false000157921400015792142023-11-062023-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 06, 2023 |

Emerald Holding, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38076 |

42-1775077 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

100 Broadway, 14th Floor |

|

New York, New York |

|

10005 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (949) 226-5700 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

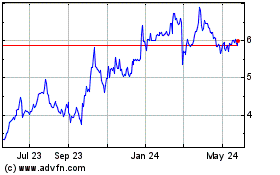

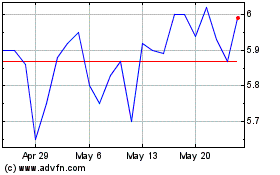

EEX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 6, 2023, Emerald Holding, Inc. (the “Company”) issued a press release announcing the financial results of the Company for the third quarter ended September 30, 2023. Copies of the press release and presentation are being furnished as Exhibit 99.1 and Exhibit 99.2, respectively, attached hereto and incorporated by reference herein. The Company will also make the financial results presentation available on its website.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibit.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

EMERALD HOLDING, INC. |

|

|

|

|

Date: |

November 6, 2023 |

By: |

/s/ Stacey Sayetta |

|

|

|

Stacey Sayetta

General Counsel and Corporate Secretary |

Exhibit 99.1

Emerald Reports Third Quarter 2023 Financial Results

Revenue Growth of 16% Year-over-Year

NEW YORK, N.Y. – November 6, 2023 – Emerald Holding, Inc. (NYSE: EEX) (“Emerald” or the “Company”), America's largest producer of trade shows and their associated conferences, content and commerce, today reported financial results for the third quarter ended September 30, 2023.

Financial Highlights

•Revenues of $72.5 million for the third quarter 2023, an increase of $10.1 million, or 16.2% over Q3 2022, primarily due to growth in events that staged in both Q3 2023 and Q3 2022, new launches and acquisitions.

•Organic Revenues, a non-GAAP measure, which takes into account the impact of acquisitions and scheduling adjustments, of $68.5 million for the third quarter 2023, an increase of $12.4 million, or 22.1%, from $56.1 million for the third quarter 2022 (Refer to Schedule 1 for a reconciliation to revenues, the most directly comparable GAAP measure)

•Net income of $10.7 million for the third quarter 2023, compared to net income of $93.0 million for the third quarter 2022

•Adjusted EBITDA, a non-GAAP measure, of $10.8 million for the third quarter of 2023, compared to $149.7 million for the third quarter 2022; Adjusted EBITDA excluding insurance proceeds, a non-GAAP measure, of $8.0 million for the third quarter 2023, compared to ($1.3) million for the third quarter 2022 (Refer to Schedule 3 for a reconciliation to net (loss) income, the most directly comparable GAAP measure)

• $200.3 million in cash at quarter end and full availability of its $110.0 million revolving credit facility

•The Company is adjusting its full year 2023 guidance and now expects to generate revenue in the range of $385 million - $395 million and Adjusted EBITDA in the range of $95 million - $100 million, due to some softness in its content business. The Company’s core trade show segment, which comprises the bulk of its operations, continues to experience strong performance

•Emerald’s Board of Directors approved an extension and expansion of the Company’s share repurchase program which allows for the repurchase of $25.0 million of the Company’s common stock through December 31, 2024

Operational Highlights

•Company’s core trade show business is strong as the post-COVID recovery cycle continues to drive growth in exhibitor and attendee counts

•Successfully launched the first edition of Cocina Sabrosa, a trade show focused on the Latin food and beverage industry, in September 2023

Hervé Sedky, Emerald’s President and Chief Executive Officer, said, “We are very pleased with the continued double-digit growth we’re seeing in our live events business. Trade shows remain a durable and high-return part of our customers’ marketing budgets, providing exhibitors with an unparalleled opportunity to access a large number of quality buyers at their industry’s must-attend event. Our focus on delivering increasing value to customers has translated to higher re-bookings along with sustained strength in pricing - trends which are reflected in our sales pacing data as we continue to book reservations for shows up to a year in advance. The performance of our content business was somewhat muted in the quarter, driven by cautious ad spending trends within the technology sector, where we have broad exposure. Nevertheless, we expect content to be a positive contributor to our results over time, offering not only opportunities for profitable growth but also synergies with our broader portfolio as we leverage the data and marketing resources of our media assets to grow our shows.”

David Doft, Emerald’s Chief Financial Officer, added, “Revenue and profitability trends in our core trade show business remain strong, as customers continue to value the high return on investment of live events. Our strong performance drove year-to-date revenue growth of 21% year-over-year, while Adjusted EBITDA increased over 85% versus the prior year. Importantly, we believe that 2024 sales pacing indicates that we can sustain double-digit top-line growth into next year with strong operating leverage, a testament to the strength and durability of our business model and the importance of our brands in their respective end markets. In our content business, reduced ad spend in the tech sector put modest downward pressure on our top line and as a result, we anticipate our FY 2023 revenue guidance will now be in the range of $385 million to $395 million. Our core trade show segment, which comprises the bulk of our operations, continues to support a strong full year performance, with Emerald set to achieve Adjusted EBITDA in the range of $95 million to $100

million in 2023. Our focus continues to be on maximizing value for our customers, which ultimately leads to stronger, more sustainable growth in per-share value for Emerald’s stockholders.”

Third Quarter 2023 Financial Performance and Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

Change |

|

|

% Change |

|

|

2023 |

|

|

2022 |

|

|

Change |

|

|

% Change |

|

|

|

(unaudited, dollars in millions, except percentages and per share data) |

|

Revenues |

|

$ |

72.5 |

|

|

$ |

62.4 |

|

|

$ |

10.1 |

|

|

|

16.2 |

% |

|

$ |

281.3 |

|

|

$ |

232.3 |

|

|

$ |

49.0 |

|

|

|

21.1 |

% |

Net income |

|

$ |

10.7 |

|

|

$ |

93.0 |

|

|

$ |

(82.3 |

) |

|

NM |

|

|

$ |

9.7 |

|

|

$ |

108.4 |

|

|

$ |

(98.7 |

) |

|

NM |

|

Net cash provided by

operating activities |

|

$ |

8.5 |

|

|

$ |

153.5 |

|

|

$ |

(145.0 |

) |

|

|

(94.5 |

%) |

|

$ |

24.7 |

|

|

$ |

198.7 |

|

|

$ |

(174.0 |

) |

|

|

(87.6 |

%) |

Diluted (loss) income per share |

|

$ |

— |

|

|

$ |

0.41 |

|

|

$ |

(0.41 |

) |

|

NM |

|

|

$ |

(0.33 |

) |

|

$ |

0.40 |

|

|

$ |

(0.73 |

) |

|

NM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP measures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

10.8 |

|

|

$ |

149.7 |

|

|

$ |

(138.9 |

) |

|

|

(92.8 |

%) |

|

$ |

61.9 |

|

|

$ |

214.5 |

|

|

$ |

(152.6 |

) |

|

|

(71.1 |

%) |

Adjusted EBITDA excluding event cancellation insurance proceeds |

|

$ |

8.0 |

|

|

$ |

(1.3 |

) |

|

$ |

9.3 |

|

|

NM |

|

|

$ |

59.1 |

|

|

$ |

31.7 |

|

|

$ |

27.4 |

|

|

|

86.4 |

% |

Free Cash Flow |

|

$ |

5.5 |

|

|

$ |

150.9 |

|

|

$ |

(145.4 |

) |

|

|

(96.4 |

%) |

|

$ |

15.3 |

|

|

$ |

191.2 |

|

|

$ |

(175.9 |

) |

|

|

(92.0 |

%) |

Free cash flow excluding event cancellation insurance proceeds, net |

|

$ |

2.7 |

|

|

$ |

(0.1 |

) |

|

$ |

2.8 |

|

|

NM |

|

|

$ |

12.5 |

|

|

$ |

8.4 |

|

|

$ |

4.1 |

|

|

|

48.8 |

% |

•Third quarter 2023 revenues were $72.5 million, an increase of $10.1 million or 16.2% versus the third quarter 2022, driven primarily by organic revenue growth of $12.4 million as well as $4.0 million in revenue from acquisitions. This growth was offset by scheduling adjustments of $5.1 million and prior year discontinued event revenue of $1.2 million. The third quarter of 2023 benefited from $2.8 million of insurance proceeds related to events cancelled or otherwise impacted by COVID-19 in prior periods.

•Third quarter 2023 Organic Revenues were $68.5 million, an increase of $12.4 million or 22.1% versus the third quarter 2022, due primarily to a $8.6 million increase in revenues from events that traded in both periods, $3.2 million from newly launched events and $0.9 million from increased subscription software revenues.

•Third quarter 2023 net income was $10.7 million, compared to net income of $93.0 million for the third quarter 2022 principally as a result of lower event cancellation insurance proceeds and higher interest expense.

•Third quarter 2023 Adjusted EBITDA was $10.8 million, compared to $149.7 million for the third quarter 2022. Excluding event cancellation insurance proceeds, third quarter 2023 Adjusted EBITDA was $8.0 million, compared to Adjusted EBITDA ex-insurance of ($1.3) million for the third quarter 2022.

For a discussion of the Company’s presentation of Organic revenues and Adjusted EBITDA, which are non-GAAP measures, see below under the heading “Non-GAAP Financial Information.” Refer to Schedule 1 for a reconciliation of Organic revenues to revenues (discussed in the first paragraph of this section), the most directly comparable GAAP measure, and refer to Schedule 3 for a reconciliation of Adjusted EBITDA to net (loss) income (discussed in the second paragraph of this section), the most directly comparable GAAP measure.

Cash Flow

•Third quarter 2023 net cash provided by operating activities was $8.5 million, compared to $153.5 million in the third quarter 2022.

•Third quarter 2023 capital expenditures were $3.0 million, compared to $2.6 million in the third quarter 2022.

•Third quarter 2023 Free Cash Flow excluding event cancellation insurance proceeds, net, which the Company defines as net cash provided by operating activities less capital expenditures, event cancellation insurance proceeds and taxes paid on event cancellation insurance proceeds, was $2.7 million, compared to ($0.1) million in the third quarter 2022. The

calculation of third quarter 2023 Free Cash Flow excluding event cancellation insurance proceeds, net, includes non-recurring acquisition related transaction costs of $0.9 million, acquisition integration, restructuring-related transition costs of $1.4 million, and non-recurring legal, audit and consulting fees of $0.8 million. The calculation of third quarter 2022 Free Cash Flow excluding event cancellation insurance proceeds, net, includes insurance settlement expenses of $7.0 million, contingent consideration paid in excess of the original estimate of $2.1 million, acquisition related transaction costs of $0.6 million, integration-related transition costs of $1.6 million, and non-recurring legal and consulting fees of $0.8 million. The total of these items is $3.1 million and $12.1 million for the quarters ended September 30, 2023 and 2022, respectively.

For a review of the Company’s presentation of Free Cash Flow, which is a non-GAAP measure, see below under the heading “Non-GAAP Financial Information.” Refer to Schedule 4 for a reconciliation of Free Cash Flow to net cash provided by operating activities (discussed in the first paragraph of this section), the most directly comparable GAAP measure.

Emerald Extends and Expands Share Repurchase Program

Emerald’s Board of Directors approved an extension and expansion of the Company’s share repurchase program that allows for the repurchase of $25.0 million of our common stock through December 31, 2024. Since the beginning of 2022, the Company has bought back 7.9 million shares of common stock. Prior to this expansion, Emerald had $3.0 million remaining available under its prior repurchase authorization.

Conference Call Webcast Details

As previously announced, the Company’s leadership will hold a conference call to discuss its third quarter 2023 results at 8:30 am EDT on Monday, November 6, 2023.

The conference call can be accessed by dialing 1-877-407-9039 (domestic) or 1-201-689-8470 (international). A telephonic replay will be available approximately two hours after the call by dialing 1-844-512-2921, or for international callers, 1-412-317-6671. The passcode for the replay is 13742126. The replay will be available until 11:59 pm (Eastern Time) on November 15, 2023.

Interested investors and other parties can access the webcast of the live conference call by visiting the Investors section of Emerald’s website at http://investor.emeraldx.com. An online replay will be available on the same website immediately following the call.

About Emerald

Emerald’s talented and experienced team grows our customers’ businesses 365 days a year through connections, content, and commerce. We expand connections that drive new business opportunities, product discovery, and relationships with over 140 annual events, matchmaking, and lead-gen services. We create content to ensure that our customers are on the cutting edge of their industries and are continually developing their skills. And we power commerce through efficient year-round buying and selling. We do all this by seamlessly integrating in-person and digital platforms and channels. Emerald is immersed in the industries we serve and committed to supporting the communities in which we operate. As true partners, we create experiences that inspire, amaze, and deliver breakthrough results. For more: http://www.emeraldx.com/.

Non-GAAP Financial Information

This press release presents certain “non-GAAP” financial measures. The components of these non-GAAP measures are computed by using amounts that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”). A reconciliation of non-GAAP financial measures used in this press release to their nearest comparable GAAP financial measures is included in the schedules attached hereto.

Organic Revenue

We define “Organic revenue growth” and “Organic revenue decline” as the growth or decline, respectively, in our revenue from one period to the next, adjusted for the revenue impact of: (i) acquisitions and dispositions, (ii) discontinued events and (iii) material show scheduling adjustments. We disclose changes in Organic revenue because we believe it assists investors and analysts in comparing Emerald’s operating performance across reporting periods on a consistent basis by excluding items that we do not believe provide a fair comparison of the trends underlying our existing event portfolio given changes in timing or strategy. Management and Emerald’s board of directors evaluate changes in Organic revenue to evaluate our historical and prospective financial performance and understand underlying revenue trends of our events.

Adjusted EBITDA

We use Adjusted EBITDA because we believe it assists investors and analysts in comparing Emerald’s operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Management and Emerald’s board of directors use Adjusted EBITDA to assess our financial performance and believe it is helpful in highlighting trends because it excludes the results of decisions that are outside the control of management, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate, and capital investments. Adjusted EBITDA should not be considered as an alternative to net income as a measure of financial performance or to cash flows from operations as a liquidity measure.

We define Adjusted EBITDA as net (loss) income before (i) interest expense, (ii) income tax benefit, (iii) depreciation and amortization, (iv) stock-based compensation, (v) deferred revenue adjustment, (vi) goodwill and other intangible asset impairment charges, and (vii) other items that management believes are not part of our core operations.

We have also presented Adjusted EBITDA excluding event cancellation insurance proceeds in order to illustrate the amount of Adjusted EBITDA from continuing operations.

Note: Schedule 3 provides reconciliations for 2023 and 2022 Adjusted EBITDA to net loss, however, it is not possible, without unreasonable efforts, to estimate the impacts of show scheduling adjustments, acquisitions and the amount and timing of receipt of event cancellation insurance proceeds and certain other special items that may occur in 2023 as these items are inherently uncertain and difficult to predict. As a result, the Company is unable to quantify certain amounts that would be included in a reconciliation of 2023 projected Adjusted EBITDA to projected net income without unreasonable efforts and has not provided reconciliations for these forward-looking non-GAAP financial measures.

Free Cash Flow

We present Free Cash Flow because we believe it is a useful indicator of liquidity that provides information to management and investors about the amount of cash generated from our core operations that, after capital expenditures, can be used to maintain and grow our business, for the repayment of indebtedness, payment of dividends and to fund strategic opportunities. Free Cash Flow is a supplemental non-GAAP measure of liquidity and is not based on any standardized methodology prescribed by GAAP. Free Cash Flow should not be considered in isolation or as an alternative to cash flows from operating activities or other measures determined in accordance with GAAP.

We have also presented Free Cash Flow excluding event cancellation insurance proceeds, net in order to illustrate the amount of Free Cash Flow from continuing operations.

Other companies may compute these measures differently. No non-GAAP metric should be considered as an alternative to any other measure derived in accordance with GAAP.

Cautionary Statement Concerning Forward-Looking Statements

This press release contains and our earnings call will contain certain forward-looking statements, including, but not limited to, our ability to return our business to pre-COVID levels; our guidance with respect to estimated revenues and Adjusted EBITDA; our ability or inability to obtain insurance coverage relating to event cancellations or interruptions; and our ability to successfully identify and acquire acquisition targets; our expectations arising from the ongoing impact of COVID-19 on our business; and how we integrate and grow acquired businesses. These statements involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of the Company’s control that may cause its business, industry, strategy, financing activities or actual results to differ materially. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. The Company undertakes no obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events or otherwise.

Contact

Emerald Holding, Inc.

Investor Relations

investor.relations@emeraldx.com

1-866-339-4688 (866EEXINVT)

Emerald Holding, Inc.

Condensed Consolidated Statements of (Loss) Income and Comprehensive (Loss) Income

(unaudited, dollars in millions, share data in thousands, except loss per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, 2023 |

|

|

Three Months Ended

September 30, 2022 |

|

|

Nine Months Ended

September 30, 2023 |

|

|

Nine Months Ended

September 30, 2022 |

|

Revenues |

|

$ |

72.5 |

|

|

$ |

62.4 |

|

|

$ |

281.3 |

|

|

$ |

232.3 |

|

Other income, net |

|

|

2.8 |

|

|

|

151.0 |

|

|

|

2.8 |

|

|

|

182.8 |

|

Cost of revenues |

|

|

25.9 |

|

|

|

22.7 |

|

|

|

101.9 |

|

|

|

83.3 |

|

Selling, general and administrative expense |

|

|

41.6 |

|

|

|

48.7 |

|

|

|

132.2 |

|

|

|

127.6 |

|

Depreciation and amortization expense |

|

|

8.8 |

|

|

|

14.7 |

|

|

|

35.2 |

|

|

|

43.0 |

|

Goodwill impairment charge |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6.3 |

|

Intangible asset impairment charge |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1.6 |

|

Operating (loss) income |

|

|

(1.0 |

) |

|

|

127.3 |

|

|

|

14.8 |

|

|

|

153.3 |

|

Interest expense |

|

|

12.1 |

|

|

|

6.8 |

|

|

|

31.5 |

|

|

|

15.5 |

|

Interest income |

|

|

1.6 |

|

|

|

0.8 |

|

|

|

5.0 |

|

|

|

1.1 |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

2.3 |

|

|

|

— |

|

Other expense |

|

|

0.1 |

|

|

|

0.1 |

|

|

|

0.3 |

|

|

|

0.2 |

|

(Loss) income before income taxes |

|

|

(11.6 |

) |

|

|

121.2 |

|

|

|

(14.3 |

) |

|

|

138.7 |

|

(Benefit from) provision for income taxes |

|

|

(22.3 |

) |

|

|

28.2 |

|

|

|

(24.0 |

) |

|

|

30.3 |

|

Net income and comprehensive income attributable to Emerald Holding, Inc. |

|

$ |

10.7 |

|

|

$ |

93.0 |

|

|

$ |

9.7 |

|

|

$ |

108.4 |

|

Accretion to redemption value of redeemable convertible preferred stock |

|

|

(10.7 |

) |

|

|

(9.9 |

) |

|

|

(31.2 |

) |

|

|

(28.7 |

) |

Participation rights on if-converted basis |

|

|

— |

|

|

|

(54.7 |

) |

|

|

— |

|

|

|

(51.9 |

) |

Net (loss) income and comprehensive (loss) income attributable to Emerald Holding, Inc. common stockholders |

|

$ |

(0.0 |

) |

|

$ |

28.4 |

|

|

$ |

(21.5 |

) |

|

$ |

27.8 |

|

Basic (loss) income per share |

|

|

— |

|

|

|

0.42 |

|

|

|

(0.33 |

) |

|

|

0.40 |

|

Diluted (loss) income per share |

|

|

— |

|

|

|

0.41 |

|

|

|

(0.33 |

) |

|

|

0.40 |

|

Basic weighted average common shares outstanding |

|

|

63,586 |

|

|

|

68,433 |

|

|

|

64,317 |

|

|

|

69,479 |

|

Diluted weighted average common shares outstanding |

|

|

63,586 |

|

|

|

68,643 |

|

|

|

64,317 |

|

|

|

69,588 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerald Holding, Inc.

Condensed Consolidated Balance Sheets

(dollars in millions, share data in thousands, except par value)

|

|

|

|

|

|

|

|

|

|

|

September 30,

2023 |

|

|

December 31,

2022 |

|

|

|

(unaudited) |

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

200.3 |

|

|

$ |

239.1 |

|

Trade and other receivables, net of allowances of $1.6 million and $1.5 million, as of September 30, 2023 and December 31, 2022, respectively |

|

|

78.6 |

|

|

|

74.9 |

|

Prepaid expenses and other current assets |

|

|

49.4 |

|

|

|

17.8 |

|

Total current assets |

|

|

328.3 |

|

|

|

331.8 |

|

Noncurrent assets |

|

|

|

|

|

|

Property and equipment, net |

|

|

1.7 |

|

|

|

2.2 |

|

Intangible assets, net |

|

|

182.7 |

|

|

|

204.8 |

|

Goodwill, net |

|

|

553.9 |

|

|

|

545.5 |

|

Right-of-use assets |

|

|

10.6 |

|

|

|

10.6 |

|

Other noncurrent assets |

|

|

3.8 |

|

|

|

3.5 |

|

Total assets |

|

$ |

1,081.0 |

|

|

$ |

1,098.4 |

|

Liabilities, Redeemable Convertible Preferred Stock and Stockholders’ Deficit |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable and other current liabilities |

|

$ |

46.2 |

|

|

$ |

58.1 |

|

Income taxes payable |

|

|

— |

|

|

|

1.2 |

|

Cancelled event liabilities |

|

|

0.7 |

|

|

|

3.3 |

|

Deferred revenues |

|

|

175.8 |

|

|

|

151.2 |

|

Contingent consideration |

|

|

0.3 |

|

|

|

3.5 |

|

Right-of-use liabilities, current portion |

|

|

4.3 |

|

|

|

4.9 |

|

Term loan, current portion |

|

|

4.2 |

|

|

|

— |

|

Total current liabilities |

|

|

231.5 |

|

|

|

222.2 |

|

Noncurrent liabilities |

|

|

|

|

|

|

Term loan, net of discount and deferred financing fees |

|

|

398.8 |

|

|

|

413.9 |

|

Deferred tax liabilities, net |

|

|

2.4 |

|

|

|

1.8 |

|

Right-of-use liabilities, noncurrent portion |

|

|

9.9 |

|

|

|

10.4 |

|

Other noncurrent liabilities |

|

|

9.2 |

|

|

|

10.8 |

|

Total liabilities |

|

|

651.8 |

|

|

|

659.1 |

|

Commitments and contingencies |

|

|

|

|

|

|

Redeemable convertible preferred stock |

|

|

|

|

|

|

7% Series A Redeemable Convertible Participating Preferred Stock,

$0.01 par value; authorized shares at September 30, 2023 and December 31,

2022: 80,000; 71,403 and 71,417 shares issued and outstanding; aggregate

liquidation preference of $492.6 million and $475.9 million at

September 30, 2023 and December 31, 2022, respectively |

|

|

494.9 |

|

|

472.4 |

|

Stockholders’ deficit |

|

|

|

|

|

|

Common stock, $0.01 par value; authorized shares at September 30, 2023

and December 31, 2022: 800,000; 62,890 and 67,588 shares

issued and outstanding at September 30, 2023 and December 31, 2022, respectively |

|

|

0.6 |

|

|

|

0.7 |

|

Additional paid-in capital |

|

|

568.1 |

|

|

|

610.3 |

|

Accumulated deficit |

|

|

(634.4 |

) |

|

|

(644.1 |

) |

Total stockholders’ deficit |

|

|

(65.7 |

) |

|

|

(33.1 |

) |

Total liabilities, redeemable convertible preferred stock and stockholders’ deficit |

|

$ |

1,081.0 |

|

|

$ |

1,098.4 |

|

Schedule 1

Emerald Holding, Inc.

UNAUDITED RECONCILIATION OF REVENUES TO ORGANIC REVENUES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Change |

|

|

Nine Months Ended

September 30, |

|

|

Change |

|

|

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

|

|

(dollars in millions)

(unaudited) |

|

Revenues |

|

$ |

72.5 |

|

|

$ |

62.4 |

|

|

$ |

10.1 |

|

|

|

16.2 |

% |

|

$ |

281.3 |

|

|

$ |

232.3 |

|

|

$ |

49.0 |

|

|

|

21.1 |

% |

Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition revenues |

|

|

(4.0 |

) |

|

|

|

|

|

|

|

|

|

|

|

(10.8 |

) |

|

|

|

|

|

|

|

|

|

Discontinued events |

|

|

|

|

|

(1.2 |

) |

|

|

|

|

|

|

|

|

|

|

|

(2.3 |

) |

|

|

|

|

|

|

Scheduling adjustments(1) |

|

|

— |

|

|

|

(5.1 |

) |

|

|

|

|

|

|

|

|

— |

|

|

|

2.0 |

|

|

|

|

|

|

|

Organic revenues |

|

$ |

68.5 |

|

|

$ |

56.1 |

|

|

$ |

12.4 |

|

|

|

22.1 |

% |

|

$ |

270.5 |

|

|

$ |

232.0 |

|

|

$ |

38.5 |

|

|

|

16.6 |

% |

Notes:

(1)For the three months ended September 30, 2023, represents revenues from four events that staged in the third quarter of fiscal 2022, but were scheduled to stage in a different quarter in fiscal 2023, offset by revenues from one event that staged in the third quarter of fiscal 2023, but was scheduled to stage in a different quarter in fiscal 2022. For the nine months ended September 30, 2023, represents revenues from four events that staged in the first nine months of fiscal 2022, but are scheduled to stage in the fourth quarter of fiscal year 2023, offset by revenues from three events that staged in the first nine months of fiscal 2023, but staged in the fourth quarter of fiscal 2022.

Schedule 2

Emerald Holding, Inc.

UNAUDITED RECONCILIATION OF REVENUES TO DISAGGREGATED REVENUES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(dollars in millions)

(unaudited) |

|

Trade shows |

|

$ |

48.6 |

|

|

$ |

37.6 |

|

|

$ |

200.8 |

|

|

$ |

166.7 |

|

Other events |

|

|

12.7 |

|

|

|

12.2 |

|

|

|

46.5 |

|

|

|

30.6 |

|

Subscription software and services |

|

|

5.4 |

|

|

|

4.6 |

|

|

|

15.9 |

|

|

|

13.1 |

|

Other marketing services |

|

|

5.8 |

|

|

|

8.0 |

|

|

|

18.1 |

|

|

|

21.9 |

|

Total Revenues |

|

$ |

72.5 |

|

|

$ |

62.4 |

|

|

$ |

281.3 |

|

|

$ |

232.3 |

|

Schedule 3

Emerald Holding, Inc.

UNAUDITED RECONCILIATION OF NET (LOSS) INCOME TO ADJUSTED EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(dollars in millions)

(unaudited) |

|

Net income |

|

$ |

10.7 |

|

|

$ |

93.0 |

|

|

$ |

9.7 |

|

|

$ |

108.4 |

|

Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

10.5 |

|

|

|

6.0 |

|

|

|

26.5 |

|

|

|

14.4 |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

2.3 |

|

|

|

— |

|

(Benefit from) provision for income taxes |

|

|

(22.3 |

) |

|

|

28.2 |

|

|

|

(24.0 |

) |

|

|

30.3 |

|

Goodwill impairment charge(1) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6.3 |

|

Intangible asset impairment charge(2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1.6 |

|

Depreciation and amortization |

|

|

8.8 |

|

|

|

14.7 |

|

|

|

35.2 |

|

|

|

43.0 |

|

Stock-based compensation |

|

|

1.9 |

|

|

|

1.3 |

|

|

|

5.9 |

|

|

|

5.0 |

|

Deferred revenue adjustment |

|

|

— |

|

|

|

0.2 |

|

|

|

— |

|

|

|

0.6 |

|

Other items(3) |

|

|

1.2 |

|

|

|

6.3 |

|

|

|

6.3 |

|

|

|

4.9 |

|

Adjusted EBITDA |

|

$ |

10.8 |

|

|

$ |

149.7 |

|

|

$ |

61.9 |

|

|

$ |

214.5 |

|

Deduct: |

|

|

|

|

|

|

|

|

|

|

|

|

Event cancellation insurance proceeds |

|

|

2.8 |

|

|

|

151.0 |

|

|

|

2.8 |

|

|

|

182.8 |

|

Adjusted EBITDA excluding event cancellation insurance proceeds |

|

$ |

8.0 |

|

|

$ |

(1.3 |

) |

|

$ |

59.1 |

|

|

$ |

31.7 |

|

Notes:

(1)For the nine months ended September 30, 2022, represents non-cash charges of $6.3 million for goodwill in connection with the Company’s interim testing of goodwill for impairment resulting from the change in operating segments and reporting units that occurred in the first quarter of 2022.

(2)Intangible asset impairment charges for the nine months ended September 30, 2022 represent non-cash charges of $1.6 million for certain indefinite-lived intangible assets in connection with the Company’s interim testing of intangibles for impairment.

(3)Other items for the three months ended September 30, 2023 included: (i) $0.9 million in acquisition-related transaction costs; (ii) $1.4 million in acquisition integration and restructuring-related transition costs, including one-time severance expense of $0.6 million; (iii) $0.8 million in non-recurring legal, audit and consulting fees and (iv) $1.9 million in gains related to the remeasurement of contingent consideration. Other items for the three months ended September 30, 2022 included: (i) $3.7 million in gains related to the remeasurement of contingent consideration; (ii) $0.8 million in non-recurring legal, audit and consulting fees; (iii) $0.6 million in acquisition-related transaction costs; (iv) $1.6 million in transition expenses and (v) $7.0 million in insurance settlement related expenses. Other items for the nine months ended September 30, 2023 included: (i) $1.8 million in acquisition-related transaction costs; (ii) $4.0 million in acquisition integration and restructuring-related transition costs, including one-time severance expense of $1.3 million; (iii) $3.0 million in non-recurring legal, audit and consulting fees and (iv) $2.5 million in gains related to the remeasurement of contingent consideration. Other items for the nine months ended September 30, 2022 included: (i) $9.5 million in gains related to the remeasurement of contingent consideration; (ii) $2.0 million in non-recurring legal, audit and consulting fees; (iii) $3.4 million in acquisition-related transaction costs; (iv) $1.9 million in transition expenses and (v) $7.0 million in insurance settlement related expenses.

Schedule 4

Emerald Holding, Inc.

UNAUDITED RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(dollars in millions)

(unaudited) |

|

Net Cash Provided by Operating Activities |

|

$ |

8.5 |

|

|

$ |

153.5 |

|

|

$ |

24.7 |

|

|

$ |

198.7 |

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

3.0 |

|

|

|

2.6 |

|

|

|

9.4 |

|

|

|

7.5 |

|

Free Cash Flow |

|

$ |

5.5 |

|

|

$ |

150.9 |

|

|

$ |

15.3 |

|

|

$ |

191.2 |

|

Event cancellation insurance proceeds |

|

|

(2.8 |

) |

|

|

(151.0 |

) |

|

|

(2.8 |

) |

|

|

(182.8 |

) |

Free cash flow excluding event cancellation insurance proceeds, net |

|

$ |

2.7 |

|

|

$ |

(0.1 |

) |

|

$ |

12.5 |

|

|

$ |

8.4 |

|

Schedule 5

Emerald Holding, Inc.

UNAUDITED RECONCILIATION OF REPORTABLE SEGMENTS RESULTS TO (LOSS) INCOME BEFORE TAXES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

(dollars in millions)

(unaudited) |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Commerce |

|

$ |

44.6 |

|

|

$ |

33.9 |

|

|

$ |

135.8 |

|

|

$ |

109.9 |

|

Design, Creative, and Technology |

|

|

19.3 |

|

|

|

23.0 |

|

|

|

125.4 |

|

|

|

108.1 |

|

All Other |

|

|

8.6 |

|

|

|

5.5 |

|

|

|

20.1 |

|

|

|

14.3 |

|

Total revenues |

|

$ |

72.5 |

|

|

$ |

62.4 |

|

|

$ |

281.3 |

|

|

$ |

232.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income, net |

|

|

|

|

|

|

|

|

|

|

|

|

Commerce |

|

$ |

2.8 |

|

|

$ |

2.4 |

|

|

$ |

2.8 |

|

|

$ |

8.0 |

|

Design, Creative, and Technology |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

25.3 |

|

All Other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.9 |

|

Total other income, net |

|

$ |

2.8 |

|

|

$ |

2.4 |

|

|

$ |

2.8 |

|

|

$ |

34.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

Commerce |

|

$ |

27.0 |

|

|

$ |

16.0 |

|

|

$ |

73.1 |

|

|

$ |

57.8 |

|

Design, Creative, and Technology |

|

|

2.7 |

|

|

|

2.5 |

|

|

|

38.6 |

|

|

|

57.0 |

|

All Other |

|

|

(3.2 |

) |

|

|

(3.1 |

) |

|

|

(5.1 |

) |

|

|

(8.3 |

) |

Subtotal Adjusted EBITDA |

|

$ |

26.5 |

|

|

$ |

15.4 |

|

|

$ |

106.6 |

|

|

$ |

106.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General corporate and other expenses |

|

|

(15.7 |

) |

|

|

(14.3 |

) |

|

|

(44.7 |

) |

|

|

(40.6 |

) |

Other income, net |

|

|

— |

|

|

|

148.6 |

|

|

|

— |

|

|

|

148.6 |

|

Interest expense, net |

|

|

(10.5 |

) |

|

|

(6.0 |

) |

|

|

(26.5 |

) |

|

|

(14.4 |

) |

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

(2.3 |

) |

|

|

— |

|

Goodwill impairment charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6.3 |

) |

Intangible asset impairment charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1.6 |

) |

Depreciation and amortization expense |

|

|

(8.8 |

) |

|

|

(14.7 |

) |

|

|

(35.2 |

) |

|

|

(43.0 |

) |

Stock-based compensation expense |

|

|

(1.9 |

) |

|

|

(1.3 |

) |

|

|

(5.9 |

) |

|

|

(5.0 |

) |

Deferred revenue adjustment |

|

|

— |

|

|

|

(0.2 |

) |

|

|

— |

|

|

|

(0.6 |

) |

Other items |

|

|

(1.2 |

) |

|

|

(6.3 |

) |

|

|

(6.3 |

) |

|

|

(4.9 |

) |

(Loss) income before taxes |

|

$ |

(11.6 |

) |

|

$ |

121.2 |

|

|

$ |

(14.3 |

) |

|

$ |

138.7 |

|

Emerald Holding, Inc. Third Quarter 2023 November 6, 2023 Exhibit 99.2

Notes Forward-Looking Statements The information provided in this presentation is for general informational purposes only. This document contains certain forward-looking statements regarding Emerald Holding, Inc. and its subsidiaries (the “Company”), including, without limitation, the Company’s ability to continue staging live events and scale its business beyond pre-COVID levels; expectations regarding interest rates and economic conditions and the Company’s 2022 and 2023 financial guidance expectations. These statements are based on management’s current expectations as well as estimates and assumptions prepared by management as of the date hereof, and although they are believed to be reasonable, they are inherently uncertain and not guaranteed. These statements involve risks and uncertainties outside of the Company’s control that may cause actual results, performance, or achievements, to differ materially and there can be no assurance that the projected results and forward-looking statements in this presentation will prove to be accurate. Forward looking statements include all statements that are not historical facts and can be identified by terms such as “anticipate,” “believes, “could,” “estimate,” “expect,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or similar expressions and the negatives of those terms. In particular, statements regarding the post-pandemic recovery for live events, expected free cash flow generation, and the multiple avenues to return to organic growth are each forward-looking statements among others. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. The Company disclaims any obligation to update or revise any of the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, or with respect to ongoing insurance recovery amounts. Past results are not indicative of future performance.

Participants Hervé Sedky President and Chief Executive Officer David Doft Chief Financial Officer

Key Q3 2023 Takeaways Sustained recovery trend in live events is driving significant year-over-year growth, supported by ongoing improvements in customer supply chains and a rebound in international travel Trajectory of recovery and forward visibility into event bookings supports updated outlook of $385-395 million in Revenue and $95-100 million in Adjusted EBITDA in FY 2023 Cautious advertising spend in the technology sector drove softness in Emerald’s Content business, contributing to a slightly lower revenue and Adjusted EBITDA outlook than previously forecast Target to expand Adj. EBITDA margins from ~25% implied in 2023 guidance to 35%+ historical levels over time Emerald continues to launch and acquire new products and services that are complementary to its core business to better support customers year-round Diversified portfolio across multiple sectors with countercyclical benefits Continue to generate positive free cash flow, supported by low-CAPEX requirements and working capital dynamics of events business where cash is collected in advance of an event staging

Revolutionizing the Trade Show Model�Integrating technology and first party data to create a next-generation B2B platform Collection of leading B2B trade shows and conferences that bring together industry-specific communities Revenue is generated from the production of trade shows and conference events, including booth space sales, registration fees and sponsorship fees Emerald’s Core Services B2B websites and publications that provide industry specific business news and information across 20 sectors Revenue primarily consists of advertising sales for industry publications and digital products SaaS software enables year-round B2B buying and selling which averages $1 billion per month of wholesale gross transaction volume Grew customer base by 30% YoY in 2022 with net revenue retention rate of 110% Revenue consists of subscription revenue, implementation fees and professional services (1) Through September 30, 2023. Includes revenue from Trade Shows and Other Events. Connections (88% of YTD 2023 Revenue)(1) Content Commerce

Enduring Value of Trade Shows (1) Source: Freeman, New Freeman Research Shows an Accelerated Return to In-Person Events. (2) Source: TSL, 2023 150+ Trade Show Stats That Reveal All. (3) Source: CEIR, Omnichannel Marketing Insights Report 1. (4) Source: Gartner, What Marketing Budgets Look Like in 2022. (5) Source: PwC, Global Entertainment & Media Outlook 2022-2026. In-person trade shows and events continue to be an integral part of businesses’ marketing budgets and among the highest ROI Generate leads and sales Introduce new products Build brands Strengthen relationships Educate the market Service customers Fulfill procurement needs Source new suppliers Reconnect with existing suppliers Identify trends Learn about new products / services Network with industry peers Value to Exhibitors Value to Attendees 85% of respondents say in-person events are irreplaceable because of their ability to drive commerce and networking that creates partnerships and innovation(1) 5:1 ROI for 14% of Fortune 500 companies from their trade show exhibitions(2) 40% of businesses say B2B exhibitions provide the highest value for their marketing objectives(3) 18% of Chief Marketing Officers cite customer acquisition, retention and engagement as their #1 priority in 2022, up from 10% in 2021(4) 17.6% 2021-2026 CAGR projected for B2B trade show market size(5)

Three Pillars of Value Creation�Emerald’s focus is on maximizing value of operations and expanding offerings Hired a head of product to action the holistic consolidated customer database 3-year brand operating plans across portfolio Value-based pricing structure Rigorous, perpetual brand reviews Improved customer retention Higher revenue per customer Focused investment in evolving brands Optimized event success and customer ROI Customer Centricity Emerald Xcelerator Targeted accretive M&A Partnership opportunities New event and content launches in growth categories Platform acquisitions in new growth categories Tuck-in acquisitions in existing strategic categories Portfolio Optimization Daily content and insights across 20 industries Scaled B2B marketplace Increased cadence of online offerings New revenue streams Powerful first-party data Improved cross selling efforts 365-Day Engagement

Acquisitions and New Event Launches Driving Portfolio Optimization�Strategic expansion into high growth industries and categories Entered long-term partnership with the NBA to launch fan events and festivals globally adjacent to high profile NBA events such as the All Star Game, NBA Draft and NBA Summer League Expect to ramp to multiple events, including international locations Select New Event Launches from Xcelerator New Event Launches Expected to Contribute 1-2 Percentage Points of Organic Revenue Growth per Year Educational platform that bridges business and Web3 innovation Will host second iteration at Retail Innovation Conference and Expo (RICE) with a focus on retail sector applications Launched in July 2023 Returned June 2023 B2B event dedicated to the Latin food and beverage sector Strengthens Emerald’s portfolio of leading food & beverage brands Launched in Sept. 2023 Social 3rd Party Digital Recent Acquisitions Leading B2B media company in the cannabis industry with portfolio of media brands + widely attended annual expo B2B e-commerce SaaS platform Premier global B2B event and thought leadership platform with a global presence Leading product database and integrator service provider for commercial AV Leading national trade show focused on educational spaces and equipment Subscription-based photography business education and e-learning service + conference Wholesale online marketplace platform to be combined with Emerald’s iconic NY NOW brand Launched June 2023 Leveraging the expertise of the Lodestone team, launched a consumer adventure travel and lifestyle show in June 2023 Leads into Emerald’s high profile Outdoor Retailer event Producer of Overland Expo adventure travel shows Launched in May 2022 New business unit dedicated to launching dynamic brands in emerging and high-growth markets Focused on new brands with an expected run rate of 4 – 6 shows per year

9 Adj. EBITDA(1) Free Cash Flow(2) Net Income Diluted Income (Loss) Per Share ($ in Millions) ($ in Millions) Excludes insurance proceeds (1) See slide 13 of this presentation for a reconciliation of Net Income (Loss) to Adjusted EBITDA and Adjusted EBITDA excluding event cancellation insurance proceeds. (2) The calculation of third quarter 2023 Free Cash Flow excluding event cancellation insurance proceeds, net, includes non-recurring acquisition related transaction costs of $0.9 million, acquisition integration, restructuring-related transition costs of $1.4 million, and non-recurring legal, audit and consulting fees of $0.8 million. The calculation of third quarter 2022 Free Cash Flow excluding event cancellation insurance proceeds, net, includes insurance settlement expenses of $7.0 million, contingent consideration paid in excess of the original estimate of $2.1 million, acquisition related transaction costs of $0.6 million, integration-related transition costs of $1.6 million, and non-recurring legal and consulting fees of $0.8 million. The total of these items is $3.1 million and $12.1 million for the quarters ended September 30, 2023 and 2022, respectively. Earnings Results Revenues of $281.3 million Diluted loss per share of ($0.33) Net income of $9.7 million Adjusted EBITDA excluding insurance proceeds of $59.1 million(1) Free cash flow excluding insurance proceeds of $12.5 million(2) Highlights and Developments Hosted first NBA Con fan event in Las Vegas in July as part of partnership with the NBA Hosted first iteration of Cocina Sabrosa in Irving, TX in September, serving the Latin food industry Events business account for 88% of YTD revenues Balance Sheet�(as of 9/30/2023) $200.3 million of cash and cash equivalents Full availability on $110 million revolver. Net debt of $214.0 million, including $414.3 million outstanding term loan balance Paid September 30th dividend on convertible preferred shares in cash, avoiding the issuance of 2.4 million shares on an as-converted basis Emerald experienced year over year growth across all categories as recovery momentum continues ($ in Millions) Excludes insurance proceeds Year-to-Date 2023 Financial Highlights and Current Liquidity Position

10 2023 Guidance Signals Covid Recovery and Company Growth Revenue ($ in Millions) Adjusted EBITDA ex-Insurance(1) ($ in Millions) $385-395 Guidance On average, revenue per event is progressing toward normalized levels Guidance implies ~25% Adj. EBITDA margins, with room for continued improvement to pre-COVID margins of ~35%+ Year-to-date Free Cash Flow consistent with expected seasonal patterns 2023 Guidance Updated FY 2023 Revenue now expected in the range of $385-395 million Updated FY 2023 Adjusted EBITDA now expected in the range of $95-100 million FY 2023 Free Cash Flow expected in the range of $50-60 million(1) (1) See slide 14 of this presentation for a reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow. (2) See slide 13 of this presentation for a reconciliation of Net (Loss) Income to Adjusted EBITDA and Adjusted EBITDA excluding event cancellation insurance proceeds.

Conservative Balance Sheet and Strong Liquidity:�Capital Structure As of September 30, 2023 Convertible Preferred Shares Issued $400M of Convertible Preferred Stock in 2020 during COVID business disruption Beginning in Q3 2023, Emerald may elect each quarter to pay the 7% per annum dividend in cash vs. in-kind (accretion to liquidation preference) Emerald can force conversion of preferred shares if common stock price exceeds $6.16 for 20 consecutive trading days (1) Debt includes outstanding gross balance of term loan. (2) Consolidated trailing twelve month EBITDA as of September 30, 2023 as defined in Amended and Restated Senior Secured Credit Facilities. Debt Full availability on $110 million revolver $403.0 million term loan balance outstanding (net of discount and fees) as of September 30, 2023 Common Shares Outstanding 62.9M Preferred Shares Liquidation Preference per Share as of September 30, 2023 $6.90 Initial Conversion Price / 3.52 Common Shares per Converted Preferred Share = 1.96 shares Convertible Preferred Shares Outstanding × 71.4M Additional Common Shares from Preferred Conversion = 139.9M Total Shares (as-converted basis) 202.8M Debt(1) $414.3 Cash and Cash Equivalents $200.3 Net Debt $214.0 Trailing Twelve Month EBITDA(2) $88.5 Net Debt / EBITDA 2.4x $ in millions

Appendix

Adjusted EBITDA UNAUDITED RECONCILIATION OF NET (LOSS) INCOME TO ADJUSTED EBITDA For the nine months ended September 30, 2022, represents non-cash charges of $6.3 million for goodwill in connection with the Company’s interim testing of goodwill for impairment resulting from the change in operating segments and reporting units that occurred in the first quarter of 2022. Intangible asset impairment charges for the nine months ended September 30, 2022 represent non-cash charges of $1.6 million for certain indefinite-lived intangible assets in connection with the Company’s interim testing of intangibles for impairment. Other items for the three months ended September 30, 2023 included: (i) $0.9 million in acquisition-related transaction costs; (ii) $1.4 million in acquisition integration and restructuring-related transition costs, including one-time severance expense of $0.6 million; (iii) $0.8 million in non-recurring legal, audit and consulting fees and (iv) $1.9 million in gains related to the remeasurement of contingent consideration. Other items for the three months ended September 30, 2022 included: (i) $3.7 million in gains related to the remeasurement of contingent consideration; (ii) $0.8 million in non-recurring legal, audit and consulting fees; (iii) $0.6 million in acquisition-related transaction costs; (iv) $1.6 million in transition expenses and (v) $7.0 million in insurance settlement related expenses. Other items for the nine months ended September 30, 2023 included: (i) $1.8 million in acquisition-related transaction costs; (ii) $4.0 million in acquisition integration and restructuring-related transition costs, including one-time severance expense of $1.3 million; (iii) $3.0 million in non-recurring legal, audit and consulting fees and (iv) $2.5 million in gains related to the remeasurement of contingent consideration. Other items for the nine months ended September 30, 2022 included: (i) $9.5 million in gains related to the remeasurement of contingent consideration; (ii) $2.0 million in non-recurring legal, audit and consulting fees; (iii) $3.4 million in acquisition-related transaction costs; (iv) $1.9 million in transition expenses and (v) $7.0 million in insurance settlement related expenses. Three Months Ended�September 30, Nine Months Ended�September 30, 2023 2022 2023 2022 (dollars in millions) �(unaudited) Net income $ 10.7 $ 93.0 $ 9.7 $ 108.4 Add (deduct): Interest expense, net 10.5 6.0 26.5 14.4 Loss on extinguishment of debt — — 2.3 — (Benefit from) provision for income taxes (22.3 ) 28.2 (24.0 ) 30.3 Goodwill impairment charge(1) — — — 6.3 Intangible asset impairment charge(2) — — — 1.6 Depreciation and amortization 8.8 14.7 35.2 43.0 Stock-based compensation 1.9 1.3 5.9 5.0 Deferred revenue adjustment — 0.2 — 0.6 Other items(3) 1.2 6.3 6.3 4.9 Adjusted EBITDA $ 10.8 $ 149.7 $ 61.9 $ 214.5 Deduct: Event cancellation insurance proceeds 2.8 151.0 2.8 182.8 Adjusted EBITDA excluding event cancellation insurance proceeds $ 8.0 $ (1.3 ) $ 59.1 $ 31.7

Free Cash Flow UNAUDITED RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW Three Months Ended�September 30, Nine Months Ended�September 30, 2023 2022 2023 2022 (dollars in millions)�(unaudited) Net Cash Provided by Operating Activities $ 8.5 $ 153.5 $ 24.7 $ 198.7 Less: Capital expenditures 3.0 2.6 9.4 7.5 Free Cash Flow $ 5.5 $ 150.9 $ 15.3 $ 191.2 Event cancellation insurance proceeds (2.8 ) (151.0 ) (2.8 ) (182.8 ) Free cash flow excluding event cancellation insurance proceeds, net $ 2.7 $ (0.1 ) $ 12.5 $ 8.4

v3.23.3

Document And Entity Information

|

Nov. 06, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 06, 2023

|

| Entity Registrant Name |

Emerald Holding, Inc.

|

| Entity Central Index Key |

0001579214

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-38076

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

42-1775077

|

| Entity Address, Address Line One |

100 Broadway, 14th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10005

|

| City Area Code |

(949)

|

| Local Phone Number |

226-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

EEX

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |