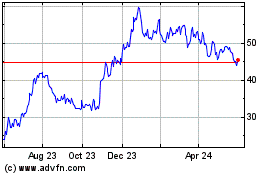

Customers Bancorp, Inc. (NYSE:CUBI):

Fourth Quarter 2024 Highlights

- Q4 2024 net income available to common shareholders was $23.3

million, or $0.71 per diluted share; ROAA was 0.48% and ROCE was

5.50%.

- Q4 2024 core earnings*1 were $44.2 million, or $1.36 per

diluted share; Core ROAA* was 0.86% and Core ROCE* was 10.44%.

- Q4 2024 net income available to common shareholders included

$20.0 million of post-tax losses in connection with the securities

portfolio repositioning executed to improve structural liquidity,

reduce asset sensitivity and benefit margin.

- Total loans and leases held for investment grew by $671.1

million in Q4 2024 from Q3 2024 or 19% annualized.

- Total deposits increased by $777.1 million or 4.3% in Q4 2024

from Q3 2024.

- Non-interest bearing demand deposits increased $937.5 million

or 20.1% in Q4 2024 from Q3 2024; non-interest bearing deposits

represented 29.7% of total deposits at December 31, 2024.

- Q4 2024 average cost of deposits was 3.07% compared to Q3 2024

of 3.46%, a decrease of 39 basis points.

- Q4 2024 net interest margin, tax equivalent (“NIM”) was 3.11%,

compared to Q3 2024 NIM of 3.06%, an increase of 5 basis points

primarily due to lower deposit costs.

- Ratio of non-performing assets to total assets was 0.25% at

December 31, 2024 compared to 0.22% at September 30, 2024.

- Q4 2024 provision for credit losses on loans and leases was

$18.2 million compared to $17.8 million in Q3 2024 and the

allowance for credit losses on loans and leases equaled 316% of

non-performing loans at December 31, 2024, compared to 281% at

September 30, 2024.

- CET 1 ratio of 12.0%2 at December 31, 2024, compared to 12.5%

at September 30, 2024.

- TCE / TA ratio* of 7.6% at December 31, 2024, compared to 7.7%

at September 30, 2024.

- Q4 2024 book value per share and tangible book value per share*

both grew by approximately $1.12, or 2.1% over Q3 2024, or 8.4%

annualized, with a tangible book value per share* of $54.08 at

December 31, 2024. This was driven by current quarter earnings and

a decrease in AOCI losses of $9.5 million.

*

Non-GAAP measure. Customers’ reasons for

the use of the non-GAAP measure and a detailed reconciliation

between the non-GAAP measure and the comparable GAAP amount are

included at the end of this document.

1

Excludes pre-tax losses on investment

securities of $26.7 million, severance expense of $1.6 million,

derivative credit valuation adjustment of $0.4 million, unrealized

gain on equity method investments of $0.4 million, legal settlement

of $0.2 million and unrealized losses on loans held for sale of

$0.1 million.

2

Regulatory capital ratios as of December

31, 2024 are estimates.

Full Year 2024 Highlights

- 2024 net income available to common shareholders was $166.4

million, or $5.09 per diluted share; ROAA was 0.85% and ROCE was

10.36%.

- 2024 core earnings* were $183.1 million, or $5.60 per diluted

share; Core ROAA* was 0.92% and Core ROCE* was 11.40%.

- Total loans and leases held for investment grew by $1.6 billion

or 12.3% from December 31, 2023 to December 31, 2024.

- Total deposits increased by $926.2 million or 5.2%, from

December 31, 2023 to December 31, 2024.

- Non-interest bearing demand deposits increased $1.2 billion, or

26.8%, from December 31, 2023 to December 31, 2024.

- 2024 NIM was 3.15% compared to 2023 NIM of 3.29%.

- Ratio of non-performing assets to total assets was 0.25% at

December 31, 2024 compared to 0.13% at December 31, 2023.

- Allowance for credit losses on loans and leases equaled 316% of

non-performing loans at December 31, 2024, compared to 499% at

December 31, 2023.

- CET 1 capital ratio of 12.0%1 at December 31, 2024, compared to

12.2% at December 31, 2023.

- TCE / TA ratio* of 7.6% at December 31, 2024, compared to 7.0%

at December 31, 2023.

- Book value per share and tangible book value per share* grew

year over year by approximately $6.47 or 13.6%, driven by strong

2024 annual earnings combined with the decreased AOCI losses of

$40.0 million over the same time period. Tangible book value per

share* has grown at a 16% compound annual growth rate (CAGR) over

the past 5 years, significantly higher than the regional bank peer

median2 of 4%.

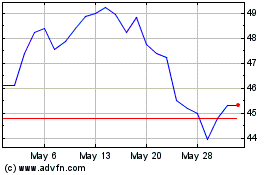

- Repurchased 393,303 common shares below book value at a

weighted-average price of $48.36 for $19.2 million in 2024.

*

Non-GAAP measure. Customers’ reasons for

the use of the non-GAAP measure and a detailed reconciliation

between the non-GAAP measure and the comparable GAAP amount is

included at the end of this document.

1

Regulatory capital ratios as of December

31, 2024 are estimates.

2

Regional bank peers based on selected 2024

proxy peers with a reporting date on or before January 22,

2025.

CEO Commentary

“We are pleased to share our fourth quarter and full year 2024

results that highlight the company’s continuing incredible deposit

transformation and underscore our success in growing franchise

value in a competitive market environment. Exceptional client

service is the cornerstone of our culture and business model, and

is so important it is in our name. To measure customer

satisfaction, we recently participated in an annual Net Promoter

Score survey, also known as NPS. Our most recent score of 73 is

well above the U.S. banking industry average of 411 and is above

the scores of many other service-oriented brands across all

industries. We are delighted by the positive response from our

customers and the trust they place in us. This is a testament to

our customer-centric mindset and commitment to service provided by

our extraordinary colleagues,” said Customers Bancorp Chairman and

CEO Jay Sidhu.

“In the fourth quarter, we once again brought in over $1 billion

of gross deposit inflows which we utilized in part to paydown

higher-cost and brokered deposits. Non-interest bearing deposits

increased by $937.5 million and represented 29.7% of total deposits

at December 31, 2024. These efforts, along with proactive

management of the cost of our existing deposit portfolio, resulted

in a 39 basis point reduction in our cost of deposits during the

quarter.

“Our deposit pipelines continue to expand with a significant

conversion ratio. In addition, deposit focused teams we have

recruited since March 2023 managed $1.7 billion or 9% of total

deposits. Enhanced by their efforts, we’ve increased commercial

deposit accounts by 48% over the past two years, adding granular

and sticky relationships while significantly lowering our cost of

deposits, increasing our non-interest bearing deposits, and driving

franchise value. During the quarter, we opportunistically

repositioned a portion of the securities portfolio to improve

structural liquidity, reduce asset sensitivity and benefit margin.

Even with the repositioning transaction and balance sheet growth we

experienced during the quarter, our TCE / TA ratio* remained

roughly flat. 2024 was a year in which we made significant

investments in our future. We believe the company is extremely

well-positioned to continue to strengthen our deposit franchise,

improve our profitability, and maintain our already strong capital

ratios,” stated Jay Sidhu.

“Our Q4 2024 GAAP earnings were $23.3 million, or $0.71 per

diluted share, and core earnings* were $44.2 million, or $1.36 per

diluted share. Fourth quarter GAAP results include losses in

connection the accretive securities portfolio repositioning. We

maintain a strong liquidity position, with $9.1 billion of

liquidity immediately available, which covers approximately 159% of

uninsured deposits2 and our loan to deposit ratio was 78%, at

December 31, 2024. We continue to focus on loan production where we

have a holistic and primary relationship. Total loans and leases

held for investment grew by $671.1 million which represent a 19%

annualized growth rate, driven by strong commercial loan growth of

$683.1 million led by growth in our existing specialized lending

verticals. In 2024, total loans and leases held for investment grew

by $1.6 billion which represent a 12.3% growth rate. Asset quality

remains strong with our NPA ratio at just 0.25% of total assets and

reserve levels are robust at 316% of total non-performing loans at

the end of Q4 2024. Total net charge-offs declined by $2.4 million.

Our exposure to the higher risk commercial real estate office

sector is minimal, representing approximately 1% of the loan

portfolio. We will remain disciplined, but opportunistic, with our

balance sheet capacity to manage risk and maintain robust capital

levels. Tangible Book Value per share* grew to $54.08. We believe

that our unique strategy and the investments we have and are

making, along with the exceptional talent in our organization, will

position us for success in 2025 and beyond. We are extremely

excited about the future of this company especially in what we

expect to be a more favorable banking environment,” Jay Sidhu

continued.

*

Non-GAAP measure. Customers’ reasons for

the use of the non-GAAP measure and a detailed reconciliation

between the non-GAAP measure and the comparable GAAP amount are

included at the end of this document.

1

The Qualtrics U.S. Banking Relational Net

Promoter® Score (NPS®) benchmark is derived from Qualtrics' vast

Customer Experience dataset. The dataset includes 2022-2023

anonymized results from 50+ U.S. banking organizations, covering

80+ separate relationship surveys, and encompassing 400,000

individual survey respondents.

2

Uninsured deposits (estimate) of $7.3

billion to be reported on the Bank’s call report, less deposits of

$1.5 billion collateralized by standby letters of credit from the

FHLB and from our affiliates of $176.2 million.

Financial Highlights

At or Three Months

Ended

(Dollars in thousands, except per share data)

December 31, 2024

September 30, 2024

Increase (Decrease)

Profitability Metrics:

Net income available for common

shareholders

$

23,266

$

42,937

$

(19,671

)

(45.8

)%

Diluted earnings per share

$

0.71

$

1.31

$

(0.60

)

(45.8

)%

Core earnings*

$

44,168

$

43,838

$

330

0.8

%

Adjusted core earnings*

$

44,168

$

41,381

$

2,787

6.7

%

Core earnings per share*

$

1.36

$

1.34

$

0.02

1.5

%

Adjusted core earnings per share*

$

1.36

$

1.26

$

0.10

7.9

%

Return on average assets (“ROAA”)

0.48

%

0.88

%

(0.40

)

Core ROAA*

0.86

%

0.89

%

(0.03

)

Adjusted core ROAA*

0.86

%

0.85

%

0.01

Return on average common equity

(“ROCE”)

5.50

%

10.44

%

(4.94

)

Core ROCE*

10.44

%

10.66

%

(0.22

)

Adjusted core ROCE*

10.44

%

10.06

%

0.38

Core pre-tax pre-provision net income*

$

84,224

$

64,824

$

19,400

29.9

%

Adjusted core pre-tax pre-provision net

income*

$

84,224

$

61,827

$

22,397

36.2

%

Net interest margin, tax equivalent

3.11

%

3.06

%

0.05

Yield on loans (Loan yield)

6.78

%

6.99

%

(0.21

)

Cost of deposits

3.07

%

3.46

%

(0.39

)

Efficiency ratio

56.86

%

62.40

%

(5.54

)

Core efficiency ratio*

56.12

%

61.69

%

(5.57

)

Adjusted core efficiency ratio*

56.12

%

63.48

%

(7.36

)

Non-interest expense to average total

assets

1.98

%

1.95

%

0.03

Core non-interest expense to average total

assets*

1.95

%

1.94

%

0.01

Adjusted core non-interest expense to

average total assets*

1.95

%

1.99

%

(0.04

)

Balance Sheet Trends:

Total assets

$

22,308,241

$

21,456,082

$

852,159

4.0

%

Total cash and investment securities

$

6,797,562

$

6,564,528

$

233,034

3.5

%

Total loans and leases

$

14,653,556

$

14,053,116

$

600,440

4.3

%

Non-interest bearing demand deposits

$

5,608,288

$

4,670,809

$

937,479

20.1

%

Total deposits

$

18,846,461

$

18,069,389

$

777,072

4.3

%

Capital Metrics:

Common Equity

$

1,698,889

$

1,663,386

$

35,503

2.1

%

Tangible Common Equity*

$

1,695,260

$

1,659,757

$

35,503

2.1

%

Common Equity to Total Assets

7.6

%

7.8

%

(0.2

)

Tangible Common Equity to Tangible

Assets*

7.6

%

7.7

%

(0.1

)

Book Value per common share

$

54.20

$

53.07

$

1.13

2.1

%

Tangible Book Value per common share*

$

54.08

$

52.96

$

1.12

2.1

%

Common equity Tier 1 capital ratio (1)

12.0

%

12.5

%

(0.5

)

Total risk based capital ratio (1)

14.8

%

15.4

%

(0.6

)

(1) Regulatory capital ratios as of

December 31, 2024 are estimates.

* Non-GAAP measure. Customers’ reasons for

the use of the non-GAAP measure and a detailed reconciliation

between the non-GAAP measure and the comparable GAAP amount are

included at the end of this document.

Financial Highlights

At or Three Months

Ended

Twelve Months Ended

(Dollars in thousands, except per share data)

December 31, 2024

December 31, 2023

Increase (Decrease)

December 31, 2024

December 31, 2023

Increase (Decrease)

Profitability Metrics:

Net income available for common

shareholders

$

23,266

$

58,223

$

(34,957

)

(60.0

)%

$

166,429

$

235,448

$

(69,019

)

(29.3

)%

Diluted earnings per share

$

0.71

$

1.79

$

(1.08

)

(60.3

)%

$

5.09

$

7.32

$

(2.23

)

(30.5

)%

Core earnings*

$

44,168

$

61,633

$

(17,465

)

(28.3

)%

$

183,105

$

248,233

$

(65,128

)

(26.2

)%

Adjusted core earnings*

$

44,168

$

61,633

$

(17,465

)

(28.3

)%

$

189,253

$

248,233

$

(58,980

)

(23.8

)%

Core earnings per share*

$

1.36

$

1.90

$

(0.54

)

(28.4

)%

$

5.60

$

7.72

$

(2.12

)

(27.5

)%

Adjusted core earnings per share*

$

1.36

$

1.90

$

(0.54

)

(28.4

)%

$

5.78

$

7.72

$

(1.94

)

(25.1

)%

Return on average assets (“ROAA”)

0.48

%

1.16

%

(0.68

)

0.85

%

1.16

%

(0.31

)

Core ROAA*

0.86

%

1.22

%

(0.36

)

0.92

%

1.22

%

(0.30

)

Adjusted core ROAA*

0.86

%

1.22

%

(0.36

)

0.95

%

1.22

%

(0.27

)

Return on average common equity

(“ROCE”)

5.50

%

15.93

%

(10.43

)

10.36

%

17.33

%

(6.97

)

Core ROCE*

10.44

%

16.87

%

(6.43

)

11.40

%

18.27

%

(6.87

)

Adjusted core ROCE*

10.44

%

16.87

%

(6.43

)

11.78

%

18.27

%

(6.49

)

Core pre-tax pre-provision net income*

$

84,224

$

101,884

$

(17,660

)

(17.3

)%

$

321,942

$

416,563

$

(94,621

)

(22.7

)%

Adjusted core pre-tax pre-provision net

income*

$

84,224

$

101,884

$

(17,660

)

(17.3

)%

$

330,259

$

416,563

$

(86,304

)

(20.7

)%

Net interest margin, tax equivalent

3.11

%

3.31

%

(0.20

)

3.15

%

3.29

%

(0.14

)

Yield on loans (Loan yield)

6.78

%

7.30

%

(0.52

)

6.99

%

7.16

%

(0.17

)

Cost of deposits

3.07

%

3.39

%

(0.32

)

3.34

%

3.27

%

0.07

Efficiency ratio

56.86

%

49.08

%

7.78

56.21

%

46.49

%

9.72

Core efficiency ratio*

56.12

%

46.70

%

9.42

56.25

%

45.45

%

10.80

Adjusted core efficiency ratio*

56.12

%

46.70

%

9.42

55.11

%

45.45

%

9.66

Non-interest expense to average total

assets

1.98

%

1.75

%

0.23

1.95

%

1.64

%

0.31

Core non-interest expense to average total

assets*

1.95

%

1.67

%

0.28

1.92

%

1.62

%

0.30

Adjusted core non-interest expense to

average total assets*

1.95

%

1.67

%

0.28

1.88

%

1.62

%

0.26

(1) Regulatory capital ratios as of

December 31, 2024 are estimates.

* Non-GAAP measure. Customers’ reasons for

the use of the non-GAAP measure and a detailed reconciliation

between the non-GAAP measure and the comparable GAAP amount are

included at the end of this document.

Financial Highlights

At or Three Months

Ended

(Dollars in thousands, except per share data)

December 31, 2024

December 31, 2023

Increase (Decrease)

Balance Sheet Trends:

Total assets

$

22,308,241

$

21,316,265

$

991,976

4.7

%

Total cash and investment securities

$

6,797,562

$

7,355,156

$

(557,594

)

(7.6

)%

Total loans and leases

$

14,653,556

$

13,202,084

$

1,451,472

11.0

%

Non-interest bearing demand deposits

$

5,608,288

$

4,422,494

$

1,185,794

26.8

%

Total deposits

$

18,846,461

$

17,920,236

$

926,225

5.2

%

Capital Metrics:

Common Equity

$

1,698,889

$

1,500,600

$

198,289

13.2

%

Tangible Common Equity*

$

1,695,260

$

1,496,971

$

198,289

13.2

%

Common Equity to Total Assets

7.6

%

7.0

%

0.6

Tangible Common Equity to Tangible

Assets*

7.6

%

7.0

%

0.6

Book Value per common share

$

54.20

$

47.73

$

6.47

13.6

%

Tangible Book Value per common share*

$

54.08

$

47.61

$

6.47

13.6

%

Common equity Tier 1 capital ratio (1)

12.0

%

12.2

%

(0.2

)

Total risk based capital ratio (1)

14.8

%

15.3

%

(0.5

)

(1) Regulatory capital ratios as of

December 31, 2024 are estimates.

* Non-GAAP measure. Customers’ reasons for

the use of the non-GAAP measure and a detailed reconciliation

between the non-GAAP measure and the comparable GAAP amount are

included at the end of this document.

Key Balance Sheet Trends

Loans and Leases

The following table presents the composition of total loans and

leases as of the dates indicated:

(Dollars in thousands)

December 31, 2024

% of Total

September 30, 2024

% of Total

December 31, 2023

% of Total

Loans and Leases Held for

Investment

Commercial:

Commercial & industrial:

Specialized lending

$

5,842,420

40.4

%

$

5,468,507

39.7

%

$

5,006,693

38.9

%

Other commercial & industrial (1)

1,062,631

7.4

1,087,222

7.9

1,162,317

9.1

Mortgage finance

1,440,847

10.0

1,367,617

9.9

1,014,742

7.9

Multifamily

2,252,246

15.6

2,115,978

15.4

2,138,622

16.6

Commercial real estate owner occupied

1,100,944

7.6

981,904

7.1

797,319

6.2

Commercial real estate non-owner

occupied

1,359,130

9.4

1,326,591

9.6

1,177,650

9.2

Construction

147,209

1.0

174,509

1.3

166,393

1.2

Total commercial loans and leases

13,205,427

91.4

12,522,328

90.9

11,463,736

89.1

Consumer:

Residential

496,559

3.4

500,786

3.6

484,435

3.8

Manufactured housing

33,123

0.3

34,481

0.3

38,670

0.3

Installment:

Personal

463,854

3.2

453,739

3.3

555,533

4.3

Other

249,799

1.7

266,362

1.9

319,393

2.5

Total installment loans

713,653

4.9

720,101

5.2

874,926

6.8

Total consumer loans

1,243,335

8.6

1,255,368

9.1

1,398,031

10.9

Total loans and leases held for

investment

$

14,448,762

100.0

%

$

13,777,696

100.0

%

$

12,861,767

100.0

%

Loans Held for Sale

Residential

$

1,836

0.9

%

$

2,523

0.9

%

$

1,215

0.3

%

Installment:

Personal

40,903

20.0

55,799

20.3

151,040

44.4

Other

162,055

79.1

217,098

78.8

188,062

55.3

Total installment loans

202,958

99.1

272,897

99.1

339,102

99.7

Total loans held for sale

$

204,794

100.0

%

$

275,420

100.0

%

$

340,317

100.0

%

Total loans and leases

portfolio

$

14,653,556

$

14,053,116

$

13,202,084

(1)

Includes PPP loans of $22.8 million, $30.5

million and $74.7 million as of December 31, 2024,

September 30, 2024 and December 31, 2023,

respectively.

Loans and Leases Held for Investment

Loans and leases held for investment were $14.4 billion at

December 31, 2024, up $671.1 million, or 4.9%, from September 30,

2024. Specialized lending increased by $373.9 million, or 6.8%

quarter-over-quarter, to $5.8 billion. Multifamily loans increased

by $136.3 million, or 6.4% to $2.3 billion. Owner-occupied

commercial real estate loans increased by $119.0 million, or 12.1%

to $1.1 billion. Mortgage finance loans increased by $73.2 million,

or 5.4% to $1.4 billion. Non-owner occupied commercial real estate

loans increased by $32.5 million, or 2.5% to $1.4 billion. These

increases were partially offset by a decrease in other commercial

and industrial loans of $24.6 million, or 2.3%, to $1.1

billion.

Loans and leases held for investment of $14.4 billion at

December 31, 2024 were up $1.6 billion, or 12.3%, year-over-year.

Specialized lending increased by $835.7 million, or 16.7%

year-over-year. Mortgage finance loans increased by $426.1 million.

Owner-occupied commercial real estate loans increased by $303.6

million. Non-owner occupied commercial real estate loans increased

by $181.5 million. Multifamily loans increased by $113.6 million.

These increases were partially offset by decreases in consumer

installment loans of $161.3 million and other commercial and

industrial loans of $99.7 million.

Loans Held for Sale

Loans held for sale decreased $70.6 million

quarter-over-quarter, and were $204.8 million at December 31,

2024.

Allowance for Credit Losses on Loans and Leases

The following table presents the allowance for credit losses on

loans and leases as of the dates and for the periods presented:

At or Three Months

Ended

At or Three Months

Ended

(Dollars in thousands)

December 31, 2024

September 30, 2024

Increase (Decrease)

December 31, 2024

December 31, 2023

Increase (Decrease)

Allowance for credit losses on loans and

leases

$

136,775

$

133,158

$

3,617

$

136,775

$

135,311

$

1,464

Provision (benefit) for credit losses on

loans and leases

$

18,229

$

17,766

$

463

$

18,229

$

13,420

$

4,809

Net charge-offs from loans held for

investment

$

14,612

$

17,044

$

(2,432

)

$

14,612

$

17,322

$

(2,710

)

Annualized net charge-offs to average

loans and leases

0.41

%

0.50

%

0.41

%

0.51

%

Coverage of credit loss reserves for loans

and leases held for investment

1.04

%

1.06

%

1.04

%

1.13

%

Net charge-offs decreased with $14.6 million in Q4 2024,

compared to $17.0 million in Q3 2024 and $17.3 million in Q4

2023.

Provision (benefit) for Credit Losses

Three Months Ended

Three Months Ended

(Dollars in thousands)

December 31, 2024

September 30, 2024

Increase (Decrease)

December 31, 2024

December 31, 2023

Increase (Decrease)

Provision (benefit) for credit losses on

loans and leases

$

18,229

$

17,766

$

463

$

18,229

$

13,420

$

4,809

Provision (benefit) for credit losses on

available for sale debt securities

2,965

(700

)

3,665

2,965

103

2,862

Provision for credit losses

21,194

17,066

4,128

21,194

13,523

7,671

Provision (benefit) for credit losses on

unfunded commitments

(664

)

642

(1,306

)

(664

)

(136

)

(528

)

Total provision for credit losses

$

20,530

$

17,708

$

2,822

$

20,530

$

13,387

$

7,143

The provision for credit losses on loans and leases in Q4 2024

was $18.2 million, compared to $17.8 million in Q3 2024. The higher

provision in Q4 2024 was primarily due to slight deterioration in

macroeconomic forecasts.

The provision for credit losses on available for sale investment

securities in Q4 2024 was a provision of $3.0 million, compared to

a benefit to provision of $0.7 million in Q3 2024.

The provision for credit losses on loans and leases in Q4 2024

was $18.2 million, compared to $13.4 million in Q4 2023. The higher

provision in Q4 2024 compared to the year ago period was primarily

due to higher balances in commercial and industrial loan balances

held for investment, partially offset by improvements in

macroeconomic forecasts and lower balances in consumer installment

loans held for investment.

The provision for credit losses on available for sale investment

securities in Q4 2024 was a provision of $3.0 million compared to

$0.1 million in Q4 2023.

Asset Quality

The following table presents asset quality metrics as of the

dates indicated:

(Dollars in thousands)

December 31, 2024

September 30, 2024

Increase (Decrease)

December 31, 2024

December 31, 2023

Increase (Decrease)

Non-performing assets (“NPAs”):

Nonaccrual / non-performing loans

(“NPLs”)

$

43,275

$

47,326

$

(4,051

)

$

43,275

$

27,110

$

16,165

Non-performing assets

$

55,807

$

47,326

$

8,481

$

55,807

$

27,209

$

28,598

NPLs to total loans and leases

0.30

%

0.34

%

0.30

%

0.21

%

Reserves to NPLs

316.06

%

281.36

%

316.06

%

499.12

%

NPAs to total assets

0.25

%

0.22

%

0.25

%

0.13

%

Loans and leases (1) risk

ratings:

Commercial loans and leases

Pass

$

11,403,930

$

10,844,500

$

559,430

$

11,403,930

$

9,955,243

$

1,448,687

Special Mention

175,055

178,026

(2,971

)

175,055

196,182

(21,127

)

Substandard

282,563

218,921

63,642

282,563

339,664

(57,101

)

Total commercial loans and leases

11,861,548

11,241,447

620,101

11,861,548

10,491,089

1,370,459

Consumer loans

Performing

1,227,359

1,240,581

(13,222

)

1,227,359

1,379,603

(152,244

)

Non-performing

15,976

14,787

1,189

15,976

18,428

(2,452

)

Total consumer loans

1,243,335

1,255,368

(12,033

)

1,243,335

1,398,031

(154,696

)

Loans and leases receivable (1)

$

13,104,883

$

12,496,815

$

608,068

$

13,104,883

$

11,889,120

$

1,215,763

(1)

Risk ratings are assigned to loans and

leases held for investment, and excludes loans held for sale, loans

receivable, mortgage finance, at fair value and eligible PPP loans

that are fully guaranteed by the Small Business Administration.

Over the last decade, the Bank has developed a suite of

commercial loan products with one particularly important common

denominator: a relatively low credit risk assumption. The Bank’s

commercial and industrial (“C&I”), mortgage finance, corporate

and specialized lending lines of business, and multifamily loans

for example, are characterized by conservative underwriting

standards and historically low loss rates. Because of this

emphasis, the Bank’s credit quality to date has been incredibly

healthy despite a challenging economic and rate environment.

Maintaining strong asset quality also requires a highly active

portfolio monitoring process. In addition to frequent client

outreach and monitoring at the individual loan level, management

employs a bottom-up data driven approach to analyze the commercial

portfolio.

Total consumer installment loans held for investment at December

31, 2024 were less than 4% of total assets and approximately 5% of

total loans and leases held for investment, and were supported by

an allowance for credit losses of $49.7 million. At December 31,

2024, the consumer installment portfolio had the following

characteristics: average original FICO score of 742, average

debt-to-income of 20% and average borrower income of $102

thousand.

Non-performing loans at December 31, 2024 decreased to 0.30% of

total loans and leases, compared to 0.34% at September 30, 2024 and

increased, compared to 0.21% at December 31, 2023.

Investment Securities

The investment securities portfolio, including debt securities

classified as available for sale (“AFS”) and held to maturity

(“HTM”) provides periodic cash flows through regular maturities and

amortization, can be used as collateral to secure additional

funding, and is an important component of the Bank’s liquidity

position.

The following table presents the composition of the investment

securities portfolio as of the dates indicated:

(Dollars in thousands)

December 31, 2024

September 30, 2024

December 31, 2023

Debt securities, available for sale

$

1,985,438

$

2,377,733

$

2,376,860

Equity securities

34,256

34,336

28,780

Investment securities, at fair value

2,019,694

2,412,069

2,405,640

Debt securities, held to maturity

991,937

1,064,437

1,103,170

Total investment securities portfolio

$

3,011,631

$

3,476,506

$

3,508,810

Customers’ securities portfolio is highly liquid, short in

duration, and high in yield. At December 31, 2024, the AFS debt

securities portfolio had a spot yield of 5.62%, an effective

duration of approximately 2.6 years, and approximately 32% are

variable rate. Additionally, 66% of the AFS securities portfolio

was AAA rated at December 31, 2024.

At December 31, 2024, the HTM debt securities portfolio

represented only 4.4% of total assets at December 31, 2024, had a

spot yield of 4.13% and an effective duration of approximately 3.5

years. Additionally, at December 31, 2024, approximately 44% of the

HTM securities were AAA rated and 52% were credit enhanced asset

backed securities with no current expectation of credit losses.

Deposits

The following table presents the composition of our deposit

portfolio as of the dates indicated:

(Dollars in thousands)

December 31, 2024

% of Total

September 30, 2024

% of Total

December 31, 2023

% of Total

Demand, non-interest bearing

$

5,608,288

29.7

%

$

4,670,809

25.9

%

$

4,422,494

24.7

%

Demand, interest bearing

5,553,698

29.5

5,606,500

31.0

5,580,527

31.1

Total demand deposits

11,161,986

59.2

10,277,309

56.9

10,003,021

55.8

Savings

1,131,819

6.0

1,399,968

7.7

1,402,941

7.8

Money market

3,844,451

20.4

3,961,028

21.9

3,226,395

18.0

Time deposits

2,708,205

14.4

2,431,084

13.5

3,287,879

18.4

Total deposits

$

18,846,461

100.0

%

$

18,069,389

100.0

%

$

17,920,236

100.0

%

Total deposits increased $777.1 million, or 4.3%, to $18.8

billion at December 31, 2024 as compared to the prior quarter.

Non-interest bearing demand deposits increased $937.5 million, or

20.1%, to $5.6 billion and time deposits increased $277.1 million,

or 11.4%, to $2.7 billion. These increases were offset by decreases

in savings deposits of $268.1 million, or 19.2%, to $1.1 billion,

money market deposits of $116.6 million, or 2.9%, to $3.8 billion

and interest bearing demand deposits of $52.8 million, or 0.9%, to

$5.6 billion. The total average cost of deposits decreased by 39

basis points to 3.07% in Q4 2024 from 3.46% in the prior quarter

primarily due to a favorable shift in deposit mix and lower market

interest rates. Total estimated uninsured deposits were $5.7

billion1, or 30% of total deposits (inclusive of accrued interest)

at December 31, 2024.

Total deposits increased $926.2 million, or 5.2%, to $18.8

billion at December 31, 2024 as compared to a year ago.

Non-interest bearing demand deposits increased $1.2 billion, or

26.8%, to $5.6 billion and money market deposits increased $618.1

million, or 19.2%, to $3.8 billion. These increases were offset by

decreases in time deposits of $579.7 million, or 17.6% to $2.7

billion, savings deposits of $271.1 million, or 19.3%, to $1.1

billion and interest bearing demand deposits of $26.8 million, or

0.5%, to $5.6 billion. The total average cost of deposits decreased

by 32 basis points to 3.07% in Q4 2024 from 3.39% in the prior year

primarily due to a favorable shift in deposit mix and lower market

interest rates.

1 Uninsured deposits (estimate) of $7.3 billion to be reported

on the Bank’s call report, less deposits of $1.5 billion

collateralized by standby letters of credit from the FHLB and from

our affiliates of $176.2 million.

Borrowings

The following table presents the composition of our borrowings

as of the dates indicated:

(Dollars in thousands)

December 31, 2024

September 30, 2024

December 31, 2023

FHLB advances

$

1,128,352

$

1,117,229

$

1,203,207

Senior notes

99,068

99,033

123,840

Subordinated debt

182,509

182,439

182,230

Total borrowings

$

1,409,929

$

1,398,701

$

1,509,277

Total borrowings increased $11.2 million, or 0.8%, to $1.4

billion at December 31, 2024 as compared to the prior quarter. This

increase primarily resulted from net draws of $25.0 million in FHLB

advances. As of December 31, 2024, Customers’ immediately available

borrowing capacity with the FRB and FHLB was approximately $7.9

billion, of which $1.1 billion of available capacity was utilized

in borrowings and $1.5 billion was utilized to collateralize

deposits.

Total borrowings decreased $99.3 million, or 6.6%, to $1.4

billion at December 31, 2024 as compared to a year ago. This

decrease primarily resulted from net repayments of $70.0 million in

FHLB advances and $25.0 million in senior notes upon maturity.

Capital

The following table presents certain capital amounts and ratios

as of the dates indicated:

(Dollars in thousands except per share

data)

December 31, 2024

September 30, 2024

December 31, 2023

Customers Bancorp, Inc.

Common Equity

$

1,698,889

$

1,663,386

$

1,500,600

Tangible Common Equity*

$

1,695,260

$

1,659,757

$

1,496,971

Common Equity to Total Assets

7.6

%

7.8

%

7.0

%

Tangible Common Equity to Tangible

Assets*

7.6

%

7.7

%

7.0

%

Book Value per common share

$

54.20

$

53.07

$

47.73

Tangible Book Value per common share*

$

54.08

$

52.96

$

47.61

Common equity Tier 1 (“CET 1”) capital

ratio (1)

12.0

%

12.5

%

12.2

%

Total risk based capital ratio (1)

14.8

%

15.4

%

15.3

%

(1) Regulatory capital ratios as of

December 31, 2024 are estimates.

* Non-GAAP measure. Customers’ reasons for

the use of the non-GAAP measure and a detailed reconciliation

between the non-GAAP measure and the comparable GAAP amount are

included at the end of this document.

Customers Bancorp’s common equity increased $35.5 million to

$1.7 billion, and tangible common equity* increased $35.5 million

to $1.7 billion, at December 31, 2024 compared to the prior

quarter, respectively, primarily from earnings of $23.3 million and

decreased unrealized losses on investment securities of $9.5

million (net of taxes) deferred in accumulated other comprehensive

income (“AOCI”). These increases were offset in part by $1.0

million of common share repurchases in Q4 2024. Similarly, book

value per common share increased to $54.20 from $53.07, and

tangible book value per common share* increased to $54.08 from

$52.96, at December 31, 2024 and September 30, 2024,

respectively.

Customers Bancorp’s common equity increased $198.3 million to

$1.7 billion, and tangible common equity* increased $198.3 million

to $1.7 billion, at December 31, 2024 compared to a year ago,

respectively, primarily from earnings of $166.4 million and

decreased unrealized losses on investment securities in AOCI of

$40.0 million (net of taxes), offset in part by $19.2 million of

common share repurchases. Similarly, book value per common share

increased to $54.20 from $47.73, and tangible book value per common

share* increased to $54.08 from $47.61, at December 31, 2024 and

December 31, 2023, respectively.

At the Customers Bancorp level, the CET 1 ratio (estimate),

total risk based capital ratio (estimate), common equity to total

assets ratio and tangible common equity to tangible assets ratio*

(“TCE / TA ratio”) were 12.0%, 14.8%, 7.6%, and 7.6%, respectively,

at December 31, 2024.

At the Customers Bank level, capital levels remained strong and

well above regulatory minimums. At December 31, 2024, Tier 1

capital (estimate) and total risk based capital (estimate) were

12.9% and 14.3%, respectively.

Key Profitability Trends

Net Interest Income

Net interest income totaled $167.8 million in Q4 2024, an

increase of $9.3 million from Q3 2024. This increase was primarily

due to lower interest expense of $11.5 million due to a favorable

shift in deposit mix and lower market interest rates. Interest

income decreased $2.2 million primarily due to lower interest

income from investment securities, partially offset by higher

balances in interest-earning deposits.

“Net interest income and net interest margin expanded in the

quarter primarily driven by improvements in the liability side of

the balance sheet as we lowered interest bearing deposit costs and

had higher levels of average non-interest bearing deposits. This is

evident in the fact that our total cost of deposits declined by 39

basis points during the quarter. Additionally, robust loan growth

late in the quarter should provide a strong foundation for our net

interest income in 2025,” stated Customers Bancorp President Sam

Sidhu. “We have positive drivers to net interest income on both

sides of the balance sheet though we continue to believe the best

opportunity remains in reducing our interest expense with continued

momentum from our new deposit focused commercial banking teams and

across our franchise.”

Net interest income totaled $167.8 million in Q4 2024, a

decrease of $4.7 million from Q4 2023. This decrease was primarily

due to lower interest income in specialized lending and investment

securities, partially offset by lower interest expense from a

favorable shift in deposit mix, lower market interest rates and

lower balances in other borrowings.

Non-Interest Income

The following table presents details of non-interest income for

the periods indicated:

Three Months Ended

Three Months Ended

(Dollars in thousands)

December 31, 2024

September 30, 2024

Increase (Decrease)

December 31, 2024

December 31, 2023

Increase (Decrease)

Commercial lease income

$

10,604

$

10,093

$

511

$

10,604

$

9,035

$

1,569

Loan fees

8,639

8,011

628

8,639

5,926

2,713

Bank-owned life insurance

2,125

2,049

76

2,125

2,160

(35

)

Mortgage finance transactional fees

1,010

1,087

(77

)

1,010

927

83

Net gain (loss) on sale of loans and

leases

(852

)

(14,548

)

13,696

(852

)

(91

)

(761

)

Net gain (loss) on sale of investment

securities

(26,260

)

—

(26,260

)

(26,260

)

(145

)

(26,115

)

Unrealized gain on equity method

investments

389

—

389

389

—

389

Other

3,954

1,865

2,089

3,954

860

3,094

Total non-interest income

$

(391

)

$

8,557

$

(8,948

)

$

(391

)

$

18,672

$

(19,063

)

Reported non-interest income totaled a loss of $0.4 million for

Q4 2024, a decrease of $8.9 million compared to Q3 2024. The

decrease was primarily due to $26.3 million in net realized loss on

sale of investment securities, partially offset by a decrease of

$13.6 million in loss on leases of commercial clean vehicles that

were accounted for as sales-type leases and included within net

gain (loss) on sale of loans and leases, and an increase in deposit

account fees of $1.9 million. The commercial clean vehicle leases

generated the same amount of investment tax credits that were

included as a benefit to income tax expense in Q4 2024 and Q3 2024.

In Q4 2024, the Bank invested the proceeds from the sale of lower

yielding investment securities into higher yielding loans and

investment securities.

Non-interest income totaled a loss of $0.4 million for Q4 2024,

a decrease of $19.1 million compared to Q4 2023. The decrease was

primarily due to $26.3 million in net realized loss on sale of

investment securities, partially offset by increases in commercial

lease income of $1.6 million, loan fees of $2.7 million primarily

resulting from increased unused line of credit fees, and deposit

account fees of $1.9 million.

Non-Interest Expense

The following table presents details of non-interest expense for

the periods indicated:

Three Months Ended

Three Months Ended

(Dollars in thousands)

December 31, 2024

September 30, 2024

Increase (Decrease)

December 31, 2024

December 31, 2023

Increase (Decrease)

Salaries and employee benefits

$

47,147

$

47,717

$

(570

)

$

47,147

$

33,965

$

13,182

Technology, communication and bank

operations

13,435

13,588

(153

)

13,435

16,887

(3,452

)

Commercial lease depreciation

8,933

7,811

1,122

8,933

7,357

1,576

Professional services

13,473

9,048

4,425

13,473

9,820

3,653

Loan servicing

4,584

3,778

806

4,584

3,779

805

Occupancy

3,335

2,987

348

3,335

2,320

1,015

FDIC assessments, non-income taxes and

regulatory fees

10,077

7,902

2,175

10,077

13,977

(3,900

)

Advertising and promotion

1,645

908

737

1,645

850

795

Other

7,746

10,279

(2,533

)

7,746

4,812

2,934

Total non-interest expense

$

110,375

$

104,018

$

6,357

$

110,375

$

93,767

$

16,608

Non-interest expenses totaled $110.4 million in Q4 2024, an

increase of $6.4 million compared to Q3 2024. The increase was

primarily attributable to increases of $4.4 million in professional

fees including continued investment in our risk management

infrastructure, and $2.2 million in FDIC assessments, non-income

taxes and regulatory fees mainly due to a credit of $3.0 million in

non-income taxes recorded in Q3 2024 for periods prior to 2024.

“In the quarter we incurred professional services expense of

approximately $5.7 million as we made investments to enhance our

risk management infrastructure. We expect these costs to remain

elevated for the next quarter or so before tapering down as we seek

to build a best-in-class risk management function which we believe

can be a competitive advantage for the bank in the future. During

the quarter we advanced our operational excellence initiative to

provide the capacity for these and other investments which we are,

and will continue to make, in our franchise to position us for

success in the both the near-term and over the long-term,” stated

Sam Sidhu.

Non-interest expenses totaled $110.4 million in Q4 2024, an

increase of $16.6 million compared to Q4 2023. The increase was

primarily attributable to increases of $13.2 million in salaries

and employee benefits primarily due to higher headcount including

the addition of new banking teams in 2024, annual merit increases,

incentives and severance, $3.7 million in professional fees

including the investment in our risk management infrastructure, and

fees paid to a fintech company related to consumer installment

loans originated and held for sale. These increases were partially

offset by decreases in FDIC assessments primarily due to $3.7

million of FDIC special assessment in Q4 2023 and deposit servicing

fees.

Taxes

Income tax expense increased by $9.7 million to a provision of

$8.9 million in Q4 2024 from a benefit of $0.7 million in Q3 2024

primarily due to lower investment tax credits in Q4 2024, partially

offset by lower pre-tax income. The decrease in investment tax

credits was primarily due to $0.6 million of investment tax credits

generated from commercial clean vehicles in Q4 2024 as compared to

$14.3 million in Q3 2024. The investment tax credits from

commercial clean vehicle leases were the same amount as the loss on

leases of commercial clean vehicles included within net gain (loss)

on sale of loans and leases in Q4 2024 and Q3 2024.

Income tax expense decreased by $12.9 million to a provision of

$8.9 million in Q4 2024 from a provision of $21.8 million in Q4

2023 primarily due to lower pre-tax income and an increase in

income tax credits for 2024, including $14.9 million of investment

tax credits generated from commercial clean vehicles in 2024. The

investment tax credits from commercial clean vehicle leases were

the same amount as the loss on leases of commercial clean vehicles

included within net gain (loss) on sale of loans and leases in

2024. The effective tax rate was 24.9% for Q4 2024 and 19.1% for

the full year 2024.

Outlook

“Looking forward, our strategy remains unchanged. We are focused

on continuing the transformation of our deposit franchise, further

strengthening our risk management and compliance infrastructure,

improving our profitability and growing net interest income, and

maintaining strong capital ratios, liquidity, and credit quality.

Our deposit transformation momentum is continuing. As a result, we

expect deposit growth of 5% to 9% during 2025 with gross inflows

expected to be higher as we continue to remix out less strategic

deposits especially in the first half of the year. With strong loan

pipelines and attractive opportunities from across our various

verticals we are targeting to increase the loan portfolio by about

7% to 10% in 2025. Through the combination of these factors we

expect our net interest income to increase between 3% to 7% in

2025. Operating efficiency has been and remains a priority for us

even while we continue to make significant investments in our

future. We see our core efficiency ratio* for the year in the low

to mid 50’s as the execution of our strategic priorities take hold

and as we move toward completion of some of our outsized

investment. We remain committed to maintaining higher levels of

capital with CET 1 ratio target of 11.5% in 2025. We expect an

effective tax rate to be between 22% to 25%. We remain focused on

executing in those areas which differentiate us from our peers and

believe that providing truly exceptional service, sophisticated

product offerings and a single-point-of-contact service model will

deliver strategic, organic growth. We believe we are incredibly

well positioned to continue to win new client relationships and

that we have the right strategy, the right team, and a

client-centric culture to achieve our goals in 2025 and beyond,”

concluded Sam Sidhu.

*

Non-GAAP measure. Customers' reasons for

the use of the non-GAAP measure and a detailed reconciliation

between the non-GAAP measure and the comparable GAAP amount are

included at the end of this document.

Webcast

Date:

Friday, January 24, 2025

Time:

9:00 AM EDT

The live audio webcast, presentation slides, and earnings press

release will be made available at https://www.customersbank.com and

at the Customers Bancorp 4th Quarter Earnings Webcast.

You may submit questions in advance of the live webcast by

emailing our Head of Corporate Communications, Jordan Baucum at

jbaucum@customersbank.com.

The webcast will be archived for viewing on the Customers Bank

Investor Relations page and available beginning approximately two

hours after the conclusion of the live event.

Institutional Background

Customers Bancorp, Inc. (NYSE:CUBI) is one of the nation’s

top-performing banking companies with over $22 billion in assets

making it one of the 80 largest bank holding companies in the U.S.

Customers Bank’s commercial and consumer clients benefit from a

full suite of technology-enabled tailored product experiences

delivered by best-in-class customer service distinguished by a

Single Point of Contact approach. In addition to traditional lines

such as C&I lending, commercial real estate lending and

multifamily lending, Customers Bank also provides a number of

national corporate banking services to specialized lending clients.

Major accolades include:

- No. 1 on American Banker 2024 list of top-performing banks with

$10B to $50B in assets

- No. 29 out of the 100 largest publicly traded banks in 2024

Forbes Best Banks list

- No. 52 on Investor’s Business Daily 100 Best Stocks for

2023

A member of the Federal Reserve System with deposits insured by

the Federal Deposit Insurance Corporation, Customers Bank is an

equal opportunity lender. Learn more: www.customersbank.com.

“Safe Harbor” Statement

In addition to historical information, this press release may

contain “forward-looking statements” within the meaning of the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include

statements with respect to Customers Bancorp, Inc.’s strategies,

goals, beliefs, expectations, estimates, intentions, capital

raising efforts, financial condition and results of operations,

future performance and business. Statements preceded by, followed

by, or that include the words “may,” “could,” “should,” “pro

forma,” “looking forward,” “would,” “believe,” “expect,”

“anticipate,” “estimate,” “intend,” “plan,” “project,” or similar

expressions generally indicate a forward-looking statement. These

forward-looking statements involve risks and uncertainties that are

subject to change based on various important factors (some of

which, in whole or in part, are beyond Customers Bancorp, Inc.’s

control). Numerous competitive, economic, regulatory, legal and

technological events and factors, among others, could cause

Customers Bancorp, Inc.’s financial performance to differ

materially from the goals, plans, objectives, intentions and

expectations expressed in such forward-looking statements,

including: a continuation of the recent turmoil in the banking

industry, responsive measures taken by us and regulatory

authorities to mitigate and manage related risks, regulatory

actions taken that address related issues and the costs and

obligations associated therewith, such as the FDIC special

assessments; the potential for negative consequences resulting from

regulatory violations, investigations and examinations, including

potential supervisory actions, the assessment of fines and

penalties, the imposition of sanctions, the need to undertake

remedial actions and possible damage to our reputation; effects of

competition on deposit rates and growth, loan rates and growth and

net interest margin; failure to identify and adequately and

promptly address cybersecurity risks, including data breaches and

cyberattacks; public health crises and pandemics and their effects

on the economic and business environments in which we operate;

geopolitical conditions, including acts or threats of terrorism,

actions taken by the United States or other governments in response

to acts or threats of terrorism and military conflicts, including

the war between Russia and Ukraine and escalating conflict in the

Middle East, which could impact economic conditions in the United

States; the impact that changes in the economy have on the

performance of our loan and lease portfolio, the market value of

our investment securities, the demand for our products and services

and the availability of sources of funding; the effects of actions

by the federal government, including the Board of Governors of the

Federal Reserve System and other government agencies, that affect

market interest rates and the money supply; actions that we and our

customers take in response to these developments and the effects

such actions have on our operations, products, services and

customer relationships; higher inflation and its impacts; and the

effects of any changes in accounting standards or policies.

Customers Bancorp, Inc. cautions that the foregoing factors are not

exclusive, and neither such factors nor any such forward-looking

statement takes into account the impact of any future events. All

forward-looking statements and information set forth herein are

based on management’s current beliefs and assumptions as of the

date hereof and speak only as of the date they are made. For a more

complete discussion of the assumptions, risks and uncertainties

related to our business, you are encouraged to review Customers

Bancorp, Inc.’s filings with the Securities and Exchange

Commission, including its most recent annual report on Form 10-K

for the year ended December 31, 2023, subsequently filed quarterly

reports on Form 10-Q and current reports on Form 8-K, including any

amendments thereto, that update or provide information in addition

to the information included in the Form 10-K and Form 10-Q filings,

if any. Customers Bancorp, Inc. does not undertake to update any

forward-looking statement whether written or oral, that may be made

from time to time by Customers Bancorp, Inc. or by or on behalf of

Customers Bank, except as may be required under applicable law.

Q4 2024 Overview

The following table presents a summary of key earnings and

performance metrics for the quarter ended December 31, 2024 and the

preceding four quarters, and full year 2024 and 2023:

CUSTOMERS BANCORP, INC. AND

SUBSIDIARIES

EARNINGS SUMMARY - UNAUDITED

Q4

Q3

Q2

Q1

Q4

Twelve Months Ended December

31,

(Dollars in thousands, except per share data and stock price data)

2024

2024

2024

2024

2023

2024

2023

GAAP Profitability Metrics:

Net income available to common

shareholders

$

23,266

$

42,937

$

54,300

$

45,926

$

58,223

$

166,429

$

235,448

Per share amounts:

Earnings per share - basic

$

0.74

$

1.36

$

1.72

$

1.46

$

1.86

$

5.28

$

7.49

Earnings per share - diluted

$

0.71

$

1.31

$

1.66

$

1.40

$

1.79

$

5.09

$

7.32

Book value per common share (1)

$

54.20

$

53.07

$

50.81

$

49.29

$

47.73

$

54.20

$

47.73

CUBI stock price (1)

$

48.68

$

46.45

$

47.98

$

53.06

$

57.62

$

48.68

$

57.62

CUBI stock price as % of book value

(1)

90

%

88

%

94

%

108

%

121

%

90

%

121

%

Average shares outstanding - basic

31,346,920

31,567,797

31,649,715

31,473,424

31,385,043

31,509,179

31,435,647

Average shares outstanding - diluted

32,557,621

32,766,488

32,699,149

32,854,534

32,521,787

32,719,134

32,158,788

Shares outstanding (1)

31,346,507

31,342,107

31,667,655

31,521,931

31,440,906

31,346,507

31,440,906

Return on average assets (“ROAA”)

0.48

%

0.88

%

1.11

%

0.94

%

1.16

%

0.85

%

1.16

%

Return on average common equity

(“ROCE”)

5.50

%

10.44

%

13.85

%

12.08

%

15.93

%

10.36

%

17.33

%

Net interest margin, tax equivalent

3.11

%

3.06

%

3.29

%

3.10

%

3.31

%

3.15

%

3.29

%

Efficiency ratio

56.86

%

62.40

%

51.87

%

54.58

%

49.08

%

56.21

%

46.49

%

Non-GAAP Profitability Metrics

(2):

Core earnings

$

44,168

$

43,838

$

48,567

$

46,532

$

61,633

$

183,105

$

248,233

Core pre-tax pre-provision net income

$

84,224

$

64,824

$

89,220

$

83,674

$

101,884

$

321,942

$

416,563

Per share amounts:

Core earnings per share - diluted

$

1.36

$

1.34

$

1.49

$

1.42

$

1.90

$

5.60

$

7.72

Tangible book value per common share

(1)

$

54.08

$

52.96

$

50.70

$

49.18

$

47.61

$

54.08

$

47.61

CUBI stock price as % of tangible book

value (1)

90

%

88

%

95

%

108

%

121

%

90

%

121

%

Core ROAA

0.86

%

0.89

%

1.00

%

0.95

%

1.22

%

0.92

%

1.22

%

Core ROCE

10.44

%

10.66

%

12.39

%

12.24

%

16.87

%

11.40

%

18.27

%

Core pre-tax pre-provision ROAA

1.51

%

1.21

%

1.71

%

1.58

%

1.90

%

1.50

%

1.94

%

Core pre-tax pre-provision ROCE

19.04

%

14.84

%

21.79

%

21.01

%

26.82

%

19.10

%

29.58

%

Core efficiency ratio

56.12

%

61.69

%

53.47

%

54.24

%

46.70

%

56.25

%

45.45

%

Asset Quality:

Net charge-offs

$

14,612

$

17,044

$

18,711

$

17,968

$

17,322

$

68,335

$

69,035

Annualized net charge-offs to average

total loans and leases

0.41

%

0.50

%

0.56

%

0.55

%

0.51

%

0.50

%

0.48

%

Non-performing loans (“NPLs”) to total

loans and leases (1)

0.30

%

0.34

%

0.35

%

0.27

%

0.21

%

0.30

%

0.21

%

Reserves to NPLs (1)

316.06

%

281.36

%

279.52

%

373.86

%

499.12

%

316.06

%

499.12

%

Non-performing assets (“NPAs”) to total

assets

0.25

%

0.22

%

0.23

%

0.17

%

0.13

%

0.25

%

0.13

%

Customers Bank Capital Ratios

(3):

Common equity Tier 1 capital to

risk-weighted assets

12.9

%

13.64

%

14.17

%

14.16

%

13.77

%

12.9

%

13.77

%

Tier 1 capital to risk-weighted assets

12.9

%

13.64

%

14.17

%

14.16

%

13.77

%

12.9

%

13.77

%

Total capital to risk-weighted assets

14.3

%

15.06

%

15.64

%

15.82

%

15.28

%

14.3

%

15.28

%

Tier 1 capital to average assets (leverage

ratio)

8.7

%

9.08

%

9.16

%

8.82

%

8.71

%

8.7

%

8.71

%

(1) Metric is a spot balance for the last

day of each quarter presented.

(2) Customers’ reasons for the use of

these non-GAAP measures and a detailed reconciliation between the

non-GAAP measures and the comparable GAAP amounts are included at

the end of this document.

(3) Regulatory capital ratios are

estimated for Q4 2024 and actual for the remaining periods. In

accordance with regulatory capital rules, Customers elected to

apply the CECL capital transition provisions which delayed the

effects of CECL on regulatory capital for two years until January

1, 2022, followed by a three-year transition period. The cumulative

CECL capital transition impact as of December 31, 2021 which

amounted to $61.6 million will be phased in at 25% per year

beginning on January 1, 2022 through December 31, 2024. As of

December 31, 2024, our regulatory capital ratios reflected 25%, or

$15.4 million, benefit associated with the CECL transition

provisions.

CUSTOMERS BANCORP, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS -

UNAUDITED

(Dollars in thousands, except per share

data)

Twelve Months Ended

Q4

Q3

Q2

Q1

Q4

December 31,

2024

2024

2024

2024

2023

2024

2023

Interest income:

Loans and leases

$

230,534

$

228,659

$

224,265

$

217,999

$

239,453

$

901,457

$

996,517

Investment securities

39,638

46,265

47,586

46,802

51,074

180,291

200,659

Interest earning deposits

48,147

44,372

45,506

52,817

44,104

190,842

125,923

Loans held for sale

9,447

10,907

13,671

12,048

8,707

46,073

36,221

Other

2,140

1,910

3,010

2,111

2,577

9,171

8,040

Total interest income

329,906

332,113

334,038

331,777

345,915

1,327,834

1,367,360

Interest expense:

Deposits

144,974

155,829

148,784

153,725

150,307

603,312

576,437

FHLB advances

12,595

12,590

13,437

13,485

18,868

52,107

80,008

FRB advances

—

—

—

—

—

—

6,286

Subordinated debt

3,349

3,537

2,734

2,689

2,688

12,309

10,755

Other borrowings

1,167

1,612

1,430

1,493

1,546

5,702

6,425

Total interest expense

162,085

173,568

166,385

171,392

173,409

673,430

679,911

Net interest income

167,821

158,545

167,653

160,385

172,506

654,404

687,449

Provision for credit losses

21,194

17,066

18,121

17,070

13,523

73,451

74,611

Net interest income after provision for

credit losses

146,627

141,479

149,532

143,315

158,983

580,953

612,838

Non-interest income:

Commercial lease income

10,604

10,093

10,282

9,683

9,035

40,662

36,179

Loan fees

8,639

8,011

5,233

5,280

5,926

27,163

20,216

Bank-owned life insurance

2,125

2,049

2,007

3,261

2,160

9,442

11,777

Mortgage finance transactional fees

1,010

1,087

1,058

946

927

4,101

4,395

Net gain (loss) on sale of loans and

leases

(852

)

(14,548

)

(238

)

10

(91

)

(15,628

)

(1,200

)

Loss on sale of capital call lines of

credit

—

—

—

—

—

—

(5,037

)

Net gain (loss) on sale of investment

securities

(26,260

)

—

(719

)

(30

)

(145

)

(27,009

)

(574

)

Unrealized gain on equity method

investments

389

—

11,041

—

—

11,430

—

Other

3,954

1,865

2,373

2,081

860

10,273

4,809

Total non-interest income

(391

)

8,557

31,037

21,231

18,672

60,434

70,565

Non-interest expense:

Salaries and employee benefits

47,147

47,717

44,947

36,025

33,965

175,836

133,275

Technology, communication and bank

operations

13,435

13,588

16,227

21,904

16,887

65,154

65,550

Commercial lease depreciation

8,933

7,811

7,829

7,970

7,357

32,543

29,898

Professional services

13,473

9,048

6,104

6,353

9,820

34,978

35,177

Loan servicing

4,584

3,778

3,516

4,031

3,779

15,909

17,075

Occupancy

3,335

2,987

3,120

2,347

2,320

11,789

10,070

FDIC assessments, non-income taxes and

regulatory fees

10,077

7,902

10,236

13,469

13,977

41,684

35,036

Advertising and promotion

1,645

908

1,254

682

850

4,489

3,095

Legal settlement expense

—

—

—

—

—

—

4,096

Other

7,746

10,279

10,219

6,388

4,812

34,632

19,391

Total non-interest expense

110,375

104,018

103,452

99,169

93,767

417,014

352,663

Income before income tax expense

(benefit)

35,861

46,018

77,117

65,377

83,888

224,373

330,740

Income tax expense (benefit)

8,946

(725

)

19,032

15,651

21,796

42,904

80,597

Net income

26,915

46,743

58,085

49,726

62,092

181,469

250,143

Preferred stock dividends

3,649

3,806

3,785

3,800

3,869

15,040

14,695

Net income available to common

shareholders

$

23,266

$

42,937

$

54,300

$

45,926

$

58,223

$

166,429

$

235,448

Basic earnings per common share

$

0.74

$

1.36

$

1.72

$

1.46

$

1.86

$

5.28

$

7.49

Diluted earnings per common share

0.71

1.31

1.66

1.40

1.79

5.09

7.32

CUSTOMERS BANCORP, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEET -

UNAUDITED

(Dollars in thousands)

December 31,

September 30,

June 30,

March 31,

December 31,

2024

2024

2024

2024

2023

ASSETS

Cash and due from banks

$

56,787

$

39,429

$

45,045

$

51,974

$

45,210

Interest earning deposits

3,729,144

3,048,593

3,003,542

3,649,146

3,801,136

Cash and cash equivalents

3,785,931

3,088,022

3,048,587

3,701,120

3,846,346

Investment securities, at fair value

2,019,694

2,412,069

2,511,650

2,604,868

2,405,640

Investment securities held to maturity

991,937

1,064,437

962,799

1,032,037

1,103,170

Loans held for sale

204,794

275,420

375,724

357,640

340,317

Loans and leases receivable

13,127,634

12,527,283

12,254,204

11,936,621

11,963,855

Loans receivable, mortgage finance, at

fair value

1,321,128

1,250,413

1,002,711

962,610

897,912

Allowance for credit losses on loans and

leases

(136,775

)

(133,158

)

(132,436

)

(133,296

)

(135,311

)

Total loans and leases receivable, net of

allowance for credit losses on loans and leases

14,311,987

13,644,538

13,124,479

12,765,935

12,726,456

FHLB, Federal Reserve Bank, and other

restricted stock

96,214

95,035

92,276

100,067

109,548

Accrued interest receivable

108,351

115,588

112,788

120,123

114,766

Bank premises and equipment, net

6,668

6,730

7,019