false000182139312/3100018213932024-10-042024-10-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 4, 2024 (October 3, 2024)

| | | | | |

THE AARON'S COMPANY, INC. |

(Exact name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Georgia | | 1-39681 | | 85-2483376 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 400 Galleria Parkway SE | Suite 300 | Atlanta | Georgia | | 30339-3194 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (678) 402-3000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.50 Par Value | AAN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

INTRODUCTION

On October 3, 2024, Polo Merger Sub, Inc., a Georgia corporation (“Merger Sub”) and a wholly owned subsidiary of IQVentures Holdings, LLC, an Ohio limited liability company (“IQV”), completed its merger (the “Merger”) with and into The Aaron’s Company, Inc. (the “Company”), pursuant to the terms of the Agreement and Plan of Merger, dated June 16, 2024 (the “Merger Agreement”), by and among IQV, Merger Sub and the Company. The Company was the surviving corporation in the Merger and, as a result, is now a wholly owned direct subsidiary of IQV.

ITEM 2.01. COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS.

The information set forth in the Introduction to this Current Report on Form 8-K (the “Introduction”) is incorporated into this Item 2.01 by reference.

As of the effective time of the Merger (the “Effective Time”), each share of the Company’s common stock, par value $0.50 per share (“Company common stock”), issued and outstanding immediately prior to the Effective Time (other than shares owned by the Company as treasury stock, shares owned by IQV or any direct or indirect wholly owned subsidiary of IQV and shares owned by shareholders who have properly exercised dissenters’ rights under the Georgia Business Corporation Code) was converted into the right to receive $10.10 in cash, without interest (the “Merger Consideration”).

In addition, pursuant to the Merger Agreement, as of the Effective Time:

•Each outstanding Company stock option granted under a Company equity incentive plan was accelerated and became fully vested (to the extent not yet vested) and was cancelled and converted into the right to receive a cash payment equal to the product of (i) the total number of shares of Company common stock subject to such Company stock option multiplied by (ii) the excess, if any, of the Merger Consideration over the applicable exercise price per share.

•Each Company stock option with an exercise price per share equal to or greater than the Merger Consideration was cancelled for no consideration.

•Each outstanding Company restricted stock unit granted under a Company equity incentive plan became fully vested (to the extent not yet vested) and was cancelled and converted into the right to receive a cash payment equal to the Merger Consideration.

•Each outstanding restricted share of Company common stock granted under a Company equity incentive plan that was vested was cancelled and converted into the right to receive a cash payment equal to the Merger Consideration.

•Each outstanding restricted share of Company common stock granted under a Company equity incentive plan that was unvested was modified to reflect an award of restricted cash in an amount equal to the Merger Consideration, having the same terms and conditions as applied thereto prior to such modification (except for any terms rendered inoperative by reason of the Merger and certain administrative changes), except that the period following a change in control of the Company during which such award is subject to vesting on a termination without “cause” or for “good reason,” as applicable (the “Protection Period”), was extended if and to the extent necessary so that it covers the entire vesting period of such award.

•Each outstanding Company time-based restricted cash award granted under a Company equity incentive plan was modified to reflect an award of restricted cash of an equal dollar amount, having the same terms and conditions as applied thereto prior to such modification (except for any terms rendered inoperative by reason of the Merger and certain administrative changes), except that the Protection Period with respect to each such award (if any) was extended if and to the extent necessary so that it covers the entire vesting period of such award.

•Each outstanding award of Company performance shares granted under a Company equity incentive plan became vested with respect to the “target” number of performance shares subject to such award, and each vested Company performance share was cancelled and converted into the right to receive a cash payment equal to the Merger Consideration.

•Each outstanding award of Company cash performance units granted under a Company equity incentive plan became vested with respect to the “target” number of performance units subject to such award, and each vested award of Company performance units was cancelled and converted into the right to receive cash in an amount equal to that number of vested units covered by such award multiplied by $1.00 per unit.

The foregoing description of the Merger Agreement and related transactions (including, without limitation, the Merger) does not purport to be complete and is subject, and qualified in its entirety by reference, to the full text of the Merger Agreement, which is attached as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (“SEC”) on June 17, 2024 and incorporated herein by reference.

ITEM 3.01. NOTICE OF DELISTING OR FAILURE TO SATISFY A CONTINUED LISTING RULE OR STANDARD; TRANSFER OF LISTING.

In connection with the closing of the Merger, the Company notified the New York Stock Exchange (the “NYSE”) of its intent to remove the Company common stock from listing on the NYSE and requested that the NYSE (i) suspend trading of the Company common stock on the NYSE immediately prior to market-open on October 4, 2024 and (ii) file a Notification of Removal from Listing and/or Registration on Form 25 with the SEC to delist and deregister the Shares under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Trading of the Company's common stock on the NYSE was suspended prior to market-open on October 4, 2024. The NYSE also filed the Form 25 on October 4, 2024.

The Company intends to file with the SEC a Form 15 under the Exchange Act requesting the deregistration of the Company common stock and the suspension of the Company’s reporting obligations under Sections 13 and 15(d) of the Exchange Act.

ITEM 3.03. MATERIAL MODIFICATION TO RIGHTS OF SECURITY HOLDERS.

The information set forth in the Introduction and Items 2.01, 3.01 and 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

As a result of the Merger, each share of Company common stock that was issued and outstanding immediately prior to the Effective Time (except as described in Item 2.01 of this Current Report on Form 8-K) was converted, at the Effective Time, into the right to receive the Merger Consideration in accordance with the terms of the Merger Agreement. Accordingly, at the Effective Time, the holders of such shares of Company common stock ceased to have any rights as shareholders of the Company, other than the right to receive the Merger Consideration.

ITEM 5.01. CHANGES IN CONTROL OF REGISTRANT.

The information set forth in the Introduction and Items 2.01, 3.03 and 5.02 of this Current Report on Form 8-K is incorporated into this Item 5.01 by reference.

As a result of the Merger, a change in control of the Company occurred, and the Company became a wholly owned direct subsidiary of IQV.

In connection with the Merger, the aggregate Merger Consideration paid was approximately $310.7 million.

ITEM 5.02. DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENT.

In connection with the consummation of the Merger and pursuant to the terms of the Merger Agreement, the directors of Merger Sub immediately prior to the Effective Time, which consisted of Michael Durbin, Cory Miller and Sean O’Brien, became the directors of the Company. Accordingly, as of the Effective Time, all directors of the Company serving as of immediately prior to the Effective Time ceased serving as directors.

ITEM 5.03. AMENDMENT TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR.

At the Effective Time, the Amended and Restated Articles of Incorporation and the Amended and Restated Bylaws of the Company, in each case as in effect immediately prior to the Effective Time, were amended and restated to be in the form of the articles of incorporation and the bylaws, respectively, of Merger Sub, in accordance with the terms of the Merger Agreement (except that references to the name of Merger Sub were replaced by the name of the Company).

Copies of such amended and restated articles of incorporation and amended and restated bylaws, as in effect following the Effective Time, are filed as Exhibits 3.1 and 3.2, respectively, to this Current Report on Form 8-K, and are incorporated herein by reference.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits:

| | | | | |

Exhibit No. | Description |

| |

| |

| |

| |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| |

* Certain schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally to the SEC a copy of any omitted schedule or exhibit upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | THE AARON'S COMPANY, INC. |

| | By: | /s/ C. Kelly Wall |

Date: | October 4, 2024 | | C. Kelly Wall Chief Financial Officer |

SECOND AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

THE AARON’S COMPANY, INC.

THE AARON’S COMPANY, INC., a corporation organized and existing under and by virtue of the General Business Corporation Code of the State of Georgia (the “GBCC”), does hereby certify:

FIRST: The name of the corporation is The Aaron’s Company, Inc.

SECOND: The corporation is authorized to issue 100 shares.

THIRD: The street address of the registered office is 289 S Culver St, Lawrenceville, GA 30046-4805, USA. The registered agent at such address is the C T Corporation System. The county of the registered office is Gwinnett County.

FOURTH: The mailing address of the corporation’s principal office is 400 Galleria Parkway SE, Suite 300, Atlanta, GA. 30339.

FIFTH: No director of the corporation shall be personally liable to the corporation or its shareholders for monetary damages for breach of his duty of care or other duty as a director; provided that this article shall eliminate or limit liability of a director only to the extent permitted from time to time by the GBCC or any successor law or laws.

SIXTH: This Second Amended and Restated Certificate of Incorporation shall become effective as of 11:59 p.m. (Atlanta, Georgia time) on October 3, 2024.

SEVENTH: This Second Amended and Restated Certificate of Incorporation has been duly approved by the requisite shareholders of the corporation on September 25, 2024.

EIGHT: This Second Amended and Restated Certificate of Incorporation has been duly and validly adopted by the directors of the corporation on June 16, 2024.

IN WITNESS WHEREOF, The Aaron’s Company, Inc. has caused these Second Amended and Restated Articles of Incorporation to be executed by its duly authorized officer on this 3rd day of October, 2024.

THE AARON’S COMPANY, INC.

By: /s/ Rachel George

Name: Rachel George

Title: EVP, General Counsel, Corporate Secretary, Chief Compliance Officer and Chief Corporate Affairs Officer

SECOND AMENDED AND RESTATED BYLAWS OF

THE AARON’S COMPANY, INC.

OCTOBER 3, 2024

ARTICLE I

PURPOSE

1. The Aaron’s Company, Inc., a Georgia corporation (the “Corporation”) shall provide supportive and oversight services to its subsidiary entities and conduct any other business permitted by law.

ARTICLE II

SHAREHOLDERS MEETINGS

1. The annual meeting of the shareholders shall be held at principal place of the business, 400 Galleria Parkway SE, Suite 300, Atlanta, GA. 30339, on such date and time as may be fixed by the Board or by the written consent of all persons entitled to vote thereat and not present at the meeting, given either before or after the meeting and filed with the Secretary of the Corporation. The Secretary of the Corporation shall record and maintain the minutes of the annual shareholder meeting.

ARTICLE III

DIRECTORS

1.The Corporation shall have at least one but not more than five directors (the “Board”), which shall delegate the management of the day-to-day operation of the business of the Corporation to a management company or other persons, provided that the business and affairs of the Corporation shall be managed and all corporate powers shall be exercised under the ultimate direction of the Board. The initial members of the Board shall be Kyle Hanson, Michael Durbin and one independent board director to be appointed at a later date.

2.Shareholders of record may vote at any meeting either in person or by proxy in writing, which shall be filed with the Secretary of the meeting before being voted. Such proxies shall entitle the holders thereof to vote at any adjournment of such meeting, but shall not be valid after the final adjournment thereof. Unless the shareholder executing the proxy shall have otherwise specified therein the length of time it is to continue in force, a proxy shall remain valid until the shareholder has cancelled such proxy. Subject to the provisions of the laws of the state of Georgia, and unless otherwise provided in the Articles of Incorporation, each holder of capital stock having voting power in this

Corporation shall be entitled at each shareholders’ meeting to one vote for every share of stock standing in his name on the books of the Corporation.

3.Any director of the Corporation may resign at any time by giving written notice to the Corporation, to the Board, or to the Chairman of the Board, or to the President or to the Secretary of the Corporation. Any such resignation shall take effect at the time specified therein, or, if the time be not specified therein, upon its acceptance by the Board. The shareholders, at any meeting called for the purpose, by vote of a majority of the shares of stock issued and outstanding, may remove from office the entire Board and elect or appoint their successors.

4.A vacancy on the Board either caused by removal of a director or resignation of a director may be filled at the annual meeting or at a special meeting of the shareholders. If the shareholders fail by vote to fill a vacancy in the Board, such vacancy shall be filled by a majority of the remaining directors. The term of a director elected to a vacancy on the Board shall expire at the date of the annual meeting of the shareholders.

5.The Board may fix in advance a date as to the record date for any such determination of shareholders, such date in any case to be not more than fifty (50) days and, in case of a meeting of shareholders, not less than ten (10) days prior to the date at which the particular action, requiring such determination of shareholders, is to be taken. If no record date is fixed for the determination of shareholders entitled to notice of or to vote at a meeting of shareholders, or shareholders entitled to receive payment of a dividend, the record date shall be at the close of business on the day next preceding the day on which the notice is given or the date on which the resolution of the Board declaring such dividend is adopted, as the case may be. When a determination of shareholders entitled to vote at any meeting of shareholders has been made as provided in this section, such determination shall apply to any adjournment thereof unless the board of directors shall fix a new record date for the adjourned meeting.

6.The regular meetings of the Board shall be held monthly or as often as the Board determines to be necessary but not less than annually.

7.Special meetings of the Board may be called by the chairperson of the Board, president, vice president or any two directors with not less than two (2) days’ written notice to all directors.

8.Any action, which may be authorized by the directors, may be so authorized by telecommunication or without a meeting of the directors upon affirmative written vote or approval of all directors entitled to vote.

ARTICLE IV

OFFICERS

The officers of the Corporation shall include, but not be limited to, a president and a secretary. The following officers are to serve in the offices as set forth opposite each such person’s name:

| | | | | |

| Name | Office |

| Douglas A. Lindsay | Chief Executive Officer |

| Steve Olsen | President |

| C. Kelly Wall | EVP, Chief Financial Officer |

| Russell Falkenstein | EVP, Chief Operating Officer, Lease-to-Own |

| Rachel G. George | EVP, General Counsel, Corporate Secretary, Chief Compliance Officer and Chief Corporate Affairs Officer |

| Douglass L. Noe | Vice President, Corporate Controller (PAO) |

1.The directors may remove with or without cause any officer without prejudice to any contract rights of such officer. The election or appointment of an officer for a given term shall not be deemed to create contract rights. The directors may fill any vacancy in any office occurring for whatever reason.

ARTICLE V

SHAREHOLDER ACTIONS

1.Shareholders at the annual meeting shall elect the Board and take any other actions as may come before the meeting. A special meeting of the shareholders may be called by the Board chairperson, the Board, or shareholder(s) holding at least twenty-five percent interest in the Corporation upon six days' written notice that may be waived in writing to all shareholders outlining the purpose of the special meeting.

2.Any action permitted or required to be taken at a meeting of the shareholders may be taken via telecommunication or without a meeting if one (1) or more shareholders consent in writing setting forth the action so taken, and such writing is signed by all shareholder entitled to vote with respect to the subject matter thereof.

3.An action of the shareholder may be taken upon a majority vote of a quorum of the shareholders. A quorum shall constitute two-thirds (2/3) of all shareholders.

ARTICLE VI

UNCERTIFICATED SHARES

1.The shares of capital stock of the Corporation will be uncertificated, and such shares of capital stock of the Corporation shall be issued to each shareholder when any of the shares are fully paid, and the Board may authorize such issuance as partly paid subject to call for the remainder of the consideration to be paid therefor. Within a reasonable time after the issuance or transfer of uncertificated stock and upon the request of a shareholder, the Corporation shall send to the record owner thereof a written notice that shall set forth the name of the Corporation, that the Corporation is organized under the laws of Georgia, the name of the shareholder, the number and class (and the designation of the series, if any) of the shares, and any restrictions on the transfer or registration of

such shares of stock imposed by the Corporation’s charter, these Amended and Restated Bylaws, any agreement among shareholders or any agreement between shareholders and the Corporation.

ARTICLE VII

AMENDMENT OF BYLAWS

1.Subject to the Corporation’s charter, amendment to these Bylaws may be adopted by affirmative vote or written consent of the Board.

2.If the Bylaws are amended without a meeting of the Board, the secretary of the Corporation shall send a copy of the amendment or the regulations to each director and shareholder for approval before the amendment becomes effective.

3.Notwithstanding anything contained in these Bylaws to the contrary, (i) no amendment, repeal or modification of these Bylaws that could reasonably be expected to adversely affect the rights of any lender (or agent thereof) who holds a proxy and/or a pledge of the Company’s share certificates as collateral (a “Company Lender”) shall be permitted without the express written consent of such Company Lender (for the avoidance of doubt, it being acknowledged and agreed that any amendment, repeal or modification (a) affecting any right of any Company Lender under any collateral documentation governing or pertaining to proxies and/or a pledge of the Company’s share certificates to such Company Lender as collateral for the indebtedness, liabilities and obligations of the Company and/or any of their respective subsidiaries to such Company Lender or (b) electing to have the Company’s shares as uncertificated), and (ii) no amendment, repeal or modification of this provision or the last sentence of this Article VII shall be permitted without the express written consent of such Company Lender, in each case, until all of the indebtedness, liabilities and obligations of the Company and their respective subsidiaries to such Company Lender have been paid in full in cash and all commitments have been terminated. Each Company Lender shall be a third party beneficiary of this Article VII.

ARTICLE VIII

INDEMNIFICATION

1.To the fullest extent permitted by law, the Corporation shall indemnify, defend and hold harmless any person (an “Indemnified Person”) who is or was a party, or is threatened to be made a party, to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, and whether formal or informal (a “Proceeding”) (other than an action or suit by or in the right of the Corporation) by reason of the fact that he or she is or was a director or officer of the Corporation, or, while a director or officer of the Corporation, is or was serving in another Corporate Status (as defined below) against all expenses (including, but not limited to, attorneys’ fees and disbursements, court costs and expert witness fees) (collectively, “Expenses”), and against all judgments, fines, penalties and amounts paid in settlement(including any excise tax assessed with respect to an employee benefit plan) (collectively, “Liabilities”)

that may be imposed upon or incurred by him or her in connection with or resulting from such Proceeding, if he or she acted in good faith and, in the case of conduct in his or her official capacity, in a manner he or she reasonably believed to be in the best interests of the Corporation, and in all other cases, in a manner he or she reasonably believed to not be opposed to the best interests of the Corporation, and with respect to any criminal Proceeding, had no reasonable cause to believe his or her conduct was unlawful. “Corporate Status” describes (a) the status of a person who is or was a director or officer of the Corporation or an individual who, while a director or officer of the Corporation, is or was serving at the Corporation’s request as a director, officer, partner, trustee, employee, administrator or agent of another foreign or domestic corporation, partnership, joint venture, trust, employee benefit plan, entity, or other enterprise, and (b) a person’s service in connection with an employee benefit plan at the Corporation’s request if such person’s duties to the Corporation also impose duties on, or otherwise involve services by, such person to the plan or to participants in or beneficiaries of the plan.

2.The Corporation shall indemnify, defend and hold harmless any Indemnified Person who is or was a party, or is threatened to be made a party, to any threatened, pending or completed Proceeding by or in the right of the Corporation, by reason of the fact that he or she is or was a director or officer of the Corporation, or, while a director or officer of the Corporation, is or was serving in another Corporate Status (a) to the fullest extent permitted by law, against all Expenses that may be imposed upon or incurred by him or her in connection with or resulting from such Proceeding, if he or she acted in good faith and, in the case of conduct in his or her official capacity, in a manner he or she reasonably believed to be in the best interests of the Corporation and in all other cases, in a manner he or she reasonably believed to not be opposed to the best interests of the Corporation, and with respect to any criminal Proceeding, had no reasonable cause to believe his or her conduct was unlawful, and (b) to the fullest extent permitted by law (including through a determination by a court of competent jurisdiction pursuant to Section 14-2-854 of the General Business Corporation Code of the State of Georgia (the “Code”)) against all Expenses and Liabilities that may be imposed upon or incurred by him or her in connection with or resulting from such Proceeding.

3.Notwithstanding any other provision of this Article VIII, to the extent that an Indemnified Person is, by reason of his or her Corporate Status, a party to and is successful on the merits or otherwise in any Proceeding, the Indemnified Person shall be indemnified against Expenses imposed upon or incurred by him or her in connection with the Proceeding, regardless of whether the Indemnified Person has met the standards set forth in the Code or in this Article VIII and without any further action or determination by the Board of the Corporation or otherwise. If an Indemnified Person is not wholly successful in such Proceeding but is successful on the merits or otherwise as to one or more but less than all claims, issues or matters in such Proceeding, the Corporation shall indemnify the Indemnified Person against all Expenses imposed upon or incurred by him or her in connection with each claim, issue or matter with respect to which the Indemnified Person was successful. For the purposes of this Section 3 and without limiting the foregoing, (a) the termination of any claim, issue or matter in any such Proceeding by dismissal, with or without prejudice, shall be deemed to be a successful

result as to such claim, issue or matter, and (b) a decision by any government, regulatory or self-regulatory authority, agency or body not to commence or pursue any investigation, civil or criminal enforcement matter or case or in any civil suit, shall be deemed to be a successful result as to such claim, issue or matter. If an Indemnified Person is entitled under any provision of the Code or this Article VIII to indemnification by the corporation for some or a portion of the Expenses or Liabilities imposed upon or incurred by him or her in connection with the investigation, defense, appeal or settlement of a Proceeding covered by this Article VIII, but is not entitled to indemnification for the total amount thereof, the Corporation shall nevertheless indemnify the Indemnified Person for the portion of such Expenses and Liabilities imposed upon or incurred by him or her to which the Indemnified Person is entitled.

4.To the fullest extent permitted by law, any Indemnified Person who acts as a witness or other participant in any Proceeding, shall be indemnified by the Corporation against all Expenses imposed upon or incurred by the Indemnified Person in connection therewith.

5.The Board shall have the power to cause the Corporation to provide to any person who is or was an employee or agent of the Corporation all or any part of the right to indemnification and other rights of the type provided under Sections 1, 2, 3, 4, 7 and 12 of this Article VIII (subject to the conditions, limitations, obligations and other provisions specified herein), upon a resolution to that effect identifying such employee or agent (by position or name) and specifying the particular rights provided, which may be different for each employee or agent identified. Each employee or agent of the corporation so identified shall be an “Indemnified Person” for purposes of the provisions of this Article VIII.

6.Sections 1, 2, 3, 4 and 7 of this Article VIII are intended to, and shall be deemed to, satisfy the requirements for authorization referred to in Section 14-2-859(a) of the Code or any successor provision and any other requirements of applicable law such that the Corporation shall be obligated to the maximum extent possible to provide such indemnification and advancement of Expenses without any further requirements for authorization or action referred to in Sections 14-2-853(c) or 14-2-855(c) of the Code or any successor provision, or otherwise. The Corporation shall act in good faith and expeditiously take all actions necessary or appropriate to make available the indemnification, advancement of Expenses and other rights provided for Indemnified Persons in this Article VIII, and shall expeditiously take all actions necessary or appropriate to remove any impediments or obstacles to such indemnification, advancement of Expenses and other rights. To the extent any determination of entitlement to indemnification is required for purposes of the Code or this Article VIII, at the request of the Indemnified Person, such determination shall be made by Special Legal Counsel (as defined below) proposed by the Indemnified Person and reasonably acceptable to the Corporation. In the event of any dispute as to whether an Indemnified Person is entitled to indemnification or advancement of Expenses under the Code or this Article VIII, the Indemnified Person shall be entitled to an expeditious and final adjudication in the Georgia State-Wide Business Court (the “Business Court”), which the Corporation agrees shall be the exclusive venue for any court action to determine

whether the Indemnified Person is entitled to such indemnification or advancement of Expenses. The Corporation shall seek expedited resolution of the matter and agrees that the Business Court may summarily determine the Corporation’s obligation to advance Expenses. The corporation irrevocably waives trial by jury with respect to the determination whether an Indemnified Person is entitled to indemnification or advancement of Expenses. If an Indemnified Person, pursuant to this Section 6, seeks a judicial adjudication of his or her rights under this Article VIII, the Indemnified Person shall be entitled to recover from the corporation, and shall be indemnified by the Corporation against, any and all Expenses actually and reasonably incurred by him of her in such judicial adjudication, but only if he or she prevails therein. If it shall be determined in such judicial adjudication that the Indemnified Person is entitled to receive part but not all of the indemnification or advancement of expenses sought, the Expenses incurred by the Indemnified Person in connection with such judicial adjudication shall be appropriately prorated. As used in this Section 6, “Special Legal Counsel” means an attorney with an active membership in good standing in the State Bar of Georgia who is experienced in matters of corporate law and neither he or she, nor his or her law firm, presently is, nor in the past five years has been, retained to represent: (i) the Corporation or the Indemnified Person in any other matter material to either such party; or (ii) any other party to the Proceeding giving rise to a claim for indemnification, provided that the term “Special Legal Counsel” shall not include any person who, under the applicable standards of professional conduct then prevailing, would have a conflict of interest in representing either the Corporation or the Indemnified Person in an action to determine the Indemnified Person’s rights under the Code or this Article VIII.

7.Expenses imposed upon or incurred by an Indemnified Person in defending any Proceeding of the kind described in Sections 1, 2 and 3 hereof shall be paid by the Corporation in advance of the final disposition of such action, suit or proceeding as set forth herein. The Corporation shall promptly pay the amount of such Expenses to the Indemnified Person, but in no event later than ten days following the Indemnified Person’s delivery to the Corporation of a written request for an advance pursuant to this Section 7, together with a reasonable accounting of such expenses; provided, however, that the Indemnified Person shall furnish the corporation a written affirmation of his or her good faith belief that he or she has met the standard of conduct set forth in the Code or that the proceeding involves conduct for which liability has been eliminated under a provision of the Corporation’s charter, as authorized by paragraph (4) of subsection (b) of Section 14-2-202 of the Code or any successor provision, and a written undertaking and agreement, executed personally or on his or her behalf, to repay to the Corporation any advances made pursuant to this Section 7 if it shall be ultimately determined that the Indemnified Person is not entitled to be indemnified by the Corporation for such amounts. The Corporation shall make the advances contemplated by this Section 7 regardless of the Indemnified Person’s financial ability to make repayment. Any advances and undertakings to repay pursuant to this Section 7 shall be unsecured and interest-free.

8.Subject to any applicable limitation imposed by the Code or the Corporation’s charter, the indemnification and advancement of expenses provided by or granted pursuant to this

Article VIII shall not be exclusive of any other rights to which a person seeking indemnification or advancement of expenses may be entitled under applicable law or any bylaw, resolution or agreement, including as may be approved by the Corporation’s shareholders.

9.The Corporation shall have the power to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the Corporation, or who, while a director, officer, employee, or agent of the Corporation, is or was serving as a director, officer, trustee, general partner, employee or agent of a Subsidiary or, at the request of the Corporation, of any other organization or in any other Corporate Status, against any liability asserted against him or her and incurred by him or her in any such capacity, or arising out of his or her status as such, whether or not the corporation would have the power to indemnify him or her against such liability under the provisions of this Article VIII.

10.The Corporation may designate certain of its assets as collateral, provide self-insurance or otherwise secure its obligations under this Article VIII, or under any indemnification agreement or plan of indemnification adopted and entered into in accordance with the provisions of this Article VIII, as the Board deems appropriate.

11.Any amendment to this Article VIII that limits or otherwise adversely affects the right of indemnification, advancement of expenses, or other rights of any Indemnified Person hereunder shall, as to such Indemnified Person, apply only to claims, actions, suits or proceedings based on actions, events or omissions (collectively, “Post Amendment Events”) occurring after such amendment and after delivery of notice of such amendment to the Indemnified Person so affected. Any Indemnified Person shall, as to any claim, action, suit or proceeding based on actions, events or omissions occurring prior to the date of receipt of such notice, be entitled to the right of indemnification, advancement of expenses and other rights under this Article VIII to the same extent as if such provisions had continued as part of the bylaws of the Corporation without such amendment. This Section 11 cannot be altered, amended or repealed in a manner effective as to any Indemnified Person (except as to Post Amendment Events) without the prior written consent of such Indemnified Person.

12.In addition to the rights provided in this Article VIII, the Corporation shall have the power, upon authorization by the Board, to enter into an agreement or agreements providing to any person who is or was a director, officer, employee or agent of the Corporation indemnification rights substantially similar to, or greater than, those provided in this Article VIII.

13.The indemnification and advancement of expenses provided by or granted pursuant to this Article VIII shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the spouse, heirs, devisees, executors, administrators and other legal representatives of such a person.

14.For purposes of this Article VIII, the terms “the Corporation” shall include any corporation, joint venture, trust, partnership or unincorporated business association that is the successor to all or substantially all of the business or assets of the Corporation, as a result of merger, consolidation, sale, liquidation or otherwise, and any such successor shall be liable to the persons indemnified under this Article VIII on the same terms and conditions and to the same extent as the Corporation.

15.Each of the sections of this Article VIII, and each of the clauses set forth herein, shall be deemed separate and independent, and should any part of any such section or clause be declared invalid or unenforceable by any court of competent jurisdiction, such invalidity or unenforceability shall in no way render invalid or unenforceable any other part thereof or any other separate section or clause of this Article VIII that is not declared invalid or unenforceable. If any section, clause or part of this Article VIII is determined to be invalid or unenforceable, the Corporation in good faith shall expeditiously take all necessary or appropriate action to provide the Indemnified Persons with rights under this Article VIII (including with respect to indemnification, advancement of Expenses and other rights) that effect the original intent of this Article VIII as closely as possible.

16.In addition to the specific indemnification rights set forth herein, the Corporation shall indemnify each of its directors and officers and advance expenses to its directors and officers to the full extent permitted by action of the Board without shareholder approval under the Code or other laws of the State of Georgia as in effect from time to time.

CERTIFICATE OF SECRETARY

I, the undersigned, do hereby certify:

(1) that I am the duly elected and acting Secretary of The Aaron’s Company, Inc., a Georgia corporation; and

(2) that the foregoing Second Amended and Restated Bylaws, comprising 8 pages, constitute the Second Amended and Restated Bylaws of said Corporation as of October 3, 2024 as duly adopted by the board of directors of said Corporation.

IN WITNESS WHEREOF, I have hereunto subscribed my name as of this 3rd day of October, 2024.

/s/ Rachel George

Rachel George, Corporate Secretary

Certificate of Second Amended and Restated Bylaws of The Aaron’s Company, Inc.

Document and Entity Information Document

|

Oct. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 04, 2024

|

| Entity Registrant Name |

THE AARON'S COMPANY, INC.

|

| Entity Central Index Key |

0001821393

|

| Current Fiscal Year End Date |

--12-31

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

GA

|

| Entity File Number |

1-39681

|

| Entity Tax Identification Number |

85-2483376

|

| Entity Address, Address Line One |

400 Galleria Parkway SE

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30339-3194

|

| City Area Code |

678

|

| Local Phone Number |

402-3000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.50 Par Value

|

| Trading Symbol |

AAN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Address, Address Line Two |

Suite 300

|

| Document Information [Line Items] |

|

| Document Period End Date |

Oct. 04, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

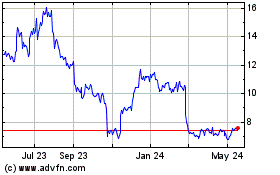

Aarons (NYSE:AAN)

Historical Stock Chart

From Dec 2024 to Jan 2025

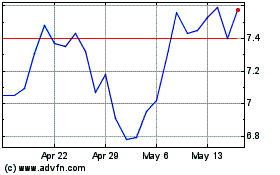

Aarons (NYSE:AAN)

Historical Stock Chart

From Jan 2024 to Jan 2025