0000040545false00000405452024-02-292024-02-290000040545us-gaap:CommonStockMember2024-02-292024-02-290000040545ge:A0.875NotesDue2025Member2024-02-292024-02-290000040545ge:A1.875NotesDue2027Member2024-02-292024-02-290000040545ge:A1.500NotesDue2029Member2024-02-292024-02-290000040545ge:A7.5GuaranteedSubordinatedNotesDue2035Member2024-02-292024-02-290000040545ge:A2.125NotesDue2037Member2024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 29, 2024

General Electric Company

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| New York | | 001-00035 | | 14-0689340 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | |

| One Financial Center, Suite 3700, | Boston, | MA | | | | 02111 |

| (Address of principal executive offices) | | | | (Zip Code) |

| | | | | | |

(Registrant’s telephone number, including area code) (617) 443-3000

_______________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common stock, par value $0.01 per share | GE | New York Stock Exchange |

0.875% Notes due 2025 | GE 25 | New York Stock Exchange |

1.875% Notes due 2027 | GE 27E | New York Stock Exchange |

1.500% Notes due 2029 | GE 29 | New York Stock Exchange |

7 1/2% Guaranteed Subordinated Notes due 2035 | GE /35 | New York Stock Exchange |

2.125% Notes due 2037 | GE 37 | New York Stock Exchange |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 8.01 Other Events.

On February 29, 2024, General Electric Company (“GE”) announced that its board of directors has approved the previously announced separation of GE Vernova LLC, a direct, wholly-owned subsidiary of GE (the “Spin-Off”). Prior to the completion of the Spin-Off, GE Vernova LLC is expected to be converted into a corporation and renamed GE Vernova Inc. (“GE Vernova”). GE also announced the timing and details regarding GE’s distribution of all of the shares of common stock, par value $0.01 per share, of GE Vernova (the “GE Vernova Common Stock”), to holders of GE common stock as a pro rata dividend in the Spin-Off. The distribution is expected to occur before the U.S. market open on April 2, 2024, and the GE Vernova Common Stock is expected to begin trading on the New York Stock Exchange on April 2, 2024 under the ticker “GEV.” Holders of GE common stock will be entitled to receive one share of GE Vernova Common Stock for every four shares of GE common stock held on March 19, 2024, the record date for the distribution. The distribution is subject to the satisfaction or waiver of certain conditions. A copy of the press release is attached as Exhibit 99.1 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit | Description |

| |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

Forward-looking statements.

This document contains “forward-looking statements” — that is, statements related to future, not past, events. These forward-looking statements often address GE’s expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “estimate,” “forecast,” “target,” “preliminary,” or “range.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and are subject to risks, uncertainties and assumptions. For GE, particular areas where risks or uncertainties could cause GE’s actual results to be materially different than those expressed in GE’s forward-looking statements include: GE’s success in executing planned and potential transactions, including GE’s plan to pursue the Spin-Off, and sales or other dispositions of GE’s remaining equity interest in GE HealthCare, the timing for such transactions, the ability to satisfy any applicable pre-conditions, and the expected proceeds, consideration and benefits to GE; changes in macroeconomic and market conditions and market volatility, including risk of recession, inflation, supply chain constraints or disruptions, interest rates, the value of securities and other financial assets (including GE’s equity interest in GE HealthCare), oil, natural gas and other commodity prices and exchange rates, and the impact of such changes and volatility on GE’s business operations, financial results and financial position; and GE’s capital allocation plans, including the timing and amount of dividends, share repurchases, acquisitions, organic investments, and other priorities; and other factors that are described in the “Risk Factors” section of GE’s Annual Report on Form 10-K for the year ended December 31, 2023, as such description may be updated or amended in any future reports that GE files with the SEC. These or other uncertainties may cause GE’s actual future results to be materially different than those expressed in its forward-looking statements. GE does not undertake to update its forward-looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | General Electric Company | |

| | (Registrant) | |

| | | |

Date: February 29, 2024 | | /s/ Brandon Smith | |

| | Brandon Smith Vice President, Chief Corporate, Securities & Finance Counsel | |

GE Board of Directors Approves Spin-Off of GE Vernova; GE Vernova and GE Aerospace to Launch April 2, 2024

•Board sets spin-off date for GE Vernova (NYSE: GEV) of April 2, 2024, pre-market

•Shareholders of record on March 19, 2024, will receive one share of GE Vernova for every four shares of GE owned

•Following the planned spin-off of GE Vernova, GE shareholders will continue to hold their GE shares as GE Aerospace shares

BOSTON – February 29, 2024 – General Electric Company (“GE”) (NYSE: GE) today announced that its Board of Directors has approved the previously announced spin-off of GE Vernova.1 The company is expected to begin trading on the New York Stock Exchange (“NYSE”) on April 2, 2024, under the ticker symbol “GEV”.

GE Chairman and CEO and GE Aerospace CEO H. Lawrence Culp, Jr. said, “Today’s announcement clears the way for the historic launches of GE Vernova and GE Aerospace, completing our transformation into three independent, investment-grade industry leaders. Beginning April 2, both companies will be fully independent, with GE Vernova positioned to lead the energy transition guided by Scott Strazik and his team, and GE Aerospace set up to define flight for today, tomorrow, and the future. We are all excited about the opportunity and the responsibility ahead of us.”

To effect the separation, GE’s Board of Directors approved a distribution to GE shareholders of all shares of GE Vernova’s common stock. Holders of GE common stock will be entitled to receive one share of GE Vernova common stock for every four shares of GE common stock held on March 19, 2024, the record date for the distribution. The distribution is expected to occur before U.S. market open on April 2, 2024. For U.S. federal income tax purposes, the distribution will be conducted in a tax-efficient manner for GE shareholders in the United States. The distribution is subject to certain conditions described in the registration statement on Form 10 filed by GE Vernova.

GE shareholders do not need to take any action to receive shares of GE Vernova common stock to which they are entitled as a GE shareholder. Additionally, shareholders do not need to pay any consideration, or surrender or exchange shares of GE common stock, to participate in the separation.

Following completion of the planned spin-off, GE will operate as GE Aerospace. GE shareholders will continue to hold their shares of GE common stock with the company name GE Aerospace, and GE Aerospace will continue GE’s listing on the NYSE under the ticker symbol “GE.”2

When-Issued Trading to Begin for GE Vernova on the New York Stock Exchange (the “NYSE”)

1 Prior to the spin-off, GE Vernova is expected to be converted into a corporation and renamed GE Vernova Inc. (“GE Vernova”)

2 General Electric Company will use the brand name GE Aerospace, which it has also registered as an assumed/doing business as name in New York state.

GE anticipates that “when-issued” trading in GE Vernova common stock on the NYSE will begin on or about March 27, 2024, under the symbol “GEV WI,” and GE Vernova common stock will begin “regular-way” trading on the NYSE on the distribution date, April 2, 2024, under the symbol “GEV.”

Beginning on March 27, 2024 and continuing through April 1, 2024, it is expected that there will be two markets in GE common stock on the NYSE: a “regular-way” market under the symbol “GE,” in which GE shares will trade with the right to receive shares of GE Vernova common stock in the distribution, and an “ex distribution market” under the symbol “GE WI” in which GE shares will trade as GE Aerospace without the right to receive shares of GE Vernova common stock in the distribution.

GE shareholders who hold shares of common stock on the record date of March 19, 2024, and decide to sell any of those shares before the distribution date should consult their stockbroker, bank or other nominee to understand whether, the shares of GE common stock will be sold with or without entitlement to GE Vernova common stock distributed pursuant to the distribution.

GE Vernova and GE Aerospace Investor Days Next Week

As previously announced, GE Vernova and GE Aerospace will host investor days on Wednesday, March 6 and Thursday, March 7, 2024 respectively, in New York, NY. Both companies’ management teams will present their growth strategies and a showcase of their innovative solutions.

Investors, media, and members of the general public are invited to learn more about the pending spin-off at: https://www.ge.com/investor-relations/spinoff-resources. Future updates to the Form 10 will be filed with the SEC and may be viewed at www.sec.gov as filings under GE Vernova. The Form 10 is subject to change and will be made final prior to the effective date. Refer also to https://www.gevernova.com/investors for information and updates about GE Vernova.

Forward-looking Statements

This document contains forward-looking statements – that is, statements related to future events that by their nature address matters that are, to different degrees, uncertain. For details on the uncertainties that may cause our actual future results to be materially different than those expressed in our forward-looking statements, including (1) our success in executing planned and potential transactions, including our plan to pursue a spin-off of GE Vernova, and sales or other dispositions of our remaining equity interest in GE HealthCare, the timing for such transactions, the ability to satisfy any applicable pre-conditions, and the expected proceeds, consideration and benefits to GE; (2) changes in macroeconomic and market conditions and market volatility, including risk of recession, inflation, supply chain constraints or disruptions, interest rates, the value of securities and other financial assets (including our equity interest in GE HealthCare), oil, natural gas and other commodity prices and exchange rates, and the impact of such changes and volatility on our business operations, financial results and financial position and (3) our capital allocation plans, including the timing and amount of dividends, share repurchases, acquisitions, organic investments, and other priorities, see https://www.ge.com/investor-relations/important-forward-looking-statement-information, as well as our SEC filings. We do not undertake to update our forward-looking statements.

About GE

GE (NYSE:GE) rises to the challenge of building a world that works. For more than 130 years, GE has invented the future of industry, and today the company’s dedicated team, leading technology, and global reach and capabilities help the world work more safely, efficiently, and reliably. GE’s people are diverse and dedicated, operating with the highest level of integrity and focus to fulfill GE’s mission and deliver for its customers. www.ge.com

About GE Aerospace

GE Aerospace, an operating unit of GE (NYSE: GE), is a world-leading provider of jet engines, components, and systems for commercial and military aircraft with a global service network to support these offerings. GE Aerospace and its joint ventures have an installed base of more than 44,000 commercial and 26,000 military aircraft engines, and the business is playing a vital role in shaping the future of flight.

About GE Vernova

GE Vernova is a planned, purpose-built global energy company that includes Power, Wind, and Electrification businesses and is supported by its accelerator businesses of Advanced Research, Consulting Services, and Financial Services. Building on over 130 years of experience tackling the world’s challenges, GE Vernova is uniquely positioned to help lead the energy transition by continuing to electrify the world while simultaneously working to decarbonize it. GE Vernova helps customers power economies and deliver electricity that is vital to health, safety, security, and improved quality of life. GE Vernova is headquartered in Cambridge, Massachusetts, U.S., with more than 80,000 employees across 100+ countries around the world.

GE Vernova’s mission is embedded in its name – it retains its legacy, “GE,” as an enduring and hard-earned badge of quality and ingenuity. “Ver” / “verde” signal Earth’s verdant and lush ecosystems. “Nova,” from the Latin “novus,” nods to a new, innovative era of lower carbon energy. Supported by the Company Purpose, The Energy to Change the World, GE Vernova will help deliver a more affordable, reliable, sustainable, and secure energy future. Learn more: GE Vernova and LinkedIn.

Contact

GE and GE Aerospace Investor Contact:

Steve Winoker

617.443.3400

swinoker@ge.com

GE Vernova Investor Contact

Michael Lapides

631.662.4317

michael.lapides@ge.com

GE Media Contact

Mary Kate Mullaney

202.304.6514

marykate.nevin@ge.com

GE Aerospace Media Contact

Nicole Sizemore

203.945.9783

nicole.sizemore@ge.com

GE Vernova Media Contact

Adam Tucker

518.227.2463

adam.tucker@ge.com

v3.24.0.1

Cover Page

|

Feb. 29, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 29, 2024

|

| Entity Registrant Name |

General Electric Co

|

| Entity Central Index Key |

0000040545

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

NY

|

| Entity File Number |

001-00035

|

| Entity Tax Identification Number |

14-0689340

|

| Entity Address, Address Line One |

One Financial Center, Suite 3700,

|

| Entity Address, City or Town |

Boston,

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02111

|

| City Area Code |

617

|

| Local Phone Number |

443-3000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

GE

|

| Security Exchange Name |

NYSE

|

| 0.875% Notes Due 2025 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.875% Notes due 2025

|

| Trading Symbol |

GE 25

|

| Security Exchange Name |

NYSE

|

| 1.875% Notes Due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.875% Notes due 2027

|

| Trading Symbol |

GE 27E

|

| Security Exchange Name |

NYSE

|

| 1.500% Notes Due 2029 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.500% Notes due 2029

|

| Trading Symbol |

GE 29

|

| Security Exchange Name |

NYSE

|

| 7.5% Guaranteed Subordinated Notes Due 2035 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

7 1/2% Guaranteed Subordinated Notes due 2035

|

| Trading Symbol |

GE /35

|

| Security Exchange Name |

NYSE

|

| 2.125% Notes Due 2037 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.125% Notes due 2037

|

| Trading Symbol |

GE 37

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A0.875NotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A1.875NotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A1.500NotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A7.5GuaranteedSubordinatedNotesDue2035Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ge_A2.125NotesDue2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

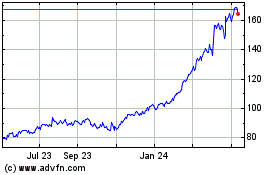

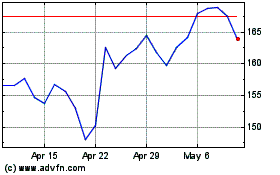

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024