Clearwater Analytics Announces Launch of Secondary Offering of Class A Common Stock

12 November 2024 - 8:36AM

Business Wire

Clearwater Analytics Holdings, Inc. (“Clearwater” or the

“Company”) (NYSE: CWAN), a leading worldwide provider of SaaS-based

investment management, accounting, reporting, and analytics

solutions, today announced that it has launched an underwritten

secondary public offering of an aggregate of 25,000,000 shares of

the Company’s Class A common stock, par value $0.001 per share (the

“Common Stock”). The Company is conducting a resale of Common Stock

on behalf of certain affiliates of each of Welsh, Carson, Anderson

& Stowe, Warburg Pincus LLC and Permira Advisers LLC

(collectively, the “Selling Stockholders”). The Company will not

receive any proceeds from the sale of the Common Stock by the

Selling Stockholders. The underwriter will offer the shares from

time to time for sale in negotiated transactions or otherwise, at

market prices prevailing at the time of sale, at prices related to

such prevailing market prices or at negotiated prices. The Common

Stock is listed on the New York Stock Exchange under the ticker

symbol “CWAN.”

J.P. Morgan is acting as the underwriter and sole book-running

manager for the proposed offering.

Shares of the Common Stock are being offered in this proposed

offering pursuant to an automatically effective shelf registration

statement on Form S-3 filed with the United States Securities and

Exchange Commission (the “SEC”) on March 8, 2023. A prospectus

relating to and describing the terms of the proposed offering will

be filed with the SEC and may be obtained from: J.P. Morgan

Securities, LLC, c/o Broadridge Financial Solutions, 1155 Long

Island Avenue, Edgewood, NY 11717, or by email at

prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com; or by accessing the SEC’s

website at www.sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

jurisdiction. Any offers, solicitations or offers to buy, or any

sales of securities will be made in accordance with the

registration requirements of the Securities Act of 1933, as

amended.

About Clearwater Analytics

Clearwater Analytics (NYSE: CWAN), a global, industry-leading

SaaS solution, automates the entire investment lifecycle. With a

single instance, multi-tenant architecture, Clearwater offers

award-winning investment portfolio planning, performance reporting,

data aggregation, reconciliation, accounting, compliance, risk, and

order management. Each day, leading insurers, asset managers,

corporations, and governments use Clearwater’s trusted data to

drive efficient, scalable investing on more than $7.3 trillion in

assets spanning traditional and alternative asset types.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are

based on management’s beliefs and assumptions and on information

currently available to management. Forward-looking statements

include information concerning the terms of the proposed public

offering, the Company’s possible or assumed future results of

operations, business strategies, technology developments, financing

and investment plans, dividend policy, competitive position,

industry, economic and regulatory environment, potential growth

opportunities and the effects of competition. Forward-looking

statements include statements that are not historical facts and can

be identified by terms such as “anticipate,” “believe,” “could,”

“estimate,” “expect,” “intend,” “aim,” “may,” “plan,” “potential,”

“predict,” “project,” “seek,” “should,” “will,” “would” or similar

expressions and the negatives of those terms, but are not the

exclusive means of identifying such statements.

Forward-looking statements involve known and unknown risks,

uncertainties, and other factors, many of which are beyond the

Company’s control, that may cause the Company’s actual results,

performance, or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. These risks and uncertainties

include, but are not limited to, those discussed under “Risk

Factors” in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023 filed with the SEC on February 29, 2024, in

the Company’s Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2024 filed with the SEC on November 6,

2024 and in other periodic reports filed by the Company with the

SEC. These filings are available at www.sec.gov and on the

Company’s website. Given these uncertainties, you should not place

undue reliance on forward-looking statements. Also, forward-looking

statements represent management’s beliefs and assumptions only as

of the date of this press release and should not be relied upon as

representing the Company’s expectations or beliefs as of any date

subsequent to the time they are made. The Company does not

undertake to and specifically declines any obligation to update any

forward-looking statements that may be made from time to time by or

on behalf of the Company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111848626/en/

Investors: Joon Park | +1 415-906-9242 |

investors@clearwaternanalytics.com

Media: Claudia Cahill | +1 703-728-1221 |

press@clearwateranalytics.com

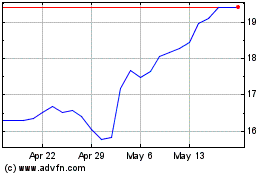

Clearwater Analytics (NYSE:CWAN)

Historical Stock Chart

From Dec 2024 to Jan 2025

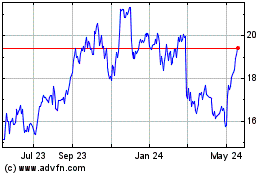

Clearwater Analytics (NYSE:CWAN)

Historical Stock Chart

From Jan 2024 to Jan 2025