Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 November 2024 - 3:49AM

Edgar (US Regulatory)

Portfolio

of

Investments

September

30,

2024

BXMX

(Unaudited)

SHARES

DESCRIPTION

VALUE

LONG-TERM

INVESTMENTS

-

99.7%

X

1,572,680,908

COMMON

STOCKS

-

99

.7

%

(a)

X

1,572,680,908

AUTOMOBILES

&

COMPONENTS

-

1.7%

3,001

Ferrari

NV

$

1,410,800

50,606

Gentex

Corp

1,502,492

92,500

(b)

Tesla

Inc

24,200,775

TOTAL

AUTOMOBILES

&

COMPONENTS

27,114,067

BANKS

-

3.3%

196,230

Bank

of

America

Corp

7,786,407

26,341

Comerica

Inc

1,578,089

158,596

Fifth

Third

Bancorp

6,794,253

51,859

First

Horizon

Corp

805,370

112,235

JPMorgan

Chase

&

Co

23,665,872

298,223

KeyCorp

4,995,235

31,173

M&T

Bank

Corp

5,552,535

31,763

Zions

Bancorp

NA

1,499,849

TOTAL

BANKS

52,677,610

CAPITAL

GOODS

-

5.9%

17,715

Allegion

plc

2,581,784

27,101

(b)

Boeing

Co/The

4,120,436

29,025

Caterpillar

Inc

11,352,258

26,735

CNH

Industrial

NV

296,759

46,441

Emerson

Electric

Co

5,079,252

9,915

Fortune

Brands

Innovations

Inc

887,690

11,114

(b)

GE

Vernova

Inc

2,833,848

44,459

General

Electric

Co

8,384,078

31,851

Graco

Inc

2,787,281

9,566

HEICO

Corp

2,501,318

28,293

Honeywell

International

Inc

5,848,446

8,860

Hubbell

Inc

3,795,181

11,615

ITT

Inc

1,736,559

43,726

Masco

Corp

3,670,360

6,090

(b)

NEXTracker

Inc,

Class

A

228,253

9,120

Northrop

Grumman

Corp

4,815,998

14,478

nVent

Electric

PLC

1,017,224

39,784

Otis

Worldwide

Corp

4,135,149

15,767

Parker-Hannifin

Corp

9,961,906

10,242

Rockwell

Automation

Inc

2,749,567

90,271

RTX

Corp

10,937,234

10,383

Timken

Co/The

875,183

3,503

Watsco

Inc

1,723,056

4,597

Woodward

Inc

788,432

TOTAL

CAPITAL

GOODS

93,107,252

COMMERCIAL

&

PROFESSIONAL

SERVICES

-

1.6%

28,578

Automatic

Data

Processing

Inc

7,908,390

9,115

Booz

Allen

Hamilton

Holding

Corp

1,483,557

29,065

(b)

CoStar

Group

Inc

2,192,664

9,803

ManpowerGroup

Inc

720,717

15,652

SS&C

Technologies

Holdings

Inc

1,161,535

11,679

TransUnion

1,222,791

13,228

Waste

Connections

Inc

2,365,431

37,983

Waste

Management

Inc

7,885,271

TOTAL

COMMERCIAL

&

PROFESSIONAL

SERVICES

24,940,356

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

-

5.8%

315,996

(b)

Amazon.com

Inc

58,879,535

8,358

American

Eagle

Outfitters

Inc

187,136

2,461

(b)

Burlington

Stores

Inc

648,424

4,252

Dick's

Sporting

Goods

Inc

887,392

8,843

Ferguson

Enterprises

Inc

1,755,955

3,114

(b)

Five

Below

Inc

275,122

43,647

Home

Depot

Inc/The

17,685,764

Portfolio

of

Investments

September

30,

2024

(continued)

BXMX

SHARES

DESCRIPTION

VALUE

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

(continued)

5,691

JD.com

Inc,

ADR

$

227,640

24,839

LKQ

Corp

991,573

29,953

Lowe's

Cos

Inc

8,112,770

12,760

Macy's

Inc

200,204

173

(b)

MercadoLibre

Inc

354,989

16,563

Nordstrom

Inc

372,502

5,048

Williams-Sonoma

Inc

782,036

TOTAL

CONSUMER

DISCRETIONARY

DISTRIBUTION

&

RETAIL

91,361,042

CONSUMER

DURABLES

&

APPAREL

-

0.9%

32,919

KB

Home

2,820,829

6,689

Kontoor

Brands

Inc

547,027

3,315

(b)

Lululemon

Athletica

Inc

899,525

25,861

(b)

Mattel

Inc

492,652

50,573

NIKE

Inc,

Class

B

4,470,653

6,048

Polaris

Inc

503,436

15,644

Toll

Brothers

Inc

2,416,842

6,182

(b)

TopBuild

Corp

2,514,899

TOTAL

CONSUMER

DURABLES

&

APPAREL

14,665,863

CONSUMER

SERVICES

-

1.7%

1,947

Booking

Holdings

Inc

8,200,998

20,067

(b)

DraftKings

Inc,

Class

A

786,626

23,509

Marriott

International

Inc/MD,

Class

A

5,844,337

17,473

McDonald's

Corp

5,320,703

16,077

Restaurant

Brands

International

Inc

1,159,473

51,807

Starbucks

Corp

5,050,665

5,468

Texas

Roadhouse

Inc

965,649

TOTAL

CONSUMER

SERVICES

27,328,451

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

-

2.2%

14,915

(b)

BJ's

Wholesale

Club

Holdings

Inc

1,230,189

4,507

Casey's

General

Stores

Inc

1,693,325

19,022

Costco

Wholesale

Corp

16,863,383

27,087

Target

Corp

4,221,780

15,913

(b)

US

Foods

Holding

Corp

978,650

118,199

Walmart

Inc

9,544,569

TOTAL

CONSUMER

STAPLES

DISTRIBUTION

&

RETAIL

34,531,896

ENERGY

-

3.3%

24,159

Cenovus

Energy

Inc

404,180

1,124

Cheniere

Energy

Inc

202,140

77,267

Chevron

Corp

11,379,111

9,675

(b)

CNX

Resources

Corp

315,115

64,103

ConocoPhillips

6,748,764

41,292

Enbridge

Inc

1,676,868

166,691

Exxon

Mobil

Corp

19,539,519

72,910

Halliburton

Co

2,118,035

25,709

Hess

Corp

3,491,282

28,016

Marathon

Petroleum

Corp

4,564,087

7,405

Ovintiv

Inc

283,686

19,719

TC

Energy

Corp

937,638

TOTAL

ENERGY

51,660,425

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

-

1.7%

95,341

American

Homes

4

Rent,

Class

A

3,660,141

33,035

American

Tower

Corp

7,682,620

93,029

CubeSmart

5,007,751

1,038

Gaming

and

Leisure

Properties

Inc

53,405

18,434

Lamar

Advertising

Co,

Class

A

2,462,782

8,339

Sabra

Health

Care

REIT

Inc

155,189

11,688

Sun

Communities

Inc

1,579,633

126,696

Weyerhaeuser

Co

4,289,927

36,748

WP

Carey

Inc

2,289,400

TOTAL

EQUITY

REAL

ESTATE

INVESTMENT

TRUSTS

(REITS)

27,180,848

SHARES

DESCRIPTION

VALUE

FINANCIAL

SERVICES

-

8.0%

64,200

Annaly

Capital

Management

Inc

$

1,288,494

76,092

(b)

Berkshire

Hathaway

Inc,

Class

B

35,022,104

17,374

(b)

Block

Inc

1,166,317

53,704

(b)

Brookfield

Corp

2,854,368

71,247

Charles

Schwab

Corp/The

4,617,518

21,911

CME

Group

Inc

4,834,662

42,085

Discover

Financial

Services

5,904,105

44,488

Intercontinental

Exchange

Inc

7,146,552

53,398

Jefferies

Financial

Group

Inc

3,286,647

35,103

KKR

&

Co

Inc

4,583,750

2,406

LPL

Financial

Holdings

Inc

559,708

22,889

Mastercard

Inc,

Class

A

11,302,588

48,313

MGIC

Investment

Corp

1,236,813

2,104

Morningstar

Inc

671,428

8,344

MSCI

Inc

4,863,968

55,304

(b)

PayPal

Holdings

Inc

4,315,371

19,659

S&P

Global

Inc

10,156,232

89,957

SLM

Corp

2,057,316

75,786

Visa

Inc,

Class

A

20,837,361

TOTAL

FINANCIAL

SERVICES

126,705,302

FOOD,

BEVERAGE

&

TOBACCO

-

2.6%

105,912

Altria

Group

Inc

5,405,748

42,851

British

American

Tobacco

PLC,

Sponsored

ADR

1,567,489

229,003

Coca-Cola

Co/The

16,456,156

33,408

(b)

Coca-Cola

Europacific

Partners

PLC

2,630,880

8,808

Hormel

Foods

Corp

279,214

132,012

Mondelez

International

Inc,

Class

A

9,725,324

80,074

(b)

Monster

Beverage

Corp

4,177,461

12,100

(b)

Post

Holdings

Inc

1,400,575

TOTAL

FOOD,

BEVERAGE

&

TOBACCO

41,642,847

HEALTH

CARE

EQUIPMENT

&

SERVICES

-

4.9%

96,418

Abbott

Laboratories

10,992,616

21,328

Alcon

Inc

2,134,293

106,173

(b)

Boston

Scientific

Corp

8,897,297

14,642

Cigna

Group/The

5,072,575

14,592

Elevance

Health

Inc

7,587,840

28,153

GE

HealthCare

Technologies

Inc

2,642,159

16,250

HCA

Healthcare

Inc

6,604,488

7,324

(b)

IDEXX

Laboratories

Inc

3,700,231

82,736

Medtronic

PLC

7,448,722

36,459

UnitedHealth

Group

Inc

21,316,848

638

(b)

Veeva

Systems

Inc,

Class

A

133,897

TOTAL

HEALTH

CARE

EQUIPMENT

&

SERVICES

76,530,966

HOUSEHOLD

&

PERSONAL

PRODUCTS

-

1.4%

15,340

(b)

BellRing

Brands

Inc

931,445

117,126

Procter

&

Gamble

Co/The

20,286,223

TOTAL

HOUSEHOLD

&

PERSONAL

PRODUCTS

21,217,668

INSURANCE

-

2.2%

28,004

Allstate

Corp/The

5,310,959

34,937

Arthur

J

Gallagher

&

Co

9,830,224

23,577

Fidelity

National

Financial

Inc

1,463,189

38,545

Hartford

Financial

Services

Group

Inc/The

4,533,278

9,393

Lincoln

National

Corp

295,973

3,360

RenaissanceRe

Holdings

Ltd

915,264

29,077

Travelers

Cos

Inc/The

6,807,507

89,232

W

R

Berkley

Corp

5,062,131

TOTAL

INSURANCE

34,218,525

MATERIALS

-

2.2%

9,313

Avery

Dennison

Corp

2,055,938

74,375

Barrick

Gold

Corp

1,479,319

6,364

Chemours

Co/The

129,316

Portfolio

of

Investments

September

30,

2024

(continued)

BXMX

SHARES

DESCRIPTION

VALUE

MATERIALS

(continued)

52,881

Corteva

Inc

$

3,108,874

7,888

Crown

Holdings

Inc

756,301

62,947

Dow

Inc

3,438,795

23,362

Eastman

Chemical

Co

2,615,376

20,828

Linde

PLC

9,932,040

8,265

Martin

Marietta

Materials

Inc

4,448,636

20,588

Nucor

Corp

3,095,200

2,959

Nutrien

Ltd

142,210

10,656

Olin

Corp

511,275

8,167

Rio

Tinto

PLC,

Sponsored

ADR

581,245

14,399

RPM

International

Inc

1,742,279

5,718

Sonoco

Products

Co

312,374

7,007

Southern

Copper

Corp

810,500

TOTAL

MATERIALS

35,159,678

MEDIA

&

ENTERTAINMENT

-

8.0%

196,776

Alphabet

Inc,

Class

A

32,635,300

164,297

Alphabet

Inc,

Class

C

27,468,816

1,834

(b)

Baidu

Inc,

Sponsored

ADR

193,102

73,685

Meta

Platforms

Inc

42,180,241

17,694

(b)

Netflix

Inc

12,549,823

17,899

New

York

Times

Co/The,

Class

A

996,437

91,848

News

Corp,

Class

A

2,445,912

11,727

(b)

Roku

Inc

875,538

10,009

Sirius

XM

Holdings

Inc

236,713

63,594

Walt

Disney

Co/The

6,117,107

TOTAL

MEDIA

&

ENTERTAINMENT

125,698,989

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

-

6.9%

70,152

AbbVie

Inc

13,853,617

3,338

(b)

Alnylam

Pharmaceuticals

Inc

918,050

25,349

Amgen

Inc

8,167,701

56,490

(b)

Avantor

Inc

1,461,396

97,561

Bristol-Myers

Squibb

Co

5,047,806

27,106

Eli

Lilly

&

Co

24,014,289

12,832

(b)

Exact

Sciences

Corp

874,116

67,257

Gilead

Sciences

Inc

5,638,827

5,303

(b)

ICON

PLC

1,523,605

94,929

Johnson

&

Johnson

15,384,194

108,854

Merck

&

Co

Inc

12,361,460

201,702

Pfizer

Inc

5,837,256

28,283

(b)

Teva

Pharmaceutical

Industries

Ltd,

Sponsored

ADR

509,660

20,510

Thermo

Fisher

Scientific

Inc

12,686,871

TOTAL

PHARMACEUTICALS,

BIOTECHNOLOGY

&

LIFE

SCIENCES

108,278,848

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

-

11.4%

62,993

(b)

Advanced

Micro

Devices

Inc

10,335,892

42,222

Applied

Materials

Inc

8,530,955

1,597

ASML

Holding

NV

1,330,700

157,670

Broadcom

Inc

27,198,075

13,344

Entegris

Inc

1,501,600

148,181

Intel

Corp

3,476,326

9,062

Lam

Research

Corp

7,395,317

21,297

Marvell

Technology

Inc

1,535,940

48,971

Micron

Technology

Inc

5,078,782

809,244

NVIDIA

Corp

98,274,591

19,176

NXP

Semiconductors

NV

4,602,432

32,082

(b)

ON

Semiconductor

Corp

2,329,474

50,975

QUALCOMM

Inc

8,668,299

TOTAL

SEMICONDUCTORS

&

SEMICONDUCTOR

EQUIPMENT

180,258,383

SOFTWARE

&

SERVICES

-

11.1%

20,218

Accenture

PLC,

Class

A

7,146,659

20,473

(b)

Adobe

Inc

10,600,510

20,604

(b)

Akamai

Technologies

Inc

2,079,974

SHARES

DESCRIPTION

VALUE

SOFTWARE

&

SERVICES

(continued)

3,648

(b)

Atlassian

Corp

PLC,

Class

A

$

579,339

15,194

(b)

Autodesk

Inc

4,185,643

10,744

(b)

Check

Point

Software

Technologies

Ltd

2,071,551

3,886

(b)

Manhattan

Associates

Inc

1,093,443

251,426

Microsoft

Corp

108,188,608

73,142

Oracle

Corp

12,463,397

43,629

Salesforce

Inc

11,941,693

10,782

(b)

ServiceNow

Inc

9,643,313

6,661

(b)

Shopify

Inc,

Class

A

533,812

14,844

(b)

VeriSign

Inc

2,819,766

1,241

(b)

Workday

Inc,

Class

A

303,313

10,368

(b)

Zoom

Video

Communications

Inc,

Class

A

723,064

TOTAL

SOFTWARE

&

SERVICES

174,374,085

TECHNOLOGY

HARDWARE

&

EQUIPMENT

-

8.6%

490,952

Apple

Inc

114,392,712

20,728

CDW

Corp/DE

4,690,746

19,049

(b)

Ciena

Corp

1,173,228

220,344

Cisco

Systems

Inc

11,726,708

6,851

Dell

Technologies

Inc,

Class

C

812,118

34,963

(b)

Flex

Ltd

1,168,813

5,140

(b)

Lumentum

Holdings

Inc

325,773

199,033

Telefonaktiebolaget

LM

Ericsson,

Sponsored

ADR

1,508,670

TOTAL

TECHNOLOGY

HARDWARE

&

EQUIPMENT

135,798,768

TELECOMMUNICATION

SERVICES

-

0.6%

213,828

Verizon

Communications

Inc

9,603,016

TOTAL

TELECOMMUNICATION

SERVICES

9,603,016

TRANSPORTATION

-

1.3%

47,269

(b)

American

Airlines

Group

Inc

531,304

23,404

Canadian

Pacific

Railway

Ltd

2,001,978

4,425

(b)

Lyft

Inc,

Class

A

56,419

21,947

Norfolk

Southern

Corp

5,453,829

2,565

(b)

Saia

Inc

1,121,572

68,042

(b)

Uber

Technologies

Inc

5,114,037

40,842

United

Parcel

Service

Inc,

Class

B

5,568,398

8,969

(b)

XPO

Inc

964,257

TOTAL

TRANSPORTATION

20,811,794

UTILITIES

-

2.4%

103,393

Ameren

Corp

9,042,752

12,874

Atmos

Energy

Corp

1,785,753

53,103

Evergy

Inc

3,292,917

2,933

National

Fuel

Gas

Co

177,769

89,247

NextEra

Energy

Inc

7,544,049

52,512

OGE

Energy

Corp

2,154,042

56,692

Pinnacle

West

Capital

Corp

5,022,344

91,439

WEC

Energy

Group

Inc

8,794,603

TOTAL

UTILITIES

37,814,229

TOTAL

COMMON

STOCKS

(Cost

$415,505,009)

1,572,680,908

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$415,505,009)

1,572,680,908

Portfolio

of

Investments

September

30,

2024

(continued)

BXMX

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

SHORT-TERM

INVESTMENTS

-

3.8%

X

59,155,696

REPURCHASE

AGREEMENTS

-

3

.8

%

X

59,155,696

$

53,750,000

(c)

Fixed

Income

Clearing

Corporation

4

.820

%

10/01/24

$

53,750,000

5,405,696

(d)

Fixed

Income

Clearing

Corporation

1

.520

10/01/24

5,405,696

TOTAL

REPURCHASE

AGREEMENTS

(Cost

$59,155,696)

59,155,696

TOTAL

SHORT-TERM

INVESTMENTS

(Cost

$59,155,696)

59,155,696

TOTAL

INVESTMENTS

-

103

.5

%

(Cost

$

474,660,705

)

1,631,836,604

OTHER

ASSETS

&

LIABILITIES,

NET

- (3.5)%

(

54,530,280

)

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

1,577,306,324

Options

Written

Type

Description

(e)

Number

of

Contracts

Notional

Amount

(f)

Exercise

Price

Expiration

Date

Value

Call

S&P

500

Index

(300)

$

(

165,000,000

)

$

5,500

10/18/24

$

(

8,425,500

)

Call

S&P

500

Index

(300)

(

170,250,000

)

5,675

10/18/24

(

3,855,000

)

Call

S&P

500

Index

(300)

(

174,000,000

)

5,800

10/18/24

(

1,404,000

)

Call

S&P

500

Index

(300)

(

176,250,000

)

5,875

10/18/24

(

565,500

)

Call

S&P

500

Index

(300)

(

177,000,000

)

5,900

10/18/24

(

396,000

)

Call

S&P

500

Index

(301)

(

170,065,000

)

5,650

11/15/24

(

6,421,835

)

Call

S&P

500

Index

(301)

(

173,075,000

)

5,750

11/15/24

(

4,305,805

)

Call

S&P

500

Index

(301)

(

177,590,000

)

5,900

12/20/24

(

3,151,470

)

Call

S&P

500

Index

(300)

(

180,000,000

)

6,000

12/20/24

(

1,884,000

)

Total

Options

Written

(premiums

received

$24,171,728)

(2,703)

$(1,563,230,000)

$(30,409,110)

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Common

Stocks

$

1,572,680,908

$

–

$

–

$

1,572,680,908

Short-Term

Investments:

Repurchase

Agreements

–

59,155,696

–

59,155,696

Investments

in

Derivatives:

Options

Written

(30,409,110)

–

–

(30,409,110)

Total

$

1,542,271,798

$

59,155,696

$

–

$

1,601,427,494

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(a)

The

Fund

may

designate

up

to

100%

of

its

common

stock

investments

to

cover

outstanding

options

written.

(b)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(c)

Agreement

with

Fixed

Income

Clearing

Corporation,

4.820%

dated

9/30/24

to

be

repurchased

at

$53,757,197

on

10/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

4.625%

and

maturity

date

4/30/31,

valued

at

$54,825,019.

(d)

Agreement

with

Fixed

Income

Clearing

Corporation,

1.520%

dated

9/30/24

to

be

repurchased

at

$5,405,925

on

10/1/24,

collateralized

by

Government

Agency

Securities,

with

coupon

rate

3.500%

and

maturity

date

9/30/26,

valued

at

$5,513,883.

(e)

Exchange-traded,

unless

otherwise

noted.

(f)

For

disclosure

purposes,

Notional

Amount

is

calculated

by

multiplying

the

Number

of

Contracts

by

the

Exercise

Price

by

100.

ADR

American

Depositary

Receipt

REIT

Real

Estate

Investment

Trust

S&P

Standard

&

Poor's

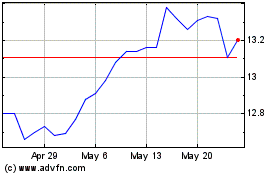

Nuveen S&P 500 Buy Write... (NYSE:BXMX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nuveen S&P 500 Buy Write... (NYSE:BXMX)

Historical Stock Chart

From Jan 2024 to Jan 2025