UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22535

ARES DYNAMIC

CREDIT ALLOCATION FUND, INC.

(Exact name of registrant as specified in charter)

2000 AVENUE OF THE STARS

12TH FLOOR

LOS ANGELES, CALIFORNIA 90067

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) |

Copy to: |

| |

|

|

Ian Fitzgerald

2000 Avenue of the Stars, 12th Floor

Los Angeles, California 90067 |

P.

Jay Spinola, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, New York 10019 |

Registrant’s telephone number, including area code: (310)

201-4100

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Item 1. Report to Stockholders.

| (a) | Report to Stockholders is attached herewith. |

Ares Dynamic Credit Allocation Fund, Inc.

(NYSE: ARDC)

Semi-Annual Report

June 30, 2023

Ares Dynamic Credit Allocation Fund, Inc.

|

Letter to Shareholders |

|

|

1 |

|

|

|

Fund Profile & Financial Data |

|

|

4 |

|

|

|

Schedule of Investments |

|

|

5 |

|

|

|

Statement of Assets and Liabilities |

|

|

14 |

|

|

|

Statement of Operations |

|

|

15 |

|

|

|

Statements of Changes in Net Assets |

|

|

16 |

|

|

|

Statement of Cash Flows |

|

|

17 |

|

|

|

Financial Highlights |

|

|

18 |

|

|

|

Notes to Financial Statements |

|

|

19 |

|

|

|

Proxy & Portfolio Information |

|

|

34 |

|

|

|

Dividend Reinvestment Plan |

|

|

35 |

|

|

|

Corporate Information |

|

|

36 |

|

|

|

Privacy Notice |

|

|

37 |

|

|

|

Directors and Officers |

|

|

38 |

|

|

Semi-Annual Report 2023

Ares Dynamic Credit Allocation Fund, Inc.

Letter to Shareholders

As of June 30, 2023

Dear Shareholders,

We thank you for your support of the Ares Dynamic Credit Allocation Fund, Inc. ("ARDC" or the "Fund") and recognize the trust and confidence that you have demonstrated in the Ares Management Corporation ("Ares") platform through your investment in ARDC.

In the first six months of 2023, the Ares management team at ARDC employed a thoughtful and disciplined approach to navigating the uncertainty in the capital markets by seeking to reduce the risk in the portfolio while also positioning the Fund to have the opportunity to benefit from higher market rates. This letter provides our assessment of the market environment, our portfolio strategy and future investment opportunities for ARDC.

Economic Conditions and Market Update

After experiencing significant volatility in 2022, asset prices in the broader capital markets rallied in the first half of 2023 as inflation eased and the Federal Reserve (the "Fed") appeared to be near the end of its historic monetary tightening cycle. Despite the broader firming of the capital markets during 2023, periods of short-lived volatility complicated the first half of the year, including, for example, the regional banking crisis and the U.S. government debt ceiling standoff. However, the impacts of these events have been largely offset by progress toward a possible "soft landing" of the economy.

As mentioned, the Fed has continued its tightening regime, increasing the Federal Funds target rate in the first half of the year by an additional 75 basis points (bps) to 5.25%.1 The continued expansion of market rates resulted in tepid new issuance volumes as the disparity between issuer expectations and required market rates continued to impact activity levels. Specifically, in the leveraged loan and high yield bond markets, respectively, new issuance loan volume declined 41% year-over-year in the first half of 2023,2 and high yield bond transaction volumes in the first half of 2023 were among the slowest since 2009. While new deal activity remained below historical levels, overall credit quality remained strong, supported by healthy corporate earnings and stable overall labor markets. Default rates for leverage loans and high yield bonds ended the first half of 2023 at 1.64% and 2.41%, respectively, below their respective long-term historical averages.3 Against this more positive market tone, high yield bonds, leveraged loans and the S&P 500 delivered total returns of 5.42%,4 6.33%5 and 16.88%,6 respectively.

Consistent with the broader credit markets, collateralized loan obligations ("CLOs") experienced slow new issuance volumes, but compelling performance, in the first six months of 2023. U.S. new CLO issuance volume of $55.7 billion across 129 deals during the first half of 2023 decreased 24% over the same period last year,7 reflecting the low supply of newly issued leveraged loans. With respect to performance, CLOs outperformed similarly rated assets with BB CLOs generating total returns of 8.44% in the first half of the year.8

Looking forward, while many market participants are taking the view that the economy remains resilient amid declining inflation and a robust job market, the underlying inflation and recession dynamic still indicates a risk of further volatility in the second half of 2023. Loan and high yield default rates could increase toward their historical averages (or higher) given the level of market rates and the Fed's continued efforts to slow the economy. As we look to the months ahead, we anticipate increased dispersion in credit fundamentals and remain acutely focused on security selection both in seeking to outperform against the upcoming default cycle, as well as to avoid the significant downdraft in price and liquidity that we have seen when a company misses forecasted earnings.9

Portfolio Positioning and Performance

With respect to our portfolio positioning, our overarching focus over the first six months of the year was to continue to reduce risk in the portfolio by moving towards higher quality, shorter dated investments. This enabled us to benefit from higher market rates, while reducing the risk associated with the inverted yield curve. ARDC ended the first half of the year with 42.2% of the portfolio in first lien loans and bonds, an increase from 31.6% as of December 31, 2022, and maintained over half of our portfolio in BB or higher rated investments.

Since one of our 2023 goals is to further reduce the already low duration of our portfolio, we increased our portfolio's allocation to loans from 18.6% at year-end 2022 to 30.9% as of June 30, 2023, and decreased our portfolio's allocation to corporate bonds from 51.3% at year-end 2022 to 42.0% as of June 30, 2023. We also reduced the duration of our bond portfolio to an effective duration that is 19% lower than the broader high yield index as of June 30, 2023.10 As a result of these actions, the effective duration of the entire portfolio decreased by 27% to 1.28 as of June 30, 2023.

As it relates to our positioning in CLOs, we maintained a relatively consistent allocation to CLO debt and equity throughout the first half of 2023. We remain constructive on this asset class as we believe the non-mark-to- market nature of CLO

Semi-Annual Report 2023

1

Ares Dynamic Credit Allocation Fund, Inc.

Letter to Shareholders (continued)

As of June 30, 2023

capital structures, active credit management, conservative leverage, and flexibility to capture value during periods of loan market dislocations should ultimately be accretive to returns for our investors. Furthermore, we believe CLOs offer attractive risk adjusted returns with materially higher spreads for comparable ratings. For example, BB-rated CLO debt offers over 400 bps of yield premium for similarly rated loans.11 Underpinning our positive view of the opportunity are our deep credit capabilities and experience managing these assets, which includes the tracking of every loan held within every CLO the Fund holds on a daily basis.

We believe ARDC is well positioned in this environment due to our strategy of maintaining a highly diversified portfolio with low duration. Reflecting this disciplined approach to risk management, our portfolio is diversified across 228 issuers and 23 industries. The average position size across ARDC is 0.4% and the largest position is 1.4%.12 As a testament to our strong underwriting, we have incurred no defaults across our loan, high yield and CLO securities since COVID-19 began in 2020.13

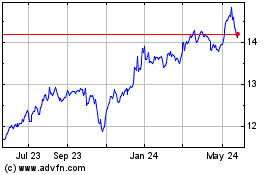

Supported by ARDC's positioning and our portfolio investment allocations, ARDC's performance remained strong through the first six months of 2023. ARDC's market-price based total returns of 12.25% compared favorably to our peer set median of 8.18%,14 and ARDC's net investment total returns of 8.09% were also higher than the peer set median of 7.04%.15 Over longer time horizons, including the past one, three and five years ended June 30, 2023, ARDC has outperformed the peer set median based on both market and net investment total returns.14,15

Looking Ahead

As we look ahead into the second half of 2023, we are continuing to closely monitor macroeconomic conditions and proactively manage exposures to identify relative value opportunities created by shifts in sentiment on rates, growth expectations, and idiosyncratic credit news. We believe ARDC is well positioned in this environment as we continue to leverage the strengths of the Ares platform, including our tenured portfolio managers and quantitative risk team, to remain active and tactical in our rotation among asset classes, sectors and specific credits.

We appreciate the trust and confidence you have demonstrated in Ares through your investment in ARDC. We thank you again for your continued support.

Best Regards,

Ares Capital Management II LLC

Ares Dynamic Credit Allocation Fund, Inc.

ARDC is a closed-end fund that trades on the New York Stock Exchange under the symbol "ARDC" and is externally managed by Ares Capital Management II LLC (the "Adviser"), a subsidiary of Ares. ARDC's investment objective is to provide an attractive level of total return, primarily through current income and, secondarily, through capital appreciation by investing in a broad, dynamically-managed portfolio of below investment grade senior secured loans, high yield corporate bonds and collateralized loan obligation securities. Thank you again for your continued support of ARDC. If you have any questions about the Fund, please call 1-877-855-3434, or visit the Fund's website at www.arespublicfunds.com.

Note: The opinions of the Adviser expressed herein are subject to change without notice. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed. This communication is distributed for informational purposes only and should not be considered investment advice or an offer of any security for sale. This material may contain "forward-looking" information that is not purely historical in nature. No representations are made as to the accuracy of such information or that such information will be realized. Actual events or conditions are unlikely to be consistent with, and may differ materially from, those assumed. Past performance is not indicative of future results. Ares does not undertake any obligation to publicly update or review any forward-looking information, whether as a result of new information, future developments or otherwise, except as required by law.

Indices are provided for illustrative purposes only and not indicative of any investment. They have not been selected to represent appropriate benchmarks or targets for ARDC. Rather, the indices shown are provided solely to illustrate the performance of well-known and widely recognized indices. Any comparisons herein of the investment performance of ARDC to an index are qualified as follows: (i) the volatility of such index will likely be materially different from that of ARDC; (ii) such index will, in many cases, employ different investment guidelines and criteria than ARDC and, therefore, holdings in ARDC will differ significantly from holdings of the securities that comprise such index and ARDC may invest in different asset classes altogether from the illustrative index, which may materially impact the performance of ARDC relative to the index; and (iii) the performance of such index is disclosed solely to allow for comparison on ARDC's performance to that of a well-known index. Comparisons to indices have limitations because indices have risk profiles, volatility, asset composition and other material characteristics that will differ from ARDC. The indices do not reflect the deduction of fees or expenses. You cannot invest directly in an index. No representation is being made as to the risk profile of any benchmark or index relative to the risk profile of ARDC. There can be no assurance that the future performance of any specific investment, or product will be profitable, equal any corresponding indicated historical performance, or be suitable for a portfolio.

This may contain information sourced from Bank of America, used with permission. Bank of America's Global Research division's fixed income index platform is licensing the ICE BofA Indices and related data "as is," makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or any data included in, related to, or derived therefrom, assumes no liability in connection with their use and does not sponsor, endorse, or recommend Ares, or any of its products or services.

Semi-Annual Report 2023

2

Ares Dynamic Credit Allocation Fund, Inc.

Letter to Shareholders (continued)

As of June 30, 2023

The ICE BofA US High Yield Index ("H0A0") tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. Qualifying securities must have a below investment grade rating (based on an average of Moody's, S&P and Fitch), at least 18 months to final maturity at the time of issuance, at least one-year remaining term to final maturity as of the rebalancing date, a fixed coupon schedule and a minimum amount outstanding of $100 million. Index constituents are capitalization-weighted based on their current amount outstanding times the market price plus accrued interest. Accrued interest is calculated assuming next-day settlement. Cash flows from bond payments that are received during the month are retained in the index until the end of the month and then are removed as part of the rebalancing. Cash does not earn any reinvestment income while it is held in the index. The index is rebalanced on the last calendar day of the month, based on information available up to and including the third business day before the last business day of the month. No changes are made to constituent holdings other than on month end rebalancing dates. Inception date: August 31, 1986.

The Morningstar LSTA US Leveraged Loan Index is a market-value weighted index designed to measure the performance of the US leveraged loan market. The index was launched on December 31, 2000, with backtested performance available from December 31, 1996. The index was calculated on a monthly basis from January 1, 1997 until December 31, 1998. From January 1, 1999 until March 30, 2007 it was calculated on a weekly basis. Since March 30, 2007 it has been calculated daily.

REF: TC- 03456

1 Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate and Federal Funds Target Range — Upper Limit, retrieved from FRED, Federal Reserve Bank of St. Louis, June 30, 2023.

2 S&P Global, LCD Quarterly Review, Second Quarter 2023.

3 J.P. Morgan Default Monitor, July 5, 2023. Represents the par weighted default rate for the respective asset classes. Historical averages based on the 25-year average default rate for high yield bonds and leveraged loans of 3.0% and 2.9%, respectively.

4 Measured by the ICE BofA High Yield Master II Index ("H0A0").

5 Measured by the Credit Suisse Leveraged Loan Index ("CSLLI").

6 Bloomberg as of June 30, 2023.

7 J.P. Morgan CLO Issuance Package as of June 30, 2023.

8 J.P. Morgan CLOIE Monitor as of June 30, 2023.

9 Projections and forward looking statements are not reliable indicators of future events and no guarantee or assurance is given that such activities will occur as expected or at all.

10 As of June 30, 2023. Represented by the ICE BofA High Yield Master II Index ("H0A0").

11 J.P. Morgan CLOIE Monitor and Morningstar LSTA US Leveraged Loan Index Factsheet as of June 30, 2023.

12 As of June 30, 2023. Diversification does not assure profit or protect against market loss.

13 Not all of the effects, directly or indirectly, resulting from COVID-19 and/or the current market environment may be reflected herein. The full impact of COVID-19 and its ultimate potential effects on portfolio company performance and valuations is particularly uncertain and difficult to predict.

14 Market price-based total returns reflect annualized stock-based total returns assuming dividend reinvestment. Peer set includes the following closed end funds: ACP, AIF, BGB, BGH, DHF, DSU, GHY, HFRO, HNW and KIO. Past performance is not indicative of future results.

15 Net investment total returns reflect annualized NAV-based total returns assuming dividend reinvestment. Peer set includes the following closed end funds: ACP, AIF, BGB, BGH, DHF, DSU, GHY, HFRO, HNW and KIO. Past performance is not indicative of future results.

Semi-Annual Report 2023

3

Ares Dynamic Credit Allocation Fund, Inc.

Fund Profile & Financial Data

June 2023

Fund Highlights as of 6.30.23

|

Weighted Average Floating Coupon1 |

|

|

8.98 |

% |

|

|

Weighted Average Bond Coupon2 |

|

|

7.08 |

% |

|

|

Distribution Rate3 |

|

|

10.95 |

% |

|

|

Monthly Dividend Per Share4 |

|

$ |

0.1125 |

|

|

1 The weighted-average gross interest rate on the pool of loans as of June 30, 2023.

2 The weighted-average gross interest rate on the pool of bonds at the time the securities were issued.

3 Dividend per share annualized and divided by the June 30, 2023 market price per share. The distribution rate alone is not indicative of Fund performance.

4 Represents the Fund's June 2023 dividend of $0.1125 per share, which was comprised of net investment income. To the extent that any portion of the current distributions were estimated to be sourced from something other than income, such as return of capital, the source would have been disclosed in a Section 19(a) Notice located under the "Investor Documents" section of the Fund's website. Please note that distribution classifications are preliminary and certain distributions may be re-classified at year end. Please refer to year-end tax documents for the final classifications of the Fund's distributions for a given year.

Top 10 Holdings5 as of 6.30.23

|

Caesars Entertainment Inc |

|

|

1.38 |

% |

|

|

Uber |

|

|

1.28 |

% |

|

|

Power Solutions |

|

|

1.22 |

% |

|

|

Chart Industries |

|

|

1.10 |

% |

|

|

Sprint |

|

|

1.06 |

% |

|

|

Internet Brands |

|

|

1.02 |

% |

|

|

Ford Motor Credit Company |

|

|

0.97 |

% |

|

|

AMF Bowlmor |

|

|

0.95 |

% |

|

|

HCA Healthcare Inc |

|

|

0.95 |

% |

|

|

Williams Cos Inc/The |

|

|

0.92 |

% |

|

5 Market value percentage may represent multiple instruments by the named issuer and/or multiple issuers being consolidated to the extent they are owned by the same parent company. These values may be different than the issuer concentrations in certain regulatory filings.

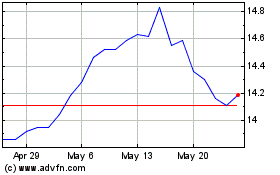

Performance as of 6.30.23

|

|

|

ARDC

NAV |

|

ARDC

Market |

|

|

1 Month |

|

|

2.07 |

% |

|

|

5.53 |

% |

|

|

Year to Date |

|

|

8.09 |

% |

|

|

12.25 |

% |

|

|

3 Years |

|

|

7.12 |

% |

|

|

10.43 |

% |

|

|

5 Years |

|

|

2.98 |

% |

|

|

3.59 |

% |

|

|

Since Inception* |

|

|

4.63 |

% |

|

|

3.98 |

% |

|

* Since Inception of fund (11/27/2012).

Source: Ares

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The NAV total return takes into account the Fund's total annual expenses and does not reflect transaction charges. If transaction charges were reflected, NAV total return would be reduced. Since Inception returns assume a purchase of common shares at the initial offering price of $20.00 per share for market price returns or initial net asset value (NAV) of $19.10 per share for NAV returns. Returns for periods of less than one year are not annualized. All distributions are assumed to be reinvested either in accordance with the dividend reinvestment plan (DRIP) for market price returns or NAV for NAV returns.

Current Portfolio Mix as of 6.30.23

55.3% Floating Rate

This data is subject to change on a daily basis. As of 6.30.23, the Fund held a negative traded cash balance of -2.2%.

Industry Allocation6 as of 6.30.23

6 Credit Suisse industry classifications weighted by market value. These values may be different than industry classifications in certain regulatory filings.

Semi-Annual Report 2023

4

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments

June 30, 2023 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans 50.4%(b)(c)(d)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Automobiles & Components 1.8% |

|

Clarios Global, LP, 1st Lien Term Loan,

1M SOFR + 3.75%, 8.85%, 05/06/2030 |

|

$ |

2,813 |

|

|

$ |

2,803 |

|

|

Wand Newco 3, Inc., 1st Lien Term Loan,

1M LIBOR + 2.75%, 7.94%,

02/05/2026(e) |

|

|

2,996 |

|

|

|

2,967 |

|

|

|

|

|

|

|

|

5,770 |

|

|

|

Capital Goods 5.0% |

|

Chart Industries, Inc., 1st Lien

Term Loan, 1M SOFR + 3.75%,

8.94%, 03/15/2030(e) |

|

|

4,391 |

|

|

|

4,378 |

|

|

Gates Global, LLC, 1st Lien Term Loan,

1M SOFR + 3.50%, 8.60%, 11/16/2029 |

|

|

2,978 |

|

|

|

2,975 |

|

|

Pike Corp., 1st Lien Term Loan,

1M SOFR + 3.00%, 8.22%, 01/21/2028 |

|

|

2,500 |

|

|

|

2,487 |

|

|

Pike Corp., 1st Lien Term Loan,

1M SOFR + 3.50%, 8.60%, 01/21/2028 |

|

|

1,492 |

|

|

|

1,491 |

|

|

Traverse Midstream Partners, LLC,

1st Lien Term Loan, 1M LIBOR + 3.75%,

8.94%, 02/16/2028 |

|

|

2,791 |

|

|

|

2,774 |

|

|

Tutor Perini Corp., 1st Lien Term Loan,

3M SOFR + 4.75%, 10.25%, 08/18/2027 |

|

|

1,745 |

|

|

|

1,562 |

|

|

|

|

|

|

|

|

15,667 |

|

|

|

Commercial & Professional Services 1.5% |

|

Eagle Parent Corp., 1st Lien Term Loan,

3M SOFR + 4.25%, 9.49%, 04/02/2029 |

|

|

3,022 |

|

|

|

2,941 |

|

|

GFL Environmental, Inc., 1st Lien

Term Loan (Canada), 1M SOFR + 3.00%,

8.15%, 05/31/2027 |

|

|

1,849 |

|

|

|

1,848 |

|

|

|

|

|

|

|

|

4,789 |

|

|

|

Consumer Durables & Apparel 1.9% |

|

Hanesbrands, Inc., 1st Lien Term Loan,

1M SOFR + 3.75%, 8.85%, 03/08/2030(f) |

|

|

2,534 |

|

|

|

2,540 |

|

|

Topgolf Callaway Brands Corp.,

1st Lien Term Loan, 1M SOFR + 3.50%,

8.70%, 03/15/2030 |

|

|

3,491 |

|

|

|

3,486 |

|

|

|

|

|

|

|

|

6,026 |

|

|

|

Consumer Services 8.4% |

|

Belfor Holdings, Inc., 1st Lien Term Loan,

04/06/2026(e)(f) |

|

|

421 |

|

|

|

421 |

|

|

Belfor Holdings, Inc., 1st Lien Term Loan,

1M LIBOR + 4.00%, 9.22%, 04/06/2026 |

|

|

994 |

|

|

|

991 |

|

|

Senior Loans(b)(c)(d) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Belron Finance US, LLC, 1st Lien

Term Loan, 3M SOFR + 2.75%,

7.83%, 04/18/2029(e) |

|

$ |

2,230 |

|

|

$ |

2,229 |

|

|

Equinox Holdings, Inc., 1st Lien

Term Loan, 3M LIBOR + 9.00%,

14.73%, 03/08/2024 |

|

|

1,971 |

|

|

|

1,823 |

|

|

Fertitta Entertainment, LLC, 1st Lien

Term Loan, 1M SOFR + 4.00%,

9.10%, 01/27/2029 |

|

|

1,234 |

|

|

|

1,217 |

|

|

Global Education Management Systems

Establishment, 1st Lien Term Loan

(Cayman Islands), 3M SOFR + 5.00%,

10.53%, 07/31/2026 |

|

|

3,517 |

|

|

|

3,518 |

|

|

Raptor Acquisition Corp., 1st Lien

Term Loan (Canada), 3M LIBOR + 4.00%,

9.52%, 11/01/2026 |

|

|

3,744 |

|

|

|

3,728 |

|

|

IRB Holding Corp., 1st Lien Term Loan,

1M SOFR + 3.00%, 8.20%, 12/15/2027 |

|

|

726 |

|

|

|

721 |

|

|

Kingpin Intermediate Holdings, LLC,

1st Lien Term Loan, 1M SOFR + 3.50%,

8.65%, 02/08/2028(e) |

|

|

4,946 |

|

|

|

4,907 |

|

|

Penn Entertainment, Inc., 1st Lien

Term Loan, 1M SOFR + 2.75%,

7.95%, 05/03/2029 |

|

|

2,985 |

|

|

|

2,973 |

|

|

Whatabrands, LLC, 1st Lien Term Loan,

1M LIBOR + 3.25%, 8.47%, 08/03/2028 |

|

|

2,481 |

|

|

|

2,463 |

|

|

Wyndham Hotels and Resorts, Inc.,

1st Lien Term Loan, 1M SOFR + 1.75%,

6.95%, 04/08/2027(f) |

|

|

1,479 |

|

|

|

1,457 |

|

|

|

|

|

|

|

|

26,448 |

|

|

|

Energy 1.5% |

|

Gulf Finance, LLC, 1st Lien Term Loan,

1M SOFR + 6.75%, 12.00%, 08/25/2026 |

|

|

2,985 |

|

|

|

2,895 |

|

|

Whitewater Whistler Holdings, LLC,

1st Lien Term Loan, 3M SOFR + 3.25%,

8.15%, 02/15/2030 |

|

|

1,750 |

|

|

|

1,747 |

|

|

|

|

|

|

|

|

4,642 |

|

|

|

Financial Services 1.9% |

|

Axalta Coating Systems Dutch

Holding B B.V., 1st Lien Term Loan,

(Netherlands), 3M SOFR + 3.00%,

8.24%, 12/20/2029 |

|

|

1,384 |

|

|

|

1,385 |

|

|

Focus Financial Partners, LLC, 1st Lien

Term Loan, 06/30/2028(e) |

|

|

2,285 |

|

|

|

2,268 |

|

|

Motion Acquisition Ltd., 1st Lien

Term Loan (Great Britain), 11/12/2026(e) |

|

|

312 |

|

|

|

309 |

|

|

Semi-Annual Report 2023

5

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2023 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Motion Acquisition Ltd., 1st Lien

Term Loan (Great Britain), 3M LIBOR +

3.25%, 8.79%, 11/12/2026(e) |

|

$ |

2,188 |

|

|

$ |

2,167 |

|

|

|

|

|

|

|

|

6,129 |

|

|

|

Food & Beverage 3.3% |

|

Chobani, LLC, 1st Lien Term Loan,

1M SOFR + 3.50%, 8.72%, 10/25/2027 |

|

|

2,977 |

|

|

|

2,957 |

|

|

Froneri Lux Finco SARL, 1st Lien

Term Loan (Luxembourg), 6M EURIBOR +

2.13%, 5.07%, 01/29/2027 |

|

€ |

3,000 |

|

|

|

3,181 |

|

|

Quirch Foods Holdings, LLC, 1st Lien

Term Loan, 1M SOFR + 4.75%,

9.99%, 10/27/2027 |

|

$ |

2,977 |

|

|

|

2,832 |

|

|

Woof Holdings, Inc., 2nd Lien Term Loan,

3M LIBOR + 7.25%, 12.42%, 12/21/2028 |

|

|

1,635 |

|

|

|

1,308 |

|

|

|

|

|

|

|

|

10,278 |

|

|

|

Healthcare Equipment & Services 3.9% |

|

Bausch + Lomb Corp., 1st Lien

Term Loan (Canada), 3M SOFR + 3.25%,

8.59%, 05/10/2027 |

|

|

2,476 |

|

|

|

2,399 |

|

|

Ensemble RCM, LLC, 1st Lien Term Loan,

08/03/2026(e) |

|

|

1,300 |

|

|

|

1,298 |

|

|

Fortrea Holdings, Inc., 1st Lien Term Loan,

06/12/2030(e) |

|

|

600 |

|

|

|

600 |

|

|

Mamba Purchaser, Inc., 2nd Lien

Term Loan, 1M LIBOR + 6.50%,

11.65%, 10/15/2029 |

|

|

2,796 |

|

|

|

2,629 |

|

|

Medline Borrower, LP, 1st Lien Term Loan,

1M SOFR + 3.25%, 8.35%, 10/23/2028 |

|

|

2,494 |

|

|

|

2,463 |

|

|

Sotera Health Holdings, LLC, 1st Lien

Term Loan, 3M LIBOR + 2.75%,

8.02%, 12/11/2026 |

|

|

3,000 |

|

|

|

2,949 |

|

|

|

|

|

|

|

|

12,338 |

|

|

|

Household & Personal Products 0.9% |

|

Sunshine Luxembourg VII SARL, 1st Lien

Term Loan (Luxembourg), 10/01/2026(e) |

|

|

3,000 |

|

|

|

2,980 |

|

|

|

Insurance 1.4% |

|

HUB International, Ltd., 1st Lien

Term Loan, 06/20/2030(e) |

|

|

4,530 |

|

|

|

4,538 |

|

|

|

Materials 1.8% |

|

Ineos US Finance, LLC, 1st Lien

Term Loan, 1M EURIBOR + 4.00%,

7.42%, 11/08/2027 |

|

€ |

1,102 |

|

|

|

1,182 |

|

|

Senior Loans(b)(c)(d) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Ineos US Finance, LLC, 1st Lien

Term Loan, 3M SOFR + 3.50%,

8.70%, 02/18/2030 |

|

$ |

1,500 |

|

|

$ |

1,490 |

|

|

Starfruit Finco B.V., 1st Lien Term Loan

(Netherlands), 3M SOFR + 4.00%,

8.99%, 04/03/2028 |

|

|

1,000 |

|

|

|

990 |

|

|

Starfruit Finco B.V., 1st Lien Term Loan

(Netherlands), 3M SOFR + 2.75%,

7.90%, 10/01/2025 |

|

|

2,064 |

|

|

|

2,062 |

|

|

|

|

|

|

|

|

5,724 |

|

|

|

Media & Entertainment 3.3% |

|

Creative Artists Agency, LLC, 1st Lien

Term Loan, 1M SOFR + 3.50%,

8.60%, 11/27/2028 |

|

|

3,327 |

|

|

|

3,316 |

|

|

Formula One Management Ltd., 1st Lien

Term Loan (Great Britain), 1M SOFR +

3.00%, 8.10%, 01/15/2030 |

|

|

2,000 |

|

|

|

1,999 |

|

|

Lamar Media Corp., 1st Lien Term Loan,

1M LIBOR + 1.50%, 6.69%, 02/05/2027 |

|

|

1,035 |

|

|

|

1,012 |

|

|

Univision Communications, Inc., 1st Lien

Term Loan, 3M SOFR + 4.25%,

9.49%, 06/24/2029 |

|

|

992 |

|

|

|

988 |

|

|

William Morris Endeavor Entertainment,

LLC, 1st Lien Term Loan, 1M LIBOR +

2.75%, 7.95%, 05/18/2025 |

|

|

2,980 |

|

|

|

2,970 |

|

|

|

|

|

|

|

|

10,285 |

|

|

|

Pharmaceuticals, Biotechnology & Life Sciences 0.9% |

|

Precision Medicine Group, LLC, 1st Lien

Term Loan, 3M SOFR + 3.00%,

8.34%, 11/18/2027(f) |

|

|

2,992 |

|

|

|

2,865 |

|

|

|

Software & Services 7.4% |

|

Asurion, LLC, 1st Lien Term Loan,

1M SOFR + 4.00%, 9.20%, 08/19/2028 |

|

|

3,474 |

|

|

|

3,284 |

|

|

Asurion, LLC, 1st Lien Term Loan,

1M SOFR + 4.25%, 9.45%, 08/19/2028 |

|

|

998 |

|

|

|

947 |

|

|

Byju's Alpha, Inc., 1st Lien Term Loan,

3M LIBOR + 8.00%, 12.93%, 11/24/2026 |

|

|

1,158 |

|

|

|

722 |

|

|

CDK Global Inc., 1st Lien Term Loan,

3M SOFR + 4.25%, 9.49%, 07/06/2029 |

|

|

2,608 |

|

|

|

2,599 |

|

|

Ivanti Software, Inc., 1st Lien

Revolving Loan, PRIME + 2.75%,

11.00%, 12/01/2025(f)(g) |

|

|

250 |

|

|

|

— |

|

|

MH Sub I, LLC, 1st Lien Term Loan,

1M SOFR + 4.25%, 9.40%, 05/03/2028 |

|

|

5,500 |

|

|

|

5,269 |

|

|

Semi-Annual Report 2023

6

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2023 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Senior Loans(b)(c)(d) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Open Text Corp., 1st Lien Term Loan

(Canada), 1M SOFR + 3.25%,

8.75%, 01/31/2030 |

|

$ |

4,030 |

|

|

$ |

4,046 |

|

|

Proofpoint, Inc., 2nd Lien Term Loan,

3M SOFR + 6.25%,

11.40%, 08/31/2029(f) |

|

|

3,000 |

|

|

|

3,000 |

|

|

Quartz Acquireco, LLC, 1st Lien

Term Loan, 04/14/2030(e)(f) |

|

|

2,500 |

|

|

|

2,497 |

|

|

Quest Software US Holdings, Inc.,

1st Lien Term Loan, 3M SOFR + 4.25%,

9.45%, 02/01/2029(e) |

|

|

925 |

|

|

|

715 |

|

|

Quest Software US Holdings, Inc.,

2nd Lien Term Loan, 3M SOFR + 7.50%,

12.70%, 02/01/2030 |

|

|

659 |

|

|

|

431 |

|

|

|

|

|

|

|

|

23,510 |

|

|

|

Technology Hardware & Equipment 0.7% |

|

Emerald Debt Merger Sub, LLC, 1st Lien

Term Loan, 3M SOFR + 3.00%,

8.26%, 05/31/2030(e) |

|

|

2,276 |

|

|

|

2,273 |

|

|

|

Telecommunication Services 0.9% |

|

Lumen Technologies, Inc., 1st Lien

Term Loan, 1M SOFR + 2.00%,

7.22%, 01/31/2025 |

|

|

2,912 |

|

|

|

2,768 |

|

|

|

Transportation 2.9% |

|

AAdvantage Loyality IP Ltd., 1st Lien

Term Loan, 3M LIBOR + 4.75%,

10.00%, 04/20/2028 |

|

|

3,846 |

|

|

|

3,923 |

|

|

Apple Bidco, LLC, 1st Lien Term Loan,

1M SOFR + 4.00%, 9.10%, 09/22/2028 |

|

|

2,244 |

|

|

|

2,231 |

|

|

SkyMiles IP, Ltd., 1st Lien Term Loan,

3M SOFR + 3.75%, 8.80%, 10/20/2027 |

|

|

1,800 |

|

|

|

1,868 |

|

|

Uber Technologies, Inc., 1st Lien

Term Loan, 3M SOFR + 2.75%,

8.03%, 03/03/2030 |

|

|

995 |

|

|

|

994 |

|

|

|

|

|

|

|

|

9,016 |

|

|

|

Utilities 1.0% |

|

CQP Holdco, LP, 1st Lien Term Loan,

3M LIBOR + 3.75%, 8.66%, 06/05/2028 |

|

|

3,283 |

|

|

|

3,275 |

|

|

Total Senior Loans

(Cost: $160,261) |

|

|

|

|

159,321 |

|

|

Corporate Bonds 68.5%

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Automobiles & Components 1.1% |

|

|

Clarios Global, LP, 6.75%, 05/15/2025(d) |

|

$ |

2,000 |

|

|

$ |

2,001 |

|

|

|

Clarios Global, LP, 8.50%, 05/15/2027(d) |

|

|

1,500 |

|

|

|

1,503 |

|

|

|

|

|

|

|

|

3,504 |

|

|

|

Capital Goods 3.9% |

|

Chart Industries, Inc.,

7.50%, 01/01/2030(d) |

|

|

1,000 |

|

|

|

1,020 |

|

|

Chart Industries, Inc.,

9.50%, 01/01/2031(d) |

|

|

250 |

|

|

|

265 |

|

|

CP Atlas Buyer, Inc.,

7.00%, 12/01/2028(d) |

|

|

2,500 |

|

|

|

1,963 |

|

|

Specialty Building Products Holdings, LLC,

6.38%, 09/30/2026(d) |

|

|

3,000 |

|

|

|

2,834 |

|

|

|

Tutor Perini Corp., 6.88%, 05/01/2025(d) |

|

|

1,000 |

|

|

|

829 |

|

|

United Rentals North America, Inc.,

6.00%, 12/15/2029(d) |

|

|

2,791 |

|

|

|

2,784 |

|

|

VistaJet Malta Finance PLC, (Switzerland),

6.38%, 02/01/2030(d) |

|

|

2,000 |

|

|

|

1,611 |

|

|

VistaJet Malta Finance PLC, (Switzerland),

9.50%, 06/01/2028(d) |

|

|

1,000 |

|

|

|

919 |

|

|

|

|

|

|

|

|

12,225 |

|

|

|

Commercial & Professional Services 0.5% |

|

Clean Harbors, Inc.,

6.38%, 02/01/2031(d) |

|

|

1,600 |

|

|

|

1,610 |

|

|

|

Consumer Discretionary Distribution & Retail 1.5% |

|

Bath & Body Works, Inc.,

6.63%, 10/01/2030(d) |

|

|

1,000 |

|

|

|

966 |

|

|

Bath & Body Works, Inc.,

9.38%, 07/01/2025(d) |

|

|

1,151 |

|

|

|

1,222 |

|

|

Constellation Automotive Financing PLC,

(Great Britain), 4.88%, 07/15/2027 |

|

£ |

2,500 |

|

|

|

2,428 |

|

|

|

|

|

|

|

|

4,616 |

|

|

|

Consumer Services 11.4% |

|

Caesars Entertainment, Inc.,

6.25%, 07/01/2025(d) |

|

$ |

3,250 |

|

|

|

3,235 |

|

|

Caesars Entertainment, Inc.,

8.13%, 07/01/2027(d) |

|

|

2,773 |

|

|

|

2,837 |

|

|

Caesars Resort Collection, LLC,

5.75%, 07/01/2025(d) |

|

|

1,000 |

|

|

|

1,012 |

|

|

Gems Menasa Cayman, Ltd.,

(Cayman Islands), 7.13%, 07/31/2026(d) |

|

|

1,250 |

|

|

|

1,209 |

|

|

Semi-Annual Report 2023

7

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2023 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Corporate Bonds (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Golden Entertainment, Inc.,

7.63%, 04/15/2026(d) |

|

$ |

3,750 |

|

|

$ |

3,766 |

|

|

Hilton Domestic Operating Co., Inc.,

5.75%, 05/01/2028(d) |

|

|

3,500 |

|

|

|

3,446 |

|

|

International Game Technology PLC,

(Great Britain), 6.50%, 02/15/2025(d) |

|

|

2,861 |

|

|

|

2,861 |

|

|

|

IRB Holding Corp., 7.00%, 06/15/2025(d) |

|

|

1,173 |

|

|

|

1,179 |

|

|

Lottomatica SpA, (Italy),

7.13%, 06/01/2028(d) |

|

€ |

2,482 |

|

|

|

2,764 |

|

|

MGM Resorts International,

6.75%, 05/01/2025 |

|

$ |

4,000 |

|

|

|

4,010 |

|

|

Six Flags Theme Parks, Inc.,

7.00%, 07/01/2025(d) |

|

|

2,517 |

|

|

|

2,530 |

|

|

|

VICI Properties LP, 5.63%, 05/01/2024(d) |

|

|

888 |

|

|

|

883 |

|

|

|

VICI Properties LP, 5.75%, 02/01/2027(d) |

|

|

3,000 |

|

|

|

2,936 |

|

|

|

Viking Cruises Ltd., 9.13%, 07/15/2031(d) |

|

|

3,224 |

|

|

|

3,257 |

|

|

|

|

|

|

|

|

35,925 |

|

|

|

Consumer Staples Distribution & Retail 0.5% |

|

Albertsons Cos., Inc.,

7.50%, 03/15/2026(d) |

|

|

1,500 |

|

|

|

1,525 |

|

|

|

Energy 13.7% |

|

Antero Resources Corp.,

7.63%, 02/01/2029(d) |

|

|

2,222 |

|

|

|

2,254 |

|

|

Ascent Resources Utica Holdings, LLC,

8.25%, 12/31/2028(d)(h) |

|

|

2,501 |

|

|

|

2,459 |

|

|

Blue Racer Midstream, LLC,

6.63%, 07/15/2026(d) |

|

|

1,500 |

|

|

|

1,485 |

|

|

Blue Racer Midstream, LLC,

7.63%, 12/15/2025(d) |

|

|

2,000 |

|

|

|

2,022 |

|

|

Callon Petroleum Co.,

7.50%, 06/15/2030(d) |

|

|

1,000 |

|

|

|

944 |

|

|

Callon Petroleum Co.,

8.00%, 08/01/2028(d) |

|

|

1,000 |

|

|

|

989 |

|

|

Citgo Holding, Inc.,

9.25%, 08/01/2024(d) |

|

|

1,750 |

|

|

|

1,750 |

|

|

Citgo Petroleum Corp.,

7.00%, 06/15/2025(d) |

|

|

2,250 |

|

|

|

2,208 |

|

|

DCP Midstream Operating, LP,

8.13%, 08/16/2030 |

|

|

3,330 |

|

|

|

3,757 |

|

|

Enviva Partners, LP,

6.50%, 01/15/2026(d) |

|

|

2,500 |

|

|

|

1,969 |

|

|

EQM Midstream Partners, LP,

6.50%, 07/01/2027(d) |

|

|

750 |

|

|

|

740 |

|

|

Corporate Bonds (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

EQM Midstream Partners, LP,

6.50%, 07/15/2048 |

|

$ |

1,500 |

|

|

$ |

1,356 |

|

|

Moss Creek Resources Holdings, Inc.,

7.50%, 01/15/2026(d) |

|

|

1,284 |

|

|

|

1,179 |

|

|

Moss Creek Resources Holdings, Inc.,

10.50%, 05/15/2027(d) |

|

|

1,500 |

|

|

|

1,434 |

|

|

NGL Energy Operating, LLC,

7.50%, 02/01/2026(d) |

|

|

3,095 |

|

|

|

3,048 |

|

|

Occidental Petroleum Corp.,

8.88%, 07/15/2030 |

|

|

3,500 |

|

|

|

4,023 |

|

|

Tallgrass Energy Partners, LP,

7.50%, 10/01/2025(d) |

|

|

3,000 |

|

|

|

2,994 |

|

|

Transocean, Inc., (Cayman Islands),

6.80%, 03/15/2038 |

|

|

1,061 |

|

|

|

737 |

|

|

Transocean, Inc., (Cayman Islands),

8.75%, 02/15/2030(d) |

|

|

750 |

|

|

|

761 |

|

|

Transocean, Inc., (Cayman Islands),

11.50%, 01/30/2027(d) |

|

|

750 |

|

|

|

780 |

|

|

Western Midstream Operating, LP,

5.50%, 02/01/2050 |

|

|

2,125 |

|

|

|

1,740 |

|

|

|

Williams Cos., Inc., 8.75%, 03/15/2032 |

|

|

4,000 |

|

|

|

4,747 |

|

|

|

|

|

|

|

|

43,376 |

|

|

|

Equity Real Estate Investment Trusts (REITs) 1.7% |

|

Brookfield Property REIT, Inc.,

5.75%, 05/15/2026(d) |

|

|

2,500 |

|

|

|

2,290 |

|

|

Iron Mountain, Inc.,

5.63%, 07/15/2032(d) |

|

|

3,500 |

|

|

|

3,131 |

|

|

|

|

|

|

|

|

5,421 |

|

|

|

Financial Services 2.2% |

|

|

Ally Financial, Inc., 8.00%, 11/01/2031 |

|

|

2,000 |

|

|

|

2,074 |

|

|

Ford Motor Credit Co., LLC,

6.80%, 05/12/2028 |

|

|

2,500 |

|

|

|

2,504 |

|

|

Ford Motor Credit Co., LLC,

6.95%, 06/10/2026 |

|

|

1,000 |

|

|

|

1,006 |

|

|

Ford Motor Credit Co., LLC,

7.35%, 11/04/2027 |

|

|

1,465 |

|

|

|

1,497 |

|

|

|

|

|

|

|

|

7,081 |

|

|

|

Food & Beverage 0.3% |

|

|

Chobani LLC, Inc., 7.50%, 04/15/2025(d) |

|

|

1,000 |

|

|

|

995 |

|

|

|

Healthcare Equipment & Services 2.1% |

|

Fortrea Holdings, Inc.,

7.50%, 07/01/2030(d) |

|

|

1,667 |

|

|

|

1,706 |

|

|

Semi-Annual Report 2023

8

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2023 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Corporate Bonds (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

HCA, Inc., 7.69%, 06/15/2025 |

|

$ |

4,750 |

|

|

$ |

4,880 |

|

|

|

|

|

|

|

|

6,586 |

|

|

|

Materials 7.6% |

|

|

Avient Corp., 7.13%, 08/01/2030(d) |

|

|

1,500 |

|

|

|

1,513 |

|

|

Celanese US Holdings, LLC,

5.90%, 07/05/2024 |

|

|

1,500 |

|

|

|

1,497 |

|

|

Celanese US Holdings, LLC,

6.05%, 03/15/2025 |

|

|

1,500 |

|

|

|

1,494 |

|

|

Crown Cork & Seal Co., Inc.,

7.38%, 12/15/2026 |

|

|

4,350 |

|

|

|

4,498 |

|

|

First Quantum Minerals, Ltd., (Canada),

6.88%, 03/01/2026(d) |

|

|

1,250 |

|

|

|

1,230 |

|

|

First Quantum Minerals, Ltd., (Canada),

6.88%, 10/15/2027(d) |

|

|

2,500 |

|

|

|

2,439 |

|

|

Kobe US Midco 2, Inc.,

9.25%, 11/01/2026(d)(i) |

|

|

1,334 |

|

|

|

880 |

|

|

Owens-Brockway Glass Container, Inc.,

6.38%, 08/15/2025(d) |

|

|

3,000 |

|

|

|

3,007 |

|

|

Owens-Brockway Glass Container, Inc.,

6.63%, 05/13/2027(d) |

|

|

1,500 |

|

|

|

1,486 |

|

|

|

Sealed Air Corp., 6.13%, 02/01/2028(d) |

|

|

1,600 |

|

|

|

1,588 |

|

|

Summit Materials, LLC,

6.50%, 03/15/2027(d) |

|

|

2,750 |

|

|

|

2,733 |

|

|

Trident TPI Holdings, Inc.,

12.75%, 12/31/2028(d) |

|

|

1,500 |

|

|

|

1,556 |

|

|

|

|

|

|

|

|

23,921 |

|

|

|

Media & Entertainment 7.2% |

|

Altice Financing S.A., (Luxembourg),

5.75%, 08/15/2029(d) |

|

|

3,500 |

|

|

|

2,712 |

|

|

|

Belo Corp., 7.25%, 09/15/2027 |

|

|

3,250 |

|

|

|

3,120 |

|

|

|

CCO Holdings, LLC, 6.38%, 09/01/2029(d) |

|

|

4,000 |

|

|

|

3,768 |

|

|

|

CSC Holdings, LLC, 7.50%, 04/01/2028(d) |

|

|

2,500 |

|

|

|

1,425 |

|

|

Gray Television, Inc.,

7.00%, 05/15/2027(d) |

|

|

4,500 |

|

|

|

3,828 |

|

|

Live Nation Entertainment, Inc.,

6.50%, 05/15/2027(d) |

|

|

3,250 |

|

|

|

3,268 |

|

|

Nexstar Broadcasting Inc,

5.63%, 07/15/2027(d) |

|

|

2,000 |

|

|

|

1,865 |

|

|

Univision Communications, Inc.,

6.63%, 06/01/2027(d) |

|

|

1,500 |

|

|

|

1,450 |

|

|

Univision Communications, Inc.,

7.38%, 06/30/2030(d) |

|

|

1,500 |

|

|

|

1,428 |

|

|

|

|

|

|

|

|

22,864 |

|

|

Corporate Bonds (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Semiconductors & Semiconductor Equipment 0.8% |

|

Amkor Technology, Inc.,

6.63%, 09/15/2027(d) |

|

$ |

2,500 |

|

|

$ |

2,504 |

|

|

|

Software & Services 1.6% |

|

|

Leidos, Inc., 7.13%, 07/01/2032 |

|

|

2,500 |

|

|

|

2,628 |

|

|

|

Sabre GLBL, Inc., 7.38%, 09/01/2025(d) |

|

|

2,750 |

|

|

|

2,441 |

|

|

|

|

|

|

|

|

5,069 |

|

|

|

Technology Hardware & Equipment 1.6% |

|

Dell International, LLC,

6.02%, 06/15/2026 |

|

|

2,350 |

|

|

|

2,388 |

|

|

Dell International, LLC,

6.10%, 07/15/2027 |

|

|

1,500 |

|

|

|

1,545 |

|

|

Emerald Debt Merger Sub LLC,

6.38%, 12/15/2030(d) |

|

€ |

861 |

|

|

|

936 |

|

|

|

|

|

|

|

|

4,869 |

|

|

|

Telecommunication Services 5.8% |

|

Altice France Holding S.A., (Luxembourg),

10.50%, 05/15/2027(d) |

|

$ |

2,000 |

|

|

|

1,211 |

|

|

Altice France S.A., (France),

8.13%, 02/01/2027(d) |

|

|

500 |

|

|

|

431 |

|

|

|

AT&T, Inc., 3.50%, 06/01/2041 |

|

|

2,500 |

|

|

|

1,913 |

|

|

Connect Finco SARL, (Cayman Islands),

6.75%, 10/01/2026(d) |

|

|

2,450 |

|

|

|

2,380 |

|

|

Iliad Holding S.A.S, (France),

6.50%, 10/15/2026(d) |

|

|

3,000 |

|

|

|

2,832 |

|

|

Iliad Holding S.A.S, (France),

7.00%, 10/15/2028(d) |

|

|

1,000 |

|

|

|

922 |

|

|

Sable International Finance, Ltd.,

(Cayman Islands), 5.75%, 09/07/2027(d) |

|

|

2,500 |

|

|

|

2,337 |

|

|

|

Sprint, LLC, 7.63%, 03/01/2026 |

|

|

5,250 |

|

|

|

5,454 |

|

|

Telesat Canada, (Canada),

5.63%, 12/06/2026(d) |

|

|

1,000 |

|

|

|

617 |

|

|

Telesat Canada, (Canada),

6.50%, 10/15/2027(d) |

|

|

913 |

|

|

|

367 |

|

|

|

|

|

|

|

|

18,464 |

|

|

|

Transportation 4.2% |

|

AAdvantage Loyality IP Ltd.,

11.75%, 07/15/2025(d) |

|

|

750 |

|

|

|

822 |

|

|

|

GLP Capital, LP, 5.38%, 04/15/2026 |

|

|

3,000 |

|

|

|

2,937 |

|

|

Mileage Plus Holdings, LLC,

6.50%, 06/20/2027(d) |

|

|

4,000 |

|

|

|

4,009 |

|

|

Semi-Annual Report 2023

9

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2023 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Corporate Bonds (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Uber Technologies, Inc.,

7.50%, 05/15/2025(d) |

|

$ |

3,000 |

|

|

$ |

3,035 |

|

|

Uber Technologies, Inc.,

7.50%, 09/15/2027(d) |

|

|

1,000 |

|

|

|

1,023 |

|

|

Uber Technologies, Inc.,

8.00%, 11/01/2026(d) |

|

|

1,500 |

|

|

|

1,529 |

|

|

|

|

|

|

|

|

13,355 |

|

|

|

Utilities 0.8% |

|

Vistra Operations Co., LLC,

5.50%, 09/01/2026(d) |

|

|

2,000 |

|

|

|

1,924 |

|

|

Vistra Operations Co., LLC,

5.63%, 02/15/2027(d) |

|

|

750 |

|

|

|

719 |

|

|

|

|

|

|

|

|

2,643 |

|

|

Total Corporate Bonds

(Cost: $227,810) |

|

|

|

|

216,553 |

|

|

Collateralized Loan Obligations 47.7%(d)(f)

|

Collateralized Loan Obligations — Debt 34.4%(b)(c) |

|

AMMC CLO XI, Ltd., (Cayman Islands),

3M LIBOR + 5.80%,

11.10%, 04/30/2031 |

|

|

2,000 |

|

|

|

1,718 |

|

|

AMMC CLO XXII, Ltd., (Cayman Islands),

3M LIBOR + 5.50%, 10.76%, 04/25/2031 |

|

|

3,000 |

|

|

|

2,583 |

|

|

Atlas Senior Loan Fund VII, Ltd.,

(Cayman Islands), 3M LIBOR + 8.05%,

13.51%, 11/27/2031 |

|

|

775 |

|

|

|

430 |

|

|

Bain Capital Credit CLO, Ltd. 2017-2,

(Cayman Islands), 3M LIBOR + 6.86%,

12.12%, 07/25/2034 |

|

|

3,000 |

|

|

|

2,784 |

|

|

Bain Capital Credit CLO, Ltd. 2019-2,

(Cayman Islands), 3M LIBOR + 6.32%,

11.58%, 10/17/2032 |

|

|

2,500 |

|

|

|

2,198 |

|

|

Bain Capital Credit CLO, Ltd. 2019-4,

(Cayman Islands), 3M LIBOR + 7.99%,

13.07%, 04/23/2035 |

|

|

1,000 |

|

|

|

908 |

|

|

Bain Capital Credit CLO, Ltd. 2020-1,

(Cayman Islands), 3M LIBOR + 8.25%,

13.51%, 04/18/2033 |

|

|

3,000 |

|

|

|

2,895 |

|

|

Bain Capital Credit CLO, Ltd. 2021-5,

(Cayman Islands), 3M LIBOR + 6.50%,

11.77%, 10/23/2034 |

|

|

2,000 |

|

|

|

1,763 |

|

|

Barings CLO, Ltd. 2020-I,

(Cayman Islands), 3M LIBOR + 6.65%,

11.91%, 10/15/2036 |

|

|

1,000 |

|

|

|

918 |

|

|

Canyon Capital CLO, Ltd. 2018-1,

(Cayman Islands), 3M LIBOR + 5.75%,

11.01%, 07/15/2031 |

|

|

750 |

|

|

|

622 |

|

|

Collateralized Loan Obligations(d)(f) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Carlyle Global Market Strategies CLO,

Ltd. 2017-1, (Cayman Islands),

3M LIBOR + 6.00%, 11.25%, 04/20/2031 |

|

$ |

3,000 |

|

|

$ |

2,443 |

|

|

Carlyle US CLO, Ltd. 2021-10,

(Cayman Islands), 3M LIBOR + 6.50%,

11.75%, 10/20/2034 |

|

|

1,000 |

|

|

|

893 |

|

|

Cedar Funding CLO II, Ltd.,

(Cayman Islands), 3M LIBOR + 7.30%,

12.55%, 04/20/2034 |

|

|

1,750 |

|

|

|

1,613 |

|

|

CIFC Funding, Ltd. 2019-4A,

(Cayman Islands), 3M LIBOR + 6.60%,

11.86%, 10/15/2034 |

|

|

1,500 |

|

|

|

1,407 |

|

|

CIFC Funding, Ltd. 2021-VI,

(Cayman Islands), 3M LIBOR + 6.25%,

11.51%, 10/15/2034 |

|

|

2,000 |

|

|

|

1,814 |

|

|

CIFC Funding, Ltd. 2021-VII,

(Cayman Islands), 3M LIBOR + 6.35%,

11.62%, 01/23/2035 |

|

|

2,406 |

|

|

|

2,157 |

|

|

Crestline Denali CLO XIV, Ltd.,

(Cayman Islands), 3M LIBOR + 6.35%,

11.62%, 10/23/2031 |

|

|

2,000 |

|

|

|

1,607 |

|

|

Crestline Denali CLO XV, Ltd.,

(Cayman Islands), 3M LIBOR + 7.35%,

12.60%, 04/20/2030 |

|

|

3,875 |

|

|

|

2,626 |

|

|

Denali Capital CLO XII, Ltd.,

(Cayman Islands), 3M LIBOR + 5.90%,

11.16%, 04/15/2031 |

|

|

5,000 |

|

|

|

3,788 |

|

|

Dryden 26 Senior Loan Fund,

(Cayman Islands), 3M LIBOR + 5.54%,

10.80%, 04/15/2029 |

|

|

2,000 |

|

|

|

1,736 |

|

|

Dryden 40 Senior Loan Fund,

(Cayman Islands), 3M LIBOR + 5.75%,

11.07%, 08/15/2031 |

|

|

3,000 |

|

|

|

2,453 |

|

|

Dryden 45 Senior Loan Fund,

(Cayman Islands), 3M LIBOR + 5.85%,

11.11%, 10/15/2030 |

|

|

3,000 |

|

|

|

2,514 |

|

|

Dryden 85 CLO, Ltd., (Cayman Islands),

3M LIBOR + 6.50%, 11.76%, 10/15/2035 |

|

|

2,000 |

|

|

|

1,758 |

|

|

Elmwood CLO I, Ltd., (Cayman Islands),

3M LIBOR + 7.71%, 12.96%, 10/20/2033 |

|

|

3,000 |

|

|

|

2,959 |

|

|

Elmwood CLO II, Ltd., (Cayman Islands),

3M LIBOR + 6.80%, 12.05%, 04/20/2034 |

|

|

1,500 |

|

|

|

1,443 |

|

|

Elmwood CLO III, Ltd., (Cayman Islands),

3M LIBOR + 6.50%, 11.75%, 10/20/2034 |

|

|

1,750 |

|

|

|

1,665 |

|

|

Elmwood CLO VIII, Ltd., (Cayman Islands),

3M LIBOR + 6.00%, 11.25%, 01/20/2034 |

|

|

1,000 |

|

|

|

966 |

|

|

Elmwood CLO VIII, Ltd., (Cayman Islands),

3M LIBOR + 8.00%, 13.25%, 01/20/2034 |

|

|

1,000 |

|

|

|

852 |

|

|

Semi-Annual Report 2023

10

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2023 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Collateralized Loan Obligations(d)(f) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Elmwood CLO XX, Ltd., (Cayman Islands),

3M LIBOR + 8.55%, 13.54%, 10/17/2034 |

|

$ |

1,700 |

|

|

$ |

1,693 |

|

|

Generate CLO VIII, Ltd., (Cayman Islands),

3M LIBOR + 6.95%, 12.20%, 10/20/2034 |

|

|

1,000 |

|

|

|

943 |

|

|

Highbridge Loan Management, Ltd.

2014-4, (Cayman Islands), 3M LIBOR +

7.36%, 12.63%, 01/28/2030 |

|

|

2,000 |

|

|

|

1,535 |

|

|

ICG U.S. CLO, Ltd. 2018-2,

(Cayman Islands), 3M LIBOR + 5.75%,

11.02%, 07/22/2031 |

|

|

1,200 |

|

|

|

881 |

|

|

Invesco CLO, Ltd., (Cayman Islands),

3M LIBOR + 6.15%, 11.41%, 07/15/2034 |

|

|

1,000 |

|

|

|

900 |

|

|

LCM XVII, LP, (Cayman Islands),

3M LIBOR + 6.00%, 11.26%, 10/15/2031 |

|

|

3,750 |

|

|

|

2,710 |

|

|

LCM XXIII, Ltd., (Cayman Islands),

3M LIBOR + 7.05%, 12.30%, 10/20/2029 |

|

|

3,000 |

|

|

|

1,969 |

|

|

Madison Park Funding XIV, Ltd.,

(Cayman Islands), 3M LIBOR + 7.77%,

13.04%, 10/22/2030 |

|

|

2,500 |

|

|

|

1,945 |

|

|

Madison Park Funding XXVI, Ltd.,

(Cayman Islands), 3M LIBOR + 6.50%,

11.80%, 07/29/2030 |

|

|

1,500 |

|

|

|

1,410 |

|

|

Madison Park Funding XXVIII, Ltd.,

(Cayman Islands), 3M LIBOR + 7.60%,

12.86%, 07/15/2030 |

|

|

1,000 |

|

|

|

836 |

|

|

Madison Park Funding XXXII, Ltd.,

(Cayman Islands), 3M LIBOR + 6.20%,

11.47%, 01/22/2031 |

|

|

3,000 |

|

|

|

2,858 |

|

|

Madison Park Funding XXXV, Ltd.,

(Cayman Islands), 3M LIBOR + 6.10%,

11.35%, 04/20/2032 |

|

|

1,500 |

|

|

|

1,432 |

|

|

Madison Park Funding XXXVI, Ltd.,

(Cayman Islands), 3M LIBOR + 7.05%,

12.04%, 04/15/2035 |

|

|

1,000 |

|

|

|

948 |

|

|

Madison Park Funding XXXVII, Ltd.,

(Cayman Islands), 3M LIBOR + 6.15%,

11.41%, 07/15/2033 |

|

|

1,000 |

|

|

|

958 |

|

|

Magnetite XIX, Ltd., (Cayman Islands),

3M LIBOR + 6.40%, 11.66%, 04/17/2034 |

|

|

2,000 |

|

|

|

1,924 |

|

|

Magnetite XXIV, Ltd., (Cayman Islands),

3M LIBOR + 6.40%, 11.39%, 04/15/2035 |

|

|

1,500 |

|

|

|

1,409 |

|

|

Northwoods Capital XII-B, Ltd.,

(Cayman Islands), 3M LIBOR + 5.79%,

11.34%, 06/15/2031 |

|

|

2,000 |

|

|

|

1,507 |

|

|

Oak Hill Credit Partners X-R, Ltd.,

(Cayman Islands), 3M LIBOR + 6.25%,

11.50%, 04/20/2034 |

|

|

1,500 |

|

|

|

1,420 |

|

|

Collateralized Loan Obligations(d)(f) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Oaktree CLO, Ltd. 2019-2,

(Cayman Islands), 3M LIBOR + 6.77%,

12.03%, 04/15/2031 |

|

$ |

2,000 |

|

|

$ |

1,768 |

|

|

OHA Credit Funding 3, Ltd.,

(Cayman Islands), 3M LIBOR + 6.25%,

11.50%, 07/02/2035 |

|

|

1,000 |

|

|

|

969 |

|

|

OHA Credit Funding 4, Ltd.,

(Cayman Islands), 3M LIBOR + 6.40%,

11.67%, 10/22/2036 |

|

|

1,000 |

|

|

|

986 |

|

|

OHA Credit Partners VII, Ltd.,

(Cayman Islands), 3M LIBOR + 6.25%,

11.63%, 02/20/2034 |

|

|

3,000 |

|

|

|

2,913 |

|

|

OHA Credit Partners XI, Ltd.,

(Cayman Islands), 3M LIBOR + 7.90%,

13.15%, 01/20/2032 |

|

|

2,750 |

|

|

|

2,229 |

|

|

Sixth Street CLO XX, Ltd,

(Cayman Islands), 3M LIBOR + 6.15%,

11.40%, 10/20/2034 |

|

|

1,250 |

|

|

|

1,230 |

|

|

Sound Point CLO XXVI, Ltd.,

(Cayman Islands), 3M LIBOR + 6.86%,

12.11%, 07/20/2034 |

|

|

1,000 |

|

|

|

848 |

|

|

Tallman Park CLO, Ltd., (Cayman Islands),

3M LIBOR + 6.35%, 11.60%, 04/20/2034 |

|

|

2,000 |

|

|

|

1,857 |

|

|

TCI-Flatiron CLO, Ltd. 2018-1,

(Cayman Islands), 3M LIBOR + 6.15%,

11.45%, 01/29/2032 |

|

|

3,000 |

|

|

|

2,869 |

|

|

TICP CLO VI, Ltd. 2016-2,

(Cayman Islands), 3M LIBOR + 6.25%,

11.51%, 01/15/2034 |

|

|

2,250 |

|

|

|

2,064 |

|

|

TICP CLO XIII, Ltd., (Cayman Islands),

3M LIBOR + 6.20%, 11.46%, 04/15/2034 |

|

|

1,250 |

|

|

|

1,177 |

|

|

Trestles CLO, Ltd. 2017-1,

(Cayman Islands), 3M LIBOR + 6.25%,

11.51%, 04/25/2032 |

|

|

1,000 |

|

|

|

943 |

|

|

Venture XXIV CLO, Ltd., (Cayman Islands),

3M LIBOR + 6.72%, 11.97%, 10/20/2028 |

|

|

700 |

|

|

|

557 |

|

|

Venture XXVII CLO, Ltd., (Cayman Islands),

3M LIBOR + 6.35%, 11.60%, 07/20/2030 |

|

|

2,025 |

|

|

|

1,340 |

|

|

Venture XXXVI CLO, Ltd., (Cayman Islands),

3M LIBOR + 6.92%, 12.17%, 04/20/2032 |

|

|

2,000 |

|

|

|

1,405 |

|

|

Vibrant CLO X, Ltd., (Cayman Islands),

3M LIBOR + 6.45%, 11.50%, 10/20/2031 |

|

|

3,000 |

|

|

|

2,234 |

|

|

Voya CLO, Ltd. 2013-3, (Cayman Islands),

3M LIBOR + 6.16%, 11.14%, 10/18/2031 |

|

|

2,750 |

|

|

|

2,341 |

|

|

Voya CLO, Ltd. 2015-3, (Cayman Islands),

3M LIBOR + 6.46%, 11.51%, 10/20/2031 |

|

|

3,000 |

|

|

|

2,216 |

|

|

|

|

|

|

|

|

108,737 |

|

|

Semi-Annual Report 2023

11

Ares Dynamic Credit Allocation Fund, Inc.

Schedule of Investments (continued)

June 30, 2023 (Unaudited)

(in thousands, except shares, percentages and as otherwise noted)

Collateralized Loan Obligations(d)(f) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

|

Collateralized Loan Obligations — Equity 13.3% |

|

AIMCO CLO XI, Ltd., (Cayman Islands),

24.31%, 10/17/2034 |

|

$ |

1,985 |

|

|

$ |

1,729 |

|

|

AIMCO CLO XVI, Ltd., (Cayman Islands),

15.80%, 01/17/2035 |

|

|

1,150 |

|

|

|

913 |

|

|

Allegro CLO V, Ltd., (Cayman Islands),

3.37%, 10/16/2030 |

|

|

2,000 |

|

|

|

421 |

|

|

Bain Capital Credit CLO, Ltd. 2020-2,

(Cayman Islands), 43.33%, 07/19/2034 |

|

|

1,250 |

|

|

|

784 |

|

|

Bain Capital Credit CLO, Ltd. 2022-1,

(Cayman Islands), 18.26%, 04/18/2035 |

|

|

1,500 |

|

|

|

934 |

|

|

Canyon Capital CLO, Ltd. 2019-1,

(Cayman Islands), 15.12%, 04/15/2032 |

|

|

1,000 |

|

|

|

483 |

|

|

Carlyle Global Market Strategies CLO,

Ltd. 2018-3, (Cayman Islands),

8.82%, 10/15/2030 |

|

|

3,223 |

|

|

|

1,247 |

|

|

Cedar Funding CLO V, Ltd.,

(Cayman Islands), 20.05%, 07/17/2031 |

|

|

2,546 |

|

|

|

1,585 |

|

|

Cedar Funding CLO VIII, Ltd.,

(Cayman Islands), 14.98%, 10/17/2034 |

|

|

2,930 |

|

|

|

1,331 |

|

|

CIFC Funding, Ltd. 2018-5A,

(Cayman Islands), 19.51%, 01/15/2032 |

|

|

375 |

|

|

|

179 |

|

|

CIFC Funding, Ltd. 2020-3A,

(Cayman Islands), 18.22%, 10/20/2034 |

|

|

1,750 |

|

|

|

1,363 |

|

|

CIFC Funding, Ltd. 2021-5A,

(Cayman Islands), 16.24%, 07/15/2034 |

|

|

2,250 |

|

|

|

1,629 |

|

|

Dryden 98 CLO, Ltd., (Cayman Islands),

18.16%, 04/20/2035 |

|

|

1,100 |

|

|

|

783 |

|

|

Elmwood CLO XI, Ltd., (Cayman Islands),

16.84%, 10/20/2034 |

|

|

1,200 |

|

|

|

1,020 |

|

|

Halcyon Loan Advisors Funding, Ltd.

2017-1, (Cayman Islands), 06/25/2029 |

|

|

1,750 |

|

|

|

187 |

|

|

ICG U.S. CLO, Ltd. 2021-1,

(Cayman Islands), 15.51%, 04/17/2034 |

|

|

2,000 |

|

|

|

1,220 |

|

|

Invesco CLO 2021-3, Ltd.,

(Cayman Islands), 10/22/2034 |

|

|

113 |

|

|

|

33 |

|

|

Invesco CLO 2021-3, Ltd.,

(Cayman Islands), 16.06%, 10/22/2034 |

|

|

1,130 |

|

|

|

692 |

|

|

LCM XV, LP, (Cayman Islands),

1.26%, 07/20/2030 |

|

|

5,875 |

|

|

|

682 |

|

|

Madison Park Funding LIII, Ltd.,

(Cayman Islands), 18.85%, 04/21/2035 |

|

|

2,000 |

|

|

|

1,644 |

|

|

Madison Park Funding LIX, Ltd.,

(Cayman Islands), 16.87%, 01/18/2034 |

|

|

2,250 |

|

|

|

1,789 |

|

|

Madison Park Funding XII, Ltd.,

(Cayman Islands), 07/20/2026 |

|

|

4,000 |

|

|

|

8 |

|

|

Collateralized Loan Obligations(d)(f) (continued)

|

|

|

Principal

Amount(a) |

|

Value(a) |

|

Madison Park Funding XXII, Ltd.,

(Cayman Islands), 19.22%, 01/15/2033 |

|

$ |

4,000 |

|

|

$ |

2,476 |

|

|

Madison Park Funding XXXI, Ltd.,

(Cayman Islands), 19.47%, 01/23/2048 |

|

|

2,000 |

|

|

|

1,318 |

|

|

Madison Park Funding XXXII, Ltd.,

(Cayman Islands), 28.16%, 01/22/2048 |

|

|

2,000 |

|

|

|

1,156 |

|

|

Madison Park Funding, Ltd.,

(Cayman Islands), 04/21/2035 |

|

|

1,500 |

|

|

|

1,313 |

|

|

Magnetite XXVIII, Ltd., (Cayman Islands),

21.05%, 01/20/2035 |

|

|

2,500 |

|

|

|

2,031 |

|

|

Oaktree CLO, Ltd. 2015-1,

(Cayman Islands), 10/20/2027 |

|

|

4,000 |

|

|

|

125 |

|

|

OHA Credit Partners VII, Ltd.,

(Cayman Islands), 21.69%, 02/20/2034 |

|

|

2,672 |

|

|

|

1,296 |

|

|

OHA Credit Partners XIII Ltd.,

(Cayman Islands), 14.86%, 10/21/2034 |

|

|

1,000 |

|

|

|

649 |

|

|

OHA Credit Partners XVI,

(Cayman Islands), 17.67%, 10/18/2034 |

|

|

1,635 |

|

|

|

1,271 |

|

|

OHA Loan Funding, Ltd. 2016-1,

(Cayman Islands), 20.58%, 01/20/2033 |

|

|

3,250 |

|

|

|

2,033 |

|

|

RR 19, Ltd., (Cayman Islands),

16.26%, 10/15/2035 |

|

|

2,350 |

|

|

|

1,870 |

|

|

Signal Peak CLO V, Ltd., (Cayman Islands),

6.71%, 04/25/2031 |