|

PRICING SUPPLEMENT dated December 18, 2024

(To Product Supplement No. WF1 dated November 25, 2024,

Prospectus Supplement dated May 26, 2022

and Prospectus dated May 26, 2022)

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-264388

|

| |

Bank of Montreal

Senior

Medium-Term Notes, Series I

Equity Linked Securities

|

| |

Market Linked Securities—Auto-Callable

with Contingent Coupon and Contingent Downside

Principal at Risk Securities

Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| n | Linked to the common stock

of Uber Technologies, Inc. (the “Underlier”) |

| n | Unlike ordinary debt securities,

the securities do not provide for fixed payments of interest, do not repay a fixed amount of principal at stated maturity and are subject

to potential automatic call prior to stated maturity upon the terms described below. Whether the securities pay a contingent coupon, whether

the securities are automatically called prior to stated maturity and, if they are not automatically called, whether you receive the face

amount of your securities at stated maturity, will depend, in each case, on the closing value of the Underlier on the relevant calculation

day |

| n | Contingent Coupon.

The securities will pay a contingent coupon on a quarterly basis until the earlier of stated maturity or automatic call if, and only if,

the closing value of the Underlier on the calculation day for that quarter is greater than or equal to the coupon threshold value. However,

if the closing value of the Underlier on a calculation day is less than the coupon threshold value, you will not receive any contingent

coupon for the relevant quarter. If the closing value of the Underlier is less than the coupon threshold value on every calculation day,

you will not receive any contingent coupons throughout the entire term of the securities. The coupon threshold value is equal to 70% of

the starting value. The contingent coupon rate is 13.20% per annum |

| n | Automatic Call.

If the closing value of the Underlier on any of the quarterly calculation days scheduled to occur from March 2025 to September 2027, inclusive,

is greater than or equal to the starting value, the securities will be automatically called for the face amount plus a final contingent

coupon payment |

| n | Potential Loss of Principal.

If the securities are not automatically called prior to stated maturity, you will receive the face amount at stated maturity if, and only

if, the closing value of the Underlier on the final calculation day is greater than or equal to the downside threshold value. If the closing

value of the Underlier on the final calculation day is less than the downside threshold value, you will lose more than 30%, and possibly

all, of the face amount of your securities. The downside threshold value is equal to 70% of the starting value |

| n | If the securities are not

automatically called prior to stated maturity, you will have full downside exposure to the Underlier from the starting value if the closing

value on the final calculation day is less than the downside threshold value, but you will not participate in any appreciation of the

Underlier and will not receive any dividends on the Underlier |

| n | All payments on the securities

are subject to our credit risk, and you will have no ability to pursue the Underlier for payment; if Bank of Montreal defaults on its

obligations, you could lose some or all of your investment |

| n | No exchange listing; designed

to be held to maturity or automatic call |

On the date of this pricing supplement, the

estimated initial value of the securities is $951.10 per security. As discussed in more detail in this pricing supplement, the actual

value of the securities at any time will reflect many factors and cannot be predicted with accuracy. See “Estimated Value of the

Securities” in this pricing supplement.

The securities have complex features and investing

in the securities involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations”

beginning on page PRS- 10 herein and “Risk Factors” beginning on page PS-5 of the accompanying product supplement, page S-2

of the prospectus supplement and page 8 of the prospectus.

The securities are the unsecured obligations

of Bank of Montreal, and, accordingly, all payments on the securities are subject to the credit risk of Bank of Montreal. If Bank of Montreal

defaults on its obligations, you could lose some or all of your investment. The securities are not insured by the Federal Deposit Insurance

Corporation, the Deposit Insurance Fund, the Canada Deposit Insurance Corporation or any other governmental agency.

The securities are not bail-inable notes and

are not subject to conversion into our common shares or the common shares of any of our affiliates under subsection 39.2(2.3) of the Canada

Deposit Insurance Corporation Act.

Neither the Securities and Exchange Commission

nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the accuracy

or adequacy of this pricing supplement or the accompanying product supplement, prospectus supplement and prospectus. Any representation

to the contrary is a criminal offense.

| |

Original Offering Price

|

Agent Discount(1)(2)

|

Proceeds to Bank of Montreal

|

| Per Security |

$1,000.00 |

$23.25 |

$976.75 |

| Total |

$3,092,000.00 |

$71,889.00 |

$3,020,111.00 |

| (1) | Wells Fargo Securities, LLC is the agent for the distribution of the securities and is acting as principal.

See “Terms of the Securities—Agent” and “Estimated Value of the Securities” in this pricing supplement for

further information. |

| (2) | In respect of certain securities sold in this offering, our affiliate, BMO Capital Markets Corp., may

pay a fee of up to $3.50 per security to selected securities dealers in consideration for marketing and other services in connection with

the distribution of the securities to other securities dealers. |

Wells Fargo Securities

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| Issuer: |

Bank of Montreal. |

| Market Measure: |

The common stock of Uber Technologies, Inc. (the “Underlier”) (Bloomberg ticker symbol: UBER). |

| Pricing Date: |

December 18, 2024. |

| Issue Date: |

December 23, 2024. |

Original Offering

Price: |

$1,000 per security. |

| Face Amount: |

$1,000 per security. References in this pricing supplement to a “security” are to a security with a face amount of $1,000. |

Contingent

Coupon

Payments: |

On each contingent coupon payment date,

unless the securities have been automatically called, you will receive a contingent coupon payment at a per annum rate equal to the contingent

coupon rate if, and only if, the closing value of the Underlier on the related calculation day is greater than or equal to the coupon

threshold value.

Each “contingent coupon payment,”

if any, will be calculated per security as follows: ($1,000 × contingent coupon rate)/4. Any contingent coupon payment will be rounded

to the nearest cent, with one-half cent rounded upward.

If the closing value of the Underlier

on any calculation day is less than the coupon threshold value, you will not receive any contingent coupon payment on the related contingent

coupon payment date. If the closing value of the Underlier is less than the coupon threshold value on all calculation days, you will

not receive any contingent coupon payments over the term of the securities. |

Contingent

Coupon

Payment Dates: |

Quarterly, on the third business day following each calculation day (as each such calculation day may be postponed pursuant to “—Market Disruption Events and Postponement Provisions” below, if applicable); provided that the contingent coupon payment date with respect to the final calculation day will be the stated maturity date. |

Contingent

Coupon Rate: |

The “contingent coupon rate” is 13.20% per annum. |

Calculation

Days: |

Quarterly, on the 18th day of each March, June, September and December, commencing March 2025 and ending September 2027, and the final calculation day, each subject to postponement as described below under “— Market Disruption Events and Postponement Provisions.” We refer to December 20, 2027 as the “final calculation day.” |

| Automatic Call: |

If the closing value of the Underlier

on any of the calculation days scheduled to occur from March 2025 to September 2027, inclusive, is greater than or equal to the starting

value, the securities will be automatically called, and on the related call settlement date, you will be entitled to receive a cash payment

per security in U.S. dollars equal to the face amount per security plus a final contingent coupon payment.

If the securities are automatically

called, they will cease to be outstanding on the related call settlement date and you will have no further rights under the securities

after such call settlement date. You will not receive any notice from us if the securities are automatically called. |

Call Settlement

Date: |

Three business days after the applicable calculation day (as each such calculation day may be postponed pursuant to “—Market Disruption Events and Postponement Provisions” below, if applicable). |

Stated Maturity

Date: |

December 23, 2027, subject to postponement. The securities are not subject to repayment at the option of any holder of the securities prior to the stated maturity date. |

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

Maturity

Payment

Amount: |

If the securities are not automatically

called prior to the stated maturity date, you will be entitled to receive on the stated maturity date a cash payment per security in U.S.

dollars equal to the maturity payment amount (in addition to a final contingent coupon payment, if otherwise payable). The “maturity

payment amount” per security will equal:

• if

the ending value is greater than or equal to the downside threshold value: $1,000; or

• if

the ending value is less than the downside threshold value:

$1,000 × performance factor

If the securities are not automatically

called prior to stated maturity and the ending value is less than the downside threshold value, you will lose more than 30%, and possibly

all, of the face amount of your securities at stated maturity.

Any return on the securities

will be limited to the sum of your contingent coupon payments, if any. You will not participate in any appreciation of the Underlier,

but you will have full downside exposure to the Underlier if the ending value is less than the downside threshold value. |

Performance

Factor: |

The ending value divided by the starting value (expressed as a percentage). |

| Starting Value: |

$61.23, the closing value of the Underlier on the pricing date. |

| Closing Value: |

Closing value has the meaning assigned to “stock closing price” set forth under “General Terms of the Securities—Certain Terms for Securities Linked to an Underlying Stock—Certain Definitions” in the accompanying product supplement. The closing value of the Underlier is subject to adjustment through the adjustment factor as described in the accompanying product supplement. |

| Ending Value: |

The “ending value” will be the closing value of the Underlier on the final calculation day. |

Coupon

Threshold

Value: |

$42.861, which is equal to 70% of the starting value. |

Downside

Threshold

Value: |

$42.861, which is equal to 70% of the starting value. |

Market

Disruption

Events and

Postponement

Provisions: |

Each calculation day is subject to postponement

due to non-trading days and the occurrence of a market disruption event. In addition, the stated maturity date will be postponed if the

final calculation day is postponed and will be adjusted for non-business days.

For more information regarding adjustments

to the calculation days, the contingent coupon payment dates, the call settlement dates and the stated maturity date, see “General

Terms of the Securities—Consequences of a Market Disruption Event; Postponement of a Calculation Day—Securities Linked to

a Single Market Measure” and “—Payment Dates” in the accompanying product supplement. For purposes of the accompanying

product supplement, each contingent coupon payment date, each call settlement date and the stated maturity date is a “payment date.”

In addition, for information regarding the circumstances that may result in a market disruption event, see “General Terms of the

Securities—Certain Terms for Securities Linked to an Underlying Stock —Market Disruption Events” in the accompanying

product supplement. |

Calculation

Agent: |

BMO Capital Markets Corp. (“BMOCM”) |

Material Tax

Consequences: |

For a discussion of material U.S. federal income tax consequences and Canadian federal income tax consequences of the ownership and disposition of the securities, see “United States Federal Income Tax Considerations” below and the sections of the product supplement entitled “United States Federal Income Tax Considerations” and “Canadian Federal Income Tax Consequences.” |

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| Agent: |

Wells Fargo Securities, LLC (“WFS”)

is the agent for the distribution of the securities. The agent will receive an agent discount of up to $23.25 per security. The agent

may resell the securities to other securities dealers at the original offering price of the securities less a concession not in excess

of $17.50 per security. Such securities dealers may include Wells Fargo Advisors (“WFA”) (the trade name of the retail

brokerage business of WFS’s affiliates, Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC). In

addition to the concession allowed to WFA, WFS may pay $0.75 per security of the agent discount that it receives to WFA as a distribution

expense fee for each security sold by WFA.

In addition, in respect of certain

securities sold in this offering, BMOCM may pay a fee of up to $3.50 per security to selected securities dealers in consideration for

marketing and other services in connection with the distribution of the securities to other securities dealers.

WFS, BMOCM and/or one or more of

their respective affiliates expects to realize hedging profits projected by their proprietary pricing models to the extent they assume

the risks inherent in hedging our obligations under the securities. If WFS or any other dealer participating in the distribution of the

securities or any of their affiliates conduct hedging activities for us in connection with the securities, that dealer or its affiliates

will expect to realize a profit projected by its proprietary pricing models from those hedging activities. Any such projected profit

will be in addition to any discount, concession or fee received in connection with the sale of the securities to you. |

| Denominations: |

$1,000 and any integral multiple of $1,000. |

| CUSIP: |

06376CKM7 |

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| Additional Information About the Issuer and the Securities |

You should read this pricing supplement together

with product supplement no. WF1 dated November 25, 2024, the prospectus supplement dated May 26, 2022 and the prospectus dated May 26,

2022 for additional information about the securities. To the extent that disclosure in this pricing supplement is inconsistent with the

disclosure in the product supplement, prospectus supplement or prospectus, the disclosure in this pricing supplement will control. Certain

defined terms used but not defined herein have the meanings set forth in the product supplement, prospectus supplement or prospectus.

Our Central Index Key, or CIK, on the SEC website

is 927971. When we refer to “we,” “us” or “our” in this pricing supplement, we

refer only to Bank of Montreal.

You may access the product supplement, prospectus

supplement and prospectus on the SEC website www.sec.gov as follows (or if such address has changed, by reviewing our filings for the

relevant date on the SEC website):

| • | Product Supplement No. WF1 dated November 25, 2024: |

https://www.sec.gov/Archives/edgar/data/927971/000121465924019574/g1121240424b2.htm

| • | Prospectus Supplement and Prospectus dated May 26, 2022: |

https://www.sec.gov/Archives/edgar/data/927971/000119312522160519/d269549d424b5.htm

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| Estimated Value of the Securities |

Our estimated initial value of the securities on

the date of this pricing supplement, which is set forth on the cover page of this pricing supplement, equals the sum of the values of

the following hypothetical components:

| · | a fixed-income debt component with the same tenor as the securities, valued using our internal funding

rate for structured notes; and |

| · | one or more derivative transactions relating to the economic terms of the securities. |

The internal funding rate used in the determination

of the initial estimated value generally represents a discount from the credit spreads for our conventional fixed-rate debt. The value

of these derivative transactions is derived from our internal pricing models. These models are based on factors such as the traded market

prices of comparable derivative instruments and on other inputs, which include volatility, dividend rates, interest rates and other factors.

As a result, the estimated initial value of the securities on the pricing date was determined based on market conditions at that time.

For more information about the estimated initial

value of the securities, see “Selected Risk Considerations” below.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

The securities are not appropriate for all investors.

The securities may be an appropriate investment for investors who:

| § | seek an investment with contingent coupon payments

at a rate equal to the contingent coupon rate until the earlier of stated maturity or automatic call, if, and only if, the closing

value of the Underlier on the applicable calculation day is greater than or equal to the coupon threshold value; |

| § | understand that if the securities are not automatically

called prior to the stated maturity date and the ending value is less than the downside threshold value, they will be fully exposed to

the decline in the Underlier from the starting value and will lose a significant portion, and possibly all, of the face amount of the

securities at stated maturity; |

| § | are willing to accept the risk that they may

receive few or no contingent coupon payments over the term of the securities; |

| § | understand that the securities may be automatically

called prior to stated maturity and that the term of the securities may be reduced; |

| § | understand and are willing to accept the full

downside risks of the Underlier; |

| § | are willing to forgo participation in any appreciation

of the Underlier and dividends on the Underlier; and |

| § | are willing to hold the securities until maturity

or automatic call. |

The securities may not be an appropriate investment

for investors who:

| § | seek a liquid investment or are unable or unwilling

to hold the securities to maturity or automatic call; |

| § | require full payment of the face amount of the

securities at stated maturity; |

| § | seek a security with a fixed term; |

| § | are unwilling to purchase securities with an

estimated value as of the pricing date that is lower than the original offering price, as set forth on the cover page; |

| § | are unwilling to accept the risk that the ending

value may be less than the downside threshold value; |

| § | seek the certainty of current income over the

term of the securities; |

| § | seek exposure to the upside performance of the

Underlier; |

| § | are unwilling to accept the risk of exposure

to the Underlier; |

| § | are unwilling to accept the credit risk of Bank

of Montreal to obtain exposure to the Underlier; or |

| § | prefer the lower risk of fixed income investments

with comparable maturities issued by companies with comparable credit ratings. |

The considerations identified above are not

exhaustive. Whether or not the securities are an appropriate investment for you will depend on your individual circumstances, and you

should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered

the appropriateness of an investment in the securities in light of your particular circumstances. You should also review carefully the

sections titled “Selected Risk Considerations” herein and “Risk Factors” in the accompanying product supplement

for risks related to an investment in the securities. For more information about the Underlier, please see the section titled “The

Underlier” below.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| Determining Payment On A Contingent Coupon Payment Date And At Maturity |

If the securities have not been previously automatically

called, on each contingent coupon payment date, you will either receive a contingent coupon payment or you will not receive a contingent

coupon payment, depending on the closing value of the Underlier on the related calculation day.

If the securities have not been automatically called

prior to the stated maturity date, then at maturity you will receive (in addition to a final contingent coupon payment, if otherwise payable)

a cash payment per security (the maturity payment amount) calculated as follows:

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| Hypothetical Payout Profile |

The following profile illustrates the potential

maturity payment amount on the securities (excluding the final contingent coupon payment, if otherwise payable) for a range of hypothetical

performances of the Underlier from the starting value to the ending value, assuming the securities have not been automatically called

prior to the stated maturity date. As this profile illustrates, in no event will you have a positive rate of return based solely on the

maturity payment amount received at maturity; any positive return will be based solely on the contingent coupon payments, if any, received

during the term of the securities. This graph has been prepared for purposes of illustration only. Your actual return will depend on whether

the securities are automatically called, the actual ending value and whether you hold your securities to stated maturity.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| Selected Risk Considerations |

The securities have complex features and investing

in the securities will involve risks not associated with an investment in conventional debt securities. Some of the risks that apply to

an investment in the securities are summarized below, but we urge you to read the more detailed explanation of the risks relating to the

securities generally in the “Risk Factors” section of the accompanying product supplement and prospectus supplement. You should

reach an investment decision only after you have carefully considered with your advisors the appropriateness of an investment in the securities

in light of your particular circumstances.

Risks Relating To The Securities Generally

If The Securities Are Not Automatically Called

Prior To Stated Maturity, You May Lose Some Or All Of The Face Amount Of Your Securities At Stated Maturity.

We will not repay you a fixed amount on the securities

at stated maturity. If the securities are not automatically called prior to stated maturity, you will receive a maturity payment amount

that will be equal to or less than the face amount, depending on the ending value.

If the ending value is less than the downside threshold

value, the maturity payment amount will be reduced by an amount equal to the decline in the value of the Underlier from the starting value

(expressed as a percentage of the starting value). The downside threshold value is 70% of the starting value. For example, if the securities

are not automatically called and the Underlier has declined by 30.1% from the starting value to the ending value, you will not receive

any benefit of the contingent downside protection feature and you will lose 30.1% of the face amount. As a result, you will not receive

any protection if the value of the Underlier declines significantly and you may lose some, and possibly all, of the face amount at stated

maturity, even if the value of the Underlier is greater than or equal to the starting value or the downside threshold value at certain

times during the term of the securities.

Even if the ending value is greater than the downside

threshold value, the maturity payment amount will not exceed the face amount, and your yield on the securities, taking into account any

contingent coupon payments you may have received during the term of the securities, may be less than the yield you would earn if you bought

a traditional interest-bearing debt security of Bank of Montreal or another issuer with a similar credit rating with the same stated maturity

date.

The Securities Do Not Provide For Fixed Payments

Of Interest And You May Receive No Contingent Coupon Payments On One Or More Contingent Coupon Payment Dates, Or Even Throughout The Entire

Term Of The Securities.

On each contingent coupon payment date you will

receive a contingent coupon payment if, and only if, the closing value of the Underlier on the related calculation day is greater

than or equal to the coupon threshold value. If the closing value of the Underlier on any calculation day is less than the coupon threshold

value, you will not receive any contingent coupon payment on the related contingent coupon payment date, and if the closing value of the

Underlier is less than the coupon threshold value on each calculation day over the term of the securities, you will not receive any contingent

coupon payments over the entire term of the securities.

You May Be Fully Exposed To The Decline In The

Underlier From The Starting Value, But Will Not Participate In Any Positive Performance Of The Underlier.

Even though you will be fully exposed to a decline

in the value of the Underlier if the ending value is below the downside threshold value, you will not participate in any increase in the

value of the Underlier over the term of the securities. Your maximum possible return on the securities will be limited to the sum of the

contingent coupon payments you receive, if any. Consequently, your return on the securities may be significantly less than the return

you could achieve on an alternative investment that provides for participation in an increase in the value of the Underlier.

Higher Contingent Coupon Rates Are Associated

With Greater Risk.

The securities offer contingent coupon payments

at a higher rate, if paid, than the fixed rate we would pay on conventional debt securities of the same maturity. These higher potential

contingent coupon payments are associated with greater levels of expected risk as of the pricing date as compared to conventional debt

securities, including the risk that you may not receive a contingent coupon payment on one or more, or any, contingent coupon payment

dates and the risk that you may lose a substantial portion, and possibly all, of the face amount at maturity. The volatility of the Underlier

is an important factor affecting this risk. Volatility is a measurement of the size and frequency of daily fluctuations in the value of

the Underlier, typically observed over a specified period of time. Volatility can be measured in a variety of ways, including on a historical

basis or on an expected basis as implied by option prices in the market. Greater expected volatility of the Underlier as of the pricing

date may result in a higher contingent coupon rate, but it also represents a greater expected likelihood as of the pricing date that the

closing value of the Underlier will be less than the coupon threshold value on one or more calculation days, such that you will not receive

one or more, or any, contingent coupon payments during the term of the securities, and that the closing value of the Underlier will be

less than the downside threshold value on the final calculation day such that you will lose a substantial portion, and possibly all, of

the face amount at maturity. In general, the higher the contingent coupon rate is relative to the fixed rate we would pay on conventional

debt securities, the greater the expected risk that you will not receive one or more, or any, contingent coupon payments during the term

of the securities and that you will lose a substantial portion, and possibly all, of the face amount at maturity.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

You Will Be Subject To Reinvestment Risk.

If your securities are automatically called, the

term of the securities may be reduced. There is no guarantee that you would be able to reinvest the proceeds from an investment in the

securities at a comparable return for a similar level of risk in the event the securities are automatically called prior to maturity.

The Securities Are Subject To Credit Risk.

The securities are our obligations and are not,

either directly or indirectly, an obligation of any third party. Any amounts payable under the securities are subject to our creditworthiness

and you will have no ability to pursue the Underlier for payment. As a result, our actual and perceived creditworthiness may affect the

value of the securities and, in the event we were to default on our obligations under the securities, you may not receive any amounts

owed to you under the terms of the securities.

The U.S. Federal Income Tax Consequences Of

An Investment In The Securities Are Unclear.

There is no direct legal authority regarding the

proper U.S. federal income tax treatment of the securities, and significant aspects of the tax treatment of the securities are uncertain.

Moreover, non-U.S. investors should note that we intend to withhold on any coupon paid to a non-U.S. investor, generally at a rate of

30%. We will not pay any additional amounts in respect of such withholding. You should review carefully the section entitled “United

States Federal Income Tax Considerations” herein, in combination with the section entitled “United States Federal Income Tax

Considerations” in the accompanying product supplement, and consult your tax advisor regarding the U.S. federal income tax consequences

of an investment in the securities.

The Stated Maturity Date May Be Postponed If

The Final Calculation Day Is Postponed.

The final calculation day will be postponed if

the originally scheduled final calculation day is not a trading day or if the calculation agent determines that a market disruption event

has occurred or is continuing on the final calculation day. If such a postponement occurs, the stated maturity date may be postponed.

For additional information, see “General Terms of the Securities—Consequences of a Market Disruption Event; Postponement of

a Calculation Day—Securities Linked to a Single Market Measure” and “—Payment Dates” in the accompanying

product supplement.

Risks Relating To The Estimated Value Of

The Securities And Any Secondary Market

The Estimated Value Of The Securities On The

Pricing Date, Based On Our Proprietary Pricing Models, Will Be Less Than The Original Offering Price.

Our initial estimated value of the securities is

only an estimate, and is based on a number of factors. The original offering price of the securities may exceed our initial estimated

value, because costs associated with offering, structuring and hedging the securities are included in the original offering price, but

are not included in the estimated value. These costs will include any agent discount and selling concessions and the cost of hedging our

obligations under the securities through one or more hedge counterparties (which may be one or more of our affiliates or an agent or its

affiliates). Such hedging cost includes our or our hedge counterparty’s expected cost of providing such hedge, as well as the profit

we or our hedge counterparty expect to realize in consideration for assuming the risks inherent in providing such hedge.

The Terms Of The Securities Are Not Determined

By Reference To The Credit Spreads For Our Conventional Fixed-Rate Debt.

To determine the terms of the securities, we use

an internal funding rate that represents a discount from the credit spreads for our conventional fixed-rate debt. As a result, the terms

of the securities are less favorable to you than if we had used a higher funding rate.

The Estimated Value Of The Securities Is Not

An Indication Of The Price, If Any, At Which WFS Or Any Other Person May Be Willing To Buy The Securities From You In The Secondary Market.

Our initial estimated value of the securities is

derived using our internal pricing models. This value is based on market conditions and other relevant factors, which include volatility

of the Underlier, dividend rates and interest rates. Different pricing models and assumptions, including those used by the agent, its

affiliates or other market participants, could provide values for the securities that are greater than or less than our initial estimated

value. In addition, market conditions and other relevant factors after the pricing date are expected to change, possibly rapidly, and

our assumptions may prove to be incorrect. After the pricing date, the value of the securities could change dramatically due to changes

in market conditions, our creditworthiness, and the other factors discussed in the next risk factor. These changes are likely to impact

the price, if any, at which WFS or its affiliates or any other party (including us or our affiliates) would be willing to purchase the

securities from you in any secondary market transactions. Our initial estimated value does not represent a minimum price at which WFS

or any other party (including us or our affiliates) would be willing to buy your securities in any secondary market at any time.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

WFS has advised us that if it, WFA or any of their

affiliates makes a secondary market in the securities at any time, the secondary market price offered by it, WFA or any of their affiliates

will be affected by changes in market conditions and other factors described in the next risk factor. WFS has advised us that if it, WFA

or any of their affiliates makes a secondary market in the securities at any time up to the issue date or during the 3-month period following

the issue date, the secondary market price offered by it, WFA or any of its affiliates will be increased by an amount reflecting a portion

of the costs associated with selling, structuring and hedging the securities that are included in their original offering price. Because

this portion of the costs is not fully deducted upon issuance, WFS has advised us that any secondary market price it, WFA or any of their

affiliates offers during this period will be higher than it otherwise would be after this period, as any secondary market price offered

after this period will reflect the full deduction of the costs as described above. WFS has advised us that the amount of this increase

in the secondary market price will decline steadily to zero over this 3-month period. WFS has advised us that, if you hold the securities

through an account with WFS, WFA or any of their affiliates, WFS expects that this increase will also be reflected in the value indicated

for the securities on your brokerage account statement. If you hold your securities through an account at a broker-dealer other than WFS,

WFA or any of their affiliates, the value of the securities on your brokerage account statement may be different than if you held your

securities at WFS, WFA or any of their affiliates.

The Value Of The Securities Prior To Stated

Maturity Will Be Affected By Numerous Factors, Some Of Which Are Related In Complex Ways.

The value of the securities prior to stated maturity

will be affected by the then-current value of the Underlier, interest rates at that time and a number of other factors, some of which

are interrelated in complex ways. The effect of any one factor may be offset or magnified by the effect of another factor. The following

factors, which are described in more detail in the accompanying product supplement, are expected to affect the value of the securities:

performance of the Underlier; interest rates; volatility of the Underlier; time remaining to maturity; and dividend yields on the Underlier.

When we refer to the “value” of your securities, we mean the value you could receive for your securities if you are

able to sell them in the open market before the stated maturity date.

In addition to these factors, the value of the

securities will be affected by actual or anticipated changes in our creditworthiness. The value of the securities will also be limited

by the automatic call feature because if the securities are automatically called, you will not receive the contingent coupon payments

that would have accrued, if any, had the securities been called on a later calculation day or held until the stated maturity date. You

should understand that the impact of one of the factors specified above, such as a change in interest rates, may offset some or all of

any change in the value of the securities attributable to another factor, such as a change in the value of the Underlier. Because numerous

factors are expected to affect the value of the securities, changes in the value of the Underlier may not result in a comparable change

in the value of the securities.

The Securities Will Not Be Listed On Any Securities

Exchange And We Do Not Expect A Trading Market For The Securities To Develop.

The securities will not be listed or displayed

on any securities exchange. Although the agent and/or its affiliates may purchase the securities from holders, they are not obligated

to do so and are not required to make a market for the securities. There can be no assurance that a secondary market will develop. Because

we do not expect that any market makers will participate in a secondary market for the securities, the price at which you may be able

to sell your securities is likely to depend on the price, if any, at which the agent is willing to buy your securities. If a secondary

market does exist, it may be limited. Accordingly, there may be a limited number of buyers if you decide to sell your securities prior

to stated maturity. This may affect the price you receive upon such sale. Consequently, you should be willing to hold the securities to

stated maturity.

Risks Relating To The Underlier

Any Payments On The Securities And Whether The

Securities Are Automatically Called Will Depend Upon The Performance Of The Underlier And Therefore The Securities Are Subject To The

Following Risks, Each As Discussed In More Detail In The Accompanying Product Supplement.

| · | Investing In The Securities Is Not The Same

As Investing In The Underlier. Investing in the securities is not equivalent to investing in the Underlier. As an investor in the

securities, your return will not reflect the return you would realize if you actually owned and held the Underlier for a period similar

to the term of the securities because you will not receive any dividend payments, distributions or any other payments paid on the Underlier.

As a holder of the securities, you will not have any voting rights or any other rights that holders of the Underlier would have. |

| · | Historical Values Of The Underlier Should

Not Be Taken As An Indication Of The Future Performance Of The Underlier During The Term Of The Securities. |

| · | The Securities May Become Linked To The Common

Stock Of A Company Other Than The Original Underlying Stock Issuer. |

| · | We Cannot Control Actions By The Underlying

Stock Issuer. |

| · | We And Our Affiliates Have No Affiliation

With The Underlying Stock Issuer And Have Not Independently Verified Its Public Disclosure Of Information. |

| · | You Have Limited Anti-dilution Protection. |

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

The Securities Will Be Subject To Single Stock

Risk.

The value of the Underlier can rise or fall sharply

due to factors specific to the Underlier, such as stock price volatility, earnings, financial conditions, corporate, industry and regulatory

developments, management changes and decisions and other events, as well as general market factors, such as general stock market volatility

and prices, interest rates and economic and political conditions.

Risks Relating To Conflicts Of Interest

Our Economic Interests And Those Of Any Dealer

Participating In The Offering Are Potentially Adverse To Your Interests.

You should be aware of the following ways in which

our economic interests and those of any dealer participating in the distribution of the securities, which we refer to as a “participating

dealer,” are potentially adverse to your interests as an investor in the securities. In engaging in certain of the activities

described below and as discussed in more detail in the accompanying product supplement, our affiliates or any participating dealer or

its affiliates may take actions that may adversely affect the value of and your return on the securities, and in so doing they will have

no obligation to consider your interests as an investor in the securities. Our affiliates or any participating dealer or its affiliates

may realize a profit from these activities even if investors do not receive a favorable investment return on the securities.

| · | The calculation agent is our affiliate

and may be required to make discretionary judgments that affect the return you receive on the securities. BMOCM, which is our

affiliate, will be the calculation agent for the securities. As calculation agent, BMOCM will determine any values of the Underlier and

make any other determinations necessary to calculate any payments on the securities. In making these determinations, BMOCM may be required

to make discretionary judgments that may adversely affect any payments on the securities. See the sections entitled “General Terms

of the Securities—Certain Terms for Securities Linked to an Underlying Stock—Market Disruption Events” and “—Adjustment

Events” in the accompanying product supplement. In making these discretionary judgments, the fact that BMOCM is our affiliate may

cause it to have economic interests that are adverse to your interests as an investor in the securities, and BMOCM’s determinations

as calculation agent may adversely affect your return on the securities. |

| · | The estimated value of the securities was

calculated by us and is therefore not an independent third-party valuation. |

| · | Research reports by our affiliates or any

participating dealer or its affiliates may be inconsistent with an investment in the securities and may adversely affect the value of

the Underlier. |

| · | Business activities of our affiliates or

any participating dealer or its affiliates with the Underlying Stock Issuer may adversely affect the value of the Underlier. |

| · | Hedging activities by our affiliates or

any participating dealer or its affiliates may adversely affect the value of the Underlier. |

| · | Trading activities by our affiliates or

any participating dealer or its affiliates may adversely affect the value of the Underlier. |

| · | A participating dealer or its affiliates

may realize hedging profits projected by its proprietary pricing models in addition to any selling concession and/or other fee, creating

a further incentive for the participating dealer to sell the securities to you. |

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

If the securities are automatically called:

If the securities are automatically called prior

to stated maturity, you will receive the face amount of your securities plus a final contingent coupon payment on the call settlement

date. In the event the securities are automatically called, your total return on the securities will equal any contingent coupon payments

received prior to the call settlement date and the contingent coupon payment received on the call settlement date.

If the securities are not automatically called:

If the securities are not automatically called

prior to stated maturity, the following table illustrates, for a range of hypothetical performance factors, the hypothetical maturity

payment amount payable at stated maturity per security (excluding the final contingent coupon payment, if otherwise payable). The performance

factor is the ending value expressed as a percentage of the starting value (i.e., the ending value divided by the starting value).

Hypothetical Performance

Factor |

Hypothetical Maturity Payment

Amount per Security |

| |

|

| 175.00% |

$1,000.00 |

| 160.00% |

$1,000.00 |

| 150.00% |

$1,000.00 |

| 140.00% |

$1,000.00 |

| 130.00% |

$1,000.00 |

| 120.00% |

$1,000.00 |

| 110.00% |

$1,000.00 |

| 100.00% |

$1,000.00 |

| 90.00% |

$1,000.00 |

| 80.00% |

$1,000.00 |

| 70.00% |

$1,000.00 |

| 69.00% |

$690.00 |

| 60.00% |

$600.00 |

| 50.00% |

$500.00 |

| 40.00% |

$400.00 |

| 30.00% |

$300.00 |

| 25.00% |

$250.00 |

| 0.00% |

$0.00 |

| |

|

|

The above figures do not take into account contingent coupon payments,

if any, received during the term of the securities. As evidenced above, in no event will you have a positive rate of return based solely

on the maturity payment amount received at maturity; any positive return will be based solely on the contingent coupon payments, if any,

received during the term of the securities.

The above figures are for purposes of illustration

only and may have been rounded for ease of analysis. If the securities are not automatically called prior to the stated maturity date,

the actual amount you will receive at stated maturity will depend on the actual ending value.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| Hypothetical Contingent Coupon Payments |

Set forth below are examples that illustrate how

to determine whether a contingent coupon payment will be paid and whether the securities will be automatically called, if applicable,

on a contingent coupon payment date prior to the stated maturity date. The following examples assume the securities are subject to automatic

call on the applicable calculation day. The following examples assume the hypothetical starting value, coupon threshold value and closing

values indicated in the examples. The terms used for purposes of these hypothetical examples do not represent the actual starting value

or coupon threshold value. The hypothetical starting value of $100.00 has been chosen for illustrative purposes only and does not represent

the actual starting value. The actual starting value and coupon threshold value are set forth under “Terms of the Securities”

above. For actual historical data of the Underlier, see the historical information set forth herein. These examples are for purposes of

illustration only and the values used in the examples may have been rounded for ease of analysis.

Example 1. The closing value of the Underlier

on the relevant calculation day is greater than or equal to the coupon threshold value and less than the starting value. As a result,

investors receive a contingent coupon payment on the applicable contingent coupon payment date and the securities are not automatically

called:

| |

The Underlier |

| Hypothetical starting value: |

$100.00 |

| Hypothetical closing value: |

$90.00 |

| Hypothetical coupon threshold value: |

$70.00 |

| Performance factor: |

90.00% |

Since the hypothetical closing value

of the Underlier on the relevant calculation day is greater than or equal to the hypothetical coupon threshold value, but less than the

hypothetical starting value, you would receive a contingent coupon payment on the applicable contingent coupon payment date and the securities

would not be automatically called. The contingent coupon payment would be equal to $33.00 per security, determined as follows: (i) $1,000

multiplied by 13.20% per annum divided by (ii) 4, rounded to the nearest cent.

Example 2. The closing value of the Underlier

on the relevant calculation day is less than the coupon threshold value. As a result, investors do not receive a contingent coupon payment

on the applicable contingent coupon payment date and the securities are not automatically called:

| |

The Underlier |

| Hypothetical starting value: |

$100.00 |

| Hypothetical closing value on the relevant calculation day: |

$69.00 |

| Hypothetical coupon threshold value: |

$70.00 |

| Performance factor: |

69.00% |

Since the hypothetical closing value

of the Underlier on the relevant calculation day is less than the hypothetical coupon threshold value, you would not receive a contingent

coupon payment on the applicable contingent coupon payment date, and the securities would not be automatically called.

Example 3. The closing value of the Underlier

on the relevant calculation day is greater than or equal to the starting value. As a result, the securities are automatically called on

the applicable contingent coupon payment date for the face amount plus a final contingent coupon payment:

| |

The Underlier |

| Hypothetical starting value: |

$100.00 |

| Hypothetical closing value on the relevant calculation day: |

$115.00 |

| Hypothetical coupon threshold value: |

$70.00 |

| Performance factor: |

115.00% |

Since the hypothetical closing value

of the Underlier on the relevant calculation day is greater than or equal to the hypothetical starting value, the securities would be

automatically called and you would receive the face amount plus a final contingent coupon payment on the applicable contingent coupon

payment date, which is also referred to as the call settlement date. On the call settlement date, you would receive $1,033.00 per security.

You will not receive any further payments

after the call settlement date.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| Hypothetical Payment at Stated Maturity |

Set forth below are examples of calculations of

the maturity payment amount payable at stated maturity, assuming that the securities have not been automatically called prior to the stated

maturity date and assuming the hypothetical starting value, coupon threshold value, downside threshold value and ending values indicated

in the examples. The terms used for purposes of these hypothetical examples do not represent the actual starting value, coupon threshold

value or downside threshold value. The hypothetical starting value of $100.00 has been chosen for illustrative purposes only and does

not represent the actual starting value. The actual starting value, coupon threshold value and downside threshold value are set forth

under “Terms of the Securities” above. For actual historical data of the Underlier, see the historical information set forth

herein. These examples are for purposes of illustration only and the values used in the examples may have been rounded for ease of analysis.

Example 1. The ending value is greater

than the starting value. As a result, the maturity payment amount is equal to the face amount of your securities and you receive a final

contingent coupon payment:

| |

The Underlier |

| Hypothetical starting value: |

$100.00 |

| Hypothetical ending value: |

$145.00 |

| Hypothetical coupon threshold value: |

$70.00 |

| Hypothetical downside threshold value: |

$70.00 |

| Performance factor: |

145.00% |

Since the hypothetical ending value

is greater than the hypothetical downside threshold value, the maturity payment amount would equal the face amount. Although the hypothetical

ending value is significantly greater than the hypothetical starting value in this scenario, the maturity payment amount will not exceed

the face amount.

In addition to any contingent coupon

payments received during the term of the securities, on the stated maturity date you would receive $1,000 per security. In addition, because

the hypothetical ending value is greater than the hypothetical coupon threshold value, you would receive a final contingent coupon payment

on the stated maturity date.

Example 2. The ending value is less than

the starting value but greater than the coupon threshold value and the downside threshold value. As a result, the maturity payment amount

is equal to the face amount of your securities and you will receive a final contingent coupon payment:

| |

The Underlier |

| Hypothetical starting value: |

$100.00 |

| Hypothetical ending value: |

$90.00 |

| Hypothetical coupon threshold value: |

$70.00 |

| Hypothetical downside threshold value: |

$70.00 |

| Performance factor: |

90.00% |

Since the hypothetical ending value

is less than the hypothetical starting value, but not by more than 30%, you would receive the face amount of your securities at maturity.

In addition to any contingent coupon

payments received during the term of the securities, on the stated maturity date you would receive $1,000 per security. In addition, because

the hypothetical ending value is greater than the hypothetical coupon threshold value, you would receive a final contingent coupon payment

on the stated maturity date.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

Example 3. The ending value is less than

the downside threshold value. As a result, the maturity payment amount is less than the face amount of your securities and you do not

receive a contingent coupon payment at maturity:

| |

The Underlier |

| Hypothetical starting value: |

$100.00 |

| Hypothetical ending value: |

$45.00 |

| Hypothetical coupon threshold value: |

$70.00 |

| Hypothetical downside threshold value: |

$70.00 |

| Performance factor: |

45.00% |

Since the hypothetical ending value

of the Underlier on the final calculation day is less than the hypothetical starting value by more than 30%, you would lose a portion

of the face amount of your securities and receive the maturity payment amount equal to $450.00 per security, calculated as follows:

= $1,000 × performance

factor

= $1,000 × 45.00%

= $450.00

In addition to any contingent coupon

payments received during the term of the securities, on the stated maturity date you would receive $450.00 per security. Because the hypothetical

ending value is less than the hypothetical coupon threshold value, you would not receive a final contingent coupon payment on the stated

maturity date.

These examples illustrate that you will not participate

in any appreciation of the Underlier, but will be fully exposed to a decrease in the Underlier if the ending value is less than the downside

threshold value.

To the extent that the starting value, coupon threshold

value, downside threshold value and ending value differ from the values assumed above, the results indicated above would be different.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

The Underlier is registered under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). Companies with securities registered under the Exchange Act

are required to file financial and other information specified by the SEC periodically. Information provided to or filed with the SEC

by the issuer of the Underlier can be located on a website maintained by the SEC at https://www.sec.gov by reference to that issuer’s

SEC file number provided below. Information from outside sources is not incorporated by reference in, and should not be considered part

of, this pricing supplement. We have not independently verified the accuracy or completeness of the information contained in outside sources.

According to publicly available information, Uber

Technologies, Inc. operates proprietary technology applications that connect (i) consumers with providers of ride services for ridesharing

services, (ii) consumers with restaurants, grocers and other stores with delivery service providers for meal preparation, grocery and

other delivery services, (iii) consumers with public transportation networks and (iv) shippers with carriers in the freight industry.

The issuer of the Underlier’s SEC file number

is 001-38902. The Underlier is listed on the New York Stock Exchange under the ticker symbol “UBER.”

Historical Information

We obtained the closing prices of the Underlier

in the graph below from Bloomberg Finance L.P. (“Bloomberg”), without independent verification. The historical prices

below may have been adjusted by Bloomberg to reflect any stock splits, reverse stock splits or other corporate transactions.

The following graph sets forth daily closing prices

of the Underlier for the period from May 10, 2019 to December 18, 2024. The closing price on December 18, 2024 was $61.23. The historical

performance of the Underlier should not be taken as an indication of its future performance during the term of the securities.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| United States Federal Income Tax Considerations |

Although there is uncertainty regarding the U.S.

federal income tax consequences of an investment in the securities due to the lack of governing authority, in the opinion of our counsel

Davis Polk & Wardwell LLP, under current law, and based on current market conditions, it is reasonable to treat a security as a single

prepaid financial contract with associated coupons for U.S. federal income tax purposes. Assuming this treatment of the securities is

respected, the tax consequences are as outlined in the discussion under “United States Federal Income Tax Considerations—Tax

Consequences to U.S. Holders—Securities Treated as Prepaid Financial Contracts with Associated Coupons” in the accompanying

product supplement.

We do not plan to request a ruling from the Internal

Revenue Service (the “IRS”) regarding the treatment of the securities. If the IRS were successful in asserting an alternative

treatment of the securities, the tax consequences of the ownership and disposition of the securities, including the timing and character

of income recognized by U.S. investors, might be materially and adversely affected. For example, under one alternative characterization

the securities may be treated as contingent payment debt instruments, which would require U.S. investors to accrue income periodically

based on a “comparable yield” and generally would require non-U.S. investors to certify their non-U.S. status on an IRS Form

W-8 to avoid a 30% (or a lower treaty rate) U.S. withholding tax. In addition, the U.S. Treasury Department and the IRS have requested

comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar financial

instruments and have indicated that such transactions may be the subject of future regulations or other guidance. Furthermore, members

of Congress have proposed legislative changes to the tax treatment of derivative contracts. Any legislation, Treasury regulations or other

guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in

the securities, possibly with retroactive effect.

Non-U.S. Holders. The U.S. federal income tax treatment

of the coupons is unclear. We intend to withhold on any coupon paid to a Non-U.S. Holder, generally at a rate of 30% or at a reduced rate

specified by an applicable income tax treaty under an “other income” or similar provision. In order to claim an exemption

from, or a reduction in, the 30% withholding under an applicable treaty, you will need to comply with certification requirements to establish

that you are not a U.S. person and are eligible for such an exemption or reduction under an applicable tax treaty. You should consult

your tax advisor regarding the tax treatment of the securities, including the possibility of obtaining a refund of all or a portion of

any amounts withheld.

As discussed in the accompanying product supplement,

Section 871(m) of the Code and the Treasury regulations thereunder (“Section 871(m)”) generally impose a 30% (or lower

treaty rate) withholding tax on “dividend equivalents” paid or deemed paid to non-U.S. investors with respect to certain financial

instruments linked to equities that could pay U.S.-source dividends for U.S. federal income tax purposes (“underlying securities”),

as defined under the applicable Treasury regulations, or indices that include underlying securities. Section 871(m) generally applies

to financial instruments that substantially replicate the economic performance of one or more underlying securities, as determined based

on tests set forth in the applicable Treasury regulations. Pursuant to an IRS notice, Section 871(m) will not apply to securities issued

before January 1, 2027 that do not have a delta of one with respect to any underlying security. Based on our determination that the securities

do not have a delta of one with respect to any underlying security, the securities should not be subject to Section 871(m). Our determination

is not binding on the IRS, and the IRS may disagree with this determination. Section 871(m) is complex and its application may depend

on your particular circumstances, including whether you enter into other transactions with respect to an underlying security. You should

consult your tax advisor regarding the potential application of Section 871(m) to the securities.

If withholding is required, we will not be required

to pay any additional amounts with respect to the amounts so withheld.

Both U.S. and non-U.S. investors considering an

investment in the securities should read the discussion under “United States Federal Income Tax Considerations” in the accompanying

product supplement and consult their tax advisors regarding all aspects of the U.S. federal income and estate tax consequences of an investment

in the securities, including possible alternative treatments, and any tax consequences arising under the laws of any state, local or non-U.S.

taxing jurisdiction.

Market Linked Securities—Auto-Callable with Contingent Coupon and Contingent Downside

Principal at Risk Securities Linked to the Common Stock of Uber Technologies, Inc. due December 23, 2027 |

| Validity of the Securities |

In the opinion of Osler, Hoskin & Harcourt

LLP, the issue and sale of the securities has been duly authorized by all necessary corporate action of the Bank of Montreal in conformity

with the indenture, and when this pricing supplement has been attached to, and duly notated on, the master note that represents the securities,

the securities will have been validly executed, authenticated, issued and delivered, to the extent that validity of the securities is

a matter governed by the laws of the Province of Ontario and the federal laws of Canada applicable therein and will be valid obligations

of the Bank of Montreal, subject to the following limitations (i) the enforceability of the indenture may be limited by the Canada Deposit

Insurance Corporation Act (Canada), the Winding-up and Restructuring Act (Canada) and bankruptcy, insolvency, reorganization, receivership,

moratorium, arrangement or winding-up laws or other similar laws affecting the enforcement of creditors’ rights generally; (ii)

the enforceability of the indenture may be limited by equitable principles, including the principle that equitable remedies such as specific

performance and injunction may only be granted in the discretion of a court of competent jurisdiction; (iii) pursuant to the Currency

Act (Canada) a judgment by a Canadian court must be awarded in Canadian currency and that such judgment may be based on a rate of exchange

in existence on a day other than the day of payment; and (iv) the enforceability of the indenture will be subject to the limitations contained

in the Limitations Act, 2002 (Ontario), and such counsel expresses no opinion as to whether a court may find any provision of the indenture

to be unenforceable as an attempt to vary or exclude a limitation period under that Act. This opinion is given as of the date hereof and

is limited to the laws of the Provinces of Ontario and the federal laws of Canada applicable therein. In addition, this opinion is subject

to certain assumptions about (i) the trustees’ authorization, execution and delivery of the indenture, (ii) the genuineness of signatures

and (iii) certain other matters, all as stated in the letter of such counsel dated May 26, 2022, which has been filed as Exhibit 5.3 to

Bank of Montreal’s Form 6-K filed with the SEC and dated May 26, 2022.

In the opinion of Davis Polk & Wardwell LLP,

as special United States products counsel to the Bank of Montreal, when the securities offered by this pricing supplement have been issued

by the Bank of Montreal pursuant to the indenture, the trustee has made the appropriate entries or notations to the master global note

that represents such securities (the “master note”), and such securities have been delivered against payment as contemplated

herein, such securities will be valid and binding obligations of the Bank of Montreal, enforceable in accordance with their terms, subject

to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable

principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith) and

possible judicial or regulatory actions or applications giving effect to governmental actions or foreign laws affecting creditors’

rights, provided that such counsel expresses no opinion as to (i) the enforceability of any waiver of rights under any usury or

stay law; or (ii) the effect of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed

above. This opinion is given as of the date hereof and is limited to the laws of the State of New York. Insofar as the foregoing opinion

involves matters governed by the laws of the Provinces of Ontario and Québec and the federal laws of Canada, you have received,

and we understand that you are relying upon, the opinion of Osler, Hoskin & Harcourt LLP, Canadian counsel for the Bank of Montreal,

set forth above. In addition, this opinion is subject to customary assumptions about the trustee’s authorization, execution and

delivery of the indenture and the authentication of the master note and the validity, binding nature and enforceability of the indenture

with respect to the trustee, all as stated in the opinion of Davis Polk & Wardwell LLP dated November 20, 2024, which has been filed

as an exhibit to Bank of Montreal’s report on Form 6-K filed with the SEC on November 20, 2024.

PRS-20

424B2

EX-FILING FEES

0000927971

333-264388

0000927971

2024-12-20

2024-12-20

iso4217:USD

xbrli:pure

xbrli:shares

EX-FILING FEES

CALCULATION OF FILING FEE TABLES

F-3

BANK OF MONTREAL /CAN/

Narrative Disclosure

The maximum aggregate offering price of the securities to which the prospectus relates is $3,092,000.00.

The

prospectus is a final prospectus for the related offering.

v3.24.4

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_RegnFileNb |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.4

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FnlPrspctsFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NrrtvDsclsr |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NrrtvMaxAggtAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

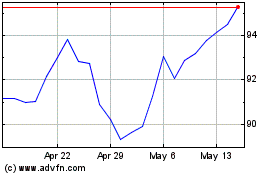

Bank of Montreal (NYSE:BMO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bank of Montreal (NYSE:BMO)

Historical Stock Chart

From Dec 2023 to Dec 2024