Genesis Energy, L.P. Announces Tender Offer for up to $385 Million Aggregate Principal Amount of Its 8.0% Senior Notes Due 2027

06 December 2024 - 1:16AM

Business Wire

Genesis Energy, L.P. (NYSE: GEL) today announced the

commencement of a cash tender offer to purchase up to $385 million

(the “Tender Cap”) of the outstanding aggregate principal amount of

the 8.0% senior notes due 2027 (the “Notes”) that we co-issued with

our subsidiary, Genesis Energy Finance Corporation (such

transaction, the “Tender Offer”). As of December 5, 2024,

$981,245,000 aggregate principal amount of the Notes were

outstanding. The Tender Offer is being made pursuant to the terms

and conditions of an offer to purchase, dated as of December 5,

2024 (as may be amended or supplemented from time to time, the

“Offer to Purchase”).

Notes validly tendered and not validly withdrawn at or prior to

5:00 p.m., New York City time, on December 18, 2024, unless

extended (such time and date as the same may be extended the “Early

Tender Deadline”), will be eligible to receive a purchase price of

$1,021.90 per $1,000 principal amount of Notes tendered, including

an early tender payment of $30.00 per $1,000 principal amount of

the Notes tendered. Notes validly tendered and not validly

withdrawn after the Early Tender Deadline but at or prior to 5:00

p.m., New York City time, on January 6, 2025, unless extended or

earlier terminated (such time and date as the same may be extended

the “Expiration Time”), will be eligible to receive a purchase

price of $991.90 per $1,000 principal amount of Notes tendered.

Tendering holders will also receive accrued and unpaid interest

from the last interest payment date to, but not including, the

applicable settlement date. Settlement for the Notes validly

tendered and not validly withdrawn by the Early Tender Deadline is

expected to occur on December 20, 2024 and settlement for the Notes

validly tendered and not validly withdrawn after the Early Tender

Deadline but at or prior to the Expiration Time is expected to

occur on January 8, 2025, in each case assuming the Early Tender

Deadline and Expiration Time, respectively, are not extended by us

and that the Tender Offer is not terminated by us.

The Tender Offer is contingent upon, among other things, the

receipt by us after the date hereof of net proceeds from one or

more offerings of senior notes by us (the “Financing”) which will

provide us with an amount of funds that is sufficient in our

reasonable discretion to fund the purchase of all the Notes that

would be accepted for payment in the Tender Offer, assuming the

Tender Offer was fully subscribed. The Tender Offer is not

conditioned on any minimum amount of Notes being tendered. We may

amend, extend or terminate the Tender Offer in our sole discretion,

subject to applicable law. We expressly reserve the right, in our

sole discretion, subject to applicable law, to terminate the Tender

Offer at any time prior to the Expiration Time. We will not be

required to purchase any of the Notes tendered unless certain

conditions have been satisfied.

We currently intend, but are not obligated, to exercise our

right to redeem Notes in an aggregate principal amount that

together with the aggregate principal amount of notes purchased in

the Tender Offer would equal the Tender Offer Cap. However, we may,

but are not obligated to, redeem a greater amount of Notes that

remain outstanding after completion of the Tender Offer.

Subject to certain exceptions, tendered Notes can only be

withdrawn before 5:00 p.m., New York City time, on the Early Tender

Deadline, unless extended (such time and date as the same may be

extended the “Withdrawal Deadline”). Following the Withdrawal

Deadline, holders who have tendered their Notes may not withdraw

such Notes unless we are required to extend withdrawal rights under

applicable law.

In connection with the Tender Offer, we have retained Wells

Fargo Securities, LLC as the Dealer Manager. Questions regarding

the Tender Offer should be directed to Wells Fargo Securities, LLC

by calling collect at (704) 410-4820 or toll free at (866) 309-

6316. Requests for copies of the Offer to Purchase and related

documents should be directed to D.F. King & Co., Inc., the

Tender Agent and Information Agent for the Tender Offer, at (866)

342-4883 (toll free).

This press release is not an offer to purchase or a solicitation

of an offer to sell with respect to any Notes or any other

securities. Any offer to purchase the Notes will be made by means

of an Offer to Purchase. No offer to purchase will be made in any

jurisdiction in which such an offer to purchase would be unlawful.

In addition, nothing contained herein constitutes a notice of

redemption of the Notes. No recommendation is made as to whether

holders of the Notes should tender their Notes.

This press release includes forward-looking statements as

defined under federal law. Although we believe that our

expectations are based upon reasonable assumptions, no assurance

can be given that our goals will be achieved, including statements

related to the Tender Offer. For a discussion of some of the risks

and important factors that could affect such forward-looking

statements, see the sections entitled “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” in the Company’s most recent Annual Report

on Form 10-K and Quarterly Reports on Form 10-Q, which are publicly

available on our website at https://www.genesisenergy.com/. Actual

results may vary materially. We undertake no obligation to publicly

update or revise any forward- looking statement.

Genesis Energy, L.P. is a diversified midstream energy master

limited partnership headquartered in Houston, Texas. Genesis’

operations include offshore pipeline transportation, soda and

sulfur services, marine transportation and onshore facilities and

transportation. Genesis’ operations are primarily located in the

Gulf Coast region of the United States, Wyoming and the Gulf of

Mexico.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241205461743/en/

Genesis Energy, L.P. Dwayne Morley VP – Investor Relations (713)

860-2536

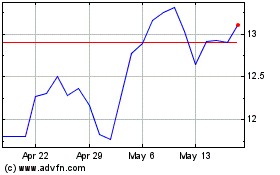

Genesis Energy (NYSE:GEL)

Historical Stock Chart

From Nov 2024 to Dec 2024

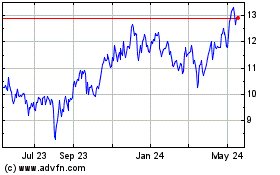

Genesis Energy (NYSE:GEL)

Historical Stock Chart

From Dec 2023 to Dec 2024