0000807707false00008077072024-01-092024-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 09, 2024 |

VOXX INTERNATIONAL CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

0-28839 |

13-1964841 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2351 J. Lawson Boulevard |

|

Orlando, Florida |

|

32824 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (800) 645-7750 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock $.01 par value |

|

VOXX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 9, 2024, VOXX International Corporation (the "Company") issued a press release announcing its earnings for the three months ended November 30, 2023. A copy of the release is furnished herewith as Exhibit 99.1.

Item 8.01 Other Events.

On January 10, 2024, the Company held a conference call to discuss its financial results for the three months ended November 30, 2023. The Company has prepared a transcript of that conference call, a copy of which is annexed hereto as Exhibit 99.2.

The information furnished under Items 2.02 and 8.01, including Exhibits 99.1 and 99.2, shall not be deemed to be filed for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

VOXX INTERNATIONAL CORPORATION

(Registrant) |

|

|

|

|

Date: |

January 16, 2024 |

By: |

/s/ Charles M. Stoehr |

|

|

|

Charles M. Stoehr

Senior Vice President

Chief Financial Officer |

Exhibit 99.1

VOXX International Corporation Reports its Fiscal 2024 Third Quarter Financial Results

ORLANDO, FL.— January 9, 2024 — VOXX International Corporation (NASDAQ: VOXX), a leading manufacturer and distributor of automotive and consumer technologies for the global markets, today announced its financial results for its Fiscal 2024 third quarter ended November 30, 2023.

Commenting on the Company’s results and business outlook, Pat Lavelle, Chief Executive Officer stated, “For the third quarter comparisons, our gross margins grew by 90 basis points and our operating expenses improved by over 2%, resulting in operating income comparable with the prior year period, despite lower sales. The market remained challenging, especially at retail, and the UAW strike adversely impacted our Automotive business as well during the quarter. We see the economy slowing and we’re taking steps to mitigate any further risk, while at the same time, have introduced several new products in new categories that are growing, with an impressive product line-up and a strong customer base in place as we enter calendar year 2024. We expect some continued softness near-term but believe conditions should improve throughout 2024 and into our Fiscal 2025.”

Fiscal 2024 and Fiscal 2023 Third Quarter Comparisons

Net sales in the Fiscal 2024 third quarter ended November 30, 2023, were $135.3 million as compared to $143.1 million in the Fiscal 2023 third quarter ended November 30, 2022, a decrease of $7.8 million or 5.4%. On a sequential basis as compared to the Fiscal 2024 second quarter, net sales increased by $21.6 million or 19.0%.

•Automotive Electronics segment net sales in the Fiscal 2024 third quarter were $35.9 million as compared to $48.6 million in the comparable year-ago period, a decrease of $12.6 million or 26.0%. For the same comparable periods, OEM product sales were $10.0 million as compared to $19.1 million and aftermarket product sales were $25.9 million as compared to $29.4 million. The decline in year-over-year sales was primarily related to lower sales of OEM and aftermarket rear-seat entertainment products and aftermarket security products, partially offset by an increase in satellite radio products.

•Consumer Electronics segment net sales in the Fiscal 2024 third quarter were $100.0 million as compared to $94.1 million in the comparable year-ago period, an increase of $5.9 million or 6.2%. For the same comparable periods, Premium Audio product sales were $79.9 million as compared to $73.5 million and other consumer electronics (“CE”) product sales were $20.1 million as compared to $20.6 million. The increase in Premium Audio product sales was primarily related to higher sales of premium home theater speakers and wireless speakers domestically and internationally, offset by lower sales domestically of Onkyo and Pioneer products. Other CE product sales for the comparable periods declined across various categories primarily due to retail softness and global economic challenges, partially offset by higher sales of domestic accessory products driven by the launch of new RCA hearing aid products.

•Biometrics segment net sales in the Fiscal 2024 third quarter were $0.1 million as compared to $0.3 million in the comparable year-ago period, with the decline primarily related to a large one-time sale during the prior year period that did not repeat in the current year.

1

The gross margin in the Fiscal 2024 third quarter was 26.9% as compared to 26.0% in the Fiscal 2023 third quarter, an increase of 90 basis points. Gross margin improved by 170 basis points on a sequential basis when compared to the Fiscal 2024 second quarter.

When comparing the Fiscal 2024 and Fiscal 2023 third quarters, the Company reported:

•Automotive Electronics segment gross margin of 25.8% as compared to 24.6%. The year-over-year improvement of 120 basis points was primarily related to better margins as a result of relocated manufacturing operations, ongoing cost savings and greater efficiencies. The improvement was also related to product mix given less volume of lower-margin OEM rear-seat entertainment products. On a sequential basis when compared to the Fiscal 2024 second quarter, Automotive Electronics segment gross margin improved by 150 basis points.

•Consumer Electronics segment gross margin of 27.1% as compared to 26.6%. The year-over-year improvement of 50 basis points was primarily driven by higher sales of premium home speakers, improved vendor pricing, and fewer close-out and promotional sales for the comparable periods. Lower sales of Onkyo and Pioneer products and challenging market conditions continued to impact gross margins, despite the year-over-year segment improvement. On a sequential basis when compared to the Fiscal 2024 second quarter, Consumer Electronics segment gross margin improved by 160 basis points.

•Biometrics segment gross margin of 1.1% as compared to 22.7% in the comparable year-ago period.

Total operating expenses in the Fiscal 2024 third quarter were $34.1 million as compared to $34.8 million in the comparable Fiscal 2023 period, an improvement of $0.7 million or 2.1%. On a sequential basis when compared to the Fiscal 2024 second quarter, total operating expenses declined by $3.1 million or 8.2%.

When comparing the Fiscal 2024 and Fiscal 2023 third quarters, the Company reported:

•Selling expenses of $11.0 million as compared to $11.4 million. The year-over-year improvement of $0.4 million or 3.9%, was driven by lower employee salaries, related benefits and payroll taxes, as well as lower advertising and website expenses. This was partially offset by higher advertising expenses related to the Company’s new RCA hearing aid products.

•General and administrative (“G&A”) expenses of $15.9 million as compared to $15.9. The Company had lower salary and occupancy expenses and lower depreciation and amortization expense, which was partially offset by higher legal and professional fees primarily related to the Company’s final arbitration award that will be paid in the fourth quarter of Fiscal 2024.

•Engineering and technical support expenses of $7.1 million as compared to $7.2 million. The year-over-year improvement of $0.1 million or 1.5%, was primarily due to a decline in labor expenses resulting from a reduction in the use of outside labor, lower payroll tax expense, offset by an increase in research and development expenses related to the timing of projects.

•Restructuring expenses, which primarily represented costs related to the relocation of certain OEM production operations from Florida to Mexico, decreased by $0.2 million.

The Company reported operating income of $2.3 million in both the Fiscal 2024 and Fiscal 2023 third quarters. The Company reported an operating loss of $8.5 million in its Fiscal 2024 second quarter, representing a sequential improvement of $10.8 million.

2

Total other expense, net, in the Fiscal 2024 third quarter increased by $1.4 million over the comparable Fiscal 2023 third quarter. Interest and bank charges increased by $0.4 million, equity in income of equity investee declined by $0.9 million, and the charges related to the final arbitration award associated with the Seaguard arbitration declined by $0.2 million. Other, net was negatively impacted by $0.3 million, primarily as a result of losses in foreign currency.

Net income attributable to VOXX International Corporation in the Fiscal 2024 third quarter was $1.9 million as compared to a net income attributable to VOXX International Corporation of $7.4 million in the comparable Fiscal 2023 period. The Company reported basic and diluted income per share attributable to VOXX International Corporation of $0.08 in the Fiscal 2024 third quarter as compared to basic and diluted income per common share attributable to VOXX International Corporation of $0.30, in the comparable Fiscal 2023 period.

The Company reported Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) in the Fiscal 2024 third quarter of $6.5 million as compared to EBITDA in the comparable Fiscal 2023 third quarter of $7.7 million. Adjusted EBITDA in the Fiscal 2024 third quarter was $8.0 million as compared to Adjusted EBITDA of $9.0 million in the comparable Fiscal 2023 period.

Fiscal 2024 and Fiscal 2023 Nine-month Comparisons

Net sales in the Fiscal 2024 nine-month period ended November 30, 2023, were $360.8 million as compared to $397.5 million in the Fiscal 2023 nine-month period ended November 30, 2022, a decrease of $36.7 million or 9.2%.

•Automotive Electronics segment net sales in the Fiscal 2024 nine-month period were $109.7 million as compared to $125.4 million in the comparable year-ago period, a decrease of $15.6 million or 12.5%. For the same comparable periods, OEM product sales were $46.5 million as compared to $51.1 million and aftermarket product sales were $63.2 million as compared to $74.3 million. The decline in OEM sales was primarily related to lower customer volumes which were due in part to the United Auto Workers strike that took place during the Company’s Fiscal 2024 third quarter. The decline in aftermarket sales was primarily related to lower sales of aftermarket security and rear-seat entertainment products, partially offset by an increase in sales of satellite radio and collision avoidance products.

•Consumer Electronics segment net sales in the Fiscal 2024 nine-month period were $251.4 million as compared to $271.1 million in the comparable year-ago period, a decrease of $19.7 million or 7.3%. For the same comparable periods, Premium Audio product sales were $180.7 million as compared to $212.6 million and other CE product sales were $70.7 million as compared to $58.4 million. The decline in Premium Audio product sales was primarily related to ongoing softness in the global economy, which impacted consumer spending across categories, as well as higher sales in the prior year period related to Onkyo and Pioneer products. The increase in other CE product sales was primarily due to higher European accessory sales of the Company’s new balcony solar power products, and higher domestic accessory sales driven by wireless speakers and the Company’s new RCA hearing aids.

•Biometrics segment net sales in the Fiscal 2024 nine-month period were $0.4 million as compared to $0.7 million in the comparable year-ago period, with the decline primarily related to a large one-time sale during the prior year period that did not repeat in the current year.

The gross margin in the Fiscal 2024 nine-month period was 25.6% as compared to 25.1% in the Fiscal 2023 nine-month period, an increase of 50 basis points. For the same comparable periods, the Company reported:

•Automotive Electronics segment gross margin of 23.6% as compared to 23.8%. The 20 basis point decline in gross margin was primarily related to product mix and lower sales of higher margin products such as

3

security and rear-seat entertainment, partially offset by the positive impact from transitioning certain manufacturing to Mexico.

•Consumer Electronics segment gross margin of 26.2% as compared to 25.5%. The year-over-year improvement of 70 basis points was primarily driven by higher sales of wireless accessory speakers domestically and the Company’s new balcony solar products internationally, partially offset by lower sales volumes of Onkyo and Pioneer products, among other factors.

•Biometrics segment gross margin of 26.4% as compared to 31.3% in the comparable year-ago period.

Total operating expenses in the Fiscal 2024 nine-month period were $110.2 million as compared to $114.0 million in the comparable Fiscal 2023 period, an improvement of $3.8 million or 3.3%. Excluding restructuring expenses and acquisition costs, total operating expenses for the comparable Fiscal 2024 and Fiscal 2023 nine-month periods declined by $5.3 million or 4.7%. For the same comparable periods:

•Selling expenses of $32.2 million as compared to $35.6 million. The year-over-year improvement of $3.4 million or 9.6%, was primarily driven by lower sales employee salaries and related benefits and payroll taxes, as well as due to Employee Retention Credits which have offset payroll tax expenses. Additionally, commission expenses and advertising and website expenses decreased, partially offset by higher advertising related to RCA hearing aids.

•General and administrative expenses of $52.6 million as compared to $53.9 million. The year-over-year improvement of $1.3 million or 2.4%, was primarily due to lower depreciation and amortization expense, office expense, legal and professional fees, as well as taxes, licensing fees and payroll taxes. This was partially offset by an increase in bad debt expense due to releases in the prior year that did not repeat, as well as higher travel expenses.

•Engineering and technical support expenses of $23.3 million as compared to $23.8 million. The year-over-year improvement of $0.6 million or 2.5%, was primarily due to lower research and development expenses and ongoing cost cutting measures. There was also a decline in payroll expense which was partially offset by higher travel expense.

•Acquisition costs of $0.1 million were incurred in the Fiscal 2023 nine-month period associated with the acquisition of certain assets of Onkyo Home Entertainment Corporation which was completed in September 2021. There were no related costs incurred in the comparable Fiscal 2024 period.

•Restructuring expenses of $2.2 million increased by $1.6 million as the Company initiated actions to lower its headcount and other expenses during the Fiscal 2024 nine-month period, as well as actions taken to relocate certain OEM production operations from Florida to Mexico.

The Company reported an operating loss in the Fiscal 2024 nine-month period of $17.7 million as compared to an operating loss of $14.3 million in the comparable Fiscal 2023 period.

Total other expense, net, in the Fiscal 2024 nine-month period was $5.9 million as compared to total other expense, net, of $3.9 million in the comparable Fiscal 2023 period. Interest and bank charges increased by $1.9 million and charges related to the final arbitration award associated with the Seaguard arbitration increased by $0.4 million. Equity in income of equity investee declined by $1.4 million and other, net improved by $1.7 million, primarily as a result of changes in foreign currency.

Net loss attributable to VOXX International Corporation in the Fiscal 2024 nine-month period was $19.9 million as compared to a net loss attributable to VOXX International Corporation of $9.3 million in the comparable Fiscal

4

2023 period. The Company reported a basic and diluted loss per share attributable to VOXX International Corporation of $0.85 in the Fiscal 2024 nine-month period as compared to a basic and diluted loss per common share attributable to VOXX International Corporation of $0.38, in the comparable Fiscal 2023 period.

The Company reported an EBITDA loss in the Fiscal 2024 nine-month period of $6.5 million as compared to an EBITDA loss in the comparable Fiscal 2023 period of $3.2 million. The Company reported Adjusted EBITDA in the Fiscal 2024 nine-month period of $3.0 million as compared to Adjusted EBITDA in the comparable Fiscal 2023 period of $5.6 million.

Balance Sheet Update

As of November 30, 2023, the Company had cash and cash equivalents of $10.4 million as compared to $6.1 million as of February 28, 2023. Total debt as of November 30, 2023 was $48.6 million as compared to $39.2 million as of February 28, 2023. The increase in total debt is primarily related to a $10.0 million increase in outstanding debt on the Company’s Domestic Credit Facility as a result of higher borrowings during the current period, partially offset by a $0.4 million decline associated with the Company’s Florida mortgage and a $0.2 million decline in the shareholder loan payable to Sharp Corporation. Total long-term debt, net of debt issuance costs as of November 30, 2023 was $47.1 million as compared to $37.5 million as of February 28, 2023.

Seaguard Settlement (Subsequent Event)

On December 22, 2023, the Company and Seaguard entered into a Settlement Agreement and Mutual Release, with an effective date of January 10, 2024, in which the Company agreed to pay Seaguard $42.0 million in full and final settlement of all judgments and claims that have been awarded or asserted or could have been asserted by Seaguard against the Company and its subsidiaries. An initial payment of $10.0 million was made on December 27, 2023 and the final payment of $32.0 million is due on the agreement effective date of January 10, 2024. Upon receipt of the final payment, Seaguard will file a Satisfaction of Judgment with the court and a Dismissal of the Arbitration with the American Arbitration Association. The Company will file a Dismissal of the Appeal within five days after the filing of the Satisfaction of Judgment. Further, the Company filed a Form 8-K with the Securities and Exchange Commission on January 3, 2024, announcing the terms of the settlement.

Conference Call Information

The Company will be hosting its conference call and webcast on Wednesday, January 10, 2024 at 10:00 a.m. ET.

•To attend the webcast: https://edge.media-server.com/mmc/p/63gsho99

•To access by phone: https://register.vevent.com/register/BI1d071c6695bf4c8986ac36ee001b1125

Participants are requested to register a day in advance or at a minimum 15 minutes before the start of the call. Those wishing to ask questions following management’s remarks should use the dial-in numbers provided.

•A replay of the webcast will be available approximately two hours after the call and archived under “Events and Presentations” in the Investor Relations section of the Company’s website at https://investors.voxxintl.com/events-and-presentations

Non-GAAP Measures

EBITDA and Adjusted EBITDA are not financial measures recognized by GAAP. EBITDA represents net loss attributable to VOXX International Corporation and Subsidiaries, computed in accordance with GAAP, before interest expense and bank charges, taxes, and depreciation and amortization. Adjusted EBITDA represents EBITDA adjusted for stock-based compensation expense, gains on the sale of certain assets, foreign currency losses (gains), restructuring expenses, acquisition costs, certain non-routine legal fees, and awards. Depreciation, amortization, stock-based compensation, and foreign currency losses (gains) are non-cash items.

5

We present EBITDA and Adjusted EBITDA in this release because we consider them to be useful and appropriate supplemental measures of our performance. Adjusted EBITDA helps us to evaluate our performance without the effects of certain GAAP calculations that may not have a direct cash impact on our current operating performance. In addition, the exclusion of certain costs or gains relating to certain events allows for a more meaningful comparison of our results from period-to-period. These non-GAAP measures, as we define them, are not necessarily comparable to similarly entitled measures of other companies and may not be an appropriate measure for performance relative to other companies. EBITDA and Adjusted EBITDA should not be assessed in isolation from, are not intended to represent, and should not be considered to be more meaningful measures than, or alternatives to, measures of operating performance as determined in accordance with GAAP.

About VOXX International Corporation

VOXX International Corporation (NASDAQ: VOXX) has grown into a leader in Automotive Electronics and Consumer Electronics, with emerging Biometrics technology to capitalize on the increased need for advanced security. Over the past several decades, with a portfolio of approximately 35 trusted brands, VOXX has built market-leading positions in in-vehicle entertainment, automotive security, reception products, a number of premium audio market segments, and more. VOXX is a global company, with an extensive distribution network that includes power retailers, mass merchandisers, 12-volt specialists and many of the world's leading automotive manufacturers. For additional information, please visit our website at www.voxxintl.com

Safe Harbor Statement

Except for historical information contained herein, statements made in this release constitute forward-looking statements and thus may involve certain risks and uncertainties. All forward-looking statements made in this release are based on currently available information and the Company assumes no responsibility to update any such forward-looking statements. The following factors, among others, may cause actual results to differ materially from the results suggested in the forward-looking statements. The factors include, but are not limited to the risk factors described in the “Risk Factors” section of the Company's Annual Report on Form 10-K for the fiscal year ended February 28, 2023, and other filings made by the Company from time to time with the SEC, as such descriptions may be updated or amended in any future reports we file with the SEC. The factors described in such SEC filings include, without limitation: impacts related to the COVID-19 pandemic, global supply shortages and logistics costs and delays; global economic trends; cybersecurity risks; risks that may result from changes in the Company's business operations; operational execution by our businesses; changes in law, regulation or policy that may affect our businesses; our ability to increase margins through implementation of operational improvements, restructuring and other cost reduction methods; our ability to keep pace with technological advances; significant competition in the automotive electronics, consumer electronics and biometrics businesses; our relationships with key suppliers and customers; quality and consumer acceptance of newly introduced products; market volatility; non-availability of product; excess inventory; price and product competition; new product introductions; foreign currency fluctuations; and restrictive debt covenants. Many of the foregoing risks and uncertainties are, and will be, exacerbated by the War in the Ukraine and any worsening of the global business and economic environment as a result.

Investor Relations Contact:

Glenn Wiener, GW Communications (for VOXX)

Email: gwiener@GWCco.com

Tables to Follow

6

VOXX International Corporation and Subsidiaries Consolidated Balance Sheets

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

November 30,

2023 |

|

|

February 28,

2023 |

|

|

|

(unaudited) |

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

10,393 |

|

|

$ |

6,134 |

|

Accounts receivable, net of allowances of $2,165 and $2,515 at November 30, 2023 and February 28, 2023, respectively |

|

|

91,631 |

|

|

|

82,753 |

|

Inventory |

|

|

146,244 |

|

|

|

175,129 |

|

Receivables from vendors |

|

|

1,668 |

|

|

|

112 |

|

Due from GalvanEyes LLC |

|

|

2,547 |

|

|

|

— |

|

Prepaid expenses and other current assets |

|

|

20,259 |

|

|

|

19,817 |

|

Income tax receivable |

|

|

1,354 |

|

|

|

1,076 |

|

Total current assets |

|

|

274,096 |

|

|

|

285,021 |

|

Investment securities |

|

|

909 |

|

|

|

1,053 |

|

Equity investment |

|

|

21,523 |

|

|

|

22,018 |

|

Property, plant and equipment, net |

|

|

45,857 |

|

|

|

47,044 |

|

Operating lease, right of use assets |

|

|

3,082 |

|

|

|

3,632 |

|

Goodwill |

|

|

64,122 |

|

|

|

65,308 |

|

Intangible assets, net |

|

|

84,760 |

|

|

|

90,437 |

|

Deferred income tax assets |

|

|

1,209 |

|

|

|

1,218 |

|

Other assets |

|

|

2,831 |

|

|

|

3,720 |

|

Total assets |

|

$ |

498,389 |

|

|

$ |

519,451 |

|

Liabilities, Redeemable Equity, Redeemable Non-Controlling Interest, and Stockholders' Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

35,818 |

|

|

$ |

35,099 |

|

Accrued expenses and other current liabilities |

|

|

41,073 |

|

|

|

41,856 |

|

Income taxes payable |

|

|

170 |

|

|

|

2,276 |

|

Accrued sales incentives |

|

|

24,036 |

|

|

|

21,778 |

|

Contingent consideration, current |

|

|

— |

|

|

|

4,500 |

|

Final arbitration award payable |

|

|

46,738 |

|

|

|

43,388 |

|

Contract liabilities, current |

|

|

3,341 |

|

|

|

3,990 |

|

Current portion of long-term debt |

|

|

500 |

|

|

|

500 |

|

Total current liabilities |

|

|

151,676 |

|

|

|

153,387 |

|

Long-term debt, net of debt issuance costs |

|

|

47,088 |

|

|

|

37,513 |

|

Finance lease liabilities, less current portion |

|

|

319 |

|

|

|

63 |

|

Operating lease liabilities, less current portion |

|

|

2,192 |

|

|

|

2,509 |

|

Deferred compensation |

|

|

909 |

|

|

|

1,053 |

|

Deferred income tax liabilities |

|

|

4,777 |

|

|

|

4,855 |

|

Other tax liabilities |

|

|

768 |

|

|

|

966 |

|

Prepaid ownership interest in EyeLock LLC due to GalvanEyes LLC |

|

|

9,817 |

|

|

|

7,317 |

|

Other long-term liabilities |

|

|

2,120 |

|

|

|

2,947 |

|

Total liabilities |

|

|

219,666 |

|

|

|

210,610 |

|

Commitments and contingencies |

|

|

|

|

|

|

Redeemable equity |

|

|

4,087 |

|

|

|

4,018 |

|

Redeemable non-controlling interest |

|

|

(2,691 |

) |

|

|

232 |

|

Stockholders' equity: |

|

|

|

|

|

|

Preferred stock: |

|

|

|

|

|

|

No shares issued or outstanding |

|

|

— |

|

|

|

— |

|

Common stock: |

|

|

|

|

|

|

Class A, $.01 par value, 60,000,000 shares authorized, 24,558,184 and 24,538,184 shares issued and 20,332,009 and 21,167,527 shares outstanding at November 30, 2023 and February 28, 2023, respectively |

|

|

246 |

|

|

|

246 |

|

Class B Convertible, $.01 par value, 10,000,000 shares authorized, 2,260,954 shares issued and outstanding at both November 30, 2023 and February 28, 2023 |

|

|

22 |

|

|

|

22 |

|

Paid-in capital |

|

|

297,220 |

|

|

|

296,577 |

|

Retained earnings |

|

|

79,232 |

|

|

|

97,997 |

|

Accumulated other comprehensive loss |

|

|

(17,405 |

) |

|

|

(18,680 |

) |

Less: Treasury stock, at cost, 4,226,175 and 3,370,657 shares of Class A Common Stock at November 30, 2023 and February 28, 2023, respectively |

|

|

(38,940 |

) |

|

|

(30,285 |

) |

Less: Redeemable equity |

|

|

(4,087 |

) |

|

|

(4,018 |

) |

Total VOXX International Corporation stockholders' equity |

|

|

316,288 |

|

|

|

341,859 |

|

Non-controlling interest |

|

|

(38,961 |

) |

|

|

(37,268 |

) |

Total stockholders' equity |

|

|

277,327 |

|

|

|

304,591 |

|

Total liabilities, redeemable equity, redeemable non-controlling interest, and stockholders' equity |

|

$ |

498,389 |

|

|

$ |

519,451 |

|

7

VOXX International Corporation and Subsidiaries

Unaudited Consolidated Statements of Operations and Comprehensive Income (Loss)

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

November 30, |

|

|

Nine months ended

November 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net sales |

|

$ |

135,260 |

|

|

$ |

143,055 |

|

|

$ |

360,828 |

|

|

$ |

397,492 |

|

Cost of sales |

|

|

98,918 |

|

|

|

105,918 |

|

|

|

268,281 |

|

|

|

297,859 |

|

Gross profit |

|

|

36,342 |

|

|

|

37,137 |

|

|

|

92,547 |

|

|

|

99,633 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Selling |

|

|

10,967 |

|

|

|

11,413 |

|

|

|

32,154 |

|

|

|

35,563 |

|

General and administrative |

|

|

15,944 |

|

|

|

15,920 |

|

|

|

52,621 |

|

|

|

53,903 |

|

Engineering and technical support |

|

|

7,063 |

|

|

|

7,171 |

|

|

|

23,257 |

|

|

|

23,844 |

|

Acquisition costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

136 |

|

Restructuring expenses |

|

|

101 |

|

|

|

303 |

|

|

|

2,168 |

|

|

|

532 |

|

Total operating expenses |

|

|

34,075 |

|

|

|

34,807 |

|

|

|

110,200 |

|

|

|

113,978 |

|

Operating income (loss) |

|

|

2,267 |

|

|

|

2,330 |

|

|

|

(17,653 |

) |

|

|

(14,345 |

) |

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and bank charges |

|

|

(1,892 |

) |

|

|

(1,460 |

) |

|

|

(5,011 |

) |

|

|

(3,101 |

) |

Equity in income of equity investee |

|

|

1,101 |

|

|

|

2,022 |

|

|

|

3,958 |

|

|

|

5,373 |

|

Final arbitration award (see Note 24) |

|

|

(752 |

) |

|

|

(986 |

) |

|

|

(3,350 |

) |

|

|

(2,958 |

) |

Other, net |

|

|

156 |

|

|

|

460 |

|

|

|

(1,497 |

) |

|

|

(3,169 |

) |

Total other (expense) income, net |

|

|

(1,387 |

) |

|

|

36 |

|

|

|

(5,900 |

) |

|

|

(3,855 |

) |

Income (loss) before income taxes |

|

|

880 |

|

|

|

2,366 |

|

|

|

(23,553 |

) |

|

|

(18,200 |

) |

Income tax expense (benefit) |

|

|

97 |

|

|

|

(3,988 |

) |

|

|

(54 |

) |

|

|

(5,788 |

) |

Net income (loss) |

|

|

783 |

|

|

|

6,354 |

|

|

|

(23,499 |

) |

|

|

(12,412 |

) |

Less: net loss attributable to non-controlling interest |

|

|

(1,129 |

) |

|

|

(1,067 |

) |

|

|

(3,609 |

) |

|

|

(3,090 |

) |

Net income (loss) attributable to VOXX International Corporation and Subsidiaries |

|

$ |

1,912 |

|

|

$ |

7,421 |

|

|

$ |

(19,890 |

) |

|

$ |

(9,322 |

) |

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

279 |

|

|

|

957 |

|

|

|

1,337 |

|

|

|

(2,665 |

) |

Derivatives designated for hedging |

|

|

(29 |

) |

|

|

78 |

|

|

|

(55 |

) |

|

|

264 |

|

Pension plan adjustments |

|

|

(1 |

) |

|

|

(19 |

) |

|

|

(7 |

) |

|

|

53 |

|

Other comprehensive income (loss), net of tax |

|

|

249 |

|

|

|

1,016 |

|

|

|

1,275 |

|

|

|

(2,348 |

) |

Comprehensive income (loss) attributable to VOXX International Corporation and Subsidiaries |

|

$ |

2,161 |

|

|

$ |

8,437 |

|

|

$ |

(18,615 |

) |

|

$ |

(11,670 |

) |

Income (loss) per share - basic: Attributable to VOXX International Corporation and Subsidiaries |

|

$ |

0.08 |

|

|

$ |

0.30 |

|

|

$ |

(0.85 |

) |

|

$ |

(0.38 |

) |

Income (loss) per share - diluted: Attributable to VOXX International Corporation and Subsidiaries |

|

$ |

0.08 |

|

|

$ |

0.30 |

|

|

$ |

(0.85 |

) |

|

$ |

(0.38 |

) |

Weighted-average common shares outstanding (basic) |

|

|

23,270,834 |

|

|

|

24,389,375 |

|

|

|

23,510,578 |

|

|

|

24,408,541 |

|

Weighted-average common shares outstanding (diluted) |

|

|

23,467,022 |

|

|

|

24,621,359 |

|

|

|

23,510,578 |

|

|

|

24,408,541 |

|

8

Reconciliation of GAAP Net Loss Attributable to VOXX International Corporation

to EBITDA and Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

November 30, |

|

|

Nine months ended

November 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net income (loss) attributable to VOXX International Corporation and Subsidiaries |

|

$ |

1,912 |

|

|

$ |

7,421 |

|

|

$ |

(19,890 |

) |

|

$ |

(9,322 |

) |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense and bank charges (1) |

|

|

1,688 |

|

|

|

1,263 |

|

|

|

4,405 |

|

|

|

2,500 |

|

Depreciation and amortization (1) |

|

|

2,808 |

|

|

|

3,053 |

|

|

|

9,003 |

|

|

|

9,406 |

|

Income tax expense (benefit) |

|

|

97 |

|

|

|

(3,988 |

) |

|

|

(54 |

) |

|

|

(5,788 |

) |

EBITDA |

|

|

6,505 |

|

|

|

7,749 |

|

|

|

(6,536 |

) |

|

|

(3,204 |

) |

Stock-based compensation |

|

|

177 |

|

|

|

145 |

|

|

|

643 |

|

|

|

407 |

|

Gain on sale of tradename |

|

|

— |

|

|

|

— |

|

|

|

(450 |

) |

|

|

— |

|

Foreign currency losses (gains) (1) |

|

|

144 |

|

|

|

(223 |

) |

|

|

2,320 |

|

|

|

3,867 |

|

Restructuring expenses |

|

|

101 |

|

|

|

303 |

|

|

|

2,168 |

|

|

|

532 |

|

Acquisition costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

136 |

|

Non-routine legal fees |

|

|

318 |

|

|

|

28 |

|

|

|

1,549 |

|

|

|

886 |

|

Final arbitration award |

|

|

752 |

|

|

|

986 |

|

|

|

3,350 |

|

|

|

2,958 |

|

Adjusted EBITDA |

|

$ |

7,997 |

|

|

$ |

8,988 |

|

|

$ |

3,044 |

|

|

$ |

5,582 |

|

(1)For purposes of calculating Adjusted EBITDA for the Company, interest expense and bank charges, depreciation and amortization, as well as foreign currency losses (gains) have been adjusted in order to exclude the non-controlling interest portion of these expenses attributable to EyeLock LLC and Onkyo Technology KK.

9

Exhibit 99.2

VOXX (2024 Q3 Results)

January 10, 2024

Corporate Speakers:

•Glenn Wiener; GW Communications; Investor Relations

•Patrick Lavelle; VOXX International; Director, President and Chief Executive Officer

•Charles Stoehr; VOXX International; Senior Vice President and Chief Financial Officer

Operator^ Good day, ladies and gentlemen. Thank you for standing by. Welcome to VOXX International Third Quarter Earnings Conference Call. (Operator Instructions) Please note that today's conference is being recorded. I now hand the conference over to your speaker host, Mr. Glenn Wiener. Please go ahead.

Glenn Wiener^ Olivia. Good morning. And welcome to VOXX International's Fiscal 2024 Third Quarter Nine Month Results Conference Call. Yesterday, we filed our Form 10-Q, and we issued our press and both documents can be found in the Investor Relations section of the website at www.voxxintl.com, and we expect to post an updated investor presentation later this week.

Speaking from management today will be Pat Lavelle, Chief Executive Officer, who is currently out in Las Vegas, attending the 2024 Consumer Electronics Show; and Michael Stoehr, Senior Vice President and Chief Financial Officer. Their remarks will be followed by question and answers.

As for today, I would like to remind everyone that except for historical information contained herein, statements made on today's call and webcast that would constitute forward-looking statements are based on currently available information. The company assumes no responsibility to update any such forward-looking statements and I'd like you to point you to the risk factors associated with our business were detailed in our Form 10-K for the period ended February 28, 2023. Thank you for your continued support, and I would like to now turn the call over to Pat.

Patrick Lavelle^ Thank you, Glenn. And good morning, everyone. Let me start off by wishing you all a happy and healthy new year. As Glenn said, I'm out with our team at CES and show kicked-off yesterday. It's early, but the response to our new lineup and the various projects that we have in development has been very positive, and I'm expecting more of the same over the next few days.

2023 has been tough for everyone, not just as VOXX. Our entire industry has had a very challenging year. And we're certainly happy to be turning the page. The global economy remains challenging, and we're doing all that we can to navigate through those challenges, focusing three primary areas: protecting and growing sales in both the short and long term, improving gross margins through supply chain and internal efficiencies, and lowering both our fixed and variable expenses.

During the quarter, we were successful achieving two of these three objectives as our gross margins grew by 90 basis points, and our operating expenses improved by a little over 2%. Sales declined roughly 5.4% with Consumer up and Automotive down. But overall, operating income was the same as the prior year. Mike will provide more financial details during his remarks, and I'll focus on the segments, what's happening and what we expect to close out the year and as we move into fiscal 2025.

So let me start with Consumer as we have a lot of new news to report. Consumer sales came -- were up over 6% in Q3, with Premium Audio the driver. This is a big positive for us as the segment has been on the decline since the big bump that we had from [COVID]. We made a lot of changes and investments and they're starting to pay off as evidenced by the growth this quarter amidst very challenging global economic environments.

Within Premium Audio, we saw good growth in North America market in Q3, driven by home speakers, wireless speaker systems and our new lines of party speaker systems. Europe was up as well, but our APAC sales declined as the market continues to be hard pressed. Overall, our Premium Audio business had a strong quarter with a number of new products on the horizon in new and rapidly growing categories.

Looking at the recent NPD report for November, industry-wide speaker sales were down approximately 17%, but we were only down 9%. [AVR] sales were down 15%, and we were down 14%. The takeaway is somewhat positive, while our Premium Audio sales are down year-to-date. We are growing our market share, especially domestically and the new products and the new categories that we introduced here at the show and those that will launch in the early part of next year should help drive future growth into fiscal '25.

Here at CES, we had a complete lineup on display under all of our audio brands. And as I mentioned last quarter, we have developed a completely new sound bar offering and had a number of new products on display, some of which have launched with others to be launched early this year. Our big announcement was the all-new Klipsch Flexus Sound System powered by Onkyo. This is the first product that combines the Klipsch's Acoustics with Onkyo's electronic technology. It officially comes to market this year, and we have high hopes for this product, as do our customers.

I also talked on prior calls about our new party speakers, our Gig series, which was introduced in September in time for the holiday season, and it has done growth and has helped offset weakness in other areas. Party speakers are one of the hottest categories in the industry. It is competitive, but the market is open. We have great products slated for launch in the coming months.

Here at CES, we unveiled our new Klipsch GiG series, one product with the GiG [Max], is the first-party speaker that will be introduced with Klipsch legendary, horn-loaded technology that we've been perfecting since 1946.

These are powerful, portable speakers, top-of-the-line products that deliver Klipsch's heritage sound.

Another highlight was the launch of our new Klipsch Music City portable Bluetooth speakers. We unveiled three new models, the Klipsch Austin, the Klipsch Nashville and the Klipsch Detroit, with the Detroit being the premier model and the biggest in our Music City series. In this series, along with other compatible Klipsch models, feature the innovative Klipsch broadcast mode, which allows you to connect up to 100 speakers at once to create a fully immersive listening experience wirelessly through Bluetooth. We have strong Premium Audio lineup in 2024 and moving into 2025.

And also some big news on Monday with respect to Klipsch, and the Panasonic Automotive collaboration that we've had for a number of years. Panasonic Automotive Systems Company of America and INFINITI jointly announced on Monday, the partnership between our companies. The all-new and flagship 2025 INFINITI QX80 will feature the premium Klipsch reference premier audio system powered by Panasonic.

The car with our speaker system is being featured here at CES in Panasonic booth and the vehicle is set to debut later this spring. It has 24 specifically designed titanium tweeters, a high-performance subwoofer, roof-mounted speakers and Panasonic proprietary DJX 3D surround sound processing. This adds to our program that we announced last year on the Dodge EV RAM truck.

As for other CE products, sales were essentially flat with last year. We saw growth in sales of our recently launched RCA hearing aid products with some other puts and taste between the categories. Year-to-date, other CE sales are up approximately 21%. And while you expect some softness near term due to the overall environment, we have strong share in a diverse customer base, and we expect to see growth in some of the newer categories to help combat this. A big launch at CES for our accessory group with the new hearing aids under RCA.

We launched four new products to expand our presence in this category. We also unveiled a new wireless HDMI Signal centers under the Turk brand, which connects devices to TVs and enables streaming content without cables. As well, we had additional other products under our RCA, Turk and AR brands.

Moving on to Automotive. We had some challenges in Q3 as our OEM business was almost cut in half as we and our customers felt the impact of the UAW strike. As always, we base plans on our customer forecast, which obviously were not met when production lines were either impacted or completely shut down. With the strike now behind us, we expect to see the Automotive business begin to normalize. With the contracts that we

have been awarded, we should be in a position of growth. However, with the general economy slowing based on the Fed's moves to date and car prices at all-time highs, we anticipate some near-term softness.

During the quarter, Automotive sales were down 26%, with the miss in OEM, as I just mentioned. And primarily in rear-seat infotainment, which are the biggest -- for our OEM business. Business with Ford and Stellantis were both down due to UAW strike with Nissan sales also down.

VSM sales were up slightly given the volume of programs in the heavy-duty truck market and the new lighting programs previously awarded. We have a lot of OEM business in front of us, but with all of the supply chain and production issues over the past year or two, it has been challenging, and we are mitigating higher costs and improving our margins where we can.

Our aftermarket business was down approximately $3.5 million, general economy and slow down due to lower inventories at new car dealers, impacted sales across most categories, with some up and others down.

For the year, the Automotive segment sales are off about 12.5%, and Q4 is going to be up based on the current conditions, though, again, some loosening on the OEM side with the strike behind us. And as we move into fiscal '25 and in the years that follow, we have significant opportunities for value creation through the programs that we've been awarded and the ones that we're on, which will give us new business opportunities to build our future pipeline.

As for biometrics, sales came in less than anticipated, mostly due to the low in implementation. All of the projects that I had mentioned previously are still in motion. Nothing has changed. But during the quarter, we experienced very little progression in terms of rollouts. It was more testing, discussions and planning. We should see sequential improvements in Q4 and assuming all those as planned, some nice growth in 2025.

My comments from Q2 remain: projects with governments, financial service companies, health care companies, car dealerships and more continue and we hope to have more to report in the coming quarters as these programs build.

To sum it up, our sales were down in Q3, but operating income remained flat with the improvements we made to our business, resulting in better gross margins and lower expenses. As we look into Q4 in the first half of calendar '24, we believe it's going to be tight. Look at what's happening now. Interest rates almost all-time highs, and that impacts not only consumers, but our customers as well. Credit card debt is very high.

Government subsidies from the pandemic are over. After a decent holiday season amid all of these challenges, we feel the economy is slowing. And therefore, we expect the next few months may be soft, and we're going to continue to be diligent in managing our costs.

However, these are the same conditions that also get the Fed to start cutting rates and stimulating the economy, and that will be good for consumers and for VOXX. The new launch of products, especially within the Consumer segment should help offset some of the economic softness and the steps to reduce overhead that have taken place should materialize further in the fourth quarter and throughout next year.

Margin should also increase given new products and programs underway in those launching this year. We are in constant communication with our customers. We're managing our inventory tightly, and we're looking at all aspects of our business to get back to profitability. With that, I'd like to thank you. And then I'll turn the call over to Mike, and then we'll open it up for questions. Michael?

Charles Stoehr^ Thanks, Pat. And good morning, everyone. I'll primarily cover our 9-month results and balance sheet, but first, a few comments with respect to the third quarter.

As Pat mentioned, net sales were down 5.4%, gross margins grew by 90 basis points and operating expenses declined 2.1%. This resulted in operating income for both fiscal '24 and fiscal 2023 third quarters of $2.3 million. Net income attributable to VOXX was $1.9 million, which declined by approximately $5.5 million.

This is principally due to a $4 million income tax benefit recorded in the prior fiscal year period compared to an expense of $100,000. Additional variance was in other income and expense. We reported total other expense of $1.4 million versus total other income of $36,000 in the comparable period -- prior period.

Additionally, EBITDA was $6.5 million compared to $7.7 million and adjusted EBITDA was $8 million compared to $9 million. As for the 9-month comparisons, all numbers are for the period ended November 30, 2023, and November 30, 2022. We reported 9-month sales of $360.8 million, a decline of $36.7 million or 9.2%.

Within this, Automotive segment sales were down $15.6 million with OEM product sales down $4.6 million, and aftermarket product sales down $11.1 million. Consumer segment sales were down $19.7 million with Premium Audio product sales down $31.9 million and other CE product sales up by $12.2 million. Biometric sales declined by approximately $300,000.

Sales are down for the year, and we'll continue to see some pressure in Q4 consistent with Pat's remarks. Our Automotive business was impacted by the strike and customer production lines and we're hoping we'll see some more normalization in the coming quarters. Retail is tight, but we're starting to turn the corner with new products in Premium Audio and our accessory products. Those other CE products have held up well this year with solar power balcony products, wireless speakers and hearing aids, helping economic and consumer softness.

We continue to take steps to improve our gross margins, which were up 170 basis points sequentially and up 50 basis points year-to-date. For the 9-month period comparisons, gross margins came in at 25.6% as compared to 25.1% with Automotive segment margins down 20 basis points and Consumer segment margins up 70 basis points.

Over time, we expect Automotive margins to improve with the relocation of manufacturing to Mexico price increases and other steps we've taken to enhance our supply chain and lower costs.

However, we need production to catch up. Consumer segment margins continue to improve sequentially. And again, new products should help continue to drive improvements if we maintain volume and of course, depending on product mix and customer programs.

Total operating expenses. For the 9-month comparison were $110.2 million as compared to $114 million, an improvement of $3.8 million or 3.3%. Excluding acquisition and restructuring costs, total operating expenses improved by $5.3 million or 4.7%. We're continuing to look at all aspects of our operations to remove nonessential costs and are looking to lower our overhead further in light of the ongoing economic softness. We're tightly managing expenses, inventory and our cash.

Selling expenses declined $3.4 million, an improvement of 9.6% versus the prior year. G&A expenses declined $1.3 million, an improvement of 2.4%, and engineering and technical support expenses declined by approximately $600,000, an improvement of 2.5%. We had restructuring costs of approximately $2.2 million related to our restructuring and manufacturing relocation programs in fiscal 2024 year-to-date. This compares approximately -- to approximately $500,000 of restructuring costs and $100,000 of acquisition costs in fiscal 2023 9-month period.

We reported an operating loss of $17.7 million compared to an operating loss of $14.3 million, principally due to lower sales volume. Net loss attributable to VOXX was $19.9 million compared to a net loss of $9.3 million. EBITDA for fiscal 2024 9-month period was a loss of $6.5 million, and adjusted EBITDA was $3 million. This compares to an EBITDA loss in comparable fiscal 2023 9-month period of $3.2 million and an adjusted EBITDA of [$5.6 million]. Moving on to the balance sheet.

As of November 30, we had cash and cash equivalents of $10.4 million, which compares to $6.1 million as of our fiscal 2023 year-end on February 28. Cash and cash equivalents stood at $5.9 million at the end of our fiscal 2024 second quarter ended August 31. Our accounts receivable increased by $8.9 million as we're in the higher volume holiday season.

Our inventory declined by $28.9 million for the nine months as we are moving through all the product lines. We still have inventory on hand to move through, and we're focused on that given the launches underway and upcoming, especially in our Consumer segment.

As I noted during our last quarterly call, we expect inventories to continue to decline as we move through the fourth and first quarters.

Total debt stood at $48.6 million as compared to $39.2 million as of February 28. The increase of $9.4 million relates to a $10 million increase in our borrowings associated with our domestic credit line, partially offset by a $400,000 decline to our Florida mortgage and a $200,000 decline in the amount owed on the shareholder loan, payable to Sharp as part of our joint venture.

Total long-term debt, net of debt issuance costs was $47.1 million as compared to $37.5 million as of February 28. As noted, the increase in total debt relates to the increase in our borrowings. This is typical during the third quarter as our sales and receivables increased than normally collected during the fourth quarter. This will be the case.

During the fourth quarter, we'll be using our credit facility to support the final arbitration settlement, which was announced earlier this month. As reported, we entered into a settlement agreement and mutual release with Seaguard with an effective date of today, January 10. We have agreed to pay Seaguard $42 million in total, of which a payment of $10 million was already on December 27 and the final payment of $32 million will be made today.

While we're not happy with the [loans], we feel it is our best interest as well as our shareholders to move forward and focus on our business and stop accruing interest and legal fees, which continue to mount.

With the banking relationships in place, and the cash availability we have, the payment will be made, and we have sufficient working capital to fund our business moving forward. Of course, we're hopeful that market conditions improve sooner rather than later, and we can get back to cash flow generation and profitability. Operator, we're now ready to open the call for questions.

Glenn Wiener^ Thank you, Mike.

Operator^ (Operator Instructions) And there [happen] to be no questions in the queue at this time. I'll turn the call back over to Mr. Pat Lavelle.

Patrick Lavelle^ Okay. Thank you. I want to thank you for taking the time to join us this morning. I look forward to 2024 with enthusiasm as new product has always been the lifeline and the key to our growth, and we have a lot of new products scheduled for next year. So with that, thank you, and have a great day.

Operator^ Ladies and gentlemen, that does conclude conference for today. Thank you for your participation. You may now disconnect.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

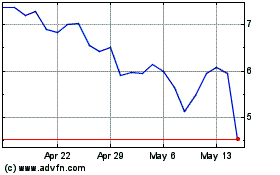

VOXX (NASDAQ:VOXX)

Historical Stock Chart

From Dec 2024 to Jan 2025

VOXX (NASDAQ:VOXX)

Historical Stock Chart

From Jan 2024 to Jan 2025