Equitable Holdings Mitigates Remaining Redundant Reserves Associated with New York’s Regulation 213 Through Proceeds of Reinsurance Transaction

16 August 2022 - 10:15PM

Business Wire

Equitable Holdings, Inc. (the “Company”) (NYSE: EQH) announced

today that it has mitigated the remaining $1 billion of redundant

reserves associated with New York’s Regulation 213 (“Reg. 213”).

The Company’s principal operating subsidiary Equitable Financial

Life Insurance Company (“EFLIC”) has entered into an agreement with

Global Atlantic Financial Group subsidiary, First Allmerica

Financial Life Insurance Company, to reinsure1 a 50% quota share of

pre-2009 Group Retirement VA contracts supported by approximately

$4 billion of general account assets and $6 billion of separate

account value.

The transaction completes a series of actions the Company has

taken to mitigate redundant statutory reserves associated with Reg.

213 by year end 2022.

The details of the transaction are as follows:

- The transaction is expected to result in a positive ceding

commission of approximately $1.1 billion to Equitable Financial

which the company will use to fund the remaining Reg. 213 redundant

reserves, securing future cash flows.

- The transaction predominantly includes our policies with the

highest guaranteed general account crediting rates of 3%.

- The general account assets will be transferred upon the close

of the transaction, which is expected in the second half of 2022.

AB will continue to be the preferred investment manager of

approximately half of the general account assets transferred.

- As a result of the transaction, there is a limited impact to

Group Retirement operating earnings of $10-15 million earnings per

annum.

Goldman Sachs & Co. LLC is serving as sole financial advisor

with Willkie Farr & Gallagher LLP acting as legal counsel to

Equitable in connection with this transaction.

About Equitable Holdings

Equitable Holdings, Inc. (NYSE: EQH) is a financial services

holding company comprised of two complementary and well-established

principal franchises, Equitable and AllianceBernstein. Founded in

1859, Equitable provides advice, protection and retirement

strategies to individuals, families and small businesses.

AllianceBernstein is a global investment management firm that

offers high-quality research and diversified investment services to

institutional investors, individuals and private wealth clients in

major world markets. Equitable Holdings has approximately 12,000

employees and financial professionals, $754 billion in assets under

management (as of 6/30/2022) and more than 5 million client

relationships globally.

Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Words such as “expects,” “believes,” “anticipates,”

“intends,” “seeks,” “aims,” “plans,” “assumes,” “estimates,”

“projects,” “should,” “would,” “could,” “may,” “will,” “shall” or

variations of such words are generally part of forward-looking

statements. Forward-looking statements are made based on

management’s current expectations and beliefs concerning future

developments and their potential effects upon Equitable Holdings,

Inc. (“Holdings”) and its consolidated subsidiaries. “We,” “us” and

“our” refer to Holdings and its consolidated subsidiaries, unless

the context refers only to Holdings as a corporate entity. There

can be no assurance that future developments affecting Holdings

will be those anticipated by management. Forward-looking statements

include, without limitation, all matters that are not historical

facts.

These forward-looking statements are not a guarantee of future

performance and involve risks and uncertainties, and there are

certain important factors that could cause actual results to

differ, possibly materially, from expectations or estimates

reflected in such forward-looking statements, including, among

others: (i) conditions in the financial markets and economy,

including the impact of COVID-19 and related economic conditions,

equity market declines and volatility, interest rate fluctuations,

impacts on our goodwill and changes in liquidity and access to and

cost of capital; (ii) operational factors, including reliance on

the payment of dividends to Holdings by its subsidiaries,

protection of confidential customer information or proprietary

business information, operational failures by us or our service

providers, and catastrophic events, such as the outbreak of

pandemic diseases including COVID-19; (iii) credit, counterparties

and investments, including counterparty default on derivative

contracts, failure of financial institutions, defaults by third

parties and affiliates and economic downturns, defaults and other

events adversely affecting our investments; (iv) our reinsurance

and hedging programs; (v) our products, structure and product

distribution, including variable annuity guaranteed benefits

features within certain of our products, variations in statutory

capital requirements, financial strength and claims-paying ratings,

state insurance laws limiting the ability of our insurance

subsidiaries to pay dividends and key product distribution

relationships; (vi) estimates, assumptions and valuations,

including risk management policies and procedures, potential

inadequacy of reserves and experience differing from pricing

expectations, amortization of deferred acquisition costs and

financial models; (vii) our Investment Management and Research

segment, including fluctuations in assets under management and the

industry-wide shift from actively-managed investment services to

passive services; (viii) legal and regulatory risks, including

federal and state legislation affecting financial institutions,

insurance regulation and tax reform; (ix) risks related to our

common stock and (x) general risks, including strong industry

competition, information systems failing or being compromised and

protecting our intellectual property.

Forward-looking statements should be read in conjunction with

the other cautionary statements, risks, uncertainties and other

factors identified in Holdings’ filings with the Securities and

Exchange Commission. Further, any forward-looking statement speaks

only as of the date on which it is made, and we undertake no

obligation to update or revise any forward-looking statement to

reflect events or circumstances after the date on which the

statement is made or to reflect the occurrence of unanticipated

events, except as otherwise may be required by law.

_______________________ 1 Equitable Financial entered into an

agreement with First Allmerica Financial Life Insurance Company, a

wholly-owned subsidiary of Global Atlantic, pursuant to which

Equitable Financial will cede a 50% quota share on a combined

coinsurance and modified coinsurance basis.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220816005555/en/

Investor Relations Işıl Müderrisoğlu (212) 314-2476

IR@equitable.com

Media Relations Todd Williamson (212) 314-2010

mediarelations@equitable.com

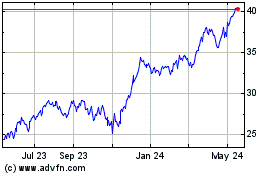

Equitable (NYSE:EQH)

Historical Stock Chart

From Oct 2024 to Nov 2024

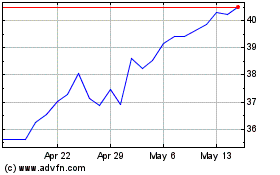

Equitable (NYSE:EQH)

Historical Stock Chart

From Nov 2023 to Nov 2024