Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

23 May 2024 - 6:22AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material under §240.14a-12 |

Braemar Hotels & Resorts Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price of other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction |

| | | |

| | (5) | Total fee paid: |

| | | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offset fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

On May 22, 2024, the following article appeared in The Dallas Morning News. Other than the express quotes or statements attributed to Mr. Bennett, the views expressed in this article are the views of The Dallas Morning News. The article contained the following text:

Monty Bennett speaks amid tense battle with ‘nuisance’ activist investor

Real estate investment trust Ashford Hospitality leader ousted from board but then reinstated

By Arcelia Martin

Shareholders of Dallas-based hotel real estate investment trust Ashford Hospitality voted out Chairman Monty Bennett last week. After he and another director handed in their resignation letters, the rest of the board refused them and reinstated the hotelier.

But it doesn’t mark the end of Bennett’s battle to maintain control of his companies. He’s up for another proxy fight at Braemar Hotels & Resorts Inc., another one of his hospitality REITs.

The initial vote to oust Bennett came after Blackwells Capital LLC, a New York-based activist investor that owns 1,000 shares of Ashford Hospitality, urged other shareholders to vote to remove the two board members and others aligned with Bennett, citing underperformance and unethical behavior.

The proxy advisory firm Institutional Shareholder Services recommended that shareholders vote against Bennett and his colleague for not completing a shareholder outreach plan, Bennett said in an emailed response to The Dallas Morning News.

Bennett said that the advisory firm was wrong, as Ashford Hospitality management had completed the plan. When they notified ISS, they were told that the process was closed and the recommendation would not be changed.

“This abusive behavior by ISS is why the Texas state legislature has been investigating ISS and other proxy advisory firms,” Bennett said. “It’s very discouraging.”

In recent years, the state has focused its push against environmental, social and corporate governance policies on financial firms, including ISS. As of 2021, Texas requires state pensions to divest from asset managers that “boycott” fossil fuels and exclude banks from underwriting bond sales over their gun safety rules.

Bennett attributes the ISS’ recommendation as the cause for the discrepancy in confidence between shareholders and the surviving board members who reinstated him.

Blackwells created campaign sites like nomoremonty.com and montymustgo.com, where it alleges that Bennett has been pocketing increasing advisory fees despite company hardships.

Bennett said Blackwells is a well-known greenmailer or a firm that buys enough shares in a company to threaten it so the target company will repurchase its shares at a premium.

“Blackwells is not a traditional investor that invests in a company such as Braemar and hopes that value increases over time,” Bennett said. “They buy shares, immediately attack, then hope to get paid off as a nuisance.”

It’s been a tumultuous year for the companies Bennett oversees. The real estate trust handed over the keys to some of its hotels to lenders in December after the company missed mortgage payments on 19 hotels. The portfolio in default includes two North Texas properties — Courtyard Plano Legacy Park and Residence Inn Plano — and other hotels in cities like Las Vegas and Atlanta.

Ashford Inc., a real estate firm that Bennett heads, announced last month its plans to remove its shares from public trading on the New York Stock Exchange and go private. It’s an effort to focus the firm’s resources on enhancing long-term stockholder value and avoid the costs of being a public reporting company, according to an April statement from Ashford.

While Ashford lost $40.8 million, or $13.69 per share, last year, the company’s total revenue was nearly $340 million, a 20% growth rate over the previous year, according to Ashford’s 2023 financial results.

It’s not just the turbulence around Bennett’s businesses that distress his investors. It’s also his contentious role in the public eye. He’s nearly a decade-long donor to Republican Party candidates and is the publisher of the formerly Black-owned progressive newspaper The Dallas Express, now a right-leaning news site.

He offended the city’s bigwigs at a Downtown Dallas Inc. luncheon in March, using his few paid minutes of speaking time as an event sponsor to say he wouldn’t move his office downtown because it’s unsafe.

The hotel magnate became the poster child of corporate greed after applying for $126 million in forgivable loans and receiving the largest payout in the country at $69 million. After a change to qualifications for receiving aid, the companies were made to return the money.

The loans would have helped the 13,000 employees at his companies and their more than 130 hotels around the U.S. and the Caribbean, Bennett told The News in 2020. Bennett’s two real estate investment trusts both laid off 90% of their property-level staff, he said.

Blackwells’ Chief Investment Officer Jason Aintabi called the reappointment hours after the failed re-election of Bennett and board member Kamal Jafarnia at the annual meeting a “shameless maneuver.”

“Blackwells will hold Ashford and each of its directors accountable for the massive harm they have caused to shareholders,” Aintabi said.

Ashford presented the shakeup in a different light on May 14, stating that Blackwells’ attempted proxy fight had no meaningful impact on the outcomes of its annual stockholders meeting.

On the same day, Breamer released a similar statement to update stockholders that Blackwells’ attempted proxy campaign at Ashford failed and to disregard any proxy materials received from Blackwells Capital ahead of the July annual meeting.

For the investor group, Braemar’s congratulations on Ashford Hospitality’s reappointment of its board members highlights the lack of separation between Braemar and other companies affiliated with Bennett.

“It further foreshadows the types of improper entrenchment mechanisms that Monty and his cronies will employ at Braemar to prevent independent voices from gaining access to the boardroom,” Aintabi stated.

Ahead of the July 30 shareholder meeting, Bennett said he’s planning to communicate with shareholders about the value creation plan and explain how Blackwells’ true motives don’t align with theirs, he said.

Forward-Looking Statements

Certain statements and assumptions in this communication contain or are based upon “forward-looking” information and are being made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this communication include, among others, statements about the Company’s strategy and future plans. These forward-looking statements are subject to risks and uncertainties. When we use the words “will likely result,” “may,” “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” or similar expressions, we intend to identify forward-looking statements. Such statements are subject to numerous assumptions and uncertainties, many of which are outside Braemar’s control.

These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated, including, without limitation: our ability to complete the shareholder value creation plan on a timely basis, if at all; our ability to repay, refinance or restructure our debt and the debt of certain of our subsidiaries; anticipated or expected purchases or sales of assets; our projected operating results; completion of any pending transactions; risks associated with our ability to effectuate our dividend policy, including factors such as operating results and the economic outlook influencing our board’s decision whether to pay further dividends at levels previously disclosed or to use available cash to pay dividends; our understanding of our competition; market trends; projected capital expenditures; the impact of technology on our operations and business; general volatility of the capital markets and the market price of our common stock and preferred stock; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the markets in which we operate, interest rates or the general economy; and the degree and nature of our competition. These and other risk factors are more fully discussed in Braemar’s filings with the Securities and Exchange Commission (the “SEC”).

The forward-looking statements included in this communication are only made as of the date of this communication. Such forward-looking statements are based on our beliefs, assumptions, and expectations of our future performance taking into account all information currently known to us. These beliefs, assumptions, and expectations can change as a result of many potential events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity, results of operations, plans, and other objectives may vary materially from those expressed in our forward-looking statements. You should carefully consider this risk when you make an investment decision concerning our securities. Investors should not place undue reliance on these forward-looking statements. The Company can give no assurance that these forward-looking statements will be attained or that any deviation will not occur. We are not obligated to publicly update or revise any forward-looking statements, whether as a result of new information, future events or circumstances, changes in expectations, or otherwise, except to the extent required by law.

Additional Information and Where to Find it

The Company has filed a revised Preliminary Proxy Statement on Schedule 14A with the SEC on April 25, 2024 (the “Preliminary Proxy Statement”) and intends to file a definitive proxy statement and other relevant materials with respect to the Company’s solicitation of proxies for the annual meeting of stockholders expected to be held on July 30, 2024 (the “Annual Meeting”). INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE PRELIMINARY PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND THE DEFINITIVE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT MATERIALS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ANY SOLICITATION. The Preliminary Proxy Statement (and the definitive proxy statement and other relevant materials when they become available), and any other documents filed by the Company with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC at the Company’s website, http://www.bhrreit.com, under the “Investor” link, or by requesting them in writing or by telephone from us at 14185 Dallas Parkway, Suite 1200, Dallas, Texas 75254, Attn: Investor Relations or (972) 490-9600.

Participants

The Company and its directors and executive officers will be participants in the solicitation of proxies with respect to a solicitation by the Company. Information about those executive officers and directors of the Company and their ownership of the Company’s common stock is set forth in the Preliminary Proxy Statement. Investors and security holders may obtain additional information regarding direct and indirect interests of the Company and its executive officers and directors in the matters to be voted upon at the Annual Meeting by reading the Preliminary Proxy Statement. These documents are or will be available free of charge at the SEC’s website at www.sec.gov.

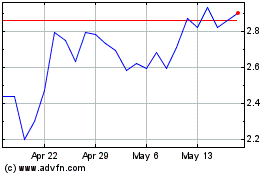

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From May 2024 to Jun 2024

Braemar Hotels and Resorts (NYSE:BHR)

Historical Stock Chart

From Jun 2023 to Jun 2024