0001022079false00010220792024-10-222024-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): October 22, 2024

Quest Diagnostics Incorporated

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | | | | | | | |

| 001-12215 | | | 16-1387862 |

| (Commission File Number) | | | (I.R.S. Employer Identification No.) |

| | | | |

| 500 Plaza Drive | | | |

| Secaucus, | NJ | | | 07094 |

| (Address of principal executive offices) | | | (Zip Code) |

| | | | |

| | (973) | 520-2700 | |

| (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | DGX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On October 22, 2024, Quest Diagnostics Incorporated (the "Company") issued a press release announcing, among other things, its results for the quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

| | | | | | | | |

| d. | Exhibit | |

| | |

| 99.1 | |

| | |

| | |

| | |

| 104 | The cover page from this current report on Form 8-K, formatted in Inline XBRL. |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

October 22, 2024

| | | | | |

| QUEST DIAGNOSTICS INCORPORATED |

| |

| By: | /s/ Sean D. Mersten |

| Sean D. Mersten |

| Vice President and Corporate Secretary |

Exhibit 99.1

Quest Diagnostics Reports Third Quarter 2024 Financial Results;

Updates Guidance for Full Year 2024

•Third quarter revenues of $2.49 billion, up 8.5% from 2023

•Third quarter reported diluted earnings per share ("EPS") of $1.99, up 1.5% from 2023; and adjusted diluted EPS of $2.30, up 3.6% from 2023

•Full year 2024 revenues now expected to be between $9.80 billion and $9.85 billion; reported diluted EPS now expected to be between $7.60 and $7.70; and adjusted diluted EPS expected to be between $8.85 and $8.95

SECAUCUS, N.J., October 22, 2024 - Quest Diagnostics Incorporated (NYSE: DGX), a leading provider of diagnostic information services, today announced financial results for the third quarter ended September 30, 2024.

"We delivered a strong third quarter, with total revenue growth of 8.5%, including 4.2% organic growth," said Jim Davis, Chairman, CEO and President. "Our performance was driven by new customer wins and expanded business with physicians and hospitals as well as recent acquisitions, including LifeLabs. We are now on track to complete eight acquisitions by year's end that meet our criteria for profitability, growth and returns."

“We have increased our 2024 revenue guidance due to contributions from recent acquisitions and have maintained the midpoint of our adjusted EPS guidance despite the impact of Hurricane Milton in the fourth quarter," Mr. Davis continued. "Given the strength of our business and revenue from acquisitions, we are well positioned to drive accelerated revenue and earnings growth in 2025."

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | |

| 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change | |

| (dollars in millions, except per share data) | |

| Reported: | | | | | | | | | | | | |

| Net revenues | $ | 2,488 | | | $ | 2,295 | | | 8.5 | % | | $ | 7,251 | | | $ | 6,964 | | | 4.1 | % | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Diagnostic Information Services revenues | $ | 2,427 | | | $ | 2,228 | | | 9.0 | % | | $ | 7,058 | | | $ | 6,755 | | | 4.5 | % | |

| Revenue per requisition | | | | | 3.3 | % | | | | | | 1.7 | % | |

| Requisition volume | | | | | 5.5 | % | | | | | | 2.7 | % | |

| Organic requisition volume | | | | | 0.5 | % | | | | | | 0.7 | % | |

| Operating income (a) | $ | 330 | | | $ | 342 | | | (3.3) | % | | $ | 985 | | | $ | 995 | | | (1.0) | % | |

| Operating income as a percentage of net revenues (a) | 13.3 | % | | 14.9 | % | | (1.6) | % | | 13.6 | % | | 14.3 | % | | (0.7) | % | |

| Net income attributable to Quest Diagnostics (a) | $ | 226 | | | $ | 225 | | | 0.5 | % | | $ | 649 | | | $ | 662 | | | (1.9) | % | |

| Diluted EPS (a) | $ | 1.99 | | | $ | 1.96 | | | 1.5 | % | | $ | 5.74 | | | $ | 5.79 | | | (0.9) | % | |

| Cash provided by operations | $ | 356 | | | $ | 207 | | | 72.5 | % | | $ | 870 | | | $ | 745 | | | 17.0 | % | |

| Capital expenditures | $ | 106 | | | $ | 105 | | | 1.0 | % | | $ | 302 | | | $ | 336 | | | (10.4) | % | |

| | | | | | | | | | | | |

| Adjusted (a): | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Operating income | $ | 385 | | | $ | 380 | | | 1.3 | % | | $ | 1,132 | | | $ | 1,119 | | | 1.1 | % | |

| Operating income as a percentage of net revenues | 15.5 | % | | 16.6 | % | | (1.1) | % | | 15.6 | % | | 16.1 | % | | (0.5) | % | |

| Net income attributable to Quest Diagnostics | $ | 262 | | | $ | 254 | | | 3.1 | % | | $ | 758 | | | $ | 749 | | | 1.2 | % | |

| Diluted EPS | $ | 2.30 | | | $ | 2.22 | | | 3.6 | % | | $ | 6.70 | | | $ | 6.56 | | | 2.1 | % | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(a)For further details impacting the year-over-year comparisons related to operating income, operating income as a percentage of net revenues, net income attributable to Quest Diagnostics, and diluted EPS, see note 2 of the financial tables attached below.

Updated Guidance for Full Year 2024

The company updates its full year 2024 guidance as shown in the table below. The updated guidance reflects the impact of recent acquisitions including LifeLabs as well as the impact from Hurricane Milton in the fourth quarter. The company projects the disruption from Hurricane Milton to negatively impact net revenues by approximately $15 million and EPS by approximately 8 cents in the fourth quarter.

| | | | | | | | | | | | | | | | | | | | | | | |

| Updated Guidance | | Prior Guidance |

| Low | | High | | Low | | High |

| Net revenues | $9.80 billion | | $9.85 billion | | $9.50 billion | | $9.58 billion |

| Net revenues increase | 5.9% | | 6.5% | | 2.7% | | 3.5% |

| | | | | | | |

| | | | | | | |

| | | |

| | | |

| Reported diluted EPS | $7.60 | | $7.70 | | $7.57 | | $7.77 |

| Adjusted diluted EPS | $8.85 | | $8.95 | | $8.80 | | $9.00 |

| Cash provided by operations | Approximately $1.3 billion | | Approximately $1.3 billion |

| Capital expenditures | Approximately $420 million | | Approximately $420 million |

Note on Non-GAAP Financial Measures

As used in this press release the term “reported” refers to measures under accounting principles generally accepted in the United States (“GAAP”). The term “adjusted” refers to non-GAAP operating performance measures that exclude special items such as restructuring and integration charges, amortization expense, excess tax benefits ("ETB") associated with stock-based compensation, gains and losses associated with changes in the carrying value of our strategic investments, and other items.

Non-GAAP adjusted measures are presented because management believes those measures are useful adjuncts to GAAP results. Non-GAAP adjusted measures should not be considered as an alternative to the corresponding measures determined under GAAP. Management may use these non-GAAP measures to evaluate our performance period over period and relative to competitors, to analyze the underlying trends in our business, to establish operational budgets and forecasts and for incentive compensation purposes. We believe that these non-GAAP measures are useful to investors and analysts to evaluate our performance period over period and relative to competitors, as well as to analyze the underlying trends in our business and to assess our performance. The additional tables attached below include reconciliations of non-GAAP adjusted measures to GAAP measures.

Conference Call Information

Quest Diagnostics will hold its quarterly conference call to discuss financial results beginning at 8:30 a.m. Eastern Time today. The conference call can be accessed by dialing 888-455-0391 within the U.S. and Canada, or 773-756-0467 internationally, passcode: 7895081; or via live webcast on our website at www.QuestDiagnostics.com/investor. We suggest participants dial in approximately 10 minutes before the call.

A replay of the call may be accessed online at www.QuestDiagnostics.com/investor or, from approximately 10:30 a.m. Eastern Time on October 22, 2024 until midnight Eastern Time on November 5, 2024, by phone at 800-839-5154 for domestic callers or 203-369-3358 for international callers. Anyone listening to the call is encouraged to read our periodic reports, on file with the Securities and Exchange Commission, including the discussion of risk factors and historical results of operations and financial condition in those reports.

About Quest Diagnostics

Quest Diagnostics works across the healthcare ecosystem to create a healthier world, one life at a time. We provide diagnostic insights from the results of our laboratory testing to empower people, physicians and organizations to take action to improve health outcomes. Derived from one of the world's largest databases of de-identifiable clinical lab results, Quest's diagnostic insights reveal new avenues to identify and treat disease, inspire healthy behaviors and improve healthcare management. Quest Diagnostics annually serves one in three adult Americans and half the physicians and hospitals in the United States, and our more than 50,000 employees understand that, in the right hands and with the right context, our diagnostic insights can inspire actions that transform lives and create a healthier world. www.QuestDiagnostics.com.

Forward Looking Statements

The statements in this press release which are not historical facts may be forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date that they are made and which reflect management’s current estimates, projections, expectations or beliefs and which involve risks and uncertainties that could cause actual results and outcomes to be materially different. Risks and uncertainties that may affect the future results of the company include, but are not limited to, adverse results from pending or future government investigations, lawsuits or private actions, the competitive environment, the complexity of billing, reimbursement and revenue recognition for clinical laboratory testing, changes in government regulations, changing relationships with customers, payers, suppliers or strategic partners, acquisitions and other factors discussed in the company's most recently filed Annual Report on Form 10-K and in any of the company's subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, including those discussed in the “Business,” “Risk Factors,” “Cautionary Factors that May Affect Future Results” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of those reports.

For further information: Wendy Bost, Quest Diagnostics (Media): 973-520-2800, Shawn Bevec, Quest Diagnostics (Investors): 973-520-2900

This earnings release, including the attached financial tables, is available online in the Newsroom section at www.QuestDiagnostics.com.

ADDITIONAL TABLES FOLLOW

Quest Diagnostics Incorporated and Subsidiaries

Consolidated Statements of Operations

For the Three and Nine Months Ended September 30, 2024 and 2023

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net revenues | $ | 2,488 | | | $ | 2,295 | | | $ | 7,251 | | | $ | 6,964 | |

| | | | | | | |

| Operating costs and expenses and other operating income: | | | | | | | |

| Cost of services | 1,677 | | | 1,541 | | | 4,865 | | | 4,647 | |

| Selling, general and administrative | 448 | | | 380 | | | 1,304 | | | 1,235 | |

| Amortization of intangible assets | 32 | | | 27 | | | 90 | | | 81 | |

| | | | | | | |

| Other operating expense, net | 1 | | | 5 | | | 7 | | | 6 | |

| Total operating costs and expenses, net | 2,158 | | | 1,953 | | | 6,266 | | | 5,969 | |

| | | | | | | |

| Operating income | 330 | | | 342 | | | 985 | | | 995 | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Interest expense, net | (49) | | | (40) | | | (136) | | | (112) | |

| Other income (expense), net | 15 | | | (3) | | | 27 | | | 10 | |

| Total non-operating expense, net | (34) | | | (43) | | | (109) | | | (102) | |

| | | | | | | |

| Income before income taxes and equity in earnings of equity method investees | 296 | | | 299 | | | 876 | | | 893 | |

| Income tax expense | (65) | | | (68) | | | (205) | | | (208) | |

| Equity in earnings of equity method investees, net of taxes | 6 | | | 6 | | | 14 | | | 18 | |

| | | | | | | |

| | | | | | | |

| Net income | 237 | | | 237 | | | 685 | | | 703 | |

| Less: Net income attributable to noncontrolling interests | 11 | | | 12 | | | 36 | | | 41 | |

| Net income attributable to Quest Diagnostics | $ | 226 | | | $ | 225 | | | $ | 649 | | | $ | 662 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per share attributable to Quest Diagnostics’ common stockholders: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | 2.01 | | | $ | 1.99 | | | $ | 5.80 | | | $ | 5.87 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted | $ | 1.99 | | | $ | 1.96 | | | $ | 5.74 | | | $ | 5.79 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 112 | | | 112 | | | 111 | | | 112 | |

| | | | | | | |

| Diluted | 113 | | | 114 | | | 112 | | | 114 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Quest Diagnostics Incorporated and Subsidiaries

Consolidated Balance Sheets

September 30, 2024 and December 31, 2023

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 764 | | | $ | 686 | |

| Accounts receivable, net | 1,376 | | | 1,210 | |

| Inventories | 184 | | | 190 | |

| Prepaid expenses and other current assets | 299 | | | 286 | |

| | | |

| Total current assets | 2,623 | | | 2,372 | |

| Property, plant and equipment, net | 2,093 | | | 1,816 | |

| Operating lease right-of-use assets | 661 | | | 602 | |

| Goodwill | 8,605 | | | 7,733 | |

| Intangible assets, net | 1,716 | | | 1,166 | |

| Investments in equity method investees | 125 | | | 135 | |

| Other assets | 272 | | | 198 | |

| | | |

| Total assets | $ | 16,095 | | | $ | 14,022 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 1,313 | | | $ | 1,359 | |

| Current portion of long-term debt | 603 | | | 303 | |

| Current portion of long-term operating lease liabilities | 176 | | | 153 | |

| | | |

| Total current liabilities | 2,092 | | | 1,815 | |

| Long-term debt | 5,648 | | | 4,410 | |

| Long-term operating lease liabilities | 543 | | | 503 | |

| Other liabilities | 891 | | | 876 | |

| | | |

| Redeemable noncontrolling interest | 80 | | | 76 | |

| Stockholders’ equity: | | | |

| Quest Diagnostics stockholders’ equity: | | | |

Common stock, par value $0.01 per share; 600 shares authorized as of both September 30, 2024 and December 31, 2023; 162 shares issued as of both September 30, 2024 and December 31, 2023 | 2 | | | 2 | |

| Additional paid-in capital | 2,332 | | | 2,320 | |

| Retained earnings | 9,222 | | | 8,825 | |

| Accumulated other comprehensive loss | (15) | | | (14) | |

Treasury stock, at cost; 50 shares and 51 shares as of September 30, 2024 and December 31, 2023, respectively | (4,732) | | | (4,826) | |

| Total Quest Diagnostics stockholders’ equity | 6,809 | | | 6,307 | |

| Noncontrolling interests | 32 | | | 35 | |

| Total stockholders’ equity | 6,841 | | | 6,342 | |

| Total liabilities and stockholders’ equity | $ | 16,095 | | | $ | 14,022 | |

Quest Diagnostics Incorporated and Subsidiaries

Consolidated Statements of Cash Flows

For the Nine Months Ended September 30, 2024 and 2023

(in millions)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 685 | | | $ | 703 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 358 | | | 330 | |

| Provision for credit losses | 4 | | | — | |

| Deferred income tax benefit | (21) | | | (39) | |

| Stock-based compensation expense | 61 | | | 58 | |

| | | |

| | | |

| Other, net | 17 | | | 12 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (140) | | | (86) | |

| Accounts payable and accrued expenses | (102) | | | (231) | |

| Income taxes payable | 31 | | | — | |

| | | |

| Other assets and liabilities, net | (23) | | | (2) | |

| Net cash provided by operating activities | 870 | | | 745 | |

| | | |

| Cash flows from investing activities: | | | |

| Business acquisitions, net of cash acquired | (1,781) | | | (611) | |

| | | |

| | | |

| Capital expenditures | (302) | | | (336) | |

| | | |

| | | |

| Other investing activities, net | 37 | | | — | |

| Net cash used in investing activities | (2,046) | | | (947) | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from borrowings | 1,846 | | | 1,703 | |

| Repayments of debt | (302) | | | (1,426) | |

| | | |

| Exercise of stock options | 52 | | | 60 | |

| Employee payroll tax withholdings on stock issued under stock-based compensation plans | (24) | | | (28) | |

| Dividends paid | (247) | | | (234) | |

| Distributions to noncontrolling interest partners | (35) | | | (41) | |

| | | |

| | | |

| Other financing activities, net | (36) | | | (4) | |

| Net cash provided by financing activities | 1,254 | | | 30 | |

| | | |

| Net change in cash and cash equivalents and restricted cash | 78 | | | (172) | |

| | | |

| Cash and cash equivalents and restricted cash, beginning of period | 686 | | | 315 | |

| Cash and cash equivalents and restricted cash, end of period | $ | 764 | | | $ | 143 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Cash paid during the period for: | | | |

| Interest | $ | 167 | | | $ | 97 | |

| Income taxes | $ | 179 | | | $ | 233 | |

Notes to Financial Tables

1)The computation of basic and diluted earnings per common share is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in millions, except per share data) |

| Amounts attributable to Quest Diagnostics' common stockholders: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Net income attributable to Quest Diagnostics | $ | 226 | | | $ | 225 | | | $ | 649 | | | $ | 662 | |

| | | | | | | |

| | | | | | | |

| Less: earnings allocated to participating securities | 1 | | | 2 | | | 3 | | | 4 | |

Earnings available to Quest Diagnostics' common stockholders - basic and diluted | $ | 225 | | | $ | 223 | | | $ | 646 | | | $ | 658 | |

| | | | | | | |

| Weighted average common shares outstanding - basic | 112 | | | 112 | | | 111 | | | 112 | |

| Effect of dilutive securities: | | | | | | | |

| Stock options and performance share units | 1 | | | 2 | | | 1 | | | 2 | |

| Weighted average common shares outstanding - diluted | 113 | | | 114 | | | 112 | | | 114 | |

| | | | | | | |

| Earnings per share attributable to Quest Diagnostics' common stockholders: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | 2.01 | | | $ | 1.99 | | | $ | 5.80 | | | $ | 5.87 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted | $ | 1.99 | | | $ | 1.96 | | | $ | 5.74 | | | $ | 5.79 | |

2)The following tables reconcile reported GAAP results to non-GAAP adjusted results:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 |

| (dollars in millions, except per share data) |

| Operating income | | Operating income as a percentage of net revenues | | Income tax expense (e) | | Equity in earnings of equity method investees, net of taxes | | Net income attributable to Quest Diagnostics | | Diluted EPS |

| As reported | $ | 330 | | | 13.3 | % | | $ | (65) | | | $ | 6 | | | $ | 226 | | | $ | 1.99 | |

| Restructuring and integration charges (a) | 18 | | | 0.7 | | | (3) | | | — | | | 15 | | | 0.13 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other charges (b) | 5 | | | 0.2 | | | — | | | — | | | 4 | | | 0.04 | |

| Gains and losses on investments (c) | — | | | — | | | — | | | 2 | | | 2 | | | 0.02 | |

| Other gains (d) | — | | | — | | | 2 | | | — | | | (6) | | | (0.06) | |

| | | | | | | | | | | |

| Amortization expense | 32 | | | 1.3 | | | (8) | | | — | | | 24 | | | 0.21 | |

| ETB | — | | | — | | | (3) | | | — | | | (3) | | | (0.03) | |

| As adjusted | $ | 385 | | | 15.5 | % | | $ | (77) | | | $ | 8 | | | $ | 262 | | | $ | 2.30 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 |

| (dollars in millions, except per share data) |

| Operating income | | Operating income as a percentage of net revenues | | Income tax expense (e) | | Equity in earnings of equity method investees, net of taxes | | Net income attributable to Quest Diagnostics | | Diluted EPS |

| As reported | $ | 985 | | | 13.6 | % | | $ | (205) | | | $ | 14 | | | $ | 649 | | | $ | 5.74 | |

| Restructuring and integration charges (a) | 45 | | | 0.6 | | | (10) | | | — | | | 35 | | | 0.31 | |

| | | | | | | | | | | |

| Other charges (b) | 12 | | | 0.2 | | | — | | | — | | | 11 | | | 0.10 | |

| Gains and losses on investments (c) | — | | | — | | | (3) | | | 11 | | | 8 | | | 0.07 | |

| Other gains (d) | — | | | — | | | 2 | | | — | | | (6) | | | (0.06) | |

| Amortization expense | 90 | | | 1.2 | | | (23) | | | — | | | 67 | | | 0.59 | |

| ETB | — | | | — | | | (6) | | | — | | | (6) | | | (0.05) | |

| As adjusted | $ | 1,132 | | | 15.6 | % | | $ | (245) | | | $ | 25 | | | $ | 758 | | | $ | 6.70 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| (dollars in millions, except per share data) |

| Operating income | | Operating income as a percentage of net revenues | | Income tax expense (e) | | Equity in earnings of equity method investees, net of taxes | | Net income attributable to Quest Diagnostics | | Diluted EPS |

| As reported | $ | 342 | | | 14.9 | % | | $ | (68) | | | $ | 6 | | | $ | 225 | | | $ | 1.96 | |

| Restructuring and integration charges (a) | 6 | | | 0.3 | | | (1) | | | — | | | 5 | | | 0.05 | |

| Other charges (b) | 5 | | | 0.2 | | | — | | | — | | | 5 | | | 0.04 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Amortization expense | 27 | | | 1.2 | | | (6) | | | — | | | 21 | | | 0.18 | |

| ETB | — | | | — | | | (2) | | | — | | | (2) | | | (0.01) | |

| As adjusted | $ | 380 | | | 16.6 | % | | $ | (77) | | | $ | 6 | | | $ | 254 | | | $ | 2.22 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| (dollars in millions, except per share data) |

| Operating income | | Operating income as a percentage of net revenues | | Income tax expense (e) | | Equity in earnings of equity method investees, net of taxes | | Net income attributable to Quest Diagnostics | | Diluted EPS |

| As reported | $ | 995 | | | 14.3 | % | | $ | (208) | | | $ | 18 | | | $ | 662 | | | $ | 5.79 | |

| Restructuring and integration charges (a) | 32 | | | 0.5 | | | (8) | | | — | | | 24 | | | 0.22 | |

| Other charges (b) | 11 | | | 0.1 | | | (2) | | | — | | | 9 | | | 0.08 | |

| Gains and losses on investments (c) | — | | | — | | | (1) | | | 3 | | | 2 | | | 0.02 | |

| | | | | | | | | | | |

| Amortization expense | 81 | | | 1.2 | | | (20) | | | — | | | 61 | | | 0.53 | |

| ETB | — | | | — | | | (9) | | | — | | | (9) | | | (0.08) | |

| As adjusted | $ | 1,119 | | | 16.1 | % | | $ | (248) | | | $ | 21 | | | $ | 749 | | | $ | 6.56 | |

| | | | | | | | | | | |

(a)For both the three and nine months ended September 30, 2024 and 2023, the pre-tax impact represents costs primarily associated with workforce reductions and integration costs incurred in connection with further restructuring and integrating our business. The following table summarizes the pre-tax impact of restructuring and integration charges on our consolidated statements of operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (dollars in millions) |

| Cost of services | $ | 5 | | | $ | 2 | | | $ | 19 | | | $ | 12 | |

| Selling, general and administrative | 15 | | | 4 | | | 28 | | | 20 | |

| Other operating expense, net | (2) | | | — | | | (2) | | | — | |

| Operating income | $ | 18 | | | $ | 6 | | | $ | 45 | | | $ | 32 | |

| | | | | | | |

| | | | | | | |

(b)For the periods presented other operating expense, net includes pre-tax losses associated with the increase in the fair value of the contingent consideration accrual associated with previous acquisitions. Additionally, for the nine months ended September 30, 2023, selling, general and administrative expenses includes the impairment of a corporate facility that was sold. The following table summarizes the pre-tax impact of these other items on our consolidated statements of operations:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (dollars in millions) |

| Selling, general and administrative | $ | 1 | | | $ | 1 | | | $ | 2 | | | $ | 7 | |

| Other operating expense, net | 4 | | | 4 | | | 10 | | | 4 | |

| Operating income | $ | 5 | | | $ | 5 | | | $ | 12 | | | $ | 11 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(c)For both the three and nine months ended September 30, 2024 and for the nine months ended September 30, 2023, the pre-tax impact represents gains and losses associated with changes in the carrying value of our strategic investments, recorded in equity in earnings of equity method investees, net of taxes.

(d)For the three and nine months ended September 30, 2024, other income (expense), net includes a non-recurring $8 million pre-tax gain associated with a foreign exchange forward contract utilized in conjunction with an acquisition.

(e)For restructuring and integration charges, gains and losses on investments, other charges and gains, and amortization expense, income tax impacts, where recorded, were primarily calculated using combined statutory income tax rates of 25.5% for both 2024 and 2023.

3)The outlook for adjusted diluted EPS represents management’s estimates for the full year 2024 before the impact of special items. Further impacts to earnings related to special items may occur throughout 2024. Additionally, the amount of ETB is dependent upon employee stock option exercises and our stock price, which are difficult to predict. The following table reconciles our 2024 outlook for diluted EPS under GAAP to our outlook for adjusted diluted EPS:

| | | | | | | | | | | |

| Low | | High |

| Diluted EPS | $ | 7.60 | | | $ | 7.70 | |

| Restructuring and integration charges (a) | 0.34 | | | 0.34 | |

| | | |

| | | |

| | | |

| Amortization expense (b) | 0.85 | | | 0.85 | |

| Other charges (c) | 0.12 | | | 0.12 | |

| Gains and losses on investments (d) | 0.07 | | | 0.07 | |

| Other gains (e) | (0.06) | | | (0.06) | |

| ETB | (0.07) | | | (0.07) | |

| Adjusted diluted EPS | $ | 8.85 | | | $ | 8.95 | |

(a)Represents estimated pre-tax charges of $50 million primarily associated with workforce reductions and integration costs incurred in connection with further restructuring and integrating our business. Income tax benefits were primarily calculated using a combined statutory income tax rate of 25.5%.

(b)Represents estimated pre-tax amortization expenses of $129 million. Income tax benefits were primarily calculated using a combined statutory income tax rate of 25.5%.

(c)Principally represents estimated pre-tax net losses of $13 million associated with the increase in the fair value of the contingent consideration accrual associated with previous acquisitions. No income tax benefits are recorded on the losses associated with the contingent consideration accrual.

(d)Represents $11 million of pre-tax losses associated with changes in the carrying value of our strategic investments. Income tax impacts were calculated using a combined statutory income tax rate of 25.5%.

(e)Includes a non-recurring $8 million pre-tax gain associated with a foreign exchange forward contract utilized in conjunction with an acquisition. Income tax impacts on the gain were calculated using a combined statutory income tax rate of 25.5%.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

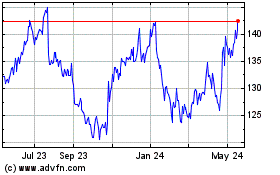

Quest Diagnostics (NYSE:DGX)

Historical Stock Chart

From Nov 2024 to Dec 2024

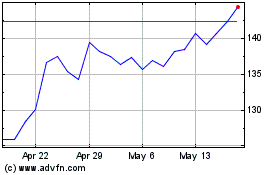

Quest Diagnostics (NYSE:DGX)

Historical Stock Chart

From Dec 2023 to Dec 2024