- Record Q2 2024 sales of $2.5 billion, up 3%, or 6% constant

currency1 (cc)

- Q2 2024 diluted EPS of $0.45, up 32%, or 47% cc; core

diluted EPS2 of $0.74, up 7%, or 15% cc

- H1 2024 cash from operations of $871 million; free cash

flow3 of $667 million, up $478 million, or 253%

- Received U.S. FDA clearance of Unity VCS/CS and PDUFA date

for AR-15512 of May 30th, 2025

Ad Hoc Announcement Pursuant to Art. 53 LR

Alcon (SIX/NYSE:ALC), the global leader in eye care, reported

its financial results for the three and six month periods ending

June 30, 2024. For the second quarter of 2024, sales were $2.5

billion, an increase of 3% on a reported basis and 6% on a constant

currency basis1, as compared to the same quarter of the previous

year. Alcon reported diluted earnings per share of $0.45 and core

diluted earnings per share2 of $0.74 in the second quarter of

2024.

"We are pleased with our solid second-quarter results, which

were driven by robust demand for our innovative products, our

balanced geographic footprint and strong execution by our team.

These factors contributed to another quarter of sales and earnings

growth and robust cash generation," said David J. Endicott, Alcon's

Chief Executive Officer. "As we look to the second half of the

year, our focus will be on preparing for product launches that will

position us well for our next phase of growth in 2025 and

beyond."

Second-quarter and first-half 2024 key

figures

Three months ended June

30

Six months ended June

30

2024

2023

2024

2023

Net sales ($ millions)

2,482

2,402

4,926

4,735

Operating margin (%)

12.8%

11.2%

13.9%

11.4%

Diluted earnings per share ($)

0.45

0.34

0.95

0.69

Core results (non-IFRS

measure)2

Core operating margin (%)

19.8%

19.9%

20.9%

20.3%

Core diluted earnings per share ($)

0.74

0.69

1.52

1.39

Cash flows ($ millions)

Net cash flows from operating

activities

871

410

Free cash flow (non-IFRS measure)3

667

189

1.

Constant currency is a non-IFRS measure.

Refer to the 'Footnotes' section for additional information.

2.

Core results, such as core operating

income, core operating margin and core diluted EPS, are non-IFRS

measures. Refer to the 'Footnotes' section for additional

information.

3.

Free cash flow is a non-IFRS measure.

Refer to the 'Footnotes' section for additional information.

Second-quarter and first-half 2024 results

Sales for the second quarter of 2024 were $2.5 billion, an

increase of 3% on a reported basis and 6% on a constant currency

basis, compared to the second quarter of 2023. Sales for the first

half of 2024 were $4.9 billion, an increase of 4% on a reported

basis and 7% on a constant currency basis, compared to the first

half of 2023.

The following table highlights net sales by segment for the

second quarter and first half of 2024:

Three months ended June

30

Change %

Six months ended June

30

Change %

($ millions unless indicated

otherwise)

2024

2023

$

cc1

(non-IFRS measure)

2024

2023

$

cc1

(non-IFRS measure)

Surgical

Implantables

464

437

6

9

897

864

4

8

Consumables

736

714

3

5

1,422

1,370

4

6

Equipment/other

223

231

(3

)

(1

)

442

452

(2

)

—

Total Surgical

1,423

1,382

3

6

2,761

2,686

3

6

Vision Care

Contact lenses

636

594

7

9

1,307

1,209

8

10

Ocular health

423

426

(1

)

2

858

840

2

5

Total Vision Care

1,059

1,020

4

6

2,165

2,049

6

8

Net sales to third parties

2,482

2,402

3

6

4,926

4,735

4

7

Surgical growth reflects strength in international markets

For the second quarter of 2024, Surgical net sales, which

include implantables, consumables and equipment/other, were $1.4

billion, an increase of 3% on a reported basis and 6% on a constant

currency basis versus the second quarter of 2023.

- Implantables net sales were $464 million, an increase of 6%.

Excluding unfavorable currency impacts of 3%, implantables net

sales increased 9% in constant currency. Growth was led by advanced

technology intraocular lenses in international markets.

- Consumables net sales were $736 million, an increase of 3%,

driven by cataract and vitreoretinal consumables, particularly in

international markets, and price increases. Excluding unfavorable

currency impacts of 2%, consumables net sales increased 5% constant

currency.

- Equipment/other net sales were $223 million, a decrease of 3%.

Excluding unfavorable currency impacts of 2%, equipment/other net

sales decreased 1% constant currency as the prior year period

benefited from strong demand for cataract equipment in

international markets.

For the first half of 2024, Surgical net sales were $2.8

billion, an increase of 3% on a reported basis and 6% on a constant

currency basis versus the first half of 2023.

Vision Care growth reflects strength in contact lenses

For the second quarter of 2024, Vision Care net sales, which

include contact lenses and ocular health, were $1.1 billion, an

increase of 4% on a reported basis and 6% on a constant currency

basis, versus the second quarter of 2023.

- Contact lenses net sales were $636 million, an increase of 7%,

driven by product innovation, including our toric and multifocal

modalities, and price increases. Growth was partially offset by

unfavorable currency impacts of 2%. Contact lenses net sales

increased 9% constant currency.

- Ocular health net sales were $423 million, a decrease of 1%.

Excluding unfavorable currency impacts of 3%, ocular health net

sales increased 2% in constant currency. This constant currency

growth was primarily driven by the portfolio of eye drops,

including continued strength from the Systane family of artificial

tears. Growth was partially offset by a decline of 4% due to

contact lens care, primarily driven by the prior year period

benefit from the recovery from supply chain challenges.

For the first half of 2024, Vision Care net sales were $2.2

billion, an increase of 6% on a reported basis and 8% on a constant

currency basis versus the first half of 2023.

Operating income

Second-quarter 2024 operating income was $318 million, compared

to $270 million in the prior year period. Operating margin

increased 1.6 percentage points, reflecting improved underlying

operating leverage from higher sales. The prior year period

included $26 million for the transformation program which was

completed in the fourth quarter of 2023. The second quarter of 2024

included significantly higher inventory provisions in Vision Care

due to a supplier-related quality issue which resulted in a

negative impact of $30 million or 1.2 percentage points to

operating margin. Operating margin was also impacted by higher

costs of inventory in Surgical and a negative 1.0 percentage point

impact from currency. Operating margin increased 2.6 percentage

points on a constant currency basis.

Adjustments to arrive at core operating income2 in the current

year period were $173 million, mainly due to $165 million of

amortization. Excluding these and other adjustments, second-quarter

2024 core operating income was $491 million.

Second-quarter 2024 core operating margin was 19.8%. Core

operating margin decreased 0.1 percentage point, including a

negative 0.8 percentage point impact from currency. Core operating

margin increased 0.7 percentage points on a constant currency

basis, reflecting improved underlying operating leverage from

higher sales. The second quarter of 2024 included significantly

higher inventory provisions in Vision Care due to a

supplier-related quality issue which resulted in a negative impact

of $30 million or 1.2 percentage points to core operating margin.

There were also higher costs of inventory in Surgical.

First-half 2024 operating income was $686 million and operating

margin was 13.9%, which increased 2.5 percentage points on a

reported basis and 3.7 percentage points on a constant currency

basis. Adjustments to arrive at core operating income in the

current year period were $342 million, mainly due to $331 million

of amortization. Excluding these and other adjustments, core

operating income was $1.0 billion.

First-half 2024 core operating margin was 20.9%, an increase of

0.6 percentage points on a reported basis and 1.6 percentage points

on a constant currency basis.

Diluted earnings per share (EPS)

Second-quarter 2024 diluted earnings per share of $0.45

increased 32%, or 47% on a constant currency basis. Core diluted

earnings per share of $0.74 increased 7%, or 15% on a constant

currency basis.

First-half 2024 diluted earnings per share of $0.95 increased

38%, or 55% on a constant currency basis. Core diluted earnings per

share for the first six months of $1.52 increased 9%, or 18% on a

constant currency basis.

Cash flow highlights

The Company ended the first six months of 2024 with a cash

position of $1.4 billion. Net cash flows from operating activities

amounted to $871 million in the first six months of 2024, compared

to $410 million in the prior year period. The current year period

includes increased collections associated with higher sales, lower

taxes paid due to timing of payments and lower transformation

payments following completion of the transformation program in the

fourth quarter of 2023, partially offset by associate short-term

incentive payments, which generally occur in the first quarter and

were higher than in the prior year period, and increased payments

for operating expenses. The prior period included a cash outflow

for a legal settlement. Both periods were impacted by changes in

net working capital.

Free cash flow was an inflow of $667 million in the first six

months of 2024, compared to $189 million in the prior year period,

primarily due to increased cash flows from operating

activities.

2024 outlook

The Company updated its 2024 outlook as per the table below.

2024 outlook4

as of February

as of May

as of August

Comments

Net sales (USD)

$9.9 to $10.1 billion

$9.9 to $10.1 billion

$9.9 to $10.1 billion

Maintain

Change vs. prior year (cc)1

(non-IFRS measure)

+6% to +8%

+7% to +9%

+7% to +9%

Maintain

Core operating margin2 (non-IFRS

measure)

20.5% to 21.5%

20.5% to 21.5%

20.5% to 21.5%

Maintain

Interest expense and Other

financial income & expense

$190 to $210 million

$180 to $200 million

$160 to $180 million

Decrease

Core effective tax rate5

(non-IFRS measure)

~20%

~20%

~20%

Maintain

Core diluted EPS2 (non-IFRS

measure)

$3.00 to $3.10

$3.00 to $3.10

$3.00 to $3.10

Maintain

Change vs. prior year (cc)1

(non-IFRS measure)

+13% to +16%

+15% to +18%

+15% to +18%

Maintain

This outlook assumes the following:

- Aggregated markets grow in line with historical averages

(mid-single digits);

- Exchange rates as of the end of July 2024 prevail through

year-end;

- Approximately 498 million weighted-averaged diluted

shares.

4.

The forward-looking guidance included in

this press release cannot be reconciled to the comparable IFRS

measures without unreasonable effort, because we are not able to

predict with reasonable certainty the ultimate amount or nature of

exceptional items in the fiscal year. Refer to the 'Footnotes'

section for additional information.

5.

Core effective tax rate, a non-IFRS

measure, is the applicable annual tax rate on core taxable income.

Refer to the 'Footnotes' section for additional information.

Executive Committee Changes

The Company has made the following changes to its Executive

Committee (ECA), which will take effect September 1, 2024:

Ian Bell, currently President, Global Business & Innovation,

and a member of the ECA, is named Senior Vice President and Chief

Operating Officer (COO). Sue-Jean Lin, currently Senior Vice

President, Chief Information and Transformation Officer, will step

down from the ECA ahead of her retirement from the Company. Kim

Martin, currently Senior Vice President, Chief Human Resources

Officer and Corporate Communications, will join the ECA.

Webcast and Conference Call Instructions

The Company will host a conference call on August 21, 2024 at

8:00 a.m. Eastern Daylight Time / 2:00 p.m. Central European Summer

Time to discuss its second-quarter 2024 earnings results. The

webcast can be accessed online through Alcon's Investor Relations

website, investor.alcon.com. Listeners should log on approximately

10 minutes in advance. A replay will be available online within 24

hours after the event.

The Company's interim financial report and supplemental

presentation materials can be found online through Alcon's Investor

Relations website, or by clicking on the link:

https://investor.alcon.com/news-and-events/events-and-presentations/event-details/2024/Alcons-Second-Quarter-2024-Earnings-Conference-Call-2024-gjVAL2EgFs/default.aspx

Footnotes (pages 1-4)

- Constant currency (cc) is a non-IFRS measure. Growth in

constant currency (cc) is calculated by translating the current

year’s foreign currency items into US dollars using average

exchange rates from the historical comparative period and comparing

them to the values from the historical comparative period in US

dollars. An explanation of non-IFRS measures can be found in the

'Non-IFRS measures as defined by the Company' section.

- Core results, such as core operating income, core operating

margin and core EPS, are non-IFRS measures. For additional

information, including a reconciliation of such core results to the

most directly comparable measures presented in accordance with

IFRS, see the explanation of non-IFRS measures and reconciliation

tables in the 'Non-IFRS measures as defined by the Company' and

'Financial tables' sections.

- Free cash flow is a non-IFRS measure. For additional

information regarding free cash flow, see the explanation of

non-IFRS measures and reconciliation tables in the 'Non-IFRS

measures as defined by the Company' and 'Financial tables'

sections.

- The forward-looking guidance included in this press release

cannot be reconciled to the comparable IFRS measures without

unreasonable efforts, because we are not able to predict with

reasonable certainty the ultimate amount or nature of exceptional

items in the fiscal year. Refer to the section 'Non-IFRS measures

as defined by the Company' for more information.

- Core effective tax rate, a non-IFRS measure, is the applicable

annual tax rate on core taxable income. For additional information,

see the explanation regarding reconciliation of forward-looking

guidance in the 'Non-IFRS measures as defined by the Company'

section.

Cautionary Note Regarding Forward-Looking Statements

This document contains, and our officers and representatives may

from time to time make, certain “forward-looking statements” within

the meaning of the safe harbor provisions of the US Private

Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as “anticipate,”

“intend,” “commitment,” “look forward,” “maintain,” “plan,” “goal,”

“seek,” “target,” “assume,” “believe,” “project,” “estimate,”

“expect,” “strategy,” “future,” “likely,” “may,” “should,” “will”

and similar references to future periods. Examples of

forward-looking statements include, among others, statements we

make regarding our liquidity, revenue, gross margin, operating

margin, effective tax rate, foreign currency exchange movements,

earnings per share, our plans and decisions relating to various

capital expenditures, capital allocation priorities and other

discretionary items such as our market growth assumptions, our

social impact and sustainability plans, targets, goals and

expectations, and generally, our expectations concerning our future

performance.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding the

future of our business, future plans and strategies, and other

future conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties and risks that

are difficult to predict such as: cybersecurity breaches or other

disruptions of our information technology systems; compliance with

data privacy, identity protection and information security laws,

particularly with the increased use of artificial intelligence; the

impact of a disruption in our global supply chain or important

facilities, particularly when we single-source or rely on limited

sources of supply; our ability to forecast sales demand and manage

our inventory levels and the changing buying patterns of our

customers; our ability to manage social impact and sustainability

matters; our reliance on outsourcing key business functions; global

and regional economic, financial, monetary, legal, tax, political

and social change; our success in completing and integrating

strategic acquisitions; the success of our research and development

efforts, including our ability to innovate to compete effectively;

our ability to comply with the US Foreign Corrupt Practices Act of

1977 and other applicable anti-corruption laws; pricing pressure

from changes in third party payor coverage and reimbursement

methodologies; our ability to properly educate and train healthcare

providers on our products; our ability to protect our intellectual

property; our ability to comply with all laws to which we may be

subject; the ability to obtain regulatory clearance and approval of

our products as well as compliance with any post-approval

obligations, including quality control of our manufacturing; the

effect of product recalls or voluntary market withdrawals; the

accuracy of our accounting estimates and assumptions, including

pension and other post-employment benefit plan obligations and the

carrying value of intangible assets; the impact of unauthorized

importation of our products from countries with lower prices to

countries with higher prices; our ability to service our debt

obligations; the need for additional financing through the issuance

of debt or equity; the effects of litigation, including product

liability lawsuits and governmental investigations; supply

constraints and increases in the cost of energy; our ability to

attract and retain qualified personnel; legislative, tax and

regulatory reform; the impact of being listed on two stock

exchanges; the ability to declare and pay dividends; the different

rights afforded to our shareholders as a Swiss corporation compared

to a US corporation; the effect of maintaining or losing our

foreign private issuer status under US securities laws; and the

ability to enforce US judgments against Swiss corporations.

Additional factors are discussed in our filings with the United

States Securities and Exchange Commission, including our Form 20-F.

Should one or more of these uncertainties or risks materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those anticipated. Therefore, you should not

rely on any of these forward-looking statements. Forward-looking

statements in this document speak only as of the date of its

filing, and we assume no obligation to update forward-looking

statements as a result of new information, future events or

otherwise.

Intellectual Property

This report may contain references to our proprietary

intellectual property. All product names appearing in italics or

ALL CAPS are trademarks owned by or licensed to Alcon Inc. Product

names identified by a "®" or a "™" are trademarks that are not

owned by or licensed to Alcon or its subsidiaries and are the

property of their respective owners.

Non-IFRS measures as defined by the Company

Alcon uses certain non-IFRS metrics when measuring performance,

including when measuring current period results against prior

periods, including core results, percentage changes measured in

constant currency and free cash flow.

Because of their non-standardized definitions, the non-IFRS

measures (unlike IFRS measures) may not be comparable to the

calculation of similar measures of other companies. These

supplemental non-IFRS measures are presented solely to permit

investors to more fully understand how Alcon management assesses

underlying performance. These supplemental non-IFRS measures are

not, and should not be viewed as, a substitute for IFRS

measures.

Core results

Alcon core results, including core operating income and core net

income, exclude all amortization and impairment charges of

intangible assets, excluding software, net gains and losses on fund

investments and equity securities valued at fair value through

profit and loss ("FVPL"), fair value adjustments of financial

assets in the form of options to acquire a company carried at FVPL

and certain acquisition related items. The following items that

exceed a threshold of $10 million and are deemed exceptional are

also excluded from core results: integration and divestment related

income and expenses, divestment gains and losses, restructuring

charges/releases and related items, legal related items,

gains/losses on early extinguishment of debt or debt modifications,

past service costs for post-employment benefit plans, impairments

of property, plant and equipment and software, as well as income

and expense items that management deems exceptional and that are or

are expected to accumulate within the year to be over a $10 million

threshold.

Taxes on the adjustments between IFRS and core results take into

account, for each individual item included in the adjustment, the

tax rate that will finally be applicable to the item based on the

jurisdiction where the adjustment will finally have a tax impact.

Generally, this results in amortization and impairment of

intangible assets and acquisition-related restructuring and

integration items having a full tax impact. There is usually a tax

impact on other items, although this is not always the case for

items arising from legal settlements in certain jurisdictions.

Alcon believes that investor understanding of its performance is

enhanced by disclosing core measures of performance because, since

they exclude items that can vary significantly from period to

period, the core measures enable a helpful comparison of business

performance across periods. For this same reason, Alcon uses these

core measures in addition to IFRS and other measures as important

factors in assessing its performance.

A limitation of the core measures is that they provide a view of

Alcon operations without including all events during a period, such

as the effects of an acquisition, divestment, or

amortization/impairments of purchased intangible assets and

restructurings.

Constant currency

Changes in the relative values of non-US currencies to the US

dollar can affect Alcon's financial results and financial position.

To provide additional information that may be useful to investors,

including changes in sales volume, we present information about

changes in our net sales and various values relating to operating

and net income that are adjusted for such foreign currency

effects.

Constant currency calculations have the goal of eliminating two

exchange rate effects so that an estimate can be made of underlying

changes in the Consolidated Income Statement excluding:

- the impact of translating the income statements of consolidated

entities from their non-US dollar functional currencies to the US

dollar; and

- the impact of exchange rate movements on the major transactions

of consolidated entities performed in currencies other than their

functional currency.

Alcon calculates constant currency measures by translating the

current year's foreign currency values for sales and other income

statement items into US dollars, using the average exchange rates

from the historical comparative period and comparing them to the

values from the historical comparative period in US dollars.

Free cash flow

Alcon defines free cash flow as net cash flows from operating

activities less cash flow associated with the purchase or sale of

property, plant and equipment. Free cash flow is presented as

additional information because Alcon management believes it is a

useful supplemental indicator of Alcon's ability to operate without

reliance on additional borrowing or use of existing cash. Free cash

flow is not intended to be a substitute measure for net cash flows

from operating activities as determined under IFRS.

Growth rate and margin

calculations

For ease of understanding, Alcon uses a sign convention for its

growth rates such that a reduction in operating expenses or losses

compared to the prior year is shown as a positive growth.

Gross margins, operating income margins and core operating

income margins are calculated based upon net sales to third parties

unless otherwise noted.

Reconciliation of guidance for

forward-looking non-IFRS measures

The forward-looking guidance included in this press release

cannot be reconciled to the comparable IFRS measures without

unreasonable efforts, because we are not able to predict with

reasonable certainty the ultimate amount or nature of exceptional

items in the fiscal year. These items are uncertain, depend on many

factors and could have a material impact on our IFRS results for

the guidance period.

Financial tables

Net sales by region

Three months ended June

30

Six months ended June

30

($ millions unless indicated

otherwise)

2024

2023

2024

2023

United States

1,141

46%

1,105

46%

2,290

46%

2,183

46%

International

1,341

54%

1,297

54%

2,636

54%

2,552

54%

Net sales to third parties

2,482

100%

2,402

100%

4,926

100%

4,735

100%

Consolidated Income Statement (unaudited)

Three months ended June

30

Six months ended June

30

($ millions except earnings per share)

2024

2023

2024

2023

Net sales to third parties

2,482

2,402

4,926

4,735

Other revenues

14

20

29

39

Net sales and other revenues

2,496

2,422

4,955

4,774

Cost of net sales

(1,108

)

(1,040

)

(2,171

)

(2,070

)

Cost of other revenues

(14

)

(19

)

(28

)

(36

)

Gross profit

1,374

1,363

2,756

2,668

Selling, general & administration

(837

)

(832

)

(1,639

)

(1,617

)

Research & development

(220

)

(217

)

(419

)

(419

)

Other income

5

5

11

10

Other expense

(4

)

(49

)

(23

)

(104

)

Operating income

318

270

686

538

Interest expense

(50

)

(48

)

(95

)

(95

)

Other financial income & expense

12

(9

)

24

(17

)

Income before taxes

280

213

615

426

Taxes

(57

)

(44

)

(144

)

(83

)

Net income

223

169

471

343

Earnings per share ($)

Basic

0.45

0.34

0.95

0.70

Diluted

0.45

0.34

0.95

0.69

Weighted average number of shares

outstanding (millions)

Basic

494.5

493.2

494.1

492.8

Diluted

497.0

495.7

496.7

495.9

Balance sheet highlights

($ millions)

June 30, 2024

December 31, 2023

Cash and cash equivalents

1,372

1,094

Current financial debts

137

63

Non-current financial debts

4,550

4,676

Free cash flow (non-IFRS measure)

The following is a summary of free cash flow for the six months

ended June 30, 2024 and 2023, together with a reconciliation to net

cash flows from operating activities, the most directly comparable

IFRS measure:

Six months ended June

30

($ millions)

2024

2023

Net cash flows from operating

activities

871

410

Purchase of property, plant &

equipment

(204

)

(221

)

Free cash flow

667

189

Reconciliation of IFRS results to core results (non-IFRS

measure)

Three months ended June 30, 2024

($ millions except earnings per share)

IFRS results

Amortization of certain

intangible assets(1)

Impairments(2)

Other items(4)

Core results

(non-IFRS measure)

Gross profit

1,374

165

—

—

1,539

Operating income

318

165

9

(1

)

491

Income before taxes

280

165

9

(1

)

453

Taxes(5)

(57

)

(30

)

—

1

(86

)

Net income

223

135

9

—

367

Basic earnings per share ($)

0.45

0.74

Diluted earnings per share ($)

0.45

0.74

Basic - weighted average shares

outstanding (millions)(6)

494.5

494.5

Diluted - weighted average shares

outstanding (millions)(6)

497.0

497.0

Refer to the associated explanatory footnotes at the end of the

'Reconciliation of IFRS results to core results (non-IFRS measure)'

tables.

Three months ended June 30, 2023

($ millions except earnings per share)

IFRS

results

Amortization of certain

intangible assets(1)

Transformation

costs(3)

Other items(4)

Core results (non-IFRS

measure)

Gross profit

1,363

164

—

5

1,532

Operating income

270

168

26

15

479

Income before taxes

213

168

26

15

422

Taxes(5)

(44

)

(30

)

(4

)

(3

)

(81

)

Net income

169

138

22

12

341

Basic earnings per share ($)

0.34

0.69

Diluted earnings per share ($)

0.34

0.69

Basic - weighted average shares

outstanding (millions)(6)

493.2

493.2

Diluted - weighted average shares

outstanding (millions)(6)

495.7

495.7

Refer to the associated explanatory footnotes at the end of the

'Reconciliation of IFRS results to core results (non-IFRS measure)'

tables.

Six months ended June 30, 2024

($ millions except earnings per share)

IFRS

results

Amortization of certain

intangible assets(1)

Impairments(2)

Other

items(4)

Core results (non-IFRS

measure)

Gross profit

2,756

329

—

3

3,088

Operating income

686

331

9

2

1,028

Income before taxes

615

331

9

2

957

Taxes(5)

(144

)

(59

)

—

—

(203

)

Net income

471

272

9

2

754

Basic earnings per share ($)

0.95

1.53

Diluted earnings per share ($)

0.95

1.52

Basic - weighted average shares

outstanding (millions)(6)

494.1

494.1

Diluted - weighted average shares

outstanding (millions)(6)

496.7

496.7

Refer to the associated explanatory footnotes at the end of the

'Reconciliation of IFRS results to core results (non-IFRS measure)'

tables.

Six months ended June 30, 2023

($ millions except earnings per share)

IFRS

results

Amortization of certain

intangible assets(1)

Transformation

costs(3)

Other items(4)

Core results (non-IFRS

measure)

Gross profit

2,668

333

—

9

3,010

Operating income

538

341

52

28

959

Income before taxes

426

341

52

28

847

Taxes(5)

(83

)

(61

)

(9

)

(6

)

(159

)

Net income

343

280

43

22

688

Basic earnings per share ($)

0.70

1.40

Diluted earnings per share ($)

0.69

1.39

Basic - weighted average shares

outstanding (millions)(6)

492.8

492.8

Diluted - weighted average shares

outstanding (millions)(6)

495.9

495.9

Refer to the associated explanatory footnotes at the end of the

'Reconciliation of IFRS results to core results (non-IFRS measure)'

tables.

Explanatory footnotes to IFRS to core reconciliation

tables

(1)

Includes recurring amortization for all

intangible assets other than software.

(2)

Includes impairment charges related to

intangible assets.

(3)

Transformation costs, primarily related to

restructuring and third party consulting fees, for the multi-year

transformation program. The transformation program was completed in

the fourth quarter of 2023.

(4)

For the three months ended June 30, 2024,

Operating income includes fair value adjustments of financial

assets, partially offset by the amortization of option rights.

For the three months ended June 30, 2023,

Gross profit includes the amortization of inventory fair value

adjustments related to a recent acquisition. Operating income also

includes integration related expenses for a recent acquisition and

the amortization of option rights.

For the six months ended June 30, 2024,

Gross profit includes the amortization of inventory fair value

adjustments related to a recent acquisition. Operating income also

includes the amortization of option rights, offset by fair value

adjustments of financial assets.

For the six months ended June 30, 2023,

Gross profit includes the amortization of inventory fair value

adjustments related to a recent acquisition. Operating income also

includes integration related expenses for a recent acquisition,

fair value adjustments of financial assets and the amortization of

option rights.

(5)

For the three months ended June 30, 2024,

tax associated with operating income core adjustments of $173

million totaled $29 million with an average tax rate of 16.8%.

For the three months ended June 30, 2023,

tax associated with operating income core adjustments of $209

million totaled $37 million with an average tax rate of 17.7%.

For the six months ended June 30, 2024,

tax associated with operating income core adjustments of $342

million totaled $59 million with an average tax rate of 17.3%.

For the six months ended June 30, 2023,

tax associated with operating income core adjustments of $421

million totaled $76 million with an average tax rate of 18.1%.

(6)

Core basic earnings per share is

calculated using the weighted-average shares of common stock

outstanding during the period. Core diluted earnings per share also

contemplate dilutive shares associated with unvested equity-based

awards as described in Note 3 to the Condensed Consolidated Interim

Financial Statements.

About Alcon

Alcon helps people see brilliantly. As the global leader in eye

care with a heritage spanning over 75 years, we offer the broadest

portfolio of products to enhance sight and improve people’s lives.

Our Surgical and Vision Care products touch the lives of people in

over 140 countries each year living with conditions like cataracts,

glaucoma, retinal diseases and refractive errors. Our more than

25,000 associates are enhancing the quality of life through

innovative products, partnerships with Eye Care Professionals and

programs that advance access to quality eye care. Learn more at

www.alcon.com.

Connect with us on Facebook LinkedIn

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819645885/en/

Investor Relations Daniel

Cravens Allen Trang + 41 589 112 110 (Geneva) + 1 817 615 2789

(Fort Worth) investor.relations@alcon.com

Media Relations Steven Smith

+ 41 589 112 111 (Geneva) + 1 817 551 8057 (Fort Worth)

globalmedia.relations@alcon.com

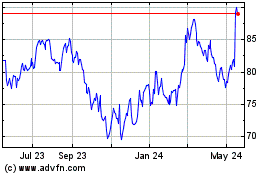

Alcon (NYSE:ALC)

Historical Stock Chart

From Oct 2024 to Nov 2024

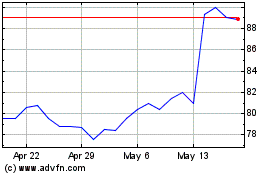

Alcon (NYSE:ALC)

Historical Stock Chart

From Nov 2023 to Nov 2024