Prospectus Supplement

(To Prospectus dated May 3, 2024) |

Filed pursuant to Rule 424(b)(5)

Registration No. 333-278886 |

Up to US$30,000,000

Common Shares

ZENTEK LTD.

We have entered into an At The Market Offering Agreement, or the Sales Agreement, with Rodman & Renshaw LLC, or the Sales Agent, relating to our common shares, no par value, offered by this prospectus supplement and the accompanying base prospectus. In accordance with the terms of the Sales Agreement, we may offer and sell our common shares having an aggregate offering price of up to US$30,000,000 from time to time through the Sales Agent, acting as sales agent or principal.

Our common shares are listed on the Nasdaq Capital Market under the symbol "ZTEK." The last reported sale price of our common shares on the Nasdaq Capital Market on February 27, 2025 was US$0.93 per share.

Upon our delivery of a placement notice and subject to the terms and conditions of the Sales Agreement, the Sales Agent may sell our common shares by methods deemed to be an "at the market offering" as defined in Rule 415(a)(4) promulgated under the U.S. Securities Act of 1933, as amended, or the Securities Act. The Sales Agent will use its commercially reasonable efforts consistent with its normal trading and sales practices and applicable state and federal laws, rules and regulations and the rules of the Nasdaq Capital Market. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

We will pay the Sales Agent a total commission for its services in acting as agent in the sale of common shares equal to up to 3.0% of the gross sales price per share of all shares sold through the Sales Agent as agent under the Sales Agreement. See "Plan of Distribution" for information relating to certain expenses of the Sales Agent to be reimbursed by us.

In connection with the sale of the common shares on our behalf, the Sales Agent will be deemed to be an "underwriter" within the meaning of the Securities Act and the compensation of the Sales Agent will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contribution to the Sales Agent with respect to certain liabilities, including liabilities under the Securities Act and the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act.

We are an "emerging growth company" and a "foreign private issuer" as defined under U.S. federal securities laws, and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus supplement and the accompanying base prospectus, and the documents incorporated by reference herein and therein, and may elect to comply with reduced public company reporting requirements in future filings. See "Prospectus Supplement Summary-Implications of Being an Emerging Growth Company" and "Prospectus Supplement Summary-Implications of Being a Foreign Private Issuer" for more information.

Investing in our common shares involves a high degree of risk. You should carefully review the risks and uncertainties described under the heading "Risk Factors" in this prospectus supplement beginning on page S-11, and under similar headings in the accompanying base prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Rodman & Renshaw LLC

The date of this prospectus supplement is March 3, 2025

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying base prospectus are part of a "shelf" registration statement on Form F-3 (File No. 333-278886) that we filed with the U.S. Securities and Exchange Commission, or the SEC, and was declared effective by the SEC on May 3, 2024. This prospectus supplement and the accompanying base prospectus relate to an "at the market" offering of our common shares. Before buying any of the common shares offered hereby, we urge you to read carefully this prospectus supplement, the accompanying base prospectus, and the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus supplement entitled "Where You Can Find More Information" and "Information Incorporated by Reference." These documents contain important information that you carefully should consider when making your investment decision.

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering of our common shares and also adds to and updates information contained in the accompanying base prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus. The second part, the accompanying base prospectus, provides more general information, some of which may not apply to this offering. Generally, when we refer to "this prospectus," we are referring to both parts of this document combined. The information included or incorporated by reference in this prospectus supplement also adds to, updates, and changes information contained or incorporated by reference in the accompanying base prospectus. If information included or incorporated by reference in this prospectus supplement is inconsistent with the accompanying base prospectus or the information incorporated by reference therein, then this prospectus supplement or the information incorporated by reference in this prospectus supplement will apply and will supersede the information in the accompanying base prospectus and the documents incorporated by reference therein.

You should rely only on the information contained in, or incorporated by reference into, this prospectus supplement and the accompanying base prospectus. We have not, and the Sales Agent has not, authorized anyone to provide you with different or additional information, or to make any representations other than those contained in, or incorporated by reference into, this prospectus supplement and the accompanying base prospectus. We and the Sales Agent take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not making offers to sell or solicitations to buy our common shares in any jurisdiction in which an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

You should assume that the information in this prospectus supplement and the accompanying base prospectus is accurate only as of the date on the front of the respective document and that any information that we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement or the accompanying base prospectus or the time of any sale of our common shares. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus supplement and the accompanying base prospectus contain summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated herein by reference as exhibits to the registration statement of which this prospectus supplement is a part, and you may obtain copies of those documents as described below under the section entitled "Where You Can Find More Information."

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus supplement, the accompanying base prospectus, and the documents incorporated by reference in this prospectus supplement and the accompanying base prospectus, contain references to trademarks, trade names and service marks. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus supplement, the accompanying base prospectus, and the documents incorporated by reference in this prospectus supplement and the accompanying base prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to such trademarks, trade names and service marks. We do not intend our use or display of other entities' trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other entities.

Unless the context indicates otherwise, as used in this prospectus, the terms "us," "our," "Zentek," "we," the "Company" and similar designations refer to Zentek Ltd. and, where appropriate, its consolidated subsidiaries.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere, or incorporated by reference, in this prospectus supplement or the accompanying base prospectus and does not contain all of the information you should consider in making your investment decision. This summary is qualified in its entirety by the more detailed information included elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying base prospectus. Before deciding to purchase any of our common shares in this offering, you should read this summary together with the more detailed information included elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying base prospectus. You should carefully consider, among other things, the matters discussed in "Risk Factors" and "Special Note Regarding Forward-Looking Statements," in each case, included elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying base prospectus, as well as our consolidated financial statements and related notes, incorporated by reference into this prospectus supplement and the accompanying base prospectus.

Overview

We are an intellectual property development and commercialization company focused primarily on commercializing ZenGUARD™, as well as on the development of certain rapid detection technologies and other nanomaterials-based technologies. Our ZenGUARDTM production facility is located in Guelph, Ontario, Canada.

We were incorporated under the Business Corporations Act (Ontario) as a numbered company in July 2008, and have undergone several name changes, the most recent of which was the changing of our name from "ZEN Graphene Solutions Ltd." to "Zentek Ltd." on October 28, 2021.

We originally commenced operations as a junior mineral exploration company focused primarily on mineral deposits in Northern Ontario, Canada. In May 2018, we began to focus our resources on the research and development of graphene and related applications, and we opened a research facility in Guelph, Ontario, Canada, in February 2020, to support our university and industrial partners' ongoing research and to scale-up production of graphene products.

Subsequently, the COVID-19 pandemic halted research at our collaborators' laboratories, and we pivoted towards focusing our resources to develop graphene-based solutions for the fight against COVID-19.

In September 2020, we announced the development and successful testing of a graphene oxide (“GO”)/silver compound that showed effectiveness against the COVID-19 virus after application of the coating to N95 mask material. In December 2020, we announced the successful testing of the GO/silver compound that showed effectiveness against both gram-positive and gram-negative aerobic bacteria as well as against fungus/yeast. We filed two provisional patent applications relating to our antimicrobial coating, and in April 2021, announced the brand name ZenGUARD™ for such coating.

In November 2021, we announced that we had been issued a Medical Device Establishment License from Health Canada for the manufacture and distribution of any Class I medical devices, including any such devices with or without the ZenGUARD™ coating.

In December 2022, our patent application directed to the ZenGUARD™ technology for use on personal protective equipment, and heating, ventilation, and air conditioning, or HVAC, filters, was granted with a term expiring in September 2041.

Our common shares are listed in the United States on the Nasdaq Capital Market under the symbol "ZTEK," and in Canada on the TSX Venture Exchange under the symbol "ZEN."

Our principal executive office is located at 24 Corporate Court, Guelph, Ontario, Canada N1G 5G5, and our telephone number is (844) 730-9822.

We currently have two material wholly-owned subsidiaries, (i) Albany Graphite Corp., or AGC, incorporated under the laws of the Province of British Columbia, and (ii) Triera Biosciences Ltd., or Triera, incorporated under the laws of the Province of Ontario.

We also have two other wholly-owned subsidiaries, (i) 1000114904 Ontario Inc., incorporated under the laws of the Province of Ontario, and Zentek USA Inc., incorporated under the laws of the State of Delaware.

AGC owns the Albany Graphite Project, an igneous-hosted fluid-derived graphite deposit located in Claim Block 4F, comprised of 521 mining claims (461 single-cell claims and 60 boundary-cell claims). The Albany Graphite Project is located west of the communities of Constance Lake First Nation and Hearst, Ontario.

Triera owns the exclusive, global licensing rights for all aptamer-based technology from our collaboration with McMaster University.

Additional information regarding us and our business are set forth in our most recent Annual Information Form attached as an Exhibit to our most recent Annual Report on Form 40-F filed with the SEC and our most recent Management's Discussion and Analysis attached as an Exhibit to our Report of Foreign Private Issuer on Form 6-K furnished with the SEC, and in each case incorporated by reference into this prospectus supplement. See "Where You Can Find More Information" and "Information Incorporated by Reference."

Our agent for service of process in the United States is Cogency Global Inc., located at 122 East 42nd Street, 18th Floor, New York, New York 10168.

Our website address is https://www.zentek.com. We do not incorporate the information on or accessible through our website into this prospectus supplement or the accompanying base prospectus, and you should not consider any information on, or that can be accessed through, our website as part of this prospectus supplement or the accompanying base prospectus. Our website address is included in this prospectus supplement as an inactive textual reference only.

Recent Events

On October 18, 2024, we listed for sale, 24 Corporate Court. in Guelph, Ontario which is currently our registered head office and principal executive offices. Permission to list the property was given by our board of directors in June 2024. The building and land are expected to sell during the next 12 months.

Implications of Being an Emerging Growth Company

We are an "emerging growth company" as defined in the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to take, have taken, and intend to take, advantage of certain exemptions from various reporting requirements applicable to other public companies that are not emerging growth companies for as long as we continue to be an emerging growth company, including the exemption from the auditor attestation requirements with respect to internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act of 2002.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year during which we have total annual gross revenues of at least US$1.235 billion; (ii) the last day of our fiscal year following the fifth anniversary of our first sale of securities pursuant to an effective registration statement under the Securities Act; (iii) the date on which we have, during the preceding three year period, issued more than US$1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a "large accelerated filer" under the Exchange Act, which could occur if the market value of our common shares that are held by non-affiliates is US$700 million or more as of the last business day of our most recently completed second fiscal quarter.

Implications of Being a Foreign Private Issuer

We are subject to the information reporting requirements of the Exchange Act that are applicable to "foreign private issuers," and under those requirements we file and furnish certain reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and less frequent than those of U.S. domestic reporting companies. For example, we have four months after the end of each fiscal year to file our annual reports with the SEC and we are not required to file current reports as frequently or promptly as U.S. domestic reporting companies. We also present our financial statements pursuant to International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB, instead of pursuant to U.S. generally accepted accounting principles, or U.S. GAAP. IFRS differs in certain significant respects from U.S. GAAP. Furthermore, our officers, directors and principal shareholders are exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are also not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private issuer, we are permitted to follow, have followed, and intend to follow, certain home country corporate governance practices instead of those otherwise required under the listing rules of the Nasdaq Stock Market LLC, or Nasdaq, for domestic U.S. issuers. These exemptions and leniencies will reduce the frequency and scope of information and protections available to you in comparison to those applicable to U.S. domestic reporting companies.

THE OFFERING

|

Common shares offered by us pursuant to this prospectus supplement

|

Common shares having an aggregate offering price of up to US$30,000,000.

|

|

Common shares to be outstanding immediately after this offering

|

Up to 136,569,514 shares (as more fully described in the notes following this table), assuming sales of 32,258,064 common shares in this offering at an offering price of US$0.93 per share, which was the last reported sale price of our common shares on the Nasdaq Capital Market on February 27, 2025. The actual number of shares issued will vary depending on the sales price under this offering.

|

|

Manner of Offering

|

"At the market offering" as defined in Rule 415(a)(4) under the Securities Act, including sales made directly on or through the Nasdaq Capital Market, or any other existing trading market for our common shares in the United States or to or through a market maker, through the Sales Agent. See "Plan of Distribution" on page S-22 of this prospectus supplement.

|

|

Use of proceeds

|

We intend to use the net proceeds of this offering for working capital and general corporate purposes. See "Use of Proceeds."

|

|

Risk factors

|

Investing in our common shares involves a high degree of risk and purchasers of our common shares may lose part or all of their investment. You should read this prospectus supplement and the accompanying base prospectus, and the documents incorporated by reference herein and therein carefully, including the sections entitled "Risk Factors" and our consolidated financial statements and related notes, before investing in our common shares.

|

|

Nasdaq Capital Market Symbol

|

"ZTEK"

|

The number of common shares to be outstanding immediately after this offering is based on 104,311,450 common shares outstanding as of February 26, 2025, and excludes, as of that date, the following:

- 6,283,334 common shares issuable upon the exercise of options outstanding under our Omnibus Long-Term Incentive Plan, or our LTIP, and our previous option plan, or the Legacy Stock Option Plan, and together with the LTIP, our Option Plans, at a weighted average exercise price of C$2.28 (approximately US$1.58(1)) per share;

- 1,180,750 common shares issuable upon the exercise of outstanding warrants, with a weighted average exercise price of C$3.00 (approximately US$2.08(1)) per share; and

- 4,846,250 common shares that are available for issuance under our Option Plans.

(1) Based on a daily average exchange rate of C$1.00 = US$0.6934 on February 27, 2025, as reported by the Bank of Canada. See "Currency and Exchange Rate Information" for additional details.

Except as otherwise noted, all information in this prospectus supplement assumes no exercise of the warrants and options described above.

RISK FACTORS

Investing in our common shares involves a high degree of risk and uncertainty. Before deciding whether to invest in our common shares, you should carefully consider the risks and uncertainties described below, as well as the risks and uncertainties described under the section titled "Risk Factors" and elsewhere in our most recent Annual Information Form attached as an Exhibit to our most recent Annual Report on Form 40-F filed with the SEC, as well as our subsequent filings with the SEC which are incorporated by reference into this prospectus supplement, together with other information in this prospectus supplement and the documents incorporated by reference herein. The risks described in these documents are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially adversely affected. This could cause the trading price of our common shares to decline, resulting in a loss of all or part of your investment. Please also carefully read the section titled "Special Note Regarding Forward-Looking Statements."

Additional Risks Related to this Offering and Ownership of Our Common Shares

An investment in the common shares offered hereby is extremely speculative and there can be no assurance of any return on any such investment.

An investment in the common shares offered hereby is extremely speculative and there is no assurance that investors will obtain any return on their investment. Investors will be subject to substantial risks involved in an investment in us, including the risk of losing their entire investment.

The actual number of common shares we will issue under the Sales Agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver instructions to the Sales Agent to sell our common shares at any time throughout the term of the Sales Agreement. The number of common shares that are sold through the Sales Agent after our instruction will fluctuate based on a number of factors, including the market price of our common shares during the sales period, the limits we set in any instruction to the Sales Agent under the Sales Agreement to sell common shares, and the demand for our common shares during the sales period. Because the price per share of each common share sold will fluctuate during this offering, it is not currently possible to predict the number of common shares that will be sold or the gross proceeds to be raised in connection with those sales, if any.

The common shares offered hereby will be sold in "at the market offerings," and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices and, as such, may experience different levels of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of common shares, if any, to be sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

You may experience immediate and substantial dilution in the net tangible book value per common share you purchase in this offering.

The offering price per share in this offering may exceed the net tangible book value per common share outstanding prior to this offering. The exercise of outstanding warrants and stock options may also result in further dilution of your investment. See the section entitled "Dilution" below for a more detailed illustration of the dilution you may incur if you participate in this offering.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional common shares or other securities convertible into or exchangeable for our common shares. We may not be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing shareholders. The price per share at which we sell additional common shares or other securities convertible into or exchangeable for our common shares in future transactions may be higher or lower than the price per share in this offering.

We will have broad discretion in how we use the net proceeds from this offering and may not use such proceeds effectively, which could affect our results of operations and cause our share price to decline.

We will have considerable discretion in the application of the net proceeds from this offering, and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Due to the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. As a result, investors will be relying upon management's judgment with only limited information about our specific intentions for the use of the net proceeds of this offering. We may use the net proceeds for purposes that do not yield a significant return or any return at all for our shareholders. In addition, pending their use, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value. See "Use of Proceeds" on page S-17 of this prospectus supplement for a description of our proposed use of proceeds from this offering.

We may not be able to maintain a listing of our common shares on Nasdaq.

Although our common shares are listed on Nasdaq, we must meet certain financial and liquidity criteria to maintain such listing. If we violate Nasdaq's listing requirements, or if we fail to meet any of Nasdaq's listing standards, our common shares may be delisted.

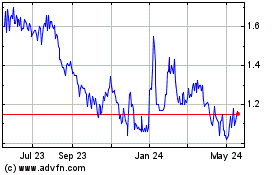

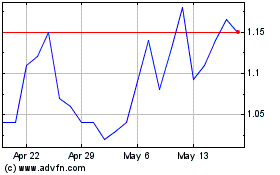

On September 11, 2024, we received a written notification from Nasdaq that we were not in compliance with Nasdaq Listing Rule 5550(a)(2), as the minimum bid price of our common shares had been below US$1.00 per share for 30 consecutive business days. In accordance with Nasdaq rules, we had a period of 180 calendar days (or until March 10, 2025) to regain compliance with the minimum bid price requirement. On December 3, 2024, we received written notification from the Nasdaq that we had regained compliance with Nasdaq Listing Rule 5550(a)(2), as the minimum bid price of our common shares had been above US$1.00 per share for 10 consecutive business days.

Although we have regained compliance, we cannot assure you that we will not, in the future, fail to comply with Nasdaq's requirements to maintain the listing of our common shares on Nasdaq, or that we will be able to regain compliance in the event of any such non-compliance. In addition, our board of directors may determine that the cost of maintaining our listing on a U.S. national securities exchange outweighs the benefits of such listing. A delisting of our common shares from Nasdaq may materially impair our shareholders' ability to buy and sell our common shares and could have an adverse effect on the market price of, and the efficiency of the trading market for, our common shares. The delisting of our common shares could significantly impair our ability to raise capital and the value of your investment.

Because we have no current plans to pay cash dividends on our common shares, you may not receive any return on investment unless you sell your common shares for a price greater than that which you paid for it.

We have never declared or paid cash dividends on our common shares. We currently intend to retain all available funds and any future earnings for use in the operation of our business and do not anticipate paying any cash dividends on our common shares in the near future. We may also enter into credit agreements or other borrowing arrangements in the future that may restrict our ability to declare or pay cash dividends on our common shares. Any future determination to declare dividends will be made at the discretion of our board of directors and will depend on our financial condition, operating results, capital requirements, general business conditions, and other factors that our board of directors may deem relevant. We may not pay any dividends on our common shares in the foreseeable future. As a result, capital appreciation, if any, of our common shares will be your sole source of gain for the foreseeable future.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying base prospectus, and the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus contain "forward-looking statements" within the meaning of U.S. federal securities laws. Such forward-looking statements are based on expectations, estimates and projections as at the date of this prospectus supplement, the accompanying base prospectus, or the documents incorporated by reference herein and in the accompanying base prospectus, as applicable. All statements other than statements of historical facts are forward-looking statements.

We sometimes use words such as "anticipate," "believe," "budget," "can," "contemplate," "continue," "could," "estimate," "expect," "forecast," "future," "intend," "may," "might," "plan," "possible," "potential," "predict," "project," "schedule," "seek." "should," "target," "will," "would," or the negative or variations of such terms or other similar or comparable terms, phrases and expressions, including references to assumptions, in the aforementioned documents to identify forward-looking statements, although the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements include, but are not limited to, statements and information concerning:

- our intentions, plans, goals, strategies, future growth, future activities and future actions;

- our market position, ability to compete and future financial or operating performance;

- anticipated developments in operations;

- planned business activities and planned future acquisitions;

- the timing and amount of funding required to execute our development and business plans;

- the adequacy of our financial resources;

- requirements for additional capital;

- our projected intellectual property expenditures;

- our projected capital and exploration and development expenditures;

- the effect on us of any changes to existing legislation or policy;

- the length of time required to obtain permits, certifications and approvals;

- the markets for our products and our ability to supply those markets;

- the success of our exploration, development and mining activities;

- demand and market outlook;

- the geology of mineral properties;

- the availability of labor;

- progress in development of mineral properties;

- the timing and possible outcome of litigation;

- the timing and possible outcome of regulatory and permitting matters;

- limitations of insurance coverage;

- our anticipated use of net proceeds from this offering; and

- and other events or conditions that may occur in the future.

Forward-looking statements are based on current expectations and beliefs of our management, as well as on assumptions, which our management believes to be reasonable based on information available at the time such statements were made. However, by their nature, forward-looking statements are inherently uncertain and involve known and unknown risks, uncertainties and other factors (some of which are beyond our control) that may cause the actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. These risks and uncertainties include, without limitation, those risks and uncertainties outlined under the heading "Risk Factors" and elsewhere in this prospectus supplement, the accompanying base prospectus, and the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus.

The lists of risk factors set forth in the aforementioned documents are not exhaustive. It is not possible to predict or identify all risks, and there may be additional risks that we currently consider immaterial or which are unknown.

We do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

For all of these reasons, you should not place undue reliance on forward-looking statements.

All forward-looking statements included in or incorporated by reference into this prospectus supplement are qualified by the foregoing cautionary statements.

MARKET, INDUSTRY AND OTHER DATA

We obtained the industry, market and competitive position data included or incorporated by reference in this prospectus supplement and the accompanying base prospectus from our internal estimates and research, as well as from independent market research, industry and general publications and surveys, governmental agencies and publicly available information in addition to research, surveys and studies conducted by third parties. We have not independently verified the accuracy or completeness of the data contained in the third-party research and other publicly available information. Further, while we believe that our internal research is reliable, such research has not been verified by any third party. While we believe the industry, market and competitive position data included or incorporated by reference in this prospectus supplement and the accompanying base prospectus are reliable and based on reasonable assumptions, such data involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" in this prospectus supplement and the accompanying base prospectus, and under similar headlines in the documents incorporated by reference herein and therein. These and other factors could cause results to differ materially from those expressed in the estimates made by the third parties or by us.

PRESENTATION OF FINANCIAL INFORMATION

We present our financial statements in Canadian dollars. Our fiscal year (which we also refer to as our financial year) ends on March 31 of each year.

Our annual consolidated financial statements are prepared in accordance with IFRS, as issued by the IASB, and our condensed interim consolidated financial statements are prepared in accordance with IFRS as issued by the IASB applicable to the preparation of interim financial statements, including International Accounting Standard 34 -Interim Financial Reporting. As a result, certain financial information included in or incorporated by reference in this prospectus supplement or the accompanying base prospectus may not be comparable to financial information prepared by companies in the United States reporting under U.S. GAAP.

Certain calculations included in tables and other figures in this prospectus supplement or the documents incorporated by reference herein have been rounded for clarity of presentation. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

CURRENCY AND EXCHANGE RATE INFORMATION

This prospectus supplement contains references to United States dollars and Canadian dollars. All references to "US$" in this prospectus supplement are to United States dollars and all references to "C$" are to Canadian dollars.

This prospectus supplement, the accompanying base prospectus, and the documents incorporated by reference into this prospectus supplement and the accompanying base prospectus contain translations of certain Canadian dollar amounts into U.S. dollars (or vice versa) at specified rates. In translating such amounts at such rates, we make no representation that the Canadian dollar or U.S. dollar amounts referred to in such documents could have been or could be converted into U.S. dollars or Canadian dollars, as the case may be, at any particular rate.

The following table sets forth, for each of the periods indicated, the high, low and average exchange rates, and the exchange rate at the end of the period, for US$1.00 into the Canadian dollar equivalent, based on the indicative exchange rate as reported by the Bank of Canada:

|

|

Nine months ended December 31,

|

Year ended March 31,

|

|

|

2024

|

2023

|

2024

|

2023

|

|

High

|

C$1.4416

|

C$1.3875

|

C$1.3875

|

C$1.3856

|

|

Low

|

C$1.3460

|

C$1.3128

|

C$1.3128

|

C$1.2451

|

|

Average

|

C$1.3768

|

C$1.3487

|

C$1.3487

|

C$1.3230

|

|

Rate at end of period

|

C$1.4389

|

C$1.3226

|

C$1.3574

|

C$1.3533

|

On February 27, 2025, the exchange rate for United States dollars expressed in terms of the Canadian dollar, as reported by the Bank of Canada, was US$1.00 = C$1.4422.

USE OF PROCEEDS

We may issue and sell common shares having aggregate sales proceeds of up to US$30,000,000 from time to time, before deducting sales agent commissions and expenses. The amount of proceeds from this offering will depend upon the number of our common shares sold and the market price at which they are sold. Because there is no minimum offering amount required as a condition of this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. There can be no assurance that we will be able to sell any shares under or fully utilize the Sales Agreement with the Sales Agent as a source of financing.

We intend to use the net proceeds, if any, from this offering for general corporate purposes and working capital. The foregoing expected use of the net proceeds from this offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. We cannot predict with certainty the particular uses for the net proceeds to be received from this offering. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering, and investors will be relying on the judgment of our management regarding the application of the net proceeds.

Pending our use of the net proceeds from this offering, we may invest the net proceeds in a variety of capital preservation investments, including short-term, interest-bearing instruments.

DIVIDEND POLICY

We have never declared or paid cash dividends on our common shares. We currently intend to retain all available funds and any future earnings to finance our growth and expand our operation, and do not anticipate paying any cash dividends on our common shares in the near future. We may also enter into credit agreements or other borrowing arrangements in the future that may restrict our ability to declare or pay cash dividends on our common shares. Any future determination to declare dividends will be made at the discretion of our board of directors and will depend on our financial condition, operating results, capital requirements, general business conditions, and other factors that our board of directors may deem relevant. We may not pay any dividends on our common shares in the foreseeable future.

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our cash and our capitalization as of December 31, 2024:

- on an as adjusted basis to give effect to the sale and issuance by us of 32,258,064 common shares in this offering at an assumed offering price of US$0.93 per share, the last reported sale price of our common shares on the Nasdaq Capital Market on February 27, 2025, for net proceeds of US$28,980,000 after deducting Sales Agent commissions and estimated offering expenses payable by us, and assuming the net proceeds are held as cash and cash equivalents.

You should read the information below in conjunction with our consolidated financial statements and the related notes thereto incorporated by reference into this prospectus supplement.

The conversions from Canadian dollars to United States dollars in the table below are based on a conversion rate of C$1.00 to US$0.6950, being the rate for Canadian dollars in terms of the United States dollar on December 31, 2024, as quoted by the Bank of Canada.

62,367

| |

|

Actual |

|

As adjusted |

| |

|

C$ |

|

US$ |

|

C$ |

|

US$ |

| Cash and cash equivalents |

|

1,484,730 |

|

1,031,887 |

|

43,295,071 |

|

30,090,074 |

| Total long-term obligations |

|

206,926 |

|

143,814 |

|

206,926 |

|

143,814 |

| Shareholders' equity: |

|

|

|

|

|

|

|

|

| Share capital |

|

89,223,668 |

|

62,010,449 |

|

131,034,009 |

|

91,068,636 |

| Warrants |

|

89,737 |

|

62,367 |

|

89,737 |

|

62,367 |

| Share-based payment reserve |

|

8,958,633 |

|

6,226,250 |

|

8,958,633 |

|

6,226,250 |

| Shares to be issued |

|

472,500 |

|

328,388 |

|

472,500 |

|

328,388 |

| Deficit |

|

(82,547,600) |

|

(57,370,582) |

|

(82,547,600) |

|

(57,370,582) |

| Total shareholders' equity |

|

16,196,938 |

|

11,256,872 |

|

58,007,279 |

|

40,315,059 |

| Total capitalization(1) |

|

16,403,864 |

|

11,400,686 |

|

58,214,205 |

|

40,458,873 |

(1) Total capitalization equals the sum of total long-term obligations and total shareholders' equity.

There is no minimum offering amount required as a condition of this offering. The net proceeds that we have used for our as adjusted estimates assumes that we sell all US$30,000,000 of common shares being offered hereby at substantially the same time. Our as adjusted data could be significantly different if we do not sell all of the US$30,000,000 of common shares offered hereby or if such sales do not occur at substantially the same time.

DILUTION

If you invest in our common shares in this offering, your ownership interest may be diluted to the extent of the difference between the public offering price per common share and the as adjusted net tangible book value per common share after this offering. As of December 31, 2024, our historical net tangible book value was US$11,256,872 million, or US$0.11 per share. Our historical net tangible book value is the amount of our total tangible assets less our total liabilities. Historical net tangible book value per share represents historical net tangible book value divided by the 104,105,642 common shares outstanding as of December 31, 2024.

After giving effect to the sale of 32,258,064 common shares pursuant to this prospectus supplement and the accompanying base prospectus in the aggregate amount of approximately US$30,000,000 at an assumed price of US$0.93 per share, which was the last reported sale price of our common shares on the Nasdaq Capital Market on February 27, 2025, and after deducting Sales Agent commissions and estimated offering expenses payable by us (estimated at US$1,020,000), our as adjusted net tangible book value as of December 31, 2024 would have been approximately US$40,315,059, or approximately US$0.30 per share. This represents an immediate increase in as adjusted net tangible book value of approximately US$0.19 per common share to our existing shareholders and an immediate dilution in as adjusted net tangible book value of approximately US$0.63 per common share to purchasers of our common shares in this offering.

The following table illustrates this dilution on a per share basis:

| Assumed public offering price per share |

|

|

|

US$0.93 |

| Historical net tangible book value per share as of December 31, 2024 |

|

US$0.11 |

|

|

| Increase in net tangible book value per share attributable to this offering |

|

US$0.19 |

|

|

| As adjusted net tangible book value per share after giving effect to this offering |

|

|

|

US$0.30 |

| Dilution per share to new investors purchasing shares in this offering |

|

|

|

US$0.63

|

The information discussed above is illustrative only and will adjust based on the actual price at which our common shares are sold.

The table and discussion above excludes:

-

205,808 common shares issued subsequent to December 31, 2024;

-

6,283,334 common shares issuable upon the exercise of options outstanding under our Option Plans, at a weighted average exercise price of C$2.28 (approximately US$1.58(1)) per share;

-

1,180,750 common shares issuable upon the exercise of outstanding warrants, with a weighted average exercise price of C$3.00 (approximately US$2.08(1)) per share; and

- 4,846,250 common shares that are available for issuance under our Option Plans.

(1) Based on a daily average exchange rate of C$1.00 = US$0.6934 on February 27, 2025, as reported by the Bank of Canada.

DESCRIPTION OF SHARE CAPITAL

Common Shares

We are authorized to issue an unlimited number of common shares, without par value. As at February 26, 2025, a total of 104,311,450 common shares were issued and outstanding, held by 52 holders as shown on our shareholder list dated as of February 26, 2025.

Each common share entitles the holder thereof to receive notice of any meetings of our shareholders, to attend, and to cast one vote per common share at all such meetings. Holders of common shares do not have cumulative voting rights with respect to the election of directors. Accordingly, holders of a majority of the common shares entitled to vote in any election of directors may elect all of the directors standing for election. Holders of common shares are entitled to receive, on a pro rata basis, such dividends if any, as and when declared by our board of directors at its discretion from funds legally available therefor and, upon our liquidation, dissolution, or winding up, are entitled to receive, on a pro rata basis, our net assets. Our common shares do not carry any pre-emptive, subscription, redemption, retraction, or conversion rights, nor do they contain any sinking or purchase fund provisions.

Our common shares are registered under Section 12 of the Exchange Act and are listed in the United States on the Nasdaq Capital Market under the symbol "ZTEK," and in Canada on the TSX Venture Exchange under the symbol "ZEN." No other securities of the Company are registered under Section 12 of the Exchange Act.

The transfer agent and registrar for our common shares is TSX Trust Company.

Warrants

As of February 26, 2025, there were warrants to purchase an aggregate of 1,180,750 of our common shares outstanding, with a weighted average exercise price of C$3.00 per share (approximately US$2.08 per share, based on the daily average exchange rate of C$1.00 = US$0.6934 on February 27, 2025, as reported by the Bank of Canada).

Options

As of February 26, 2025, there were options to purchase an aggregate of 6,283,334 of our common shares outstanding under our Stock Option Plans with a weighted average exercise price of C$2.28 per share (approximately US$1.58 per share, based on the daily average exchange rate of C$1.00 = US$0.6934 on February 27, 2025, as reported by the Bank of Canada).

Changes to Our Share Capital

A description of changes to our share capital, is set forth in the accompanying base prospectus. See the section titled "Description of Share Capital" beginning on page 12 of the accompanying base prospectus. Such information is supplemented as set forth below:

Subsequent to Nine Months Ended December 31, 2024

On January 17, 2025, we issued 150,000 shares in connection with the exercise of stock options.

Nine Months Ended September 30, 2024

On August 19, 2024, we completed a non-brokered private placement in which a total of 2,361,500 units were issued at C$1.30 per unit (approximately US$0.95, based on the daily average exchange rate of C$1.00 = US$0.7325 on August 19, 2024) for gross proceeds of C$3,069,950 (approximately US$2,248,738, based on the daily average exchange rate of C$1.00 = US$0.7325 on August 19, 2024). Each unit consisted of one common share and one-half of one common share purchase warrant with each whole warrant exercisable at C$3.00 (approximately US$2.08, based on the daily average exchange rate of C$1.00 = US$0.6934 on February 27, 2025) for a period of two years.

During the nine months ended December 31, 2024, we issued 1,027,465 common shares in connection with the exercise of 1,325,000 options. Of the 1,325,000 options exercised, 1,025,000 were exercised using a "cashless" exercise method whereby 297,535 fewer shares were issued than exercised.

During the nine months ended December 31, 2024, we also purchased, and subsequently cancelled, 102,900 of our common shares at a cost of C$142,866 (approximately US$103,792, based on average exchange rate of C$1.00 = US$0.7265 for the nine month period ended December 31, 2024).

Fiscal Year Ended March 31, 2024

During the fiscal year ended March 31, 2024, we issued 1,527,696 common shares in connection with the exercise of 2,000,000 options. Of the 2,000,000 options exercised, 1,900,000 were exercised using a "cashless" exercise method whereby 472,304 fewer shares were issued than exercised.

During the fiscal year ended March 31, 2024, we also repurchased, and subsequently cancelled, 245,100 of our common shares at a cost of C$408,853 (approximately US$303,205, based on average exchange rate of C$1.00 = US$0.7416 for the fiscal year ended March 31, 2024).

All references to the exchange rates above are in reference to such rates as reported by the Bank of Canada on the specified dates.

Our Articles of Association

A description of our Articles of Association is set forth in the accompanying base prospectus. See the section titled "Description of Share Capital-Our Articles of Association" beginning on page 13 of the accompanying base prospectus.

PLAN OF DISTRIBUTION

We entered into the Sales Agreement with Rodman & Renshaw LLC as the Sales Agent under which we may issue and sell from time to time up to US$30,000,000 of our common shares through or to the Sales Agent as sales agent or principal. This following summary of the material provisions of the Sales Agreement does not purport to be a complete statement of its terms and conditions. The Sales Agreement will be furnished as an exhibit to a Report of Foreign Private Issuer on Form 6-K and incorporated into the registration statement of which this prospectus supplement forms a part. Sales of common shares, if any, will be made at market prices by methods deemed to be an "at the market offering" as defined in Rule 415(a) promulgated under the Securities Act.

Upon delivery of a placement notice, the Sales Agent may offer the common shares subject to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by us and the Sales Agent. We will designate the maximum amount of common shares to be sold through the Sales Agent on a daily basis or otherwise determine such maximum amount together with the Sales Agent. Subject to the terms and conditions of the Sales Agreement, the Sales Agent will use its commercially reasonable efforts to sell on our behalf all of the common shares requested to be sold by us. We may instruct the Sales Agent not to sell common shares if the sales cannot be effected at or above the price designated by us in any such instruction. We or the Sales Agent may suspend the offering of the common shares being made through the Sales Agent under the Sales Agreement upon proper notice to the other party and subject to other conditions.

We will pay the Sales Agent a commission, in cash, for its services in acting as agent in the sale of our common shares. The aggregate compensation payable to the Sales Agent shall be equal to up to 3.0% of the gross sales price per share of all shares sold through the Sales Agent under the Sales Agreement. We also have agreed to reimburse the Sales Agent up to a maximum of US$50,000 for reasonable fees and expenses of its legal counsel, and up to US$5,000 per applicable due diligence update session for ongoing diligence expenses. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. The total expenses of the offering payable by us, excluding commissions payable to the Sales Agent under the Sales Agreement, is approximately US$120,000.

Settlement for sales of common shares will occur on the first trading day following the date on which any sales are made, or on some other date that is agreed upon by us and the Sales Agent in connection with a particular transaction, in return for payment of the net proceeds to us. Sales of our common shares as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and the Sales Agent may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

The Sales Agent is not required to sell any specific amount of securities, but will act as our sales agent using its commercially reasonable efforts, consistent with its sales and trading practices under the terms and subject to the conditions set forth in the Sales Agreement. In connection with the sales of the common shares on our behalf, the Sales Agent will be deemed to be an "underwriter" within the meaning of the Securities Act, and the compensation to them will be deemed to be underwriting commissions or discounts. We have also agreed in the Sales Agreement to provide indemnification and contribution to the Sales Agent with respect to certain liabilities, including liabilities under the Securities Act.

The offering of our common shares pursuant to the Sales Agreement will terminate automatically upon the sale of all common shares subject to the Sales Agreement and this prospectus supplement or as otherwise permitted therein. We and the Sales Agent may each terminate the Sales Agreement at any time upon five business days' prior written notice.

The Sales Agent and its affiliates may in the future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees. To the extent required by Regulation M, the Sales Agent will not engage in any market making activities involving our common shares while the offering is ongoing under this prospectus.

A prospectus supplement and the accompanying base prospectus in electronic format may be made available on a website maintained by the Sales Agent, and the Sales Agent may distribute the prospectus supplement and the accompanying base prospectus electronically.

The transfer agent and registrar for our common shares is TSX Trust Company.

Our common shares are listed in the United States on the Nasdaq Capital Market under the symbol "ZTEK."

Our common shares are also listed in Canada on the TSX Venture Exchange under the symbol "ZEN."

MATERIAL UNITED STATES AND CANADIAN INCOME TAX CONSIDERATIONS

Canadian Income Tax Considerations

The following summary describes, as of the date hereof, the material Canadian federal income tax considerations generally applicable to a purchaser who acquires, as a beneficial owner, common shares pursuant to this prospectus supplement and who, at all relevant times, for the purposes of the application of the Income Tax Act (Canada) and the Income Tax Regulations (which we collectively refer to as the Canadian Tax Act), (i) is not, and is not deemed to be, resident in Canada for purposes of the Canadian Tax Act and any applicable income tax treaty or convention; (ii) deals at arm's length with us; (iii) is not affiliated with us; (iv) does not use or hold, and is not deemed to use or hold, common shares in a business or part of a business carried on in Canada; (v) is not an "insurer" as that term is defined in the Canadian Tax Act; (vi) has not entered into, with respect to the common shares, a "derivative forward agreement," as that term is defined in the Canadian Tax Act; and (vii) holds the common shares as capital property (which we refer to as a Non-Canadian Holder). This summary does not apply to a Non-Canadian Holder that is an insurer carrying on an insurance business in Canada and elsewhere or an "authorized foreign bank", as that term is defined in the Canadian Tax Act. Such Non-Canadian Holders should consult their tax advisors for advice having regards to their particular circumstances.

This summary is based on the current provisions of the Canadian Tax Act, and an understanding of the current administrative policies of the Canada Revenue Agency published in writing prior to the date hereof. It takes into account all specific proposals to amend the Canadian Tax Act and the Canada-United States Tax Convention (1980), as amended, or the Canada-U.S. Tax Treaty, publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (which we refer to as the Proposed Amendments) and assumes that all Proposed Amendments will be enacted in the form proposed. However, no assurances can be given that the Proposed Amendments will be enacted as proposed, or at all. This summary does not otherwise take into account or anticipate any changes in law or administrative policy or assessing practice whether by legislative, regulatory, administrative or judicial action nor does it take into account tax legislation or considerations of any province, territory or foreign jurisdiction, which may differ from those discussed herein.

This summary is of a general nature only and is not, and is not intended to be, legal or tax advice to any particular shareholder, and no representations with respect to the income tax consequences to any particular shareholder are made. This summary is not exhaustive of all Canadian federal income tax considerations. Accordingly, you should consult your own tax advisor with respect to your particular circumstances.

Generally, for purposes of the Canadian Tax Act, all amounts relating to the acquisition, holding or disposition of the common shares must be converted into Canadian dollars based on the exchange rates as determined in accordance with the Canadian Tax Act. The amount of any dividends, capital gains or capital losses realized by a Non-Canadian Holder may be affected by fluctuations in the Canadian exchange rate.

Dividends

Dividends paid or credited on the common shares or deemed to be paid or credited on the common shares to a Non-Canadian Holder will be subject to Canadian withholding tax at the rate of 25%, subject to any reduction in the rate of withholding to which the Non-Canadian Holder is entitled under any applicable income tax treaty or convention between Canada and the country in which the Non-Canadian Holder is resident. For example, under the Canada-U.S. Tax Treaty, where dividends on the common shares are considered to be paid to or derived by a Non-Canadian Holder that is a beneficial owner of the dividends and is a U.S. resident for the purposes of, and is entitled to benefits of, the Canada-U.S. Tax Treaty, the applicable rate of Canadian withholding tax is generally reduced to 15% (or 5% in the case of a U.S. Holder that is a corporation beneficially owning at least 10% of all of the issued voting shares). We will be required to withhold the applicable withholding tax from any dividend and remit it to the Canadian government for the Non-Canadian Holder's account. Non-Canadian Holders are urged to consult their own tax advisors to determine their entitlement to relief under an applicable income tax treaty.

Dispositions

A Non-Canadian Holder will not be subject to tax under the Canadian Tax Act on any capital gain realized on a disposition or deemed disposition of a common share, nor will capital losses arising therefrom be recognized under the Canadian Tax Act, unless (i) the common shares are "taxable Canadian property" to the Non-Canadian Holder for purposes of the Canadian Tax Act at the time of disposition; and (ii) the Non-Canadian Holder is not entitled to relief under an applicable income tax treaty or convention between Canada and the country in which the Non-Canadian Holder is resident.

Generally, the common shares will not constitute "taxable Canadian property" to a Non-Canadian Holder at a particular time provided that the common shares are listed at that time on a "designated stock exchange" (as defined in the Canadian Tax Act), which includes Nasdaq unless at any particular time during the 60-month period that ends at that time:

- at least 25% of the issued shares of any class or series of our capital stock was owned by or belonged to any combination of (a) the Non-Canadian Holder, (b) persons with whom the Non-Canadian Holder does not deal at arm's length, and (c) partnerships in which the Non-Canadian Holder or a person described in (b) holds a membership interest directly or indirectly through one or more partnerships, and

- more than 50% of the fair market value of the common shares was derived, directly or indirectly, from one or any combination of: (i) real or immoveable property situated in Canada, (ii) "Canadian resource properties" (as that term is defined in the Canadian Tax Act), (iii) "timber resource properties" (as that term is defined in the Canadian Tax Act) and (iv) options in respect of, or interests in, or for civil law rights in, property in any of the foregoing whether or not the property exists.

Notwithstanding the foregoing, in certain circumstances, common shares could be deemed to be "taxable Canadian property."

A Non-Canadian Holder's capital gain (or capital loss) of a disposition or deemed disposition of common shares that constitute or are deemed to constitute taxable Canadian property (and are not "treaty-protected property" as defined in the Canadian Tax Act) generally will be computed and taxed as though the Canadian Holder were a Resident Holder. Such Non-Canadian Holder may be required to report the disposition or deemed disposition of common shares by filing a tax return in accordance with the Canadian Tax Act. Non-Canadian Holders whose common shares may be taxable Canadian property should consult their own tax advisors regarding the tax and compliance considerations that may be relevant to them.

U.S. Federal Income Taxation Considerations

The following discussion describes the material U.S. federal income tax consequences relating to the ownership and disposition of common shares by U.S. Holders (as defined below). This discussion applies to U.S. Holders that purchase our common shares pursuant to this prospectus supplement and hold such common shares as capital assets. This discussion is based on the U.S. Internal Revenue Code of 1986, as amended, or the Code, U.S. Treasury regulations promulgated thereunder and administrative and judicial interpretations thereof, all as in effect on the date hereof and all of which are subject to change, possibly with retroactive effect. This discussion does not address all of the U.S. federal income tax consequences that may be relevant to specific U.S. Holders in light of their particular circumstances or to U.S. Holders subject to special treatment under U.S. federal income tax law such as certain financial institutions, insurance companies, currency or securities dealers and traders in securities or other persons that generally mark their securities to market for U.S. federal income tax purposes, tax-exempt entities, retirement plans, regulated investment companies, real estate investment trusts, certain former citizens or residents of the United States, persons who hold our common shares as part of a "straddle", "hedge", "conversion transaction", "synthetic security" or integrated investment, persons that have a "functional currency" other than the U.S. dollar, persons that own directly, indirectly or through attribution 10% or more of the voting power of our shares, corporations that accumulate earnings to avoid U.S. federal income tax, persons subject to special tax accounting rules under Section 451(b) of the Code, partnerships and other pass-through entities, and investors in such pass-through entities. This discussion does not address any U.S. state or local or non-U.S. tax consequences or any U.S. federal estate, gift or alternative minimum tax consequences.

As used in this discussion, the term "U.S. Holder" means a beneficial owner of our common shares that is, for U.S. federal income tax purposes, (i) an individual who is a citizen or resident of the United States, (ii) a corporation (or entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States, any state thereof, or the District of Columbia, (iii) an estate the income of which is subject to U.S. federal income tax regardless of its source or (iv) a trust (x) with respect to which a court within the United States is able to exercise primary supervision over its administration and one or more United States persons have the authority to control all of its substantial decisions or (y) that has elected under applicable U.S. Treasury regulations to be treated as a domestic trust for U.S. federal income tax purposes.

If an entity treated as a partnership for U.S. federal income tax purposes holds our common shares, the U.S. federal income tax consequences relating to an investment in our common shares will depend in part upon the status and activities of such entity and the particular partner. Any such entity should consult its own tax advisor regarding the U.S. federal income tax consequences applicable to it and its partners of the purchase, ownership and disposition of our common shares. Persons considering an investment in our common shares should consult their own tax advisors as to the particular tax consequences applicable to them relating to the purchase, ownership and disposition of our common shares, including the applicability of U.S. federal, state and local tax laws and non-U.S. tax laws.

Passive Foreign Investment Company Consequences

In general, a corporation organized outside the United States will be treated as a passive foreign investment company, or PFIC, for any taxable year in which either (i) at least 75% of its gross income is "passive income" or (ii) on average at least 50% of its assets, determined on a quarterly basis, are assets that produce passive income or are held for the production of passive income. Passive income for this purpose generally includes, among other things, dividends, interest, royalties, rents, and gains from the sale or exchange of property that gives rise to passive income. Assets that produce or are held for the production of passive income generally include cash, even if held as working capital or raised in a public offering, marketable securities, and other assets that may produce passive income. Generally, in determining whether a non-U.S. corporation is a PFIC, a proportionate share of the income and assets of each corporation in which it owns, directly or indirectly, at least a 25% interest (by value) is taken into account.

Although we do not believe that we were a PFIC for the year ending March 31, 2024, our determination is based on an interpretation of complex provisions of the law, which are not addressed in a significant number of administrative pronouncements or rulings by the Internal Revenue Service, or IRS. Accordingly, there can be no assurance that our conclusions regarding our status as a PFIC for the 2024 taxable year will not be challenged by the IRS and, if challenged, upheld in appropriate proceedings. In addition, because PFIC status is determined on an annual basis and generally cannot be determined until the end of the taxable year, there can be no assurance that we will not be a PFIC for the current taxable year. Because we may continue to hold a substantial amount of cash and cash equivalents, and because the calculation of the value of our assets may be based in part on the value of our common shares, which may fluctuate considerably, we may be a PFIC in future taxable years. Even if we determine that we are not a PFIC for a taxable year, there can be no assurance that the IRS will agree with our conclusion and that the IRS would not successfully challenge our position. Our status as a PFIC is a fact-intensive determination made on an annual basis.

If we are a PFIC in any taxable year during which a U.S. Holder owns our common shares, the U.S. Holder could be liable for additional taxes and interest charges under the "PFIC excess distribution regime" upon (i) a distribution paid during a taxable year that is greater than 125% of the average annual distributions paid in the three preceding taxable years, or, if shorter, the U.S. Holder's holding period for our common shares, and (ii) any gain recognized on a sale, exchange or other disposition, including a pledge, of our common shares, whether or not we continue to be a PFIC. Under the PFIC excess distribution regime, the tax on such distribution or gain would be determined by allocating the distribution or gain ratably over the U.S. Holder's holding period for our common shares. The amount allocated to the current taxable year (i.e., the year in which the distribution occurs or the gain is recognized) and any year prior to the first taxable year in which we are a PFIC will be taxed as ordinary income earned in the current taxable year. The amount allocated to other taxable years will be taxed at the highest marginal rates in effect for individuals or corporations, as applicable, to ordinary income for each such taxable year, and an interest charge, generally applicable to underpayments of tax, will be added to the tax.

If we are a PFIC for any year during which a U.S. Holder holds our common shares, we must generally continue to be treated as a PFIC by that holder for all succeeding years during which the U.S. Holder holds our common shares, unless we cease to meet the requirements for PFIC status and the U.S. Holder makes a "deemed sale" election with respect to our common shares. If the election is made, the U.S. Holder will be deemed to sell our common shares it holds at their fair market value on the last day of the last taxable year in which we qualified as a PFIC, and any gain recognized from such deemed sale would be taxed under the PFIC excess distribution regime. After the deemed sale election, the U.S. Holder's common shares would not be treated as shares of a PFIC unless we subsequently become a PFIC.

If we are a PFIC for any taxable year during which a U.S. Holder holds our common shares and one of our non-U.S. corporate subsidiaries is also a PFIC (i.e., a lower-tier PFIC), such U.S. Holder would be treated as owning a proportionate amount (by value) of the shares of the lower-tier PFIC and would be taxed under the PFIC excess distribution regime on distributions by the lower-tier PFIC and on gain from the disposition of shares of the lower-tier PFIC even though such U.S. Holder would not receive the proceeds of those distributions or dispositions. Each U.S. Holder is advised to consult its tax advisors regarding the application of the PFIC rules to our non-U.S. subsidiaries.

If we are a PFIC, a U.S. Holder will not be subject to tax under the PFIC excess distribution regime on distributions or gain recognized on our common shares if such U.S. Holder makes a valid "mark-to-market" election for our common shares. A mark-to-market election is available to a U.S. Holder only for "marketable stock".

Our common shares will be marketable stock so long as they remain listed on Nasdaq and are regularly traded, other than in de minimis quantities, on at least 15 days during each calendar quarter. If a mark-to-market election is in effect, a U.S. Holder generally would take into account, as ordinary income each year, the excess of the fair market value of our common shares held at the end of such taxable year over the adjusted tax basis of such common shares. The U.S. Holder would also take into account, as an ordinary loss each year, the excess of the adjusted tax basis of such our common shares over their fair market value at the end of the taxable year, but only to the extent of the excess of amounts previously included in income over ordinary losses deducted as a result of the mark-to-market election. The U.S. Holder's tax basis in our common shares would be adjusted to reflect any income or loss recognized as a result of the mark-to-market election. Any gain from a sale, exchange or other disposition of our common shares in any taxable year in which we are a PFIC would be treated as ordinary income and any loss from such sale, exchange or other disposition would be treated first as ordinary loss (to the extent of any net mark-to-market gains previously included in income) and thereafter as capital loss.

A mark-to-market election will not apply to our common shares for any taxable year during which we are not a PFIC, but will remain in effect with respect to any subsequent taxable year in which we become a PFIC. Such election will not apply to any non-U.S. subsidiaries that we may organize or acquire in the future. Accordingly, a U.S. Holder may continue to be subject to tax under the PFIC excess distribution regime with respect to any lower-tier PFICs that we may organize or acquire in the future notwithstanding the U.S. Holder's mark-to-market election for our common shares.