Ziff Davis, Inc. (NASDAQ: ZD) (“Ziff Davis”) today reported

unaudited financial results for the fourth quarter and year ended

December 31, 2022.

"Delivering bottom-line growth in Q4 and throughout 2022 is

impressive given the challenges in the advertising market and the

overall tech sector," said Vivek Shah, Chief Executive Officer of

Ziff Davis. "While we've been judicious in our spending, we

continue to confidently pursue organic growth and seek compelling

investment choices for our capital."

FOURTH QUARTER 2022

RESULTS

On October 7, 2021, Ziff Davis completed the spin-off of its

Consensus Cloud Solutions, Inc. (“Consensus”) business. Ziff Davis

has classified Consensus as a discontinued operation in its

financial statements for the three months and year ended December

31, 2021 results. Historical results in this press release

represent continuing operations, except for the Statement of Cash

Flows, Net cash provided by operating activities and Free cash

flow, which are on a combined continuing and discontinued

operations basis(1).

Q4 2022 quarterly revenues decreased 2.9% to $396.7 million

compared to $408.6 million for Q4 2021.

Net income from continuing operations decreased to $69.2 million

compared to $378.9 million for Q4 2021 primarily due to the

unrealized gain on investment of $298.5 million recorded during the

three months ended December 31, 2021 in connection with the

Company’s investment in Consensus that did not recur.

Adjusted net income from continuing operations(2) increased by

0.9% to $106.0 million compared to $105.1 million for Q4 2021.

Net income per diluted share from continuing operations(3)

decreased to $1.37 in Q4 2022 compared to $7.81 for Q4 2021. The

decrease is primarily driven by the unrealized gain on investment

of $298.5 million ($6.15 per share, after tax) recorded during the

three months ended December 31, 2021 in connection with the

Company’s investment in Consensus that did not recur.

Adjusted net income per diluted share from continuing

operations(3)(4) (or “Adjusted diluted EPS”) for the quarter

increased 3.7% to $2.26 compared to $2.18 for Q4 2021.

Adjusted EBITDA(5) for the quarter increased 4.1% to $168.3

million compared to $161.6 million for Q4 2021.

Net cash provided by operating activities from continuing and

discontinued operations was $43.2 million in Q4 2022 compared to

$86.3 million in Q4 2021. Free cash flow from continuing and

discontinued operations(6) was $17.8 million in Q4 2022 compared to

$60.0 million in Q4 2021.

Ziff Davis ended the quarter with approximately $839.1 million

in cash, cash equivalents, and investments after deploying

approximately $1.4 million during the quarter for prior year

acquisitions. No funds were deployed in Q4 2022 for current year

acquisitions.

Key unaudited financial results for Q4 2022 versus Q4 2021 are

set forth in the following table (in millions, except per share

amounts). Reconciliations of Adjusted net income per diluted share

from continuing operations, Adjusted EBITDA and Free cash flow from

continuing and discontinued operations(1) to their nearest

comparable GAAP financial measures are presented in the attached

schedules.

The following table reflects Actual Results from Continuing

Operations, except for Cash provided by operating activities and

Free Cash Flow, which are on a combined basis of continuing

operations and discontinued operations(1), for the fourth quarter

of 2022 and 2021 (in millions, except per share amounts).

Actual Results

Three months ended December

31,

2022

2021

% Change

Revenues

Digital Media

$321.7

$325.7

(1.2)%

Cybersecurity and Martech

$75.0

$82.9

(9.5)%

Total revenue (7)

$396.7

$408.6

(2.9)%

Income from operations

$93.5

$85.4

9.5%

Operating income margin

23.6%

20.9%

2.7%

Net income from continuing

operations

$69.2

$378.9

(81.7)%

Adjusted net income from continuing

operations

$106.0

$105.1

0.9%

Net income per diluted share from

continuing operations (3)

$1.37

$7.81

(82.5)%

Adjusted diluted EPS (3) (4)

$2.26

$2.18

3.7%

Adjusted EBITDA (5)

$168.3

$161.6

4.1%

Adjusted EBITDA margin (5)

42.4%

39.5%

2.9%

Net cash provided by operating

activities from continuing and discontinued operations (6)

$43.2

$86.3

(49.9)%

Free cash flow from continuing and

discontinued operations (1)(6)

$17.8

$60.0

(70.3)%

FULL YEAR 2022 HIGHLIGHTS

2022 revenues decreased 1.8% to $1.39 billion compared to $1.42

billion for 2021. Excluding divested businesses(8), 2022 revenues

increased 0.6% to $1.39 billion as compared to $1.38 billion for

2021.

Net income from continuing operations decreased to $65.5 million

compared to $401.4 million for 2021 primarily due to an unrealized

gain on investment of $298.5 million in the prior year recorded in

connection with the Company’s investment in Consensus that did not

recur.

Adjusted net income from continuing operations(2) increased by

5.0% to $312.6 million as compared to $297.7 million for 2021.

Excluding divested businesses(8), Adjusted net income from

continuing operations increased by 8.8% to $312.6 million as

compared to $287.4 million for 2021.

Net income per diluted share(3) from continuing operations

decreased to $1.39 in 2022 compared to $8.38 for 2021. The net

income decrease was primarily due to an unrealized gain on

investment of $298.5 million ($6.24 per share, after tax) in the

prior year recorded in connection with the Company’s investment in

Consensus that did not recur.

Adjusted diluted EPS(3)(4) for the year increased by 3.3% to

$6.65 compared to $6.44 for 2021. Excluding divested businesses(8),

Adjusted diluted EPS(3)(4) for the year increased 7.1% to $6.65 as

compared to $6.21 for 2021.

Adjusted EBITDA(5) for the year increased 1.6% to $507.2 million

compared to $499.0 million for 2021. Excluding divested

businesses(8), Adjusted EBITDA(5) for the year increased 4.6% to

$507.2 million compared to $484.9 million for 2021.

Net cash provided by operating activities from continuing and

discontinued operations was $336.4 million during 2022 compared to

$516.5 million in 2021. Free cash flow from continuing and

discontinued operations(6) was $230.3 million during 2022 compared

to $403.5 million in 2021.

The following table reflects Actual Results from Continuing

Operations and Results from Continuing Operations excluding

divested businesses, except for Cash provided by operating

activities and Free Cash Flow, which are on a combined basis of

continuing operations and discontinued operations, for the years

ended December 31, 2022 and 2021 (in millions, except per share

amounts). Results from Continuing Operations excluding divested

businesses below exclude the operating results from Voice assets in

the United Kingdom that were sold in February 2021 and the

Company’s B2B Backup business that was sold in September 2021.

Actual Results

Results excluding divested

businesses(8)

Year ended December

31,

Year ended December

31,

2022

2021

% Change

2022

2021

% Change

Revenues

Digital Media

$1,078.4

$1,068.5

0.9%

$1,078.4

$1,068.5

0.9%

Cybersecurity and Martech

$312.6

$348.2

(10.2)%

$312.6

$314.7

(0.7)%

Total revenue (7)

$1,391.0

$1,416.7

(1.8)%

$1,391.0

$1,383.2

0.6%

Income from operations

$198.9

$167.3

18.9%

Operating income margin

14.3%

11.8%

2.5%

Net income from continuing

operations

$65.5

$401.4

(83.7)%

Adjusted net income from continuing

operations

$312.6

$297.7

5.0%

$312.6

$287.4

8.8%

Net income per diluted share from

continuing operations (3)

$1.39

$8.38

(83.4)%

Adjusted diluted EPS (3) (4)

$6.65

$6.44

3.3%

$6.65

$6.21

7.1%

Adjusted EBITDA (5)

$507.2

$499.0

1.6%

$507.2

$484.9

4.6%

Adjusted EBITDA margin (5)

36.5%

35.2%

1.3%

36.5%

35.1%

1.4%

Net cash provided by operating

activities from continuing operations (6)

$336.4

$516.5

(34.9)%

Free cash flow from continuing and

discontinued operations (1)(6)

$230.3

$403.5

(42.9)%

ZIFF DAVIS GUIDANCE

The Company’s full year 2023 outlook is as follows (in millions,

except per share data):

2022 Actual

2023 Range of

Estimates

Growth (Decline)

(unaudited)

Low

High

Low

High

Revenue

$

1,391.0

$

1,350.0

$

1,408.0

(2.9

)%

1.2

%

Adjusted EBITDA

$

507.2

$

479.0

$

514.0

(5.6

)%

1.3

%

Adjusted diluted EPS*

$

6.65

$

6.02

$

6.54

(9.5

)%

(1.7

)%

* Adjusted diluted EPS for 2023 excludes share based

compensation ranging between $28 million and $30 million,

amortization of acquired intangibles and the impact of any

currently unanticipated items, in each case net of tax. It is

anticipated that Adjusted effective tax rate for 2023 (exclusive of

the release of reserves for uncertain tax positions) will be

between 23.0% and 25.0%.

Notes:

(1)

For the three months and year ended

December 31, 2022, the Loss from discontinued operations, net of

income taxes did not have an impact on Net cash provided by

operating activities from continuing and discontinued

operations.

(2)

Adjusted net income from continuing

operations is Net income from continuing operations with

modifications due to the items used to reconcile GAAP to non-GAAP

financial measures, as defined further in this Press Release.

(3)

The estimated GAAP effective tax rates

were approximately 27.0% and 1.6% for the three months ended

December 31, 2022 and 2021, respectively, and 44.2% and (4.0)% for

the years ended December 31, 2022 and 2021, respectively. The

estimated Adjusted effective tax rates were approximately 23.2% and

23.2% for the three months ended December 31, 2022 and 2021,

respectively, and 22.9% and 23.2% for the years ended December 31,

2022 and 2021, respectively.

(4)

Adjusted diluted EPS excludes certain

non-GAAP items, as defined in the Reconciliation of GAAP to

non-GAAP financial measures. For the three months ended December

31, 2022 and 2021, excluded non-GAAP items totaled $0.89 and

$(5.63) per diluted share, respectively. For the years ended

December 31, 2022 and 2021, excluded non-GAAP items totaled $5.26

and $(1.94) per diluted share, respectively.

(5)

Adjusted EBITDA is defined as net income

from continuing operations before interest; gain on sale of

businesses; loss on investments, net; unrealized gain (loss) on

short-term investments held at the reporting date; other income

(expense), net; income tax (expense) benefit; (loss) income from

equity method investments, net; depreciation and amortization; and

the items used to reconcile GAAP to non-GAAP financial measures, as

defined in the Reconciliation of GAAP to Adjusted financial

measures. Adjusted EBITDA margin is calculated by dividing Adjusted

EBITDA by Revenue. Adjusted EBITDA and Adjusted EBITDA margin

amounts are not meant as a substitute for financial information

prepared in accordance with GAAP, but are solely for informational

purposes.

(6)

Free cash flow from continuing and

discontinued operations is defined as net cash provided by

operating activities from continuing and discontinued operations,

less purchases of property and equipment from continuing and

discontinued operations, plus contingent consideration from

continuing and discontinued operations. Free cash flow from

continuing and discontinued operations amounts are not meant as a

substitute for GAAP, but are solely for informational purposes.

(7)

The revenues associated with each of the

businesses may not foot precisely since each is presented

independently.

(8)

Excluding divested businesses figures are

provided taking into consideration the sale of certain Voice assets

in the United Kingdom in February 2021 as well as the sale of the

Company’s B2B Backup business in September 2021 as if they had

occurred in a prior period presented.

About Ziff Davis

Ziff Davis, Inc. (NASDAQ: ZD) is a vertically focused digital

media and internet company whose portfolio includes leading brands

in technology, shopping, gaming and entertainment, connectivity,

health, cybersecurity, and martech. For more information, visit

www.ziffdavis.com.

“Safe Harbor” Statement Under the Private Securities

Litigation Reform Act of 1995: Certain statements in this Press

Release are “forward-looking statements” within the meaning of The

Private Securities Litigation Reform Act of 1995, including those

contained in Vivek Shah’s quote and the “Ziff Davis Guidance”

portion regarding the Company’s expected fiscal 2023 financial

performance. These forward-looking statements are based on

management’s current expectations or beliefs and are subject to

numerous assumptions, risks and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. These factors and uncertainties

include, among other items: the Company’s ability to grow

advertising revenues, profitability and cash flows; the Company’s

ability to make interest and debt payments; the Company’s ability

to identify, close and successfully transition acquisitions;

subscriber growth and retention; variability of the Company’s

revenue based on changing conditions in particular industries and

the economy generally; protection of the Company’s proprietary

technology or infringement by the Company of intellectual property

of others; the risk of losing critical third-party vendors or key

personnel; the risks associated with fraudulent activity, system

failure or a security breach; risks related to our ability to

adhere to our internal controls and procedures; the risk of adverse

changes in the U.S. or international regulatory environments,

including but not limited to the imposition or increase of taxes or

regulatory-related fees; the risks related to supply chain

disruptions, inflationary conditions and rising interest rates; the

risk of liability for legal and other claims; and the numerous

other factors set forth in Ziff Davis’ filings with the Securities

and Exchange Commission (“SEC”). For a more detailed description of

the risk factors and uncertainties affecting Ziff Davis, refer to

the 2021 Annual Report on Form 10-K filed by Ziff Davis on March

15, 2022, and the other reports filed by Ziff Davis from

time-to-time with the SEC, each of which is available at

www.sec.gov. The forward-looking statements provided in this press

release, including those contained in Vivek Shah’s quote and in the

“Ziff Davis Guidance” portion regarding the Company’s expected

fiscal 2022 financial performance are based on limited information

available to the Company at this time, which is subject to change.

Although management’s expectations may change after the date of

this Press Release, the Company undertakes no obligation to revise

or update these statements.

About Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements,

which are prepared and presented in accordance with U.S. generally

accepted accounting principles (“GAAP”), we use the following

non-GAAP financial measures: Revenues excluding divested

businesses, Adjusted diluted EPS and Adjusted diluted EPS excluding

divested business, Adjusted net income from continuing operations

and Adjusted net income from continuing operations excluding

divested businesses, Adjusted EBITDA and Adjusted EBITDA excluding

divested businesses, Adjusted EBITDA margin and Adjusted EBITDA

margin excluding divested businesses, and Free cash flow from

continuing and discontinued operations. The presentation of this

financial information is not intended to be considered in isolation

or as a substitute for, or superior to, the financial information

prepared and presented in accordance with GAAP.

We use these non-GAAP financial measures for financial and

operational decision making and as a means to evaluate

period-to-period comparisons. We believe that these non-GAAP

financial measures provide meaningful supplemental information

regarding our performance and liquidity by excluding certain

expenses and expenditures that may not be indicative of our

recurring core business operating results. We believe that both

management and investors benefit from referring to these non-GAAP

financial measures in assessing our performance and when planning,

forecasting, and analyzing future periods. These non-GAAP financial

measures also facilitate management’s internal comparisons to our

historical performance and liquidity. We believe these non-GAAP

financial measures are useful to investors both because (1) they

allow for greater transparency with respect to key metrics used by

management in its financial and operational decision-making and (2)

they are used by our institutional investors and the analyst

community to help them analyze the health of our business.

For more information on these non-GAAP financial measures,

please see the appropriate GAAP to Adjusted reconciliation tables

that are presented in the attached schedules.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED, IN

THOUSANDS)

December 31,

2022

2021

ASSETS

Cash and cash equivalents

$

652,793

$

694,842

Short-term investments

58,421

229,200

Accounts receivable, net of allowances

304,739

316,342

Prepaid expenses and other current

assets

68,319

60,290

Total current assets

1,084,272

1,300,674

Long-term investments

127,871

122,593

Property and equipment, net

178,184

161,209

Operating lease right-of-use assets

40,640

55,617

Trade names, net

136,192

147,761

Customer relationships, net

208,057

275,451

Goodwill

1,591,474

1,531,455

Other purchased intangibles, net

118,566

149,513

Deferred income taxes, noncurrent

8,523

5,917

Other assets

39,491

20,090

TOTAL ASSETS

$

3,533,270

$

3,770,280

LIABILITIES AND STOCKHOLDERS’

EQUITY

Accounts payable and accrued expenses

$

202,546

$

226,621

Income taxes payable, current

19,712

3,151

Deferred revenue, current

187,904

185,571

Current portion of long-term debt

—

54,609

Operating lease liabilities, current

22,153

27,156

Other current liabilities

133

130

Total current liabilities

432,448

497,238

Long-term debt

999,053

1,036,018

Deferred revenue, noncurrent

9,103

14,839

Operating lease liabilities,

noncurrent

33,996

53,708

Income taxes payable, noncurrent

11,675

11,675

Liability for uncertain tax positions

40,379

42,546

Deferred income taxes

79,007

108,982

Other long-term liabilities

34,998

37,542

TOTAL LIABILITIES

1,640,659

1,802,548

Common stock

473

474

Additional paid-in capital

439,681

509,122

Retained earnings

1,537,830

1,515,358

Accumulated other comprehensive loss

(85,373

)

(57,222

)

TOTAL STOCKHOLDERS’ EQUITY

1,892,611

1,967,732

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

$

3,533,270

$

3,770,280

ZIFF DAVIS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(UNAUDITED, IN THOUSANDS

EXCEPT SHARE AND PER SHARE DATA)

Three months ended

December 31,

Year ended

December 31,

2022

2021

2022

2021

Total revenues

$

396,700

$

408,628

$

1,390,997

$

1,416,722

Operating expenses:

Cost of revenues (1)

50,847

45,718

195,554

188,053

Sales and marketing (1)

129,764

138,100

490,777

493,049

Research, development and engineering

(1)

18,210

21,875

74,093

78,874

General and administrative (1)

104,421

117,541

404,263

456,777

Goodwill impairment on business

—

—

27,369

32,629

Total operating expenses

303,242

323,234

1,192,056

1,249,382

Income from operations

93,458

85,394

198,941

167,340

Interest expense, net

(5,423

)

(15,043

)

(33,842

)

(72,023

)

(Loss) gain on debt extinguishment,

net

—

(5,274

)

11,505

(5,274

)

Loss on sale of businesses, net

—

—

—

(21,798

)

Gain (loss) on investments, net

1,029

—

(46,743

)

(16,677

)

Unrealized gain (loss) on short-term

investments held at the reporting date, net

7,020

298,490

(7,145

)

298,490

Other (expense) income, net

(4,525

)

1,759

8,437

1,293

Income from continuing operations before

income tax (expense) benefit and changes from equity method

investment

91,559

365,326

131,153

351,351

Income tax (expense) benefit

(24,726

)

(5,684

)

(57,957

)

14,199

Income (loss) from equity method

investment, net

2,347

19,249

(7,730

)

35,845

Net income from continuing operations

69,180

378,891

65,466

401,395

(Loss) income from discontinued

operations, net of income taxes

(1,709

)

(18,385

)

(1,709

)

95,319

Net income

$

67,471

$

360,506

$

63,757

$

496,714

Net income per common share from

continuing operations:

Basic

$

1.47

$

7.93

$

1.39

$

8.74

Diluted

$

1.37

$

7.81

$

1.39

$

8.38

Net (loss) income per common share from

discontinued operations:

Basic

$

(0.04

)

$

(0.38

)

$

(0.04

)

$

2.08

Diluted

$

(0.03

)

$

(0.38

)

$

(0.04

)

$

1.99

Net income per common share:

Basic

$

1.44

$

7.54

$

1.36

$

10.81

Diluted

$

1.34

$

7.43

$

1.36

$

10.37

Weighted average shares outstanding:

Basic

46,915,647

47,778,545

46,954,558

45,893,928

Diluted

52,114,995

48,514,588

47,025,849

47,862,745

(1) Includes share-based compensation

expense as follows:

Cost of revenues

$

52

$

86

$

341

$

306

Sales and marketing

636

410

3,083

1,288

Research, development and engineering

455

594

2,503

1,984

General and administrative

4,652

5,037

20,674

20,551

Total

$

5,795

$

6,127

$

26,601

$

24,129

ZIFF DAVIS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(UNAUDITED, IN

THOUSANDS)

Year ended December

31,

2022

2021

Cash flows from operating activities:

Net income

$

63,757

$

496,714

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

233,400

258,303

Amortization of financing costs and

discounts

2,692

26,090

Non-cash operating lease costs

13,412

1,485

Share-based compensation

26,601

25,248

Provision for credit losses (benefit) on

accounts receivable

(255

)

8,738

Deferred income taxes, net

(12,991

)

(13,433

)

(Gain) loss on extinguishment of debt,

net

(11,505

)

14,024

Loss on sale of businesses

—

21,798

Goodwill impairment on business

27,369

32,629

Changes in fair value of contingent

consideration

(2,575

)

(1,223

)

Loss (income) from equity method

investments

7,730

(35,845

)

Unrealized loss (gain) on short-term

investments held at the reporting date

7,145

(281,527

)

Loss on investment, net

46,743

—

Other

945

12,894

Decrease (increase) in:

Accounts receivable

14,948

(18,050

)

Prepaid expenses and other current

assets

9,665

(15,650

)

Operating lease right-of-use assets

3,739

15,267

Other assets

(19,979

)

(3,824

)

Increase (decrease) in:

Accounts payable and accrued expenses

(37,569

)

22,262

Income taxes payable

17,323

(21,783

)

Deferred revenue

(20,962

)

14,282

Operating lease liabilities

(27,131

)

(30,581

)

Liability for uncertain tax positions

(2,167

)

(10,383

)

Other long-term liabilities

(3,891

)

(899

)

Net cash provided by operating

activities

336,444

516,536

Cash flows from investing activities:

Purchases of property and equipment

(106,154

)

(113,740

)

Purchases of intangible assets

(50

)

(78

)

Acquisition of businesses, net of cash

received

(104,094

)

(141,146

)

Proceeds from divestiture of discontinued

operations

—

259,104

Proceeds from sale of available-for-sale

investments

—

663

Investment in available-for-sale

securities

(15,000

)

—

Distribution from equity method

investment

—

15,327

Purchases of equity method investment

—

(23,249

)

Purchases of equity investments

—

(999

)

Proceeds from sale of equity

investments

4,527

14,330

Proceeds from sale of businesses, net of

cash divested

—

48,876

Net cash (used in) provided by investing

activities

(220,771

)

59,088

Cash flows from financing activities:

Payment of debt

(166,904

)

(512,388

)

Proceeds from term loan

112,286

—

Debt extinguishment costs

(756

)

(1,096

)

Proceeds from bridge loan

—

485,000

Repurchase of common stock

(78,291

)

(78,327

)

Issuance of common stock under employee

stock purchase plan

9,431

9,231

Proceeds from exercise of stock

options

148

2,939

Deferred payments for acquisitions

(16,116

)

(14,387

)

Other

(630

)

(4,060

)

Net cash used in financing activities

(140,832

)

(113,088

)

Effect of exchange rate changes on cash

and cash equivalents

(16,890

)

(10,346

)

Net change in cash and cash

equivalents

(42,049

)

452,190

Cash and cash equivalents at beginning of

period

694,842

242,652

Cash and cash equivalents at beginning of

period associated with discontinued operations

—

66,210

Cash and cash equivalents at beginning of

period associated with continuing operations

694,842

176,442

Cash and cash equivalents at end of

period

652,793

694,842

Cash and cash equivalents at end of period

associated with discontinued operations

—

—

Cash and cash equivalents at end of period

associated with continuing operations

$

652,793

$

694,842

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS)

Adjusted net income from continuing

operations is Net income from continuing operations with the

following modifications: (1) elimination of share-based

compensation; (2) elimination of certain acquisition, integration

and other costs; (3) elimination of certain interest costs; (4)

elimination of (gains) losses resulted from the extinguishment of

debt; (5) elimination of amortization of patents and intangible

assets that we acquired; (6) elimination of change in value of

investments; (7) elimination of (gains) losses on sale of assets;

(8) elimination of lease asset impairments and other charges; (9)

elimination of disposal related costs; (10) elimination of goodwill

impairment on business; and (11) elimination of dilutive effect of

the convertible debt.

Three months ended December

31,

2022

Per diluted share*

2021

Per diluted share*

Net income from continuing

operations

$

69,180

$

1.37

$

378,891

$

7.81

Plus:

Share-based compensation (1)

6,044

0.13

4,302

0.09

Acquisition, integration and other costs

(2)

7,401

0.16

1,924

0.04

Interest costs, net (3)

120

—

3,017

0.06

Loss on debt extinguishment (4)

—

—

3,292

0.07

Amortization (5)

28,696

0.61

28,581

0.59

Investments (6)

(6,210

)

(0.13

)

(316,722

)

(6.59

)

Sale of assets (7)

—

—

(942

)

(0.02

)

Lease asset impairments and other charges

(8)

559

0.01

2,619

0.05

Disposal related costs (9)

395

0.01

135

—

Goodwill impairment on business (10)

(222

)

—

(33

)

—

Convertible debt dilution (11)

—

0.10

—

0.08

Adjusted net income from continuing

operations

$

105,963

$

2.26

$

105,064

$

2.18

* The reconciliation of Net income per diluted share from

continuing operations to Adjusted diluted EPS may not foot since

each is calculated independently.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS)

Adjusted net income from continuing

operations is Net income from continuing operations with the

following modifications: (1) elimination of share-based

compensation; (2) elimination of certain acquisition, integration

and other costs; (3) elimination of certain interest costs; (4)

elimination of (gains) losses resulted from the extinguishment of

debt; (5) elimination of amortization of patents and intangible

assets that we acquired; (6) elimination of change in value of

investments; (7) elimination of (gains) losses on sale of assets;

(8) elimination of lease asset impairments and other charges; (9)

elimination of disposal related costs; (10) elimination of goodwill

impairment on business; and (11) elimination of dilutive effect of

the convertible debt.

Year ended December

31,

2022

Per diluted share*

2021

Per diluted share*

Net income from continuing

operations

$

65,466

$

1.39

$

401,395

$

8.38

Plus:

Share based compensation (1)

23,209

0.49

15,510

0.34

Acquisition, integration and other costs

(2)

13,278

0.28

6,672

0.14

Interest costs, net (3)

374

0.01

15,477

0.33

(Gain) loss on debt extinguishment (4)

(9,094

)

(0.19

)

3,292

0.07

Amortization (5)

119,170

2.53

127,258

2.75

Investments (6)

76,679

1.63

(321,730

)

(6.96

)

Sale of assets (7)

—

—

15,462

0.33

Lease asset impairments and other charges

(8)

1,640

0.03

9,333

0.20

Disposal related costs (9)

1,449

0.03

407

0.01

Goodwill impairment on business (10)

20,414

0.43

24,602

0.53

Convertible debt dilution (11)

—

0.02

—

0.32

Adjusted net income from continuing

operations

$

312,585

$

6.65

$

297,678

$

6.44

* The reconciliation of Net income per diluted share from

continuing operations to Adjusted diluted EPS may not foot since

each is calculated independently.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS)

Three months ended December

31,

2022

2021

Cost of revenues

$

50,847

$

45,718

Plus:

Share-based compensation (1)

(52

)

(86

)

Acquisition, integration and other costs

(2)

(245

)

(96

)

Amortization (5)

(221

)

(250

)

Adjusted cost of revenues

$

50,329

$

45,286

Sales and marketing

$

129,764

$

138,100

Plus:

Share-based compensation (1)

(636

)

(409

)

Acquisition, integration and other costs

(2)

(3,825

)

(178

)

Adjusted sales and marketing

$

125,303

$

137,513

Research, development and

engineering

$

18,210

$

21,875

Plus:

Share-based compensation (1)

(455

)

(594

)

Acquisition, integration and other costs

(2)

(528

)

(358

)

Adjusted research, development and

engineering

$

17,227

$

20,923

General and administrative

$

104,421

$

117,541

Plus:

Share-based compensation(1)

(4,652

)

(5,038

)

Acquisition, integration and other costs

(2)

(5,155

)

(2,903

)

Amortization (5)

(37,641

)

(45,053

)

Lease asset impairments and other charges

(8)

(778

)

(3,133

)

Disposal related costs (9)

—

(136

)

Investments (6)

—

(1,500

)

Adjusted general and

administrative

$

56,195

$

59,778

Interest expense, net

$

(5,423

)

$

(15,043

)

Plus:

Interest costs, net (3)

96

4,775

Adjusted interest expense, net

$

(5,327

)

$

(10,268

)

Loss on debt extinguishment,

net

$

—

$

(5,274

)

Plus:

Loss on debt extinguishment (4)

—

4,527

Adjusted loss on debt extinguishment,

net

$

—

$

(747

)

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES - CONTINUED

(UNAUDITED, IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS)

Three months ended December

31,

2022

2021

Gain on investment, net

$

1,029

$

—

Plus:

Investments (6)

(1,029

)

—

Adjusted gain on investment,

net

$

—

$

—

Unrealized gain on short-term

investments held at period end

$

7,020

$

298,490

Plus:

Investments (6)

(7,020

)

(298,490

)

Adjusted unrealized gain on short-term

investments held at period end, net

$

—

$

—

Other (expense) income, net

$

(4,525

)

$

1,759

Plus:

Acquisition, integration and other costs

(2)

(195

)

—

Sale of assets (7)

—

857

Disposal related costs (9)

314

—

Adjusted other (expense) income,

net

$

(4,406

)

$

2,616

Income tax expense

$

(24,726

)

$

(5,684

)

Plus the tax effect of:

Share-based compensation (1)

249

(1,825

)

Acquisition, integration and other costs

(2)

(2,158

)

(1,611

)

Interest costs, net (3)

23

(1,758

)

Loss on debt extinguishment, net

—

(1,235

)

Amortization (5)

(9,163

)

(16,722

)

Investments (6)

4,185

(483

)

Sale of assets (7)

—

(1,799

)

Lease asset impairments and other charges

(8)

(219

)

(514

)

Disposal related costs (9)

81

(1

)

Goodwill impairment on business (10)

(223

)

(33

)

Adjusted income tax expense

$

(31,951

)

$

(31,665

)

Loss from equity method investment,

net

$

2,347

$

19,249

Plus:

Investments (6)

(2,347

)

(19,249

)

Adjusted loss from equity method

investment, net

$

—

$

—

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES - CONTINUED

(UNAUDITED, IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS)

Three months ended December

31,

2022

2021

Total adjustments

$

(36,782

)

$

273,827

Net income per diluted share from

continuing operations

$

1.37

$

7.81

Adjustments *

$

0.89

$

(5.63

)

Adjusted diluted EPS

$

2.26

$

2.18

* The reconciliation of Net income per diluted share from

continuing operations to Adjusted diluted EPS may not foot since

each is calculated independently.

The Company discloses Adjusted diluted EPS as a supplemental

non-GAAP financial performance measure, as it believes it is a

useful metric by which to compare the performance of its business

from period to period. The Company also understands that an

Adjusted diluted EPS measure is broadly used by analysts, rating

agencies and investors in assessing the Company’s performance.

Accordingly, we believe that the presentation of Adjusted diluted

EPS provides useful information to investors.

Adjusted diluted EPS is not in accordance with, or an

alternative to, Net income per diluted share from continuing

operations and may be different from non-GAAP measures with similar

or even identical names used by other companies. In addition,

Adjusted diluted EPS is not based on any comprehensive set of

accounting rules or principles. The Adjusted diluted EPS measure

has limitations in that it does not reflect all of the amounts

associated with the Company’s results of operations determined in

accordance with GAAP.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS)

Year ended December

31,

2022

2021

Cost of revenues

$

195,554

$

188,053

Plus:

Share-based compensation (1)

(341

)

(306

)

Acquisition, integration and other costs

(2)

(364

)

(382

)

Amortization(5)

(1,000

)

(1,547

)

Adjusted cost of revenues

$

193,849

$

185,818

Sales and marketing

$

490,777

$

493,049

Plus:

Share-based compensation (1)

(3,083

)

(1,288

)

Acquisition, integration and other costs

(2)

(6,293

)

(1,824

)

Adjusted sales and marketing

$

481,401

$

489,937

Research, development and

engineering

$

74,093

$

78,874

Plus:

Share-based compensation (1)

(2,503

)

(1,984

)

Acquisition, integration and other costs

(2)

(1,199

)

(1,457

)

Adjusted research, development and

engineering

$

70,391

$

75,433

General and administrative

$

404,263

$

456,777

Plus:

Share-based compensation (1)

(20,674

)

(20,551

)

Acquisition, integration and other costs

(2)

(9,570

)

(6,987

)

Amortization (5)

(156,922

)

(185,855

)

Investments (6)

—

(1,500

)

Lease asset impairments and other charges

(8)

(2,178

)

(12,860

)

Disposal related costs (9)

(1,328

)

(607

)

Adjusted general and

administrative

$

213,591

$

228,417

Goodwill impairment on business

$

27,369

$

32,629

Plus:

Goodwill impairment on business (10)

(27,369

)

(32,629

)

Adjusted goodwill impairment on

business

$

—

$

—

Interest expense, net

$

(33,842

)

$

(72,023

)

Plus:

Interest costs, net (3)

433

21,278

Adjusted interest expense, net

$

(33,409

)

$

(50,745

)

Gain (loss) on debt extinguishment,

net

$

11,505

$

(5,274

)

Plus:

(Gain) loss on debt extinguishment (4)

(12,060

)

4,527

Adjusted loss on debt extinguishment,

net

$

(555

)

$

(747

)

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES - CONTINUED

(UNAUDITED, IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS)

Year ended December

31,

2022

2021

Gain on sale of businesses

$

—

$

(21,798

)

Plus:

Sale of assets (7)

—

21,798

Adjusted gain on sale of

businesses

$

—

$

—

Loss on investments, net

$

(46,743

)

$

(16,677

)

Plus:

Investments (6)

46,743

16,677

Adjusted loss on investments,

net

$

—

$

—

Unrealized (loss) gain on short-term

investments held at period end

$

(7,145

)

$

298,490

Plus:

Investments (6)

7,145

(298,490

)

Adjusted unrealized (loss) gain on

short-term investments held at period end, net

$

—

$

—

Other income, net

$

8,437

$

1,293

Plus:

Investments (6)

(624

)

—

Acquisition, integration and other costs

(2)

(195

)

—

Sale of assets (7)

—

857

Disposal related costs (9)

203

—

Adjusted other income, net

$

7,821

$

2,150

Income tax (expense) benefit

$

(57,957

)

$

14,199

Plus the tax effect of:

Share-based compensation (1)

(3,392

)

(8,619

)

Acquisition, integration and other costs

(2)

(3,954

)

(3,978

)

Interest costs, net (3)

(60

)

(5,802

)

(Gain) loss on debt extinguishment, net

(4)

2,967

(1,234

)

Amortization (5)

(38,752

)

(60,144

)

Investments (6)

15,686

(5,572

)

Sale of assets (7)

—

(7,193

)

Lease asset impairments and other charges

(8)

(538

)

(3,527

)

Disposal related costs (9)

(81

)

(200

)

Goodwill impairment on business (10)

(6,956

)

(8,027

)

Adjusted income tax expense

$

(93,037

)

$

(90,097

)

(Loss) income from equity method

investment, net

$

(7,730

)

$

35,845

Plus:

Investments (6)

7,730

(35,845

)

Adjusted (loss) income from equity

method investment, net

$

—

$

—

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES - CONTINUED

(UNAUDITED, IN THOUSANDS,

EXCEPT PER SHARE AMOUNTS)

Year ended December

31,

2022

2021

Total adjustments

$

(247,119

)

$

103,717

Net income per diluted share from

continuing operations

$

1.39

$

8.38

Adjustments *

$

5.26

$

(1.94

)

Adjusted diluted EPS

$

6.65

$

6.44

* The reconciliation of Net income per diluted share from

continuing operations to Adjusted diluted EPS may not foot since

each is calculated independently.

The Company discloses Adjusted diluted EPS as a supplemental

non-GAAP financial performance measure, as it believes it is a

useful metric by which to compare the performance of its business

from period to period. The Company also understands that an

Adjusted diluted EPS measure is broadly used by analysts, rating

agencies and investors in assessing the Company’s performance.

Accordingly, we believe that the presentation of Adjusted diluted

EPS provides useful information to investors.

Adjusted diluted EPS is not in accordance with, or an

alternative to, Net income per diluted share from continuing

operations and may be different from non-GAAP measures with similar

or even identical names used by other companies. In addition,

Adjusted diluted EPS is not based on any comprehensive set of

accounting rules or principles. The Adjusted diluted EPS measure

has limitations in that it does not reflect all of the amounts

associated with the Company’s results of operations determined in

accordance with GAAP.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements,

which are prepared and presented in accordance with GAAP, we use

the following non-GAAP financial measures: Revenues excluding

divested businesses, Adjusted diluted EPS and Adjusted diluted EPS

excluding divested business, Adjusted net income from continuing

operations and Adjusted net income from continuing operations

excluding divested businesses, Adjusted EBITDA and Adjusted EBITDA

excluding divested businesses, Adjusted EBITDA margin and Adjusted

EBITDA margin excluding divested businesses, and Free cash flow

from continuing and discontinued operations (collectively the

“non-GAAP financial measures”). The presentation of this financial

information is not intended to be considered in isolation or as a

substitute for, or superior to, the financial information prepared

and presented in accordance with U.S. GAAP. We use these non-GAAP

financial measures for financial and operational decision making

and as a means to evaluate period-to-period comparisons. We believe

that they provide useful information about core operating results,

enhance the overall understanding of past financial performance and

future prospects, and allow for greater transparency with respect

to key metrics used by management in its financial and operational

decision making.

Non-GAAP financial measures exclude the charges listed below.

Excluding these charges from the non-GAAP measures facilitates

comparisons to historical operating results and comparisons to

peers, many of which exclude the similar items. We believe that

non-GAAP financial measures excluding these items provide

meaningful supplemental information regarding operational

performance. We further believe these measures are useful to

investors in that they allow for greater transparency of certain

line items in the Company’s financial statements.

(1) Share-Based Compensation. We exclude stock-based

compensation because it is non-cash in nature.

(2) Acquisition, Integration and Other costs. We exclude certain

acquisition and related integration costs, including adjustments to

contingent consideration, lease terminations, retention bonuses,

other acquisition-specific items, and other costs, including

severance.

(3) Interest Costs, Net. In June 2014, we issued $402.5 million

aggregate principal amount of 3.25% convertible senior notes and in

November 2019, we issued $550.0 million aggregate principal amount

of 1.75% convertible senior notes. For the three months and year

ended December 31, 2021, we separately accounted for the value of

the liability and equity features of the outstanding convertible

senior notes in a manner that reflects the Company’s

non-convertible debt borrowing rate. The value of the conversion

feature, reflected as a debt discount, was amortized to interest

expense over time. Accordingly, we recognized imputed interest

expense on our 3.25% and 1.75% convertible senior notes of

approximately 5.8% and 5.5%, respectively, in the Company’s

statement of operations during the three months and year ended

December 31, 2021. We excluded the difference between the imputed

interest expense and the coupon interest expense of 3.25% and

1.75%, respectively, because this difference was non-cash in nature

and because we believe that the non-GAAP financial measures

excluding this item provide meaningful supplemental information

regarding core operational performance. During 2022, we adopted ASU

2020-06, Debt-Debt with Conversion and Other Options (Subtopic

470-20) and Derivatives and Hedging - Contracts in Entity’s own

Equity (Subtopic 815-40): Accounting for Convertible Instruments

and Contracts in an Entity’s Own Equity, whereby a portion of the

convertible senior notes is no longer recorded in equity with a

debt discount and amortization in interest expense. Therefore, no

similar adjustment was made for the three months and year ended

December 31, 2022. We have also excluded the difference between the

imputed and coupon interest expense associated with the 4.625%

Senior Notes in each period presented.

(4) (Gain) loss on extinguishment of debt. We exclude gains and

losses associated with extinguishment of debt. For the three months

and year ended December 31, 2022, we recorded a gain on

extinguishment associated with the repurchase of our 4.625% Senior

Notes, which is included within this non-GAAP adjustment.

(5) Amortization. We exclude amortization of patents and

acquired intangible assets because it is non-cash in nature.

(6) Change in Value on Investments. We exclude the change in

value of our investments, which includes income (loss) from equity

method investments, the unrealized gain (loss) on our investment in

Consensus and other income (loss) on investments (including

Consensus).

(7) Gain (Loss) on Sale of Assets. We exclude the gain (loss) on

the sale of certain assets.

(8) Lease Asset Impairments and Other Charges. We exclude lease

asset impairments and other charges as they are non-cash in

nature.

(9) Disposal Related Costs. We exclude expenses associated with

the disposal of certain businesses.

(10) Goodwill Impairment on Business. We exclude the goodwill

impairment on business because it is non-cash in nature.

(11) Convertible Debt Dilution. We exclude convertible debt

dilution from diluted earnings per share.

We present Adjusted cost of revenues, Adjusted sales and

marketing, Adjusted research, development and engineering, Adjusted

general and administrative, Adjusted goodwill impairment on

business, Adjusted interest expense, net, Adjusted gain on sale of

businesses, Adjusted interest expense, net, Adjusted (gain) loss on

extinguishment of debt, net, Adjusted loss on investments, net,

Adjusted unrealized loss on short-term investments held at period

end, net, Adjusted Other income (expense), Adjusted income tax

expense (benefit), Adjusted income (loss) from equity method

investment, net and Adjusted net income because we believe that

these provide useful information about our operating results and

enhance the overall understanding of past financial performance and

future prospects.

Financial Results Excluding Divested Businesses

Key financial results excluding divested businesses for the

years ended December 31, 2022 and 2021, are set forth in the

following table (in millions, except per share amounts). The

financial results excluding divested businesses below reflect the

Company’s results taking into consideration the sale of certain

Voice assets in the United Kingdom as well as the sale of the

Company’s B2B Backup business as if they had occurred in a prior

period presented.

Year ended December

31,

2022

2021

Total Revenues

$

1,391.0

$

1,416.7

Revenue adjustments related to divested

businesses

$

—

$

(33.5

)

Total Revenue excluding divested

businesses (1)

$

1,391.0

$

1,383.2

Adjusted diluted EPS (1)

$

6.65

$

6.44

Adjusted diluted EPS adjustments related

to divested businesses

$

—

$

(0.23

)

Adjusted diluted EPS excluding divested

businesses (1)

$

6.65

$

6.21

Adjusted net income from continuing

operations

$

312.6

$

297.7

Net income from continuing operations

adjustments related to divested businesses

$

—

$

(10.3

)

Adjusted net income from continuing

operations excluding divested businesses

$

312.6

$

287.4

Adjusted EBITDA (1)

$

507.2

$

499.0

EBITDA adjustments related to divested

businesses

$

—

$

(14.1

)

Adjusted EBITDA excluding divested

businesses (1)

$

507.2

$

484.9

Adjusted EBITDA margin (1)

36.5

%

35.2

%

EBITDA margin adjustments related to

divested businesses

0.0

%

(0.1

)%

Adjusted EBITDA margin excluding divested

businesses (1)

36.5

%

35.1

%

(1)

Refer to the notes earlier in this Press Release.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

The following table sets forth a

reconciliation of Adjusted EBITDA to Net income from continuing

operations:

Three months ended December

31,

Year ended

December 31,

2022

2021

2022

2021

Net income from continuing operations

$

69,180

$

378,891

$

65,466

$

401,395

Plus:

Interest expense, net

5,423

15,043

33,842

72,023

Loss (gain) on debt extinguishment,

net

—

5,274

(11,505

)

5,274

Loss on sale of businesses

—

—

—

21,798

Unrealized (gain) loss on short-term

investments held at the reporting date

(7,020

)

(298,490

)

7,145

(298,490

)

(Gain) loss on investments, net

(1,029

)

—

46,743

16,677

Other expense (income), net

4,525

(1,759

)

(8,437

)

(1,293

)

Income tax expense (benefit)

24,726

5,684

57,957

(14,199

)

Loss (income) from equity method

investment, net

(2,347

)

(19,249

)

7,730

(35,845

)

Depreciation and amortization

58,520

61,791

233,400

249,292

Reconciliation of GAAP to Non-GAAP

financial measures:

Share-based compensation

5,795

6,127

26,601

24,129

Acquisition, integration and other

costs

9,753

3,535

17,426

10,650

Lease asset impairments and other

charges

778

3,133

2,178

12,860

Investments

—

1,500

—

1,500

Disposal related costs

—

135

1,328

606

Goodwill impairment on business

—

—

27,369

32,629

Adjusted EBITDA

$

168,304

$

161,615

$

507,243

$

499,006

Adjusted EBITDA as calculated above represents net income from

continuing operations before interest, gain on sale of businesses,

unrealized (gain) loss on short-term investments held at the

reporting date, other (income) loss, net, income tax expense

(benefit), loss (income) from equity method investments, net,

depreciation and amortization and the items used to reconcile GAAP

to Non-GAAP financial measures, including (1) share-based

compensation, (2) certain acquisition, integration and other costs,

(3) lease asset impairments and other charges, (4) disposal related

costs and (5) goodwill impairment on business. We disclose Adjusted

EBITDA as a supplemental non-GAAP financial performance measure as

we believe it is a useful metric by which to compare the

performance of our business from period to period. We understand

that measures similar to Adjusted EBITDA are broadly used by

analysts, rating agencies and investors in assessing our

performance. Accordingly, we believe that the presentation of

Adjusted EBITDA provides useful information to investors.

Adjusted EBITDA is not in accordance with, or an alternative to,

net income from continuing operations, and may be different from

non-GAAP measures used by other companies. In addition, Adjusted

EBITDA is not based on any comprehensive set of accounting rules or

principles. This Adjusted measure has limitations in that it does

not reflect all of the amounts associated with the Company’s

results of operations determined in accordance with GAAP.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

NON-GAAP FINANCIAL

MEASURES

(UNAUDITED, IN

THOUSANDS)

2022

Q1

Q2

Q3

Q4(1)

YTD(1)

Net cash provided by operating activities

from continuing and discontinued operations

$

116,511

$

75,973

$

100,735

$

43,225

$

336,444

Less: Purchases of property and

equipment

(30,502

)

(23,374

)

(26,891

)

(25,387

)

(106,154

)

Free cash flow from continuing and

discontinued operations

$

86,009

$

52,599

$

73,844

$

17,838

$

230,290

2021

Q1

Q2(2)

Q3

Q4

YTD

Net cash provided by operating activities

from continuing and discontinued operations

$

178,724

$

111,298

$

140,230

$

86,284

$

516,536

Less: Purchases of property and

equipment

(26,269

)

(31,497

)

(29,729

)

(26,245

)

(113,740

)

Add: Contingent consideration

—

685

—

—

685

Free cash flow from continuing and

discontinued operations

$

152,455

$

80,486

$

110,501

$

60,039

$

403,481

(1)

For the three months and year ended

December 31, 2022, the Loss from discontinued operations, net of

income taxes did not have an impact on Net cash provided by

operating activities from continuing and discontinued

operations.

(2)

Free cash flows from continuing and

discontinued operations of $80.5 million for Q2 2021 is before the

effect of payments associated with certain contingent consideration

related to acquisitions.

The Company discloses Free cash flows from continuing and

discontinued operations as supplemental non-GAAP financial

performance measures, as it believes these are useful metrics by

which to compare the performance of its business from period to

period. The Company also understands that these non-GAAP measures

are broadly used by analysts, rating agencies and investors in

assessing the Company’s performance. Accordingly, we believe that

the presentation of these non-GAAP financial measures provides

useful information to investors.

Free cash flows from continuing and discontinued operations are

not in accordance with, or an alternative to, Net cash provided by

operating activities and Net cash provided by operating activities

from continuing and discontinued operations, respectively, and may

be different from non-GAAP measures with similar or even identical

names used by other companies. In addition, these non-GAAP measures

are not based on any comprehensive set of accounting rules or

principles. These non-GAAP measures have limitations in that they

do not reflect all of the amounts associated with the Company’s

results of operations determined in accordance with GAAP.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

Three months ended December

31, 2022

Digital

Cybersecurity

Media

and Martech

Corporate

Total

Revenues

$

321,670

$

75,030

$

—

$

396,700

Operating profit

Income (loss) from operations

$

95,015

$

11,554

$

(13,111

)

$

93,458

Non-GAAP adjustments:

Share-based compensation

2,225

563

3,007

5,795

Acquisition, integration and other

costs

7,784

1,179

790

9,753

Amortization

29,731

8,121

10

37,862

Lease asset impairments and other

charges

791

(13

)

—

778

Adjusted operating profit (loss)

$

135,546

$

21,404

$

(9,304

)

$

147,646

Depreciation

16,630

4,028

—

20,658

Adjusted EBITDA

$

152,176

$

25,432

$

(9,304

)

$

168,304

Table above excludes certain intercompany allocations.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

Three months ended December

31, 2021

Digital

Cybersecurity

Media

and Martech

Corporate

Total

Revenues

$

325,747

$

82,881

$

—

$

408,628

Operating profit

Income (loss) from operations

$

92,422

$

9,492

$

(16,520

)

$

85,394

Non-GAAP adjustments:

Share-based compensation

2,178

1,227

2,722

6,127

Acquisition, integration and other

costs

855

1,473

1,207

3,535

Amortization

32,746

12,486

71

45,303

Lease asset impairments and other

charges

3,666

(533

)

—

3,133

Investments

—

—

1,500

1,500

Disposal related costs

—

84

51

135

Adjusted operating profit (loss)

$

131,867

$

24,229

$

(10,969

)

$

145,127

Depreciation

13,597

2,636

255

16,488

Adjusted EBITDA

$

145,464

$

26,865

$

(10,714

)

$

161,615

Table above excludes certain intercompany allocations.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

Year ended December 31,

2022

Digital

Cybersecurity

Media

and Martech

Corporate

Total

Revenues

$

1,078,391

$

312,606

$

—

$

1,390,997

Operating profit

Income (loss) from operations

$

198,171

$

50,960

$

(50,190

)

$

198,941

Non-GAAP adjustments:

Share-based compensation

10,433

4,280

11,888

26,601

Acquisition, integration and other

costs

14,121

2,111

1,194

17,426

Amortization

122,869

35,025

28

157,922

Lease asset impairments and other

charges

1,631

547

—

2,178

Disposal related costs

11

—

1,317

1,328

Goodwill impairment on a business

27,369

—

—

27,369

Adjusted operating profit (loss)

$

374,605

$

92,923

$

(35,763

)

$

431,765

Depreciation

61,789

13,689

—

75,478

Adjusted EBITDA

$

436,394

$

106,612

$

(35,763

)

$

507,243

Table above excludes certain intercompany allocations.

ZIFF DAVIS, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(UNAUDITED, IN

THOUSANDS)

Year ended December 31,

2021

Digital

Cybersecurity

Media

and Martech

Corporate

Total

Revenues

$

1,068,476

$

348,246

$

—

$

1,416,722

Operating profit

Income (loss) from operations

$

216,950

$

10,769

$

(60,379

)

$

167,340

Non-GAAP adjustments:

Share-based compensation

7,734

4,481

11,914

24,129

Acquisition, integration and other

costs

3,449

5,968

1,233

10,650

Amortization

144,621

42,493

288

187,402

Lease asset impairments and other

charges

12,229

631

—

12,860

Investments

—

—

1,500

1,500

Disposal related costs

—

84

522

606

Goodwill impairment on a business

—

32,629

—

32,629

Adjusted operating profit (loss)

$

384,983

$

97,055

$

(44,922

)

$

437,116

Depreciation

49,151

12,484

255

61,890

Adjusted EBITDA

$

434,134

$

109,539

$

(44,667

)

$

499,006

Table above excludes certain intercompany allocations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230215005851/en/

Rebecca Wright Ziff Davis, Inc. 800-577-1790

investor@ziffdavis.com

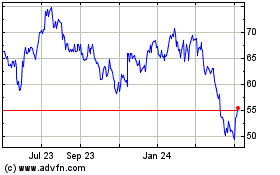

Ziff Davis (NASDAQ:ZD)

Historical Stock Chart

From Mar 2024 to Apr 2024

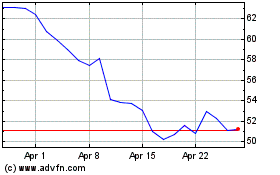

Ziff Davis (NASDAQ:ZD)

Historical Stock Chart

From Apr 2023 to Apr 2024