Buenaventura Announces Fourth Quarter 2022 Production and Volume Sold per Metal Results

17 February 2023 - 9:12AM

Business Wire

Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced 4Q22 results for production and volume sold.

4Q22 and FY22 Production per Metal(100% basis)

1Q22(Actual) 2Q22(Actual) 3Q22(Actual)

4Q22(Actual) FY22(Actual) 2023 Guidance

(1)(2)(3) Gold (Oz.) Orcopampa

19,031

17,749

20,164

17,535

74,478

72k - 80k

Tambomayo

13,867

14,351

13,755

12,348

54,320

35k - 40k

La Zanja

5,900

4,767

8,786

10,163

29,616

-

Coimolache

19,512

19,930

21,899

21,067

82,408

60k - 65k

El Brocal

4,350

4,457

7,085

7,467

23,359

24k - 26k

Silver (Oz.)

Uchucchacua

0

0

0

0

0

0.7M - 1.0M

Yumpag

0

0

0

0

0

1.6M - 1.8M

El Brocal

1,059,666

806,123

813,272

877,768

3,556,829

2.7M - 3.0M

Tambomayo

419,396

433,820

546,256

463,938

1,863,411

1.9M - 2.2M

Julcani

661,132

640,557

692,876

646,125

2,640,689

2.6M - 2.8M

Lead (MT)

El Brocal

2,497

1,306

1,781

1,207

6,791

7.5k - 8.3k

Uchucchacua

0

0

0

0

0

1.4k - 1.5k

Yumpag

0

0

0

0

0

0.3k - 0.4k

Tambomayo

2,509

2,823

2,639

2,320

10,290

2.9k - 3.2k

Zinc (MT)

El Brocal

8,772

4,146

6,403

4,037

23,359

23.0k - 25.0k

Uchucchacua

0

0

0

0

0

2.0k - 2.2k

Yumpag

0

0

0

0

0

-

Tambomayo

3,543

3,920

3,446

2,601

13,511

4.8k - 5.3k

Copper (MT)

El Brocal

10,159

10,537

12,108

14,548

47,352

45.0k - 50.0k

- 2023 outlook projections shown above are considered

forward-looking statements and represent management’s good faith

estimates or expectations of future production results as of

February 2023.

- 2023 Guidance for Uchucchacua and Yumpag is subject of permit

approval to begin production.

- During the 1Q23 El Brocal will be stockpiling ore mined from

the open pit. Lead and Zinc ore will be treated at the processing

plant since 2Q23. The underground mine will operate continuously

throughout 2023.

4Q22 and 2023 Guidance Comments

Tambomayo:

- 2022 gold, silver, lead and zinc production were in line with

Buenaventura’s revised 2022 guidance announced in the third quarter

2022.

- 2023 Guidance: the Company expects a year on year decrease in

gold production due to the planned mining sequence which entails

mining narrower veins. This will result in a 20% decrease in annual

throughput as well as lower gold, lead and zinc grades.

Orcopampa:

- 2022 gold production was in line with Buenaventura’s revised

2022 guidance.

- 2023 Guidance: gold production is expected to exceed 2022

production due to an anticipated increase in 2023 throughput.

Coimolache:

- 2022 gold production was in line with Buenaventura’s revised

guidance.

- 2023 Guidance: the Company expects a decrease in 2023 gold

production due to leach pad capacity limitations resulting from

leach pad expansion permitting delays.

La Zanja:

- 2022 gold production was below revised guidance due to the

re-assessment of economics for the Phase V-Pampa Verde open pit.

Mining at Phase V-Pampa Verde was postponed due to

inflation-related OpEx increases and to enable early access for

exploring the sulfides potential below the pit.

- Mining activities at the Pampa Verde pit will be paused during

2023 to focus on exploration. However, leaching will continue at La

Zanja’s San Pedro pad to the extent that this remains

profitable.

Julcani:

- 2022 silver production was in line with revised 2022

guidance.

- 2023 Guidance: 2023 silver production is expected to be

consistent with that of prior years.

Yumpag:

- Yumpag project construction and permitting will continue

according to schedule.

- 2023 Guidance: Production is subject of permit approval, which

is expected to be granted during 3Q23 and assumes initial

production beginning in 4Q23.

Uchucchacua:

- Exploration and mine development at the Uchucchacua mine will

continue as planned. The 2H23 target to resume ore beneficiation at

Uchucchacua’s processing plant remains unchanged.

- 2023 Guidance: Production will resume ramp-up during 4Q23.

El Brocal:

- 2022 gold, silver and copper production exceeded Buenaventura’s

revised 2022 guidance.

- 2022 lead and zinc production were in line with revised

guidance.

- Buenaventura has recorded a US$16.4M write-off within its 4Q

2022 results related to inventories associated with low grade

polymetallic mineral stocks from its Tajo Norte open pit. This

represents a one-time accounting effect and does not represent a

cash outflow. This has been recorded within the company’s 4Q 2022

results as related metallurgical tests were completed from June to

November 2022 and concluded that the inventory’s sulfides ore has

oxidized, adversely affecting its metallurgical performance and

therefore its value.

- 2023 Guidance: copper, gold, zinc and lead production is

expected to be in line with that of 2022 production while silver

production is expected to decrease by 20%:

- The Marcapunta underground mine is progressing according to

plan and is expected to reach 9,000 tpd by the end of 2023 with

sustained stable copper and gold production and strong economic

margins. A portion of the surplus underground mine production will

be processed at El Brocal’s Plant #2 which is equipped to process

copper ore but had previously focused primarily on processing

polymetallic ore from the open pit.

- Silver production is expected to decrease due to reduced

production from the Tajo Norte open pit as tailings dam capacity is

prioritized for higher-margin ore derived from the Marcapunta

underground mine. Permitting delays and a renewed mine strategy for

the Tajo Norte open pit will also temporarily reduce 2023

throughput.

4Q22 and FY22 Payable Volume Sold

4Q22 and FY22 Volume Sold per Metal(100% basis)

1Q22(Actual) 2Q22(Actual) 3Q22(Actual)

4Q22(Actual) FY22(Actual) Gold (Oz.)

Orcopampa

19,307

17,719

19,814

17,514

74,354

Tambomayo

12,181

12,917

12,150

10,999

48,247

La Zanja

5,773

4,452

8,575

10,576

29,376

Coimolache

20,586

20,551

21,431

23,442

86,010

El Brocal

2,907

2,590

5,229

5,492

16,217

Silver (Oz.)

Uchucchacua

18,730

139,688

150,426

152,471

461,315

El Brocal

852,933

650,260

642,558

712,041

2,857,792

Tambomayo

351,077

376,313

468,076

402,538

1,598,004

Julcani

636,303

605,634

651,077

605,128

2,498,142

Lead (MT)

El Brocal

2,239

1,071

1,568

1,036

5,914

Uchucchacua

0

18

0

0

18

Tambomayo

2,275

2,629

2,449

2,126

9,479

Zinc (MT)

El Brocal

7,256

3,370

5,229

3,311

19,166

Uchucchacua

0

0

0

0

0

Tambomayo

2,922

3,262

2,832

2,038

11,054

Copper (MT)

El Brocal

9,697

10,311

11,431

13,772

45,211

Realized Metal Prices* 1Q22(Actual)

2Q22(Actual) 3Q22(Actual) 4Q22(Actual)

FY22(Actual) Gold (Oz)

1,896

1,825

1,678

1,747

1,781

Silver (Oz)

24.10

22.71

17.33

19.62

20.89

Lead (MT)

2,363

2,180

1,713

2,037

2,082

Zinc (MT)

4,105

4,489

3,412

1,575

3,557

Copper (MT)

9,950

9,073

7,261

6,804

8,113

*Buenaventura consolidated figures.

Appendix

1. 4Q22 and FY22 Production per Metal(100% basis)

1Q22(Actual) 2Q22(Actual) 3Q22(Actual)

4Q22(Actual) FY22(Actual) Silver (Oz.)

Orcopampa

7,856

7,334

8,247

8,687

32,124

La Zanja

23,363

30,318

31,665

20,088

105,435

Coimolache

77,195

75,504

76,133

68,135

296,968

Lead (MT)

Julcani

99

124

140

167

530

2. 4Q22 and FY22 Volume Sold

per Metal (100% basis)

1Q22 (Actual)

2Q22 (Actual)

3Q22 (Actual)

4Q22 (Actual)

FY22 (Actual)

Silver (Oz.)

Orcopampa

6,928

12,411

7,715

7,461

34,516

La Zanja

21,818

29,273

34,147

24,707

109,944

Coimolache

96,634

84,859

78,028

76,077

335,598

Lead (MT)

Julcani

76

93

112

138

418

Company Description Compañía de Minas Buenaventura S.A.A.

is Peru’s largest, publicly traded precious and base metals Company

and a major holder of mining rights in Peru. The Company is engaged

in the exploration, mining development, processing and trade of

gold, silver and other base metals via wholly-owned mines and

through its participation in joint venture projects. Buenaventura

currently operates several mines in Peru (Orcopampa*, Uchucchacua*,

Julcani*, Tambomayo*, La Zanja*, El Brocal and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

For a printed version of the Company’s 2021 Form 20-F, please

contact the persons indicated above, or download a PDF format file

from the Company’s web site. (*) Operations wholly owned by

Buenaventura

Note on Forward-Looking Statements This press release may

contain forward-looking information (as defined in the U.S. Private

Securities Litigation Reform Act of 1995) that involve risks and

uncertainties, including those concerning Cerro Verde’s costs and

expenses, results of exploration, the continued improving

efficiency of operations, prevailing market prices of gold, silver,

copper and other metals mined, the success of joint ventures,

estimates of future explorations, development and production,

subsidiaries’ plans for capital expenditures, estimates of reserves

and Peruvian political, economic, social and legal developments.

These forward-looking statements reflect the Company’s view with

respect to Cerro Verde’s future financial performance. Actual

results could differ materially from those projected in the

forward-looking statements as a result of a variety of factors

discussed elsewhere in this Press Release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230216005854/en/

Contacts in Lima: Daniel Dominguez, Chief Financial Officer

(511) 419 2540

Gabriel Salas, Head of Investor Relations (511) 419 2591 /

Gabriel.salas@buenaventura.pe

Company Website: www.buenaventura.com.pe/ir

Contacts in NY: Barbara Cano (646) 452 2334

barbara@inspirgroup.com

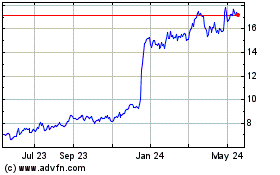

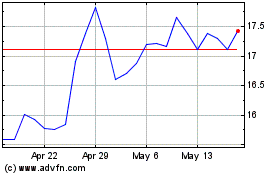

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Dec 2023 to Dec 2024