false

0001701963

A1

CA

0001701963

2024-10-07

2024-10-07

0001701963

VS:CommonSharesMember

2024-10-07

2024-10-07

0001701963

VS:UnitWarrantsMember

2024-10-07

2024-10-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 7, 2024

| VERSUS SYSTEMS INC. |

| (Exact name of registrant as specified in its charter) |

| British Columbia |

|

001-39885 |

|

46-4542599 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

2900 – 500 Burrard Street

Vancouver BC V6C 0A3 Canada |

| (Address of principal executive offices, including Zip Code) |

Registrant’s telephone number, including

area code: (604) 639-4457

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Shares |

|

VS |

|

The Nasdaq Capital Market |

| Unit A Warrants |

|

VSSYW |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On October 7, 2024, Versus Systems Inc. (the “Company”)

entered into two agreements with ASPIS Cyber Technologies, Inc. (“ASPIS”). ASPIS, an affiliate of the Company’s largest

shareholder—Cronus Equity Capital Group, LLC (“CECG”)—is a cloud-based mobile endpoint cyber security technology

company for anti-tapping and anti-hacking within the government, finance, gaming and social media sectors. CEGC holds approximately 39.5%

of the outstanding common shares of the Company based on the amount of Company common shares issued and outstanding as of August 12, 2024,

without regard to the transactions described in this Current Report on Form 8-K. CEGC’s managing member and its Schedule 13D appointee, which Schedule 13D, as may be amended, was originally filed with the Securities and Exchange Commission December 7, 2023, is the Chairman and a shareholder of ASPIS. One of the Company’s

directors—Luis Goldner—is a shareholder of ASPIS and serves on the board of directors of ASPIS.

The first agreement is a Technology License and

Software Development Agreement (the “License Agreement”), entered into on October 7, 2024 and effective as of October 4, 2024,

which provides for the Company to license its gamification, engagement and QR code technology (the “Versus Technology”) to

ASPIS for use in ASPIS’s website business and for development of additional functionality for the Versus Technology. The second

agreement is a Business Funding Agreement (the “Funding Agreement,” and together with the License Agreement, the “Investment

Documents”)), entered into and effective October 7, 2024, which provides for ASPIS to make a $2,500,000 investment in the Company.

The Investment Documents are the basis of the Company’s

Compliance Plan that it submitted to The Nasdaq Capital Market (“Nasdaq”) on October 7, 2024 (the “Company’s Plan”)

outlining how the Company intends to regain compliance with Nasdaq’s minimum shareholders’ equity requirement (the “Required

Amount”) of at least $2,500,000 as outlined in Nasdaq Listing Rule 5550(b)(1). The Investment Documents are expected to allow the

Company to exceed the Required Amount and maintain the Required Amount until at least September 30, 2025.

License Agreement

Pursuant to the License Agreement,

the Company granted ASPIS a perpetual, non-exclusive, non-transferable (except as provided in the License Agreement) license to use the

Versus Technology in ASPIS’s website business that provides cybersecurity technology. ASPIS will pay for any required technology

modifications, improvements and developments to the Versus Technology (the “Modified Technology”) in addition to a license

fee (the “License Fee”) of $165,000 per month beginning in January 2025. The Company will retain ownership of the Modified

Technology and ASPIS will hold an exclusive license to use the Modified Technology in the cybersecurity industry so long as ASPIS continues

to pay the License Fee. The Company and ASPIS expect development of the Modified Technology to begin immediately. The License Agreement

has an initial term of one (1) year with successive renewal terms of one (1) year each upon ASPIS’s written approval, subject to

earlier termination by the Company or ASPIS.

The License Agreement will be filed as an exhibit

to the Company’s next Quarterly Report on Form 10-Q and is incorporated herein by reference. The foregoing description of the License

Agreement and the transactions contemplated thereby is qualified in its entirety by reference to the full text of the License Agreement.

Funding Agreement

Pursuant to the Funding Agreement,

| (i) | ASPIS agreed to deliver to the Company $500,000 (the “Initial Investment Amount” and the date of funding the Initial

Investment Amount, which has not yet occurred, the “Initial Funding Date”), and agreed to, on or before November 15,

2024 (the date of the wire, the “Second Funding Date”), deliver to the Company $2,000,000 (collectively with the

Initial Investment Amount, the “Investment Amount”); and |

| (ii) | the Company agreed to, on the Initial Funding Date, issue to ASPIS a senior convertible promissory note (the “Note”) in

the principal amount of the Investment Amount (or such lesser amount if less is funded; such actually funded amount, the “Funded

Amount”) that provides for, upon approval (the “Shareholder Approval”) by the Company’s shareholders of the Conversion

and the Company’s redomiciling to Delaware at the Company’s annual shareholders meeting expected to be held in December 2024,

if received, automatic conversion (the “Conversion”) of the Funded Amount plus, at ASPIS’s option, any accrued and unpaid

interest thereon, into units (“Units”) of the Company, each equal to (a) one common share (“Common Share”) of

the Company and (b) a warrant (each, a “Warrant,” and collectively, the “Warrants”) to purchase one-half of one

Common Share at a purchase price of $4.00 per one whole share, exercisable for five (5) years, at a conversion rate (the “Conversion

Rate”) equal to the greater of (1) a prior five-day volume weighted average price of the Common Shares based on the Initial Funding

Date and (2) $1.16 per share; |

provided, however, that if the Conversion would result in the issuance

of a fractional share, the Company would pay ASPIS an amount in cash equal to the product of the then-purchase value of one Common Share

and such fraction, unless such amount is less than $10.00.

Also pursuant to the Funding Agreement, the

Company and ASPIS agreed to, on or about the Initial Funding Date, enter into a subscription agreement pursuant to which ASPIS would

purchase from the Company and the Company would sell to ASPIS the Note, the Units issuable upon the Conversion, the Common Shares

and Warrants issuable upon the Conversion and the Common Shares issuable upon exercise of the Warrants.

Notwithstanding anything to the contrary in the

foregoing, if Nasdaq denies the Company’s Plan, then the amount due on the Second Funding Date would be suspended until the Company’s

Plan is approved and the underlying deficiency is rectified. In addition, if Nasdaq determines that the Funding Amount is insufficient

to meet the Required Amount and requires additional funding (the “Additional Amount”), ASPIS will have the exclusive right

and obligation (or the right, but not the obligation, if greater than $500,000) to provide the Additional Amount on the same terms as

the Funding Amount. In the event that ASPIS funds an Additional Amount prior to the Conversion, if the Conversion occurs, the Note would

be amended to include the Additional Amount. In the event that ASPIS funds an Additional Amount following the Conversion, if the Conversion

occurs, the Company would issue a new note for the Additional Amount unless outside securities counsel advises the Company that it could

issue the stock directly to ASPIS.

Under the terms of the Investment Documents, assuming

the Company receives shareholder approval of the issuance of equity under the Note and the Company’s redomiciling to Delaware, no

Additional Amount is funded and a Conversion Rate of $1.16 per share, ASPIS would receive upon the Conversion and exercise of the Warrants,

2,155,172 Common Shares and warrants to purchase an additional 1,077,586 shares. Upon the Conversion, ASPIS would hold approximately 45.8%

of the outstanding Common Shares of the Company. This percentage does not account for shares issuable upon exercise of the Warrants or

ASPIS’s option under the Note to convert any accrued and unpaid cash interest on the Note into Units, which would result in additional

shares issuable to ASPIS.

The Funding Agreement will be filed as an exhibit

to the Company’s next Quarterly Report on Form 10-Q and is incorporated herein by reference. The foregoing description of the Funding

Agreement and the transactions contemplated thereby is qualified in its entirety by reference to the full text of the Funding Agreement.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking

statements”. Statements in this Current Report on Form 8-K which are not purely historical are forward-looking statements and include

any statements regarding beliefs, plans, outlook, expectations or intentions regarding the future, including statements regarding the

Company’s plans to regain compliance. It is important to note that actual outcomes and the Company’s actual results could

differ materially from those in such forward-looking statements. Actual results could differ from those projected in any forward-looking

statements due to numerous factors. Such factors include, among others: uncertainty whether the Company’s Plan will be accepted

or, if accepted, whether the Company will regain compliance with the minimum shareholders’ equity rule within the timelines required

by Nasdaq, failing which, the Company’s securities will be delisted by Nasdaq; uncertainty whether the Company would appeal any

delisting notice or whether any such appeal would be successful, failing which, the Company’s securities will be delisted by Nasdaq;

the risk that delisting of the Company’s securities may have a material adverse effect on the Company’s share liquidity and

trading price and on the Company’s ability to obtain financing and continue its business; whether the Company will realize long-term

benefits and synergies from the partnership with ASPIS; and the risk of changes in business strategy or plans. Readers should also refer

to the risk disclosures outlined in the Company’s quarterly reports on Form 10-Q, the Company’s annual reports on Form 10-K,

and the Company’s other disclosure documents filed from time-to-time with the Securities and Exchange Commission at www.sec.gov

and the Company’s interim and annual filings and other disclosure documents filed in Canada from time-to-time under the Company's

profile on SEDAR+ at https://www.sedarplus.ca.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VERSUS SYSTEMS INC. |

| |

|

|

| Date: October 15, 2024 |

By: |

/s/ Curtis Wolfe |

| |

Name: |

Curtis Wolfe |

| |

Title: |

Interim Chief Executive Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=VS_CommonSharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=VS_UnitWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

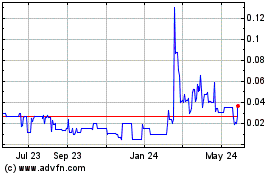

Versus Systems (NASDAQ:VSSYW)

Historical Stock Chart

From Jan 2025 to Feb 2025

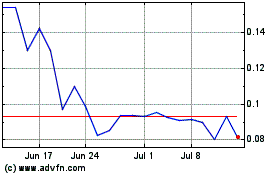

Versus Systems (NASDAQ:VSSYW)

Historical Stock Chart

From Feb 2024 to Feb 2025