false 0001876588 0001876588 2024-02-28 2024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

ZimVie Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

001-41242 |

|

87-2007795 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

| 10225 Westmoor Drive |

|

|

| Westminster, Colorado |

|

|

|

80021 |

| (Address of Principal Executive Offices) |

|

|

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 303 443-7500

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

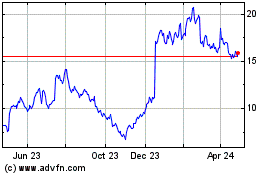

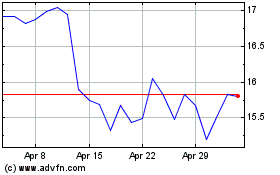

ZIMV |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 28, 2024, ZimVie Inc. (the “Company”) issued a press release reporting its financial results for the quarter and year ended December 31, 2023. The press release is attached hereto as Exhibit 99.1 and the information set forth therein is incorporated herein by reference and constitutes a part of this report.

Item 7.01 Regulation FD Disclosure.

On February 28, 2024, the Company also made available a presentation that contains supplemental financial information. A copy of the presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K and the information set forth therein is incorporated herein by reference.

The information contained in Item 2.02 and Item 7.01 of this report, including Exhibit 99.1 and Exhibit 99.2 hereto, is being furnished and shall not be deemed to be “filed” with the Securities and Exchange Commission for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section and is not incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ZimVie Inc. |

|

|

|

|

| Date: February 28, 2024 |

|

|

|

By: |

|

/s/ Heather Kidwell |

|

|

|

|

|

|

Name: Heather Kidwell Title: Senior Vice President, Chief Legal, Compliance and Human Resources Officer and Corporate Secretary |

Exhibit 99.1

ZimVie Reports Fourth Quarter and Full Year 2023 Financial Results

| • |

|

FY 2023 Third Party Net Sales from Continuing Operations of $457.2 million |

| • |

|

FY 2023 Third Party Net Sales from Discontinued Operations of $409.2 million |

| • |

|

Updated Reporting Framework: Continuing Operations consists of the Dental Business and the majority of

Corporate while Discontinued Operations consists of the Spine Business |

| • |

|

Advancing plan to complete sale of Spine Business for $375M in total consideration; sale remains on track to

be completed in 1H 2024 |

WESTMINSTER, Colorado, February 28, 2024 (GLOBE NEWSWIRE) – ZimVie Inc. (Nasdaq: ZIMV), a global

life sciences leader in the dental and spine markets, today reported financial results for the quarter and year ended December 31, 2023. Management will host a corresponding conference call today, February 28, 2024, at 4:30 p.m. Eastern

Time.

“We had significant accomplishments in 2023. We invested to further differentiate our portfolio which helped us make gains in the markets we

serve, and we improved our operating efficiency through restructuring and cost reduction initiatives,” said Vafa Jamali, President and Chief Executive Officer. “In addition, we successfully executed an agreement to sell our spine business

and transform ZimVie into a pure play dental company with a comprehensive and industry leading portfolio. We are optimistic about the future of ZimVie as a purely dental focused company with a strong capital structure.”

Fourth Quarter 2023 Financial Results: Continuing Operations

Third party net sales for the fourth quarter of 2023 were $113.1 million, a decrease of 2.4% on a reported basis and (3.6%) on a constant currency[1] basis, versus the fourth quarter of 2022.

Net loss for the fourth quarter of 2023 was ($22.2)

million, a change of ($6.8) million versus a net loss of ($15.4) million in the fourth quarter of 2022, and as a percentage of net sales was (19.6%).

Adjusted net income[1] for the fourth quarter of 2023 was $2.6 million, an increase of

$0.7 million versus the same prior year period.

Basic and diluted EPS were ($0.83) and adjusted diluted EPS[1] was $0.10 for the fourth quarter of 2023. Weighted average shares outstanding for each of basic and adjusted diluted EPS was 26.6 million.

Adjusted EBITDA[1] for the fourth quarter of 2023 was $13.9 million, or 12.3% of third party net

sales, which is an increase of 160 basis points from the fourth quarter 2022 margin of 10.7%.

Cash and cash equivalents at the end of the fourth quarter

of 2023 were $71.5 million.

Fourth Quarter 2023 Financial Results: Discontinued Operations

Third party net sales from Discontinued Operations for the fourth quarter of 2023 were $100.5 million, a decrease of 10.6% on a reported basis and 10.6%

on a constant currency[1] basis, versus the fourth quarter of 2022.

Net loss from Discontinued

Operations was ($312.7) million, a change of ($297.7) million versus net loss of ($15.0) million in the fourth quarter of 2022.

Adjusted net income[1] from Discontinued Operations for the fourth quarter of 2023 was $2.9 million, an increase of $0.5 million versus the same prior year period.

Basic and diluted EPS from Discontinued Operations were ($11.76). Adjusted diluted EPS[1] was $0.11 for

the fourth quarter of 2023. Weighted average shares outstanding for each of basic and adjusted diluted EPS was 26.6 million.

Adjusted EBITDA[1] from Discontinued Operations for the

fourth quarter of 2023 was $15.5 million, or 15.4% of net sales to Discontinued Operations, a decrease of $0.2 million and 1.1%, respectively, from the fourth quarter of 2022.

Cash and cash equivalents from Discontinued Operations at the end of the fourth quarter of 2023 were $16.3 million.

Full Year 2023 Financial Results: Continuing Operations

Third party net sales for the full year 2023 were $457.2 million, a decrease of 0.5% on a reported basis and 0.6% on a constant currency[1] basis, versus the full year 2022.

Net loss for the full year 2023 was ($56.0) million, a decrease of

$9.1 million versus the net loss of ($46.9) million in the full year 2022, and as a percentage of third-party net sales was (12.3%).

Adjusted net

income[1] for the full year 2023 was $5.8 million, a decrease of $10.1 million versus the prior year.

Basic and diluted EPS were ($2.12) and adjusted diluted EPS[1] was $0.22 for the full year 2023. Weighted

average shares outstanding for each of basic EPS and diluted EPS were 26.5 million.

Adjusted

EBITDA[1] for the full year 2023 was $50.8 million, or 11.1% of third-party net sales, a decrease of $6.3 million and a decrease of 130 basis points from 12.4% in 2022.

Full Year 2023 Financial Results: Discontinued Operations

Third party net sales from Discontinued Operations were $409.2 million, a decrease of 9.0% on a reported basis and 9.2% on a constant currency[1] basis, versus the full year 2022.

Net loss from Discontinued Operations for the full year 2023 was

($337.2) million, a change of ($320.2) million versus the net loss of ($17.0) million in the full year 2022, and as a percentage of third-party net sales attributable to Discontinued Operations was (82.4%). Adjusted net income[1] attributable to Discontinued Operations for the full year 2023 was $12.7 million, a decrease of $19.3 million versus the prior year. The increase in net loss was primarily due to a

$289.5M write-down of the Spine disposal group to fair value.

Basic and diluted EPS from Discontinued Operations were ($12.75) and adjusted diluted EPS[1] was $0.48 for the full year 2023. Weighted average shares outstanding for each of basic EPS and diluted EPS was 26.5 million.

Adjusted EBITDA[1] from Discontinued Operations for the full year 2023 was $65.6 million, or 16.0%

of third-party net sales.

First Quarter 2024 Financial Guidance:

|

|

|

| Projected Quarter Ending March 31, 2024 |

|

Guidance |

| Net Sales: Continuing Operations |

|

$115M-$118M |

| Net Sales: Discontinued Operations |

|

$89-$91M |

2

Management Raises Financial Targets for Continuing Operations for the 12 Month Period Post-Spine Sale:

|

|

|

| Year 1 Post-Close |

|

Guidance |

| Net Sales |

|

$455M+ |

| Adjusted EBITDA Margin[2] |

|

15%+ |

| Net Debt |

|

<$200M[2][4] |

| [1] |

This is a non-GAAP financial measure. Refer to “Note on Non-GAAP Financial Measures” and the reconciliations in this release for further information. |

| [2] |

This is a non-GAAP financial measure for which a reconciliation to

the most directly comparable GAAP financial measure is not available without unreasonable efforts. Refer to “Forward-Looking Non-GAAP Financial Measures” in this release, which identifies the

information that is unavailable without unreasonable efforts and provides additional information. It is probable that this forward-looking non-GAAP financial measure may be materially different from the

corresponding GAAP financial measure. |

| [3] |

Represents projected net debt one year following the closing of the sale of the spine business and excludes

proceeds from expected future repayment of seller note to ZimVie. |

Financial Information

The financial information included in this release for periods prior to March 1, 2022 is derived from the financial statements and records of the Dental

and Spine businesses of Zimmer Biomet due to the fact that during such periods, ZimVie was still a wholly-owned subsidiary of, and operated under those businesses of, Zimmer Biomet.

Conference Call

ZimVie will host a conference call

today, February 28, 2024, at 4:30 p.m. ET to discuss its fourth quarter and full year 2023 financial results. To access the call, please register online at https://investor.zimvie.com/events-presentations/event-calendar. A live and

archived audio webcast will also be available on this site.

About ZimVie

ZimVie is a global life sciences leader in the dental and spine markets that develops, manufactures, and delivers a comprehensive portfolio of products and

solutions designed to support dental tooth replacement and restoration procedures and treat a wide range of spine pathologies. In March 2022 the company became an independent, publicly traded spin-off of the

dental and spine business units of Zimmer Biomet to breathe new life, dedicated energy, and strategic focus to its portfolio of trusted brands and products. From its headquarters in Westminster, Colorado, and additional facilities around the globe,

the company serves customers in over 70 countries worldwide with a robust offering of dental and spine solutions including differentiated product platforms supported by extensive clinical evidence. For more information about ZimVie, please visit us

at www.ZimVie.com. Follow @ZimVie on Twitter, Facebook, LinkedIn, or Instagram.

Note on Non-GAAP Financial Measures

This press release includes non-GAAP financial

measures that differ from financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may not be comparable to similar

measures reported by other companies and should be considered in addition to, and not as a substitute for, or superior to, other measures prepared in accordance with GAAP.

Adjusted EBITDA is a non-GAAP financial measure provided in this release for certain periods, and is calculated by

excluding certain items from net loss from Continuing Operations or Discontinued Operations, as applicable, on a GAAP basis, as detailed in the reconciliations presented later in this press release. Adjusted EBITDA margin is Adjusted EBITDA divided

by third party net sales from Continuing Operations or Discontinued Operations, as applicable, for the applicable period.

Sales change information in

this release is presented on a GAAP (reported) basis and on a constant currency basis. Constant currency percentage changes exclude the effects of foreign currency exchange rates. They are calculated by translating current and prior-period sales

from Continuing Operations or Discontinued Operations, as applicable, at the same predetermined exchange rate. The translated results are then used to determine year-over-year percentage increases or decreases.

3

Net loss and diluted loss per share in this release are presented on a GAAP (reported) basis and on an

adjusted basis. Adjusted net income and adjusted diluted earnings per share exclude the effects of certain items, which are detailed in the reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures presented later in this press release.

Reconciliations of these

non-GAAP measures to the most directly comparable GAAP financial measures are included in this press release.

Management uses non-GAAP financial measures internally to evaluate the performance of the business. Additionally,

management believes these non-GAAP measures provide meaningful incremental information to investors to consider when evaluating the performance of the company. Management believes these measures offer the

ability to make period-to-period comparisons that are not impacted by certain items that can cause dramatic changes in reported income but that do not impact the

fundamentals of our operations. The non-GAAP measures enable the evaluation of operating results and trend analysis by allowing a reader to better identify operating trends that may otherwise be masked or

distorted by these types of items that are excluded from the non-GAAP measures.

Forward-Looking Non-GAAP Financial Measures

This press release also includes certain forward-looking

non-GAAP financial measures for the quarter ending March 31, 2024 and the twelve-month period following the closing of the sale of the spine business. We calculate forward-looking non-GAAP financial measures based on internal forecasts that omit certain amounts that would be included in GAAP financial measures. We have not provided quantitative reconciliations of these forward-looking non-GAAP financial measures to the most directly comparable forward-looking GAAP financial measures because the excluded items are not available on a prospective basis without unreasonable efforts. For example, the

timing of certain transactions is difficult to predict because management’s plans may change. In addition, the company believes such reconciliations would imply a degree of precision and certainty that could be confusing to investors. It is

probable that these forward-looking non-GAAP financial measures may be materially different from the corresponding GAAP financial measures.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of federal securities laws, including, among others, any statements about our

expectations, plans, intentions, strategies, or prospects. We generally use the words “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,”

“projects,” “assumes,” “guides,” “targets,” “forecasts,” “sees,” “seeks,” “should,” “could,” “would,” “predicts,” “potential,”

“strategy,” “future,” “opportunity,” “work toward,” “intends,” “guidance,” “confidence,” “positioned,” “design,” “strive,” “continue,”

“track,” “look forward to,” “optimistic” and similar expressions to identify forward-looking statements. All statements other than statements of historical or current fact are, or may be deemed to be forward-looking

statements. Such statements are based upon the current beliefs, expectations, and assumptions of management and are subject to significant risks, uncertainties, and changes in circumstances that could cause actual outcomes and results to differ

materially from the forward-looking statements. These risks, uncertainties and changes in circumstances include, but are not limited to: uncertainties as to the timing of the sale of our spine business and the risk that the transaction may not be

completed in a timely manner or at all; the possibility that any or all of the conditions to the consummation of the sale of our spine business may not be satisfied or waived; the effect of the announcement or pendency of the transaction on our

ability to retain and hire key personnel and to maintain relationships with customers, suppliers and other business partners; management’s attention being diverted from our ongoing business operations due to the sale of our spine business;

uncertainties and matters related to the sale of our spine business beyond the control of management; dependence on new product development, technological advances and innovation; shifts in the product category or regional sales mix of our products

and services; supply and prices of raw materials and products; pricing pressures from competitors, customers, dental practices and insurance providers; changes in customer demand for our products and services caused by demographic changes or other

factors; challenges relating to changes in and compliance with governmental laws and regulations affecting our U.S. and international businesses, including regulations of the U.S. Food and Drug Administration and foreign government regulators, such

as more stringent requirements for regulatory clearance of products; competition; the impact of healthcare reform measures; reductions in reimbursement levels by third-party payors; cost containment efforts sponsored by government agencies,

legislative bodies, the private sector and healthcare group purchasing organizations, including the volume-based procurement process in China; control of costs and expenses; dependence on a limited

4

number of suppliers for key raw materials and outsourced activities; the ability to obtain and maintain adequate intellectual property protection; breaches or failures of our information

technology systems or products, including by cyberattack, unauthorized access or theft; the ability to retain the independent agents and distributors who market our products; our ability to attract, retain and develop the highly skilled employees we

need to support our business; the effect of mergers and acquisitions on our relationships with customers, suppliers and lenders and on our operating results and businesses generally; a determination by the Internal Revenue Service that the

distribution or certain related transactions should be treated as taxable transactions; financing transactions undertaken in connection with the separation and risks associated with additional indebtedness; the impact of the separation on our

businesses and the risk that the separation and the results thereof may be more difficult, time-consuming and/or costly than expected, which could impact our relationships with customers, suppliers, employees and other business counterparties;

restrictions on activities following the distribution in order to preserve the tax-free treatment of the distribution; the ability to form and implement alliances; changes in tax obligations arising from tax

reform measures, including European Union rules on state aid, or examinations by tax authorities; product liability, intellectual property and commercial litigation losses; changes in general industry and market conditions, including domestic and

international growth rates; changes in general domestic and international economic conditions, including inflation and interest rate and currency exchange rate fluctuations; the effects of the COVID-19 global

pandemic and other adverse public health developments on the global economy, our business and operations and the business and operations of our suppliers and customers, including the deferral of elective procedures and our ability to collect

accounts receivable; and the impact of the ongoing financial and political uncertainty on countries in the Euro zone on the ability to collect accounts receivable in affected countries. You are cautioned not to rely on these forward-looking

statements, since there can be no assurance that these forward-looking statements will prove to be accurate. Forward-looking statements speak only as of the date they are made, and we expressly disclaim any intention or obligation to update or

revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Media Contact Information:

ZimVie

Laura Driscoll •

Laura.Driscoll@ZimVie.com

(774) 284-1606

Investor Contact Information:

Gilmartin Group LLC

Marissa Bych • Marissa@gilmartinir.com

5

ZIMVIE INC.

CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(unaudited) |

|

|

|

|

| |

|

For the Three Months

Ended December 31, |

|

|

For the Years Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Third party, net |

|

$ |

113,066 |

|

|

$ |

115,798 |

|

|

$ |

457,197 |

|

|

$ |

459,681 |

|

| Related party, net |

|

|

— |

|

|

|

747 |

|

|

|

236 |

|

|

|

3,611 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Net Sales |

|

|

113,066 |

|

|

|

116,545 |

|

|

|

457,433 |

|

|

|

463,292 |

|

| Cost of products sold, excluding intangible asset amortization |

|

|

(42,573 |

) |

|

|

(42,197 |

) |

|

|

(166,819 |

) |

|

|

(165,960 |

) |

| Related party cost of products sold, excluding intangible asset amortization |

|

|

— |

|

|

|

(731 |

) |

|

|

(231 |

) |

|

|

(3,386 |

) |

| Intangible asset amortization |

|

|

(6,134 |

) |

|

|

(6,599 |

) |

|

|

(26,512 |

) |

|

|

(26,982 |

) |

| Research and development |

|

|

(6,893 |

) |

|

|

(6,993 |

) |

|

|

(26,162 |

) |

|

|

(31,147 |

) |

| Selling, general and administrative |

|

|

(62,909 |

) |

|

|

(66,820 |

) |

|

|

(248,964 |

) |

|

|

(253,158 |

) |

| Restructuring and other cost reduction initiatives |

|

|

717 |

|

|

|

(1,545 |

) |

|

|

(4,489 |

) |

|

|

(2,559 |

) |

| Acquisition, integration, divestiture and related |

|

|

(10,548 |

) |

|

|

(4,221 |

) |

|

|

(15,195 |

) |

|

|

(26,587 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

(128,340 |

) |

|

|

(129,106 |

) |

|

|

(488,372 |

) |

|

|

(509,779 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Loss |

|

|

(15,274 |

) |

|

|

(12,562 |

) |

|

|

(30,939 |

) |

|

|

(46,487 |

) |

| Other income, net |

|

|

1,515 |

|

|

|

2,631 |

|

|

|

326 |

|

|

|

2,857 |

|

| Interest expense, net |

|

|

(4,976 |

) |

|

|

(3,599 |

) |

|

|

(20,234 |

) |

|

|

(10,870 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing operations before income taxes |

|

|

(18,735 |

) |

|

|

(13,530 |

) |

|

|

(50,847 |

) |

|

|

(54,500 |

) |

| (Provision) benefit for income taxes from continuing operations |

|

|

(3,428 |

) |

|

|

(1,822 |

) |

|

|

(5,202 |

) |

|

|

7,596 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss from Continuing Operations of ZimVie Inc. |

|

|

(22,163 |

) |

|

|

(15,352 |

) |

|

|

(56,049 |

) |

|

|

(46,904 |

) |

| Loss from discontinued operations, net of tax |

|

|

(312,689 |

) |

|

|

(14,992 |

) |

|

|

(337,233 |

) |

|

|

(16,977 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss of ZimVie Inc. |

|

$ |

(334,852 |

) |

|

$ |

(30,344 |

) |

|

$ |

(393,282 |

) |

|

$ |

(63,881 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic Loss Per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

(0.83 |

) |

|

$ |

(0.59 |

) |

|

$ |

(2.12 |

) |

|

$ |

(1.80 |

) |

| Discontinued operations |

|

|

(11.76 |

) |

|

|

(0.57 |

) |

|

|

(12.75 |

) |

|

|

(0.65 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(12.59 |

) |

|

$ |

(1.16 |

) |

|

$ |

(14.87 |

) |

|

$ |

(2.45 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted Loss Per Common Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

(0.83 |

) |

|

$ |

(0.59 |

) |

|

$ |

(2.12 |

) |

|

$ |

(1.80 |

) |

| Discontinued operations |

|

|

(11.76 |

) |

|

|

(0.57 |

) |

|

|

(12.75 |

) |

|

|

(0.65 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(12.59 |

) |

|

$ |

(1.16 |

) |

|

$ |

(14.87 |

) |

|

$ |

(2.45 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

ZIMVIE INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

71,511 |

|

|

$ |

68,275 |

|

| Accounts receivable, less allowance for credit losses |

|

|

65,168 |

|

|

|

67,031 |

|

| Related party receivable |

|

|

— |

|

|

|

3,154 |

|

| Inventories |

|

|

79,600 |

|

|

|

77,425 |

|

| Prepaid expenses and other current assets |

|

|

23,825 |

|

|

|

28,340 |

|

| Current assets of discontinued operations |

|

|

242,773 |

|

|

|

293,638 |

|

|

|

|

|

|

|

|

|

|

| Total Current Assets |

|

|

482,877 |

|

|

|

537,863 |

|

| Property, plant and equipment, net |

|

|

54,167 |

|

|

|

58,500 |

|

| Goodwill |

|

|

262,111 |

|

|

|

259,999 |

|

| Intangible assets, net |

|

|

114,354 |

|

|

|

138,685 |

|

| Other assets |

|

|

26,747 |

|

|

|

17,377 |

|

| Noncurrent assets of discontinued operations |

|

|

265,089 |

|

|

|

629,632 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

1,205,345 |

|

|

$ |

1,642,056 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

| Current Liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

27,785 |

|

|

$ |

26,498 |

|

| Related party payable |

|

|

— |

|

|

|

2,632 |

|

| Income taxes payable |

|

|

2,863 |

|

|

|

13,769 |

|

| Other current liabilities |

|

|

67,108 |

|

|

|

78,879 |

|

| Current liabilities of discontinued operations |

|

|

75,858 |

|

|

|

95,531 |

|

|

|

|

|

|

|

|

|

|

| Total Current Liabilities |

|

|

173,614 |

|

|

|

217,309 |

|

| Deferred income taxes |

|

|

265 |

|

|

|

2,152 |

|

| Lease liability |

|

|

9,080 |

|

|

|

9,960 |

|

| Other long-term liabilities |

|

|

9,055 |

|

|

|

8,925 |

|

| Non-current portion of debt |

|

|

508,797 |

|

|

|

532,233 |

|

| Noncurrent liabilities of discontinued operations |

|

|

95,041 |

|

|

|

112,873 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

795,852 |

|

|

|

883,452 |

|

|

|

|

|

|

|

|

|

|

| Commitments and Contingencies (Note 16) |

|

|

|

|

|

|

|

|

| Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Common stock, $0.01 par value, 150,000 shares authorized

Shares, issued and outstanding, of

27,076 and 26,222, respectively |

|

|

271 |

|

|

|

262 |

|

| Preferred stock, $0.01 par value, 15,000 shares authorized, 0 shares issued and

outstanding |

|

|

— |

|

|

|

— |

|

| Additional paid in capital |

|

|

922,996 |

|

|

|

897,028 |

|

| Accumulated deficit |

|

|

(440,814 |

) |

|

|

(47,532 |

) |

| Accumulated other comprehensive loss |

|

|

(72,960 |

) |

|

|

(91,154 |

) |

|

|

|

|

|

|

|

|

|

| Total Stockholders’ Equity |

|

|

409,493 |

|

|

|

758,604 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Stockholders’ Equity |

|

$ |

1,205,345 |

|

|

$ |

1,642,056 |

|

|

|

|

|

|

|

|

|

|

7

ZIMVIE INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

For the Years Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Cash flows provided by operating activities: |

|

|

|

|

|

|

|

|

| Net loss of ZimVie Inc. |

|

$ |

(393,282 |

) |

|

$ |

(63,881 |

) |

| Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

121,686 |

|

|

|

122,789 |

|

| Share-based compensation |

|

|

27,020 |

|

|

|

30,289 |

|

| Deferred income tax provision |

|

|

(17,088 |

) |

|

|

(70,422 |

) |

| Loss on disposal of fixed assets |

|

|

2,996 |

|

|

|

3,358 |

|

| Other non-cash items |

|

|

3,245 |

|

|

|

1,172 |

|

| Write-down of spine disposal group to fair value (Note 3) |

|

|

289,456 |

|

|

|

— |

|

| Changes in operating assets and liabilities, net of acquired assets and liabilities: |

|

|

|

|

|

|

|

|

| Income taxes |

|

|

(15,054 |

) |

|

|

5,485 |

|

| Accounts receivable |

|

|

21,083 |

|

|

|

(26,156 |

) |

| Related party receivables |

|

|

8,483 |

|

|

|

(8,483 |

) |

| Inventories |

|

|

25,446 |

|

|

|

10,210 |

|

| Prepaid expenses and other current assets |

|

|

5,340 |

|

|

|

(19,951 |

) |

| Accounts payable and accrued liabilities |

|

|

(24,759 |

) |

|

|

21,842 |

|

| Related party payable |

|

|

(13,176 |

) |

|

|

13,176 |

|

| Other assets and liabilities |

|

|

(4,248 |

) |

|

|

5,200 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

37,148 |

|

|

|

24,628 |

|

|

|

|

|

|

|

|

|

|

| Cash flows used in investing activities: |

|

|

|

|

|

|

|

|

| Additions to instruments |

|

|

(5,978 |

) |

|

|

(10,089 |

) |

| Additions to other property, plant and equipment |

|

|

(6,509 |

) |

|

|

(16,457 |

) |

| Other investing activities |

|

|

(2,687 |

) |

|

|

(2,117 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(15,174 |

) |

|

|

(28,663 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows (used in) provided by financing activities: |

|

|

|

|

|

|

|

|

| Net transactions with Zimmer Biomet |

|

|

— |

|

|

|

6,920 |

|

| Dividend paid to Zimmer Biomet |

|

|

— |

|

|

|

(540,567 |

) |

| Proceeds from debt |

|

|

4,760 |

|

|

|

595,000 |

|

| Payments on debt |

|

|

(29,304 |

) |

|

|

(58,544 |

) |

| Debt issuance costs |

|

|

— |

|

|

|

(5,170 |

) |

| Payments related to tax withholding for share-based compensation |

|

|

(3,402 |

) |

|

|

— |

|

| Proceeds from stock option activity |

|

|

2,280 |

|

|

|

1,059 |

|

| Other financing activities |

|

|

— |

|

|

|

(5 |

) |

|

|

|

|

|

|

|

|

|

| Net cash (used in) provided by financing activities |

|

|

(25,666 |

) |

|

|

(1,307 |

) |

|

|

|

|

|

|

|

|

|

| Effect of exchange rates on cash and cash equivalents |

|

|

1,859 |

|

|

|

(5,456 |

) |

|

|

|

|

|

|

|

|

|

| (Decrease) increase in cash and cash equivalents |

|

|

(1,833 |

) |

|

|

(10,798 |

) |

| Cash and cash equivalents, beginning of year |

|

|

89,601 |

|

|

|

100,399 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents, end of period |

|

$ |

87,768 |

|

|

$ |

89,601 |

|

|

|

|

|

|

|

|

|

|

| Presentation includes cash of both continuing and discontinued operations |

|

|

|

|

|

|

|

|

| Supplemental cash flow information: |

|

|

|

|

|

|

|

|

| Income taxes paid, net |

|

$ |

20,152 |

|

|

$ |

25,730 |

|

| Interest paid |

|

|

37,709 |

|

|

|

17,283 |

|

| Derecognition of

right-of-use assets |

|

|

(1,222 |

) |

|

|

(14,174 |

) |

| Derecognition of lease liabilities |

|

|

1,225 |

|

|

|

15,303 |

|

8

Net Sales Continuing Operations and Discontinued Operations ($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

December 31, |

|

|

|

|

|

|

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

|

Change (%) |

|

|

Foreign

Exchange

Impact |

|

|

Constant

Currency %

Change |

|

| United States |

|

$ |

65,383 |

|

|

$ |

67,535 |

|

|

|

-3.2 |

% |

|

|

0.0 |

% |

|

|

-3.2 |

% |

| International |

|

|

47,683 |

|

|

|

48,263 |

|

|

|

-1.2 |

% |

|

|

2.9 |

% |

|

|

-4.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Dental Third Party Sales (Continuing Operations of ZimVie Inc.) |

|

|

113,066 |

|

|

|

115,798 |

|

|

|

-2.4 |

% |

|

|

1.2 |

% |

|

|

-3.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related Party Net Sales |

|

|

— |

|

|

|

747 |

|

|

|

-100.0 |

% |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Dental Net Sales (Continuing Operations of ZimVie Inc.) |

|

$ |

113,066 |

|

|

$ |

116,545 |

|

|

|

-3.0 |

% |

|

|

1.2 |

% |

|

|

-4.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

$ |

81,528 |

|

|

$ |

90,902 |

|

|

|

-10.3 |

% |

|

|

0.0 |

% |

|

|

-10.3 |

% |

| International |

|

|

18,927 |

|

|

|

21,465 |

|

|

|

-11.8 |

% |

|

|

0.1 |

% |

|

|

-11.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Spine Third Party Sales (Discontinued Operations) |

|

|

100,455 |

|

|

|

112,367 |

|

|

|

-10.6 |

% |

|

|

0.0 |

% |

|

|

-10.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related Party Net Sales |

|

|

— |

|

|

|

208 |

|

|

|

-100.0 |

% |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Spine Net Sales (Discontinued Operations) |

|

$ |

100,455 |

|

|

$ |

112,575 |

|

|

|

-10.8 |

% |

|

|

0.0 |

% |

|

|

-10.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Twelve Months Ended

December 31, |

|

|

|

|

|

|

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

|

Change (%) |

|

|

Foreign

Exchange

Impact |

|

|

Constant

Currency %

Change |

|

| United States |

|

$ |

269,557 |

|

|

$ |

272,726 |

|

|

|

-1.2 |

% |

|

|

0.0 |

% |

|

|

-1.2 |

% |

| International |

|

|

187,640 |

|

|

|

186,955 |

|

|

|

0.4 |

% |

|

|

0.1 |

% |

|

|

0.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Dental Third Party Sales (Continuing Operations of ZimVie Inc.) |

|

|

457,197 |

|

|

|

459,681 |

|

|

|

-0.5 |

% |

|

|

0.0 |

% |

|

|

-0.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related Party Net Sales |

|

|

236 |

|

|

|

3,611 |

|

|

|

-93.5 |

% |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Dental Net Sales (Continuing Operations of ZimVie Inc.) |

|

$ |

457,433 |

|

|

$ |

463,292 |

|

|

|

-1.3 |

% |

|

|

0.1 |

% |

|

|

-1.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

|

$ |

327,343 |

|

|

$ |

357,416 |

|

|

|

-8.4 |

% |

|

|

0.0 |

% |

|

|

-8.4 |

% |

| International |

|

|

81,838 |

|

|

|

92,390 |

|

|

|

-11.4 |

% |

|

|

0.6 |

% |

|

|

-12.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Spine Third Party Sales (Discontinued Operations) |

|

|

409,181 |

|

|

|

449,806 |

|

|

|

-9.0 |

% |

|

|

0.1 |

% |

|

|

-9.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Related Party Net Sales |

|

|

103 |

|

|

|

764 |

|

|

|

-86.5 |

% |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Spine Net Sales (Discontinued Operations) |

|

$ |

409,284 |

|

|

$ |

450,570 |

|

|

|

-9.2 |

% |

|

|

0.2 |

% |

|

|

-9.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9

Continuing Operations Q4 FY23 (in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended December 31, 2023 |

|

| |

|

Net Sales |

|

|

Cost of

products sold,

excluding

intangible asset

amortization |

|

|

Operating

expenses,

excluding

cost of

products sold |

|

|

Operating

(Loss) Income |

|

|

Net (Loss)

Income |

|

|

Diluted EPS |

|

| Continuing Operations of ZimVie Inc. |

|

$ |

113,066 |

|

|

$ |

(42,573 |

) |

|

$ |

(85,767 |

) |

|

$ |

(15,274 |

) |

|

$ |

(22,163 |

) |

|

$ |

(0.83 |

) |

| Restructuring and other cost reduction initiatives [1] |

|

|

— |

|

|

|

— |

|

|

|

(717 |

) |

|

|

(717 |

) |

|

|

(717 |

) |

|

|

(0.03 |

) |

| Acquisition, integration, divestiture and related [2] |

|

|

— |

|

|

|

— |

|

|

|

10,548 |

|

|

|

10,548 |

|

|

|

10,548 |

|

|

|

0.41 |

|

| European union medical device regulation [3] |

|

|

— |

|

|

|

— |

|

|

|

347 |

|

|

|

347 |

|

|

|

347 |

|

|

|

0.01 |

|

| Other charges [4] |

|

|

— |

|

|

|

278 |

|

|

|

286 |

|

|

|

564 |

|

|

|

564 |

|

|

|

0.02 |

|

| Intangible asset amortization |

|

|

— |

|

|

|

— |

|

|

|

6,134 |

|

|

|

6,134 |

|

|

|

6,134 |

|

|

|

0.23 |

|

| Spin-related share-based compensation expense [5] |

|

|

— |

|

|

|

— |

|

|

|

5,335 |

|

|

|

5,335 |

|

|

|

5,335 |

|

|

|

0.20 |

|

| Tax effect of above adjustments & other [6] |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,524 |

|

|

|

0.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted |

|

$ |

113,066 |

|

|

$ |

(42,295 |

) |

|

$ |

(63,834 |

) |

|

$ |

6,937 |

|

|

$ |

2,572 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [1] |

In April 2023, we initiated restructuring activities to better position our organization for future success

based on the current business environment, and in July 2023, we took additional actions. The expenses incurred were primarily related to severance and professional fees. In June 2022 we initiated a restructuring plan and the expenses incurred were

primarily related to employee termination benefits. |

| [2] |

Acquisition, integration, divestiture, and related expenses include costs incurred to prepare for and complete

the separation from our former parent (such as professional fees, transition services agreements, costs to stand up our corporate organization and infrastructure), changes in the fair value of contingent consideration for acquisitions closed prior

to the separation date and costs related to the evaluation of strategic options for our portfolio. Acquisition, integration, divestiture and related expenses increased by $6.3 million in 4Q 2023 compared to 4Q 2022, due primarily to increased

costs related to the pending sale of our spine segment ($10.1 million), partially offset by decreases in separation-related professional fees ($2.0 million), separation-related employee costs ($0.3 million) and separation-related lease costs ($0.1

million). |

| [3] |

Expenses incurred for initial compliance with the European Union (“EU”) Medical Device Regulation

(“MDR”) for previously-approved products. |

| [4] |

Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. |

| [5] |

Spin-related share-based compensation expense from grants provided due to the successful separation from Zimmer

Biomet, including the impact of accelerating the vesting of these awards in Q4 2023. |

| [6] |

Reflects the tax effect of the adjustments from reported to adjusted, as well as an adjustment for

management’s expectation of ZimVie’s statutory tax rate based on current tax law and adjusted pre-tax income. |

10

Continuing Operations Q4 FY22 (in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended December 31, 2022 |

|

| |

|

Net Sales |

|

|

Cost of

products sold,

excluding

intangible asset

amortization |

|

|

Operating

expenses,

excluding

cost of

products sold |

|

|

Operating

(Loss) Income |

|

|

Net (Loss)

Income |

|

|

Diluted EPS |

|

| Continuing Operations of ZimVie Inc. |

|

$ |

116,545 |

|

|

$ |

(42,928 |

) |

|

$ |

(86,178 |

) |

|

$ |

(12,561 |

) |

|

$ |

(15,352 |

) |

|

$ |

(0.59 |

) |

| Restructuring and other cost reduction initiatives [1] |

|

|

— |

|

|

|

— |

|

|

|

1,545 |

|

|

|

1,545 |

|

|

|

1,545 |

|

|

|

0.06 |

|

| Acquisition, integration, divestiture and related [2] |

|

|

— |

|

|

|

— |

|

|

|

4,221 |

|

|

|

4,221 |

|

|

|

4,221 |

|

|

|

0.16 |

|

| European union medical device regulation [3] |

|

|

— |

|

|

|

— |

|

|

|

1,005 |

|

|

|

1,005 |

|

|

|

1,005 |

|

|

|

0.04 |

|

| Intangible asset amortization |

|

|

— |

|

|

|

— |

|

|

|

6,599 |

|

|

|

6,599 |

|

|

|

6,599 |

|

|

|

0.25 |

|

| Related party |

|

|

(747 |

) |

|

|

731 |

|

|

|

— |

|

|

|

(16 |

) |

|

|

(16 |

) |

|

|

— |

|

| Spin-related share-based compensation expense [4] |

|

|

— |

|

|

|

— |

|

|

|

856 |

|

|

|

856 |

|

|

|

856 |

|

|

|

0.03 |

|

| Other charges [5] |

|

|

— |

|

|

|

1,875 |

|

|

|

— |

|

|

|

1,875 |

|

|

|

1,875 |

|

|

|

0.07 |

|

| Tax effect of above adjustments & other [6] |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,158 |

|

|

|

0.05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted |

|

$ |

115,798 |

|

|

$ |

(40,322 |

) |

|

$ |

(71,952 |

) |

|

$ |

3,524 |

|

|

$ |

1,891 |

|

|

$ |

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [1] |

In June 2022 we initiated a restructuring plan and the expenses incurred were primarily related to employee

termination benefits. |

| [2] |

Acquisition, integration, divestiture, and related expenses include costs incurred to prepare for and complete

the separation from our former parent (such as professional fees, transition services agreements, costs to stand up our corporate organization and infrastructure), changes in the fair value of contingent consideration for acquisitions closed prior

to the separation date and costs related to the evaluation of strategic options for our portfolio. Acquisition, integration, divestiture and related expenses decreased by $6.1 million in 4Q 2022 compared to 4Q 2021, due primarily to decreases

in separation-related employee costs ($3.9 million) and separation-related lease costs ($0.5 million). |

| [3] |

Expenses incurred for initial compliance with the EU MDR for previously-approved

products. |

| [4] |

Spin-related share-based compensation expense from grants provided due to the successful separation from Zimmer

Biomet. |

| [5] |

Expenses captured through allocations made for purposes of the GAAP

carve-out financial statement results. |

| [6] |

Reflects the tax effect of the adjustments from reported to adjusted, as well as an adjustment for

management’s expectation of ZimVie’s statutory tax rate based on current tax law and adjusted pre-tax income. |

11

Continuing Operations FY23 (in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Twelve Months Ended December 31, 2023 |

|

| |

|

Net Sales |

|

|

Cost of

products sold,

excluding

intangible asset

amortization |

|

|

Operating

expenses,

excluding

cost of

products sold |

|

|

Operating

(Loss) Income |

|

|

Net (Loss)

Income |

|

|

Diluted EPS |

|

| Continuing Operations of ZimVie Inc. |

|

$ |

457,433 |

|

|

$ |

(167,050 |

) |

|

$ |

(321,322 |

) |

|

$ |

(30,939 |

) |

|

$ |

(56,049 |

) |

|

$ |

(2.12 |

) |

| Restructuring and other cost reduction initiatives [1] |

|

|

— |

|

|

|

— |

|

|

|

4,489 |

|

|

|

4,489 |

|

|

|

4,489 |

|

|

|

0.17 |

|

| Acquisition, integration, divestiture and related [2] |

|

|

— |

|

|

|

— |

|

|

|

15,195 |

|

|

|

15,195 |

|

|

|

15,195 |

|

|

|

0.57 |

|

| European union medical device regulation [3] |

|

|

— |

|

|

|

— |

|

|

|

2,574 |

|

|

|

2,574 |

|

|

|

2,574 |

|

|

|

0.10 |

|

| Related party |

|

|

(236 |

) |

|

|

231 |

|

|

|

— |

|

|

|

(5 |

) |

|

|

(5 |

) |

|

|

— |

|

| Other charges [4] |

|

|

— |

|

|

|

1,143 |

|

|

|

1,145 |

|

|

|

2,288 |

|

|

|

2,288 |

|

|

|

0.09 |

|

| Intangible asset amortization |

|

|

— |

|

|

|

— |

|

|

|

26,512 |

|

|

|

26,512 |

|

|

|

26,512 |

|

|

|

1.00 |

|

| Spin-related share-based compensation expense [5] |

|

|

— |

|

|

|

— |

|

|

|

7,679 |

|

|

|

7,679 |

|

|

|

7,679 |

|

|

|

0.29 |

|

| Tax effect of above adjustments & other [6] |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,152 |

|

|

|

0.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted |

|

$ |

457,197 |

|

|

$ |

(165,676 |

) |

|

$ |

(263,728 |

) |

|

$ |

27,793 |

|

|

$ |

5,835 |

|

|

$ |

0.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [1] |

In April 2023, we initiated restructuring activities to better position our organization for future success

based on the current business environment, and in July 2023, we took additional actions. The expenses incurred under this plan were primarily related to severance and professional fees. In June 2022 we initiated restructuring plans and the expenses

incurred were primarily related to employee termination benefits. |

| [2] |

Acquisition, integration, divestiture, and related expenses include costs incurred to prepare for and complete

the separation from our former parent (such as professional fees, transition services agreements, costs to stand up our corporate organization and infrastructure), changes in the fair value of contingent consideration for acquisitions closed prior

to the separation date and costs related to the evaluation of strategic options for our portfolio. Acquisition, integration, divestiture and related expenses decreased by $11.4 million in 2023 compared to 2022, due primarily to decreases in

separation-related professional fees ($8.2 million), separation-related employee costs ($5.3 million), separation-related lease costs ($3.2 million) and contingent consideration ($2.8 million), partially offset by increased costs related to the

pending sale of our spine segment ($11.6 million). |

| [3] |

Expenses incurred for initial compliance with the EU MDR for previously-approved

products. |

| [4] |

Inventory write-offs resulting from restructuring activities and property, plant, and equipment step-up amortization from prior acquisitions. |

| [5] |

Spin-related share-based compensation expense from grants provided due to the successful separation from Zimmer

Biomet, including the impact of accelerating the vesting of these awards in Q4 2023. |

| [6] |

Reflects the tax effect of the adjustments from reported to adjusted, as well as an adjustment for

management’s expectation of ZimVie’s statutory tax rate based on current tax law and adjusted pre-tax income. |

12

Continuing Operations FY22 (in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Twelve Months Ended December 31, 2022 |

|

| |

|

Net Sales |

|

|

Cost of

products sold,

excluding

intangible asset

amortization |

|

|

Operating

expenses,

excluding

cost of

products sold |

|

|

Operating (Loss)

Income |

|

|

Net (Loss)

Income |

|

|

Diluted EPS |

|

| Continuing Operations of ZimVie Inc. |

|

$ |

463,292 |

|

|

$ |

(169,346 |

) |

|

$ |

(340,433 |

) |

|

$ |

(46,487 |

) |

|

$ |

(46,904 |

) |

|

$ |

(1.80 |

) |

| Pre vs. post-spin Cost Structure Differences [1] |

|

|

— |

|

|

|

— |

|

|

|

5,271 |

|

|

|

5,271 |

|

|

|

5,271 |

|

|

|

0.20 |

|

| Restructuring and other cost reduction initiatives [2] |

|

|

— |

|

|

|

— |

|

|

|

2,559 |

|

|

|

2,559 |

|

|

|

2,559 |

|

|

|

0.10 |

|

| Acquisition, integration, divestiture and related [3] |

|

|

— |

|

|

|

— |

|

|

|

26,587 |

|

|

|

26,587 |

|

|

|

26,587 |

|

|

|

1.02 |

|

| European union medical device regulation [4] |

|

|

— |

|

|

|

— |

|

|

|

3,146 |

|

|

|

3,146 |

|

|

|

3,146 |

|

|

|

0.12 |

|

| Intangible asset amortization |

|

|

— |

|

|

|

— |

|

|

|

26,982 |

|

|

|

26,982 |

|

|

|

26,982 |

|

|

|

1.03 |

|

| Related party |

|

|

(3,611 |

) |

|

|

3,386 |

|

|

|

— |

|

|

|

(225 |

) |

|

|

(225 |

) |

|

|

(0.01 |

) |

| Spin-related share-based compensation expense [5] |

|

|

— |

|

|

|

1,331 |

|

|

|

10,386 |

|

|

|

11,717 |

|

|

|

11,717 |

|

|

|

0.45 |

|

| Tax effect of above adjustments & other [6] |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13,196 |

) |

|

|

(0.50 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted |

|

$ |

459,681 |

|

|

$ |

(164,629 |

) |

|

$ |

(265,502 |

) |

|

$ |

29,550 |

|

|

$ |

15,937 |

|

|

$ |

0.61 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [1] |

Reflects certain items captured in the GAAP carve-out financial

statements that have not continued post-spin, including, but not limited to, facilities that did not convey with ZimVie in the spin, redundant personnel costs incurred as a result of the spin, and the difference between the pre-spin allocations of Zimmer Biomet’s corporate costs in accordance with GAAP, versus the expected post-spin corporate costs for ZimVie. |

| [2] |

In June 2022 we initiated restructuring plans and the expenses incurred were primarily related to employee

termination benefits. |

| [3] |

Acquisition, integration, divestiture, and related expenses include costs incurred to prepare for and complete

the separation from our former parent (such as professional fees, transition services agreements, costs to stand up our corporate organization and infrastructure), changes in the fair value of contingent consideration for acquisitions closed prior

to the separation date and costs related to the evaluation of strategic options for our portfolio. Acquisition, integration, divestiture and related expenses increased by $15.6 million in 2022 compared to 2021, due primarily to increases in

separation-related professional fees ($7.9 million), separation-related employee costs ($2.7 million), separation-related lease costs ($2.7 million) and contingent consideration ($1.3 million). |

| [4] |

Expenses incurred for initial compliance with the EU MDR for previously-approved

products. |

| [5] |

Spin-related share-based compensation expense from grants provided due to the successful separation from Zimmer

Biomet. |

| [6] |

Reflects the tax effect of the adjustments from reported to adjusted, as well as an adjustment for

management’s expectation of ZimVie’s statutory tax rate based on current tax law and adjusted pre-tax income. |

13

Reconciliation of Adjusted EBITDA ($ in thousands) – Continuing Operations

RECONCILIATION OF ADJUSTED EBITDA ($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

December 31, |

|

|

For the Twelve Months Ended

December 31, |

|

| Continuing Operations of ZimVie Inc. |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Third Party Sales |

|

$ |

113,066 |

|

|

$ |

115,798 |

|

|

$ |

457,197 |

|

|

$ |

459,681 |

|

| Related Party Sales |

|

|

— |

|

|

|

747 |

|

|

|

236 |

|

|

|

3,611 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Net Sales |

|

$ |

113,066 |

|