UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of December, 2024

Commission File Number: 001-36000

XTL Biopharmaceuticals Ltd.

(Translation of registrant’s name into

English)

26 Ben-Gurion St.

Ramat Gan

5112001, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

RAMAT GAN, ISRAEL - (December 30,

2024) – XTL Biopharmaceuticals Ltd. (NASDAQ: XTLB, TASE: XTLB.TA) (“XTL” or the “Company”) today

announced financial results for the six months ended June 30, 2024.

The foregoing description of the Company’s

business and operations is as of June 30, 2024 and has not been updated for subsequent events.

On March 20, 2024, the Company announced that

it entered into a binding term sheet with The Social Proxy Ltd. (the “Social Proxy”) an artificial intelligence web data company,

developing and powering a unique ethical, intellectual property based, proxy and data extraction platform for artificial intelligence

and BI applications at scale (the “Term Sheet”).

Pursuant to the Term Sheet, the Company will acquire

all of the issued and outstanding share capital of Social Proxy on a fully diluted basis (assuming that Social Proxy will be debt free,

except as agreed by the Company) in exchange for the issuance by the Company to the shareholders of Social Proxy, such number of ordinary

shares of the Company, representing immediately after such issuance, 44.6% of the issued and outstanding share capital of the Company

and the payment of $430,000 to the shareholders of Social Proxy (the “Transaction”). The proposed Transaction is part of the

Company’s strategy to expand its assets portfolio with high potential assets. In addition, as part of the Transaction, the shareholders

of Social Proxy will be issued additional warrants or ordinary shares, which may only be exercised or granted upon reaching certain financial

measured milestones within a period of up to three years from the closing of the Transaction. The securities to be issued to the owners

of Social Proxy will be issued pursuant to an exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933 (the

“Securities Act”), as amended, for transactions not involving a public offering. The Transaction is conditioned upon certain

closing conditions which are fully described in the Term Sheet. Social Proxy will operate as fully owned subsidiary of the Company and

its shareholders will be entitled to appoint two representatives to the Company’s board of directors out of a total of up to seven

directors.

Prior to signing the term sheet, and in order

to support the Company’s financial needs and the Transaction, the company has secured a commitment of an investment of an amount

of $1,500,000 through a private placement to be consummated upon and subject to the closing of the Transaction (the “Private Placement”).

In exchange for the investment in the Private Placement, the investors will be issued 1,500,000 units (reflecting a price per each unit

of $1.00) consisting of one ADS and one warrant, such warrant may be exercised during a period of five years from its issuance into one

ADS at an exercise price of $1.20 per warrant. Consummation of the Private Placement is conditioned upon consummation of the Transaction

as well as customary closing conditions and obtaining shareholders’ approval as Alexander Rabinovich, a 23.5% shareholder and a

director of the Company, is one of the investors in this Private Placement.

On March 27, 2024 we entered into a loan agreement with Social Proxy. According to the loan agreement, through June 2024, we provided

a $300,000 loan to Social Proxy. The loan bears an annual interest of 8%. The loan and accrued interest will be repaid at the earlier

of (1) 120 days following March 27, 2024, or (2) the date upon which the parties decide to abandon attempts for Transaction. Social Proxy

may repay the outstanding loan and accrued interest in 18 equal monthly installments. Social Proxy provided a first priority floating

charge over all of it assets as a security to ensure repayment of the loan and accrued interest.

On August 14, 2024, the Company announced it has

completed the acquisition of the Social Proxy and on November 11, 2024 it has adjusted the consideration under the acquisition to the

previous shareholders of the Social Proxy (the “Shareholders”) by, among other things, adjust the number of ADSs and warrants

issuable to the Shareholders under the share purchase agreement between the Company, Social Proxy and the Shareholders dated June 5, 2024

(the “SPA”).

The Company acquired all of the issued and outstanding

share capital of Social Proxy (the “Transaction”) in exchange for (i) the issuance by the Company to the shareholders of Social

Proxy, by way of a private placement, 1,864,790 unregistered American Depositary Shares (“ADSs”), representing immediately

after such issuance, 21.16% of the issued and outstanding share capital of the Company, and (ii) the payment of US$430,000 to the shareholders

of Social Proxy.

The value of Social Proxy was estimated to be

$5.8 million according to third party valuation.

In addition, as part of the Transaction, the shareholders

of Social Proxy were issued additional warrants, which may only be exercised upon reaching certain financial measured milestones within

a period of up to three (3) years from the closing of the Transaction.

Social Proxy will operate as wholly owned subsidiary

of the Company and its shareholders are entitled to appoint one (1) representative to the company’s board of directors.

The Transaction is part of the Company’s

strategy to expand its assets portfolio with high potential assets.

The private placement and the acquisition of Social

Proxy were approved by the Company’s shareholders on April 30, 2024 and July 22, 2024, respectively.

In October 2023, Hamas terrorists infiltrated

Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian and military targets, launched extensive

rocket attacks and kidnapped many Israeli civilians and soldiers. Following the attack, Israel declared war against Hamas. In parallel,

border clashes between Israel and the Hezbollah terrorist group on Israel’s northern border with Lebanon intensified and may escalate

into a greater regional conflict. The Israel Defence Force (the “IDF”), the national military of Israel, is a conscripted

military service, subject to certain exceptions. Since October 7, 2023, the IDF has called up several hundred thousand of its reserve

forces to serve.

As a result, the Company’s operations in

Israel may be disrupted by such absences, which disruption may materially and adversely affect our business, prospects, financial condition

and results of operations. In addition, since the commencement of these events, there have been continued hostilities along Israel’s

northern border with Lebanon (with the Hezbollah terror organization) and southern border (with the Houthi movement in Yemen). It is possible

that hostilities with Hezbollah in Lebanon will escalate, and that other terrorist organizations, including Palestinian military organizations

in the West Bank as well as other hostile countries, such as Iran, will join the hostilities. Such clashes may escalate in the future

into a greater regional conflict. Although until approval of these financial statements, the impact of the war on the Company was negligible,

it is currently not possible to predict the duration or severity of the ongoing conflict or its effects on the Company’s business,

operations and financial conditions. The ongoing conflict is rapidly evolving and developing, and could disrupt its business and operations,

and hamper its ability to raise additional funds or sell its securities, among others.

To date, the Company’s management confirms

that the Company has not seen any material impact on its ongoing operations in Israel and its ability to continue searching for new assets,

aside from a negative effect on our marketable securities and potentially our ability to raise additional funds if needed. At the same

time, the Company continues to monitor its ongoing activities and make any needed adjustments to ensure a smooth continuity of its business.

The Company notes that its headquarters are in the center of the country, near Tel Aviv, and not near any borders.

Financial Overview for Six Months Ended

June 30, 2024

XTL reported approximately $0.594 million in cash

and cash equivalents and approximately $0.99 million in marketable securities as of June 30, 2024 compared to $1.40 million in

cash and cash equivalents and approximately $0.60 million in marketable securities as of December 31, 2023. The decrease of approximately

$0.80 million since December 31, 2023, in cash and cash equivalents derives from operating expenses and the grant of loan to Social Proxy.

Research and development expenses for the six

months ended June 30, 2024 were $12 thousand compared to $19 thousand for the corresponding period in 2023. The decrease of $7 thousands

in research and development expenses considered to be immaterial.

General and administrative expenses for the six

months ended June 30, 2024 were $584 thousand compared to $395 thousand for the corresponding period in 2023. The increase of $189 thousand

were mainly due to higher share based compensation expenses which were partly offset by a lower insurance policy fee and lower professional

fees.

Finance income, net for the six months ended June

30, 2024 were $377 thousand compared to finance expense, net of $869 thousand for the corresponding period in 2023. The difference is

primarily from revaluation of marketable securities

XTL reported an operating loss for the six

months ended June 30, 2024 of $596 thousand compared to $414 thousand for the corresponding period in 2023. The Company reported a

total loss for the period ended June 30, 2024 of approximately $219 thousand, compared to total loss of $1,283 thousand in the

corresponding period in 2023. The change is driven primarily by the revaluation of marketable securities and share based

compensation expenses as described above.

XTL Biopharmaceuticals, Ltd. and Subsidiary

(USD in thousands)

Unaudited Condensed Consolidated Statements

of Financial Position

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

U.S. dollars in thousands | |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash and cash equivalents | |

| 594 | | |

| 1,401 | |

| Marketable securities – InterCure Ltd. | |

| 992 | | |

| 605 | |

| Loan receivable | |

| 304 | | |

| - | |

| Prepaid expenses and other current assets | |

| 128 | | |

| 40 | |

| | |

| 2,018 | | |

| 2,046 | |

| | |

| | | |

| | |

| NON-CURRENT ASSETS: | |

| | | |

| | |

| Intangible assets, net | |

| 380 | | |

| 380 | |

| Total assets | |

| 2,398 | | |

| 2,426 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Accounts payable | |

| 165 | | |

| 206 | |

| Total liabilities | |

| 165 | | |

| 206 | |

| | |

| | | |

| | |

| EQUITY ATTRIBUTABLE TO EQUITY HOLDERS OF THE COMPANY: | |

| | | |

| | |

| Share capital - ordinary shares of NIS 0.1 par value: authorized shares - 1,450,000,000 on June 30, 2024 and December 31, 2023; issued and outstanding: 544,906,149 on June 30, 2024 and December 31, 2023; | |

| 14,120 | | |

| 14,120 | |

| Additional paid in capital | |

| 146,326 | | |

| 146,326 | |

| Reserve from transactions with non-controlling interests | |

| 20 | | |

| 20 | |

| Accumulated deficit | |

| (158,233 | ) | |

| (158,246 | ) |

| Total equity | |

| 2,233 | | |

| 2,220 | |

| Total liabilities and equity | |

| 2,398 | | |

| 2,426 | |

XTL Biopharmaceuticals, Ltd. and Subsidiary

(USD in thousands, except per share amounts)

Unaudited Condensed Consolidated Statements

of Comprehensive Loss

| | |

For the six months ended | |

| | |

June 30, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Research and Development expenses | |

$ | (12 | ) | |

$ | (19 | ) |

| General and administrative expenses (*) | |

| (584 | ) | |

| (395 | ) |

| Operating Loss | |

$ | (596 | ) | |

$ | (414 | ) |

| | |

| | | |

| | |

| Revaluation of marketable securities | |

$ | 387 | | |

$ | (833 | ) |

| Other finance income | |

| 19 | | |

| 21 | |

| Other finance expense | |

| (29 | ) | |

| (57 | ) |

| | |

| | | |

| | |

| Finance income (expenses), net | |

| 377 | | |

| (869 | ) |

| | |

| | | |

| | |

| Total comprehensive loss for the period | |

$ | (219 | ) | |

$ | (1,283 | ) |

| | |

| | | |

| | |

| Basic loss per share (in U.S. dollars): | |

| (0.000 | ) | |

$ | (0.000 | ) |

| Diluted loss per share (in U.S. dollars): | |

| (0.000 | ) | |

$ | (0.000 | ) |

| Weighted average number of issued ordinary shares (basic) | |

| 544,906,149 | | |

| 544,906,149 | |

| Weighted average number of issued ordinary shares (diluted) | |

| 544,906,149 | | |

| 544,906,149 | |

| (*) | Including share based compensation expenses of $233 thousand

and $3 thousands for the six months ended June 30, 2024 and 2023, respectively. |

About hCDR1

hCDR1 is a novel compound with a unique mechanism

of action and clinical data on over 400 patients in three clinical studies. The drug has a favorable safety profile, is well tolerated

by patients and has demonstrated efficacy in at least one clinically meaningful endpoint. For more information, please see the peer reviewed

article in Lupus Science and Medicine journal titled “Safety and efficacy of hCDR1 (Edratide) in patients with active systemic lupus

erythematosus: results of phase II study”.

About XTL Biopharmaceuticals Ltd. (XTL)

XTL is an IP portfolio

company. The Company holds 100% of the share capital of The Social Proxy Ltd. (the “Social Proxy”), a web data company and

has an IP portfolio surrounding hCDR1 for the treatment of Lupus disease (SLE), which it has decided to explore collaboration with a strategic

partner to develop

XTL is traded on

the Nasdaq Capital Market (NASDAQ: XTLB) and the Tel Aviv Stock Exchange (TASE: XTLB.TA).

For further information, please contact:

Investor Relations, XTL Biopharmaceuticals

Ltd.

Tel: +972 3 611 6666

Email: info@xtlbio.com

www.xtlbio.com

Cautionary Statement

This disclosure may contain forward-looking statements,

about XTL’s expectations, beliefs or intentions regarding, among other things, its product development efforts, business, financial

condition, results of operations, strategies or prospects. In addition, from time to time, XTL or its representatives have made or may

make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking words

such as “believe,” “expect,” “intend,” “plan,” “may,” “should”

or “anticipate” or their negatives or other variations of these words or other comparable words or by the fact that these

statements do not relate strictly to historical or current matters. These forward-looking statements may be included in, but are not limited

to, various filings made by XTL with the U.S. Securities and Exchange Commission, press releases or oral statements made by or with the

approval of one of XTL’s authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities,

trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these

statements are inherently subject to risks and uncertainties that could cause XTL’s actual results to differ materially from any

future results expressed or implied by the forward-looking statements. Many factors could cause XTL’s actual activities or results

to differ materially from the activities and results anticipated in such forward-looking statements, including, but not limited to, the

factors summarized in XTL’s filings with the SEC and in its periodic filings with the TASE. In addition, XTL operates in an industry

sector where securities values are highly volatile and may be influenced by economic and other factors beyond its control. XTL does not

undertake any obligation to publicly update these forward-looking statements, whether as a result of new information, future events or

otherwise. Please see the risk factors associated with an investment in our ADSs or ordinary shares which are included in our Annual Report

on Form 20-F filed with the U.S. Securities and Exchange Commission on April 30, 2024.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: December 30, 2024 |

XTL BIOPHARMACEUTICALS LTD. |

| |

|

| |

By: |

/s/ Shlomo Shalev |

| |

|

Shlomo Shalev

Chief Executive Officer |

7

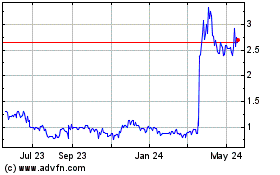

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Dec 2024 to Jan 2025

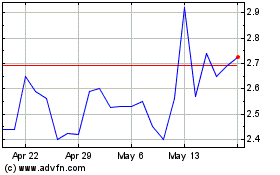

XTL Biopharmaceuticals (NASDAQ:XTLB)

Historical Stock Chart

From Jan 2024 to Jan 2025