- Vertical Aerospace secures agreement under which Mudrick

Capital will commit up to $50 million in the next equity round,

promoting financial stability.

- Transaction is expected to add approximately $180 million to

Vertical’s balance sheet, including through the conversion of

approximately $130 million of debt into equity, significantly

reducing Vertical’s debt. The conversion price of the remaining

convertible notes will be fixed.

- Founder, Stephen Fitzpatrick, retains a strategic role as a

board director to guide the company through its Flightpath 2030

Strategy.

Vertical Aerospace (Vertical) [NYSE: EVTL], a global aerospace

and technology company pioneering electric aviation, today

announced the signing of a term sheet among the Company, its

majority shareholder Stephen Fitzpatrick, and its primary creditor

Mudrick Capital Management.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241125462402/en/

The VX4 during piloted, untethered

testing (Photo: Business Wire)

This term sheet secures a commitment to $50 million in new

funding, strengthening Vertical’s financial position. The funding

will support the company’s newly launched Flightpath 2030 Strategy

to establish itself as a global leader in the eVTOL market by the

end of the decade, including the ongoing development and

certification of the VX4.

The term sheet includes:

- $50 million funding commitment by Mudrick Capital:

commitment includes $25 million in upfront funding, and an

additional $25 million backstop that will be reduced by any amounts

raised from third parties. The term sheet includes the option for

Stephen Fitzpatrick to invest a further $25 million on the same

terms.

- Balance sheet strengthening: approximately $130 million

of convertible notes (50% of the outstanding amount) will be

converted into equity at $2.75 per share, substantially reducing

Vertical’s debt and significantly deleveraging the company’s

balance sheet, enhancing its financial position.

- Greater certainty for future investors: by fixing the

conversion price for the remaining outstanding convertible notes at

$3.50 per share, Vertical’s future fundraising plans will be

supported.

- Remaining loan repayment date extended to December 2028:

extension of term provides further security through Vertical’s

certification programme.

- Renewed commitment to the UK: Vertical will continue to

operate from its UK headquarters, maintaining its brand identity

and focus on innovation.

As part of the agreement, Vertical Aerospace’s founder, Stephen

Fitzpatrick, will remain on the board, continuing to provide

strategic direction as the company progresses through its

certification programme.

Stephen Fitzpatrick, Founder of Vertical Aerospace:

“It is great to be able to announce this new funding today. We

have been working hard to find a way to support the company in the

short term, but also set us up for long term success. The

additional equity and stronger balance sheet will enable us to fund

the next phase of our development programme and deliver on our

mission to bring the amazing electric aircraft to the skies.

This comprehensive deal - alongside the recent piloted flight

campaign and launch of the Flightpath 2030 strategy - means

Vertical is positioned to be a winner in one of the 21st century's

most exciting technologies.

The UK has been at the forefront of the aerospace industry for

the last hundred years. Aviation is one of the hardest sectors to

decarbonise but ambitious British companies like Vertical are

leading the world in pioneering zero emissions electric

aircraft.”

Jason Mudrick, Founder and Chief Investment Officer at

Mudrick Capital:

“This agreement underscores our appreciation of Vertical

Aerospace’s position in the eVTOL sector and a team that has

demonstrated its ability to deliver groundbreaking solutions for

the future of sustainable aviation. By committing up to $50 million

to the business and converting substantial debt into equity, we’re

supporting a company, its leadership team and partners, as Vertical

brings the safest and most versatile aircraft to market.”

Stuart Simpson, CEO of Vertical Aerospace:

"This funding agreement underscores the strong confidence of our

investors in our Flightpath 2030 Strategy and our ambition to lead

the global eVTOL market. By addressing our more immediate capital

needs and positioning us well to secure funding for the long-term,

we can focus on advancing our piloted flight test programme and

bringing the VX4 to market."

Vertical’s piloted flight test programme is progressing further

toward certification, recently achieving untethered, piloted

thrustborne flight in Phase 2 of testing. With the VX4 prototype

performing beyond expectations, the company is now working with the

UK Civil Aviation Authority to secure permits to move into Phase 3

— wingborne flight tests, which is a critical step toward

certification.

The parties have signed a non-binding term sheet reflecting the

material terms of the agreement in principle. It remains subject to

implementation and execution of final transaction agreements, as

well as shareholder approval of amendments to Vertical’s articles

of association. Additional information can be found in the

Company’s Form 6-K furnished to the Securities and Exchange

Commission on November 25, 2024.

About Vertical Aerospace

Vertical Aerospace is a global aerospace and technology company

pioneering electric aviation. Vertical is creating a safer, cleaner

and quieter way to travel. Vertical’s VX4 is a piloted, four

passenger, Electric Vertical Take-Off and Landing (eVTOL) aircraft,

with zero operating emissions. Vertical combines partnering with

leading aerospace companies, including GKN, Honeywell and Leonardo,

with developing its own proprietary battery and propeller

technology to develop the world’s most advanced and safest

eVTOL.

Vertical has c.1,500 pre-orders of the VX4, with customers

across four continents, including American Airlines, Japan

Airlines, GOL and Bristow. Headquartered in Bristol, the epicentre

of the UK’s aerospace industry, Vertical was founded in 2016 by

Stephen Fitzpatrick, founder of the OVO Group, Europe’s largest

independent energy retailer. Vertical’s experienced leadership team

comes from top tier automotive and aerospace companies such as

Rolls-Royce, Airbus, GM and Leonardo. Together they have previously

certified and supported over 30 different civil and military

aircraft and propulsion systems.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Any express or implied statements contained in this Form 6-K

that are not statements of historical fact may be deemed to be

forward-looking statements, including, without limitation,

statements regarding the consummation of the agreement in

principle, including the entry into final transaction agreements

and the satisfaction of all closing conditions, completion of the

committed funding from Mudrick Capital and use of proceeds

therefrom, the sufficiency of the proceeds from the committed

funding to meet the Company’s more immediate capital expenditure

requirements, the Company’s satisfaction of all closing conditions

to the committed funding, our ability and plans to raise additional

capital to fund our operations, as well as statements that include

the words “expect,” “intend,” “plan,” “believe,” “project,”

“forecast,” “estimate,” “may,” “should,” “anticipate,” “will,”

“aim,” “potential,” “continue,” “is/are likely to” and similar

statements of a future or forward-looking nature. These

forward-looking statements reflect our current views with respect

to future events and are not a guarantee of future performance.

Actual outcomes may differ materially from the information

contained in the forward-looking statements as a result of a number

of factors, including, without limitation, the important factors

discussed under the caption “Risk Factors” in the Company's Annual

Report on Form 20-F filed with the U.S. Securities and Exchange

Commission (“SEC”) on March 14, 2024, as such factors may be

updated from time to time in the Company’s other filings with the

SEC. Any forward-looking statements contained in this Form 6-K

speak only as of the date hereof and accordingly undue reliance

should not be placed on such statements. The Company disclaims any

obligation or undertaking to update or revise any forward-looking

statements contained in this Form 6-K, whether as a result of new

information, future events or otherwise, other than to the extent

required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125462402/en/

For more information:

Justin Bates, Head of Communications

justin.bates@vertical-aerospace.com +44 7878 357 463

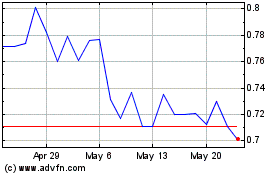

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Feb 2024 to Feb 2025