false

--12-31

0001898604

0001898604

2023-11-20

2023-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 20, 2023

Yoshiharu

Global Co.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41494 |

|

87-3941448 |

(State

or other Jurisdiction

of Incorporation) |

|

(Commission

File No.) |

|

(IRS

Employer

Identification No.) |

6940

Beach Blvd., Suite D-705

Buena

Park, CA 90621

(Address

of principal executive offices and zip code)

(714)

694-2403

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock, $0.0001 par value |

|

YOSH |

|

The

Nasdaq Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item

5.03 |

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year |

On

November 22, 2023, Yoshiharu Global Co. (the “Company”) filed a Certificate of Amendment (the “Certificate of

Amendment”) to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of its issued

Class A common stock, par value $0.0001 per share (“Class A Common Stock”) and Class B common stock, par value $0.0001 per

share (“Class B Common Stock” and, together with Class A common Stock, “Common Stock”), in the ratio of 1-for-10

(the “Reverse Stock Split”) to be effective at 11:59 p.m. eastern on November 27, 2023. The Common Stock will begin

trading on a split-adjusted basis at the market open on Tuesday, November 28, 2023.

The

Reverse Stock Split and the form of Certificate of Amendment were previously approved by the Company’s Board of Directors and the

Company’s stockholders (as noted below). The new CUSIP number for the Common Stock following the Reverse Stock Split is 98740Y

302. No fractional shares will be issued as a result of the Reverse Stock Split. Instead, any fractional shares that would have resulted

from the Reverse Stock Split will be rounded up to the next whole number. The Reverse Stock Split affects all stockholders uniformly

and will not alter any stockholder’s percentage interest in the Company’s outstanding Common Stock, except for adjustments

that may result from the treatment of fractional shares. The number of authorized shares of Common Stock of the Company and number of

authorized, issued, and outstanding shares of the preferred stock of the Company were not changed.

The

above description of the Certificate of Amendment does not purport to be complete and is qualified in its entirety by reference to the

full text of the Certificate of Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated by reference

herein.

| Item

5.07 |

Submission

of Matters to a Vote of Security Holders. |

An

annual meeting (the “Annual Meeting”) of the stockholders of the Company was held on November 20, 2023. As of October 20,

2023, the record date for the Annual Meeting, 11,940,000 shares of Class A Common Stock were issued and outstanding and 1,000,000 shares

of Class B Common Stock were issued and outstanding. A summary of the matters voted upon by stockholders at the Annual Meeting is set

forth below. The voting results reported below are final.

Proposal

No. 1

The

Company’s stockholders elected James Chae, Jay Kim, Harinne Kim and Yusil Yeo to the Company’s Board of Directors, to hold

office until the 2024 annual meeting of stockholders or until his or her successor shall have been duly elected or appointed and qualify,

based upon the following votes:

| Nominee |

|

Votes

“FOR” |

|

Votes

WITHHELD |

| James

Chae |

|

17,574,189 |

|

86,601 |

| Jay

Kim |

|

17,573,568 |

|

87,222 |

| Harinne

Kim |

|

17,599,684 |

|

61,106 |

| Yusil

Yeo |

|

17,569,360 |

|

91,430 |

Proposal

No. 2

The

Company’s stockholders ratified the appointment of BF Borgers CPA PC as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2024, based upon the following votes:

| Votes

“FOR” |

|

Votes

AGAINST |

|

Votes

ABSTAINED |

|

BROKER

NON-VOTES |

| 17,617,734 |

|

7,164 |

|

35,892 |

|

— |

Proposal

No. 3

The

Company’s stockholders approved a reverse stock split of the Class A Common Stock and Class B Common Stock at a ratio of not more

than 1-for-40, such ratio to be determined by the Board of Directors on or prior to December 31, 2023, in its sole discretion:

| Votes

“FOR” |

|

Votes

AGAINST |

|

Votes

ABSTAINED |

|

BROKER

NON-VOTES |

17,484,450 |

|

176,228 |

|

112 |

|

— |

On

November 24, 2023, the Company issued a press release announcing the Reverse Stock Split. A copy of the press release is furnished

herewith as Exhibit 99.1 to the Current Report on Form 8-K.

| Item

9.01. |

Financial

Statements and Exhibits |

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 24, 2023

| |

YOSHIHARU

GLOBAL CO. |

| |

|

| |

By: |

/s/

James Chae |

| |

Name:

|

James

Chae |

| |

Title:

|

Chief

Executive Officer |

Exhibit 3.1

CERTIFICATE

OF AMENDMENT

TO

THE

AMENDED AND RESTATED

CERTIFICATE

OF INCORPORATION

OF

YOSHIHARU

GLOBAL CO.

Yoshiharu

Global Co. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation

Law of the State of Delaware (the “DGCL”), does hereby certify:

FIRST.

The Amended and Restated Certificate of Incorporation of the Corporation is hereby amended by changing Article IV, so that, as amended,

Section 4.1 shall become Section 4.1(a) and the following shall be added as Section 4.1(b):

“(b)

Reverse Stock Split. Effective at 11:59 p.m., Eastern Time, on November 27, 2023 (the “Reverse Split Effective

Time”), every ten (10) shares of Class A Common Stock issued and outstanding or held by the Corporation as treasury shares

as of the Reverse Split Effective Time shall automatically, and without action on the part of the stockholders, be combined, reclassified

and changed into one (1) validly issued, fully paid and non-assessable share of Class A Common Stock, without effecting a change to the

par value per share of Class A Common Stock; and every ten (10) shares of Class B Common Stock issued and outstanding or held by the

Corporation as treasury shares as of the Reverse Split Effective Time shall automatically, and without action on the part of the stockholders,

be combined, reclassified and changed into one (1) validly issued, fully paid and non-assessable share of Class B Common Stock, without

effecting a change to the par value per share of Class B Common Stock, in each case, subject to the treatment of fractional interests

as described below (the “Reverse Split”). No fractional shares shall be issued in connection with the exchange. In

lieu thereof, any person who holds a fraction of one (1) share of Class A Common Stock or Class B Common Stock after the exchange shall

have their fraction of one (1) share rounded up to the nearest whole fraction of one (1) share of Class A Common Stock or Class B Common

Stock, respectively. As of the Reverse Split Effective Time and thereafter, a certificate(s) representing shares of Class A Common Stock

or Class B Common Stock prior to the Reverse Split is deemed to represent the number of post-Reverse Split shares into which the pre-Reverse

Split shares were reclassified and combined. The Reverse Split shall also apply to any outstanding securities or rights convertible into,

or exchangeable or exercisable for, Class A Common Stock or Class B Common Stock of the Corporation and all references to such Class

A Common Stock and Class B Common Stock in agreements, arrangements, documents and plans relating thereto or any option or right to purchase

or acquire shares of Class A Common Stock or Class B Common Stock shall be deemed to be references to the Class A Common Stock or Class

B Common Stock, as applicable, or options or rights to purchase or acquire shares of Class A Common Stock or Class B Common Stock, as

the case may be, after giving effect to the Reverse Split.”

SECOND.

That a resolution was duly adopted by unanimous written consent of the directors of the Corporation, pursuant to Section 242 of the DGCL,

setting forth the above mentioned amendment to the Amended and Restated Certificate of Incorporation and declaring said amendment to

be advisable.

THIRD.

That this amendment was duly authorized by the holders of a majority of the voting stock of the Corporation by written consent of the

stockholders of the Corporation. Said amendment was duly adopted in accordance with the provisions of the DGCL.

IN

WITNESS WHEREOF, this Certificate of Amendment of the Amended and Restated Certificate of Incorporation has been signed by the Chief

Executive Officer of the Corporation this 22nd day of November, 2023.

| YOSHIHARU

GLOBAL CO. |

|

| |

|

| By: |

/s/

James Chae |

|

| Name: |

James

Chae |

|

| Title: |

Chief

Executive Officer |

|

Exhibit

99.1

Yoshiharu

to Conduct 1-for-10 Reverse Stock Split

BUENA

PARK, CA – November 24, 2023 - Yoshiharu Global Co. (NASDAQ: YOSH) (“Yoshiharu” or the “Company”),

a California-based restaurant operator specializing in authentic Japanese ramen, today announced that it will conduct a reverse stock

split of its outstanding shares of Class A common stock and Class B common stock at a ratio of 1-for-10. The reverse stock split will

become effective at 11:59 p.m. Eastern Time, on November 27, 2023. The Company’s Class A common stock will begin trading

on a post-split basis at the market open on November 28, 2023, under the Company’s existing trading symbol “YOSH.”

The reverse stock split is part of the Company’s plan to regain compliance with the Minimum Bid Price Requirement of $1.00 per

share required to maintain continued listing on The Nasdaq Capital Market, among other benefits.

The

reverse stock split was approved by the Company’s stockholders at the Annual Meeting of Stockholders held on November 20, 2023,

to be effected in the board of directors (the “Board”) of the Company’s discretion within approved parameters. The

final ratio was approved by the Company’s Board on November 20, 2023.

The

reverse stock split reduces the number of shares of the Company’s issued and outstanding Class A common stock from 11,940,000 shares

to 1,194,000 shares and the number of shares of the Company’s issued and outstanding Class B common stock from 1,000,000 to 100,000

shares, in each case, subject to adjustment due to fractional shares. As a result of the reverse stock split, proportionate adjustments

will be made to the number of shares of the Company’s common stock underlying the Company’s outstanding equity awards and

warrants and the number of shares issuable under the Company’s equity incentive plans and other existing agreements, as well as

the applicable exercise prices.

Where

the reverse stock split results in a fractional share, the number of new common shares issued will be rounded up to the nearest whole

share. No fractional shares will be issued. The reverse stock split will not reduce the authorized number of shares of the Company’s

capital stock.

About

Yoshiharu Global Co.

Yoshiharu

is a fast-growing restaurant operator and was born out of the idea of introducing the modernized Japanese dining experience to customers

all over the world. Specializing in Japanese ramen, Yoshiharu gained recognition as a leading ramen restaurant in Southern California

within six months of its 2016 debut and has continued to expand its top-notch restaurant service across Southern California, currently

owning and operating nine restaurants.

For

more information, please visit www.yoshiharuramen.com.

Forward

Looking Statements

This

press release includes certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995, including without limitation, statements regarding our position to execute on our growth strategy, and our ability to expand

our leadership position. These forward-looking statements include, but are not limited to, the Company’s beliefs, plans, goals,

objectives, expectations, assumptions, estimates, intentions, future performance, other statements that are not historical facts and

statements identified by words such as “expects”, “anticipates”, “intends”, “plans”,

“believes”, “seeks”, “estimates” or words of similar meaning. These forward-looking statements reflect

our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available

to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected

in, or suggested by, these forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations

or strategies will be attained or achieved. Forward-looking statements involve inherent risks and uncertainties which could cause actual

results to differ materially from those in the forward-looking statements, as a result of various factors including those risks and uncertainties

described in the Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations sections

of our recent filings with the Securities and Exchange Commission (“SEC”) which can be found on the SEC’s website at

www.sec.gov. Such risks, uncertainties, and other factors include, but are not limited to, the risk that we may not be able to successfully

implement our growth strategy if we are unable to identify appropriate sites for restaurant locations, expand in existing and new markets,

obtain favorable lease terms, attract guests to our restaurants or hire and retain personnel; that our operating results and growth strategies

will be closely tied to the success of our future franchise partners and we will have limited control with respect to their operations;

the risk that we may face negative publicity or damage to our reputation, which could arise from concerns regarding food safety and foodborne

illness or other matters; that minimum wage increases and mandated employee benefits could cause a significant increase in our labor

costs; We urge you to consider those risks and uncertainties in evaluating our forward-looking statements. We caution readers not to

place undue reliance upon any such forward-looking statements, which speak only as of the date made. The Company undertakes no obligation

to update these statements for revisions or changes after the date of this release, except as required by law.

Investor

Relations Contact:

Cody

Cree and John Yi

Gateway

Group, Inc.

949-574-3860

YOSH@gateway-grp.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

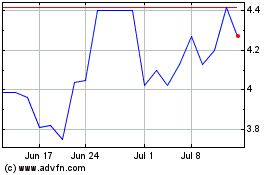

Yoshiharu Global (NASDAQ:YOSH)

Historical Stock Chart

From Apr 2024 to May 2024

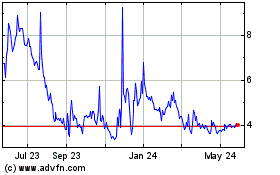

Yoshiharu Global (NASDAQ:YOSH)

Historical Stock Chart

From May 2023 to May 2024