AMG Announces Partnership with NorthBridge Partners

06 February 2025 - 10:45PM

AMG, a strategic partner to leading independent investment

management firms globally, today announced that it acquired a

minority equity interest in NorthBridge Partners, LLC

(“NorthBridge”).

NorthBridge is a leading vertically integrated real estate

investment manager specializing in industrial logistics assets, a

high-growth sector benefiting from the expanding digital economy

and evolving supply chain dynamics. With approximately $2 billion

in assets under management, the firm invests in last-mile logistics

properties, acquiring, repositioning, and developing strategically

located real estate assets in major markets. Led by partners Greg

Lauze, Dean Atkins, and David Aisner, NorthBridge has deep sector

expertise and a targeted investment strategy in a market segment

with strong secular tailwinds, including robust e-commerce growth,

accelerating consumer demand for shorter delivery times, and the

onshoring of supply chains.

“Our partnership with NorthBridge broadens AMG’s participation

in private markets and underscores our focus on investing in areas

of secular growth,” said Jay C. Horgen, President and Chief

Executive Officer of AMG. “Given the growing demand for industrial

logistics assets, and the entrepreneurialism of its principals,

NorthBridge has excellent forward prospects, and AMG’s strategic

partnership solutions can magnify the firm’s long-term success. I

am delighted to welcome Greg, Dean, David, and their partners to

our Affiliate group.”

“AMG’s unique partnership approach provides NorthBridge with

access to strategic capabilities and growth capital to further our

long-term objectives and maintain our independence,” said Mr.

Lauze. “We are pleased to have found in AMG a partner that shares

our commitment to entrepreneurial values and is aligned with us for

the long term. We are confident that our partnership will enhance

our competitive advantages, which will benefit both our clients and

the Northbridge team.”

“We are operating in a rapidly evolving sector, characterized by

transformative trends that generate compelling investment

opportunities,” added Mr. Atkins. “Our partnership with AMG will

enable us to capitalize on these trends as we further invest in our

operational capabilities, increasingly differentiating our firm, to

enhance our long-term success.”

The terms of the transaction were not disclosed. The management

team of NorthBridge will continue to hold a significant majority of

the equity and direct the firm’s day-to-day operations.

About AMG

AMG (NYSE: AMG) is a strategic partner to leading independent

investment management firms globally. AMG’s strategy is to generate

long-term value by investing in high-quality independent

partner-owned firms, through a proven partnership approach, and

allocating resources across AMG's unique opportunity set to the

areas of highest growth and return. Through its distinctive

approach, AMG magnifies its Affiliates' existing advantages and

actively supports their independence and ownership culture. As of

December 31, 2024, AMG’s aggregate assets under management were

approximately $708 billion across a diverse range of private

markets, liquid alternative, and differentiated long-only

investment strategies. For more information, please visit the

Company’s website at www.amg.com.

About NorthBridge Partners

NorthBridge Partners, LLC, founded in 2014, is a vertically

integrated real estate investment manager specializing in last-mile

logistics properties, acquiring, repositioning, and developing

strategically located industrial real estate assets in major

markets. NorthBridge has completed over 100 transactions totaling

over 15 million square feet throughout its history and currently

has approximately $2 billion in assets under management. For more

information, please visit www.northbridgecre.com.

Certain matters discussed in this press release issued by

Affiliated Managers Group, Inc. (“AMG” or the “Company”) may

constitute forward-looking statements within the meaning of the

federal securities laws, and could be impacted by a number of

factors, including those described under the section entitled “Risk

Factors” in AMG’s most recent Annual Report on Form 10-K, as such

factors may be updated from time to time in the Company’s periodic

filings with the SEC, which are accessible on the SEC's website at

www.sec.gov. AMG undertakes no obligation to publicly update or

review any forward-looking statements, whether as a result of new

information, future developments or otherwise, except as required

by applicable law. From time to time, AMG may use its website as a

distribution channel of material Company information. AMG routinely

posts financial and other important information regarding the

Company in the Investor Relations section of its website at

www.amg.com and encourages investors to consult that section

regularly.

AMG Media & Investor Relations:

Patricia Figueroa(617) 747-3300ir@amg.compr@amg.com

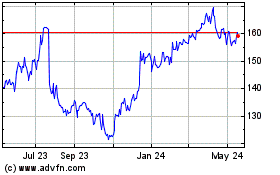

Affiliated Managers (NYSE:AMG)

Historical Stock Chart

From Jan 2025 to Feb 2025

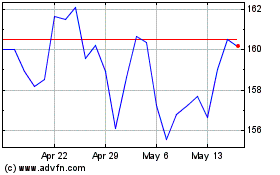

Affiliated Managers (NYSE:AMG)

Historical Stock Chart

From Feb 2024 to Feb 2025