Form S-3ASR - Automatic shelf registration statement of securities of well-known seasoned issuers

31 October 2024 - 7:07AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on October 30, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CAMPING WORLD HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

81-1737145

(I.R.S. Employer

Identification Number)

|

|

2 Marriott Drive

Lincolnshire, IL 60069

(847) 808-3000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Thomas E. Kirn

Chief Financial Officer

Camping World Holdings, Inc.

2 Marriott Drive

Lincolnshire, IL 60069

(847) 808-3000

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Marc D. Jaffe, Esq.

Ian D. Schuman, Esq.

Benjamin J. Cohen, Esq.

Latham & Watkins LLP

1271 Avenue of the Americas

New York, NY 10020

(212) 906-1200

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☒

|

|

|

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☐

|

|

|

Smaller reporting company

☐

|

|

| |

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for comply with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

PROSPECTUS

Camping World Holdings, Inc.

Class A Common Stock

We may offer and sell the securities identified above from time to time in one or more offerings. This prospectus provides you with a general description of the securities.

Each time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering and the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in any of our securities.

We may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

INVESTING IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 6 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

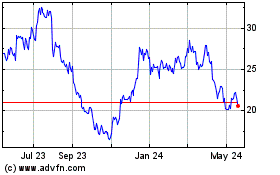

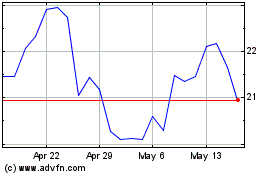

Our Class A common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “CWH”. On October 29, 2024, the last reported sale price of our Class A common stock on the NYSE was $22.89 per share.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 30, 2024.

TABLE OF CONTENTS

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

2 |

|

|

| |

|

|

|

|

|

3 |

|

|

| |

|

|

|

|

|

5 |

|

|

| |

|

|

|

|

|

6 |

|

|

| |

|

|

|

|

|

7 |

|

|

| |

|

|

|

|

|

8 |

|

|

| |

|

|

|

|

|

14 |

|

|

| |

|

|

|

|

|

15 |

|

|

| |

|

|

|

|

|

15

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “SEC”) as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. By using a shelf registration statement, we may sell securities from time to time and in one or more offerings as described in this prospectus. Each time that we offer and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities being offered and sold and the specific terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. The prospectus supplement or free writing prospectus may also add, update or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement or free writing prospectus, you should rely on the prospectus supplement or free writing prospectus, as applicable. Before purchasing any securities, you should carefully read both this prospectus and the applicable prospectus supplement (and any applicable free writing prospectuses), together with the additional information described under the heading “Where You Can Find More Information; Incorporation by Reference”.

We have not authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus incorporates by reference, and any prospectus supplement or free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus, any prospectus supplement or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus, the applicable prospectus supplement and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. Accordingly, investors should not place undue reliance on this information.

“We,” “us”, “our”, the “Company”, “Camping World”, “Good Sam” and similar references refer to Camping World Holdings, Inc., and, unless otherwise stated, all of its subsidiaries, including CWGS Enterprises, LLC, which we refer to as “CWGS LLC” and, unless otherwise stated, all of its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). All statements other than statements of historical facts contained, or incorporated by reference, in this prospectus are forward-looking statements. Statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding the timeline for and benefits of our restructuring activities; expected new store location openings and closures, including greenfield locations and acquired locations; sufficiency of our sources of liquidity and capital and potential need for additional financing; our stock repurchase program; future capital expenditures, including with respect to our expansion of dealerships through acquisition and construction, and debt service obligations; refinancing, retirement or exchange of outstanding debt; expectations regarding industry trends and consumer behavior and growth; industry trends or forecasts predicted by us or third parties; our ability to capture positive industry trends and pursue growth; our product offerings and strategy; inventory management and impacts on gross margins; expectations regarding our pending litigation, and our plans related to dividend payments, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe”, “can”, “continue”, “could”, “designed”, “estimate”, “expect”, “forecast”, “goal”, “intend”, “may”, “might”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “target”, “will”, “would” or the negative of these terms or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs.

These forward-looking statements involve known and unknown risks, uncertainties, and other important factors, including those incorporated by reference into this prospectus from our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act and in our other filings with the SEC, that may cause our actual results, performance and/or achievements to differ materially and adversely from any future results, performance, or achievements expressed or implied by the forward-looking statements.

Any forward-looking statements made herein speak only as of the date of this prospectus, and you should not rely on forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future effects, results, performance, or achievements reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this prospectus or to conform these statements to actual results or revised expectations.

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available Information

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our web site address is www.campingworld.com. The information on our web site, however, is not, and should not be deemed to be, a part of this prospectus.

This prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Other documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement or documents incorporated by reference in the registration statement. Statements in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

Incorporation by Reference

The SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently filed document incorporated by reference modifies or replaces that statement.

This prospectus and any accompanying prospectus supplement incorporate by reference the documents set forth below that have previously been filed with the SEC:

•

•

Our Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2024, filed with the SEC on May 3, 2024, for the fiscal quarter ended June 30, 2024, filed with the SEC on August 1, 2024, and for the fiscal quarter ended September 30, 2024, filed with the SEC on October 29, 2024.

•

•

•

All reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act” in this prospectus, prior to the termination of this offering but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing of such reports and documents.

You may request a free copy of any of the documents incorporated by reference in this prospectus by writing or telephoning us at the following address:

Camping World Holdings, Inc.

2 Marriott Drive

Lincolnshire, IL 60069

(847) 808-3000

Exhibits to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus or any accompanying prospectus supplement.

THE COMPANY

Camping World Holdings, Inc. (together with its subsidiaries) is the world’s largest retailer of RVs and related products and services. Through our Camping World and Good Sam brands, our vision is to build a business that makes RVing and other outdoor activities fun and easy. We strive to build long-term value for our customers, employees, and stockholders by combining a unique and comprehensive assortment of RV products and services with a national network of RV dealerships, service centers and customer support centers along with the industry’s most extensive online presence and a highly-trained and knowledgeable team of associates serving our customers, the RV lifestyle, and the communities in which we operate. We also believe that our Good Sam organization and family of highly specialized services and plans, including roadside assistance, protection plans and insurance, uniquely enables us to connect with our customers as stewards of an outdoor and recreational lifestyle. On September 30, 2024, we operated a total of 207 locations, with all of them selling and/or servicing RVs.

We filed our certificate of incorporation with the Secretary of State of the State of Delaware on March 8, 2016.

Our principal executive offices are located at 2 Marriott Drive, Lincolnshire, IL 60069, and our telephone number is (847) 808-3000.

Camping World Holdings, Inc. is a holding company and the sole managing member of CWGS LLC, and our principal asset consists of common units of CWGS LLC.

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. Before deciding whether to invest in our securities, you should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in the applicable prospectus supplement and any applicable free writing prospectus. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment. Please also carefully read the section entitled “Cautionary Note Regarding Forward-Looking Statements” included in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

USE OF PROCEEDS

We intend to use the net proceeds from the sale of the securities as set forth in the applicable prospectus supplement.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock is not complete and may not contain all the information you should consider before investing in our capital stock. This description is summarized from, and qualified in its entirety by reference to, our amended and restated certificate of incorporation (the “certificate”) and amended and restated bylaws (“bylaws”), which have been publicly filed with the SEC. See “Where You Can Find More Information; Incorporation by Reference”.

Our certificate authorizes capital stock consisting of:

•

250,000,000 shares of Class A common stock, $0.01 par value;

•

75,000,000 shares of Class B common stock, $0.0001 par value;

•

One share of Class C common stock, $0.0001 par value; and

•

20,000,000 shares of preferred stock, $0.01 par value.

Certain provisions of our certificate and our bylaws summarized below may be deemed to have an anti-takeover effect and may delay or prevent a tender offer or takeover attempt that a stockholder might consider to be in its best interest, including those attempts that might result in a premium over the market price for the shares of common stock.

Class A Common Stock

Holders of shares of our Class A common stock are entitled to one vote for each share held of record on all matters submitted to a vote of the holders of Class A common stock, whether voting separately as a class or otherwise. The holders of our Class A common stock do not have cumulative voting rights in the election of directors. Holders of shares of our Class A common stock, Class B common stock and Class C common stock vote together as a single class (or, if any holders of shares of preferred stock are entitled to vote together with the holders of common stock, as a single class with such holders of preferred stock) on all matters presented to our stockholders for their vote or approval, except for certain amendments to our certificate described below or as otherwise required by applicable law or the certificate.

Holders of shares of our Class A common stock are entitled to receive dividends when and if declared by our board of directors out of funds legally available therefor, subject to any statutory or contractual restrictions on the payment of dividends and to any restrictions on the payment of dividends imposed by the terms of any outstanding preferred stock.

Upon our dissolution or liquidation, after payment in full of all amounts required to be paid to creditors and to the holders of preferred stock having liquidation preferences, if any, the holders of shares of our Class A common stock, Class B common stock and Class C common stock will be entitled to receive pro rata our remaining assets available for distribution in proportion to the number of shares held by each such stockholder; provided, that the holders of shares of Class B common stock and Class C common stock will be entitled to receive $0.01 per share, and upon receiving such amount, the holders of shares of Class B common stock and Class C common stock, as such, shall not be entitled to receive any other assets or funds of the Company.

Holders of shares of our Class A common stock do not have preemptive, subscription, redemption or conversion rights. There will be no redemption or sinking fund provisions applicable to the Class A common stock.

Class B Common Stock

Each share of our Class B common stock entitles its holders to one vote per share on all matters submitted to a vote of the holders of Class B common stock, whether voting separately as a class or otherwise; provided that, for as long as ML Acquisition Company, LLC, a Delaware limited liability company (“ML Acquisition”), and its Permitted Transferees (as defined in the certificate) of the common units of CWGS Enterprises, LLC, a Delaware limited liability company (“CWGS LLC”) (ML Acquisition and such Permitted Transferees collectively, the “ML Related Parties”), directly or indirectly,

beneficially own in the aggregate 27.5% or more of all of the outstanding common units of CWGS LLC, the shares of our Class B common stock held by the ML Related Parties entitle the ML Related Parties to the number of votes necessary such that the ML Related Parties, in the aggregate, cast 47% of the total votes eligible to be cast by all of our stockholders on all matters presented to a vote of our stockholders generally. The holders of shares of our Class B common stock do not have cumulative voting rights in the election of directors.

Additional shares of Class B common stock may be issued only to the extent necessary to maintain a one-to-one ratio between the number of common units of CWGS LLC held by the ML Related Parties and CVRV Acquisition LLC (“Crestview” and its Permitted Transferees, “Crestview Holders” and together with the ML Related Parties, the “Permitted Class B Owners”) and the number of shares of Class B common stock issued to the Permitted Class B Owners. Shares of Class B common stock are transferable only to the extent provided by the Amended and Restated Limited Liability Company Agreement of CWGS LLC, dated March 8, 2016 and must be transferred together with an equal number of common units of CWGS LLC.

Holders of our Class B common stock do not have any right to receive dividends. Additionally, holders of shares of our Class B common stock do not have preemptive, subscription, redemption or conversion rights. There are no redemption or sinking fund provisions applicable to the Class B common stock.

Class C Common Stock

The one share of our Class C common stock entitles its holder, ML RV Group, LLC, a Delaware limited liability company (“ML RV Group”), to the number of votes necessary such that the holder casts 5% of the total votes eligible to be cast by all of our stockholders on all matters presented to our stockholders generally for as long as there is no Class C Change of Control (as defined below). Upon a Class C Change of Control, our Class C common stock shall no longer have any voting rights, such share of our Class C common stock will be cancelled for no consideration and will be retired, and we will not reissue such share of Class C common stock.

For purposes of our Class C common stock, “Class C Change of Control” means the occurrence of any of the following events: (1) any “person” or “group” (within the meaning of Sections 13(d) and 14(d) of the Exchange Act (excluding the ML Related Parties and Crestview)) becomes the beneficial owner of securities of the Company representing more than fifty percent (50%) of the combined voting power of our then outstanding voting securities; (2) our stockholders approve a plan of complete liquidation or dissolution of the Company; (3) the merger or consolidation of the Company with any other person, other than a merger or consolidation which would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) more than fifty percent (50%) of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately after such merger or consolidation; (4) we cease to be the sole managing member of CWGS LLC; or (5) the ML Related Parties directly or indirectly, beneficially own in the aggregate, less than 27.5% of all of the outstanding common units of CWGS LLC. Notwithstanding the foregoing, a “Class C Change of Control” shall not be deemed to have occurred by virtue of the consummation of any transaction or series of integrated transactions immediately following which the record holders of the Class A common stock, Class B common stock and Class C common stock immediately prior to such transaction or series of transactions continue to have substantially the same proportionate ownership in and voting control over, and own substantially all of the shares of, an entity which owns all or substantially all of the assets of the Company immediately following such transaction or series of transactions.

The holder of the one share of our Class C common stock does not have cumulative voting rights in the election of directors. The one share of our Class C common stock is not transferable.

The holder of the one share of our Class C common stock does not have any right to receive dividends. Additionally, the holder of the one share of our Class C common stock does not have preemptive, subscription, redemption or conversion rights. There are not any redemption or sinking fund provisions applicable to the Class C common stock.

Preferred Stock

The total of our authorized shares of preferred stock is 20,000,000 shares. We have no shares of preferred stock outstanding.

Under the terms of our certificate, our board of directors is authorized to direct us to issue shares of preferred stock in one or more series without stockholder approval. Our board of directors has the discretion to determine the powers, designations, preferences and relative, participating, optional or other special rights, and qualifications, limitations or restrictions, of each series of preferred stock.

The purpose of authorizing our board of directors to issue preferred stock and determine its rights and preferences is to eliminate delays associated with a stockholder vote on specific issuances. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions, future financings and other corporate purposes, could have the effect of making it more difficult for a third-party to acquire, or could discourage a third-party from seeking to acquire, a majority of our outstanding voting stock. Additionally, the issuance of preferred stock may adversely affect the holders of our Class A common stock by restricting dividends on the Class A common stock, diluting the voting power of the Class A common stock or subordinating the liquidation rights of the Class A common stock. As a result of these or other factors, the issuance of preferred stock could have an adverse impact on the market price of our Class A common stock.

Forum Selection

Our certificate provides that unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware will, to the fullest extent permitted by applicable law, be the sole and exclusive forum for (i) any derivative action or proceeding brought on our behalf; (ii) any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders; (iii) any action asserting a claim arising pursuant to any provision of the Delaware General Corporation Law (“DGCL”), as to which the DGCL confers jurisdiction on the Court of Chancery; or (iv) any action asserting a claim against us, any director or our officers or employees that is governed by the internal affairs doctrine.

In addition, our bylaws provide that the federal district courts of the United States are the exclusive forum for any complaint raising a cause of action arising under the Securities Act.

Dividends

The DGCL permits a corporation to declare and pay dividends out of “surplus” or, if there is no “surplus”, out of its net profits for the fiscal year in which the dividend is declared and/or the preceding fiscal year. “Surplus” is defined as the excess of the net assets of the corporation over the amount determined to be the capital of the corporation by the board of directors. The capital of the corporation is typically calculated to be (and cannot be less than) the aggregate par value of all issued shares of capital stock. Net assets equals the fair value of the total assets minus total liabilities. The DGCL also provides that dividends may not be paid out of net profits if, after the payment of the dividend, capital is less than the capital represented by the outstanding stock of all classes having a preference upon the distribution of assets.

Declaration and payment of any dividend will be subject to the discretion of our board of directors. The time and amount of dividends will be dependent upon our financial condition, operations, cash requirements and availability, debt repayment obligations, capital expenditure needs and restrictions in our debt instruments, industry trends, the provisions of Delaware law affecting the payment of distributions to stockholders and any other factors our board of directors may consider relevant.

Anti-Takeover Provisions

Our certificate and bylaws contain provisions that may delay, defer or discourage another party from acquiring control of us. We expect that these provisions, which are summarized below, will discourage coercive takeover practices or inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors,

which we believe may result in an improvement of the terms of any such acquisition in favor of our stockholders. However, they also give our board of directors the power to discourage acquisitions that some stockholders may favor.

Authorized but unissued shares.

The authorized but unissued shares of our common stock and our preferred stock are available for future issuance without stockholder approval, subject to any limitations imposed by the listing standards of the NYSE. These additional shares may be used for a variety of corporate finance transactions, acquisitions, employee benefit plans and funding of redemptions of common units of CWGS LLC. The existence of authorized but unissued and unreserved common stock and preferred stock could make more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or otherwise.

Classified board of directors.

Our certificate provides that our board of directors is divided into three classes, with the classes as nearly equal in number as possible and each class serving three-year staggered terms. Directors may only be removed from our board of directors for cause by the affirmative vote of the holders of a majority of the voting power of all of the outstanding shares of stock of the Company which are present in person or by proxy and entitled to vote thereon, except as provided in Section 2(b) of the voting agreement we entered into with ML Acquisition, entities affiliated with Crestview, and ML RV Group (the “Voting Agreement”). These provisions may have the effect of deferring, delaying or discouraging hostile takeovers, or changes in control of us or our management.

Stockholder action by written consent.

Our certificate provides that any action required or permitted to be taken by our stockholders at an annual meeting or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote, if a written consent is signed by the holders of our outstanding shares of common stock representing not less than the minimum number of votes that would be necessary to authorize such action at a meeting at which all outstanding shares of common stock entitled to vote thereon. Subject to the rights of any series of Preferred Stock permitting the holders of such series of Preferred Stock to act by written consent, at such time as the ML Related Parties, directly or indirectly, beneficially own in the aggregate, less than 27.5% of all of the outstanding common units of CWGS LLC, our certificate and our bylaws provide that, any action required or permitted to be taken by our stockholders at an annual meeting or special meeting of stockholders may not be taken by written consent in lieu of a meeting.

Special meetings of stockholders.

Our bylaws provide that a majority of our stockholders or a majority of our board of directors may call special meetings of our stockholders, and at such time as the ML Related Parties, directly or indirectly, beneficially own in the aggregate, less than 27.5% of all of the outstanding common units of CWGS LLC, our bylaws provide that, except as otherwise required by law, only a majority of our board of directors may call special meetings of our stockholders.

Advance notice requirements for stockholder proposals and director nominations.

In addition, our bylaws provide for an advance notice procedure for stockholder proposals to be brought before an annual meeting of stockholders, including proposed nominations of candidates for election to our board of directors. In order for any matter to be “properly brought” before a meeting, a stockholder will have to comply with advance notice and duration of ownership requirements and provide us with certain information. Stockholders at an annual meeting may only consider proposals or nominations specified in the notice of meeting or brought before the meeting by or at the direction of our board of directors or by a qualified stockholder of record on the record date for the meeting, who is entitled to vote at the meeting and who has delivered timely written notice in proper form to our secretary of the stockholder’s intention to bring such business before the meeting. These provisions

could have the effect of delaying stockholder actions that are favored by the holders of a majority of our outstanding voting securities until the next stockholder meeting.

Amendment of certificate or bylaws.

The DGCL provides generally that the affirmative vote of a majority of the shares entitled to vote on any matter is required to amend a corporation’s certificate of incorporation or bylaws, unless a corporation’s certificate of incorporation or bylaws, as the case may be, requires a greater percentage. Subject to the provisions of the Voting Agreement, our bylaws may be amended or repealed by a majority vote of our board of directors or by the affirmative vote of a majority of the votes which all our stockholders would be eligible to cast in an election of directors. At such time as the ML Related Parties, directly or indirectly, beneficially own in the aggregate, less than 27.5% of all of the outstanding common units of CWGS LLC, our bylaws may be amended or repealed by a majority vote of our board of directors or by the affirmative vote of the holders of at least 662∕3% of the votes which all our stockholders would be eligible to cast in any annual election of directors. In addition, the affirmative vote of a majority of the votes which all our stockholders would be eligible to cast in an election of directors will be required to amend or repeal or to adopt any provisions inconsistent with any of the provisions of our certificate, and any amendment of our certificate that gives holders of our Class B common stock or the holder of our Class C common stock (i) any rights to receive dividends or any other kind of distribution, (ii) any right to convert into or be exchanged for Class A common stock or (iii) any other economic rights will require, in addition to stockholder approval, the affirmative vote of the holders of a majority of shares of our Class A common stock voting separately as a class. At such time as the ML Related Parties, directly or indirectly, own in the aggregate, less than 27.5% of all of the outstanding common units of CWGS LLC, the affirmative vote of the holders of at least 662∕3% of the votes which all our stockholders would be entitled to cast in any election of directors will be required to amend or repeal or to adopt any provisions contained in our certificate described above.

Section 203 of the DGCL.

We have opted out of Section 203 of the DGCL. However, our certificate contains provisions that are similar to Section 203. Specifically, our certificate provides that, subject to certain exceptions, we will not be able to engage in a “business combination” with any “interested stockholder” for three years following the date that the person became an interested stockholder, unless the interested stockholder attained such status with the approval of our board of directors or unless the business combination is approved by the board of directors and authorized at an annual or special meeting of stockholders by the affirmative vote of at least 662∕3% of the outstanding shares of capital stock of the Company that is not owned by such interested stockholder. A “business combination” includes, among other things, a merger or consolidation involving us and the “interested stockholder” and the sale of more than 10% of our assets. In general, an “interested stockholder” is any entity or person beneficially owning 15% or more of our outstanding voting stock and any entity or person affiliated with or controlling or controlled by such entity or person. However, in our case, ML Acquisition and Crestview and any of their respective affiliates and any of their respective direct or indirect transferees receiving 15% or more of our outstanding voting stock will not be deemed to be interested stockholders regardless of the percentage of our outstanding voting stock owned by them, and accordingly will not be subject to such restrictions.

Limitations on Liability and Indemnification of Officers and Directors

Our certificate and bylaws provide indemnification for our directors and officers to the fullest extent permitted by the DGCL. We have entered into indemnification agreements with each of our directors and certain of our officers that may, in some cases, be broader than the specific indemnification provisions contained under Delaware law. In addition, as permitted by Delaware law, our certificate includes provisions that eliminate the personal liability of our directors for monetary damages resulting from breaches of certain fiduciary duties as a director. The effect of this provision is to restrict our rights and the rights of our stockholders in derivative suits to recover monetary damages against a director for breach of fiduciary duties as a director.

These provisions may be held not to be enforceable for violations of the federal securities laws of the United States.

Corporate Opportunity Doctrine

Delaware law permits corporations to adopt provisions renouncing any interest or expectancy in certain opportunities that are presented to the corporation or its officers, directors or stockholders. Our certificate, to the maximum extent permitted from time to time by Delaware law, renounces any interest or expectancy that we have in, or right to be offered an opportunity to participate in, specified business opportunities that are from time to time presented to certain of our officers, directors or stockholders or their respective affiliates, other than those officers, directors, stockholders or affiliates acting in their capacity as our employee or director. Our certificate provides that, to the fullest extent permitted by law, any director or stockholder who is not employed by us or our affiliates will not have any duty to refrain from (1) engaging in a corporate opportunity in the same or similar lines of business in which we or our affiliates now engage or propose to engage or (2) otherwise competing with us or our affiliates. In addition, to the fullest extent permitted by law, in the event that any director or stockholder, other than director or stockholder who is not employed by us or our affiliates acting in their capacity as our director or stockholder who is not employed by us or our affiliates, acquires knowledge of a potential transaction or other business opportunity which may be a corporate opportunity for itself or himself or its or his affiliates or for us or our affiliates, such person will have no duty to communicate or offer such transaction or business opportunity to us or any of our affiliates and they may take any such opportunity for themselves or offer it to another person or entity. To the fullest extent permitted by Delaware law, no potential transaction or business opportunity may be deemed to be a corporate opportunity of the corporation or its subsidiaries unless (a) we or our subsidiaries would be permitted to undertake such transaction or opportunity in accordance with our certificate, (b) we or our subsidiaries, at such time have sufficient financial resources to undertake such transaction or opportunity, (c) we have an interest or expectancy in such transaction or opportunity and (d) such transaction or opportunity would be in the same or similar line of our or our subsidiaries’ business in which we or our subsidiaries are engaged or a line of business that is reasonably related to, or a reasonable extension of, such line of business. Our certificate does not renounce our interest in any business opportunity that is expressly offered to an employee director or employee in his or her capacity as a director or employee of the Company. To the fullest extent permitted by law, no business opportunity will be deemed to be a potential corporate opportunity for us unless we would be permitted to undertake the opportunity under our certificate, we have sufficient financial resources to undertake the opportunity and the opportunity would be in line with our business.

Dissenters’ Rights of Appraisal and Payment

Under the DGCL, with certain exceptions, our stockholders have appraisal rights in connection with a merger or consolidation of the Company. Pursuant to the DGCL, stockholders who properly request and perfect appraisal rights in connection with such merger or consolidation will have the right to receive payment of the fair value of their shares as determined by the Delaware Court of Chancery.

Stockholders’ Derivative Actions

Under the DGCL, any of our stockholders may bring an action in our name to procure a judgment in our favor, also known as a derivative action, provided that the stockholder bringing the action is a holder of our shares at the time of the transaction to which the action relates or such stockholder’s stock thereafter devolved by operation of law.

Transfer Agent and Registrar

The transfer agent and registrar for our Class A common stock is Equiniti Trust Company, LLC.

Trading Symbol and Market

Our Class A common stock is listed on the NYSE under the symbol “CWH”.

PLAN OF DISTRIBUTION

We may sell the offered securities from time to time:

•

through underwriters or dealers;

•

through agents;

•

directly to one or more purchasers; or

•

through a combination of any of these methods of sale.

We will identify the specific plan of distribution, including any underwriters, dealers, agents or direct purchasers and their compensation in the applicable prospectus supplement.

LEGAL MATTERS

Latham & Watkins LLP will pass upon certain legal matters relating to the issuance and sale of the securities offered hereby on behalf of Camping World Holdings, Inc. Additional legal matters may be passed upon for us or any underwriters, dealers or agents, by counsel that we will name in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of Camping World Holdings, Inc. incorporated by reference in this prospectus, and the effectiveness of Camping World Holdings, Inc.’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm, given their authority as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following is an estimate of the expenses (all of which are to be paid by the registrant) that we may incur in connection with the securities being registered hereby.

| |

SEC registration fee

|

|

|

$(1)

|

|

| |

The New York Stock Exchange supplemental listing fee

|

|

|

$(2)

|

|

| |

Printing expenses

|

|

|

$(2)

|

|

| |

Legal fees and expenses

|

|

|

$(2)

|

|

| |

Accounting fees and expenses

|

|

|

$(2)

|

|

| |

Blue Sky, qualification fees and expenses

|

|

|

$(2)

|

|

| |

Transfer agent fees and expenses

|

|

|

$(2)

|

|

| |

Miscellaneous

|

|

|

$(2)

|

|

| |

Total

|

|

|

$(2)

|

|

(1)

Pursuant to Rules 456(b) and 457(r) under the Securities Act of 1933, as amended, the SEC registration fee will be paid at the time of any particular offering of securities under the registration statement, and is therefore not currently determinable.

(2)

These fees are calculated based on the securities offered and the number of issuances and accordingly cannot be estimated at this time.

Item 15. Indemnification of Directors and Officers

Section 102 of the General Corporation Law of the State of Delaware permits a corporation to eliminate the personal liability of directors and officers of a corporation to the corporation or its stockholders for monetary damages for a breach of fiduciary duty as a director or officer, except (i) where the director or officer breached his duty of loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, or obtained an improper personal benefit, (ii) where the director authorized the payment of a dividend or approved a stock repurchase in violation of Delaware corporate law or (iii) any officer in any action by or in the right of the corporation. Our amended and restated certificate of incorporation provides that no director of Camping World Holdings, Inc. shall be personally liable to it or its stockholders for monetary damages for any breach of fiduciary duty as a director, notwithstanding any provision of law imposing such liability, except to the extent that the General Corporation Law of the State of Delaware prohibits the elimination or limitation of liability of directors for breaches of fiduciary duty.

Section 145 of the General Corporation Law of the State of Delaware provides that a corporation has the power to indemnify a director, officer, employee, or agent of the corporation, or a person serving at the request of the corporation for another corporation, partnership, joint venture, trust or other enterprise in related capacities against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with an action, suit or proceeding to which he was or is a party or is threatened to be made a party to any threatened, ending or completed action, suit or proceeding by reason of such position, if such person acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful, except that, in the case of actions brought by or in the right of the corporation, no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or other adjudicating court determines that, despite the adjudication of liability but in view of all of the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Our amended and restated certificate of incorporation and bylaws provide indemnification for our directors and officers to the fullest extent permitted by the General Corporation Law of the State of

Delaware. We will indemnify each person who was or is a party or threatened to be made a party to any threatened, pending or completed action, suit or proceeding (other than an action by or in the right of us) by reason of the fact that he or she is or was, or has agreed to become, a director or officer, or is or was serving, or has agreed to serve, at our request as a director, officer, partner, employee or trustee of, or in a similar capacity with, another corporation, partnership, joint venture, trust or other enterprise (all such persons being referred to as an “Indemnitee”), or by reason of any action alleged to have been taken or omitted in such capacity, against all expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding and any appeal therefrom, if such Indemnitee acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, our best interests, and, with respect to any criminal action or proceeding, he or she had no reasonable cause to believe his or her conduct was unlawful. Our amended and restated certificate of incorporation and bylaws provide that we will indemnify any Indemnitee who was or is a party to an action or suit by or in the right of us to procure a judgment in our favor by reason of the fact that the Indemnitee is or was, or has agreed to become, a director or officer, or is or was serving, or has agreed to serve, at our request as a director, officer, partner, employee or trustee of, or in a similar capacity with, another corporation, partnership, joint venture, trust or other enterprise, or by reason of any action alleged to have been taken or omitted in such capacity, against all expenses (including attorneys’ fees) and, to the extent permitted by law, amounts paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding, and any appeal therefrom, if the Indemnitee acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, our best interests, except that no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable to us, unless a court determines that, despite such adjudication but in view of all of the circumstances, he or she is entitled to indemnification of such expenses. Notwithstanding the foregoing, to the extent that any Indemnitee has been successful, on the merits or otherwise, he or she will be indemnified by us against all expenses (including attorneys’ fees) actually and reasonably incurred in connection therewith. Expenses must be advanced to an Indemnitee under certain circumstances.

We have entered into separate indemnification agreements with each of our directors and certain officers. Each indemnification agreement provides, among other things, for indemnification to the fullest extent permitted by law and our amended and restated certificate of incorporation and bylaws against any and all expenses, judgments, fines, penalties and amounts paid in settlement of any claim. The indemnification agreements provide for the advancement or payment of all expenses to the indemnitee and for the reimbursement to us if it is found that such indemnitee is not entitled to such indemnification under applicable law and our amended and restated certificate of incorporation and bylaws.

We maintain a general liability insurance policy that covers certain liabilities of directors and officers of our corporation arising out of claims based on acts or omissions in their capacities as directors or officers.

Any underwriting agreement or distribution agreement that we enter into with any underwriters or agents involved in the offering or sale of any securities registered hereby may require such underwriters or dealers to indemnify the registrant, some or all of its directors and officers and its controlling persons, if any, for specified liabilities, which may include liabilities under the Securities Act of 1933, as amended.

Item 16. Exhibits

*

To be filed by amendment or incorporated by reference in connection with the offering of the securities.

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (a)(1)(i), (a)(1)(ii), and (a)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(5) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(A) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(6) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv) Any other communications that is an offer in the offering made by the undersigned registrant to the purchaser.

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and

Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Lincolnshire, IL, on October 30, 2024.

Camping World Holdings, Inc.

| |

|

|

|

By:

|

|

|

/s/ Marcus A. Lemonis

Marcus A. Lemonis

Chairman and Chief Executive Officer

|

|

POWER OF ATTORNEY

Each of the undersigned officers and directors of the registrant hereby severally constitutes and appoints Marcus A. Lemonis and Thomas E. Kirn , and each of them singly (with full power to each of them to act alone), as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution in each of them, for him or her and in his or her name, place and stead, and in any and all capacities, to file and sign any and all amendments, including post-effective amendments, to this registration statement and any other registration statement for the same offering that is to be effective under Rule 462(b) of the Securities Act of 1933, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith and about the premises as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof. This power of attorney shall be governed by and construed with the laws of the State of Delaware and applicable federal securities laws.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed below by the following persons on behalf of the registrant in the capacities and on the dates indicated.

| |

SIGNATURE

|

|

|

TITLE

|

|

|

DATE

|

|

| |

/s/ Marcus A. Lemonis

Marcus A. Lemonis

|

|

|

Chairman, Chief Executive Officer and Director

(Principal Executive Officer)

|

|

|

October 30, 2024

|

|

| |

/s/ Thomas E. Kirn

Thomas E. Kirn

|

|

|

Chief Financial Officer (Principal Financial

Officer and Principal Accounting Officer)

|

|

|

October 30, 2024

|

|

| |

/s/ Andris A. Baltins

Andris A. Baltins

|

|

|

Director

|

|

|

October 30, 2024

|

|

| |

/s/ Brian P. Cassidy

Brian P. Cassidy

|

|

|

Director

|

|

|

October 30, 2024

|

|

| |

/s/ Mary J. George

Mary J. George

|

|

|

Director

|

|

|

October 30, 2024

|

|

| |

/s/ Kathleen S. Lane

Kathleen S. Lane

|

|

|

Director

|

|

|

October 30, 2024

|

|

| |

SIGNATURE

|

|

|

TITLE

|

|

|

DATE

|

|

| |

/s/ Michael W. Malone

Michael W. Malone

|

|

|

Director

|

|

|

October 30, 2024

|

|

| |

/s/ Brent L. Moody

Brent L. Moody

|

|

|

Director

|

|

|

October 30, 2024

|

|

| |

/s/ K. Dillon Schickli

K. Dillon Schickli

|

|

|

Director

|

|

|

October 30, 2024

|

|

Exhibit 5.1

| |

1271 Avenue of the Americas |

| |

New York, New York 10020-1401 |

| |

Tel: +1.212.906.1200 Fax: +1.212.751.4864 |

| |

www.lw.com |

| |

|

|

FIRM / AFFILIATE OFFICES |

| |

Austin |

Milan |

| |

Beijing |

Munich |

| |

Boston |

New York |

| |

Brussels |

Orange County |

| |

Century City |

Paris |

| |

Chicago |

Riyadh |

| October 30, 2024 |

Dubai |

San Diego |

| |

Düsseldorf |

San Francisco |

| |

Frankfurt |

Seoul |

| Camping World Holdings, Inc. |

Hamburg |

Silicon Valley |

| 2 Marriott Drive |

Hong Kong |

Singapore |

| Lincolnshire, IL 60069 |

Houston |

Tel Aviv |

| |

London |

Tokyo |

| |

Los Angeles |

Washington, D.C. |

| |

Madrid |

|

Re: Registration Statement on Form S-3

To the addressee set forth above:

We have acted as special counsel to Camping World

Holdings, Inc., a Delaware corporation (the “Company”), in connection with its filing on the date hereof

with the Securities and Exchange Commission (the “Commission”) of a registration statement on Form S-3

(as amended, the “Registration Statement”), including a base prospectus (the “Base Prospectus”),

which provides that it will be supplemented by one or more prospectus supplements (each such prospectus supplement, together with the

Base Prospectus, a “Prospectus”), under the Securities Act of 1933, as amended (the “Act”),

relating to the registration for issue and sale by the Company of shares of the Company’s Class A common stock, $0.01 par value

per share (“Class A Common Stock”).

This opinion is being furnished in connection with

the requirements of Item 601(b)(5) of Regulation S-K under the Act, and no opinion is expressed herein as to any matter pertaining

to the contents of the Registration Statement or related applicable Prospectus, other than as expressly stated herein with respect to

the issue of the Class A Common Stock.

As such counsel, we have examined such matters

of fact and questions of law as we have considered appropriate for purposes of this letter. With your consent, we have relied upon certificates

and other assurances of officers of the Company and others as to factual matters without having independently verified such factual matters.

We are opining herein as to the General Corporation Law of the State of Delaware, and we express no opinion with respect to the applicability

thereto, or the effect thereon, of the laws of any other jurisdiction or, in the case of Delaware, any other laws, or as to any matters

of municipal law or the laws of any local agencies within any state.

Subject to the foregoing and the other matters

set forth herein, it is our opinion that, as of the date hereof, when an issuance of Class A

Common Stock has been duly authorized by all necessary corporate action of the Company, upon issuance, delivery and payment therefor in

an amount not less than the par value thereof in the manner contemplated by the applicable Prospectus and by such corporate action, and

in total amounts and numbers of shares that do not exceed the respective total amounts and numbers of shares (a) available under

the certificate of incorporation, and (b) authorized by the board of directors in connection with the offering contemplated by the

applicable Prospectus, such shares of Class A Common Stock will be validly issued, fully paid and nonassessable. In rendering the

foregoing opinion, we have assumed that the Company will comply with all applicable notice requirements regarding uncertificated shares

provided in the General Corporation Law of the State of Delaware.

This opinion is for your benefit in connection with the Registration

Statement and may be relied upon by you and by persons entitled to rely upon it pursuant to the applicable provisions of the Act. We

consent to your filing this opinion as an exhibit to the Registration Statement and to the reference to our firm contained in the Prospectus

under the heading “Legal Matters.” In giving such consent, we do not thereby admit that we are in the category of persons

whose consent is required under Section 7 of the Act or the rules and regulations of the Commission thereunder.

| |

Sincerely, |

| |

|

| |

/s/ Latham & Watkins LLP |

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement

on Form S-3 of our reports dated February 26, 2024 relating to the consolidated financial statements of Camping World Holdings, Inc.

and the effectiveness of Camping World Holdings, Inc.'s internal control over financial reporting, appearing in the Annual Report

on Form 10-K of Camping World Holdings, Inc. for the year ended December 31, 2023. We also consent to the reference to

us under the heading "Experts" in such Registration Statement.

| /s/ Deloitte & Touche LLP |

|

Chicago, Illinois

October 30, 2024

S-3

S-3ASR

EX-FILING FEES

0001669779

Camping World Holdings, Inc.

0001669779

2024-10-23

2024-10-23

0001669779

1

2024-10-23

2024-10-23

iso4217:USD

xbrli:pure

xbrli:shares

|

Calculation of Filing Fee Tables

|

|

S-3

|

|

Camping World Holdings, Inc.

|

|

Table 1: Newly Registered and Carry Forward Securities

|

|

|

|

Security Type

|

Security Class Title

|

Fee Calculation or Carry Forward Rule

|

Amount Registered

|

Proposed Maximum Offering Price Per Unit

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

Carry Forward Form Type

|

Carry Forward File Number

|

Carry Forward Initial Effective Date

|

Filing Fee Previously Paid in Connection with Unsold Securities to be Carried Forward

|

|

Newly Registered Securities

|

|

Fees to be Paid

|

1

|

Equity

|

Class A common stock, $0.01 par value per share

|

457(r)

|

|

|

|

0.0001531

|

|

|

|

|

|

|

Fees Previously Paid

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carry Forward Securities

|

|

Carry Forward Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Offering Amounts:

|

|

$

0.00

|

|

$

0.00

|

|

|

|

|

|

|

|

|

Total Fees Previously Paid:

|

|

|

|

$

0.00

|

|

|

|

|

|

|

|

|

Total Fee Offsets:

|

|

|

|

$

0.00

|

|

|

|

|

|

|

|

|

Net Fee Due:

|

|

|

|

$

0.00

|

|

|

|

|

|

1

|

An unspecified number of shares of Class A common stock is being registered as may from time to time be offered at unspecified prices. Includes rights to acquire shares of Class A common stock under any shareholder rights plan then in effect, if applicable under the terms of such plan. Separate consideration may or may not be received for shares of Class A common stock that are issued on exercise, conversion or exchange of other securities. In accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended, the registrant is deferring payment of all registration fees and will pay the registration fees subsequently in advance or on a "pay-as-you-go" basis.

|

|

|

v3.24.3

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |