Form 8-K - Current report

23 December 2024 - 11:28PM

Edgar (US Regulatory)

0001393612FALSE00013936122024-12-232024-12-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 23, 2024

DISCOVER FINANCIAL SERVICES

(Exact name of registrant as specified in its charter)

Commission File Number: 001-33378

| | | | | | | | |

| Delaware | | 36-2517428 |

(State or other jurisdiction

of incorporation) | | (IRS Employer

Identification No.) |

2500 Lake Cook Road, Riverwoods, Illinois 60015

(Address of principal executive offices, including zip code)

(224) 405-0900

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | DFS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On December 23, 2024, Discover Financial Services (the “Company”) filed an amended annual report on Form 10-K/A for the year ended December 31, 2023, which included restated audited financial statements as of December 31, 2023 and 2022, and for each of the three years in the period ended December 31, 2023 that were previously included in the Company’s annual report on Form 10-K for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission (the "SEC") on February 23, 2024. The Company also filed amended quarterly reports on Form 10-Q/A to restate its unaudited condensed consolidated financial statements previously included in its quarterly reports on Form 10-Q for the quarterly periods ended March 31, 2024 and June 30, 2024 previously filed with the SEC on May 1, 2024 and July 31, 2024, respectively (collectively, with the Form 10-K/A, the "Amended Reports"), and its quarterly report on Form 10-Q for the quarterly period ended September 30, 2024. Attached as Exhibit 99.1 to this Current Report on Form 8-K is an updated financial data supplement presenting certain financial data and periods in order to reflect the restatements to the financial statements included in the Amended Reports along with the related restatement impacts. The adjusted results for the quarter ended and nine months ended September 30, 2024 reflect amendments arising after the earnings release on October 16, 2024, but prior to the filing of the Company's quarterly report on Form 10-Q for the quarterly period ended September 30, 2024.

The information contained in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly stated by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| | Updated Financial Data Supplement of the Company |

| 104 | | Cover Page Interactive Data File — the cover page from this Current Report on Form 8-K, formatted as Inline XBRL (included as Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | DISCOVER FINANCIAL SERVICES |

| | |

Dated: December 23, 2024 | | By: | | /s/ Efie Vainikos |

| | | | Name: Efie Vainikos |

| | | | Title: Assistant Secretary |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | | | | | | | | | | | | | | | | Exhibit 99.1 |

| RECONCILIATION OF PRIOR PERIOD RESTATED FINANCIAL RESULTS | | | | | | | | | | | | | | |

| (unaudited, in millions, except per share statistics) | | | | | | | | | | | | | | |

| As Restated | As Adjusted 1 |

| Quarter Ended | | Twelve Months

Ended | | Quarter Ended | | Nine Months

Ended |

| Mar 31,

2023 | | Jun 30,

2023 | | Sep 30,

2023 | | Dec 31,

2023 | | Dec 31,

2023 | | Mar 31,

2024 | | Jun 30,

2024 | | Sep 30,

2024 | | Sep 30,

2024 |

| EARNINGS SUMMARY | | | | | | | | | | | | | | | | |

| Discount/Interchange Revenue | $1,030 | | $1,141 | | $1,147 | | $1,142 | | $4,460 | | $1,024 | | $1,153 | | $1,142 | | $3,319 |

| Discount and Interchange Revenue, net | 314 | | 353 | | 360 | | 354 | | 1,381 | | 321 | | 437 | | 363 | | 1,121 |

| Total Non-Interest Income | 594 | | 684 | | 705 | | 712 | | 2,695 | | 673 | | 1,014 | | 798 | | 2,485 |

| Revenue Net of Interest Expense | $3,726 | | $3,861 | | $4,027 | | $4,180 | | $15,794 | | $4,160 | | $4,538 | | $4,453 | | $13,151 |

| | | | | | | | | | | | | | | | | |

| Other Expense | $124 | | $162 | | $254 | | $263 | | $803 | | $148 | | $336 | | $277 | | $761 |

| Total Operating Expense | $1,383 | | $1,404 | | $1,564 | | $1,788 | | $6,139 | | $1,544 | | $1,738 | | $1,788 | | $5,070 |

| | | | | | | | | | | | | | | | | |

| Income/ (Loss) Before Income Taxes | $1,241 | | $1,152 | | $761 | | $483 | | $3,637 | | $1,119 | | $2,061 | | $1,192 | | $4,372 |

| Tax Expense | 286 | | 263 | | 175 | | 117 | | 841 | | 268 | | 538 | | 322 | | 1,128 |

| Net Income/ (Loss) | $955 | | $889 | | $586 | | $366 | | $2,796 | | $851 | | $1,523 | | $870 | | $3,244 |

| | | | | | | | | | | | | | | | | |

| Net Income/ (Loss) Allocated to Common Stockholders | $918 | | $883 | | $550 | | $364 | | $2,715 | | $813 | | $1,515 | | $834 | | $3,162 |

| | | | | | | | | | | | | | | | | |

| Operating Efficiency | 37.1 | % | | 36.4% | | 38.9 | % | | 42.8% | | 38.9% | | 37.1 | % | | 38.3% | | 40.1 | % | | 38.6% |

| ROE | 28 | % | | 26% | | 17 | % | | 10% | | 20% | | 24 | % | | 40% | | 21 | % | | 28% |

| Payout Ratio | 149 | % | | 98% | | 31 | % | | 40% | | 94% | | 22 | % | | 12% | | 19 | % | | 16% |

| | | | | | | | | | | | | | | | | |

| PER SHARE STATISTICS | | | | | | | | | | | | | | | | |

| Basic EPS | $3.50 | | | $3.49 | | | $2.21 | | | $1.45 | | | $10.71 | | | $3.25 | | | $6.04 | | | $3.32 | | | $12.61 | |

| Diluted EPS | $3.50 | | | $3.49 | | | $2.21 | | | $1.45 | | | $10.70 | | | $3.25 | | | $6.03 | | | $3.32 | | | $12.61 | |

| Book Value per share | $53.00 | | | $53.54 | | | $54.65 | | | $56.92 | | | $56.92 | | | $58.54 | | | $63.76 | | | $68.11 | | | $68.11 | |

| | | | | | | | | | | | | | | | | |

| SEGMENT RESULTS | | | | | | | | | | | | | | | | |

| Digital Banking | | | | | | | | | | | | | | | | |

| Non-Interest Income | $506 | | | $569 | | | $575 | | | $595 | | | $2,245 | | | $541 | | | $691 | | | $669 | | | $1,901 | |

| Revenue Net of Interest Expense | 3,638 | | | 3,746 | | | 3,897 | | | 4,063 | | | 15,344 | | | 4,028 | | | 4,215 | | | 4,324 | | | 12,567 | |

| | | | | | | | | | | | | | | | | |

| Total Operating Expense | 1,342 | | | 1,359 | | | 1,519 | | | 1,725 | | | 5,945 | | | 1,494 | | | 1,692 | | | 1,743 | | | 4,929 | |

| Income/ (Loss) Before Income Taxes | $1,194 | | | $1,082 | | | $676 | | | $429 | | | $3,381 | | | $1,037 | | | $1,784 | | | $1,108 | | | $3,929 | |

| | | | | | | | | | | | | | | | | |

| Pretax Return on Loan Receivables | 4.32 | % | | 3.77 | % | | 2.23 | % | | 1.35 | % | | 2.86 | % | | 3.28 | % | | 5.65 | % | | 3.45 | % | | 4.12 | % |

| | | | | | | | | | | | | | | | | |

1 Incremental information arising after the earnings release on October 16, 2024 for the period ended September 30, 2024, but prior to the filing of the Company's quarterly report on Form 10-Q for the quarter ended September 30, 2024, has increased the estimate for probable penalties related to the card product misclassification by $90 million. This charge is included in the results for the quarter ended September 30, 2024, as well as the nine month period ended on the same date. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF PRIOR PERIOD RESTATED FINANCIAL RESULTS | | | | | | | | | | | | | |

| (unaudited, in millions, except per share statistics) | | | | | | | | | | | | | | | |

| As Restated | As Adjusted 1 | | | | |

| Quarter Ended | | | | |

| Mar 31,

2023 | | Jun 30,

2023 | | Sep 30,

2023 | | Dec 31,

2023 | | Mar 31,

2024 | | Jun 30,

2024 | | Sep 30,

2024 | | | | |

| BALANCE SHEET SUMMARY | | | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | | |

| Other Assets | $4,610 | | | $4,975 | | | $5,696 | | | $5,858 | | | $6,083 | | | $5,973 | | | $5,371 | | | | | |

| Total Assets | $133,290 | | | $138,235 | | | $143,615 | | | $151,713 | | | $152,707 | | | $150,888 | | | $151,615 | | | | | |

| | | | | | | | | | | | | | | | | |

| Liabilities & Stockholders' Equity | | | | | | | | | | | | | | | | | |

| Accrued Expenses and Other Liabilities | $5,789 | | | $5,590 | | | $6,464 | | | $7,216 | | | $7,132 | | | $7,387 | | | $6,477 | | | | | |

| Total Liabilities | 119,692 | | | 124,853 | | | 129,950 | | | 137,478 | | | 138,037 | | | 134,878 | | | 134,506 | | | | | |

| Total Equity | 13,598 | | | 13,382 | | | 13,665 | | | 14,235 | | | 14,670 | | | 16,010 | | | 17,109 | | | | | |

| Total Liabilities and Stockholders' Equity | $133,290 | | | $138,235 | | | $143,615 | | | $151,713 | | | $152,707 | | | $150,888 | | | $151,615 | | | | | |

| | | | | | | | | | | | | | | | | |

| BALANCE SHEET STATISTICS | | | | | | | | | | | | | | | | | |

| Total Common Equity | $12,542 | | | $12,326 | | | $12,609 | | | $13,179 | | | $13,614 | | | $14,954 | | | $16,053 | | | | | |

| Total Common Equity/Total Assets | 9.4 | % | | 8.9 | % | | 8.8 | % | | 8.7 | % | | 8.9 | % | | 9.9 | % | | 10.6 | % | | | | |

| Total Common Equity/Net Loans | 11.9 | % | | 11.2 | % | | 11.1 | % | | 11.1 | % | | 11.6 | % | | 12.5 | % | | 13.5 | % | | | | |

| | | | | | | | | | | | | | | | | |

| Tangible Assets | $133,035 | | | $137,980 | | | $143,360 | | | $151,458 | | | $152,452 | | | $150,633 | | | $151,360 | | | | | |

| Tangible Common Equity | $12,287 | | | $12,071 | | | $12,354 | | | $12,924 | | | $13,359 | | | $14,699 | | | $15,798 | | | | | |

| Tangible Common Equity/Tangible Assets | 9.2 | % | | 8.7 | % | | 8.6 | % | | 8.5 | % | | 8.8 | % | | 9.8 | % | | 10.4 | % | | | | |

| Tangible Common Equity/Net Loans | 11.7 | % | | 11.0 | % | | 10.8 | % | | 10.8 | % | | 11.4 | % | | 12.3 | % | | 13.3 | % | | | | |

| Tangible Common Equity per share | $47.89 | | | $48.29 | | | $49.41 | | | $51.67 | | | $53.31 | | | $58.53 | | | $62.89 | | | | | |

| | | | | | | | | | | | | | | | | |

| REGULATORY CAPITAL RATIOS | | | | | | | | | | | | | | | | | |

| Total Risk Based Capital Ratio | 14.3 | % | | 13.8 | % | | 13.6 | % | | 13.2 | % | | 13.3 | % | | 14.2 | % | | 14.9 | % | | | | |

| Tier 1 Risk Based Capital Ratio | 12.5 | % | | 12.1 | % | | 12.0 | % | | 11.6 | % | | 11.7 | % | | 12.6 | % | | 13.4 | % | | | | |

| Tier 1 Leverage Ratio | 11.1 | % | | 10.8 | % | | 10.6 | % | | 10.3 | % | | 10.1 | % | | 11.1 | % | | 11.4 | % | | | | |

| Common Equity Tier 1 Capital Ratio | 11.6 | % | | 11.2 | % | | 11.1 | % | | 10.8 | % | | 10.9 | % | | 11.8 | % | | 12.5 | % | | | | |

| | | | | | | | | | | | | | | | | |

1 Incremental information arising after the earnings release on October 16, 2024 for the period ended September 30, 2024, but prior to the filing of the Company's quarterly report on Form 10-Q for the quarter ended September 30, 2024, has increased the estimate for probable penalties related to the card product misclassification by $90 million. This charge is included in the results for the quarter ended September 30, 2024. | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF PRIOR PERIOD RESTATED FINANCIAL RESULTS | | | | | | | | | | | | | | | |

| (unaudited, in millions, except per share statistics) | | | | | | | | | | | | | | | |

| Restatement Impacts | Adjustments 1 | |

| Quarter Ended | | Twelve Months

Ended | | Quarter Ended | | Nine Months

Ended | |

| Mar 31,

2023 | | Jun 30,

2023 | | Sep 30,

2023 | | Dec 31,

2023 | | Dec 31,

2023 | | Mar 31,

2024 | | Jun 30,

2024 | | Sep 30,

2024 | | Sep 30,

2024 | |

| EARNINGS SUMMARY | | | | | | | | | | | | | | | | | |

| Discount/Interchange Revenue | ($16) | | ($17) | | ($17) | | ($16) | | ($66) | | ($50) | | $— | | $— | | ($50) | |

| Discount and Interchange Revenue, net | (16) | | (17) | | (17) | | (16) | | (66) | | (50) | | — | | — | | (50) | |

| Total Non-Interest Income | (16) | | (17) | | (17) | | (16) | | (66) | | (50) | | — | | — | | (50) | |

| Revenue Net of Interest Expense | ($16) | | ($17) | | ($17) | | ($16) | | ($66) | | ($50) | | $— | | $— | | ($50) | |

| | | | | | | | | | | | | | | | | | |

| Other Expense | $— | | $— | | $110 | | $13 | | $123 | | ($765) | | $9 | | $96 | | ($660) | |

| Total Operating Expense | $— | | $— | | $110 | | $13 | | $123 | | ($765) | | $9 | | $96 | | ($660) | |

| | | | | | | | | | | | | | | | | | |

| Income/ (Loss) Before Income Taxes | ($16) | | ($17) | | ($127) | | ($29) | | ($189) | | $715 | | ($9) | | ($96) | | $610 | |

| Tax Expense | (3) | | (5) | | (30) | | (7) | | (45) | | 172 | | (2) | | (1) | | 169 | |

| Net Income/ (Loss) | ($13) | | ($12) | | ($97) | | ($22) | | ($144) | | $543 | | ($7) | | ($95) | | $441 | |

| | | | | | | | | | | | | | | | | | |

| Net Income/ (Loss) Allocated to Common Stockholders | ($13) | | ($12) | | ($97) | | ($22) | | ($144) | | $539 | | ($6) | | ($94) | | $439 | |

| | | | | | | | | | | | | | | | | | |

| Operating Efficiency | 20 | | bps | 20 | bps | 290 | | bps | 50 | bps | 100 | | bps | (1,780) | bps | 20 | | bps | 210 | | bps | (480) | | bps |

| ROE | 100 | | bps | — | bps | (200) | | bps | (100) | bps | (100) | | bps | 1,600 | bps | — | | bps | (200) | | bps | 400 | | bps |

| Payout Ratio | 200 | | bps | 100 | bps | 500 | | bps | 300 | bps | 500 | | bps | (4,400) | bps | — | | bps | 200 | | bps | (300) | | bps |

| | | | | | | | | | | | | | | | | | |

| PER SHARE STATISTICS | | | | | | | | | | | | | | | | | |

| Basic EPS | ($0.05) | | | ($0.05) | | | ($0.38) | | | ($0.09) | | | ($0.56) | | | $2.15 | | | ($0.02) | | | ($0.37) | | | $1.75 | | |

| Diluted EPS | ($0.05) | | | ($0.05) | | | ($0.38) | | | ($0.09) | | | ($0.56) | | | $2.15 | | | ($0.03) | | | ($0.37) | | | $1.76 | | |

| Book Value per share | ($1.79) | | | ($1.90) | | | ($2.28) | | | ($2.37) | | | ($2.37) | | | ($0.20) | | | ($0.23) | | | ($0.60) | | | ($0.60) | | |

| | | | | | | | | | | | | | | | | | |

| SEGMENT RESULTS | | | | | | | | | | | | | | | | | |

| Digital Banking | | | | | | | | | | | | | | | | | |

| Non-Interest Income | ($16) | | | ($17) | | | ($17) | | | ($16) | | | ($66) | | | ($50) | | | $— | | | $— | | | ($50) | | |

| Revenue Net of Interest Expense | (16) | | | (17) | | | (17) | | | (16) | | | (66) | | | (50) | | | — | | | — | | | (50) | | |

| | | | | | | | | | | | | | | | | | |

| Total Operating Expense | — | | | — | | | 110 | | | 13 | | | 123 | | | (765) | | | 9 | | | 96 | | | (660) | | |

| Income/ (Loss) Before Income Taxes | ($16) | | | ($17) | | | ($127) | | | ($29) | | | ($189) | | | $715 | | | ($9) | | | ($96) | | | $610 | | |

| | | | | | | | | | | | | | | | | | |

| Pretax Return on Loan Receivables | (6) | | bps | (5) | | bps | (42) | | bps | (10) | | bps | (16) | | bps | 226 | | bps | (3) | | bps | (30) | | bps | 64 | | bps |

| | | | | | | | | | | | | | | | | | |

1 Incremental information arising after the earnings release on October 16, 2024 for the period ended September 30, 2024, but prior to the filing of the Company's quarterly report on Form 10-Q for the quarter ended September 30, 2024, has increased the estimate for probable penalties related to the card product misclassification by $90 million. This charge is included in the results for the quarter ended September 30, 2024, as well as the nine month period ended on the same date. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | | | | | | | | | | | | | | | | | |

| RECONCILIATION OF PRIOR PERIOD RESTATED FINANCIAL RESULTS | | | | | | | | | | | | | |

| (unaudited, in millions, except per share statistics) | | | | | | | | | | | | | | | |

| Restatement Impacts | Adjustments 1 | | | | |

| Quarter Ended | | | | |

| Mar 31,

2023 | | Jun 30,

2023 | | Sep 30,

2023 | | Dec 31,

2023 | | Mar 31,

2024 | | Jun 30,

2024 | | Sep 30,

2024 | | | | |

| BALANCE SHEET SUMMARY | | | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | | |

| Other Assets | $149 | | | $153 | | | $183 | | | $191 | | | $18 | | | $21 | | | $22 | | | | | |

| Total Assets | $149 | | | $153 | | | $183 | | | $191 | | | $18 | | | $21 | | | $22 | | | | | |

| | | | | | | | | | | | | | | | | |

| Liabilities & Stockholders' Equity | | | | | | | | | | | | | | | | | |

| Accrued Expenses and Other Liabilities | $611 | | | $627 | | | $754 | | | $784 | | | $68 | | | $78 | | | $173 | | | | | |

| Total Liabilities | 611 | | | 627 | | | 754 | | | 784 | | | 68 | | | 78 | | | 173 | | | | | |

| Total Equity | (462) | | | (474) | | | (571) | | | (593) | | | (50) | | | (57) | | | (151) | | | | | |

| Total Liabilities and Stockholders' Equity | $149 | | | $153 | | | $183 | | | $191 | | | $18 | | | $21 | | | $22 | | | | | |

| | | | | | | | | | | | | | | | | |

| BALANCE SHEET STATISTICS | | | | | | | | | | | | | | | | | |

| Total Common Equity | ($462) | | | ($474) | | | ($571) | | | ($593) | | | ($50) | | | ($57) | | | ($151) | | | | | |

| Total Common Equity/Total Assets | (40) | | bps | (40) | | bps | (40) | | bps | (40) | | bps | — | | bps | — | | bps | (10) | | bps | | | |

| Total Common Equity/Net Loans | (50) | | bps | (50) | | bps | (50) | | bps | (50) | | bps | — | | bps | (10) | | bps | (20) | | bps | | | |

| | | | | | | | | | | | | | | | | |

| Tangible Assets | $149 | | | $153 | | | $183 | | | $191 | | | $18 | | | $21 | | | $22 | | | | | |

| Tangible Common Equity | ($462) | | | ($474) | | | ($571) | | | ($593) | | | ($50) | | | ($57) | | | ($151) | | | | | |

| Tangible Common Equity/Tangible Assets | (40) | | bps | (40) | | bps | (40) | | bps | (40) | | bps | — | | bps | — | | bps | (10) | | bps | | | |

| Tangible Common Equity/Net Loans | (40) | | bps | (40) | | bps | (50) | | bps | (50) | | bps | — | | bps | (10) | | bps | (20) | | bps | | | |

| Tangible Common Equity per share | ($1.79) | | | ($1.90) | | | ($2.28) | | | ($2.37) | | | ($0.20) | | | ($0.23) | | | ($0.60) | | | | | |

| | | | | | | | | | | | | | | | | |

| REGULATORY CAPITAL RATIOS | | | | | | | | | | | | | | | | | |

| Total Risk Based Capital Ratio | (40) | | bps | (50) | | bps | (50) | | bps | (50) | | bps | — | | bps | (10) | | bps | (10) | | bps | | | |

| Tier 1 Risk Based Capital Ratio | (50) | | bps | (40) | | bps | (50) | | bps | (50) | | bps | — | | bps | (10) | | bps | (10) | | bps | | | |

| Tier 1 Leverage Ratio | (30) | | bps | (30) | | bps | (40) | | bps | (40) | | bps | — | | bps | — | | bps | (10) | | bps | | | |

| Common Equity Tier 1 Capital Ratio | (50) | | bps | (50) | | bps | (50) | | bps | (50) | | bps | — | | bps | (10) | | bps | (20) | | bps | | | |

| | | | | | | | | | | | | | | | | |

1 Incremental information arising after the earnings release on October 16, 2024 for the period ended September 30, 2024, but prior to the filing of the Company's quarterly report on Form 10-Q for the quarter ended September 30, 2024, has increased the estimate for probable penalties related to the card product misclassification by $90 million. This charge is included in the results for the quarter ended September 30, 2024. | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | | | | | | | | | | | | | | | | |

| RECONCILIATION OF PRIOR PERIOD RESTATED FINANCIAL RESULTS | | | | | | | | | | | | | | |

| (unaudited, in millions, except per share statistics) | | | | | | | | | | | | | | |

| As Previously Reported |

| Quarter Ended | | Twelve Months

Ended | | Quarter Ended | | Nine Months

Ended |

| Mar 31,

2023 | | Jun 30,

2023 | | Sep 30,

2023 | | Dec 31,

2023 | | Dec 31,

2023 | | Mar 31,

2024 | | Jun 30,

2024 | | Sep 30,

2024 | | Sep 30,

2024 |

| EARNINGS SUMMARY | | | | | | | | | | | | | | | | |

| Discount/Interchange Revenue | $1,046 | | $1,158 | | $1,164 | | $1,158 | | $4,526 | | $1,074 | | $1,153 | | $1,142 | | $3,369 |

| Discount and Interchange Revenue, net | 330 | | 370 | | 377 | | 370 | | 1,447 | | 371 | | 437 | | 363 | | 1,171 |

| Total Non-Interest Income | 610 | | 701 | | 722 | | 728 | | 2,761 | | 723 | | 1,014 | | 798 | | 2,535 |

| Revenue Net of Interest Expense | $3,742 | | $3,878 | | $4,044 | | $4,196 | | $15,860 | | $4,210 | | $4,538 | | $4,453 | | $13,201 |

| | | | | | | | | | | | | | | | | |

| Other Expense | $124 | | $162 | | $144 | | $250 | | $680 | | $913 | | $327 | | $181 | | $1,421 |

| Total Operating Expense | $1,383 | | $1,404 | | $1,454 | | $1,775 | | $6,016 | | $2,309 | | $1,729 | | $1,692 | | $5,730 |

| | | | | | | | | | | | | | | | | |

| Income/ (Loss) Before Income Taxes | $1,257 | | $1,169 | | $888 | | $512 | | $3,826 | | $404 | | $2,070 | | $1,288 | | $3,762 |

| Tax Expense | 289 | | 268 | | 205 | | 124 | | 886 | | 96 | | 540 | | 323 | | 959 |

| Net Income/ (Loss) | $968 | | $901 | | $683 | | $388 | | $2,940 | | $308 | | $1,530 | | $965 | | $2,803 |

| | | | | | | | | | | | | | | | | |

| Net Income/ (Loss) Allocated to Common Stockholders | $931 | | $895 | | $647 | | $386 | | $2,859 | | $274 | | $1,521 | | $928 | | $2,723 |

| | | | | | | | | | | | | | | | | |

| Operating Efficiency | 36.9 | % | | 36.2% | | 36.0 | % | | 42.3% | | 37.9 | % | | 54.9% | | 38.1 | % | | 38.0% | | 43.4 | % |

| ROE | 27 | % | | 26% | | 19 | % | | 11% | | 21 | % | | 8% | | 40 | % | | 23% | | 24 | % |

| Payout Ratio | 147 | % | | 97% | | 26 | % | | 37% | | 89 | % | | 66% | | 12 | % | | 17% | | 19 | % |

| | | | | | | | | | | | | | | | | |

| PER SHARE STATISTICS | | | | | | | | | | | | | | | | |

| Basic EPS | $3.55 | | | $3.54 | | | $2.59 | | | $1.54 | | | $11.27 | | | $1.10 | | | $6.06 | | | $3.69 | | | $10.86 | |

| Diluted EPS | $3.55 | | | $3.54 | | | $2.59 | | | $1.54 | | | $11.26 | | | $1.10 | | | $6.06 | | | $3.69 | | | $10.85 | |

| Book Value per share | $54.79 | | | $55.44 | | | $56.93 | | | $59.29 | | | $59.29 | | | $58.74 | | | $63.99 | | | $68.71 | | | $68.71 | |

| | | | | | | | | | | | | | | | | |

| SEGMENT RESULTS | | | | | | | | | | | | | | | | |

| Digital Banking | | | | | | | | | | | | | | | | |

| Non-Interest Income | $522 | | | $586 | | | $592 | | | $611 | | | $2,311 | | | $591 | | | $691 | | | $669 | | | $1,951 | |

| Revenue Net of Interest Expense | 3,654 | | | 3,763 | | | 3,914 | | | 4,079 | | | 15,410 | | | 4,078 | | | 4,215 | | | 4,324 | | | 12,617 | |

| | | | | | | | | | | | | | | | | |

| Total Operating Expense | 1,342 | | | 1,359 | | | 1,409 | | | 1,712 | | | 5,822 | | | 2,259 | | | 1,683 | | | 1,647 | | | 5,589 | |

| Income/ (Loss) Before Income Taxes | $1,210 | | | $1,099 | | | $803 | | | $458 | | | $3,570 | | | $322 | | | $1,793 | | | $1,204 | | | $3,319 | |

| | | | | | | | | | | | | | | | | |

| Pretax Return on Loan Receivables | 4.38 | % | | 3.82 | % | | 2.65 | % | | 1.45 | % | | 3.02 | % | | 1.02 | % | | 5.68 | % | | 3.75 | % | | 3.48 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | | | | | | | | | | | | | |

| RECONCILIATION OF PRIOR PERIOD RESTATED FINANCIAL RESULTS | | | | | | | | | |

| (unaudited, in millions, except per share statistics) | | | | | | | | | | | |

| As Previously Reported |

| Quarter Ended |

| Mar 31,

2023 | | Jun 30,

2023 | | Sep 30,

2023 | | Dec 31,

2023 | | Mar 31,

2024 | | Jun 30,

2024 | | Sep 30,

2024 |

| BALANCE SHEET SUMMARY | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | |

| Other Assets | $4,461 | | | $4,822 | | | $5,513 | | | $5,667 | | | $6,065 | | | $5,952 | | | $5,349 | |

| Total Assets | $133,141 | | | $138,082 | | | $143,432 | | | $151,522 | | | $152,689 | | | $150,867 | | | $151,593 | |

| | | | | | | | | | | | | |

| Liabilities & Stockholders' Equity | | | | | | | | | | | | | |

| Accrued Expenses and Other Liabilities | $5,178 | | | $4,963 | | | $5,710 | | | $6,432 | | | $7,064 | | | $7,309 | | | $6,304 | |

| Total Liabilities | 119,081 | | | 124,226 | | | 129,196 | | | 136,694 | | | 137,969 | | | 134,800 | | | 134,333 | |

| Total Equity | 14,060 | | | 13,856 | | | 14,236 | | | 14,828 | | | 14,720 | | | 16,067 | | | 17,260 | |

| Total Liabilities and Stockholders' Equity | $133,141 | | | $138,082 | | | $143,432 | | | $151,522 | | | $152,689 | | | $150,867 | | | $151,593 | |

| | | | | | | | | | | | | |

| BALANCE SHEET STATISTICS | | | | | | | | | | | | | |

| Total Common Equity | $13,004 | | | $12,800 | | | $13,180 | | | $13,772 | | | $13,664 | | | $15,011 | | | $16,204 | |

| Total Common Equity/Total Assets | 9.8 | % | | 9.3 | % | | 9.2 | % | | 9.1 | % | | 8.9 | % | | 9.9 | % | | 10.7 | % |

| Total Common Equity/Net Loans | 12.4 | % | | 11.7 | % | | 11.6 | % | | 11.6 | % | | 11.6 | % | | 12.6 | % | | 13.7 | % |

| | | | | | | | | | | | | |

| Tangible Assets | $132,886 | | | $137,827 | | | $143,177 | | | $151,267 | | | $152,434 | | | $150,612 | | | $151,338 | |

| Tangible Common Equity | $12,749 | | | $12,545 | | | $12,925 | | | $13,517 | | | $13,409 | | | $14,756 | | | $15,949 | |

| Tangible Common Equity/Tangible Assets | 9.6 | % | | 9.1 | % | | 9.0 | % | | 8.9 | % | | 8.8 | % | | 9.8 | % | | 10.5 | % |

| Tangible Common Equity/Net Loans | 12.1 | % | | 11.4 | % | | 11.3 | % | | 11.3 | % | | 11.4 | % | | 12.4 | % | | 13.5 | % |

| Tangible Common Equity per share | $49.68 | | | $50.19 | | | $51.69 | | | $54.04 | | | $53.51 | | | $58.76 | | | $63.49 | |

| | | | | | | | | | | | | |

| REGULATORY CAPITAL RATIOS | | | | | | | | | | | | | |

| Total Risk Based Capital Ratio | 14.7 | % | | 14.3 | % | | 14.1 | % | | 13.7 | % | | 13.3 | % | | 14.3 | % | | 15.0 | % |

| Tier 1 Risk Based Capital Ratio | 13.0 | % | | 12.5 | % | | 12.5 | % | | 12.1 | % | | 11.7 | % | | 12.7 | % | | 13.5 | % |

| Tier 1 Leverage Ratio | 11.4 | % | | 11.1 | % | | 11.0 | % | | 10.7 | % | | 10.1 | % | | 11.1 | % | | 11.5 | % |

| Common Equity Tier 1 Capital Ratio | 12.1 | % | | 11.7 | % | | 11.6 | % | | 11.3 | % | | 10.9 | % | | 11.9 | % | | 12.7 | % |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

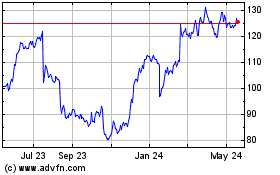

Discover Financial Servi... (NYSE:DFS)

Historical Stock Chart

From Nov 2024 to Dec 2024

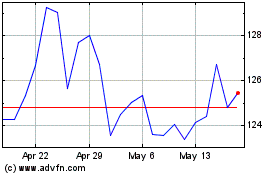

Discover Financial Servi... (NYSE:DFS)

Historical Stock Chart

From Dec 2023 to Dec 2024