UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil.

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

| Third Quarter Results 2024 |

Azul Reports All-Time

Record Revenue and EBITDA in 3Q24

São Paulo, November 14, 2024 –

Azul S.A., “Azul” (B3:AZUL4, NYSE:AZUL), the largest airline in Brazil by number of cities and departures, announces today

its results for the third quarter of 2024 (“3Q24”). The following financial information, unless stated otherwise, is presented

in Brazilian reais and in accordance with International Financial Reporting Standards (IFRS).

Financial and Operating Highlights

| § | EBITDA reached an all-time record at R$1,653.3 million,

with a margin of 32.2%, increasing 6.0% year over year and 57.1% quarter over quarter. |

| § | Operating income increased 6.7%

year over year to a record R$1,027.2 million, representing a margin of 20.0%. Compared to 2Q24, operating income increased 132.8%. |

| § | Operating revenue reached an

all-time record at R$5.1 billion, increasing 4.3% year over year and 22.9% quarter over quarter. |

| § | Passenger traffic (RPK) increased

4.3% over a capacity increase of 3.7%, resulting in a load factor of 82.6%, 0.5 percentage points higher than in 3Q23. |

| 3Q24 Highlights |

3Q24 |

3Q23¹ |

Change |

9M24 |

9M23¹ |

Change |

| Total operating revenue (R$ million) |

5,129.6 |

4,916.4 |

4.3% |

13,980.8 |

13,664.2 |

2.3% |

| Operating income (R$ million) |

1,027.2 |

962.4 |

64.8 |

2,269.1 |

2,016.7 |

252.4 |

| Operating margin (%) |

20.0% |

19.6% |

+0.4 p.p. |

16.2% |

14.8% |

+1.5 p.p. |

| EBITDA (R$ million) |

1,653.3 |

1,560.2 |

93.1 |

4,121.1 |

3,747.1 |

374.0 |

| EBITDA margin (%) |

32.2% |

31.7% |

+0.5 p.p. |

29.5% |

27.4% |

+2.1 p.p. |

| ASK (million) |

11,967 |

11,539 |

3.7% |

33,962 |

32,901 |

3.2% |

| RASK (R$ cents) |

42.87 |

42.61 |

0.6% |

41.17 |

41.53 |

-0.9% |

| PRASK (R$ cents) |

39.80 |

39.68 |

0.3% |

38.22 |

38.59 |

-1.0% |

| Yield (R$ cents) |

48.17 |

48.30 |

-0.3% |

47.38 |

47.89 |

-1.1% |

| CASK (R$ cents) |

34.28 |

34.27 |

0.0% |

34.48 |

35.40 |

-2.6% |

| Fuel cost per liter (R$) |

4.41 |

4.06 |

8.6% |

4.34 |

4.53 |

-4.2% |

¹ 3Q23 and 9M23 operating results were adjusted

for non-recurring items.

| § | CASK in 3Q24 was R$34.28 cents,

flat compared to 3Q23, even with a 13.6% average depreciation of the Brazilian real against the US dollar, 8.6% higher fuel prices, and

4.2% inflation over the last 12 months, as a result of cost reduction initiatives and productivity, in addition to the higher number of

next-generation aircraft in our fleet. |

| § | Fuel consumption per ASK dropped

2.9% in 3Q24 versus 3Q23, as a result of the higher number of next-generation aircraft in our fleet and several fuel-saving initiatives. |

| § | Immediate liquidity was R$2.5

billion, flat compared to 2Q24, representing 13.1% of the last twelve months’ revenues. In the quarter, we continued to deleverage

and paid down over R$1.4 billion in current and deferred leases and debt amortizations, with around R$700 million of cash generated by

operating activities. |

| Third Quarter Results 2024 |

| | |

Management Comments

As always, I would like to start by expressing

my gratitude to our incredible Crewmembers for their hard work. Thanks to their dedication, we delivered another set of strong results

in 3Q24.

In 3Q24, we achieved an all-time record EBITDA

of R$1.7 billion, representing an industry-leading margin of 32%, as well as an all-time record EBIT of R$1.0 billion, with a margin of

20%. Our total revenue reached another all-time record of R$5.1 billion, up 4.3% compared to 3Q23, and up an impressive 23% compared to

2Q24. Passenger demand during the quarter grew 4.3% year over year, outpacing capacity and leading to a load factor of 82.6%, while RASK

remained strong at R$42.87 cents, up 0.6% year over year. Compared to 3Q19, total revenue increased 69% while EBITDA margin expanded by

1.4 percentage point, even with fuel cost per liter up 73% and the average exchange rate up 40%. These figures represent a significant

recovery compared to the second quarter, which is seasonally weaker and was also impacted by the devastating floods in Rio Grande do Sul.

More importantly, it demonstrates the sustainability and profitability of our growth strategy.

Our business units continue to be key factors

in our growth. Our loyalty program Azul Fidelidade ended 3Q with almost 18 million members. Gross billings ex-Azul grew a strong 80%,

with most of this increase coming from direct sales to members, our recurring revenue Clube Azul program, and our industry-leading co-branded

credit card with Itaú. Azul Viagens, our vacations business, grew 42% in gross bookings versus 3Q23 and represented over 6% of

our total ASKs in 3Q24. Our logistics business Azul Cargo remained strong, with revenue growing quarter over quarter and strong recovery

in international markets, where revenue increased 23% year over year.

We continue to closely manage costs throughout

our business. CASK in 3Q24 was R$34.28 cents, flat compared to 3Q23, while CASK ex-fuel was down 3% year over year. This is an impressive

achievement given the 13.6% average depreciation of the Brazilian real against the US dollar and 4.2% inflation over the last 12 months.

We are laser-focused on our efforts to drive further margin expansion. While a key driver of CASK reduction will come from our next-generation

fleet, we are also pursuing several additional efficiency initiatives. For example, just quarter over quarter, we were able to reduce

full-time equivalent employees by 1.5%, even with the airline growing 10%, leading to an improvement of FTE per ASK of 11.3%.

Immediate liquidity remained at R$2.5 billion,

representing 13% of the last twelve months’ revenues. In the quarter, we continued to improve our cash generation, with approximately

R$700 million in cash flow from operations. Additionally, in October, we announced the successful restructuring of our agreements with

lessors and OEMs, whereby our partners agreed to convert R$3.1 billion of obligations into 100 million AZUL4 preferred shares via a one-time

issuance. This agreement is a significant vote of confidence by these partners in our business and future upside. An additional sign of

this confidence is that, even as these discussions were ongoing, just this year our lessors delivered to us 4 A330s, 2 A321 freighters

and 4 Embraer E2s.

Additionally, in October, we also announced

an agreement with our existing bondholders for up to US$500 million in new superpriority financing, with US$150 million already funded

and an incremental US$250 million expected before year-end. This agreement also provides a path for an additional US$100 million in funding

and the equitization of up to US$807 million of existing 2029 and 2030 notes, with an improvement to our cash generation of up to US$200

million per year. This represents a truly comprehensive solution to the debt burden that we were forced to assume during the Covid pandemic,

as this will potentially eliminate over R$5 billion in debt from our balance sheet. Combining this with continued growth in our earnings,

this will reduce our pro-forma leverage from 4.8x (or 4.4x excluding the lessor equity structure) to 3.4x considering last twelve months’

EBITDA.

We have made incredible progress over the

past few months, and there is still much work to do. I could not be more excited about the steps we have taken and the support we have

received from all our stakeholders, and I would like to once again thank them for their continued confidence in our company. We are truly

setting up Azul for long-term success, with a unique business model, growing profitability and cash generation, and an optimized balance

sheet. As we head into the peak Brazilian summer, these developments give us confidence and optimism in our performance going forward.

John Rodgerson, CEO of Azul S.A.

| Third Quarter Results 2024 |

| | |

Recent Developments

On October 7th, Azul announced

having successfully reached commercial agreements with lessors and OEMs to eliminate their pro-rata share of the equity issuance obligations

totaling approximately R$3 billion, in exchange for up to 100 million AZUL4 preferred shares in a one-time issuance.

This negotiation was contingent on certain

conditions, including the raising of additional financing. On October 28, 2024, Azul announced a pivotal agreement with its bondholders

to secure up to US$500 million in additional funding. This not only bolsters Azul's liquidity but also crystallizes the agreements with

lessors and OEMs.

The transaction includes a structured financing

plan, focused on improving liquidity and cash generation, reducing leverage, as summarized below:

| § | Initial funding: US$150 million

provided at the end of October with a 90-day maturity. During this period, Azul will work to finalize necessary conditions for additional

superpriority financing. |

| § | Subsequent funding: Additional

US$250 million, expected before year-end, with the potential to unlock a further US$100 million thereafter. |

| § | Cash flow improvements: The agreements

enhance cash flow by over US$150 million over the next 18 months by reducing obligations to certain lessors and OEMs. Furthermore, the

agreements envision a collaborative effort to achieve additional cash flow improvements of approximately US$100 million annually. |

| § | Potential equitization: The agreement

also contemplates the potential equitization of up to US$800 million of existing second-out debt, contingent upon achieving the cash flow

improvements above, and leading to an additional cash flow improvement of US$100 million from reduced interest payments. |

The financing will be issued by Azul Secured

Finance II LLP, guaranteed by Azul S.A. and certain subsidiaries, and secured by receivables generated by Azul Cargo, intellectual property,

financial assets, and shared collateral.

Azul is actively negotiating with commercial

partners to secure the additional concessions necessary to fulfill all aspects of these transactions. The transactions described herein

significantly improve Azul’s capital structure by eliminating not only the lessor and OEM equity structure but potentially also

its secured 2029 and 2030 Notes, as well as a portion of the unsecured 2030 lessor notes, as illustrated in the table below:

| Pro-forma Capitalization (R$ million) |

3Q24 |

Adjustments |

3Q24 Pro-forma |

| Unsecured 2024 and 2026 Notes |

556 |

(380) |

176 |

| Secured 2028 Notes |

5,268 |

- |

5,268 |

| Secured 2029 and 2030 Notes |

4,437 |

(4,437) |

- |

| New Superpriority 2029 Notes |

- |

2,725 |

2,725 |

| Other Secured Debt |

692 |

- |

692 |

| Local Secured Debt |

1,573 |

(144) |

1,429 |

| Total Loans and Financing |

12,527 |

(2,236) |

10,290 |

| Lease Liabilities |

14,268 |

- |

14,268 |

| Lessor Notes |

1,162 |

(791) |

371 |

| Total Lessor Obligations |

15,430 |

(791) |

14,639 |

| Total Debt |

27,957 |

(3,027) |

24,929 |

| Leverage using LTM EBITDA |

4.4x |

-1.0x |

3.4x |

| |

|

|

|

| Lessor Equity |

2,341 |

(2,341) |

- |

| Total Debt Including Lessor Equity |

30,298 |

(5,368) |

24,929 |

| Adj. Net Leverage using LTM EBITDA |

4.8x |

-1.4x |

3.4x |

| Third Quarter Results 2024 |

| | |

With

this debt reduction, Azul’s leverage drops significantly from 4.8x (4.4x excluding the lessor equity structure) to 3.4x considering

last twelve months’ EBITDA of R$5.8 billion, as demonstrated below:

Also, the transactions described herein significantly increase Azul’s cash generation by reducing its interest payment by almost

R$1.0 billion in 2025 and beyond, as demonstrated below:

| Third Quarter Results 2024 |

| | |

Consolidated Financial Results

The following income statement and operating data should

be read in conjunction with the quarterly results comments presented below:

| Income statement (R$ million) |

3Q24 |

3Q23¹ |

% Δ |

9M24 |

9M23¹ |

% ∆ |

| Operating Revenue |

|

|

|

|

|

|

| Passenger revenue |

4,762.8 |

4,579.2 |

4.0% |

12,978.9 |

12,697.6 |

2.2% |

| Cargo revenue and other |

366.8 |

337.2 |

8.8% |

1,001.9 |

966.6 |

3.7% |

| Total operating revenue |

5,129.6 |

4,916.4 |

4.3% |

13,980.8 |

13,664.2 |

2.3% |

| Operating Expenses |

|

|

|

|

|

|

| Aircraft fuel |

(1,493.9) |

(1,365.8) |

9.4% |

(4,220.8) |

(4,377.5) |

-3.6% |

| Salaries and benefits |

(647.9) |

(611.5) |

5.9% |

(1,978.5) |

(1,717.4) |

15.2% |

| Depreciation and amortization |

(626.1) |

(597.8) |

4.7% |

(1,852.0) |

(1,730.4) |

7.0% |

| Airport fees |

(287.1) |

(274.1) |

4.7% |

(768.9) |

(783.5) |

-1.9% |

| Traffic and customer servicing |

(221.9) |

(209.9) |

5.7% |

(636.6) |

(595.0) |

7.0% |

| Sales and marketing |

(240.2) |

(205.3) |

17.0% |

(633.6) |

(559.1) |

13.3% |

| Maintenance and repairs |

(192.2) |

(155.9) |

23.3% |

(560.6) |

(514.1) |

9.0% |

| Other |

(393.2) |

(533.8) |

-26.3% |

(1,060.7) |

(1,370.5) |

-22.6% |

| Total Operating Expenses |

(4,102.4) |

(3,954.0) |

3.8% |

(11,711.7) |

(11,647.5) |

0.6% |

| Operating Result |

1,027.2 |

962.4 |

6.7% |

2,269.1 |

2,016.7 |

12.5% |

| Operating margin |

20.0% |

19.6% |

+0.4 p.p. |

16.2% |

14.8% |

+1.5 p.p. |

| EBITDA |

1,653.3 |

1,560.2 |

6.0% |

4,121.1 |

3,747.1 |

10.0% |

| EBITDA margin |

32.2% |

31.7% |

+0.5 p.p. |

29.5% |

27.4% |

+2.1 p.p. |

| Financial Result |

|

|

|

|

|

|

| Financial income |

56.5 |

39.4 |

43.4% |

152.5 |

143.9 |

6.0% |

| Financial expenses² |

(1,250.3) |

(1,825.6) |

-31.5% |

(3,680.6) |

(4,156.3) |

-11.4% |

| Derivative financial instruments, net² |

(122.1) |

394.8 |

n.a. |

(120.8) |

154.0 |

n.a. |

| Foreign currency exchange, net |

649.7 |

(850.3) |

n.a. |

(3,282.5) |

738.0 |

n.a. |

| Result Before Income Taxes |

361.0 |

(1,279.3) |

n.a. |

(4,662.4) |

(1,103.7) |

322.4% |

| Income tax and social contribution |

(0.7) |

- |

n.a. |

(1.0) |

- |

n.a. |

| Deferred income tax and social contribution |

- |

- |

n.a. |

39.5 |

- |

n.a. |

| Net Result² |

360.3 |

(1,279.3) |

n.a. |

(4,623.8) |

(1,103.7) |

319.0% |

| Net margin |

7.0% |

-26.0% |

n.a. |

-33.1% |

-8.1% |

-25.0 p.p. |

| Adjusted Net Result² ³ |

(203.1) |

(855.9) |

-76.3% |

(1,271.7) |

(2,150.4) |

-40.9% |

| Adjusted net margin² ³ |

-4.0% |

-17.4% |

+13.5 p.p. |

-9.1% |

-15.7% |

+6.6 p.p. |

| Shares outstanding⁴ |

347.7 |

347.7 |

0.0% |

347.7 |

347.5 |

0.0% |

| EPS |

1.04 |

(3.68) |

n.a. |

(13.30) |

(3.18) |

318.8% |

| EPS (US$) |

0.19 |

(0.75) |

n.a. |

(2.54) |

(0.63) |

300.6% |

| EPADR (US$) |

0.56 |

(2.26) |

n.a. |

(7.62) |

(1.90) |

300.6% |

| Adjusted EPS³ |

(0.58) |

(2.46) |

-76.3% |

(3.66) |

(6.19) |

-40.9% |

| Adjusted EPS³ (US$) |

(0.11) |

(0.50) |

-79.1% |

(0.70) |

(1.24) |

-43.5% |

| Adjusted EPADR³ (US$) |

(0.32) |

(1.51) |

-79.1% |

(2.10) |

(3.71) |

-43.5% |

¹ 3Q23 and 9M23 operating results were adjusted

for non-recurring items.

² Excludes conversion rights related to convertible

debentures.

³ Adjusted for unrealized derivative results and

foreign currency. One ADR equals three preferred shares (PNs).

⁴ Shares outstanding do not include dilution related

to convertible and equity instruments.

| Third Quarter Results 2024 |

| | |

| Operating Data |

3Q24 |

3Q23¹ |

% Δ |

9M24 |

9M23¹ |

% ∆ |

| ASK (million) |

11,967 |

11,539 |

3.7% |

33,962 |

32,901 |

3.2% |

| Domestic |

9,533 |

8,923 |

6.8% |

27,372 |

25,711 |

6.5% |

| International |

2,434 |

2,616 |

-7.0% |

6,590 |

7,191 |

-8.4% |

| RPK (million) |

9,888 |

9,480 |

4.3% |

27,395 |

26,514 |

3.3% |

| Domestic |

7,776 |

7,174 |

8.4% |

21,731 |

20,368 |

6.7% |

| International |

2,112 |

2,306 |

-8.4% |

5,663 |

6,146 |

-7.9% |

| Load factor (%) |

82.6% |

82.2% |

+0.5 p.p. |

80.7% |

80.6% |

+0.1 p.p. |

| Domestic |

81.6% |

80.4% |

+1.2 p.p. |

79.4% |

79.2% |

+0.2 p.p. |

| International |

86.8% |

88.2% |

-1.4 p.p. |

85.9% |

85.5% |

+0.5 p.p. |

| Average fare (R$) |

588.6 |

587.6 |

0.2% |

571.7 |

576.4 |

-0.8% |

| Passengers (thousands) |

8,091 |

7,793 |

3.8% |

22,704 |

22,029 |

3.1% |

| Block hours |

146,604 |

142,663 |

2.8% |

420,648 |

413,955 |

1.6% |

| Aircraft utilization (hours per day)² |

11.5 |

10.2 |

12.5% |

11.4 |

9.8 |

16.2% |

| Departures |

83,449 |

82,167 |

1.6% |

241,378 |

238,773 |

1.1% |

| Average stage length (km) |

1,183 |

1,160 |

2.0% |

1,156 |

1,140 |

1.4% |

| End of period operating passenger aircraft |

186 |

181 |

2.8% |

186 |

181 |

2.8% |

| Fuel consumption (thousands of liters) |

339,093 |

336,765 |

0.7% |

972,818 |

966,708 |

0.6% |

| Fuel consumption per ASK |

28.3 |

29.2 |

-2.9% |

28.6 |

29.4 |

-2.5% |

| Full-time-equivalent employees |

15,521 |

14,314 |

8.4% |

15,521 |

14,314 |

8.4% |

| End of period FTE per aircraft |

83 |

79 |

5.5% |

83 |

79 |

5.5% |

| Yield (R$ cents) |

48.17 |

48.30 |

-0.3% |

47.38 |

47.89 |

-1.1% |

| RASK (R$ cents) |

42.87 |

42.61 |

0.6% |

41.17 |

41.53 |

-0.9% |

| PRASK (R$ cents) |

39.80 |

39.68 |

0.3% |

38.22 |

38.59 |

-1.0% |

| CASK (R$ cents) |

34.28 |

34.27 |

0.0% |

34.48 |

35.40 |

-2.6% |

| CASK ex-fuel (R$ cents) |

21.80 |

22.43 |

-2.8% |

22.06 |

22.10 |

-0.2% |

| Fuel cost per liter (R$) |

4.41 |

4.06 |

8.6% |

4.34 |

4.53 |

-4.2% |

| Break-even load factor (%) |

66.1% |

66.1% |

+0.0 p.p. |

67.6% |

68.7% |

-1.1 p.p. |

| Average exchange rate (R$ per US$) |

5.55 |

4.88 |

13.6% |

5.24 |

5.01 |

4.5% |

| End of period exchange rate |

5.45 |

5.01 |

8.8% |

5.45 |

5.01 |

8.8% |

| Inflation (IPCA/LTM) |

4.24% |

5.19% |

-1.0 p.p. |

4.24% |

5.19% |

-1.0 p.p. |

| WTI (average per barrel, US$) |

73.21 |

85.41 |

-14.3% |

77.44 |

78.15 |

-0.9% |

| Heating oil (US$ per gallon) |

2.32 |

3.03 |

-23.5% |

2.51 |

2.80 |

-10.2% |

¹ 3Q23 and 9M23 operating results were adjusted

for non-recurring items.

² Excludes Cessna aircraft and freighters.

Operating Revenue

In 3Q24,

Azul’s total operating revenues increased R$213.2 million, reaching an all-time record of R$5.1 billion,

4.3% higher than 3Q23 mainly due to a healthy demand environment

and robust ancillary revenues. Compared to 2Q24, operating revenue increased an impressive 22.9%.

PRASK increased

0.3% compared to 3Q23, up 12.6% versus 2Q24, enabled by our rational capacity deployment and the

sustainable competitive advantages of our business model. Total RASK reached a record level for a third quarter at R$42.87 cents, up 12.2%

quarter over quarter.

Cargo revenue and other totaled R$366.8 million,

8.8% higher than 3Q23, mainly due to a better performance of our ancillary revenues and strong

domestic demand for our cargo solutions and exclusive network, and the partial recovery of our international operation, partially offset

by the reduction in our domestic capacity in Rio Grande do Sul state. In 3Q24, Cargo revenue increased 3.6% compared to 2Q24.

| Third Quarter Results 2024 |

| | |

| R$ cents |

3Q24 |

3Q23¹ |

% Δ |

9M24 |

9M23¹ |

% Δ |

| Operating revenue per ASK |

|

|

|

|

|

|

| Passenger revenue |

39.80 |

39.68 |

0.3% |

38.22 |

38.59 |

-1.0% |

| Cargo revenue and other |

3.07 |

2.92 |

4.9% |

2.95 |

2.94 |

0.4% |

| Operating revenue (RASK) |

42.87 |

42.61 |

0.6% |

41.17 |

41.53 |

-0.9% |

| Operating expenses per ASK |

|

|

|

|

|

|

| Aircraft fuel |

(12.48) |

(11.84) |

5.5% |

(12.43) |

(13.30) |

-6.6% |

| Salaries and benefits |

(5.41) |

(5.30) |

2.2% |

(5.83) |

(5.22) |

11.6% |

| Depreciation and amortization |

(5.23) |

(5.18) |

1.0% |

(5.45) |

(5.26) |

3.7% |

| Airport fees |

(2.40) |

(2.38) |

1.0% |

(2.26) |

(2.38) |

-4.9% |

| Traffic and customer servicing |

(1.85) |

(1.82) |

2.0% |

(1.87) |

(1.81) |

3.7% |

| Sales and marketing |

(2.01) |

(1.78) |

12.8% |

(1.87) |

(1.70) |

9.8% |

| Maintenance and repairs |

(1.61) |

(1.35) |

18.9% |

(1.65) |

(1.56) |

5.6% |

| Other operating expenses |

(3.29) |

(4.63) |

-29.0% |

(3.12) |

(4.17) |

-25.0% |

| Total operating expenses (CASK) |

(34.28) |

(34.27) |

0.0% |

(34.48) |

(35.40) |

-2.6% |

| Operating income per ASK (RASK-CASK) |

8.58 |

8.34 |

2.9% |

6.68 |

6.13 |

9.0% |

¹ 3Q23 and 9M23 operating results were adjusted

for non-recurring items.

Operating Expenses

In 3Q24, operating expenses totaled R$4.1

billion, 3.8% higher than 3Q23 mainly explained by the 3.7% increase in total capacity, 13.6% depreciation of the Brazilian real against

the US dollar and 8.6% increase in fuel price, offset by higher productivity and cost-reduction initiatives.

The breakdown of our main operating expenses

compared to 3Q23 is as follows:

| § | Aircraft fuel increased

9.4% to R$1,493.9 million mostly due to an 8.6% increase in fuel price per liter (excluding hedges) and a 3.7% increase in total capacity,

partially offset by a reduction of 2.9% in fuel burn per ASK as a result of the higher utilization of our next-generation fleet. |

| § | Salaries and benefits

increased R$36.4 million compared to 3Q23, mainly driven by our capacity increase of 3.7%, a 5.5% union increase in salaries as a result

of collective bargaining agreements with unions applicable to all airline employees in Brazil, partially offset by the insourcing of certain

activities as cost-reduction initiatives. |

| § | Depreciation and amortization

increased 4.7% or R$28.4 million, driven by the increase in the right-of-use asset as a result of lease contract renegotiations with lessors. |

| § | Airport fees increased

4.7% or R$12.9 million, mostly driven by a 6.8% increase in our domestic capacity, partially offset by a 7.0% reduction in international

capacity, which have higher fares. |

| § | Traffic and customer servicing

increased 5.7% or R$12.0 million, primarily due to the 4.2% inflation in the period and the 3.8% growth in passengers. |

| § | Sales and marketing increased

17.0% or R$34.9 million, mostly driven by higher advertising campaigns and regional events, in addition to the 4.0% growth in our passenger

revenue, leading to an increase in credit card fees and commissions. |

| § | Maintenance and repairs

increased R$36.3 million compared to 3Q23, mainly due to 13.6% depreciation of the Brazilian real against the US dollar, partially offset

by the savings from insourcing of maintenance events and renegotiations with suppliers. |

| § | Other

reduced R$140.6 million, mainly due to cost-reduction initiatives and lower number of judicial claims in the period, partially offset

by the 13.6% depreciation of the Brazilian real against the US dollar.

|

| Third Quarter Results 2024 |

| | |

Non-Operating Results

| Net financial results (R$ million)¹ |

3Q24 |

3Q23 |

% Δ |

9M24 |

9M23 |

% ∆ |

| Net financial expenses |

(1,193.8) |

(1,786.2) |

-33.2% |

(3,528.1) |

(4,012.4) |

-12.1% |

| Derivative financial instruments, net |

(122.1) |

394.8 |

n.a. |

(120.8) |

154.0 |

n.a. |

| Foreign currency exchange, net |

649.7 |

(850.3) |

n.a. |

(3,282.5) |

738.0 |

n.a. |

| Net financial results |

(666.2) |

(2,241.7) |

-70.3% |

(6,931.5) |

(3,120.4) |

122.1% |

¹ Excludes the conversion right related to the

convertible debentures.

Net financial expenses were

R$1,193.8 million in the quarter, with R$635.9 million in leases recognized as interest expense and R$377.5 million in interest on

loans and financing in 3Q24.

Derivative

financial instruments resulted in a net loss of R$122.1 million in 3Q24 mostly due to fuel

hedge losses recorded during the period. As of September 30, 2024, Azul had hedged approximately 13.1% of

its expected fuel consumption for the next twelve months by using forward contracts and options.

Foreign currency exchange, net registered

a net gain of R$649.7 million in 3Q24 due to the 2.0% end of period appreciation of the Brazilian real against the US dollar, resulting

in a decrease in lease liabilities and loans denominated in foreign currency.

Liquidity and Financing

Azul ended

the third quarter with total liquidity of R$6.3 billion including short and long-term investments,

accounts receivable, security deposits and maintenance. Immediate liquidity as of September 30, 2024 was R$2.5 billion representing 13.1%

of our LTM revenues, after we paid down over R$1.4 billion in debt amortization and leases.

| Liquidity (R$ million) |

3Q24 |

2Q24 |

% Δ |

3Q23 |

% Δ |

| Cash, cash equivalents and short-term investments |

1,139.1 |

1,475.5 |

-22.8% |

1,670.1 |

-31.8% |

| Accounts receivable |

1,356.7 |

1,042.3 |

30.2% |

1,793.5 |

-24.4% |

| Immediate liquidity |

2,495.9 |

2,517.8 |

-0.9% |

3,463.5 |

-27.9% |

| Cash as % of LTM revenue |

13.1% |

13.4% |

-0.3 p.p. |

19.1% |

-6.0 p.p. |

| Long-term investments and receivables |

966.8 |

961.9 |

0.5% |

806.0 |

19.9% |

| Security deposits and maintenance reserves |

2,816.6 |

2,899.0 |

-2.8% |

2,413.6 |

16.7% |

| Total Liquidity |

6,279.3 |

6,378.7 |

-1.6% |

6,683.1 |

-6.0% |

Azul’s debt amortization schedule as of September 30, 2024 is presented below. This does not consider

the new debt and equitization from our recently-announced transaction. The chart converts our dollar-denominated debt to reais using the

quarter-end foreign exchange rate of R$5.45 .

¹Excludes convertible debentures, equity

instruments and OEMs’ notes.

| Third Quarter Results 2024 |

| | |

Compared to 2Q24, gross debt reduced R$150.1

million to R$27,956.6 million, mostly due to the 2.0% end

of period appreciation of the Brazilian real against the US dollar in the quarter, resulting in a reduction in lease liabilities and loans

denominated in foreign currency, in addition to our continued deleveraging process with R$1.4 billion in payments of leases and

debt amortizations, partially offset by the addition of R$436.6 million in lease liabilities related to new aircraft entering our fleet.

As of September 30, 2024, Azul’s average

debt maturity excluding lease liabilities and convertible debentures was 3.9 years, with an average interest rate of 11.1%. Average interest

rate on local and dollar-denominated obligations were equivalent to CDI + 4% and 10.6%, respectively.

| Loans and financing (R$ million)¹ |

3Q24 |

2Q24 |

% Δ |

3Q23 |

% Δ |

| Lease liabilities |

13,620.6 |

13,593.1 |

0.2% |

11,715.9 |

16.3% |

| Lease notes |

1,162.2 |

1,203.9 |

-3.5% |

- |

n.a. |

| Finance lease liabilities |

647.2 |

716.0 |

-9.6% |

700.4 |

-7.6% |

| Other aircraft loans and financing |

707.9 |

525.1 |

34.8% |

535.6 |

32.2% |

| Loans and financing |

11,818.8 |

12,068.7 |

-2.1% |

9,887.7 |

19.5% |

| % of non-aircraft debt in local currency |

13% |

13% |

-0.2 p.p. |

12% |

+1.1 p.p. |

| % of total debt in local currency |

6% |

6% |

-0.2 p.p. |

5% |

+0.4 p.p. |

| Gross debt |

27,956.6 |

28,106.7 |

-0.5% |

23,869.5 |

17.1% |

¹Considers the effect of hedges on debt.

Excludes convertible debentures, equity instruments and OEM notes. Consistently, shares outstanding should be adjusted to 511.9 million.

Azul’s leverage ratio measured as net debt

to LTM EBITDA was 4.4x, mainly due to the devaluation of the Brazilian real against the US dollar

this year, which impacted our dollar-denominated debt. Considering the pro-forma net debt from our recently-announced transaction, Azul’s

leverage ratio would have been 3.4x.

| Key financial ratios (R$ million) |

3Q24 |

2Q24 |

% Δ |

3Q23 |

% Δ |

| Cash¹ |

3,462.7 |

3,479.7 |

-0.5% |

4,269.6 |

-18.9% |

| Gross debt² |

27,956.6 |

28,106.7 |

-0.5% |

23,869.5 |

17.1% |

| Net debt |

24,493.9 |

24,627.0 |

-0.5% |

19,599.9 |

25.0% |

| Net debt / EBITDA (LTM) |

4.4x |

4.5x |

-0.1x |

4.0x |

0.3x |

¹ Includes cash, cash equivalents, receivables, short and long-term

investments.

² Excludes convertible debentures, equity instruments and OEM notes.

Fleet and Capex Expenditures

As of September 30, 2024, Azul had a passenger

operating fleet of 186 aircraft and a passenger contractual fleet of 186 aircraft, with an average aircraft age of 7.2 years excluding

Cessna aircraft.

Azul ended 3Q24 with approximately 83% of

its capacity coming from next-generation aircraft, considerably higher than any competitor in the region.

| Passenger Contractual Fleet¹ |

3Q24 |

2Q24 |

% Δ |

3Q23 |

% Δ |

| Airbus widebody |

12 |

11 |

9.1% |

11 |

9.1% |

| Airbus narrowbody |

57 |

57 |

- |

54 |

5.6% |

| Embraer E2 |

24 |

21 |

14.3% |

17 |

41.2% |

| Embraer E1 |

33 |

34 |

-2.9% |

45 |

-26.7% |

| ATR |

36 |

36 |

- |

43 |

-16.3% |

| Cessna |

24 |

24 |

- |

24 |

- |

| Total |

186 |

183 |

1.6% |

194 |

-4.1% |

| Aircraft under operating leases |

163 |

163 |

- |

167 |

-2.4% |

| Third Quarter Results 2024 |

| | |

| Passenger Operating Fleet |

3Q24 |

2Q24 |

% Δ |

3Q23 |

% Δ |

| Airbus widebody |

12 |

11 |

9.1% |

11 |

9.1% |

| Airbus narrowbody |

57 |

57 |

- |

54 |

5.6% |

| Embraer E2 |

24 |

21 |

14.3% |

17 |

41.2% |

| Embraer E1 |

33 |

33 |

- |

37 |

-10.8% |

| ATR |

36 |

36 |

- |

38 |

-5.3% |

| Cessna |

24 |

24 |

- |

24 |

- |

| Total |

186 |

182 |

2.2% |

181 |

2.8% |

Capex

Capital expenditures totaled R$247.5 million in 3Q24

and R$999.2 million in the nine-month period ending in September 30, 2024, mostly due to the capitalization of engine overhauls, the acquisition

of spare parts and aircraft pre-delivery payments in the quarter.

| Capex (R$ million) |

3Q24 |

3Q23 |

% Δ |

9M24 |

9M23 |

% Δ |

| Aircraft and maintenance and checks |

186.8 |

100.9 |

85.1% |

548.6 |

275.1 |

99.4% |

| Intangible assets |

41.7 |

36.9 |

13.3% |

120.1 |

129.4 |

-7.1% |

| Pre-delivery payments |

- |

13.9 |

n.a. |

276.8 |

29.1 |

850.4% |

| Other |

18.9 |

18.0 |

5.3% |

53.6 |

39.7 |

35.3% |

| Capex |

247.5 |

169.6 |

45.9% |

999.2 |

473.2 |

111.1% |

| Sale and leaseback |

-12.4 |

- |

n.a. |

-22.7 |

- |

n.a. |

| Net capex from sales and leaseback |

235.1 |

169.6 |

38.6% |

976.5 |

473.2 |

106.4% |

Environmental, Social and Governance (“ESG”)

Responsibility

The table below presents Azul’s key

ESG information according to the Sustainability Accounting Standards Board (SASB) standard for the airline industry:

| ESG Key Indicators |

3Q24 |

2Q24 |

% Δ |

| Environmental |

|

|

|

| Fuel |

|

|

|

| Total fuel consumed per ASK (GJ / ASK) |

1,064 |

1,085 |

-1.9% |

| Total fuel consumed (GJ x 1000) |

12,738 |

11,849 |

7.5% |

| Fleet |

|

|

|

| Average age of operating fleet¹ (years) |

7.2 |

7.2 |

-0.6% |

| Social |

|

|

|

| Labor Relations |

|

|

|

| Employee gender: male (%) |

59.5% |

59.4% |

0.1 p.p. |

| Employee gender: female (%) |

40.5% |

40.6% |

-0.1 p.p. |

| Employee monthly turnover (%) |

0.7% |

0.6% |

0.2 p.p. |

| Employee covered under collective bargaining agreements (%) |

100% |

100% |

- |

| Volunteers (#) |

6,875 |

7,043 |

-2.4% |

| Governance |

|

|

|

| Management |

|

|

|

| Independent directors (%) |

92% |

92% |

- |

| Percent of Board members that are women (%) |

25% |

25% |

- |

| Board of Directors' average age (years) |

59 |

59 |

0.4% |

| Director meeting attendance (%) |

100% |

100% |

- |

| Board size (#) |

12 |

12 |

- |

| Participation of women in leadership positions (%) |

38% |

38% |

- |

¹ Excludes Cessna aircraft.

| Third Quarter Results 2024 |

| | |

Conference Call Details

Thursday, November 14, 2024

10:00 a.m. (EST) | 12:00 p.m. (Brasília time)

USA: +1 253 205-0468

Brazil: +55 11 4632-2237 or +55 21 3958-7888

Code: 829 1782 4011

Webcast: ri.voeazul.com.br/en/

About Azul

Azul S.A. (B3: AZUL4, NYSE: AZUL), the largest airline

in Brazil by number of flight departures and cities served, offers 1,000 daily flights to over 160 destinations. With an operating fleet

of over 180 aircraft and more than 15,000 Crewmembers, the Company has a network of 300 non-stop routes. Azul was named by Cirium (leading

aviation data analysis company) as the most on-time airline in the world in 2022, being the first Brazilian airline to obtain this honor.

In 2020 Azul was awarded best airline in the world by TripAdvisor, the first time a Brazilian flag carrier earned the number one ranking

in the Traveler’s Choice Awards. For more information visit ri.voeazul.com.br/en/.

Contact:

Investor Relations

Tel: +55 11 4831 2880

invest@voeazul.com.br |

Media Relations

Tel: +55 11 4831 1245

imprensa@voeazul.com.br |

| Third Quarter Results 2024 |

| | |

Balance Sheet – IFRS

| (R$ million) |

September 30, 2024 |

June 30, 2024 |

September 30, 2023 |

| Assets |

23,404.2 |

22,831.2 |

19,605.1 |

| Current assets |

5,011.2 |

4,954.5 |

5,931.4 |

| Cash and cash equivalents |

1,082.2 |

1,439.6 |

1,670.1 |

| Short-term investments |

57.0 |

35.9 |

- |

| Accounts receivable |

1,356.7 |

1,034.0 |

1,721.9 |

| Sublease receivables |

- |

8.3 |

71.6 |

| Inventories |

1,026.5 |

1,000.4 |

751.6 |

| Security deposits and maintenance reserves |

596.4 |

698.6 |

987.0 |

| Taxes recoverable |

221.5 |

218.4 |

224.3 |

| Derivative financial instruments |

- |

4.3 |

113.1 |

| Prepaid expenses |

194.6 |

193.5 |

334.4 |

| Other current assets |

476.2 |

321.6 |

57.6 |

| Non-current assets |

18,393.0 |

17,876.7 |

13,673.7 |

| Long-term investments |

966.8 |

956.3 |

744.3 |

| Sublease receivables |

- |

5.6 |

61.7 |

| Security deposits and maintenance reserves |

2,220.2 |

2,200.4 |

1,426.5 |

| Derivative financial instruments |

- |

0.1 |

- |

| Prepaid expenses |

- |

- |

199.2 |

| Other non-current assets |

518.0 |

530.9 |

7.0 |

| Right of use – leased aircraft and other assets |

9,040.8 |

8,855.3 |

7,086.8 |

| Right of use – maintenance of leased aircraft |

1,154.5 |

1,037.4 |

686.3 |

| Property and equipment |

2,973.5 |

2,787.1 |

1,998.9 |

| Intangible assets |

1,519.3 |

1,503.7 |

1,462.8 |

| Liabilities and equity |

23,404.2 |

22,864.0 |

19,605.1 |

| Current liabilities |

18,521.9 |

17,441.5 |

14,064.1 |

| Loans and financing |

1,560.7 |

1,495.2 |

1,269.9 |

| Convertible instruments |

69.0 |

29.0 |

32.0 |

| Leases |

3,812.1 |

3,642.2 |

3,441.6 |

| Lease notes |

107.4 |

139.3 |

99.2 |

| Lease equity |

874.0 |

713.0 |

110.0 |

| Accounts payable |

3,699.1 |

3,193.3 |

1,901.9 |

| Factoring |

50.0 |

45.5 |

104.2 |

| Air traffic liability |

5,813.0 |

5,821.5 |

4,333.6 |

| Salaries and benefits |

564.3 |

533.2 |

514.9 |

| Insurance payable |

4.2 |

1.1 |

0.4 |

| Taxes payable |

168.9 |

161.8 |

119.2 |

| Derivative financial instruments |

117.4 |

35.5 |

9.7 |

| Provisions |

662.5 |

662.5 |

713.6 |

| Airport fees |

691.8 |

757.5 |

1,265.6 |

| Other |

327.5 |

210.9 |

148.1 |

| Non-current liabilities |

30,918.3 |

31,589.0 |

26,827.2 |

| Loans and financing |

10,966.0 |

11,098.6 |

9,153.4 |

| Convertible instruments |

1,171.1 |

972.0 |

1,118.8 |

| Leases |

10,455.7 |

10,666.9 |

8,974.6 |

| Lease notes |

1,054.8 |

1,064.6 |

930.7 |

| Lease equity |

1,467.0 |

1,659.9 |

1,444.9 |

| Accounts payable |

1,199.2 |

1,330.0 |

1,426.0 |

| Derivative financial instruments |

- |

0.0 |

0.3 |

| Provision |

2,967.8 |

2,967.8 |

2,139.9 |

| Airport fees |

748.0 |

913.1 |

586.6 |

| Other non-current liabilities |

888.6 |

916.2 |

1,051.9 |

| Equity |

(26,036.0) |

(26,166.6) |

(21,286.1) |

| Issued capital |

2,315.6 |

2,315.6 |

2,314.8 |

| Advance for future capital increase |

- |

- |

0.8 |

| Capital reserve |

2,055.5 |

2,053.3 |

2,016.3 |

| Treasury shares |

(4.3) |

(11.6) |

(9.0) |

| Accumulated other comprehensive result |

3.1 |

3.1 |

5.3 |

| Accumulated losses |

(30,405.9) |

(30,527.0) |

(25,614.3) |

| Third Quarter Results 2024 |

| | |

Cash Flow Statement – IFRS

| (R$ million) |

3Q24 |

3Q23 |

% Δ |

9M24 |

9M23 |

% Δ |

| Cash flows from operating activities |

|

|

|

|

|

|

| Net profit (loss) for the period |

121.2 |

(1,614.9) |

n.a. |

(4,738.7) |

(2,327.6) |

103.6% |

| Total non-cash adjustments |

|

|

|

|

|

|

| Depreciation and amortization |

626.1 |

625.5 |

0.1% |

1,852.0 |

1,820.3 |

1.7% |

| Unrealized derivatives |

305.1 |

(466.4) |

n.a. |

(53.3) |

44.2 |

n.a. |

| Exchange gain and (losses) in foreign currency |

(697.3) |

931.6 |

n.a. |

3,292.2 |

(748.4) |

n.a. |

| Financial income and expenses, net |

1,279.4 |

1,954.4 |

-34.5% |

3,694.3 |

4,173.5 |

-11.5% |

| Provisions |

(148.4) |

(268.2) |

-44.7% |

(114.7) |

(134.1) |

-14.5% |

| Result from modification of lease and provision |

(24.2) |

(49.3) |

-50.9% |

(113.1) |

(99.3) |

13.9% |

| Other |

(424.6) |

(5.2) |

8037.6% |

(965.5) |

248.4 |

n.a. |

| Changes in operating assets and liabilities |

|

|

|

|

|

|

| Trade and other receivables |

(116.7) |

(260.1) |

-55.1% |

131.3 |

262.7 |

-50.0% |

| Sublease receivables |

- |

2.7 |

n.a. |

- |

19.5 |

n.a. |

| Security deposits and maintenance reserves |

(55.8) |

(173.9) |

-67.9% |

(286.3) |

(295.8) |

-3.2% |

| Other assets |

(83.0) |

(36.2) |

129.6% |

(410.9) |

(106.5) |

285.8% |

| Derivatives |

(35.8) |

(32.1) |

11.4% |

(51.2) |

(154.7) |

-66.9% |

| Accounts payable |

236.2 |

(295.9) |

n.a. |

686.9 |

(241.9) |

n.a. |

| Salaries and benefits |

50.5 |

42.2 |

19.6% |

146.9 |

73.6 |

99.6% |

| Air traffic liability |

259.1 |

(112.3) |

n.a. |

756.8 |

194.9 |

288.3% |

| Provisions |

(108.8) |

(20.1) |

441.3% |

(308.9) |

(269.2) |

14.7% |

| Other liabilities |

184.6 |

18.4 |

905.5% |

87.9 |

262.3 |

-66.5% |

| Interest paid |

(673.8) |

(335.7) |

100.7% |

(1,796.9) |

(1,181.0) |

52.2% |

| Net cash generated (used) by operating activities |

693.8 |

(95.5) |

n.a. |

1,808.7 |

1,540.9 |

17.4% |

| |

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

| Short-term investment |

1.4 |

- |

n.a. |

(106.0) |

- |

n.a. |

| Sales and leaseback |

12.4 |

- |

n.a. |

22.7 |

- |

n.a. |

| Restricted cash |

- |

(256.5) |

n.a. |

- |

(256.5) |

n.a. |

| Acquisition of intangible |

(41.7) |

(36.9) |

13.3% |

(120.1) |

(129.4) |

-7.1% |

| Acquisition of property and equipment |

(205.7) |

(132.8) |

55.0% |

(879.1) |

(343.9) |

155.7% |

| Net cash generated (used) in investing activities |

(233.7) |

(426.2) |

-45.2% |

(1,082.6) |

(729.8) |

48.3% |

| |

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

| Loans and financing |

|

|

|

|

|

|

| Proceeds |

20.0 |

3,831.0 |

-99.5% |

2,299.9 |

4,733.3 |

-51.4% |

| Repayment |

(125.6) |

(1,889.8) |

-93.4% |

(1,194.3) |

(2,470.3) |

-51.7% |

| Lease repayment |

(667.1) |

(698.0) |

-4.4% |

(2,200.7) |

(1,673.2) |

31.5% |

| Factoring |

(44.8) |

- |

n.a. |

(447.6) |

(727.4) |

-38.5% |

| Capital increase |

- |

0.8 |

n.a. |

0.0 |

1.6 |

-98.9% |

| Treasury shares |

- |

(3.9) |

n.a. |

(2.6) |

(6.8) |

-62.0% |

| Net cash generated (used) in financing activities |

(817.6) |

1,240.1 |

n.a. |

(1,545.3) |

(142.8) |

982.4% |

| |

|

|

|

|

|

|

| Exchange gain (loss) on cash and cash equivalents |

0.1 |

64.8 |

-99.9% |

4.0 |

62.7 |

-93.7% |

| |

|

|

|

|

|

|

| Net decrease in cash and cash equivalents |

(357.4) |

783.2 |

n.a. |

(815.2) |

731.0 |

n.a. |

| |

|

|

|

|

|

|

| Cash and cash equivalents at the beginning of the period |

1,439.6 |

616.2 |

133.6% |

1,897.3 |

668.3 |

183.9% |

| |

|

|

|

|

|

|

| Cash and cash equivalents at the end of the period |

1,082.2 |

1,399.4 |

-22.7% |

1,082.2 |

1,399.4 |

-22.7% |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Third Quarter Results 2024 |

| | |

Operating and Financial

Review for the Nine-month period Ended September 30, 2024 and 2023

| Income statement (R$ million) |

9M24 |

9M23 |

% ∆ |

| Operating Revenue |

|

|

|

| Passenger revenue |

12,978.9 |

12,688.9 |

2.3% |

| Cargo revenue and other |

1,001.9 |

960.0 |

4.4% |

| Total operating revenue |

13,980.8 |

13,649.0 |

2.4% |

| Operating Expenses |

|

|

|

| Aircraft fuel |

(4,220.8) |

(4,377.5) |

-3.6% |

| Salaries and benefits |

(1,978.5) |

(1,728.5) |

14.5% |

| Depreciation and amortization |

(1,852.0) |

(1,820.3) |

1.7% |

| Airport fees |

(768.9) |

(785.9) |

-2.2% |

| Traffic and customer servicing |

(636.6) |

(595.0) |

7.0% |

| Sales and marketing |

(633.6) |

(559.1) |

13.3% |

| Maintenance and repairs |

(560.6) |

(665.8) |

-15.8% |

| Insurance |

(62.7) |

(46.4) |

35.2% |

| Rental |

(196.5) |

(161.7) |

21.6% |

| Other |

(801.4) |

(1,767.7) |

-54.7% |

| Total Operating Expenses |

(11,711.7) |

(12,507.9) |

-6.4% |

| Operating Result |

2,269.1 |

1,141.1 |

98.9% |

| Operating margin |

16.2% |

8.4% |

+7.9 p.p. |

| Financial Result |

|

|

|

| Financial income |

152.5 |

143.9 |

6.0% |

| Financial expenses |

(3,879.0) |

(4,339.5) |

-10.6% |

| Derivative financial instruments, net |

53.3 |

(44.2) |

n.a. |

| Foreign currency exchange, net |

(3,373.2) |

771.2 |

n.a. |

| Result Before Income Taxes |

(4,777.3) |

(2,327.6) |

105.2% |

| Income tax and social contribution |

(1.0) |

- |

n.a. |

| Deferred income tax and social contribution |

39.5 |

- |

n.a. |

| Net Result |

(4,738.7) |

(2,327.6) |

103.6% |

| Net margin |

-33.9% |

-17.1% |

-1684.1% |

In the nine-month period ended September 30,

2024, we reported an operating profit of R$2,269.1 million, compared to an operating profit of R$1,141.1 million in the same period last

year, mainly due to the increase in our revenues, in addition to our more efficient operations.

In the nine-month period ended September 30,

2024, we reported a net loss of R$4,738.7 million, compared to a net loss of R$2,327.6 million in the same period last year. This increase

in net loss for the period was primarily driven by the depreciation of the Brazilian real against the US dollar, which resulted in the

recognition of a loss of R$3,373.2 million in foreign currency exchange for the nine-month period ended September 30, 2024, compared to

a gain of R$771.2 million in the nine-month period ended September 30, 2023.

The table below sets forth a breakdown of

our net revenue and expenses on a per-ASK basis for the periods indicated:

| Third Quarter Results 2024 |

| | |

| R$ cents |

9M24 |

9M23 |

% Δ |

| Operating revenue per ASK |

|

|

|

| Passenger revenue |

38.22 |

38.57 |

-0.9% |

| Cargo revenue and other |

2.95 |

2.92 |

1.1% |

| Operating revenue (RASK) |

41.17 |

41.48 |

-0.8% |

| Operating expenses per ASK |

|

|

|

| Aircraft fuel |

(12.43) |

(13.30) |

-6.6% |

| Salaries and benefits |

(5.83) |

(5.25) |

10.9% |

| Depreciation and amortization |

(5.45) |

(5.53) |

-1.4% |

| Airport fees |

(2.26) |

(2.39) |

-5.2% |

| Traffic and customer servicing |

(1.87) |

(1.81) |

3.7% |

| Sales and marketing |

(1.87) |

(1.70) |

9.8% |

| Maintenance and repairs |

(1.65) |

(2.02) |

-18.4% |

| Other operating expenses |

(3.12) |

(6.01) |

-48.0% |

| Total operating expenses (CASK) |

(34.48) |

(38.02) |

-9.3% |

| Operating income per ASK (RASK-CASK) |

6.68 |

3.47 |

92.6% |

Total Revenue

Total revenue increased 2.4%, or R$331.8 million,

to R$13,980.8 million from R$13,649.0 million in the nine-month period ended September 30, 2023. The table below sets forth our passenger

revenue and selected operating data for the periods indicated:

| Operating Data |

9M24 |

9M23 |

% ∆ |

| Passenger revenue |

12,978.9 |

12,688.9 |

2.3% |

| ASK (million) |

33,962 |

32,901 |

3.2% |

| Load factor (%) |

80.7% |

80.6% |

+0.1 p.p. |

| PRASK (R$ cents) |

38.2 |

38.6 |

-0.9% |

| RASK (R$ cents) |

41.2 |

41.5 |

-0.8% |

| Departures |

241,378 |

238,773 |

1.1% |

| Block hours |

420,648 |

413,955 |

1.6% |

Passenger Revenue

Passenger revenue increased 2.3%, or R$289.9

million, from R$12,688.9 million in the nine-month period ended September 30, 2023, to R$12,978.9 million in the nine-month period ended

September 30, 2024, mainly due to a strong travel demand and a rational competitive environment, partially offset by the impact of the

floods in the state of Rio Grande do Sul, which closed Porto Alegre airport for approximately six months.

In the first quarter of 2024, we recorded

record levels for our PRASK, which was enabled by our rational capacity deployment and the sustainable competitive advantages of our business

model. However, our results for the second quarter of 2024 were negatively impacted by the impact of the floods in the state of Rio Grande

do Sul caused by heavy rainfall between April 29 and May 4, 2024, which forced the Porto Alegre airport, the largest in the region, to

close, with a partial reopening in October 2024. Rio Grande do Sul is the fourth largest state in Brazil in terms of economic activity

and represented over 10% of our total capacity in the first quarter of 2024.

Domestic ASK increased by 6% in the nine-month

period ended September 30, 2024, compared to the nine-month period ended September 30, 2023, which reflected our ability to redeploy capacity

that previously served Porto Alegre to serve other markets.

In addition, our results for the nine-month

period ended September 30, 2024, were also negatively affected by a temporary reduction in our international capacity, with international

ASK decreasing by 8% year over year.

| Third Quarter Results 2024 |

| | |

This temporary reduction in international

capacity was a result of the exit of the Airbus A350 from our fleet as part of our fleet transformation plan and delays in expected delivery

dates for Airbus A330 widebody aircraft that will be used in our international network.

Other Revenues

Other revenues increased 4.4%, or R$41.9 million,

from R$960.0 million in the nine-month period ended September 30, 2023, to R$1,001.9 million in the nine-month period ended September

30, 2024. This increase was primarily due to healthy cargo domestic and international demand environments and robust ancillary revenues.

Operating Expenses

Operating expenses decreased 6.4%, or R$796.2

million, from R$12,507.9 million in the nine-month period ended September 30, 2023, to R$11,711.7 million in the nine-month period ended

September 30, 2024, primarily due to a 3.6% period-over-period decrease in aircraft fuel and period-over-period decrease in other operating

expenses per ASK, as explained below.

| § | Aircraft fuel decreased

3.6%, or R$156.7 million, from R$4,377.5 million in the nine-month period ended September 30, 2023, to R$4,220.8 million in the nine-month

period ended September 30, 2024, even with an increase of 3.2% in total capacity, primarily due to a decrease of 2.5% in fuel consumption

per ASK as a result of the higher number of next-generation aircraft in our fleet and several fuel-saving initiatives, , and a 4.2% period-over-period

decrease in fuel cost per liter (excluding hedges). |

| § | Salaries and benefits

increased 14.5%, or R$249.9 million, from R$1,728.5 million in the nine-month period ended September 30, 2023, to R$1,978.5 million in

the nine-month period ended September 30, 2024, mainly driven by a period-over-period capacity increase of 3.2%, a 5.5% union increase

in salaries as a result of collective bargaining agreements with unions applicable to all airline employees in Brazil, the insourcing

of certain activities to reduce total costs, and hirings made in the fourth quarter of 2023 to reduce ground time and support our growth

plans. |

| § | Airport taxes and fees

decreased 2.2%, or R$17.0 million, from R$785.9 million in the nine-month period ended September 30, 2023, to R$768.9 million in the nine-month

period ended September 30, 2024, primarily due to an 8.4% decrease in international capacity, which incurs higher airport taxes and fees

compared to domestic services, partially offset by a 6.5% increase in our domestic capacity. |

| § | Traffic and customer servicing

increased 7.0%, or R$41.7 million, from R$595.0 million in the nine-month period ended September 30, 2023, to R$636.6 million in the nine-month

period ended September 30, 2024, primarily due to a 3.1% period-over-period increase in passengers and an inflation in the period of 4.2%. |

| § | Maintenance and repairs

decreased 15.8%, or R$105.3 million, from R$665.8 million in the nine-month period ended September 30, 2023, to R$560.6 million in the

nine-month period ended September 30, 2024, primarily due to savings from the insourcing of maintenance events and renegotiations with

suppliers. |

| § | Sales and marketing increased

13.3%, or R$74.5 million, from R$559.1 million in the nine-month period ended September 30, 2023, to R$633.6 million in the nine-month

period ended September 30, 2024, mostly driven by additional advertising campaigns during the Olympic Games and regional events and a

2.3% increase in passenger revenue, leading to an increase in credit card fees and commissions. |

| § | Depreciation and amortization

increased 1.7%, or R$31.7 million, from R$1,820.3 million in the nine-month period ended September 30, 2023, to R$1,852.0 million

in the nine-month period ended September 30, 2024, mostly driven by the increase in the right-of-use asset as a result of lease contract

renegotiations with lessors which were implemented in the second half of 2023. |

| Third Quarter Results 2024 |

| | |

| § | Insurance increased 35.2%,

or R$16.3 million, from R$46.4 million in the nine-month period ended September 30, 2023, to R$62.7 million in the nine-month period ended

September 30, 2024, primarily due to increases in insurance premium rates in the market as well as a period-over-period increase in passenger

traffic estimates, as insurance premiums are based in part upon forward-looking estimates of passenger traffic levels, in addition to

an 8.8% end of period depreciation of the Brazilian real against the US dollar. |

| § | Rental increased 21.6%,

or R$34.9 million, from R$161.7 million in the nine-month period ended September 30, 2023, to R$196.5 million in the nine-month period

ended September 30, 2024, primarily due to a one-time adjustment related to an engine maintenance agreement terminated in 1Q23, replaced

before the end of 2023, in addition to an increase in the use of alternative energy ground units to replace the use of our aircraft auxiliary

power unit, reducing fuel consumption. |

| § | Other expenses decreased

54.7%, or R$966.3 million, from R$1,767.7 million in the nine-month period ended September 30, 2023, to R$801.4 million in the nine-month

period ended September 30, 2024, primarily due to the impact of our cost-reduction initiatives and lower number of judicial claims in

the period. |

Non-Operating Results

| § | Financial income was R$152.5

million in the nine-month period ended September 30, 2024, mainly due to a higher balance of cash and cash equivalents and short-term

investments in the period, compared to R$143.9 million in the nine-month period ended September 30, 2023. |

| § | Financial expenses was

R$3,879.0 million in the nine-month period ended September 30, 2024, primarily due to a reduction in discount rate on aircraft lease and

lower interest on provisions and vendors, compared to R$4,339.5 million in the nine-month period ended September 30, 2023. |

| § | Derivative financial instruments

totaled a net gain of R$53.3 million for the nine-month period ended September 30, 2024, primarily due to fuel hedge gains recorded during

the period, compared to a loss of R$44.2 million for the nine-month period ended September 30, 2023. As of September 30, 2024, Azul had

hedged approximately 13.1% of its expected fuel consumption for the next twelve months by using forward contracts. |

| § | Foreign currency exchange,

net. The net currency exchange effect on our monetary assets and liabilities when remeasured into Brazilian reais was a loss of R$3,373.2

million in the nine-month period ended September 30, 2024, primarily due to an 8.8% end of period depreciation of the Brazilian real against

the US dollar, resulting in an increase in lease liabilities and loans denominated in foreign currency, compared to a gain of R$771.2

million in the nine-month period ended September 30, 2023. |

| Third Quarter Results 2024 |

| | |

Cash Flows

The table below presents our cash flows from

operating, investing and financing activities for the periods indicated:

| (R$ million) |

9M24 |

9M23 |

% Δ |

| Net cash generated by operating activities |

1,808,728 |

1,540,901 |

17.4% |

| Net cash used in investing activities |

(1,082,575) |

(729,776) |

48.3% |

| Net cash used in financing activities |

(1,545,290) |

(142,768) |

982.4% |

| Exchange gain on cash and cash equivalents |

3,958.0 |

62,680.0 |

-93.7% |

| Net decrease in cash and cash equivalents |

(815,179.0) |

731,037.0 |

n.a. |

Net cash generated by operating activities

in the nine-month period ended September 30, 2024 was R$1,810.1 million, primarily due to an 8.8% end of period depreciation of the

Brazilian real against the US dollar, resulting in a gain on assets and liabilities denominated in foreign currency in addition to better

payment terms with suppliers, compared to R$1,540.9 million in the nine-month period ended September 30, 2023.

Net cash used in investing activities

was R$1,083.5 million in the nine-month period ended September 30, 2024, mostly related to a 155.9% period-over-period increase in the

acquisition of property, compared to the net cash used by investing activities of R$729.8 million in the nine-month period ended September

30, 2023.

Net cash used in financing activities

was R$1,545.7 million in the nine-month period ended September 30, 2024, primarily due to a 51.4% period-over-period decrease in the proceeds

from loans and financing and 31.5% period-over-period increase in lease debt payments, compared to R$142.8 million in the nine-month period

ended September 30, 2023.

Exchange gain on cash and cash equivalents

was R$3,958.0 million in the nine-month period ended September 30, 2024, compared to exchange rate changes on cash and cash equivalents

of R$62.7 million in the nine-month period ended September 30, 2023, primarily due to the 11.2% end of period depreciation of the Brazilian

real against the US dollar on September 30, 2024, compared to the 4.0% end of period appreciation of the Brazilian real against the US

dollar on September 30, 2023.

| Third Quarter Results 2024 |

| | |

Glossary

Aircraft Utilization

Average number of block hours per day per aircraft operated.

Available Seat Kilometers (ASK)

Number of aircraft seats multiplied by the

number of kilometers flown.

Completion Factor

Percentage of scheduled

flights that were executed.

Cost per ASK (CASK)

Operating expenses divided by available seat kilometers.

Cost per ASK ex-fuel (CASK ex-fuel)

Operating expenses

divided by available seat kilometers excluding fuel expenses.

EBITDA

Earnings before interest, taxes, depreciation,

and amortization. Adjusted EBITDA excludes non-recurring items.

FTE (Full-Time Equivalent)

Equivalent number of employees assuming

all work full-time.

Immediate Liquidity

Cash, cash equivalents, short-term investments,

and receivables.

Load Factor

Number of passengers as a percentage of

number of seats flown (calculated by dividing RPK by ASK).

LTM

Last twelve months ended on the last day

of the quarter presented.

Revenue Passenger Kilometers (RPK)

One-fare paying passenger transported one

kilometer. RPK is calculated by multiplying the number of revenue passengers by the number of kilometers flown.

Passenger Revenue per Available Seat

Kilometer (PRASK)

Passenger revenue divided by available seat

kilometers (also equal to load factor multiplied by yield).

Revenue per ASK (RASK)

Operating revenue divided by available seat kilometers.

Stage Length

The average number of kilometers flown per flight.

Trip Cost

Average cost of each flight calculated by dividing total operating expenses by total number of departures.

Yield

Average amount paid per passenger to fly

one kilometer. Usually, yield is calculated as average revenue per revenue passenger kilometer.

| Third Quarter Results 2024 |

| | |

This press release includes estimates and

forward-looking statements within the meaning of the U.S. federal securities laws. These estimates and forward-looking statements are

based mainly on our current expectations and estimates of future events and trends that affect or may affect our business, financial condition,

results of operations, cash flow, liquidity, prospects, and the trading price of our preferred shares, including in the form of ADSs.

Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to many

significant risks, uncertainties and assumptions and are made in light of information currently available to us. In addition, in this

release, the words “may,” “will,” “estimate,” “anticipate,” “intend,” “expect,”

“should” and similar words are intended to identify forward-looking statements. You should not place undue reliance on such

statements, which speak only as of the date they were made. Azul is not under the obligation to update publicly or to revise any forward-looking

statements after we distribute this press release because of new information, future events, or other factors. Our independent public

auditors have neither examined nor compiled the forward-looking statements and, accordingly, do not provide any assurance with respect

to such statements. In light of the risks and uncertainties described above, the future events and circumstances discussed in this release

might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision

based upon these estimates and forward-looking statements.

In this press release, we present EBITDA

and EBITDA margin, which are non-IFRS performance measures and are not financial performance measures determined in accordance with IFRS

and should not be considered in isolation or as alternatives to operating income or net income or loss, or as indications of operating

performance, or as alternatives to operating cash flows, or as indicators of liquidity, or as the basis for the distribution of dividends.

Accordingly, you are cautioned not to place undue reliance on this information.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 14, 2024

Azul S.A.

By: /s/ Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

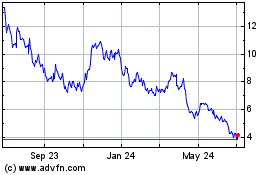

Azul (NYSE:AZUL)

Historical Stock Chart

From Dec 2024 to Jan 2025

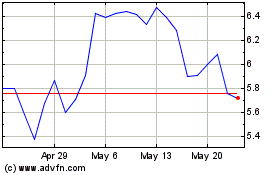

Azul (NYSE:AZUL)

Historical Stock Chart

From Jan 2024 to Jan 2025