Waterstone Financial, Inc. Announces Results of Operations for the Quarter and Nine Months Ended September 30, 2024

23 October 2024 - 7:00AM

Waterstone Financial, Inc. (NASDAQ: WSBF), holding company for

WaterStone Bank, reported net income of $4.7 million, or

$0.26 per diluted share, for the quarter ended September

30, 2024, compared to net income of $3.3 million, or $0.16 per

diluted share for the quarter ended September 30, 2023. Net income

per diluted share was $0.72 for the nine months

ended September 30, 2024, compared to net income per

diluted share of $0.46 for the nine months

ended September 30, 2023.

“The Community Banking segment achieved

growth in its loan and core deposit (excluding

brokered deposits) balances,” said William

Bruss, Chief Executive Officer of Waterstone Financial, Inc. “We

continue to maintain strong asset quality metrics and remain in a

net recovery position, resulting in a negative provision during the

quarter. While the decrease in our wholesale borrowing rate during

the quarter captures a portion of the benefit from the 50 bps cut

in the Federal Funds rate during September, the competitive retail

funding environment remains a headwind. The Mortgage Banking

segment experienced a decrease in fundings; however, it remained

profitable due in large part to our continued focus on cost

control. Waterstone Financial, Inc. remained active in share

repurchases and once again declared a dividend, as we are committed

to shareholder returns.”

Highlights of the Quarter Ended September

30, 2024

Waterstone Financial, Inc. (Consolidated)

|

● |

Consolidated net income of Waterstone Financial, Inc. totaled $4.7

million for the quarter ended September 30, 2024, compared to net

income of $3.3 million for the quarter ended September 30,

2023. |

|

● |

Consolidated return on average assets was 0.83% for the quarter

ended September 30, 2024, compared to 0.58% for the quarter

ended September 30, 2023. |

|

● |

Consolidated return on average equity was 5.55% for the quarter

ended September 30, 2024, and 3.63% for the quarter ended

September 30, 2023. |

|

● |

Dividends declared during the quarter ended September 30,

2024, totaled $0.15 per common share. |

|

● |

During the quarter ended September 30, 2024, we repurchased

approximately 71,000 shares at a cost (including the federal excise

tax) of $979,000, or $13.75 per share. |

|

● |

Nonperforming assets as a percentage of total assets was 0.25% at

September 30, 2024, 0.25% at June 30, 2024, and 0.20% at

September 30, 2023. |

|

● |

Past due loans as a percentage of total loans was 0.63% at

September 30, 2024, 0.76% at June 30, 2024, and 0.53% at September

30, 2023. |

|

● |

Book value per share was $17.58 at September 30, 2024 and

$16.94 at December 31, 2023. |

Community Banking Segment

|

● |

Pre-tax income totaled $5.6 million for the quarter

ended September 30, 2024, which represents a $14,000, or 0.2%,

decrease compared to $5.7 million for the quarter ended September

30, 2023. |

|

● |

Net interest income totaled $12.3 million for the quarter ended

September 30, 2024, which represents a $181,000, or 1.5%, decrease

compared to $12.4 million for the quarter ended September 30,

2023. |

|

● |

Average loans held for investment totaled $1.69 billion during the

quarter ended September 30, 2024, which represents an increase of

$60.9 million, or 3.7%, compared to $1.63 billion for the quarter

ended September 30, 2023. The increase was primarily due to

increases in the construction, commercial real estate, and over

four family mortgages. Average loans held for investment increased

$19.7 million compared to $1.67 billion for the quarter ended June

30, 2024. The increase was primarily due to increases in

construction and over four family mortgages. |

|

● |

Net interest margin decreased 13 basis points to 2.13% for the

quarter ended September 30, 2024, compared to 2.26% for the

quarter ended September 30, 2023, which was a result of an increase

in weighted average cost of deposits and borrowings as the federal

funds rate increases resulted in increased funding rates. Net

interest margin increased 12 basis points compared to 2.01% for the

quarter ended June 30, 2024, primarily driven by an increase in

weighted average yield on loans receivable and held for sale.

|

|

● |

Past due loans at the community banking segment totaled $8.0

million at September 30, 2024, $9.3 million at June 30, 2024,

and $6.7 million at September 30, 2023. |

|

● |

The segment had a negative provision for credit losses related to

funded loans of $218,000 for the quarter

ended September 30, 2024, compared to a provision for

credit losses related to funded loans of $206,000 for the

quarter ended September 30, 2023. The current quarter decrease

was primarily due to a decrease in historical loss rates, net

recoveries for the period, and improvements in certain

internal asset quality metrics offset by an adjustment in the

qualitative factors primarily related to increases in economic

risks related to commercial real estate loans during the

quarter. The negative provision for credit losses related to

unfunded loan commitments was $84,000 for the quarter

ended September 30, 2024, compared to a provision for

credit losses related to unfunded loan commitments of $239,000 for

the quarter ended September 30, 2023. The negative provision for

credit losses related to unfunded loan commitments for

the quarter ended September 30, 2024, was due

primarily to a decrease of loans that are currently

waiting to be funded compared to the prior quarter

end. |

|

● |

The efficiency ratio, a non-GAAP ratio, was 60.35% for the quarter

ended September 30, 2024, compared to 54.43% for the quarter ended

September 30, 2023. |

|

● |

Average deposits (excluding escrow accounts) totaled $1.25 billion

during the quarter ended September 30, 2024, an increase of $47.9

million, or 4.0%, compared to $1.20 billion during the quarter

ended September 30, 2023. Average deposits increased $27.6 million,

or 9.1% annualized, compared to $1.22 billion for the quarter ended

June 30, 2024. The increases were primarily due to an

increase in certificates of deposit balances. The segment had

$2.0 million in brokered certificate of deposits at September 30,

2024. |

Mortgage Banking Segment

|

● |

Pre-tax income totaled $144,000 for the quarter ended September 30,

2024, compared to $2.1 million of pre-tax loss for the quarter

ended September 30, 2023. |

|

● |

Loan originations decreased $38.8 million, or 6.5%, to $558.7

million during the quarter ended September 30, 2024, compared to

$597.6 million during the quarter ended September 30, 2023.

Origination volume relative to purchase activity accounted for

88.9% of originations for the quarter ended September 30,

2024, compared to 95.4% of total originations for the quarter ended

September 30, 2023. |

|

● |

Mortgage banking non-interest income decreased $66,000, or 0.3%, to

$21.4 million for the quarter ended September 30, 2024, compared to

$21.5 million for the quarter ended September 30, 2023. |

|

● |

Gross margin on loans sold totaled 3.83% for the quarter ended

September 30, 2024, compared to 3.62% for the quarter ended

September 30, 2023. |

|

● |

Total compensation, payroll taxes and other employee benefits

decreased $1.3 million, or 7.3%, to $15.9 million during the

quarter ended September 30, 2024, compared to $17.2 million

during the quarter ended September 30, 2023. The decrease primarily

related to decreased salary expense and incentives expense driven

by reduced employee headcount and a decrease in new branches added

over the past year. |

About Waterstone Financial, Inc.

Waterstone Financial, Inc. is the savings and loan holding

company for WaterStone Bank. WaterStone Bank was established in

1921 and offers a full suite of personal and business banking

products. The Bank has branches in Wauwatosa/State St, Brookfield,

Fox Point/North Shore, Franklin/Hales Corners, Germantown/Menomonee

Falls, Greenfield/Loomis Rd, Milwaukee/Oklahoma Ave, Oak Creek/27th

St, Oak Creek/Howell Ave, Oconomowoc/Lake Country, Pewaukee,

Waukesha, West Allis/Greenfield Ave, and West Allis/National Ave,

Wisconsin. WaterStone Bank is the parent company to Waterstone

Mortgage, which has the ability to lend in 48 states. For more

information about WaterStone Bank, go to

http://www.wsbonline.com.

Forward-Looking Statements

This press release contains statements or information that may

constitute forward-looking statements within the meaning of the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Such forward-looking statements include, without

limitation, statements regarding expected financial and operating

activities and results that are preceded by, followed by, or that

include words such as “may,” “expects,” “anticipates,” “estimates”

or “believes.” Any such statements are based upon current

expectations that involve a number of risks and uncertainties and

are subject to important factors that could cause actual results to

differ materially from those anticipated by the forward-looking

statements. Factors that might cause such a difference include

changes in interest rates; demand for products and services; the

degree of competition by traditional and nontraditional

competitors; changes in banking regulation or actions by bank

regulators; changes in tax laws; the impact of technological

advances; governmental and regulatory policy changes; the outcomes

of contingencies; trends in customer behavior as well as their

ability to repay loans; changes in local real estate values;

changes in the national and local economies; and other factors,

including risk factors referenced in Item 1A. Risk Factors in

Waterstone’s most recent Annual Report on Form 10-K and as may be

described from time to time in Waterstone’s subsequent SEC filings,

which factors are incorporated herein by reference. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which reflect only Waterstone’s belief as of the date

of this press release.

Non-GAAP Financial

Measures

Management uses non-GAAP financial information

in its analysis of the Company's performance. Management believes

that this non-GAAP measure provides a greater understanding of

ongoing operations and enhance comparability of results of

operations with prior periods. The Company’s management believes

that investors may use this non-GAAP measure to analyze the

Company's financial performance without the impact of unusual items

or events that may obscure trends in the Company’s underlying

performance. This non-GAAP data should be considered in addition to

results prepared in accordance with GAAP, and is not a substitute

for, or superior to, GAAP results. Limitations associated with

non-GAAP financial measures include the risks that persons might

disagree as to the appropriateness of items included in this

measure and that different companies might calculate this measure

differently.

Contact: Mark R. GerkeChief Financial

Officer414-459-4012markgerke@wsbonline.com

|

WATERSTONE FINANCIAL, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

INCOME(Unaudited) |

| |

For The Three Months Ended September 30, |

|

For The Nine Months Ended September 30, |

| |

2024 |

|

|

2023 |

|

2024 |

|

|

2023 |

| |

(In Thousands, except per share amounts) |

|

Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

$ |

26,590 |

|

|

$ |

23,825 |

|

$ |

76,675 |

|

|

$ |

65,860 |

| Mortgage-related

securities |

|

1,137 |

|

|

|

1,060 |

|

|

3,360 |

|

|

|

2,972 |

| Debt securities, federal funds

sold and short-term investments |

|

1,464 |

|

|

|

1,492 |

|

|

4,081 |

|

|

|

3,682 |

| Total interest income |

|

29,191 |

|

|

|

26,377 |

|

|

84,116 |

|

|

|

72,514 |

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

10,477 |

|

|

|

7,442 |

|

|

29,163 |

|

|

|

17,485 |

| Borrowings |

|

7,197 |

|

|

|

6,946 |

|

|

21,620 |

|

|

|

16,570 |

| Total interest expense |

|

17,674 |

|

|

|

14,388 |

|

|

50,783 |

|

|

|

34,055 |

| Net interest income |

|

11,517 |

|

|

|

11,989 |

|

|

33,333 |

|

|

|

38,459 |

| Provision (credit) for credit

losses |

|

(377 |

) |

|

|

445 |

|

|

(535 |

) |

|

|

1,091 |

| Net interest income after

provision (credit) for loan losses |

|

11,894 |

|

|

|

11,544 |

|

|

33,868 |

|

|

|

37,368 |

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Service charges on loans and

deposits |

|

545 |

|

|

|

450 |

|

|

1,434 |

|

|

|

1,491 |

| Increase in cash surrender

value of life insurance |

|

410 |

|

|

|

334 |

|

|

1,562 |

|

|

|

1,373 |

| Mortgage banking income |

|

21,294 |

|

|

|

21,172 |

|

|

66,200 |

|

|

|

59,856 |

| Other |

|

303 |

|

|

|

274 |

|

|

1,101 |

|

|

|

1,589 |

| Total noninterest income |

|

22,552 |

|

|

|

22,230 |

|

|

70,297 |

|

|

|

64,309 |

| Noninterest expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compensation, payroll taxes,

and other employee benefits |

|

21,017 |

|

|

|

21,588 |

|

|

62,655 |

|

|

|

64,035 |

| Occupancy, office furniture,

and equipment |

|

1,857 |

|

|

|

1,993 |

|

|

5,994 |

|

|

|

6,302 |

| Advertising |

|

926 |

|

|

|

916 |

|

|

2,827 |

|

|

|

2,749 |

| Data processing |

|

1,297 |

|

|

|

1,229 |

|

|

3,745 |

|

|

|

3,441 |

| Communications |

|

232 |

|

|

|

243 |

|

|

698 |

|

|

|

719 |

| Professional fees |

|

569 |

|

|

|

745 |

|

|

2,070 |

|

|

|

1,779 |

| Real estate owned |

|

- |

|

|

|

1 |

|

|

14 |

|

|

|

3 |

| Loan processing expense |

|

697 |

|

|

|

722 |

|

|

2,604 |

|

|

|

2,672 |

| Other |

|

1,965 |

|

|

|

2,584 |

|

|

5,762 |

|

|

|

8,350 |

| Total noninterest

expenses |

|

28,560 |

|

|

|

30,021 |

|

|

86,369 |

|

|

|

90,050 |

| Income before income

taxes |

|

5,886 |

|

|

|

3,753 |

|

|

17,796 |

|

|

|

11,627 |

| Income tax expense |

|

1,158 |

|

|

|

500 |

|

|

4,318 |

|

|

|

2,212 |

| Net income |

$ |

4,728 |

|

|

$ |

3,253 |

|

$ |

13,478 |

|

|

$ |

9,415 |

| Income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.26 |

|

|

$ |

0.16 |

|

$ |

0.72 |

|

|

$ |

0.46 |

| Diluted |

$ |

0.26 |

|

|

$ |

0.16 |

|

$ |

0.72 |

|

|

$ |

0.46 |

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

18,350 |

|

|

|

19,998 |

|

|

18,631 |

|

|

|

20,420 |

| Diluted |

|

18,445 |

|

|

|

20,022 |

|

|

18,677 |

|

|

|

20,473 |

|

WATERSTONE FINANCIAL, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION |

| |

September 30, |

|

|

December 31, |

|

| |

2024 |

|

|

2023 |

|

| |

(Unaudited) |

|

|

|

|

|

| Assets |

(In Thousands, except per share amounts) |

|

|

Cash |

$ |

35,770 |

|

|

$ |

30,667 |

|

| Federal funds sold |

|

5,359 |

|

|

|

5,493 |

|

| Interest-earning deposits in

other financial institutions and other short-term investments |

|

278 |

|

|

|

261 |

|

| Cash and cash equivalents |

|

41,407 |

|

|

|

36,421 |

|

| Securities available for sale

(at fair value) |

|

213,164 |

|

|

|

204,907 |

|

| Loans held for sale (at fair

value) |

|

155,846 |

|

|

|

164,993 |

|

| Loans receivable |

|

1,695,403 |

|

|

|

1,664,215 |

|

| Less: Allowance for credit

losses ("ACL") - loans |

|

18,198 |

|

|

|

18,549 |

|

| Loans receivable, net |

|

1,677,205 |

|

|

|

1,645,666 |

|

| |

|

|

|

|

|

|

|

| Office properties and

equipment, net |

|

19,450 |

|

|

|

19,995 |

|

| Federal Home Loan Bank stock

(at cost) |

|

21,681 |

|

|

|

20,880 |

|

| Cash surrender value of life

insurance |

|

69,601 |

|

|

|

67,859 |

|

| Real estate owned, net |

|

145 |

|

|

|

254 |

|

| Prepaid expenses and other

assets |

|

45,837 |

|

|

|

52,414 |

|

| Total assets |

$ |

2,244,336 |

|

|

$ |

2,213,389 |

|

| |

|

|

|

|

|

|

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

| Demand deposits |

$ |

180,449 |

|

|

$ |

187,107 |

|

| Money market and savings

deposits |

|

279,188 |

|

|

|

273,233 |

|

| Time deposits |

|

804,204 |

|

|

|

730,284 |

|

| Total deposits |

|

1,263,841 |

|

|

|

1,190,624 |

|

| |

|

|

|

|

|

|

|

| Borrowings |

|

560,127 |

|

|

|

611,054 |

|

| Advance payments by borrowers

for taxes |

|

27,847 |

|

|

|

6,607 |

|

| Other liabilities |

|

50,519 |

|

|

|

61,048 |

|

| Total liabilities |

|

1,902,334 |

|

|

|

1,869,333 |

|

| |

|

|

|

|

|

|

|

| Shareholders' equity: |

|

|

|

|

|

|

|

| Preferred stock |

|

- |

|

|

|

- |

|

| Common stock |

|

194 |

|

|

|

203 |

|

| Additional paid-in

capital |

|

92,789 |

|

|

|

103,908 |

|

| Retained earnings |

|

274,748 |

|

|

|

269,606 |

|

| Unearned ESOP shares |

|

(10,979 |

) |

|

|

(11,869 |

) |

| Accumulated other

comprehensive loss, net of taxes |

|

(14,750 |

) |

|

|

(17,792 |

) |

| Total shareholders'

equity |

|

342,002 |

|

|

|

344,056 |

|

| Total liabilities and

shareholders' equity |

$ |

2,244,336 |

|

|

$ |

2,213,389 |

|

| |

|

|

|

|

|

|

|

| Share

Information |

|

|

|

|

|

|

|

| Shares outstanding |

|

19,457 |

|

|

|

20,315 |

|

| Book value per share |

$ |

17.58 |

|

|

$ |

16.94 |

|

|

WATERSTONE FINANCIAL, INC. AND

SUBSIDIARIESSUMMARY OF KEY QUARTERLY FINANCIAL

DATA(Unaudited) |

| |

At or For the Three Months Ended |

|

| |

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

| |

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| |

(Dollars in Thousands, except per share amounts) |

|

|

Condensed Results of Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

$ |

11,517 |

|

|

$ |

10,679 |

|

|

$ |

11,137 |

|

|

$ |

11,756 |

|

|

$ |

11,989 |

|

| Provision (credit) for credit

losses |

|

(377 |

) |

|

|

(225 |

) |

|

|

67 |

|

|

|

(435 |

) |

|

|

445 |

|

| Total noninterest income |

|

22,552 |

|

|

|

26,497 |

|

|

|

21,248 |

|

|

|

16,876 |

|

|

|

22,230 |

|

| Total noninterest expense |

|

28,560 |

|

|

|

30,259 |

|

|

|

27,550 |

|

|

|

29,662 |

|

|

|

30,021 |

|

| Income (loss) before income

taxes (benefit) |

|

5,886 |

|

|

|

7,142 |

|

|

|

4,768 |

|

|

|

(595 |

) |

|

|

3,753 |

|

| Income tax expense

(benefit) |

|

1,158 |

|

|

|

1,430 |

|

|

|

1,730 |

|

|

|

(555 |

) |

|

|

500 |

|

| Net income (loss) |

$ |

4,728 |

|

|

$ |

5,712 |

|

|

$ |

3,038 |

|

|

$ |

(40 |

) |

|

$ |

3,253 |

|

| Income (loss) per share –

basic |

$ |

0.26 |

|

|

$ |

0.31 |

|

|

$ |

0.16 |

|

|

$ |

(0.00 |

) |

|

$ |

0.16 |

|

| Income (loss) per share –

diluted |

$ |

0.26 |

|

|

$ |

0.31 |

|

|

$ |

0.16 |

|

|

$ |

(0.00 |

) |

|

$ |

0.16 |

|

| Dividends declared per common

share |

$ |

0.15 |

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance Ratios

(annualized): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets -

QTD |

|

0.83 |

% |

|

|

1.02 |

% |

|

|

0.56 |

% |

|

|

-0.01 |

% |

|

|

0.58 |

% |

| Return on average equity -

QTD |

|

5.55 |

% |

|

|

6.84 |

% |

|

|

3.56 |

% |

|

|

-0.05 |

% |

|

|

3.63 |

% |

| Net interest margin - QTD |

|

2.13 |

% |

|

|

2.01 |

% |

|

|

2.15 |

% |

|

|

2.25 |

% |

|

|

2.26 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets -

YTD |

|

0.81 |

% |

|

|

0.79 |

% |

|

|

0.56 |

% |

|

|

0.44 |

% |

|

|

0.59 |

% |

| Return on average equity -

YTD |

|

5.30 |

% |

|

|

5.17 |

% |

|

|

3.56 |

% |

|

|

2.62 |

% |

|

|

3.46 |

% |

| Net interest margin - YTD |

|

2.09 |

% |

|

|

2.08 |

% |

|

|

2.15 |

% |

|

|

2.46 |

% |

|

|

2.53 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset Quality

Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Past due loans to total

loans |

|

0.63 |

% |

|

|

0.76 |

% |

|

|

0.64 |

% |

|

|

0.68 |

% |

|

|

0.53 |

% |

| Nonaccrual loans to total

loans |

|

0.32 |

% |

|

|

0.33 |

% |

|

|

0.29 |

% |

|

|

0.29 |

% |

|

|

0.25 |

% |

| Nonperforming assets to total

assets |

|

0.25 |

% |

|

|

0.25 |

% |

|

|

0.23 |

% |

|

|

0.23 |

% |

|

|

0.20 |

% |

| Allowance for credit losses -

loans to loans receivable |

|

1.07 |

% |

|

|

1.10 |

% |

|

|

1.11 |

% |

|

|

1.11 |

% |

|

|

1.12 |

% |

|

WATERSTONE FINANCIAL, INC. AND

SUBSIDIARIESSUMMARY OF QUARTERLY AVERAGE BALANCES

AND YIELD/COSTS(Unaudited) |

| |

At or For the Three Months Ended |

|

| |

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

| |

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| Average

balances |

(Dollars in Thousands) |

|

|

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans receivable and held for

sale |

$ |

1,870,627 |

|

|

$ |

1,859,608 |

|

|

$ |

1,805,102 |

|

|

$ |

1,797,988 |

|

|

$ |

1,797,233 |

|

| Mortgage related

securities |

|

170,221 |

|

|

|

171,895 |

|

|

|

172,077 |

|

|

|

172,863 |

|

|

|

174,202 |

|

| Debt securities, federal funds

sold and short-term investments |

|

115,270 |

|

|

|

107,992 |

|

|

|

110,431 |

|

|

|

106,504 |

|

|

|

132,935 |

|

|

Total interest-earning assets |

|

2,156,118 |

|

|

|

2,139,495 |

|

|

|

2,087,610 |

|

|

|

2,077,355 |

|

|

|

2,104,370 |

|

| Noninterest-earning

assets |

|

104,600 |

|

|

|

104,019 |

|

|

|

103,815 |

|

|

|

105,073 |

|

|

|

105,714 |

|

|

Total assets |

$ |

2,260,718 |

|

|

$ |

2,243,514 |

|

|

$ |

2,191,425 |

|

|

$ |

2,182,428 |

|

|

$ |

2,210,084 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing

liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demand accounts |

$ |

89,334 |

|

|

$ |

91,300 |

|

|

$ |

87,393 |

|

|

$ |

91,868 |

|

|

$ |

90,623 |

|

| Money market, savings, and

escrow accounts |

|

304,116 |

|

|

|

293,483 |

|

|

|

281,171 |

|

|

|

302,121 |

|

|

|

306,806 |

|

| Certificates of deposit |

|

786,228 |

|

|

|

758,252 |

|

|

|

739,543 |

|

|

|

735,418 |

|

|

|

719,708 |

|

|

Total interest-bearing deposits |

|

1,179,678 |

|

|

|

1,143,035 |

|

|

|

1,108,107 |

|

|

|

1,129,407 |

|

|

|

1,117,137 |

|

| Borrowings |

|

600,570 |

|

|

|

622,771 |

|

|

|

602,724 |

|

|

|

549,210 |

|

|

|

584,764 |

|

|

Total interest-bearing liabilities |

|

1,780,248 |

|

|

|

1,765,806 |

|

|

|

1,710,831 |

|

|

|

1,678,617 |

|

|

|

1,701,901 |

|

| Noninterest-bearing demand

deposits |

|

91,532 |

|

|

|

93,637 |

|

|

|

92,129 |

|

|

|

102,261 |

|

|

|

106,042 |

|

| Noninterest-bearing

liabilities |

|

49,787 |

|

|

|

48,315 |

|

|

|

45,484 |

|

|

|

56,859 |

|

|

|

46,805 |

|

|

Total liabilities |

|

1,921,567 |

|

|

|

1,907,758 |

|

|

|

1,848,444 |

|

|

|

1,837,737 |

|

|

|

1,854,748 |

|

| Equity |

|

339,151 |

|

|

|

335,756 |

|

|

|

342,981 |

|

|

|

344,691 |

|

|

|

355,336 |

|

|

Total liabilities and equity |

$ |

2,260,718 |

|

|

$ |

2,243,514 |

|

|

$ |

2,191,425 |

|

|

$ |

2,182,428 |

|

|

$ |

2,210,084 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Yield/Costs

(annualized) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans receivable and held for

sale |

|

5.65 |

% |

|

|

5.54 |

% |

|

|

5.46 |

% |

|

|

5.36 |

% |

|

|

5.26 |

% |

| Mortgage related

securities |

|

2.66 |

% |

|

|

2.63 |

% |

|

|

2.57 |

% |

|

|

2.48 |

% |

|

|

2.41 |

% |

| Debt securities, federal funds

sold and short-term investments |

|

5.05 |

% |

|

|

4.82 |

% |

|

|

4.82 |

% |

|

|

4.94 |

% |

|

|

4.45 |

% |

|

Total interest-earning assets |

|

5.39 |

% |

|

|

5.27 |

% |

|

|

5.18 |

% |

|

|

5.10 |

% |

|

|

4.97 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demand accounts |

|

0.11 |

% |

|

|

0.11 |

% |

|

|

0.11 |

% |

|

|

0.11 |

% |

|

|

0.11 |

% |

| Money market and savings

accounts |

|

1.94 |

% |

|

|

1.89 |

% |

|

|

1.79 |

% |

|

|

1.64 |

% |

|

|

1.54 |

% |

| Certificates of deposit |

|

4.54 |

% |

|

|

4.41 |

% |

|

|

4.19 |

% |

|

|

3.76 |

% |

|

|

3.43 |

% |

|

Total interest-bearing deposits |

|

3.53 |

% |

|

|

3.42 |

% |

|

|

3.26 |

% |

|

|

2.90 |

% |

|

|

2.64 |

% |

| Borrowings |

|

4.77 |

% |

|

|

4.92 |

% |

|

|

4.54 |

% |

|

|

4.83 |

% |

|

|

4.71 |

% |

|

Total interest-bearing liabilities |

|

3.95 |

% |

|

|

3.95 |

% |

|

|

3.71 |

% |

|

|

3.53 |

% |

|

|

3.35 |

% |

|

COMMUNITY BANKING SEGMENTSUMMARY OF KEY

QUARTERLY FINANCIAL DATA(Unaudited) |

| |

At or For the Three Months Ended |

|

| |

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

| |

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| |

(Dollars in Thousands) |

|

|

Condensed Results of Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

$ |

12,250 |

|

|

$ |

11,234 |

|

|

$ |

11,598 |

|

|

$ |

12,056 |

|

|

$ |

12,431 |

|

| Provision (credit) for credit

losses |

|

(302 |

) |

|

|

(279 |

) |

|

|

105 |

|

|

|

(550 |

) |

|

|

445 |

|

| Total noninterest income |

|

1,227 |

|

|

|

1,491 |

|

|

|

990 |

|

|

|

894 |

|

|

|

966 |

|

| Noninterest expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compensation, payroll taxes,

and other employee benefits |

|

5,326 |

|

|

|

5,116 |

|

|

|

5,360 |

|

|

|

5,397 |

|

|

|

4,618 |

|

| Occupancy, office furniture

and equipment |

|

904 |

|

|

|

983 |

|

|

|

1,000 |

|

|

|

916 |

|

|

|

852 |

|

| Advertising |

|

311 |

|

|

|

229 |

|

|

|

174 |

|

|

|

363 |

|

|

|

200 |

|

| Data processing |

|

720 |

|

|

|

687 |

|

|

|

693 |

|

|

|

626 |

|

|

|

672 |

|

| Communications |

|

80 |

|

|

|

72 |

|

|

|

65 |

|

|

|

75 |

|

|

|

70 |

|

| Professional fees |

|

190 |

|

|

|

177 |

|

|

|

208 |

|

|

|

186 |

|

|

|

176 |

|

| Real estate owned |

|

- |

|

|

|

1 |

|

|

|

13 |

|

|

|

1 |

|

|

|

1 |

|

| Loan processing expense |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Other |

|

602 |

|

|

|

672 |

|

|

|

691 |

|

|

|

628 |

|

|

|

703 |

|

| Total noninterest expense |

|

8,133 |

|

|

|

7,937 |

|

|

|

8,204 |

|

|

|

8,192 |

|

|

|

7,292 |

|

| Income before income

taxes |

|

5,646 |

|

|

|

5,067 |

|

|

|

4,279 |

|

|

|

5,308 |

|

|

|

5,660 |

|

| Income tax expense |

|

941 |

|

|

|

718 |

|

|

|

1,639 |

|

|

|

1,234 |

|

|

|

1,121 |

|

| Net income |

$ |

4,705 |

|

|

$ |

4,349 |

|

|

$ |

2,640 |

|

|

$ |

4,074 |

|

|

$ |

4,539 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio - QTD

(non-GAAP) |

|

60.35 |

% |

|

|

62.37 |

% |

|

|

65.17 |

% |

|

|

63.26 |

% |

|

|

54.43 |

% |

| Efficiency ratio - YTD

(non-GAAP) |

|

62.58 |

% |

|

|

63.77 |

% |

|

|

65.17 |

% |

|

|

56.86 |

% |

|

|

54.94 |

% |

|

MORTGAGE BANKING SEGMENTSUMMARY OF

KEY QUARTERLY FINANCIAL

DATA(Unaudited) |

| |

At or For the Three Months Ended |

|

| |

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

| |

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2023 |

|

| |

(Dollars in Thousands) |

|

|

Condensed Results of Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest loss |

$ |

(760 |

) |

|

$ |

(552 |

) |

|

$ |

(541 |

) |

|

$ |

(367 |

) |

|

$ |

(550 |

) |

| Provision (credit) for credit

losses |

|

(75 |

) |

|

|

54 |

|

|

|

(38 |

) |

|

|

115 |

|

|

|

- |

|

| Total noninterest income |

|

21,386 |

|

|

|

25,081 |

|

|

|

20,328 |

|

|

|

16,028 |

|

|

|

21,452 |

|

| Noninterest expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Compensation, payroll taxes,

and other employee benefits |

|

15,930 |

|

|

|

16,886 |

|

|

|

14,756 |

|

|

|

14,881 |

|

|

|

17,186 |

|

| Occupancy, office furniture

and equipment |

|

953 |

|

|

|

1,046 |

|

|

|

1,108 |

|

|

|

1,105 |

|

|

|

1,141 |

|

| Advertising |

|

615 |

|

|

|

758 |

|

|

|

740 |

|

|

|

667 |

|

|

|

716 |

|

| Data processing |

|

570 |

|

|

|

549 |

|

|

|

508 |

|

|

|

583 |

|

|

|

551 |

|

| Communications |

|

152 |

|

|

|

168 |

|

|

|

161 |

|

|

|

194 |

|

|

|

173 |

|

| Professional fees |

|

379 |

|

|

|

569 |

|

|

|

520 |

|

|

|

704 |

|

|

|

564 |

|

| Real estate owned |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Loan processing expense |

|

697 |

|

|

|

861 |

|

|

|

1,046 |

|

|

|

756 |

|

|

|

722 |

|

| Other |

|

1,261 |

|

|

|

1,641 |

|

|

|

617 |

|

|

|

2,701 |

|

|

|

1,935 |

|

| Total noninterest expense |

|

20,557 |

|

|

|

22,478 |

|

|

|

19,456 |

|

|

|

21,591 |

|

|

|

22,988 |

|

| Income (loss) before income

taxes (benefit) |

|

144 |

|

|

|

1,997 |

|

|

|

369 |

|

|

|

(6,045 |

) |

|

|

(2,086 |

) |

| Income tax expense

(benefit) |

|

194 |

|

|

|

684 |

|

|

|

71 |

|

|

|

(1,827 |

) |

|

|

(657 |

) |

| Net (loss) income |

$ |

(50 |

) |

|

$ |

1,313 |

|

|

$ |

298 |

|

|

$ |

(4,218 |

) |

|

$ |

(1,429 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency ratio - QTD

(non-GAAP) |

|

99.67 |

% |

|

|

91.64 |

% |

|

|

98.33 |

% |

|

|

137.86 |

% |

|

|

109.98 |

% |

| Efficiency ratio - YTD

(non-GAAP) |

|

96.23 |

% |

|

|

94.62 |

% |

|

|

98.33 |

% |

|

|

116.99 |

% |

|

|

111.63 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan originations |

$ |

558,729 |

|

|

$ |

634,109 |

|

|

$ |

485,109 |

|

|

$ |

458,363 |

|

|

$ |

597,562 |

|

| Purchase |

|

88.9 |

% |

|

|

92.7 |

% |

|

|

93.0 |

% |

|

|

95.7 |

% |

|

|

95.4 |

% |

| Refinance |

|

11.1 |

% |

|

|

7.3 |

% |

|

|

7.0 |

% |

|

|

4.3 |

% |

|

|

4.6 |

% |

| Gross margin on loans

sold(1) |

|

3.83 |

% |

|

|

3.93 |

% |

|

|

4.10 |

% |

|

|

3.51 |

% |

|

|

3.62 |

% |

(1) Gross margin on loans sold equals mortgage banking income

(excluding the change in interest rate lock value) divided by total

loan originations.

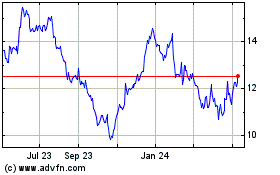

Waterstone Financial (NASDAQ:WSBF)

Historical Stock Chart

From Jan 2025 to Feb 2025

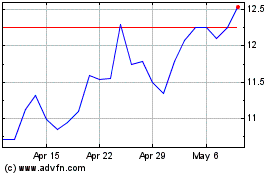

Waterstone Financial (NASDAQ:WSBF)

Historical Stock Chart

From Feb 2024 to Feb 2025