

| | | Title: | | Senior Vice President, General Counsel and Secretary |

Exhibit 99.1

Vanda Pharmaceuticals Reports Fourth Quarter and Full Year 2024 Financial Results

•Q4 2024 total revenues of $53.2 million, +17% compared to Q4 2023

•Q4 2024 Fanapt® net product sales of $26.6 million, +18% compared to Q4 2023

•Full year 2024 total revenues of $198.8 million, +3% compared to full year 2023

•Full year 2025 revenue expected to grow to $210 to $250 million

•Psychiatry portfolio revenue expected to grow to greater than $750 million in 2030

•Fanapt® MAA for bipolar I disorder and schizophrenia submitted in Q4 2024

•BysantiTM (milsaperidone) NDA for bipolar I disorder and schizophrenia expected to be submitted in Q1 2025

•HETLIOZ® MAA for Smith-Magenis syndrome submitted in Q4 2024

•Tradipitant NDA for motion sickness submitted in Q4 2024

•Imsidolimab BLA in generalized pustular psoriasis expected to be submitted in 2025

WASHINGTON – February 13, 2025 – Vanda Pharmaceuticals Inc. (Vanda) (Nasdaq: VNDA) today announced financial and operational results for the fourth quarter and full year ended December 31, 2024.

“Strong revenue growth for Fanapt is putting us on a significant growth trajectory for 2025 and beyond, supported also by the commercial performance of Hetlioz and Ponvory. The Fanapt long acting injectable program, the NDA for Bysanti for bipolar disorder and schizophrenia along with its development for major depressive disorder have the potential to drive future growth in our psychiatry portfolio for many years to come,” said Mihael H. Polymeropoulos, M.D., Vanda’s President, CEO and Chairman of the Board. “Tradipitant’s NDA for motion sickness was filed with a potential approval this year, while we are pursuing approval in gastroparesis and the development of tradipitant to improve tolerability of GLP-1 analog Wegovy. Our anti-inflammatory portfolio, anchored by Ponvory, was strengthened with the addition of imsidolimab from Anaptys, an IL-36 receptor inhibitor for the treatment of generalized pustular psoriasis. We plan to file a BLA later this year while we are exploring registration in Europe and Japan as well as the development of this novel drug for other inflammatory disorders with an unopposed action of the IL-36 system. In 2024 we returned to revenue growth driven by the commercial launches in bipolar disorder and multiple sclerosis and advanced our development pipeline with a number of products at or near marketing applications. All this was achieved by the hard work, ingenuity and efficiency of our organization and its wonderful people.”

Financial Highlights

Fourth Quarter of 2024

•Total net product sales from Fanapt®, HETLIOZ® and PONVORY® were $53.2 million in the fourth quarter of 2024, a 17% increase compared to $45.3 million in the fourth quarter of 2023 and a 12% increase compared to $47.7 million in the third quarter of 2024.

•Fanapt® net product sales were $26.6 million in the fourth quarter of 2024, an 18% increase compared to $22.6 million in the fourth quarter of 2023 and an 11% increase compared to $23.9 million in the third quarter of 2024.

•HETLIOZ® net product sales were $20.0 million in the fourth quarter of 2024, a 5% decrease compared to $21.1 million in the fourth quarter of 2023 and a 12% increase compared to $17.9 million in the third quarter of 2024.

•PONVORY® net product sales were $6.5 million in the fourth quarter of 2024, an increase of 11% compared to $5.9 million in the third quarter of 2024. The acquisition of PONVORY® from Actelion Pharmaceuticals Ltd. (Janssen), a Johnson & Johnson Company, was completed on December 7, 2023.

•Net loss was $4.9 million in the fourth quarter of 2024 compared to net loss of $2.4 million in the fourth quarter of 2023 and net loss of $5.3 million in the third quarter of 2024.

•Cash, cash equivalents and marketable securities (Cash) was $374.6 million as of December 31, 2024, representing a decrease to Cash of $1.6 million compared to September 30, 2024.

Full Year 2024

•Total net product sales from Fanapt®, HETLIOZ® and PONVORY® were $198.8 million for the full year 2024, a 3% increase compared to $192.6 million for the full year 2023.

•Fanapt® net product sales were $94.3 million for the full year 2024, a 4% increase compared to $90.9 million for the full year 2023.

•HETLIOZ® net product sales were $76.7 million for the full year 2024, a 23% decrease compared to $100.2 million for the full year 2023. The decrease relative to the full year 2023 was the result of continued generic competition in the U.S.

•PONVORY® net product sales were $27.8 million for the full year 2024. The acquisition of PONVORY® from Janssen was completed on December 7, 2023.

•Net loss was $18.9 million for the full year 2024, compared to net income of $2.5 million for the full year 2023.

•Cash was $374.6 million as of December 31, 2024, representing a decrease to Cash of $13.6 million compared to December 31, 2023.

Key Operational Highlights

Fanapt® (iloperidone)

•Fanapt® was approved in the second quarter of 2024 for the acute treatment of bipolar I disorder. Vanda initiated the commercial launch of Fanapt® in this indication in the third quarter of 2024. In the fourth quarter of 2024, as compared to the fourth quarter of 2023, new patient starts, as reflected by new to brand prescriptions (NBRx),1 increased by over 160% and Fanapt® net product sales increased by 18%.

•Vanda initiated a Phase III program for the long acting injectable (LAI) formulation of Fanapt® in the fourth quarter of 2024.

•Vanda plans to initiate a study of the Fanapt® LAI as a once-a-month injectable for the treatment of hypertension to address both treatment resistance and treatment compliance.

•Vanda submitted a Marketing Authorization Application (MAA) to the European Medicines Agency (EMA) in the fourth quarter of 2024 for Fanapt® for bipolar I disorder and schizophrenia.

Bysanti™ (milsaperidone)

•Vanda expects to submit a New Drug Application (NDA) for Bysanti™ to the U.S. Food and Drug Administration (FDA) for the treatments of acute bipolar I disorder and schizophrenia in the first quarter of 2025. Exclusivity, including pending patent applications, could extend into the 2040s.

•Vanda initiated a Phase III clinical study for Bysanti™ as a once-daily adjunctive treatment for major depressive disorder (MDD) in the fourth quarter of 2024. Results are expected in 2026.

HETLIOZ® (tasimelteon)

•Vanda has initiated clinical programs for HETLIOZ® in pediatric insomnia and delayed sleep phase disorder (DSPD) and these programs are ongoing.

•Vanda’s MAA for HETLIOZ® and HETLIOZ LQ® for Smith-Magenis Syndrome (SMS) is pending with the EMA.

PONVORY® (ponesimod)

•Vanda initiated the commercial launch of PONVORY® for the treatment of relapsing forms of multiple sclerosis in the third quarter of 2024.

•Investigational New Drug (IND) applications for PONVORY® in the treatments of psoriasis and ulcerative colitis were accepted by the FDA in the fourth quarter of 2024.

Tradipitant

•The NDA for tradipitant for the treatment of motion sickness was submitted to the FDA in the fourth quarter of 2024.

•Vanda initiated a clinical trial to study tradipitant in the prevention of vomiting induced by a GLP-1 analog, Wegovy (semaglutide), in the fourth quarter of 2024.

•Vanda has accepted the opportunity for a hearing with the FDA on the approvability of the NDA for tradipitant for the treatment of symptoms of gastroparesis.

Imsidolimab

•In February 2025, Vanda announced it entered into an exclusive, global license agreement with AnaptysBio, Inc. (Anaptys) for the development and commercialization of imsidolimab (IL-36R antagonist mAb). Vanda expects to initiate and complete the technology transfer activities in 2025 and immediately begin preparing the Biologics License Application (BLA) and MAA for generalized pustular psoriasis (GPP) for the US and EU. The imsidolimab BLA for GPP is expected to be submitted to the FDA in 2025.

Early-Stage Program Highlights

•VQW-765, an alpha-7 nicotinic acetylcholine receptor partial agonist, is currently in clinical development for the treatment of acute performance anxiety in social situations. Vanda expects to initiate a Phase III program in 2025.

•The IND application for VCA-894A in the treatment of Charcot-Marie-Tooth disease, axonal, type 2S (CMT2S), an inherited peripheral neuropathy for which there is no available treatment, was accepted by the FDA in 2024. Previously in 2023, VCA-894A was granted Orphan Drug Designation for the same indication. The Phase I clinical study for VCA-894A expects to enroll the patient by mid-2025.

•In December 2024, Vanda announced that the FDA has granted Orphan Drug Designation for VGT-1849A, a selective antisense oligonucleotide (ASO)-based JAK2 inhibitor for the treatment of polycythemia vera (PV), a form of a rare hematologic malignancy that is estimated to affect 1 in 2,000 Americans.

Key Regulatory Milestones

•Tradipitant NDA for motion sickness submitted in Q4 2024.

•Fanapt® MAA for bipolar I disorder and schizophrenia submitted in Q4 2024.

•HETLIOZ® MAA in Smith-Magenis syndrome (SMS) submitted in Q4 2024.

•Bysanti™ NDA for bipolar I disorder and schizophrenia expected to be submitted in Q1 2025.

•Imsidolimab BLA in generalized pustular psoriasis expected to be submitted in 2025.

GAAP Financial Results

Net loss was $4.9 million in the fourth quarter of 2024 compared to net loss of $2.4 million in the fourth quarter of 2023. Diluted net loss per share was $0.08 in the fourth quarter of 2024 compared to diluted net loss per share of $0.04 in the fourth quarter of 2023.

Net loss was $18.9 million for the full year 2024 compared to net income of $2.5 million for the full year 2023. Diluted net loss per share was $0.33 for the full year 2024 compared to diluted net income per share of $0.04 for the full year 2023.

2025 Financial Guidance and 2030 Revenue Targets

Vanda expects to achieve the following financial objectives in 2025:

| | | | | | |

Full Year 2025 Financial Objectives | Full Year 2025 Guidance | |

| Total revenues | $210 to $250 million | |

| | |

| | |

| | |

Vanda is providing 2030 revenue targets. For the psychiatry portfolio alone, Vanda is targeting annual revenue in excess of $750 million in 2030, assuming the potential approval of BysantiTM for the treatments of acute bipolar I disorder and schizophrenia in early 2026, the potential approval of BysantiTM for the treatment of MDD, and the potential approval of Fanapt® LAI. Vanda is also targeting total annual revenue in excess of $1 billion in 2030.

Conference Call

Vanda has scheduled a conference call for today, Thursday, February 13, 2025, at 4:30 PM ET. During the call, Vanda’s management will discuss the fourth quarter and full year 2024 financial results and other corporate activities. Investors can call 1-800-715-9871 (domestic) or 1-646-307-1963 (international) and use passcode number 2881765. A replay of the call will be available on Thursday, February 13, 2025, beginning at 8:30 PM ET and will be accessible until Thursday, February 20, 2025 at 11:59 PM ET. The replay call-in number is 1-800-770-2030 for domestic callers and 1-609-800-9909 for international callers. The passcode number is 2881765.

The conference call will be broadcast simultaneously on Vanda’s website, www.vandapharma.com. Investors should click on the Investors tab and are advised to go to the website at least 15 minutes early to register, download, and install any necessary software or presentations. The call will also be archived on Vanda’s website for a period of 30 days.

References

1.IQVIA Prescription Data

About Vanda Pharmaceuticals Inc.

Vanda is a leading global biopharmaceutical company focused on the development and commercialization of innovative therapies to address high unmet medical needs and improve the lives of patients. For more on Vanda Pharmaceuticals Inc., please visit www.vandapharma.com and follow us on X @vandapharma.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Various statements in this press release, including, but not limited to, the guidance provided under “2025 Financial Guidance and 2030 Revenue Targets” above and the related implied growth of Vanda’s business, and statements regarding Vanda’s plans for pursuit of FDA approval of BysantiTM for the treatments of acute bipolar I disorder and schizophrenia and imsidolimab for the treatment of GPP, and the related timelines; Vanda’s expectations with respect to the growth opportunities for its psychiatry frachise; Vanda’s consideration of foreign regulatory approval for imsidolimab and its potential development for other inflammatory disorders; Vanda’s clinical development plans and expected timelines for Fanapt® LAI, BysantiTM for the treatment of MDD, VQW-765 for the treatment of acute performance anxiety in social situations, and VCA-894A for the treatment of CMT2S; the commercial and therapeutic potential for BysantiTM; the potential to extend patent exclusivity for BysantiTM into the 2040s; the anticipated timing of the initiation and completion of technology transfer activities and the preparation of regulatory filings in the US and EU for imsidolimab; and the prevalence of PV are “forward-looking statements” under the securities laws. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. Forward-looking statements are based upon current expectations and assumptions that involve risks, changes in circumstances and uncertainties. Important factors that could cause actual results to differ materially from those reflected in Vanda’s forward-looking statements include, among others, Vanda’s ability to continue to grow its psychiatry portfolio and overall business; the results of Vanda’s review of foreign regulatory opportunities for imsidolmab; Vanda’s ability to identify additional indications for imsidolimab; Vanda’s ability to complete and submit to the FDA the NDA for BysantiTM for the treatments of acute bipolar I disorder and schizophrenia in the first quarter of 2025; Vanda’s ability to complete and submit the BLA for imsidolimab for the treatment of GPP in 2025; Vanda’s ability to complete the Phase III clinical study for BysantiTM for MDD and receive results in 2026; Vanda’s ability to initiate the Phase III program for VQW-765 in 2025; Vanda’s ability to enroll the CMT2S patient in the Phase I clinical study for VCA-894A by mid-2025; Vanda’s ability to complete the clinical development of, obtain regulatory approval for, and successfully commercialize, BysantiTM for the

treatments of acute bipolar I disorder, schizophrenia and MDD; Vanda’s ability to satisfy the conditions necessary to extend BysantiTM’s patent exclusivity into the 2040s; Vanda’s ability to initiate and complete the technology transfer activities and prepare the BLA and MAA for imsidolimab in the specified timeframes; and the accuracy of the estimate regarding the prevalence of PV. Therefore, no assurance can be given that the results or developments anticipated by Vanda will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Vanda. Forward-looking statements in this press release should be evaluated together with the various risks and uncertainties that affect Vanda’s business and market, particularly those identified in the “Cautionary Note Regarding Forward-Looking Statements”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of Vanda’s most recent Annual Report on Form 10-K, as updated by Vanda’s subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the U.S. Securities and Exchange Commission, which are available at www.sec.gov.

All written and verbal forward-looking statements attributable to Vanda or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Vanda cautions investors not to rely too heavily on the forward-looking statements Vanda makes or that are made on its behalf. The information in this press release is provided only as of the date of this press release, and Vanda undertakes no obligation, and specifically declines any obligation, to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

VANDA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except for share and per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31

2024 | | December 31

2023 | | December 31

2024 | | December 31

2023 |

| Revenues: | | | | | | | |

Fanapt® net product sales | $ | 26,649 | | | $ | 22,599 | | | $ | 94,297 | | | $ | 90,873 | |

HETLIOZ® net product sales | 20,044 | | | 21,072 | | | 76,675 | | | 100,167 | |

PONVORY® net product sales | 6,492 | | | 1,600 | | | 27,800 | | | 1,600 | |

| Total revenues | 53,185 | | | 45,271 | | | 198,772 | | | 192,640 | |

| Operating expenses: | | | | | | | |

| Cost of goods sold excluding amortization | 2,590 | | | 3,460 | | | 11,314 | | | 14,796 | |

| Research and development | 19,840 | | | 24,339 | | | 74,431 | | | 76,823 | |

| Selling, general and administrative | 39,282 | | | 23,613 | | | 146,414 | | | 112,883 | |

| Intangible asset amortization | 1,752 | | | 953 | | | 7,273 | | | 2,090 | |

| Total operating expenses | 63,464 | | | 52,365 | | | 239,432 | | | 206,592 | |

| Loss from operations | (10,279) | | | (7,094) | | | (40,660) | | | (13,952) | |

| Other income, net | 3,782 | | | 5,433 | | | 17,739 | | | 20,291 | |

| Income (loss) before income taxes | (6,497) | | | (1,661) | | | (22,921) | | | 6,339 | |

| Provision (benefit) for income taxes | (1,585) | | | 739 | | | (4,021) | | | 3,830 | |

| Net income (loss) | $ | (4,912) | | | $ | (2,400) | | | $ | (18,900) | | | $ | 2,509 | |

Net income (loss) per share, basic | $ | (0.08) | | | $ | (0.04) | | | $ | (0.33) | | | $ | 0.04 | |

| Net income (loss) per share, diluted | $ | (0.08) | | | $ | (0.04) | | | $ | (0.33) | | | $ | 0.04 | |

Weighted average shares outstanding, basic | 58,308,487 | | | 57,532,309 | | | 58,149,087 | | | 57,380,975 | |

| Weighted average shares outstanding, diluted | 58,308,487 | | | 57,532,309 | | | 58,149,087 | | | 57,557,911 | |

VANDA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| December 31

2024 | | December 31

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 102,316 | | | $ | 135,821 | |

| Marketable securities | 272,327 | | | 252,443 | |

| Accounts receivable, net | 47,101 | | | 34,155 | |

| Inventory | 1,726 | | | 1,357 | |

| Prepaid expenses and other current assets | 15,420 | | | 9,170 | |

| Total current assets | 438,890 | | | 432,946 | |

| Property and equipment, net | 2,132 | | | 2,037 | |

| Operating lease right-of-use assets | 5,602 | | | 7,103 | |

| Finance lease right-of-use assets | 4,943 | | | — | |

| Intangible assets, net | 114,096 | | | 121,369 | |

| Deferred tax assets | 81,440 | | | 75,000 | |

| Non-current inventory and other | 9,101 | | | 9,985 | |

| Total assets | $ | 656,204 | | | $ | 648,440 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 39,086 | | | $ | 38,460 | |

| Product revenue allowances | 60,895 | | | 49,237 | |

| | | |

| Total current liabilities | 99,981 | | | 87,697 | |

| Operating lease non-current liabilities | 4,944 | | | 7,006 | |

| Finance lease non-current liabilities | 3,146 | | | — | |

| Other non-current liabilities | 9,587 | | | 8,827 | |

| Total liabilities | 117,658 | | | 103,530 | |

| Stockholders’ equity: | | | |

| Common stock | 58 | | | 58 | |

| Additional paid-in capital | 712,706 | | | 700,274 | |

Accumulated other comprehensive income (loss) | 74 | | | (30) | |

| Accumulated deficit | (174,292) | | | (155,392) | |

| Total stockholders’ equity | 538,546 | | | 544,910 | |

| Total liabilities and stockholders’ equity | $ | 656,204 | | | $ | 648,440 | |

Corporate Contact:

Kevin Moran

Senior Vice President, Chief Financial Officer and Treasurer

Vanda Pharmaceuticals Inc.

202-734-3400

pr@vandapharma.com

Jim Golden / Jack Kelleher / Dan Moore

Collected Strategies

VANDA-CS@collectedstrategies.com

Follow us on X @vandapharma

SOURCE Vanda Pharmaceuticals Inc.

v3.25.0.1

Cover Page

|

Feb. 13, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 13, 2025

|

| Entity Registrant Name |

VANDA PHARMACEUTICALS INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34186

|

| Entity Tax Identification Number |

03-0491827

|

| Entity Address, Address Line One |

2200 Pennsylvania Avenue NW

|

| Entity Address, Address Line Two |

Suite 300E

|

| Entity Address, City or Town |

Washington

|

| Entity Address, State or Province |

DC

|

| Entity Address, Postal Zip Code |

20037

|

| City Area Code |

202

|

| Local Phone Number |

734-3400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001347178

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

VNDA

|

| Security Exchange Name |

NASDAQ

|

| Series A Junior Participating Preferred Stock Purchase Right |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series A Junior Participating Preferred Stock Purchase Right, par value $0.001 per share

|

| Trading Symbol |

-

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=vnda_SeriesAJuniorParticipatingPreferredStockPurchaseRightMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

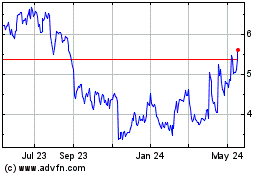

Vanda Pharmaceuticals (NASDAQ:VNDA)

Historical Stock Chart

From Jan 2025 to Feb 2025

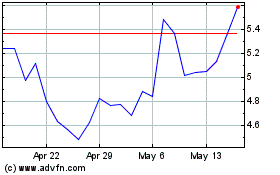

Vanda Pharmaceuticals (NASDAQ:VNDA)

Historical Stock Chart

From Feb 2024 to Feb 2025