00017251342023FYTRUE00017251342023-01-012023-12-3100017251342023-06-30iso4217:USD0001725134us-gaap:CommonClassAMember2024-04-24xbrli:shares0001725134dms:RedeemableWarrantsToAcquireClassACommonStockMember2024-04-2400017251342023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to _________

Commission file number 001-04321

Digital Media Solutions, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-38393 | 98-1399727 |

| (State of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

4800 140th Avenue N., Suite 101, Clearwater, Florida | 33762 |

(Address of Principal Executive Offices) | (Zip Code) |

Registrants’ telephone number, including area code: (877) 236-8632

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer.” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

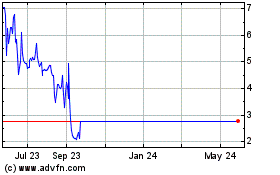

As of June 30, 2023, the last business day of the Registrant’s most recently completed second quarter, the aggregate market value of the voting and non-voting common stock held by non-affiliates, computed by reference to the closing price of $4.95 reported on the New York Stock Exchange, was approximately $3.5 million. For the purposes of this calculation, shares of common stock beneficially owned by each executive officer, director, and holder of more than 10% of our common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of April 24, 2024, 4,442,103 shares of the registrant’s Class A Common Stock and 28,443,522 warrants to purchase one-fifteenth share of the registrant’s Class A Common Stock, were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Explanatory Note

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends the Annual Report on Form 10-K of Digital Media Solutions, Inc. (the “Company”) for the fiscal year ended December 31, 2023, which was originally filed with the Securities and Exchange Commission on April 18, 2024 (the “Original Filing”).

This Amendment is being filed to include the disclosure required in Part III, Items 10, 11, 12, 13 and 14, because our proxy statement will not be filed within 120 days of the end of the 2023 fiscal year. As required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, in connection with this Form 10-K, our Chief Executive Officer and Chief Financial Officer are providing Rule 13a-14(a) certifications as included herein. We are amending Item 15 of Part IV solely to reflect the inclusion of these certifications. Except as noted above, this Amendment does not update or modify any disclosures in or reflect any events occurring after the filing of the Original Filing. Because no financial statements have been included in this Amendment and this Amendment does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4 and 5 of the certifications have been omitted.

Digital Media Solutions, Inc.

Table of Contents

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Directors, Executive Officers and Corporate Governance | |

| Executive Compensation | |

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Certain Relationships and Related Transactions, and Director Independence | |

| Principal Accounting Fees and Services | |

| | |

| | |

| | |

| | |

| | |

| Exhibit Index and Financial Statement Schedules | |

| |

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Directors

The following table lists our seven (7) current directors, their respective ages as of April 29, 2024 and their positions with us, followed by a brief biography, including their business experience. There is no familial relationship between any of our executive officers and directors.

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Joseph Marinucci | | 49 | | Chief Executive Officer and Director |

Fernando Borghese(1) | | 45 | | President, Chief Operating Officer and Director |

Scott Flanders(2) | | 67 | | Director |

| Lyndon Lea | | 55 | | Director |

Elizabeth LaPuma(3) | | 45 | | Director |

Neil Nguyen(3) | | 50 | | Director |

| Robert Darwent | | 51 | | Director |

____________________

(1) Nominated by Prism.

(2) Nominated by Prism and Clairvest for election at the 2023 annual meeting of shareholders.

(3) Appointed by the Board of Directors of the Company, as required pursuant to the Company’s senior secured credit facility.

Joseph Marinucci has served as Chief Executive Officer of DMS since co-founding DMS in 2012 and a Director since 2020. Previously, Mr. Marinucci co-founded Interactive Media Solutions, a direct response marketing firm, and served as its President from 2000 to 2012. From 2015 to 2019, Mr. Marinucci served as a board member of LeadsCouncil, an independent association whose members are companies in the online lead generation industry. Mr. Marinucci holds a Bachelor of Science in Accounting from Binghamton University. In light of our ownership structure and Mr. Marinucci’s extensive executive leadership and management experience, the Board believes it is appropriate for Mr. Marinucci to serve as our director.

Fernando Borghese has served as President since November 2023, has served as Chief Operating Officer of DMS since co-founding DMS in 2012 and has served as a Director since the completion of the Business Combination (as defined in the Annual Report on Form 10-K/A for the year ended December 31, 2023) in July 2020. Prior to DMS, Mr. Borghese was Executive Vice President at DMi Partners, a digital marketing agency. Mr. Borghese has served as a Board Member of LeadsCouncil since 2019. Mr. Borghese holds a Bachelor of Arts in Political Science from Trinity College-Hartford. In light of our ownership structure and Mr. Borghese’s extensive experience as an operating executive officer and manager, and in-depth knowledge and understanding of digital marketing, the Board believes it is appropriate for Mr. Borghese to serve as our director.

Scott Flanders has served as a Director since June 2023 at the completion of the Company’s 2023 Annual Meeting. Mr. Flanders previously served as the Chief Executive Officer of eHealth, Inc. from May 2016 to October 2021, and as a member of its board of directors since 2008. Prior to becoming the Chief Executive Officer at eHealth, Inc., Mr. Flanders served as the Chief Executive Officer of Playboy Enterprises, Inc., a media and lifestyle company, from July 2009 to May 2016, and as a member of its board of directors from July 2009 to December 2019. Previously, Mr Flanders served as the President and Chief Executive Officer of Freedom Communications, Inc., a privately-owned media company, from January 2006 to June 2009, and as a member of its board of directors from 2001 to 2009. From September 1999 to June 2005, Mr. Flanders served as the Chairman and Chief Executive Officer of Columbia House Corporation, a direct marketer of music and video products, which was acquired by Bertelsmann AG in July 2005. Mr. Flanders holds a Bachelor of Arts degree in Economics from the University of Colorado and a Juris Doctor from Indiana University Maurer School of Law. He is also a Certified Public Accountant. Mr. Flanders serves as a member of the board of directors of 890 5th Avenue Partners, Inc.; Fellow, Inc., a medical diagnostics business; and Fathom Holdings, Inc. ('FTHM"), where he is chairperson of the board and a member of the FTHM's compensation committee. He is also a member of the investment committee of Flume Ventures, a venture capital fund based in Nevada. In light of Mr. Flanders' substantial management and operational expertise, in addition to his leadership of several large media companies, the Board believes it is appropriate for Mr. Flanders to serve as our director.

Lyndon Lea has served as a Director since the completion of the Business Combination in July 2020. Mr. Lea is a founder of Lion Capital and has served as its Managing Partner since its inception in 2004. Prior to founding Lion Capital, Mr. Lea was a partner of Hicks, Muse, Tate & Furst where he co-founded its European operations in 1998. From 1994 to 1998, Mr. Lea served at Glenisla, the former European affiliate of Kohlberg Kravis Roberts & Co., prior to which he was an investment banker at

Schroders in London and Goldman Sachs in New York. Mr. Lea graduated with a BA in Honors Business Administration from the University of Western Ontario in Canada in 1990. Mr. Lea is currently a director of the following companies: Leo II; AllSaints, the UK fashion brand; Alex & Ani, the North American jewelry brand; Hatchbeauty, the North American fashion brand; food and nutrition companies Lenny & Larry’s, Nutiva (both North American), Picard Surgeles (France) and the French eyewear company Alain Afflelou.

Mr. Lea previously led investments in, and sat on the board of, UK cereal company Weetabix; French food manufacturer Materne; restaurant chain wagamama; global, luxury shoe company, Jimmy Choo; private label razor business, Personna; soft drinks business, Orangina; snack business, Kettle Foods; Finnish bakery company, Vaasan; European frozen food brand, Findus; Dutch foodservice company, Ad Van Geloven; global hair accessories brand, ghd; global brand development, marketing and entertainment company, Authentic Brands Group; UK food company, Premier Foods (LON:PFD); UK biscuit business, Burton’s Foods; UK furniture company, Christie-Tyler; leading European automotive valuation guide, EurotaxGlass’s; Polish cable company, Aster City Cable; champagne houses G.H. Mumm and Champagne-Perrier-Jouët; directories group, Yell; and clothing company, American Apparel. Mr. Lea also previously sat on the board of Aber, a diamond mining company, which owned the luxury jewelry brand Harry Winston. In light of Mr. Lea’s extensive investment experience over twenty years, as well as his service as a director of other publicly traded and private companies, the Board believes it is appropriate for Mr. Lea to serve as our director.

Elizabeth LaPuma has served as a Director since September 2023. Ms. LaPuma brings over two decades of financial advisory and board expertise across diverse industries. Ms. LaPuma currently sits on boards across fintech, artificial intelligence, consumer and real estate sectors. These include, Enterra Solutions, a private market-leading industrial scale artificial intelligence value chain solutions provider; Roundhill Capital Partners, a private real estate fund; Ventura Capital, a private equity firm; WeWork Inc., a leading global flexible space provider where she also chairs the Audit Committee and is on the Compensation and Governance Committees; Ebix, Inc., a software solutions company; Foundation Home Loans, a real estate lender; ContextLogic, a financing vehicle; OTG Management LLC, a company specializing in airport hospitality and Iconic Digital, a crypto mining company. Ms. LaPuma is also a Plan Administrator for Peer St.

Prior to these roles, Ms. LaPuma was a Managing Director and Head of Balance Sheet Advisory at UBS from 2020 to 2023. Prior to UBS, she was a Managing Director and head of Asset Management Services at Alvarez & Marsal from 2013 to 2020, advising governments and financial institutions on diverse assets. Ms. LaPuma’s earlier career includes roles at BlackRock, Lazard Frères & Co. LLC, Credit Suisse and Perella Weinberg Partners L.P. Ms. LaPuma received her Masters of Business Administration in Finance as a Palmer Scholar, Bachelor of Science in Finance and Bachelor of Arts in International Relations (Magna Cum Laude) from the Wharton School and The School of Arts and Sciences at the University of Pennsylvania. In light of Ms. Puma’s extensive finance experience, as well as her service as a director of other public companies, the Board believes it is appropriate for Ms. LaPuma to serve as our director. In addition, Ms. LaPuma’s background and skills qualify her to chair our Audit Committee and to serve as an audit committee financial expert.

Neil Nguyen has served as a Director since September 2023. Mr. Nguyen has more than two decades of senior management experience in advertising technology and media. Mr. Nguyen has been on the front lines managing companies through strategic and technology transformations and strategic transactions, and he brings a multi-faceted perspective on the advertising ecosystem, not just as a leader of Ad- Tech companies, but from the agency and marketer lens as well.

Mr. Nguyen is currently serving as the Chief Executive Officer and a member of the board of directors for MediaMath, a Searchlight Capital Partner portfolio company. Prior to joining MediaMath, Mr. Nguyen served as the Global Chief Digital & Data Officer at one of the leading performance marketing media buying agencies, Havas Edge, part of Havas Worldwide. From February 2014 to May 2017. Mr. Nguyen was Chief Executive Officer and President and member of the board of Sizmek, Inc. Prior to that, he also served as Chief Executive Officer and President and member of the board of DG, Inc. He was also Group President of Point 360 a post-production and content distribution company. He began his career at Getty Images, Inc. in 1997. Mr. Nguyen studied Business Administration, California State University, Northridge. There are no transactions since the beginning of the Company's last fiscal year to which the Company or any of its subsidiaries is a party in which Mr. Nguyen had or is to have a direct or indirect material interest. In light of Mr. Nguyen’s extensive experience in digital media and management, the Board believes it is appropriate for Mr. Nguyen to serve as our director.

Robert Darwent has served as a Director since the completion of the Business Combination in July 2020. Mr. Darwent is a founder of Lion Capital where he sits on the Investment Committee and Operating Committee of the firm. Prior to founding Lion Capital in 2004, Mr. Darwent worked with Mr. Lea in the European operations of Hicks, Muse, Tate & Furst since its formation in 1998. From 1995 to 1998, Mr. Darwent worked in the London office of Morgan Stanley in their investment banking and private equity groups. Mr. Darwent graduated from Cambridge University in 1995. Mr. Darwent is currently a director of the following companies: Loungers, the UK bar and restaurant chain; Gordon Ramsay North America, the North American restaurant group; Spence Diamonds, a North American diamond jewelry retailer and Leo II. Previously, Mr. Darwent has sat on the board of the following companies: Authentic Brands Group, the global brand licensing company AS Adventure,

the leading European outdoor specialist retailer; Burton’s Foods, the UK biscuit business; Christie-Tyler, the UK furniture manufacturer; ghd, the global hair appliances business; Jimmy Choo, the luxury shoe and accessories brand; La Senza, the UK lingerie retailer; G.H. Mumm and Champagne Perrier-Jouët, the champagne houses; wagamama, the restaurant chain; and Weetabix, the cereal company. In light of Mr. Darwent’s extensive investment experience over twenty years, as well as his service as a director of private companies, the Board believes it is appropriate for Mr. Darwent to serve as our director. In addition, Mr. Darwent’s background and skills qualify him to serve as an audit committee financial expert.

Executive Officers

In addition to Joseph Marinucci, Chief Executive Officer and Fernando Borghese, Chief Operating Officer, whose biographical information appears above, set forth below are the names, ages and biographical information for each of our current executive officers as of April 29, 2024.

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Joseph Marinucci | | 49 | | Chief Executive Officer and Director |

| Fernando Borghese | | 45 | | President, Chief Operating Officer and Director |

| Vanessa Guzmán-Clark | | 44 | | Chief Financial Officer |

| Matthew Goodman | | 50 | | Chief Security Officer |

| Anthony Saldana | | 55 | | General Counsel, Executive Vice President of Legal & Compliance and Secretary |

Joseph Marinucci’s biographical information is included under “Directors” above.

Fernando Borghese’s biographical information is included under “Directors” above.

Vanessa Guzmán-Clark has served as Chief Financial Officer of DMS since November 2023. Previously, she served as the Company’s Interim Chief Financial Officer since April 2023 and Financial Controller since June 2022. Ms. Guzmán-Clark is a Florida Certified Public Accountant (CPA) and has more than two decades of experience in finance and accounting. Prior to joining the Company, Ms. Guzmán-Clark served as the Chief Financial Officer and Vice President of Legacy Education Alliance, Inc., a publicly-traded company, from 2019 to November 2021, when she joined the Company as a Financial Consultant. From 2017 to 2019, Ms. Guzmán-Clark was the Director of Financial Systems at The Children's Home Society of Florida, Florida's oldest not-for-profit in the care of children. From 2008 to 2017, Ms. Guzmán-Clark served in a wide variety of Controller and CFO consulting roles for middle-market private and not-for-profit entities. From 2002 to 2007, Mrs. Guzmán-Clark was a Senior Auditor at PricewaterhouseCoopers, LLP. Ms. Guzmán-Clark holds a Master of Accounting & Financial Management and a Master of Business Administration from Keller Graduate School of Management.

Matthew Goodman has served as the Chief Security Officer of DMS since co-founding DMS in 2012. Previously, Mr. Goodman was Chief Information Officer of Interactive Marketing Solutions. Mr. Goodman attended the Master of Business Administration program at New York University’s Stern School of Business and earned his undergraduate degrees in Finance and Management Information System from Syracuse University.

Anthony Saldana has served as General Counsel, Executive Vice President of Legal & Compliance and Secretary of DMS since January 2021. Mr. Saldana brings to DMS over 20 years of extensive corporate law experience in mergers and acquisitions, corporate finance, corporate governance and securities matters. Prior to joining DMS, Mr. Saldana was Counsel at Skadden, Arps, Slate, Meagher & Flom LLP, where he worked from 2000 to 2020. Mr. Saldana received a J.D. from the Yale Law School and a Bachelor of Arts, Magna Cum Laude, from Harvard College.

Code of Conduct and Ethics Hotline

We have a Code of Conduct that covers our directors, officers and employees and satisfies the requirements for a “code of ethics” within the meaning of SEC rules. A copy of the code is posted in the “Governance Documents” section on the Investor Relations page of our website at www.DigitalMediaSolutions.com. The code is available in print to any person without charge, upon request sent to the Corporate Secretary at Digital Media Solutions, Inc.,4800 140th Avenue N., Suite 101, Clearwater, Florida 33762. We will disclose, in accordance with all applicable laws and regulations, amendments to, or waivers from, our Code of Conduct.

Any suggestions, concerns or reports of misconduct at our Company or complaints or concerns regarding our financial statements and accounting, auditing, internal control and reporting practices can be may made anonymously by (i) calling one of the Company’s toll-free hotlines at (800) 833-222-0944 (for English-speaking callers located in the United States or Canada) or (800) 216-1288; dial-in 001-800-681-5340 (for Spanish-speaking callers located in North America), (ii) emailing

reports@lighthouse-services.com, (iii) visiting the website at www.lighthouse-services.com/dmsgroup or (iv) faxing (215) 689-3885, each of which is managed by an independent third-party service provider allows employees to submit their report anonymously. A person may also submit a report by mail to the General Counsel or the Audit Committee of the Board at 4800 140th Avenue N., Suite 101, Clearwater, Florida 33762 or any other principal business address as updated and filed by the Company with the SEC from time to time.

Audit Committee and Audit Committee Financial Expert

The Audit Committee is responsible, among its other duties, for engaging, overseeing, evaluating and replacing the Company’s independent registered public accounting firm, pre-approving all audit and non-audit services by the independent registered public accounting firm, reviewing the scope of the audit plan and the results of each audit with management and the independent registered public accounting firm, reviewing the Company’s internal audit function, reviewing the adequacy of the Company’s system of internal accounting controls and disclosure controls and procedures, reviewing the financial statements and other financial information included in the Company’s annual and quarterly reports filed with the SEC, and exercising oversight with respect to the Code of Conduct and other policies and procedures regarding adherence with legal requirements. The Audit Committee’s duties are set forth in the Audit Committee Charter. A copy of the Audit Committee Charter is available under the “Governance Overview” section of our website at:

https://investors.digitalmediasolutions.com/governance/governance-documents/default.aspx.

During the year end December 31, 2023, the Audit Committee held four meetings. The members of the Audit Committee consist of Elizabeth LaPuma, its chairperson, Robert Darwent and Neil Nguyen. Our Board has considered the independence and other characteristics of each member of our Audit Committee and believes that the composition of the Audit Committee meets the requirements for independence under the applicable requirements of the NYSE (even though we are no longer listed on the NYSE) and the SEC. Each of Messrs. Darwent and Nguyen and Ms. LaPuma is financially literate and our Board has determined that each of Mr. Darwent and Ms. LaPuma qualify as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K promulgated by the SEC. The Board has considered the qualifications of the current members of the Audit Committee and has determined that they possess the skills necessary to review and analyze the Company’s financial statements and processes and to fulfill their other duties in accordance with the terms of the Audit Committee Charter.

Insider Trading Policy

The Company has adopted an insider trading policy governing the purchase, sale, and/or other dispositions of our securities by directors, officers and employees that are reasonably designed to promote compliance with insider trading laws, rules and regulations. The Company’s insider trading policy prohibits all employees and officers of the Company and its subsidiaries (including all members of the Board), as well as certain family members, others living in the person’s household, and persons or entities whose transactions in Company securities are subject to such person’s influence or control, from trading in securities of the Company (or securities of any other company with which the Company does business) while in possession of material nonpublic information, other than in connection with a Rule 10b5-1 plan adopted in compliance with the policy. During the three months ended December 31, 2023, no director or officer of the Company adopted or terminated a “Rule 10b5-1 trading arrangement” or “non-Rule 10b5-1 trading arrangement,” as each term is defined in Item 408(a) of Regulation S-K.Such individuals are also prohibited from engaging in hedging transactions on the Company’s common stock, including but not limited to prepaid variable forwards, equity swaps, collars and exchange funds. Transactions in put options, call options or other derivative securities on an exchange or in any other organized market, are prohibited by this policy. The policy also prohibits short sales of the Company securities and the pledging of Company securities as collateral for a margin loan, as well as the holding of Company securities in a margin account.

In addition, before any of our directors engages in certain transactions involving Company securities, such director or executive officer must obtain pre-clearance of the transaction from the Company’s General Counsel and in his absence, another employee designated by the General Counsel.

Item 11. Executive Compensation

Executive Compensation

The Company qualifies as a “smaller reporting company” under rules adopted by the SEC. Accordingly, the Company has provided scaled executive compensation disclosure that satisfies the requirements applicable to the Company in its status as a smaller reporting company. Under the scaled disclosure obligations, the Company is not required to provide, among other things, a compensation discussion and analysis or a compensation committee report, and certain other tabular and narrative disclosures relating to executive compensation. For the year end December 31, 2023, the following individuals were our named executive officers (each a “Named Executive Officer” or “NEO” and collectively the “Named Executive Officers” or “NEOs”): Joseph Marinucci, Chief Executive Officer; Fernando Borghese, Chief Operating Officer; and Anthony Saldana, General Counsel, Executive Vice President of Legal & Compliance and Secretary.

Summary Compensation Table

The following Summary Compensation Table sets forth information regarding the compensation paid to, awarded to, or earned by our Chief Executive Officer and our two other most highly compensated executive officers (“Named Executive Officers”) for the years ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary

($) | | Bonus(1) ($) | | Stock Awards(2) ($) | | Option Awards(2) ($) | | | | All Other Compensation(3) ($) | | Total

($) |

| Joseph Marinucci | | 2023 | | 500,000 | | | — | | | — | | | — | | | | | 42,735 | | | 542,735 | |

| Chief Executive Officer and Director | | 2022 | | 466,539 | | | — | | | 75,380 | | | — | | | | | 37,674 | | | 579,593 | |

| | | | | | | | | | | | | | | | |

| Fernando Borghese | | 2023 | | 500,000 | | | — | | | — | | | — | | | | | 43,010 | | | 543,010 | |

| President, Chief Operating Officer and Director | | 2022 | | 466,539 | | | — | | | 75,380 | | | — | | | | | 41,822 | | | 583,741 | |

| | | | | | | | | | | | | | | | |

| Anthony Saldana | | 2023 | | 380,000 | | | 47,500 | | | — | | | — | | | | | 35,157 | | | 462,657 | |

| General Counsel, Executive Vice President of Legal & Compliance and Secretary | | 2022 | | 378,616 | | | 150,000 | | | 15,088 | | | — | | | | | 32,794 | | | 576,498 | |

____________________

(1)Mr. Saldana’s bonus pertains to performance for the years ended December 31, 2021 and December 31, 2022 , respectively, which were payable to Mr. Saldana in the subsequent calendar year in each case.

(2)Amounts represent the aggregate grant date fair value of options and and/or restricted stock units (“RSUs”) granted in 2022, computed in accordance with ASC 718 — Stock-based Compensation. A discussion of the assumptions used in determining grant date fair value may be found in Note 13. Employee and Director Incentive Plans in the “Notes to Consolidated Financial Statements” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

(3)The other compensation listed in this column includes:

•For the year ended December 31, 2023: (a) for Mr. Marinucci: (i) matching contributions under our 401(k) savings plan of $11,400; and (ii) medical and other benefits of $31,335; (b) for Mr. Borghese: (i) matching contributions under our 401(k) savings plan of $11,400; and (ii) medical and other benefits of $31,610; and (c) for Mr. Saldana: (i) matching contributions under our 401(k) savings plan of $2,533; and (ii) medical and other benefits of $32,624.

•For the year ended December 31, 2022: (a) for Mr. Marinucci: (i) matching contributions under our 401(k) savings plan of $8,662; and (ii) medical and other benefits of $29,012; (c) for Mr. Borghese: (i) matching contributions under our 401(k) savings plan of $11,400; and (ii) medical and other benefits of $30,422; and (c) for Mr. Saldana: (i) matching contributions under our 401(k) savings plan of $2,478; and (ii) medical and other benefits of $30,316.

Narrative Disclosure to Summary Compensation Table

The primary elements of compensation for the Company’s Named Executive Officers in 2023 were base salary and short term incentive awards. The Compensation Committee did not award any equity awards to any employees, including the Named Executive Officers, in 2023. The Company’s Named Executive Officers are also eligible to participate in our employee benefit plans and programs, including medical and dental benefits, flexible spending, and short- and long-term life insurance on the same basis as our other full-time employees, subject to the terms and eligibility requirements of those plans.

Base Salaries

The Company’s Named Executive Officers receive a base salary for services rendered to the Company. The base salary payable to each Named Executive Officer is intended to provide a fixed component of compensation reflecting the executive’s skill set, experience, role and responsibilities.

Bonuses

The Company’s Named Executive Officers are entitled to receive short term incentive cash compensation, which is typically subject to the satisfaction of certain performance thresholds. Messrs. Marinucci and Borghese were eligible to receive a short term incentive bonus with respect to 2023 in the target amount of $195,000 (with upside to $260,000) in the event that the Company met certain revenue and EBITDA thresholds during the fourth quarter of 2023. Such thresholds were not met; accordingly, Messrs. Marinucci and Borghese were not entitled to receive any short term cash incentive bonuses for calendar year 2023. However, in the first quarter of 2024, the Compensation Committee granted cash awards under the 2020 Omnibus Incentive Plan to Messrs. Marinucci and Borghese in the amounts of $158,671 and $137,490, respectively, to recognize their contributions to the Company and to compensate them for the impact of certain tax consequences resulting from the Company’s internal tax reorganization in fiscal year 2022.

Mr. Saldana was eligible to receive a short term incentive bonus with respect to 2023, consisting of $56,300 in the in the event that the Company met certain revenue and EBITDA thresholds in the fourth quarter of 2024 (with upside to $75,000) and $75,000 payable on a discretionary basis. The portion based on the Company’s performance was not satisfied and only the discretionary portion is payable to Mr. Saldana during the year ending December 31, 2024.

Equity Compensation

Our Compensation Committee administers our Equity Plan and approves the amount of and terms applicable to grants of stock options and Restricted Stock Units (RSUs) to employees, including the Named Executive Officers.

Prior to 2022, the Company granted stock options in order to allow employees, including our Named Executive Officers, to purchase shares of our common stock at a price equal to the fair market value of our Common Stock on the date of grant. Generally, stock options granted under our Equity Plan have vesting schedules that are designed to encourage continued employment. Stock options granted prior to August 2021 generally vest over a three-year period, subject in most cases to continued employment, and generally expire ten years from the date of grant. Beginning in August 2021, stock options generally vest over a four-year period, subject to continued employment.

In 2023, the Company did not grant any stock options.

Generally, RSUs granted under our Equity Plan have vesting schedules that are designed to encourage continued employment. RSUs granted prior to 2021 generally vest over a three-year period, subject to continued employment. Beginning in August 2021, stock options generally vest over a four-year period, subject in most cases to continued employment. In 2022, the Company granted certain employees, including the Named Executive Officers, time-based restricted stock units (TRSUs) and performance-based restricted stock units (PRSUs).

In 2023, the Compensation Committee did not grant any awards to the Named Executive Officers.

Perquisites

The Company provides the Named Executive Officers with benefits, including medical, dental and vision plans; basic life insurance; and long-term and short-term disability, in each case, at no cost to the executive. Named executive officers also participate in our 401(k) retirement plan, with the same Company-matching contributions as all our salaried employees. The 401(k) plan provides for an employer matching contribution of 4% percent of up to 5% percent of all eligible contributions. The Company does not maintain a defined benefit pension plan or any supplemental retirement benefits.

Executive Employment Arrangements

Employment Arrangements with Joseph Marinucci

Mr. Marinucci is not party to an employment agreement or offer letter with DMS. Pursuant to Mr. Marinucci’s RSU award agreements, unvested portions of his RSU awards accelerate in certain circumstances, as further described below under “Potential Payments Upon Termination / Change in Control”.

Employment Arrangement with Fernando Borghese

Mr. Borghese is not party to an employment agreement or offer letter with DMS. Pursuant to Mr. Borghese’s RSU award agreements, unvested portions of his RSU awards accelerate in certain circumstances, as further described below under “Potential Payments Upon Termination / Change in Control”.

Employment Arrangements with Anthony Saldana

Pursuant to the terms of an Offer Letter, dated as of December 22, 2020, as amended (the “Saldana Offer Letter”), by and between the Company and Mr. Saldana, he will receive (1) an annual base salary of $320,000; (2) a pro-rated annual cash incentive bonus based upon criteria established the Company’s Board of Directors; (3) an equity grant subject to the discretion of the Company’s Board of Directors; and (4) standard employee benefits paid by the Company. The Saldana Offer Letter provides for certain severance benefits upon a termination by the Company without “cause” or for “good reason”. In the event of a termination without “cause” or “good reason” by the Company, Mr. Saldana would be entitled to (i) continued payment of his base salary for twelve (12) months and (ii) payment of the Company’s portion of the premium for healthcare continuation coverage under COBRA at the same level of coverage he was entitled to at the time of termination of employment, subject to the timely election of continuation coverage. On January 1, 2022, Mr. Saldana’s annual base salary was increased to $380,000.

Potential Payments Upon Termination / Change in Control

Executive Severance Plan

On August 4, 2022, the Board of Directors of the Company (the “Board”) approved and adopted the Digital Media Solutions, Inc. Executive Severance Plan (the “Plan”). The Plan commenced on August 4, 2022 and is administered by the Compensation Committee of the Board. The Plan is intended to provide severance benefits for certain selected senior executive employees of the Company who either have their employment terminated by the Company without “Cause” or who resign their employment for “Good Reason” (as such terms are defined in the Plan). The Plan seeks to reinforce and encourage the continued attention and dedication of those executive employees who participate in the Plan. The payments are the same whether or not in connection with a change in control of the Company.

Under the Plan, upon a termination of employment without “Cause” or a resignation for “Good Reason,” a covered executive would receive a payment equal to: (i) his or her base salary in effect at the time of termination, multiplied by 1 (or, in the case of an executive employed by the Company for less than three years, multiplied by 0.5) and (ii) his or her pro-rated target bonus opportunity for the fiscal year of termination. Terminated executives are also entitled to (x) COBRA continuation coverage paid by the Company for 12 months (or, if earlier, until the date they become eligible for coverage under another employer-provided plan) and (y) outplacement services for up to six months.

In the event an executive is eligible for severance benefits provided under an offer letter or employment agreement with the Company, severance benefits payable under the Plan will be reduced by any duplicative severance pay, salary continuation pay, termination pay or similar amounts payable under such offer letter or employment agreement.

Terminated executives are also required to sign a general waiver and release of all claims against the Company prior to receiving severance benefits under the Plan.

Further, if any payments under the Plan or otherwise would be subject to “golden parachute” excise taxes under the Internal Revenue Code, the payments will be reduced to limit or avoid the excise taxes if and to the extent such reduction would produce an expected better after-tax result for the officer.

“Cause” means: (i) the executive’s violation of Company’s current documented policies; (ii) the executive’s failure to substantially perform the executive’s duties under this Agreement; (iii) the executive’s failure to reasonably cooperate with any lawful investigation undertaken by the Company; (iv) the executive’s gross negligence or breach of fiduciary duty or (v) any (A) conviction of the executive under any local, state, provincial or federal statute which makes the performance of the executive’s duties impracticable or impossible, (B) arrest of the executive for any criminal offense against the Company or its personnel, affiliates, or customers, or (C) arrest of the executive for any other felony criminal offense which in the view of the Company may harm the reputation of the Company or any of its affiliates; (vi) any intentional misconduct, gross incompetence or conduct materially incompatible with the Employee’s duties hereunder, or prejudicial to the Company’s business; or (vii) gross insubordination or willful disobedience to the lawful directions of management of the Company, provided that the executive has been given written notice thereof and has failed to correct such conduct forthwith.

Treatment of Unvested Equity Awards of Our Named Executive Officers

Termination Without Cause.

Pursuant to the RSU and option award agreements, a pro rata portion of the RSUs and options subject to the award agreements will vest upon termination of the Named Executive Officer’s employment without cause, provided that the executive executes a general release of claims. The pro rata number of RSUs and options that will vest will be equal to the number of RSUs and

options that are scheduled to vest on the next applicable vesting date, multiplied by the quotient of the number of full calendar months the executive was employed during such year divided by twelve.

Death or Disability.

Pursuant to the RSU and option award agreements, a pro rata portion of the RSUs and options subject to the award agreements will vest upon the Named Executive Officer’s death or disability. The pro rata number of RSUs and options that will vest will be equal to the number of RSUs and options that are scheduled to vest on the next applicable vesting date.

Termination Following a Change of Control.

Pursuant to the RSU and option award agreements, if the Named Executive Officer’s employment is terminated without cause within twenty-four months following a change of control, all RSUs and options will immediately vest, provided that the executive executes a general release of claims.

Outstanding Equity Awards at Fiscal Year End

The following table sets forth information with respect to our Named Executive Officers concerning unexercised stock option awards and unvested RSU awards as of December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Options | | Stock |

| Name and Principal Position | Grant Date | Number of Securities Underlying Unexercised Options

(#) | Number of Securities Underlying Unexercised Options Exercisable(1) (#) | Option Exercise Price

($) | Option Expiration Date | | Number of Shares or Units of Stock That Have Not Vested(1) (#) | Market Value of Shares or Units of Stock That Have Not Vested(2) ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested

(#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested

($) |

| Joseph Marinucci | 10/28/2020 | — | | 3,401 | | $109.65 | 10/28/2030 | | — | | $0 | — | | $0 |

| Chief Executive Officer and Director | 8/19/2021 | 7,684 | | 7,686 | | $119.70 | 8/19/2031 | | 3,341 | | $448 | 11,025 | | $1,477 |

| 4/12/2022 | — | | — | | N/A | N/A | | 2,808 | | $376 | 2,808 | | $376 |

| | | | | | | | | | |

| Fernando Borghese | 10/28/2020 | — | | 3,401 | | $109.65 | 10/28/2030 | | — | | $0 | — | | $0 |

| President, Chief Operating Officer and Director | 8/19/2021 | 7,684 | | 7,686 | | $119.70 | 8/19/2031 | | 3,341 | | $448 | 11,025 | | $1,477 |

| 4/12/2022 | — | | — | | N/A | N/A | | 2,808 | | $376 | 2,808 | | $376 |

| | | | | | | | | | |

| Anthony Saldana | 1/14/2021 | — | | 2,096 | | $174.75 | 1/14/2031 | | — | | $0 | — | | $0 |

| General Counsel, Executive Vice President of Legal & Compliance and Secretary | 8/19/2021 | 1,538 | | 1,536 | | $119.70 | 8/19/2031 | | 669 | | $90 | 2,207 | | $296 |

| 4/12/2022 | — | | — | | N/A | N/A | | 1,382 | | $185 | 1,382 | | $185 |

____________________

N/A - Not Applicable.

(1) The options and RSUs granted in 2022 and August 2021 vest in four equal annual installments, and the options and RSUs granted in January 2021 and 2020 vest in three equal annual installments, beginning in each case on the first anniversary of the grant, subject, in each case, to the executive’s continued employment on each applicable vesting date.

(2) The dollar values are calculated using a per share stock price of $0.13, the closing price of our common stock on December 31, 2023.

Non-Employee Director Compensation

In 2023, the following annual cash compensation applied to our non-employee directors, as established by the Board:

| | | | | | | | |

| | Cash

($) |

| Director retainer | | 40,000 |

| Additional director retainer for directors unaffiliated with significant shareholders | | 120,000 |

| Lead director retainer | | 20,000 |

| Audit Committee chairperson retainer | | 20,000 |

| Compensation Committee chairperson retainer | | 15,000 |

| Strategy Committee chairperson retainer | | 264,000 |

| Audit Committee member retainer | | 10,000 |

| Compensation Committee member retainer | | 7,500 |

| Strategy Committee member retainer | | 40,000 |

2023 Director Compensation

The following table lists the compensation paid to our non-employee directors during 2023:

| | | | | | | | | | | | | | |

Name | | Fees Earned ($) | | | | | | |

| Mary Minnick | | 40,625 | | | | | | | |

| Scott Flanders | | 126,291 | | | | | | | |

| Robert Darwent | | 60,000 | | | | | | | |

| Lyndon Lea | | 52,292 | | | | | | | |

| Robbie Isenberg | | 47,500 | | | | | | | |

| Maurissa Bell | | 40,000 | | | | | | | |

| Neil Nguyen | | 61,667 | | | | | | | |

| Elizabeth LaPuma | | 150,500 | | | | | | | |

Outstanding Equity Awards of Directors at Fiscal Year End

There were no outstanding RSU awards held by our non-employee directors as of December 31, 2023.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth information known to us regarding the beneficial ownership of shares of our common stock as of the close of business on April 24, 2024 by:

•each person who is known to be the beneficial owner of more than 5% of the outstanding shares of any class of our common stock;

•each of our named executive officers and directors; and

•all of our executive officers and directors as a group.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days. Unless otherwise indicated, we believe that all persons named in the table below have or will have as of April 24, 2024, as applicable, sole voting and investment power with respect to the voting securities beneficially owned by them.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Series A Preferred Stock | | Series B Preferred Stock | | Class A Common Stock | | | | Total Voting Securities |

Name and Address of Beneficial Owners(1) | | Number of Shares(2) | | % of Series(3) | | Number of Shares(2) | | % of Series(3) | | Number of Shares | | % of Class(3) | | | | | | Number of Shares | | %(3) |

| | | | | | | | | | | | | | | | | | | | |

Clairvest Group Inc. and affiliates(4) | | — | | | —% | | — | | | —% | | 1,420,426 | | | 31.2% | | | | | | 1,420,426 | | | 16.4% |

Lion Capital (Guernsey) BridgeCo Limited(5) | | — | | | —% | | 671,806 | | | 47.8% | | 510,242 | | | 11.3% | | | | | | 1,182,048 | | | 13.7% |

Leo Investors Limited Partnership(6) | | — | | | —% | | 265,458 | | | 18.9% | | 333,346 | | | 7.2% | | | | | | 598,804 | | | 6.9% |

3i, LP(7) | | 468,632 | | | 25.0% | | — | | | —% | | — | | | —% | | | | | | 468,632 | | | 5.4% |

Altium Growth Fund, LP(8) | | 468,632 | | | 25.0% | | — | | | —% | | — | | | —% | | | | | | 468,632 | | | 5.4% |

Anson Investments Master Fund LP(9) | | 374,905 | | | 20.0% | | — | | | —% | | — | | | —% | | | | | | 374,905 | | | 4.3% |

Nomis Bay Limited(10) | | 198,639 | | | 10.6% | | — | | | —% | | — | | | —% | | | | | | 198,639 | | | 2.3% |

BPY Limited(11) | | 132,426 | | | 7.1% | | — | | | —% | | — | | | —% | | | | | | 132,426 | | | 1.5% |

Gundyco ITF Nomis Bay Ltd.(12) | | 137,567 | | | 7.3% | | — | | | —% | | — | | | —% | | | | | | 137,567 | | | 1.6% |

Anson East Master Fund LP(13) | | 93,727 | | | 5.0% | | — | | | —% | | — | | | —% | | | | | | 93,727 | | | 1.1% |

Joseph Marinucci(14) | | — | | | —% | | 175,738 | | | 12.5% | | 284,501 | | | 6.2% | | | | | | 460,239 | | | 5.3% |

Lyndon Lea(5) | | — | | | —% | | 671,806 | | | 47.8% | | 510,242 | | | 11.3% | | | | | | 1,182,048 | | | 13.7% |

Fernando Borghese(15) | | — | | | —% | | 234,317 | | | 16.7% | | 430,312 | | | 9.5% | | | | | | 664,629 | | | 7.7% |

Luis Ruelas | | — | | | —% | | — | | | —% | | 466,998 | | | 10.4% | | | | | | 466,998 | | | 5.4% |

Matthew Goodman(16) | | — | | | —% | | 58,580 | | | 4.2% | | 174,061 | | | 3.9% | | | | | | 232,641 | | | 2.7% |

Eleni Larcombe | | — | | | —% | | — | | | —% | | 250,845 | | | 5.6% | | | | | | 250,845 | | | 2.9% |

Robert Darwent(17) | | — | | | —% | | — | | | —% | | 1,953 | | | * | | | | | | 1,953 | | | * |

Anthony Saldana(18) | | — | | | —% | | — | | | —% | | 3,540 | | | * | | | | | | 3,540 | | | * |

| Scott Flanders | | — | | | —% | | — | | | —% | | — | | | —% | | | | | | — | | | —% |

| Neil Nguyen | | — | | | —% | | — | | | —% | | — | | | —% | | | | | | — | | | —% |

| Elizabeth LaPuma | | — | | | —% | | — | | | —% | | — | | | —% | | | | | | — | | | —% |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

All DMS’ directors and executive officers as a group (10 individuals) | | — | | | —% | | 1,140,441 | | | 81.1% | | 1,404,609 | | | 28.8% | | | | | | 2,545,050 | | | 29.4% |

____________________

* Less than one tenth of a percent.

(1)Unless otherwise noted, the business address of each of the following entities or individuals is c/o Digital Media Solutions, Inc., 4800 140th Avenue N., Suite 101, Clearwater, Florida 33762.

(2)Series A and Series B Preferred shares are presented on as converted into Class A Common Stock basis assuming a stated value of $111.11 per share, a conversion price of $7.26, a redemption of $15.60 and dividend of $15.60 per share into Class A common stock. Series A and Series B Preferred warrants are presented on a 1:15 converted into Class A Common Stock basis to reflect the 1:15 reverse split of our Class A common stock.

(3)Assumes 4,442,103 shares of Class A Common Stock. In addition, for each individual or entity that beneficially owns any warrants to purchase shares of Class A Common Stock, the number of outstanding shares that is assumed for purposes of calculating such individual's or entity’s ownership percentages also includes the number of warrants beneficially owned by such individual or entity but, for the avoidance of doubt, does not include any outstanding warrants that are not beneficially owned by such individual or entity. In particular, (i) the number of outstanding shares used to calculate the ownership percentages of Leo Investors Limited Partnership includes 77,926 shares subject to warrants to purchase Class A Common Stock and 187,532 shares of Class A Common Stock issuable upon conversion of Series B Preferred Stock; (ii) reserved; (iii) the number of outstanding shares used to calculate the ownership percentages of Clairvest Group Inc. and affiliates includes 61,480 shares subject to warrants to purchase Class A Common Stock; (iv) the number of outstanding shares used to calculate the ownership percentages of Joseph Marinucci includes 87,516 shares subject to warrants to purchase Class A Common Stock and 124,150 shares of common stock issuable upon conversion of Series B Preferred Stock; (v) the number of outstanding shares used to calculate the ownership percentages of Fernando Borghese includes 68,784 shares subject to warrants to purchase Class A Common Stock and 165,533 shares of common stock issuable upon conversion of Series B preferred stock; (vi) the number of outstanding shares used to calculate the ownership percentages of Matthew Goodman includes 41,384 shares of common stock issuable upon conversion of Series B Preferred Stock; and (vii) the number of outstanding shares used to calculate the ownership percentages of Lion Capital (Guernsey) Bridgeco Limited includes warrants to purchase 197,207 shares of Class A Common Stock and 474,599 shares of common stock issuable upon conversion of Series B Preferred Stock.

(4)Based on information set forth in Amendment No. 4 to the Schedule 13D/A filed with the SEC on April 16, 2024. The business address of Clairvest Group Inc. and each of the foregoing limited partnerships is 22 St. Clair Avenue East, Suite 1700, Toronto, Ontario, Canada M4T 2S3.

(5)Interests consist of (i) 101,134 shares of Class A Common Stock beneficially owned by Lion Capital Fund IV, L.P.; (ii) 114,971 shares of Class A Common Stock beneficially owned by Lion Capital Fund IV-A, L.P.; (iii) 9,005 shares of Class A Common Stock beneficially owned by Lion Capital Fund IV SBS, L.P.; (iv) 81,537 shares of Class A Common Stock beneficially owned by Lion Capital Fund IV (USD), L.P.; (v) 190,314 shares of Class A Common Stock beneficially owned by Lion Capital Fund IV-A (USD), L.P.; (v) 11,328 shares of Class A Common Stock beneficially owned by Lion Capital Fund IV SBS (USD), L.P.; and (vi) 671,806 shares of Class A Common Stock issuable upon conversion of Series B Preferred Stock and Series B Preferred Warrants, beneficially owned by Lion Capital (Guernsey) BridgeCo Limited, each which entity is managed by Lion Capital IV GP Limited, which is controlled by Lyndon Lea. The interests also include 1,953 shares of Class A common stock held by Mr. Lea. Lion Capital also holds warrants to purchase 197,207 shares of Class A Common Stock. The business address of Lyndon Lea and each such entity is 21 Grosvenor Place, London, SW1X 7HF.

(6)Based on information set forth in Amendment No. 1 to the Schedule 13G/A filed with the SEC on February 16, 2021. The Schedule 13G/A indicates 200,346 shares of Class A Common Stock, warrants to purchase 77,926 shares of Class A Common Stock (in each case, adjusted for the Company’s 15:1 reverse split). In addition, also includes 187,532 shares of Class A common stock issuable upon conversion of shares of Series B Preferred Stock, owned by Leo Investors Limited Partnership. Leo Investors Limited Partnership is controlled by its general partner, Leo Investors General Partner Limited, which is governed by a three member board of directors. Each director has one vote, and the approval of a majority of the directors is required to approve an action of the Company’s sponsor. Under the so-called “rule of three,” if voting and dispositive decisions regarding an entity’s securities are made by two or more individuals, and a voting and dispositive decision requires the approval of a majority of those individuals, then none of the individuals is deemed a beneficial owner of the entity’s securities. This is the situation with regard to the Company’s sponsor. Based on the foregoing analysis, no individual director of the general partner of Leo Investors Limited Partnership exercises voting or dispositive control over any of the securities held by Leo Investors Limited Partnership, even those in which such director directly holds a pecuniary interest. Accordingly, none of them will be deemed to have or share beneficial ownership of such shares. The business address of Leo Investors Limited Partnership is 21 Grosvenor Place, London, SW1X 7HF.

(7)Includes 137,567 shares subject to warrants to purchase Class A Common Stock. The business address of 3i, LP is 2 Wooster St., New York NY 10013-2258.

(8)Includes 137,567 shares subject to warrants to purchase Class A Common Stock. The business address of Altium Growth Fund, LP is 152 W 57TH ST FL 20, New York, NY 10019-3310.

(9)Includes 110,053 shares subject to warrants to purchase Class A Common Stock. The business address of Anson Investments Master Fund LP is 155 University Avenue, Suite 207, Toronto, ON M5H 3B7 Canada.

(10) The business address of Noomis Bay Limited is 400-145 Adelaide St W, West Toronto, Toronto, ON M5H 4E5 Canada. Murchinson Ltd. (“Murchinson”), as sub-advisor to Nomis Bay Ltd., has voting and investment power with respect to these shares. Marc Bistricer, in his capacity as CEO of Murchinson, may also be deemed to have investment discretion and voting power over the shares held by Nomis Bay Ltd. Each of Mr. Bistricer and Murchinson disclaims any beneficial ownership of these shares except of any pecuniary interests therein. The principal business address of Murchinson Ltd. 400-145 Adelaide Street West, Toronto ON M5H4E5.

(11)The business address of BPY Limited is 400-145 Adelaide St W, West Toronto, Toronto, ON M5H 4E5 Canada. Murchinson Ltd. (“Murchinson”), as sub-advisor to BPY Limited, has voting and investment power with respect to these shares. Marc Bistricer, in his capacity as CEO of Murchinson, may also be deemed to have investment discretion and voting power over the shares held by BPY Limited. Each of Mr. Bistricer and Murchinson disclaims any beneficial ownership of these shares except of any pecuniary interests therein. The principal business address of Murchinson Ltd. 400-145 Adelaide Street West, Toronto ON M5H4E5.

(12)Consists of 2,063,492 shares of Class A Common Stock issuable upon exercise of warrants. The business address of Gundyco ITF Nomis Bay Ltd. is 199 Bay Street, CCW, B2, Toronto, Ont. MSL 1G9.

(13)Includes 27,514 shares subject to warrants to purchase Class A Common Stock. The business address of Anson East Master Fund LP is 155 University Avenue, Suite 207, Toronto, ON M5H 3B7 Canada.

(14)Series B interests shown include (a) 124,150 shares of Class A Common Stock issuable upon conversion of 7,500 shares of Series B Preferred Stock and (b) Series B Preferred Warrants to purchase 51,588 shares of Class A Common Stock, beneficially owned by Bayonne Holdings, LLC, which Mr. Marinucci controls. The business address of Bayonne Holdings, LLC is 14820 Rue de Bayonne, Unit 608, Clearwater FL 33762. Class A interests include (a) 242,463 shares of Class A Common Stock held by Mr. Marinucci, (b) warrants to purchase 35,928 shares of Class A Common Stock, and (c) 6,110 option shares of Class A Common Stock that Mr. Marinucci can exercise within 60 days.

(15)Series B interests shown include (a) 165,533 shares of Class A Common Stock issuable upon conversion of 10,000 shares of Series B Preferred Stock and (b) Series B Preferred Warrants to purchase 68,784 shares of Class A Common Stock. Class A interests include (a) 388,274 shares of Class A Common Stock held by Mr. Borghese, (b) warrants to purchase 35,928 shares of Class A Common Stock, and (c) 6,110 option shares of Class A Common Stock that Mr. Borghese can exercise within 60 days.

(16)Series B interests shown include (a) 41,384 shares of Class A Common Stock issuable upon conversion of 2,500 shares of Series B Preferred Stock and (b) Series B Preferred Warrants to purchase 17,196 shares of Class A Common Stock. Class A interests include (a) 173,538 shares of Class A Common Stock held by Mr. Goodman, and (b) 523 option shares of Class A Common Stock that Mr. Goodman can exercise within 60 days.

(17)Does not include any shares indirectly owned by Mr. Darwent as a result of his partnership interest in Leo Investors Limited Partnership or its affiliates. The business address of Mr. Darwent is 21 Grosvernor Place, London, SWIX 7HF.

(18)Class A interests shown include (a) 1,374 shares of Class A Common Stock held by Mr. Saldana, and (b) 2,166 option shares of Class A Common Stock that Mr. Saldana can exercise within 60 days.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table summarizes compensation plans under which our equity securities are authorized for issuance as of December 31, 2023.

| | | | | | | | | | | | | | | | | | | | |

| Plan Category | | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

(a) | | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights(1) (b) | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a))

(c) |

| Equity compensation plans approved by security holders - 2020 Omnibus Incentive Plan | | 137,000 | | | $ | 58.77 | | | 636,333 | |

| Equity compensation plans not approved by security holders | | — | | — | | — |

| Total | | 137,000 | | | $ | 58.77 | | | 636,333 | |

____________________

(1) The weighted-average exercise price does not reflect the shares that will be issued in connection with the vesting of RSUs as RSUs have no exercise price.

For further information, see Note 13. Employee and Director Incentive Plans in the “Notes to Consolidated Financial Statements” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Item 13. Certain Relationships and Related Transactions, and Director Independence

Certain Relationships and Transactions

Policies and Procedures for Related Person Transactions

The Company has adopted a written related person transaction policy that sets forth the procedures for the review and approval or ratification of related person transactions.

A “Related Person Transaction” is a transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which DMS was, is or will be a participant, the amount of which involved exceeds $120,000, and in which any related person has or will have a direct or indirect material interest, subject to certain exceptions.

A “Related Person” means:

•any director or executive officer, or nominee for director of DMS;

•any person who is the beneficial owner of more than five percent (5%) of our common stock; and

•any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, daughter-in-law, brother-in-law or sister-in-law of a director, officer or a beneficial owner of more than five percent (5%) of our common stock, and any person (other than a tenant or employee) sharing the household of such director, executive officer, nominee for director or beneficial owner of more than five percent (5%) of our common stock.

We also have policies and procedures designed to minimize potential conflicts of interest arising from any dealings it may have with its affiliates and to provide appropriate procedures for the disclosure of any real or potential conflicts of interest that may exist from time to time. Specifically, pursuant to its charter, the Audit Committee has the responsibility to review and approve any related party transactions.

To identify any transactions with such related parties, upon nomination or appointment, each director nominee and executive officer completes a questionnaire listing his or her related parties, and any transactions with the Company in which the officer or director or their family members have an interest. Additionally, each director and executive officer is required to update his or her related parties on a quarterly basis, and confirm that he or she has disclosed any applicable transactions.

During the year ended December 31, 2023, we did not engage in any transactions with our directors and executive officers, nor are any such transactions currently proposed, in which a related person had or will have a direct or indirect material interest, except as set forth below.

Registration Rights

At the Closing of the Business Combination, the Company entered into an amended and restated registration rights agreement with certain shareholders (the “Registration Rights Agreement”), pursuant to which the Company registered for resale certain shares of Class A Common Stock and warrants to purchase Class A Common Stock that were held by the parties thereto. Additionally, the shareholders may request to sell all or any portion of their shares of Class A Common Stock in an underwritten offering that is registered pursuant to the shelf registration statement filed by the Company; however, the Company will only be obligated to effect an underwritten offering if such offering will include securities with a total offering price reasonably expected to exceed, in the aggregate, $20.0 million and will not be required to effect more than four such offerings in any six-month period. The Registration Rights Agreement also includes customary piggy-back rights, which would allow the shareholders to sell shares in the event of any offering by the Company, subject to certain cooperation and cut-back provisions. The Company will bear the expenses incurred in connection with the filing of any such registration statements.

Amended Partnership Agreement

Pursuant to the Amended Partnership Agreement, the holders of the non-controlling interests (as defined in the Amended Partnership Agreement) have the right to redeem their DMSH Units for cash (based on the market price of the shares of Class A Common Stock) or, at the Company’s option, the Company may acquire such DMSH Units (which DMSH Units are expected to be contributed to Blocker) in exchange for cash or Class A Common Stock (a “Redemption”) on a one-for-one basis (subject to customary conversion rate adjustments, including for stock splits, stock dividends and reclassifications), in each case subject to certain restrictions and conditions set forth therein. In connection with any Redemption, a number of shares of Class B Common Stock will automatically be surrendered and cancelled in accordance with the Company Certificate of Incorporation.

DMSH Member Tax Distributions

For the years ended December 31, 2023 and December 31, 2022 there were no tax distributions to members of DMSH.

Redemptions

On January 17, 2022, the sellers of SmarterChaos redeemed approximately 153.7 thousand units of their non-controlling interest held through DMSH Unit in exchange for Class A Common Stock in DMS Inc. The non-controlling interest held by the Sellers of SmarterChaos did not include related Class B Common Stock to be retired upon redemption.

On July 3, 2023 and November 17, 2023, Prism Data, LLC , a Delaware limited liability company, redeemed approximately 41.2 thousand and 1.5 million Class B Common Stock, respectively, On April 12, 2024, CEP V-A DMS AIV Limited Partnership redeemed approximately 151.2 thousand Class B Common Stock, effectively converting all of its remaining non-controlling interest held in DMSH Units into Class A Common Stock in DMS Inc. Consequently, there were no shares of the Company's Class B Common Stock outstanding after this redemption effectively converting all of its remaining non-controlling interest held in DMSH Units into Class A Common Stock in DMS Inc.

Tax Receivable Agreement

Since the year ended December 31, 2021, the Company maintains a full valuation allowance on our DTA related to the Tax Receivable Agreement along with the entire DTA inventory at DMS, Inc. and Blocker, as these assets are not more likely than not to be realized based on the positive and negative evidence that we considered. The Tax Receivable Agreement liability that originated from the Business Combination is not probable under ASC 450, Contingencies since a valuation allowance has been recorded against the related DTA. The remaining short-term Tax Receivable Agreement liability of $0.2 million is attributable to carryback claims. We will continue to evaluate the positive and negative evidence in determining the realizability of the Company’s DTAs. For further details, see Note 14. Income Taxes in the “Notes to Consolidated Financial Statements” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Prism Incentive Agreement

On October 1, 2017, DMS, through a subsidiary, acquired the assets of Mocade Media LLC (“Mocade”). On that date, in connection with the acquisition, DMS also entered into a consulting agreement with Singularity Consulting LLC (“Singularity”), a Texas limited liability company owned by the former management of Mocade. On August 1, 2018, in order to further incentivize Singularity’s efforts with respect to the acquired Mocade assets, DMS entered into an amendment to the Singularity consulting agreement. On that date, Prism Data, the then majority equity holder of DMS, also entered into an incentive agreement with Singularity, to which DMS was not a party, providing for certain incentive payments to be accounted for in accordance with applicable accounting standards by Prism Data to Singularity in the event of certain specified change of control sale transactions involving DMS. Following the Business Combination, in November 2020, DMS and Singularity resolved all outstanding amounts due under the Singularity consulting agreement between DMS and Singularity with a payment of $850,000. In addition, Prism Data and Singularity agreed that Singularity would be entitled to a payment from Prism Data of $2,000,000 in the event of certain specified change of control sale transactions involving DMS.

Indemnification Agreements

The Company has entered into indemnification agreements with each of its directors and executive officers. These agreements require the Company to indemnify such individuals, to the fullest extent permitted by Delaware law, for certain liabilities to which they may become subject as a result of their affiliation with the Company.

Private Placement of Convertible Preferred Stock and Preferred Warrants

On March 29, 2023, the Company entered into a securities purchase agreement (the “SPA”) with certain investors to purchase 80,000 shares of Series A convertible redeemable Preferred stock (“Series A Preferred stock”) and 60,000 shares of Series B convertible redeemable Preferred stock (“Series B Preferred stock”, and together with the Series A Preferred stock, the “Preferred Stock”), for an aggregate purchase price of $14.0 million (the “Preferred Offering”), including $6.0 million of related party participation. The Preferred Stock was issued at a 10% Original Issue Discount (OID) to the aggregate stated value of $15.5 million.

The Series B Preferred Stock and Warrants was issued to the following related parties:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Series B Preferred Shares | | Series B Preferred Warrants |

| Name | | Number of Shares | | % of Series | | Number of Warrants | | % of Warrants in Series |

| Lion Capital (Guernsey) BridgeCo Limited | | 28,671 | | | 47.8% | | 197,207 | | | 47.8% |

| Leo Investors Limited Partnership | | 11,329 | | | 18.9% | | 77,926 | | | 18.9% |

| Fernando Borghese | | 10,000 | | | 16.7% | | 68,784 | | | 16.7% |

| Joseph Marinucci | | 7,500 | | | 12.5% | | 51,588 | | | 12.5% |

| Matthew Goodman | | 2,500 | | | 4.2% | | 17,196 | | | 4.2% |

| Total outstanding shares as of April 24, 2024 | | 60,000 | | | 100% | | 412,701 | | | 100% |

The Company is required to redeem one-tenth of the number of shares of each series of Preferred Stock on a pro rata basis among all of the holders of each series commencing on the earlier of (i) the three-month anniversary of the closing of the Preferred Offering and on each successive monthly anniversary date thereafter and (ii) the date a registration statement relating to the underlying shares of Common Stock is declared effective and on each successive monthly anniversary date thereafter. The form of such redemptions is at the option of the Company and may be (i) in cash at 104% of the stated value of the Preferred Stock, plus accrued and unpaid dividends and any other amounts due (the “Mandatory Redemption Price”), (ii) in shares of Common Stock or (iii) a combination thereof, in each case, subject to applicable law.

The Preferred Stock is convertible at the option of the holder at any time into shares of common stock at a fixed conversion price of $8.40 (the “Conversion Price”), which Conversion Price is subject to adjustment but not below a price of $7.26. At the option of the holder, the Preferred Stock may be converted into into Class A Common Stock at either, at the option of the holder, (1) the Conversion Price or (2) the Alternate Conversion Price, which is equal to the lesser of (i) 90% of the arithmetic average of the three lowest daily volume-weight average prices (“VWAPs”) (as defined in the Securities Purchase Agreement) of the 20 trading days prior to the applicable conversion date or (ii) 90% of the VWAP of the trading day prior to the applicable conversion date.

Each series of Preferred Stock provides for the ability of a holder, subject to applicable law, to require the Company to redeem all of the holder’s shares of Preferred Stock at any time after June 15, 2023 (the “Accelerated Redemption Date”). In addition, the Company may elect to redeem all of the shares of the Series A Preferred Stock, but not Series B Preferred Stock, after the Accelerated Redemption Date. At the option of the holder being redeemed, an accelerated redemption will be (i) in cash at the Mandatory Redemption Price, (ii) in shares of Common Stock or (iii) a combination thereof.

Following certain triggering events, a holder may choose to convert Preferred Stock into shares of common stock at the Alternate Conversion Price.

The Company and the holders of the Preferred Stock also entered into a registration rights agreement to register the resale of the shares of common stock issuable upon conversion or redemption of the Preferred Stock.

The Company also issued the purchasers in the Preferred Offering warrants to acquire 963 thousand shares of Common Stock, with a 5-year maturity and an exercise price equal to $9.675, subject to adjustment and the beneficial ownership limitations set forth in the applicable warrant agreement.

Proceeds from the Preferred Offering were $13.1 million, net of transaction costs, which the Company received on March 30, 2023, and used to fund its equity cure (see Note 8. Debt in the “Notes to Consolidated Financial Statements” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023) and consummate the ClickDealer acquisition.

Director Independence

The Board annually assesses the independence of all directors. Under our approach, no director qualifies as “independent” unless the Board affirmatively determines that the director is independent under the listing standards of NYSE, which we apply to assess independence even though we are no longer listed on the NYSE. Our Corporate Governance Guidelines require that a majority of our directors be independent. Our Board believes that the independence of directors and committee members is important to assure that the Board and its committees operate in the best interests of the shareholders and to avoid any appearance of conflict of interest.

Based on the foregoing, our Board has determined that Ms. LaPuma and Messrs. Flanders, Nguyen, Lea and Darwent are independent. Messrs. Marinucci and Borghese are not independent because they are executive officers of the Company.

Item 14. Principal Accountant Fees and Services

During the fiscal years ended December 31, 2023 and December 31, 2022, and the subsequent interim period ended March 31, 2024, there were (i) no “disagreements” as that term is defined in Item 304(a)(1)(iv) of Regulation S-K, between the Company and our auditor on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, any of which that, if not resolved to our auditor’s satisfaction, would have caused them to make reference to the subject matter of any such disagreement in connection with its reports for such years and interim period and (ii) except for the matters referenced below, no "reportable events" within the meaning of Item 304(a)(1)(v) of Regulation S-K: