UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant

to Rule 13a-16 or 15d-16

under

the Securities Exchange Act of 1934

November

12, 2024

Commission

File Number: 001-37968

YATRA

ONLINE, INC.

Gulf

Adiba, Plot No. 272,

4th

Floor, Udyog Vihar, Phase-II,

Sector-20,

Gurugram-122008, Haryana

India

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Other

Events

On

November 12, 2024, Yatra Online, Inc. issued an earnings release announcing its unaudited financial and operating results for the three

months ended September 30, 2024. A copy of the earnings release is attached hereto as Exhibit 99.1.

This

Report on Form 6-K is hereby incorporated by reference into Yatra Online, Inc.’s registration statement on Form F-3 (Registration

Statement No. 333-256442) filed with the Securities and Exchange Commission on May 24, 2021 (and subsequently amended on July 7, 2021),

to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently

filed or furnished.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

YATRA

ONLINE, INC. |

| |

|

|

| Date:

November 12, 2024 |

By: |

/s/

Dhruv Shringi |

| |

|

Dhruv

Shringi |

| |

|

Chief

Executive Officer |

Exhibit

99.1

YATRA

ONLINE, INC. ANNOUNCES RESULTS FOR

THE

THREE MONTHS ENDED SEPTEMBER 30, 2024

Gurugram,

India and New York November 12, 2024— Yatra Online, Inc. (NASDAQ: YTRA) (the “Company”), India’s leading

corporate travel services provider and one of India’s leading online travel companies, today announced its unaudited financial

and operating results for the three months ended September 30, 2024.

“For

the three months ended September 30, 2024, we reported revenue of INR 2,363.3 million (USD 28.2 million), reflecting

a substantial year-over-year increase of 149.4%. Adjusted Air Ticketing Margins saw a 13.0% decline, primarily

attributable to reduced volumes in the B2C segment as we strategically adjusted discounts to address intensified

price competition. In contrast, our Adjusted Hotels and Packages margins improved significantly by 43.8%

year-over-year, driven by strong performance in our MICE (Meetings, Incentives, Conferences, and Exhibitions) business. Adjusted

EBITDA came in at INR 66.7 million (USD 0.8 million), a 91.2% increase from the prior year.

Despite

headwinds in the B2C air segment, we continue to drive strong growth in our Hotels and Packages and MICE lines of businesses,

which helped us more than offset the negative impact of the B2C air business. In the second quarter of FY25, we successfully

secured 29 new corporate clients, adding an annual billing potential of INR 1,213.0 million (USD 14.5 million).

On

September 11 2024, we successfully completed the acquisition of Globe All India Services (Globe Travels) for INR 1,280.0

million (USD 15.3 million) in cash. The results for the quarter include contribution from Globe Travels for 20 days of

the quarter from September 11, 2024 to September 30, 2024. This strategic acquisition brought approximately 360 new corporate clients,

further strengthening our leadership in India’s corporate travel sector. Globe Travels’ expertise in MICE complements our

recent organic expansion in this segment, positioning Yatra as one of India’s largest players in this segment. With minimal overlap

in client portfolios, this acquisition diversifies our client base and enhances cross-selling opportunities for hotels and expense management

services. Additionally, integrating our digital booking platform with Globe Travel’s largely offline business is expected

to drive synergies, operational efficiencies, and cost savings for our corporate clients.

Progress

on corporate restructuring is also advancing as the Company continues to engage with its counsels and other stakeholders

including certain regulators towards the formulation of a comprehensive multi-jurisdictional corporate restructuring that can reduce

administrative overhead, rationalize costs, and facilitate the growth for the Company. We are encouraged by the strong momentum

in our Corporate Travel business, underscored by our growth in new accounts and MICE capabilities. As we continue to navigate a

dynamic market, our focus remains on executing our strategic priorities to reinforce our market leadership and drive long-term value

for stakeholders.” - Dhruv Shringi, Co-founder and CEO.

Financial

and operating highlights for the three months ended September 30, 2024:

| ● |

Revenue

of INR 2,363.3 million (USD 28.2 million), representing an increase of 149.4% year-over-year basis (“YoY”). |

| ● |

Adjusted

Margin (1) from Air Ticketing of INR 885.9 million (USD 10.6 million), representing a decrease of 13.0%

YoY. |

| ● |

Adjusted

Margin (1) from Hotels and Packages of INR 400.1 million (USD 4.8 million), representing an increase of 43.8%

YoY. |

| ● |

Total

Gross Bookings (Air Ticketing, Hotels and Packages and Other Services)(3) of INR 17,651.6 million (USD 210.7 million),

representing an increase of 0.7% YoY. |

| ● |

Loss

for the period was INR 0.3

million (USD 0.1 million) versus a loss of INR 272.9 million (USD 3.3 million) for the three months ended September 30, 2023, reflecting

a decline in loss by INR 272.6 million (USD 3.3 million) YoY. |

| ● |

Result

from operations were a loss of INR 37.7 million (USD 0.4 million) versus a loss of INR 120.6 million (USD 1.4 million)

for the three months ended September 30, 2023, reflecting a decrease in loss by INR 82.9 million (USD 1.0 million) YoY. |

| ● |

Adjusted

EBITDA(2) was INR 66.7 million (USD 0.8 million) reflecting an increase by 91.2% YOY. |

| | |

Three months ended September 30, | | |

| |

| | |

2023 | | |

2024 | | |

2024 | | |

| |

| | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

YoY Change | |

| (In thousands except percentages) | |

INR | | |

INR | | |

USD | | |

% | |

| Financial Summary as per IFRS | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| 947,574 | | |

| 2,363,325 | | |

| 28,216 | | |

| 149.4 | % |

| Results from operations | |

| (120,598 | ) | |

| (37,679 | ) | |

| (449 | ) | |

| (68.8 | )% |

| Loss for the period | |

| (272,862 | ) | |

| (296 | ) | |

| (3 | ) | |

| 99.9 | % |

| Financial Summary as per non-IFRS measures | |

| | | |

| | | |

| | | |

| | |

| Adjusted

Margin (1) | |

| | | |

| | | |

| | | |

| | |

| Adjusted Margin - Air Ticketing | |

| 1,018,276 | | |

| 885,855 | | |

| 10,576 | | |

| (13.0 | )% |

| Adjusted Margin - Hotels and Packages | |

| 278,271 | | |

| 400,148 | | |

| 4,777 | | |

| 43.8 | % |

| Adjusted Margin - Other Services | |

| 49,561 | | |

| 75,935 | | |

| 907 | | |

| 53.2 | % |

| Others (Including Other Income) | |

| 169,115 | | |

| 145,895 | | |

| 1,742 | | |

| (13.7 | )% |

| Adjusted

EBITDA (2) | |

| 34,888 | | |

| 66,716 | | |

| 797 | | |

| 91.2 | % |

| Operating Metrics | |

| | | |

| | | |

| | | |

| | |

| Gross

Bookings (3) | |

| 17,520,272 | | |

| 17,651,566 | | |

| 210,739 | | |

| 0.7 | % |

| Air Ticketing | |

| 14,771,705 | | |

| 13,260,073 | | |

| 158,310 | | |

| (10.2 | )% |

| Hotels and Packages | |

| 2,183,857 | | |

| 3,661,505 | | |

| 43,714 | | |

| 67.7 | % |

| Other Services (6) | |

| 564,710 | | |

| 729,988 | | |

| 8,715 | | |

| 29.3 | % |

| Adjusted

Margin% (4) | |

| | | |

| | | |

| | | |

| | |

| Air Ticketing | |

| 6.9 | % | |

| 6.7 | % | |

| | | |

| | |

| Hotels and Packages | |

| 12.7 | % | |

| 10.9 | % | |

| | | |

| | |

| Other Services | |

| 8.8 | % | |

| 10.4 | % | |

| | | |

| | |

| Quantitative

details (5) | |

| | | |

| | | |

| | | |

| | |

| Air Passengers Booked | |

| 1,660 | | |

| 1,377 | | |

| | | |

| (17.1 | )% |

| Stand-alone Hotels Room Nights Booked | |

| 440 | | |

| 461 | | |

| | | |

| 4.7 | % |

| Packages Passengers Travelled | |

| 5 | | |

| 15 | | |

| | | |

| 223.0 | % |

Note:

| |

(1) |

As

certain parts of our revenue are recognized on a “net” basis and other parts of our revenue are recognized on a “gross”

basis, we evaluate our financial performance based on Adjusted Margin, which is a non-IFRS measure. |

| |

(2) |

See

the section below titled “Certain Non-IFRS Measures.” |

| |

(3) |

Gross

Bookings represent the total amount paid by our customers for travel services, freight services and products booked through us, including

taxes, fees and other charges, and are net of cancellation and refunds. |

| |

(4) |

Adjusted

Margin % is defined as Adjusted Margin as a percentage of Gross Bookings. |

| |

(5) |

Quantitative

details are considered on a gross basis. |

| |

(6) |

Other

Services primarily consists of freight business, IT services, bus, rail and cab and others services. |

As

of September 30, 2024, 61,723,260 ordinary shares (on an as-converted basis), par value $0.0001 per share, of the Company (the “Ordinary

Shares”) were issued and outstanding.

Convenience

Translation

The

interim unaudited condensed consolidated financial statements are stated in INR. However, solely for the convenience of readers, the

interim unaudited condensed consolidated statement of profit or loss and other comprehensive loss for the three months and six months

ended September 30, 2024, the interim unaudited condensed consolidated statement of financial position as at September 30, 2024, the

interim unaudited condensed consolidated statement of cash flows for the six months ended September 30, 2024 and discussion of the results

of the three months ended September 30, 2024 compared with three months ended September 30, 2023, were converted into U.S. dollars at

the exchange rate of 83.76 INR per USD, which is based on the noon buying rate as at September 30, 2024, in The City of New York for

cable transfers of Indian rupees as certified for customs purposes by the Federal Reserve Bank of New York. This arithmetic conversion

should not be construed as representation that the amounts expressed in INR may be converted into USD at that or any other exchange rate

as well as that such numbers are in compliance as per the requirements of the International Financial Reporting Standards (“IFRS”).

Recent

developments

The Company, through its subsidiary Yatra

Online Limited (“Yatra India”), consummated the acquisition of all of the issued and paid-up equity share capital of Globe All India

Services Limited (“GAISL”) on September 11, 2024, pursuant to a share purchase agreement dated September 2, 2024,

with GAISL and Ramkrishna Forgings Limited (the “Acquisition”). The aggregate purchase price for the

Acquisition was INR 1,280 million (USD 15.3 million), after net debt and working capital adjustments.

The Company’s financial and

operating results for the three months and six month ended September 30, 2024, include the financial and operating results

of GAISL from September 11, 2024, to September 30, 2024. Accordingly, the reported results for three months and

six months ended September 30, 2024, which are inclusive of the impact of consolidation of GAISL may not be comparable

with the reported results for the three months and six months ended September 30, 2023, which exclude the impact

of consolidation of GAISL.

Results

of Three Months Ended September 30, 2024

Revenue.

We generated Revenue of INR 2,363.3 million (USD 28.2 million) in the three months ended September 30, 2024, an increase

of 149.4% compared with INR 947.6 million (USD 11.3 million) in three months ended September 30, 2023. Increase in revenue is

mainly driven by increase in our Hotels and Packages business on account of our Meetings, Incentives, Conferences, and

Exhibitions (“MICE”) business.

Service

cost. Our Service cost increased to INR 1,427.7 million (USD 17.0 million) in the three months ended September

30, 2024, compared to Service cost of INR 166.1 million (USD 2.0 million) in the three months ended September 30, 2023. The increase

in Service cost is driven by an increase in Hotels and Packages gross bookings on account of our

MICE business.

The

following table reconciles our Revenue (an IFRS measure) to Adjusted Margin (a non-IFRS measure), for further details, see section below

titled “Certain Non-IFRS Measures.”

Reconciliation

of Revenue (an IFRS measure) to Adjusted Margin (a non-IFRS measure)

| | |

Reportable Segments | |

| | |

Air Ticketing | | |

Hotels and Packages | | |

Other Services | |

| | |

Three months ended September 30, | |

| Amount in INR thousands (Unaudited) | |

2023 | | |

2024 | | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| Revenue as per IFRS - Rendering of services | |

| 391,961 | | |

| 429,666 | | |

| 365,820 | | |

| 1,703,783 | | |

| 45,459 | | |

| 93,940 | |

| Customer promotional expenses | |

| 626,315 | | |

| 456,189 | | |

| 78,576 | | |

| 101,109 | | |

| 4,102 | | |

| 4,961 | |

| Service cost | |

| - | | |

| - | | |

| (166,125 | ) | |

| (1,404,744 | ) | |

| - | | |

| (22,966 | ) |

| Adjusted Margin | |

| 1,018,276 | | |

| 885,855 | | |

| 278,271 | | |

| 400,148 | | |

| 49,561 | | |

| 75,935 | |

Air

Ticketing. Revenue from our Air Ticketing business was INR 429.7 million (USD 5.1 million) in the three months ended September

30, 2024 as compared to INR 392.0 million (USD 4.7 million) in the three months ended September 30, 2023, reflecting an increase of 9.6%.

Adjusted

Margin (1) from our Air Ticketing business decreased to INR 885.9 million (USD 10.6 million) in the three months ended

September 30, 2024, as compared to INR 1,018.3 million (USD 12.2 million) in the three months ended September 30, 2023. In the three

months ended September 30, 2024, Adjusted Margin (1) for Air Ticketing includes the add-back of INR 456.2 million (USD 5.4

million) of consumer promotion and loyalty program costs, which had been reduced from Revenue as per IFRS 15, against an add-back of

INR 626.3 million (USD 7.5 million) in the three months ended September 30, 2023. The decrease in Adjusted Margin – Air

Ticketing was largely due to lower gross booking on account of optimization of discount amid intensifying price competition in the market.

Hotels

and Packages. Revenue from our Hotels and Packages business was INR 1,703.8 million (USD 20.3 million) in the three

months ended September 30, 2024, as compared to INR 365.8 million (USD 4.4 million) in the three months ended September 30, 2023, reflecting

an increase of 365.7%.

Adjusted

Margin (1) for this segment increased by 43.8% to INR 400.1 million (USD 4.8 million) in the three months ended

September 30, 2024 from INR 278.3 million (USD 3.3 million) in the three months ended September 30, 2023. In the three months ended September

30, 2024, Adjusted Margin (1)l for Hotels and Packages includes the add-back of customer promotional expenses, which had been

reduced from Revenue as per IFRS 15 of INR 101.1 million (USD 1.2 million) against an add-back of INR 78.6 million (USD 0.9 million)

in the three months ended September 30, 2023. The increase in adjusted margin is driven by increase in gross bookings of our Hotels

and Packages business on account of MICE business and decrease in adjusted margin % is on account of mix change impact.

Other

Services. Our Revenue from Other Services was INR 93.9 million (USD 1.1 million) in the three months ended September 30, 2024,

an increase from INR 45.5 million (USD 0.5 million) in the three months ended September 30, 2023.

Adjusted

Margin for this segment increased by 53.2% to INR 75.9 million (USD 0.9 million) in the three months ended September 30,

2024, from INR 49.6 million (USD 0.6 million) in the three months ended September 30, 2023. In the three months ended September 30, 2024,

Adjusted Margin includes the add-back of consumer promotion expenses, which had been reduced from Revenue of INR 5.0 million (USD 0.1

million) against an add-back of INR 4.1 million (USD 0.1 million) in the three months ended September 30, 2023 pursuant to IFRS 15. The

increase in adjusted margin of other services is driven by an increase in gross bookings.

| |

(1) |

See

the section titled “Certain Non-IFRS Measures.” |

Other

Revenue. Our Other Revenue was INR 135.9 million (USD 1.6 million) in the three months ended September 30, 2024, a decrease from

INR 144.3 million (USD 1.7 million) in the three months ended September 30, 2023 due to a decrease in advertising revenue.

Other

Income. Our Other Income decreased to INR 10.0 million (USD 0.1 million) in the three months ended September 30, 2024 from

INR 24.8 million (USD 0.3 million) in the three months ended September 30, 2023 due to a decrease in write back of

liabilities no longer required to be paid and a one-time interest received on pre-deposit made related to favourable settlement of

service tax related matters.

Personnel

Expenses. Our personnel expenses decreased by 5.1% to INR 366.5 million (USD 4.4 million) in the three months ended September

30, 2024 from INR 386.3 million (USD 4.6 million) in the three months ended September 30, 2023. Excluding employee share-based compensation

costs of INR 30.5 million (USD 0.4 million) in the three months ended September 30, 2024, compared to INR 107.3 million (USD 1.3

million) in the three months ended September 30, 2023, personnel expenses increased by 20.4% in the three months ended September 30,

2024 on account of increase in our leadership strength (to venture into new business/products) and an impact of our annual appraisal

cycle.

Marketing

and Sales Promotion Expenses. Marketing and sales promotion expenses decreased by 5.4% to INR 116.7 million (USD 1.4 million)

in the three months ended September 30, 2024 from INR 123.3 million (USD 1.5 million) in the three months ended September 30, 2023. Adding

back the expenses for consumer promotions and loyalty program costs, which have been deducted from Revenue per IFRS 15, our marketing

spend would have been INR 678.2 million (USD 8.1 million) in the three months ended September 30, 2024 against INR 832.3

million (USD 9.9 million) in the three months ended September 30, 2023, decreased by 18.4% on a YoY.

Other

Operating Expenses. Other operating expenses increased by 15.5% to INR 426.2 million (USD 5.1 million) in the three

months ended September 30, 2024 from INR 369.0 million (USD 4.4 million) in the three months ended September 30, 2023.

Depreciation

and Amortization. Our depreciation and amortization expenses increased by 53.2% to INR 73.9 million (USD 0.9 million) in the

three months ended September 30, 2024 from INR 48.2 million (USD 0.6 million) in the three months ended September 30, 2023.

Results

from Operations. As a result of the foregoing factors, our Results from Operations were a loss of INR 37.7 million (USD 0.4

million) in the three months ended September 30, 2024. Our results from operations for the three months ended September 30, 2023

was a loss of INR 120.6 million (USD 1.4 million). Excluding the employee share-based compensation costs, Adjusted Results from Operations(1)

would have been a loss of INR 7.2 million (USD 0.1 million) for three months ended September 30, 2024 as compared to a loss of

INR 13.3 million (USD 0.2 million) for three months ended September 30, 2023.

| |

(1) |

See

the section titled “Certain Non-IFRS Measures.” |

Finance

Income. Our finance income increased to INR 62.9 million (USD 0.8 million) in the three months ended September 30, 2024 from

INR 7.5 million (USD 0.1 million) in the three months ended September 30, 2023. This increase was primarily on account of an increase

in our term deposits.

Finance

Costs. Our finance costs of INR 25.4 million (USD 0.3 million) in the three months ended September 30, 2024 which includes interest

on the lease liability of INR 8.1 million (USD 0.1 million) decreased by INR 56.5 million (USD 0.7 million) from finance cost

of INR 81.9 million (USD 1.0 million) in the three months ended September 30, 2023, which includes interest on the lease liability of

INR 8.2 million (USD 0.1 million). This decrease is majorly driven by a decrease in our borrowings from 1,742.5 million (USD

20.8 million) in the three months ended September 30, 2023 to 277.5 million (USD 3.3 million) in the three months ended September 30,

2024.

Listing

and related expenses. Listing and related expenses relate to the expenses incurred in connection with the initial public offering

of Yatra India, our Indian subsidiary (“Indian IPO”). During the three month ended September 30, 2024, the Company has incurred

INR Nil (USD Nil) compared to an expense of INR 68.2 million (USD 0.8 million) during the three months ended September 30, 2023.

Income

Tax Expense. Our income tax expense during the three months ended September 30, 2024 was INR 0.1 million (USD 0.1

million) compared to income tax expense of INR 9.6 million (USD 0.1 million) during the three months ended September 30, 2023.

Loss

for the Period. As a result of the foregoing factors, our loss in the three months ended September 30, 2024 was INR 0.3

million (USD 0.1 million) as compared to a loss of INR 272.9 million (USD 3.3 million) in the three months ended September 30, 2023.

Excluding the employee share based compensation costs and listing and related expenses, the Adjusted Profit(1) would have

been INR 30.2 million (USD 0.4 million) for the three months ended September 30, 2024 against an Adjusted loss(1) of

INR 97.4 million (USD 1.2 million) for the three months ended September 30, 2023.

Adjusted

EBITDA(1). Due to the foregoing factors, Adjusted EBITDA (1)

increased to INR 66.7 million (USD 0.8 million) in the three months ended September 30, 2024 from an Adjusted EBITDA (1)

of INR 34.9 million (USD 0.4 million) in the three months ended September 30, 2023.

Basic

Earnings (Loss) per Share. Basic Loss per Share was INR 0.25 (USD 0.01) in the three months ended September 30,

2024 as compared to Basic Loss per share of INR 4.21 (USD 0.05) in the three months ended September 30, 2023. After excluding the employee

share-based compensation costs and listing and related expenses, Adjusted Basic Earnings per Share(1) would have been

INR 0.10 (USD 0.01) in the three months ended September 30, 2024, as compared to Adjusted Basic Loss per share of INR 2.38 (USD

0.03) in the three months ended September 30, 2023.

Diluted Earnings/(Loss)

per Share. Diluted Loss per Share was INR 0.25 (USD 0.01) in the three months ended September 30, 2024 as compared to

Diluted Loss per share of INR 4.21 (USD 0.05) in the three months ended September 30, 2023. After excluding the employee share-based

compensation costs and listing and related expenses, Adjusted Diluted Earnings per Share(1) would have been INR 0.10

(USD 0.01) in the three months ended September 30, 2024 as compared to Adjusted Diluted Loss of INR 2.38 (USD 0.03) in the

three months ended September 30, 2023.

Liquidity.

As of September 30, 2024, the balance of cash and cash equivalents and term deposits on our balance sheet was INR 2,174.9 million (USD

26.0 million).

| |

(1) |

See

the section titled “Certain Non-IFRS Measures.” |

Conference

Call

The

Company will host a conference call to discuss its unaudited results for the three months ended September 30, 2024 beginning at 8:30

AM Eastern Daylight Time (or 7:00 PM India Standard Time) on November 13, 2024. Dial in details for the conference call is as follows:

US/International dial-in number: +1 404 975 4839. Confirmation Code: 173847 (Callers should dial in 5-10 minutes prior to the start time

and provide the operator with the Confirmation Code). The conference call will also be available via webcast at https://events.q4inc.com/attendee/840082388..

Certain

Non-IFRS Measures

As

certain parts of our Revenue are recognized on a “net” basis and other parts of our Revenue are recognized on a “gross”

basis, we evaluate our financial performance based on Adjusted Margin, which is a non-IFRS measure.

We

believe that Adjusted Margin provides investors with useful supplemental information about the financial performance of our business

and more accurately reflects the value addition of the travel services that we provide to our customers. The presentation of this non-IFRS

information is not meant to be considered in isolation or as a substitute for our unaudited condensed consolidated financial results

prepared in accordance with IFRS as issued by the International Accounting Standards Board (“IASB”). Our Adjusted Margin

may not be comparable to similarly titled measures reported by other companies due to potential differences in the method of calculation.

In

addition to referring to Adjusted Margin, we also refer to Adjusted EBITDA, Adjusted Results from Operations, Adjusted Profit/(Loss)

for the Period and Adjusted Basic and Adjusted Diluted Earnings/(Loss) Per Share which are also non-IFRS measures. For our internal management

reporting, budgeting and decision-making purposes, including comparing our operating results to that of our competitors, these non-IFRS

financial measures exclude employee share-based compensation cost and listing and related expenses. Our non-IFRS financial measures reflect

adjustments based on the following:

| |

● |

Employee

share-based compensation cost - The compensation cost to be recorded is dependent on varying available valuation methodologies and

subjective assumptions that companies can use while valuing these expenses especially when adopting IFRS 2 “Share-based

Payment”. Thus, the management believes that providing non-IFRS financial measures that exclude such expenses allows investors

to make additional comparisons between our operating results and those of other companies. |

| |

|

|

| |

● |

Listing

and related expenses - These primarily reflect the non-recurring expenses incurred on the

Indian IPO process.

|

| |

|

|

| |

● |

Finance

income - These primarily reflect income on the bank deposit.

|

| |

|

|

| |

● |

Finance

cost - These primarily reflect income on the borrowings and interest in lease liability.

|

| |

|

|

| |

● |

Depreciation

and amortisation - These primarily reflect depreciation and amortisation on tangible and

intangible assets.

|

| |

|

|

| |

● |

Tax

expense - These primarily reflect income tax and deferred tax.

|

We

evaluate the performance of our business after excluding the impact of the above measures and believe it is useful to understand the

effects of these items on our results from operations, Profit/(Loss) for the period and Basic and Diluted Earnings/(Loss) Per Share.

The presentation of these non-IFRS measures is not meant to be considered in isolation or as a substitute for our unaudited condensed

consolidated financial results prepared in accordance with IFRS as issued by the IASB. These non-IFRS measures may not be comparable

to similarly titled measures reported by other companies due to potential differences in the method of calculation.

A

limitation of using Adjusted EBITDA, Adjusted Results from Operations, Adjusted Profit/(Loss) for the period and Adjusted Basic and Adjusted

Diluted Earnings/(Loss) Per Share as against using measures in accordance with IFRS as issued by the IASB are that these non-IFRS financial

measures exclude share-based compensation cost, depreciation and amortization, finance income, finance costs, listing and related expenses,

and tax expenses in case of Adjusted EBITDA. Management compensates for this limitation by providing specific information on the IFRS

amounts excluded from Adjusted EBITDA, Adjusted Results from Operations, Adjusted Profit/(Loss) for the Period and Adjusted Basic and

Adjusted Diluted Earnings/(Loss) Per Share.

The

following table reconciles our Profits/(Losses) for the periods (an IFRS measure) to Adjusted EBITDA (a non-IFRS measure) for the periods

indicated:

| Reconciliation of Adjusted EBITDA (unaudited) | |

Three months ended | | |

Six months ended | |

| Amount in INR thousands | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | |

| Loss for the period as per IFRS | |

| (272,862 | ) | |

| (296 | ) | |

| (296,806 | ) | |

| (1,057 | ) |

| Employee share-based compensation costs | |

| 107,256 | | |

| 30,514 | | |

| 121,671 | | |

| 69,306 | |

| Depreciation and amortization | |

| 48,230 | | |

| 73,881 | | |

| 96,498 | | |

| 134,803 | |

| Finance income | |

| (7,493 | ) | |

| (62,910 | ) | |

| (15,961 | ) | |

| (128,724 | ) |

| Finance costs | |

| 81,918 | | |

| 25,383 | | |

| 167,357 | | |

| 53,989 | |

| Listing and related expenses | |

| 68,221 | | |

| - | | |

| 54,238 | | |

| - | |

| Tax expense | |

| 9,618 | | |

| 144 | | |

| 23,296 | | |

| 3,991 | |

| Adjusted EBITDA | |

| 34,888 | | |

| 66,716 | | |

| 150,293 | | |

| 132,308 | |

| Reconciliation of Adjusted Results from Operations (unaudited) | |

Three months ended | | |

Six months ended | |

| Amount in INR thousands | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | |

| Results from operations (as per IFRS) | |

| (120,598 | ) | |

| (37,679 | ) | |

| (67,876 | ) | |

| (71,801 | ) |

| Employee share-based compensation costs | |

| 107,256 | | |

| 30,514 | | |

| 121,671 | | |

| 69,306 | |

| Adjusted Results from Operations | |

| (13,342 | ) | |

| (7,165 | ) | |

| 53,795 | | |

| (2,495 | ) |

| Reconciliation of Adjusted Loss (unaudited) | |

Three months ended | | |

Six months ended | |

| Amount in INR thousands | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | |

| Loss for the period (as per IFRS) | |

| (272,862 | ) | |

| (296 | ) | |

| (296,806 | ) | |

| (1,057 | ) |

| Employee share-based compensation costs | |

| 107,256 | | |

| 30,514 | | |

| 121,671 | | |

| 69,306 | |

| Listing and related expenses | |

| 68,221 | | |

| - | | |

| 54,238 | | |

| - | |

| Adjusted Profit/(Loss) for the period | |

| (97,385 | ) | |

| 30,218 | | |

| (120,897 | ) | |

| 68,249 | |

| | |

Three months ended | | |

Six months ended | |

| Reconciliation of Adjusted Basic Earnings/(Loss) (Per Share)

(unaudited) | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | |

| Basic Loss per share (as per IFRS) | |

| (4.21 | ) | |

| (0.25 | ) | |

| (4.61 | ) | |

| (0.66 | ) |

| Employee share-based compensation costs | |

| 1.14 | | |

| 0.35 | | |

| 1.30 | | |

| 0.77 | |

| Listing and related expenses | |

| 0.69 | | |

| - | | |

| 0.55 | | |

| - | |

| Adjusted Basic Earnings/(Loss) Per Share | |

| (2.38 | ) | |

| 0.10 | | |

| (2.76 | ) | |

| 0.11 | |

| | |

Three months ended | | |

Six months ended | |

| Reconciliation of Adjusted Diluted Loss (Per Share) (unaudited) | |

September 30, 2023 | | |

September 30, 2024 | | |

September 30, 2023 | | |

September 30, 2024 | |

| Diluted Earnings/(Loss) per share (as per IFRS) | |

| (4.21 | ) | |

| (0.25 | ) | |

| (4.61 | ) | |

| (0.66 | ) |

| Employee share-based compensation costs | |

| 1.14 | | |

| 0.35 | | |

| 1.30 | | |

| 0.77 | |

| Listing and related expenses | |

| 0.69 | | |

| - | | |

| 0.55 | | |

| - | |

| Adjusted Diluted Earnings/(Loss) Per Share | |

| (2.38 | ) | |

| 0.10 | | |

| (2.76 | ) | |

| 0.11 | |

The

following table reconciles our Revenue (an IFRS measure), to Adjusted Margin (a non-IFRS measure):

Reconciliation

of Revenue (an IFRS measure) to Adjusted Margin (a non-IFRS measure)

| | |

Reportable Segments | |

| | |

Air Ticketing | | |

Hotels and Packages | | |

Other Services | |

| | |

Three months ended September 30, | |

| Amount in INR thousands (Unaudited) | |

2023 | | |

2024 | | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| Revenue as per IFRS - Rendering of services | |

| 391,961 | | |

| 429,666 | | |

| 365,820 | | |

| 1,703,783 | | |

| 45,459 | | |

| 93,940 | |

| Customer promotional expenses | |

| 626,315 | | |

| 456,189 | | |

| 78,576 | | |

| 101,109 | | |

| 4,102 | | |

| 4,961 | |

| Service cost | |

| - | | |

| - | | |

| (166,125 | ) | |

| (1,404,744 | ) | |

| - | | |

| (22,966 | ) |

| Adjusted Margin | |

| 1,018,276 | | |

| 885,855 | | |

| 278,271 | | |

| 400,148 | | |

| 49,561 | | |

| 75,935 | |

| | |

Reportable Segments | |

| | |

Air Ticketing | | |

Hotels and Packages | | |

Other Services | |

| | |

Six months ended September 30, 2024 | |

| Amount in INR thousands | |

2023 | | |

2024 | | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| Revenue as per IFRS - Rendering of services | |

| 881,330 | | |

| 886,575 | | |

| 818,375 | | |

| 2,086,919 | | |

| 72,177 | | |

| 161,727 | |

| Customer promotional expenses | |

| 1,295,978 | | |

| 918,231 | | |

| 152,662 | | |

| 199,068 | | |

| 10,112 | | |

| 9,291 | |

| Service cost | |

| - | | |

| - | | |

| (385,145 | ) | |

| (1,608,698 | ) | |

| - | | |

| (22,966 | ) |

| Adjusted Margin | |

| 2,177,308 | | |

| 1,804,806 | | |

| 585,892 | | |

| 677,289 | | |

| 82,289 | | |

| 148,052 | |

Safe

Harbor Statement

This

earnings release contains certain statements concerning the Company’s future growth prospects and forward-looking statements, as

defined in the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995, as amended. These forward-looking

statements are based on the Company’s current expectations, assumptions, estimates and projections about the Company and its industry.

These forward-looking statements are subject to various risks and uncertainties. Generally, these forward-looking statements can be identified

by the use of forward-looking terminology such as “anticipate,” “believe,” “estimate,” “expect,”

“intend,” “will,” “project,” “seek,” “should” similar expressions and the

negative forms of such expressions. Such statements include, among other things, statements regarding the long-term growth trajectory

for the Indian travel market; growth of the MICE business; statements concerning management’s beliefs as well as our strategic

and operational plans; our pursuit of strategic M&A opportunities and the pipeline of prospects; our ability to simplify our corporate

structure and operations and enhance shareholder value; and our future financial performance. Forward-looking statements involve inherent

risks and uncertainties. A number of important factors could cause actual results to differ materially from those contained in any forward-looking

statement. Potential risks and uncertainties include, but are not limited to, the impact of increasing competition in the Indian travel

industry and our expectations regarding the development of our industry and the competitive environment in which we operate; the slowdown

in Indian economic growth and other declines or disruptions in the Indian economy in general and travel industry in particular, including

disruptions caused by safety concerns, terrorist attacks, regional conflicts (including the ongoing conflict between Ukraine and Russia

and the evolving events in Israel, Gaza and the Middle East), pandemics and natural calamities; our ability to successfully negotiate

our contracts with airline suppliers and global distribution system service providers and mitigate any negative impacts on our Revenue

that result from reduced commissions, incentive payments and fees we receive; the risk that airline suppliers (including our GDS service

providers) may reduce or eliminate the commission and other fees they pay to us for the sale of air tickets; our ability to pursue strategic

partnerships and the risks associated with our business partners; the potential impact of recent developments in the Indian travel industry,

including the merger between Air India and Vistara, on our profitability and financial condition; political and economic stability

in and around India and other key travel destinations; our ability to maintain and increase our brand awareness; our ability to realize

the anticipated benefits of any past or future acquisitions; our ability to successfully implement our growth strategy; our ability to

attract, train and retain executives and other qualified employees, and our ability to successfully implement any new business initiatives;

our ability to effectively integrate artificial intelligence, machine learning and automated decision-making tools; non-compliance with

Nasdaq’s continued listing requirements and consequent delisting of our ordinary shares from Nasdaq; and our ability to simplify

our multi-jurisdictional corporate structure or reduce resources and management time devoted to compliance requirement. These and other

factors are discussed in our reports filed with the U.S. Securities and Exchange Commission. All information provided in this earnings

release is provided as of the date of issuance of this earnings release, and we do not undertake any obligation to update any forward-looking

statement, except as required under applicable law.

About

Yatra Online, Inc.

Yatra

Online, Inc. is the ultimate parent company of Yatra Online Limited, a public listed company on the NSE and BSE (Formerly known as Yatra

Online Private Limited, hereinafter referred to as “Yatra India”), whose corporate office is based in Gurugram, India. Yatra

India is India’s largest corporate travel services provider in terms of number of corporate clients with approximately 800 large

corporate customers and approximately 50,000 registered SME customers and the third largest online travel company (OTC) in India among

key OTA players in terms of gross booking revenue and operating revenue for Fiscal 2023 (Source: CRISIL Report). Leisure and business

travelers use Yatra India’s mobile applications, its website, www.yatra.com, and its other offerings and services to explore, research,

compare prices and book a wide range of travel-related services. These services include domestic and international air ticketing on nearly

all Indian and international airlines, as well as bus ticketing, rail ticketing, cab bookings and ancillary services within India. With

approximately 108,000 hotels in approximately 1,500 cities and towns in India as well as more than 2 million hotels around the world,

Yatra India has the largest hotels inventory amongst key Indian online travel agency (OTA) players (Source: CRISIL Report).

For

more information, please contact:

Manish

Hemrajani

Yatra

Online, Inc.

VP,

Head of Corporate Development and Investor Relations

ir@yatra.com

Yatra

Online, Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE LOSS FOR THREE AND SIX MONTHS ENDED SEPTEMBER 30, 2024

(Amount

in thousands, except per share data and number of shares)

| | |

Three months ended September 30, | | |

Six months ended September 30, | |

| | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| | |

INR | | |

INR | | |

USD | | |

INR | | |

INR | | |

USD | |

| | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

Unaudited | | |

Unaudited | |

| Revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Rendering of services | |

| 803,239 | | |

| 2,227,389 | | |

| 26,593 | | |

| 1,771,881 | | |

| 3,135,221 | | |

| 37,431 | |

| Other revenue | |

| 144,335 | | |

| 135,936 | | |

| 1,623 | | |

| 281,509 | | |

| 278,822 | | |

| 3,329 | |

| Total revenue | |

| 947,574 | | |

| 2,363,325 | | |

| 28,216 | | |

| 2,053,390 | | |

| 3,414,043 | | |

| 40,760 | |

| Other income | |

| 24,780 | | |

| 9,960 | | |

| 119 | | |

| 41,593 | | |

| 21,557 | | |

| 257 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service cost | |

| 166,125 | | |

| 1,427,710 | | |

| 17,045 | | |

| 385,145 | | |

| 1,631,664 | | |

| 19,480 | |

| Personnel expenses | |

| 386,282 | | |

| 366,509 | | |

| 4,376 | | |

| 662,081 | | |

| 725,757 | | |

| 8,665 | |

| Marketing and sales promotion expenses | |

| 123,311 | | |

| 116,674 | | |

| 1,393 | | |

| 254,329 | | |

| 208,831 | | |

| 2,493 | |

| Other operating expenses | |

| 369,004 | | |

| 426,190 | | |

| 5,088 | | |

| 764,806 | | |

| 806,347 | | |

| 9,627 | |

| Depreciation and amortization | |

| 48,230 | | |

| 73,881 | | |

| 882 | | |

| 96,498 | | |

| 134,803 | | |

| 1,609 | |

| Results from operations | |

| (120,598 | ) | |

| (37,679 | ) | |

| (449 | ) | |

| (67,876 | ) | |

| (71,802 | ) | |

| (857 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Finance income | |

| 7,493 | | |

| 62,910 | | |

| 751 | | |

| 15,961 | | |

| 128,724 | | |

| 1,537 | |

| Finance costs | |

| (81,918 | ) | |

| (25,383 | ) | |

| (303 | ) | |

| (167,357 | ) | |

| (53,989 | ) | |

| (645 | ) |

| Listing and related expenses | |

| (68,221 | ) | |

| - | | |

| - | | |

| (54,238 | ) | |

| - | | |

| - | |

| Profit/(Loss) before taxes | |

| (263,244 | ) | |

| (152 | ) | |

| (1 | ) | |

| (273,510 | ) | |

| 2,934 | | |

| 35 | |

| Tax (expense)/benefit | |

| (9,618 | ) | |

| (144 | ) | |

| (2 | ) | |

| (23,296 | ) | |

| (3,991 | ) | |

| (48 | ) |

| Profit/(Loss) for the period | |

| (272,862 | ) | |

| (296 | ) | |

| (3 | ) | |

| (296,806 | ) | |

| (1,057 | ) | |

| (13 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive income/ (loss) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Items not to be reclassified to profit or loss in subsequent periods (net of taxes) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Remeasurement gain on defined benefit plan | |

| (1,041 | ) | |

| 380 | | |

| 5 | | |

| (971 | ) | |

| (826 | ) | |

| (10 | ) |

| Items that are or may be reclassified subsequently to profit or loss (net of taxes) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation differences loss | |

| (29,379 | ) | |

| 2,372 | | |

| 28 | | |

| (14,168 | ) | |

| 5,503 | | |

| 66 | |

| Other comprehensive profit/(loss) for the period, net of tax | |

| (30,420 | ) | |

| 2,752 | | |

| 33 | | |

| (15,139 | ) | |

| 4,677 | | |

| 56 | |

| Total comprehensive profit/(loss) for the period, net of tax | |

| (303,282 | ) | |

| 2,456 | | |

| 30 | | |

| (311,945 | ) | |

| 3,620 | | |

| 43 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Profit/(loss) attributable to : | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Owners of the Parent Company | |

| (269,396 | ) | |

| (15,723 | ) | |

| (187 | ) | |

| (294,190 | ) | |

| (41,213 | ) | |

| (492 | ) |

| Non-Controlling interest | |

| (3,466 | ) | |

| 15,428 | | |

| 184 | | |

| (2,616 | ) | |

| 40,154 | | |

| 479 | |

| Profit/(Loss) for the period | |

| (272,862 | ) | |

| (296 | ) | |

| (3 | ) | |

| (296,806 | ) | |

| (1,057 | ) | |

| (13 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive profit/(loss) attributable to : | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Owners of the Parent Company | |

| (299,485 | ) | |

| (13,106 | ) | |

| (156 | ) | |

| (309,001 | ) | |

| (36,243 | ) | |

| (433 | ) |

| Non-Controlling interest | |

| (3,797 | ) | |

| 15,563 | | |

| 186 | | |

| (2,944 | ) | |

| 39,862 | | |

| 476 | |

| Total comprehensive profit/(loss) for the period | |

| (303,282 | ) | |

| 2,456 | | |

| 30 | | |

| (311,945 | ) | |

| 3,620 | | |

| 43 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Earnings/(Loss) per share | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| (4.21 | ) | |

| (0.25 | ) | |

| (0.00 | )* | |

| (4.61 | ) | |

| (0.67 | ) | |

| (0.01 | ) |

| Diluted | |

| (4.21 | ) | |

| (0.25 | ) | |

| (0.00 | )* | |

| (4.61 | ) | |

| (0.67 | ) | |

| (0.01 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Weighted average no. of shares | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 63,955,457 | | |

| 62,059,766 | | |

| 62,059,766 | | |

| 63,844,450 | | |

| 61,973,195 | | |

| 61,973,195

| |

| Diluted | |

| 63,955,457 | | |

| 62,059,766 | | |

| 62,059,766 | | |

| 63,844,450 | | |

| 61,973,195 | | |

| 61,973,195 | |

*rounded off

Yatra

Online, Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT SEPTEMBER 30, 2024

(Amounts

in thousands, except per share data and number of shares)

| | |

March 31, 2024 | | |

September 30, 2024 | | |

September 30, 2024 | |

| | |

INR | | |

INR | | |

USD | |

| | |

Audited | | |

Unaudited | |

| Assets | |

| | | |

| | | |

| | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property, plant and equipment | |

| 73,835 | | |

| 114,853 | | |

| 1,371 | |

| Right-of-use assets | |

| 160,037 | | |

| 193,057 | | |

| 2,305 | |

| Intangible assets and goodwill | |

| 913,434 | | |

| 2,189,484 | | |

| 26,140 | |

| Prepayments and other assets | |

| 755 | | |

| 1,394 | | |

| 17 | |

| Other financial assets | |

| 24,039 | | |

| 33,695 | | |

| 402 | |

| Term deposits | |

| 137,169 | | |

| 11,093 | | |

| 132 | |

| Other non financial assets | |

| 207,555 | | |

| 161,089 | | |

| 1,923 | |

| Deferred tax asset | |

| 10,932 | | |

| 37,987 | | |

| 454 | |

| Total non-current assets | |

| 1,527,756 | | |

| 2,742,652 | | |

| 32,744 | |

| | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Inventories | |

| 53 | | |

| 56 | | |

| 1 | |

| Trade and other receivables | |

| 4,637,243 | | |

| 5,282,898 | | |

| 63,072 | |

| Prepayments and other assets | |

| 1,487,861 | | |

| 1,977,283 | | |

| 23,607 | |

| Income tax recoverable | |

| 339,316 | | |

| 410,661 | | |

| 4,903 | |

| Other financial assets | |

| 134,930 | | |

| 116,021 | | |

| 1,385 | |

| Term deposits | |

| 2,620,655 | | |

| 1,270,785 | | |

| 15,172 | |

| Cash and cash equivalents | |

| 1,741,950 | | |

| 893,055 | | |

| 10,662 | |

| Total current assets | |

| 10,962,008 | | |

| 9,950,759 | | |

| 118,802 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| 12,489,764 | | |

| 12,693,411 | | |

| 151,546 | |

| | |

| | | |

| | | |

| | |

| Equity and liabilities | |

| | | |

| | | |

| | |

| Equity | |

| | | |

| | | |

| | |

| Share capital | |

| 857 | | |

| 860 | | |

| 10 | |

| Share premium | |

| 20,511,478 | | |

| 20,556,736 | | |

| 245,424 | |

| Treasury shares | |

| (222,152 | ) | |

| (418,555 | ) | |

| (4,997 | ) |

| Other capital reserve | |

| 378,695 | | |

| 402,149 | | |

| 4,801 | |

| Accumulated deficit | |

| (20,266,628 | ) | |

| (20,307,781 | ) | |

| (242,452 | ) |

| Non-controlling interest reserve | |

| 5,032,282 | | |

| 5,032,282 | | |

| 60,080 | |

| Foreign currency translation reserve | |

| (46,059 | ) | |

| (40,556 | ) | |

| (484 | ) |

| Total equity attributable to equity holders of the Company | |

| 5,388,473 | | |

| 5,225,135 | | |

| 62,382 | |

| Total Non-controlling interest | |

| 2,371,799 | | |

| 2,411,659 | | |

| 28,793 | |

| Total equity | |

| 7,760,272 | | |

| 7,636,794 | | |

| 91,175 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Borrowings | |

| 114,677 | | |

| 24,382 | | |

| 291 | |

| Deferred tax liability | |

| 4,669 | | |

| - | | |

| - | |

| Employee benefits | |

| 55,850 | | |

| 62,879 | | |

| 751 | |

| Lease liability | |

| 164,418 | | |

| 197,390 | | |

| 2,357 | |

| Total non-current liabilities | |

| 339,614 | | |

| 284,651 | | |

| 3,399 | |

| | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Borrowings | |

| 523,515 | | |

| 253,106 | | |

| 3,022 | |

| Trade and other payables | |

| 2,608,087 | | |

| 3,069,925 | | |

| 36,651 | |

| Employee benefits | |

| 41,307 | | |

| 57,734 | | |

| 689 | |

| Deferred revenue | |

| 3,360 | | |

| 3,088 | | |

| 37 | |

| Income taxes payable | |

| 251 | | |

| 840 | | |

| 10 | |

| Lease liability | |

| 51,324 | | |

| 49,964 | | |

| 597 | |

| Other financial liabilities | |

| 418,969 | | |

| 187,957 | | |

| 2,244 | |

| Other current liabilities | |

| 743,065 | | |

| 1,149,352 | | |

| 13,722 | |

| Total current liabilities | |

| 4,389,878 | | |

| 4,771,966 | | |

| 56,972 | |

| Total liabilities | |

| 4,729,492 | | |

| 5,056,617 | | |

| 60,371 | |

| Total equity and liabilities | |

| 12,489,764 | | |

| 12,693,411 | | |

| 151,546 | |

*

Pursuant to Share Purchase Agreement executed on September 2, 2024, the Company has acquired 100% of the equity share capital of Globe

All India Services Limited for a cash consideration of INR 1,280 million resulting in a goodwill amounting to INR 1,215.5 million

(provisional).

Yatra

Online, Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR SIX MONTHS ENDED SEPTEMBER 30, 2024

(Amount

in INR thousands, except per share data and number of shares)

| | |

Attributable to shareholders of the Parent Company | | |

| | |

| |

| | |

Equity share capital | | |

Equity share premium | | |

Treasury shares | | |

Accumulated deficit | | |

Noncontrolling

interest

reserve | | |

Other capital reserve | | |

Foreign currency translation reserve | | |

Total | | |

Non controlling interest | | |

Total Equity | |

| Balance as at April 1, 2024 | |

| 857 | | |

| 20,511,478 | | |

| (222,152 | ) | |

| (20,266,628 | ) | |

| 5,032,282 | | |

| 378,695 | | |

| (46,059 | ) | |

| 5,388,473 | | |

| 2,371,799 | | |

| 7,760,272 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loss for the period | |

| | | |

| | | |

| | | |

| (41,213 | ) | |

| | | |

| | | |

| | | |

| (41,213 | ) | |

| 40,154 | | |

| (1,059 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation differences | |

| | | |

| | | |

| | | |

| - | | |

| | | |

| | | |

| 5,503 | | |

| 5,503 | | |

| - | | |

| 5,503 | |

| Re-measurement gain on defined benefit plan | |

| | | |

| | | |

| | | |

| (532 | ) | |

| | | |

| | | |

| - | | |

| (532 | ) | |

| (294 | ) | |

| (826 | ) |

| Total other comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (532 | ) | |

| - | | |

| - | | |

| 5,503 | | |

| 4,971 | | |

| (294 | ) | |

| 4,677 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive loss | |

| - | | |

| - | | |

| - | | |

| (41,745 | ) | |

| - | | |

| - | | |

| 5,503 | | |

| (36,242 | ) | |

| 39,860 | | |

| 3,618 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share based payments | |

| - | | |

| - | | |

| - | | |

| 592 | | |

| | | |

| 68,714 | | |

| - | | |

| 69,306 | | |

| - | | |

| 69,306 | |

| Exercise of options | |

| 3 | | |

| 45,258 | | |

| - | | |

| - | | |

| | | |

| (45,260 | ) | |

| - | | |

| 1 | | |

| - | | |

| 1 | |

| Own shares repurchase | |

| - | | |

| - | | |

| (196,403 | ) | |

| | | |

| | | |

| | | |

| - | | |

| (196,403 | ) | |

| - | | |

| (196,403 | ) |

| Change in non-controlling interest | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total contribution by owners | |

| 3 | | |

| 45,258 | | |

| (196,403 | ) | |

| 592 | | |

| - | | |

| 23,454 | | |

| - | | |

| (127,096 | ) | |

| - | | |

| (127,096 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as at September 30, 2024 | |

| 860 | | |

| 20,556,736 | | |

| (418,555 | ) | |

| (20,307,781 | ) | |

| 5,032,282 | | |

| 402,149 | | |

| (40,556 | ) | |

| 5,225,135 | | |

| 2,411,659 | | |

| 7,636,794 | |

Yatra

Online, Inc.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS FOR SIX MONTHS ENDED SEPTEMBER 30, 2024

(Amount

in thousands, except per share data and number of shares)

| | |

Six months ended September 30, 2024 | |

| | |

2023 | | |

2024 | | |

2024 | |

| | |

INR | | |

INR | | |

USD | |

| | |

| | |

| | |

| |

| Profit/(Loss)

before tax | |

| (273,511 | ) | |

| 2,932 | | |

| 35 | |

| Adjustments for non-cash and non-operating items | |

| 222,866 | | |

| 88,761 | | |

| 1,060 | |

| Change in working capital | |

| (122,218 | ) | |

| 84,356 | | |

| 1,007 | |

| Direct taxes paid (net of refunds) | |

| (59,603 | ) | |

| (60,094 | ) | |

| (717 | ) |

| Net cash flows generated from/(used in) operating activities | |

| (232,466 | ) | |

| 115,955 | | |

| 1,385 | |

| Net cash flows generated from/(used in) investing activities | |

| (1,862,084 | ) | |

| 171,332 | | |

| 2,046 | |

| Net cash flows generated from/(used in) financing activities | |

| 6,399,655 | | |

| (1,155,693 | ) | |

| (13,798 | ) |

| Net increase/decrease in cash and cash equivalents | |

| 4,305,105 | | |

| (868,406 | ) | |

| (10,367 | ) |

| Cash and Cash Equivalents acquired on Business acquisition | |

| - | | |

| 3,026 | | |

| 36 | |

| Effect of exchange differences on cash and cash equivalents | |

| (11,557 | ) | |

| 16,485 | | |

| 192 | |

| Cash and cash equivalents at the beginning of the period | |

| 503,601 | | |

| 1,741,950 | | |

| 20,801 | |

| Cash and cash equivalents at the end of the period | |

| 4,797,149 | | |

| 893,055 | | |

| 10,662 | |

Yatra

Online, Inc.

OPERATING

DATA

The

following table sets forth certain selected unaudited condensed consolidated financial and other data for the periods indicated:

| | |

For the three months ended September 30, | | |

For the six months ended September 30, | |

| (In thousands except percentages) | |

2023 | | |

2024 | | |

2023 | | |

2024 | |

| Quantitative details * | |

| | | |

| | | |

| | | |

| | |

| Air Passengers Booked | |

| 1,660 | | |

| 1,377 | | |

| 3,485 | | |

| 2,707 | |

| Stand-alone Hotels Room Nights Booked | |

| 440 | | |

| 461 | | |

| 931 | | |

| 878 | |

| Packages Passengers Travelled | |

| 5 | | |

| 15 | | |

| 11 | | |

| 22 | |

| Gross Bookings | |

| | | |

| | | |

| | | |

| | |

| Air Ticketing | |

| 14,771,705 | | |

| 13,260,073 | | |

| 31,695,664 | | |

| 26,780,366 | |

| Hotels and Packages | |

| 2,183,857 | | |

| 3,661,505 | | |

| 4,587,999 | | |

| 6,060,337 | |

| Other Services | |

| 564,710 | | |

| 729,988 | | |

| 1,070,985 | | |

| 1,358,512 | |

| Total | |

| 17,520,272 | | |

| 17,651,566 | | |

| 37,354,648 | | |

| 34,199,215 | |

| Adjusted Margin | |

| | | |

| | | |

| | | |

| | |

| Adjusted Margin - Air Ticketing | |

| 1,018,276 | | |

| 885,855 | | |

| 2,177,308 | | |

| 1,804,806 | |

| Adjusted Margin - Hotels and Packages | |

| 278,271 | | |

| 400,148 | | |

| 585,892 | | |

| 677,289 | |

| Adjusted Margin - Other Services | |

| 49,561 | | |

| 75,935 | | |

| 82,288 | | |

| 148,052 | |

| Others (Including Other Income) | |

| 169,115 | | |

| 145,895 | | |

| 323,102 | | |

| 300,379 | |

| Total | |

| 1,515,223 | | |

| 1,507,833 | | |

| 3,168,590 | | |

| 2,930,526 | |

| Adjusted Margin%** | |

| | | |

| | | |

| | | |

| | |

| Air Ticketing | |

| 6.9 | % | |

| 6.7 | % | |

| 6.9 | % | |

| 6.7 | % |

| Hotels and Packages | |

| 12.7 | % | |

| 10.9 | % | |

| 12.8 | % | |

| 11.2 | % |

| Other Services | |

| 8.8 | % | |

| 10.4 | % | |

| 7.7 | % | |

| 10.9 | % |

*

Quantitative details are considered on Gross basis.

**

Adjusted Margin % is defined as Adjusted Margin as a percentage of Gross Bookings.

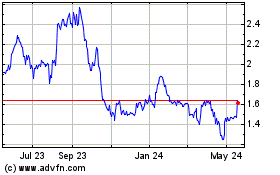

Yatra Online (NASDAQ:YTRA)

Historical Stock Chart

From Oct 2024 to Nov 2024

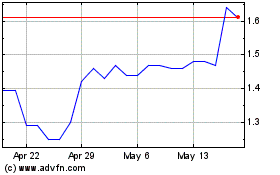

Yatra Online (NASDAQ:YTRA)

Historical Stock Chart

From Nov 2023 to Nov 2024