UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2024

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil.

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

| Material Fact December | 2024 |

Azul Updates the Market on of its

Negotiations with Creditors

São Paulo, December 9, 2024 –

Azul S.A. (“Azul”) (B3: AZUL4, NYSE: AZUL) today updates the market on the progress of its comprehensive restructuring and

recapitalization transactions announced on October 28, 2024 (“Transactions”), which considerably strengthen Azul’s liquidity

and financial position.

On November 14, 2024, Azul announced additional

information relating to the terms of the Transactions, including agreements to provide up to US$500 million through the issuance of superpriority

notes (“Superpriority Notes”), including US$150 million already provided on October 30, 2024, an additional US$250 million

expected in January 2025, and the release of a further US$100 million upon meeting specific conditions (“Delayed Draw Conditions”).

To implement some of the Transactions, Azul shall

launch exchange offers and consent solicitations (“Exchange Offers”) in respect of Azul’s first out notes and second

out notes, with consummation of the Exchange Offers being a condition precedent to the issuance of the Superpriority Notes. Azul expects

to launch the Exchange Offers at the start of next week and to consummate the Exchange Offers and to issue the Superpriority Notes in

mid-January 2025.

As contemplated in the summary term sheet for

the Transactions (“Term Sheet”) made available on Azul’s Investor Relations website, Azul was required to negotiate

certain terms of the Transactions with the ad hoc group of supporting bondholders prior to launch of the Exchange Offers. Azul today announces

that it has agreed on these matters, and Azul has today published an updated version of the Term Sheet on its Investor Relations website

to provide additional information on such terms.

The matters updated in the Term Sheet include,

among others:

| · | certain terms of the Superpriority

Notes and the notes to be issued in the Exchange Offers; and |

| · | post-Transaction governance and

management incentive plan arrangements, including board nomination rights as well as a commitment to move to a single class of shares

within a specified period of time, and related changes to the share capital and conversions of common shares, |

in each case as further described in the Term

Sheet.

Azul has continued to work collaboratively with

its OEMs, lessors, and vendors to obtain additional cash flow improvements and to satisfy other lessor/OEM conditions precedent to the

issuance of the Superpriority Notes and the consummation of the Exchange Offers. Azul expects to satisfy the Delayed Draw Conditions concurrently

with the issuance of the Superpriority Notes and the consummation of the Exchange Offers, in that case providing Azul with full access

to the US$500 million in funding in mid-January 2025.

Furthermore, the Independent Business Expert (as

defined in the Term Sheet) has completed its work to validate the Budget (as defined in the Term Sheet) and to prepare a 13-week cash

flow forecast contemplated by the Term Sheet, which cash flow forecast shall be updated as necessary prior to, and as a condition for,

the consummation of the issuance of the Superpriority Notes and consummation of the Exchange Offers.

Important

Notes

This communication

is for information purposes only and is not intended to be published or distributed, directly or indirectly, in the United States or in

any other jurisdiction. This communication is not and shall not constitute (i) an offer to buy, or a solicitation of an offer to sell,

any of Azul’s existing notes or any other securities, (ii) the solicitation of consents from any holders of Azul’s existing

notes or any other securities, or (iii) an offer to sell, or the solicitation of an offer to buy, any of Azul’s new notes, ADRs,

preferred shares or other securities. There shall be no offering or sale of securities, and no solicitation of

consents from any holders of Azul’s existing notes or any other securities, in any jurisdiction in which such offer, sale or solicitation

would be unlawful. Any offer or solicitation will only be made pursuant to a separate disclosure or solicitation document and only to

such persons and in such jurisdictions as permitted under applicable law. The offering of any Securities has not been, and will not be,

registered under the Securities Act of 1933, as amended (“Securities

Act”). No securities may be offered or sold absent registration under the Securities Act or pursuant to an offer or sale under one

or more exemptions from, or in a transaction not subject to, the registration requirements of the Securities Act.

| Material Fact December | 2024 |

The securities

have not been and will not be issued or placed, distributed, offered or traded in the Brazilian

capital markets. The issuance of any securities referred to herein has not been nor will the relevant securities be registered with the

Brazilian Securities Commission (Comissão de Valores Mobiliários) (“CVM”). Any public offering or distribution,

as defined under Brazilian laws and regulations, of any securities in Brazil is not legal without prior registration under Law No. 6,385,

dated December 15, 1976, as amended, and CVM Resolution No. 160, dated July 13, 2022, as amended. Documents relating to the offering of

the relevant securities, as well as information contained therein, may not be supplied to the public in Brazil (as the offering of the

relevant securities will not be a public offering of securities in Brazil), nor be used in connection with any offer for subscription

or sale of the relevant securities to the public in Brazil. The relevant securities will not be offered or sold in Brazil, except in circumstances,

which do not constitute a public offering, placement, distribution or negotiation of securities in the Brazilian capital markets regulated

by Brazilian legislation.

Forward-Looking

Statements

This communication

includes forward-looking statements within the meaning of the US federal securities laws. These forward-looking statements are based mainly

on our current expectations and estimates of future events and trends that affect or may affect our business, financial condition, results

of operations, cash flow, liquidity, prospects and the trading price of our securities, including

the potential impacts of the material transactions referred to in this communication. Although we believe that any forward-looking statements

are based upon reasonable assumptions in light of information currently available to us, any such forward-looking statements are subject

to many significant risks, uncertainties and assumptions, including those factors discussed under the heading “Risk Factors”

in the Company’s annual report on Form 20-F for the year ended December 31, 2023 and any other cautionary statements which may be

made or referred to in connection with any such forward-looking statements.

In this

communication, the words “believe,” “understand,” “may,” “will,” “aim,” “estimate,”

“continue,” “anticipate,” “seek,” “intend,” “expect,” “should,”

“could,” “forecast” and similar words are intended to identify forward-looking statements. You should not place

undue reliance on such statements, which speak only as of the date they were made. Except as required by applicable law, we do not undertake

any obligation to update publicly or to revise any forward-looking statements after the date of this communication because of new information,

future events or other factors. Our independent public auditors have neither examined nor compiled the forward-looking statements and,

accordingly, do not provide any assurance with respect to such statements. In light of the risks and uncertainties described above, the

future events and circumstances discussed in this communication might not occur and are not guarantees of future performance. Because

of these uncertainties, you should not make any investment decision based upon these forward-looking statements.

The updated Term Sheet is available in Azul’s investor

relations website: https://ri.voeazul.com.br/en/investor-information/debt-information.

About

Azul

Azul S.A. (B3: AZUL4, NYSE: AZUL), the largest

airline in Brazil by number of flight departures and cities served, offers 1,000 daily flights to over 160 destinations. With an operating

fleet of over 180 aircraft and more than 15,000 Crewmembers, the Company has a network of 300 non-stop routes. Azul was named by Cirium

(leading aviation data analysis company) as the most on-time airline in the world in 2022, being the first Brazilian airline to obtain

this honor. In 2020 Azul was awarded best airline in the world by TripAdvisor, first time a Brazilian Flag Carrier earns number one ranking

in the Traveler’s Choice Awards.

For more information visit https://ri.voeazul.com.br/en.

Contact:

Investor Relations

Tel: +55 11 4831 2880

invest@voeazul.com.br

Media Relations

Tel: +55 11 4831 1245

imprensa@voeazul.com.br

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 9, 2024

Azul S.A.

By: /s/ Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

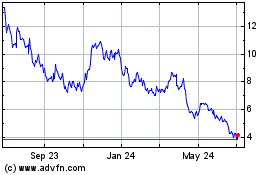

Azul (NYSE:AZUL)

Historical Stock Chart

From Dec 2024 to Jan 2025

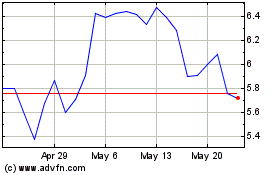

Azul (NYSE:AZUL)

Historical Stock Chart

From Jan 2024 to Jan 2025