Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

02 April 2024 - 3:47AM

Edgar (US Regulatory)

| Saba Capital Income & Opportunities Fund II |

Consolidated Schedule of Investments |

| |

January

31, 2024 |

| | |

Principal

Amount | | |

Fair

Value | |

CORPORATE BONDS - 6.78% | |

| | |

| |

| Communications - 4.85% | |

| | |

| |

| AMC Entertainment Holdings Inc, 7.50%, 02/15/2029 | |

$ | 3,110,000 | | |

$ | 2,005,950 | |

| Clear Channel Outdoor Holdings Inc, 7.75%, 04/15/2028 | |

| 5,000,000 | | |

| 4,337,500 | |

| CommScope Inc, 8.25%, 03/01/2027 | |

| 1,079,000 | | |

| 512,525 | |

| Level 3 Financing Inc, 10.50%, 05/15/2030 | |

| 5,000,000 | | |

| 4,975,000 | |

| | |

| | | |

| 11,830,975 | |

| Consumer, Non-cyclical - 1.90% | |

| | | |

| | |

| Community Health Systems Inc, 5.625%, 03/15/2027 | |

| 5,000,000 | | |

| 4,625,000 | |

| | |

| | | |

| 4,625,000 | |

| Real Estate - 0.02% | |

| | | |

| | |

| China Evergrande Group, 8.750%, 06/28/2025(b)(d) | |

| 5,000,000 | | |

| 56,250 | |

| | |

| | | |

| 56,250 | |

| | |

| | | |

| | |

| TOTAL CORPORATE BONDS | |

| | | |

| 16,512,225 | |

| (Cost $16,550,577) | |

| | | |

| | |

| | |

Principal

Amount | | |

Fair

Value | |

| SENIOR LOANS - 3.23% | |

| | |

| |

| Consumer Discretionary - 1.34% | |

| | |

| |

| R.R. Donnelley & Sons Company, First Lien Term B Loan,

TSR1M + 7.250%, 03/17/2028(a) | |

| 497,491 | | |

| 500,213 | |

| ClubCorp Holdings Inc, Term Loan, 1M SOFR + 5%, 09/18/2026 | |

| 2,799,000 | | |

| 2,769,610 | |

| | |

| | | |

| 3,269,823 | |

| Consumer, Non-cyclical - 1.28% | |

| | | |

| | |

| Revlon Intermediate Holdings IV LLC, Term Loan, 1M

SOFR + 6.875%, 05/02/2028 | |

| 3,111,000 | | |

| 3,126,555 | |

| | |

| | | |

| | |

| Industrials - 0.61% | |

| | | |

| | |

| Moran Foods 1st Lien A&R 2023 FLSO PIK Term Loan,

TSFR3M + 7.250%, 12/31/2026 | |

| 1,555,000 | | |

| 1,480,251 | |

| | |

| | | |

| 1,480,251 | |

| | |

| | | |

| | |

| TOTAL SENIOR LOANS | |

| | | |

| 7,876,629 | |

| (Cost $7,879,738) | |

| | | |

| | |

| | |

Principal

Amount | | |

Fair

Value | |

| MORTGAGE-BACKED SECURITIES - 0.54% | |

| | |

| |

| Federal National Mortgage Association (FNMA) - 0.54% | |

| | |

| |

| FNMA, 3.000%, 05/25/2051 | |

| 6,992,530 | | |

| 1,315,017 | |

| | |

| | | |

| | |

| TOTAL MORTGAGE-BACKED

SECURITIES | |

| | | |

| 1,315,017 | |

| (Cost $1,309,126) | |

| | | |

| | |

| Annual Report | January 31, 2024 |

19 |

| Saba Capital Income & Opportunities Fund II |

Consolidated Schedule of Investments |

| |

January

31, 2024 |

| | |

Shares | | |

Fair

Value | |

| COMMON STOCK - 1.48% | |

| | |

| |

| Communication Services - 1.23% | |

| | |

| |

| Arbe

Robotics, Ltd.(e) | |

| 371,004 | | |

$ | 3,005,132 | |

| | |

| | | |

| 3,005,132 | |

| Consumer Discretionary - 0.25% | |

| | | |

| | |

| Polestar Automotive Holding UK

PLC | |

| 275,437 | | |

| 597,698 | |

| | |

| | | |

| 597,698 | |

| Consumer Staples - 0.00%(c) | |

| | | |

| | |

| Moran

Foods LLC(f) | |

| 3,699,885 | | |

| - | |

| | |

| | | |

| - | |

| | |

| | | |

| | |

| TOTAL COMMON

STOCK | |

| | | |

| 3,602,830 | |

| (Cost $3,717,004) | |

| | | |

| | |

| | |

Shares | | |

Fair

Value | |

| CLOSED END FUNDS - 12.38% | |

| | |

| |

| Alternative - 1.30% | |

| | |

| |

| Blackrock ESG Capital Allocation Trust | |

| 121,074 | | |

| 1,985,614 | |

| Platinum Asia Investments Ltd | |

| 2,272,361 | | |

| 1,185,175 | |

| | |

| | | |

| 3,170,789 | |

| | |

| | | |

| | |

| Equity - 7.68% | |

| | | |

| | |

| Aberdeen Global Dynamic Dividend Fund | |

| 14,535 | | |

| 133,867 | |

| abrdn Standard Global Infrastructure Income Fund | |

| 50,927 | | |

| 883,583 | |

| abrdn Standard Global Infrastructure Income Fund | |

| 16,258 | | |

| 128,763 | |

| Adams Diversified Equity Fund, Inc. | |

| 96,976 | | |

| 1,761,084 | |

| Adams Natural Resources Fund Inc. | |

| 37,130 | | |

| 760,051 | |

| BlackRock Enhanced Global Dividend Trust | |

| 3,737 | | |

| 37,258 | |

| BlackRock Enhanced International Dividend Trust | |

| 23,807 | | |

| 125,701 | |

| BlackRock Resources & Commodities Strategy Trust | |

| 17,497 | | |

| 149,074 | |

| BlackRock Science & Technology Trust II | |

| 146,440 | | |

| 2,488,016 | |

| Gabelli Dividend & Income Trust | |

| 59,672 | | |

| 1,282,948 | |

| Gabelli Healthcare & WellnessRx Trust | |

| 23,912 | | |

| 226,447 | |

| GAMCO Natural Resources Gold & Income Trust | |

| 3,582 | | |

| 17,731 | |

| iShares Russell 2000 ETF | |

| 4,565 | | |

| 880,497 | |

| Lazard Global Total Return and Income Fund Inc | |

| 5,169 | | |

| 79,344 | |

| MainStay CBRE Global Infrastructure Megatrends Term

Fund | |

| 60,263 | | |

| 779,201 | |

| Platinum Capital, Ltd. | |

| 80,386 | | |

| 68,295 | |

| Nuveen Real Asset Income and Growth Fund | |

| 50,741 | | |

| 594,177 | |

| Tekla Healthcare Investors(e) | |

| 68,181 | | |

| 1,167,941 | |

| Tekla Life Sciences Investors(e) | |

| 128,601 | | |

| 1,764,406 | |

| Tortoise Energy Infrastructure Fund, Inc. | |

| 15,834 | | |

| 458,711 | |

| Tortoise Midstream Energy Fund, Inc. | |

| 21,652 | | |

| 753,057 | |

| Tortoise Pipeline & Energy Fund, Inc. | |

| 3,607 | | |

| 103,809 | |

| Tortoise Energy Independence Fund, Inc. | |

| 17,699 | | |

| 510,908 | |

| WAM Global Ltd | |

| 617,825 | | |

| 818,757 | |

| Hearts and Minds Investments, Ltd. | |

| 1,524,301 | | |

| 2,630,053 | |

| Pengana International Equities,

Ltd. | |

| 168,532 | | |

| 123,834 | |

| | |

| | | |

| 18,727,513 | |

| Saba Capital Income & Opportunities Fund II |

Consolidated Schedule of Investments |

| |

January

31, 2024 |

| | |

Shares | | |

Fair

Value | |

| Fixed Income - 3.08% | |

| | |

| |

| AllianceBernstein National Municipal Income

Fund | |

| 79,712 | | |

$ | 864,078 | |

| BNY Mellon Municipal Income, Inc. | |

| 20,133 | | |

| 131,468 | |

| BNY Mellon Strategic Municipals Inc. | |

| 40,417 | | |

| 239,673 | |

| BlackRock New York Municipal Income Trust | |

| 26,865 | | |

| 283,157 | |

| BlackRock MuniHoldings New York Quality Fund, Inc. | |

| 1,007 | | |

| 10,684 | |

| BNY Mellon Strategic Municipal Bond Fund, Inc. | |

| 7,596 | | |

| 43,221 | |

| DWS Strategic Municipal Income Trust | |

| 15,370 | | |

| 136,639 | |

| Eaton Vance New York Municipal Bond Fund | |

| 19,040 | | |

| 186,402 | |

| Ellsworth Growth and Income Fund, Ltd. | |

| 5,295 | | |

| 41,883 | |

| Ellsworth Growth and Income Fund, Ltd. | |

| 1,643 | | |

| 17,301 | |

| Invesco Trust for Investment Grade New York Municipals | |

| 41,156 | | |

| 434,607 | |

| Invesco Pennsylvania Value Municipal Income Trust | |

| 28,614 | | |

| 289,574 | |

| Invesco Quality Municipal Income Trust | |

| 17 | | |

| 162 | |

| New America High Income Fund, Inc. | |

| 43,258 | | |

| 317,081 | |

| Nuveen Massachusetts Quality Municipal Income Fund | |

| 15,761 | | |

| 168,012 | |

| Nuveen Missouri Quality Municipal Income Fund | |

| 2,044 | | |

| 20,747 | |

| Nuveen Arizona Quality Municipal Income Fund | |

| 12,018 | | |

| 130,636 | |

| Nuveen AMT-Free Quality Municipal Income Fund | |

| 57,098 | | |

| 629,791 | |

| Nuveen California Quality Municipal Income Fund | |

| 41,372 | | |

| 456,747 | |

| Nuveen New Jersey Quality Municipal Income Fund | |

| 43,385 | | |

| 518,451 | |

| Nuveen Variable Rate Preferred and Income Fund | |

| 78,075 | | |

| 1,346,794 | |

| Nuveen Pennsylvania Quality Municipal Income Fund | |

| 83,280 | | |

| 974,376 | |

| Pioneer Municipal High Income Opportunities Fund, Inc. | |

| 4,798 | | |

| 51,387 | |

| Pioneer Municipal High Income Advantage Fund, Inc. | |

| 326 | | |

| 2,588 | |

| Pioneer Municipal High Income

Fund, Inc. | |

| 24,447 | | |

| 210,733 | |

| | |

| | | |

| 7,506,192 | |

| Mixed Allocation - 0.32% | |

| | | |

| | |

| Calamos Long/Short Equity &

Dynamic Income Trust | |

| 51,283 | | |

| 769,245 | |

| | |

| | | |

| 769,245 | |

| | |

| | | |

| | |

| TOTAL CLOSED

END FUNDS | |

| | | |

| 30,173,739 | |

| (Cost $29,928,644) | |

| | | |

| | |

| | |

Fair

Value | |

| PRIVATE FUND - 9.85% | |

| |

| Stone Ridge Opportunities

Fund Feeder LP(e) | |

| 24,000,000 | |

| | |

| | |

| TOTAL PRIVATE FUND | |

| 24,000,000 | |

| (Cost $24,000,000) | |

| | |

| | |

Contracts | | |

Fair

Value | |

| OPTIONS - 1.02% | |

| | |

| |

| Call Option Contracts - 1.02% | |

| | |

| |

| Alibaba Group Holding Ltd, Expires 03/15/24,

Strike Pirce $75.00 | |

| 4,037 | | |

| 1,271,655 | |

| iShares Russell 2000 ETF, Expires 04/19/24, Strike

Price $2.02 | |

| 159 | | |

| 68,688 | |

| iShares Russell 2000 ETF, Expires 04/19/24, Strike

Price $2.03 | |

| 1,180 | | |

| 472,000 | |

| iShares Russell 2000 ETF, Expires 04/19/24, Strike

Price $2.04 | |

| 342 | | |

| 129,276 | |

| iShares Russell 2000 ETF, Expires 04/19/24, Strike

Price $2.05 | |

| 799 | | |

| 264,469 | |

| iShares Russell 2000 ETF, Expires 04/19/24, Strike

Price $2.06 | |

| 300 | | |

| 91,800 | |

| iShares Russell 2000 ETF, Expires

04/19/24, Strike Price $2.08 | |

| 40 | | |

| 178,160 | |

| | |

| | | |

| | |

| TOTAL OPTIONS | |

| | | |

| 2,476,048 | |

| (Premiums paid $2,420,930) | |

| | | |

| | |

| Annual Report | January 31, 2024 |

21 |

| Saba Capital Income & Opportunities Fund II |

Consolidated Schedule of Investments |

| |

January

31, 2024 |

| | |

Shares | | |

Fair

Value | |

| SHORT TERM INVESTMENTS - 61.79% | |

| | |

| |

| JPMorgan US Treasury

Plus Money Market Fund, 7 Day Yield 5.19% | |

| 150,593,502 | | |

| 150,593,502 | |

| | |

| | | |

| | |

| TOTAL SHORT

TERM INVESTMENTS | |

| | | |

| 150,593,502 | |

| (Cost $150,593,502) | |

| | | |

| | |

| Total Investments in securities

- 97.06% | |

| | | |

| 236,549,990 | |

| (Cost $236,399,521) | |

| | | |

| | |

| Other Assets in Excess of Liabilities

- 2.94% | |

| | | |

| 7,155,671 | |

| NET ASSETS

- 100.00% | |

| | | |

$ | 243,705,661 | |

Amounts above are shown as a percentage

of net assets as of January 31, 2024.

SCHEDULE OF SECURITIES SOLD SHORT

| | |

Contracts | | |

Fair

Value | |

| OPTIONS - (0.08%) | |

| | |

| |

| Call Option Contracts - (0.08%) | |

| | | |

| | |

| Alibaba Group Holding

Ltd, Expires 03/15/24, Strike Pirce $90.00 | |

| (4,037 | ) | |

| (201,850 | ) |

| | |

| | | |

| | |

| TOTAL OPTIONS | |

| | | |

| (201,850 | ) |

| (Premiumns paid $213,851) | |

| | | |

| | |

| Total Securities Sold Short -

(0.08%) | |

| | | |

| (201,850 | ) |

| (Premiumns paid $213,851) | |

| | | |

| | |

| (a) | Security

exempt from registration under Rule 144A of the Securities Act of 1933 (the "Securities

Act"). Total market value of Rule 144A securities amounts to $500,213, which represented

approximately 0.21% of net assets as of January 31, 2024. Such securities may normally be

sold to qualified institutional buyers in transactions exempt from registration. |

| (b) | Security

is in default as of year-end and is therefore non-income producing. |

| (c) | Amount

represents less than 0.005% of net assets. |

| (d) | Securities

were originally issued pursuant to Regulation S under the Securities Act of 1933, which exempts

securities offered and sold outside of the United States from registration. Such securities

cannot be sold in the United States without either an effective registration statement filed

pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. As

of January 31, 2024, the aggregate market value of those securities was $56,250, which represents

approximately 0.02% of net assets. |

| (e) | Non-income

producing security. |

| (f) | On

January 31, 2024 the value of these investments amounted to $0, representing 0.0% of the

net assets of the Fund. |

Investment Abbreviations:

ESTRON - Euro Short-Term Rate

LIBOR - London Interbank Offered Rate

OBFR - United States Overnight Bank Funding

Rate

RBACOR - RBA Interbank Overnight Cash Rate

SOFR - Secured Overnight Financing Rate

SONIA - Sterling Over Night Index Average

Reference Rates:

ESTRON - Euro Short-Term Rate as of January

31, 2024 was 3.89%

OBFR - United States Overnight Bank Funding

Rate as of January 31, 2024 was 5.32%

RBACOR - RBA Interbank Overnight Cash Rate

as of January 31, 2024 was 4.32%

SOFR - Secured Overnight Financing Rate

as of January 31, 2024 was 5.32%

| Saba Capital Income & Opportunities Fund II |

Consolidated Schedule of Investments |

| |

January

31, 2024 |

TSFR1M - CME Term SOFR 1 Month as of January

31, 2024 was 5.33%.

TSFR3M - CME Term SOFR 3 Month as of January

31, 2024 was 5.32%

SONIA- Sterling Overnight Index Average

as of January 31, 2024 was 5.20%

PRIME - US Prime Rate as of January 31,

2024 was 8.5%

Counterparty Abbreviations:

JPM - JPMorgan Chase Bank, N.A.

GSI - Goldman Sachs International

MSCS - Morgan Stanley Capital Services

BARC

- Barclays Bank PLC

MSCO – Morgan Stanley & Company

FORWARD FOREIGN

CURRENCY CONTRACTS

| Counterparty | |

Settlement Date | |

Fund Receiving | |

Value | | |

Fund Delivering | |

Cost | | |

Unrealized Appreciation |

| JPM | |

2/8/2024 | |

USD | |

$ | 5,312,109 | | |

AUD | |

$ | 5,282,227 | | $ |

29,883 |

| | |

| |

| |

| | | |

| |

| | | $ |

29,883 |

FORWARD FOREIGN

CURRENCY CONTRACTS

| Counterparty | |

Settlement Date | |

Fund Receiving | |

Value | | |

Fund Delivering | | |

Cost | | |

Unrealized Depreciation | |

| JPM | |

2/8/2024 | |

| AUD | |

$ | 1,968,155 | | |

| USD | | |

$ | 1,978,710 | | |

$ | (10,555 | ) |

| | |

| |

| | |

| | | |

| | | |

| | | |

$ | (10,555 | ) |

| | | |

| |

| | |

| | | |

| | | |

| | | |

$ | 19,327 | |

FUTURES CONTRACTS

| Description | |

Number

of Contracts | |

Maturity

Date | |

Notional

Amount | |

Unrealized

Appreciation/

(Depreciation) | |

| Short Position Contracts | |

| |

| |

| |

| | |

| E-Mini Russ 2000 Mar24 | |

(18) | |

3/15/2024 | |

1,763,922 | |

| (3,612 | ) |

| | |

| |

| |

| |

$ | (3,612 | ) |

| | |

| |

| |

| |

$ | (3,612 | ) |

INDEX CREDIT DEFAULT SWAP CONTRACTS (CENTRALLY

CLEARED)

Buy/Sell

Protection(a) | |

Reference

Obligations | |

Annual Payment

Rate Received

(Paid) | | |

Currency | | |

Maturity

Date | |

Notional Amount(b) | | |

Value | | |

Upfront

Premiums

Received/(Paid) | | |

Unrealized

Appreciation/

(Depreciation) | |

| Buy | |

Markit CDX High Yield Index, Series 41 | |

| (5.00 | )% | |

| USD | | |

12/20/2028 | |

| 83,569,860 | | |

$ | (5,210,346 | ) | |

$ | 4,870,980 | | |

$ | (339,366 | ) |

| | |

| |

| | | |

| | | |

| |

| | | |

$ | (5,210,346 | ) | |

$ | 4,870,980 | | |

$ | (339,366 | ) |

| Annual Report | January 31, 2024 |

23 |

| Saba Capital Income & Opportunities Fund II |

Consolidated Schedule of Investments |

| |

January

31, 2024 |

SINGLE NAME CREDIT DEFAULT SWAP CONTRACTS

(OVER THE COUNTER)

Buy/Sell Protection(a) | |

Reference

Obligations | |

Annual Payment Rate Received (Paid) | |

Currency | |

Maturity Date | |

Notional Amount(b) | |

Value | |

Upfront Premiums Received/(Paid) | |

Unrealized Appreciation/ (Depreciation) |

| Sell | |

British American Tobacco p.l.c. | |

1.00% | |

EUR | |

12/20/2028 | |

5,000,000 | |

$84,097 | |

$(29,940) | |

$54,157 |

| Buy | |

CommScope, Inc. | |

| 5.00% | |

USD | |

6/20/2027 | |

| 1,079,000 | |

| 475,549 | |

| (453,180) | |

| 22,369 |

| | |

| |

| | |

| |

| |

| | |

$ | 559,646 | |

$ | (483,120) | |

$ | 76,526 |

| (a) | If

the Fund is a seller of protection and a credit event occurs, as defined under the terms

of that particular swap agreement, the Fund will either (i) pay to the buyer of protection

an amount equal to the notional amount of the swap and take delivery of the referenced obligation

or underlying securities comprising the referenced index or (ii) pay a net settlement amount

in the form of cash or securities equal to the notional amount of the swap less the recovery

value of the referenced obligation or underlying securities comprising the referenced index. |

| (b) | The

maximum potential amount the Fund could be required to pay as a seller of credit protection

or receive as a buyer of credit protection if a credit event occurs as defined under the

terms of that particular swap agreement. Notional amounts are presented in the currency indicated

in the table. |

TOTAL RETURN SWAP CONTRACTS(a)

| Counterparty | |

Reference Obligations | |

Currency | |

Notional Amount(b) | |

Termination Date | |

Financing Rate

Index | |

Financing

Rate

Spread Paid/(Received) by

Fund | |

Value | |

Unrealized

Appreciation/ (Depreciation) |

| JPM | |

Aberdeen Diversified Income and Growth Trust | |

GBP | |

| 1,625,997 | | |

10/31/2024 | |

SONIA | |

40 bps | |

$ | 1,633,999 | | |

$ | 8,002 | |

| JPM | |

Abrdn UK Smaller Cos Growth Trust PLC | |

GBP | |

| 74,218 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 74,002 | | |

| (216 | ) |

| JPM | |

Baillie Gifford US Growth Trust PLC | |

GBP | |

| 8,560,691 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 8,581,497 | | |

| 20,806 | |

| JPM | |

Bellevue Healthcare Trust PLC | |

GBP | |

| 3,341,026 | | |

10/31/2024 | |

SONIA | |

35 bps | |

| 3,363,300 | | |

| 22,274 | |

| JPM | |

Brown Advisory US Smaller Companies PLC | |

GBP | |

| 691,210 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 696,593 | | |

| 5,383 | |

| JPM | |

CQS Natural Resources Growth and Income PLC | |

GBP | |

| 599,537 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 599,456 | | |

| (81 | ) |

| JPM | |

Edinburgh Worldwide Investment Trust PLC | |

GBP | |

| 780,140 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 766,760 | | |

| (13,380 | ) |

| JPM | |

European Opportunities Trust PLC | |

GBP | |

| 2,863,158 | | |

10/31/2024 | |

SONIA | |

35 bps | |

| 2,824,026 | | |

| (39,132 | ) |

| JPM | |

European Smaller Companies | |

GBP | |

| 4,265,398 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 4,278,812 | | |

| 13,414 | |

| JPM | |

The Global Smaller Companies Trust PLC | |

GBP | |

| 17,115 | | |

10/31/2024 | |

SONIA | |

35 bps | |

$ | 17,161 | | |

$ | 46 | |

| JPM | |

Henderson Opportunities Trust PLC | |

GBP | |

| 277,159 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 276,327 | | |

| (832 | ) |

| JPM | |

Herald Investment Trust PLC | |

GBP | |

| 2,363,853 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 2,387,999 | | |

| 24,146 | |

| JPM | |

Hipgnosis Songs Fund Ltd | |

GBP | |

| 1,941,944 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 1,906,034 | | |

| (35,910 | ) |

| JPM | |

Middlefield Canadian Income PC | |

GBP | |

| 403,844 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 406,873 | | |

| 3,029 | |

| JPM | |

Montanaro European Smaller Companies Trust PLC | |

GBP | |

| 14,224 | | |

10/31/2024 | |

SONIA | |

35 bps | |

| 14,355 | | |

| 131 | |

| JPM | |

River & Mercantile UK Micro Cap Inv Co Ltd | |

GBP | |

| 55,707 | | |

10/31/2024 | |

SONIA | |

40 bps | |

| 54,919 | | |

| (788 | ) |

| JPM | |

Smithson Investment Trust PLC | |

GBP | |

| 526,888 | | |

10/31/2024 | |

SONIA | |

35 bps | |

| 528,775 | | |

| 1,887 | |

| | |

| |

| |

| | | |

| |

| |

| |

$ | 28,410,888 | | |

$ | 8,779 | |

All Reference Obligations shown above

for Total Return Swap Contracts are closed end funds and common stock.

| (a) | The

Fund receives monthly payments based on any positive monthly return of the Reference Obligation.

The Fund makes payments on any negative monthly return of such Reference Obligation |

| (b) | Notional

amounts are presented in USD equivalent. |

Saba

Capital Income & Opportunities Fund |

Notes

to Consolidated Financial Statements |

| |

January 31, 2024 |

The following table summarizes the valuation

of the Fund’s financial instruments in accordance with the above fair value hierarchy levels as of January 31, 2024. Refer to the

portfolio of investments for additional details.

| Investments in Securities at fair value | |

Level 1 - Quoted Prices | | |

Level 2 - Significant

Observable Inputs | | |

Level 3 - Significant

Unobservable Inputs | | |

Total | |

| Corporate Bonds | |

$ | - | | |

$ | 16,512,225 | | |

$ | - | | |

$ | 16,512,225 | |

| Senior Loans | |

| - | | |

| 7,876,629 | | |

| - | | |

| 7,876,629 | |

| Mortgage-Backed Securities | |

| - | | |

| 1,315,017 | | |

| - | | |

| 1,315,017 | |

| Common Stock | |

| 3,602,830 | | |

| - | | |

| - | | |

| 3,602,830 | |

| Closed End Funds | |

| 30,173,739 | | |

| - | | |

| - | | |

| 30,173,739 | |

| Private Fund* | |

| - | | |

| - | | |

| - | | |

| 24,000,000 | |

| Options | |

| 2,476,048 | | |

| - | | |

| - | | |

| 2,476,048 | |

| Short Term Investments | |

| 150,593,502 | | |

| - | | |

| - | | |

| 150,593,502 | |

| Total | |

$ | 186,846,119 | | |

$ | 25,703,871 | | |

$ | - | | |

$ | 236,549,990 | |

| Securities sold short, at fair value | |

Level 1 - Quoted Prices | | |

Level 2 -

Significant

Observable Inputs | | |

Level 3 - Significant

Unobservable Inputs | | |

Total | |

| Options | |

| 201,850 | | |

| - | | |

| - | | |

| 201,850 | |

| Total | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| Derivative contracts, at fair value | |

Level 1 - Quoted Prices | | |

Level 2 - Significant

Observable Inputs | | |

Level 3 - Significant

Unobservable Inputs | | |

Total | |

| Assets | |

| | | |

| | | |

| | | |

| | |

| Forward Foreign Currency Contracts | |

$ | - | | |

$ | 29,883 | | |

$ | - | | |

$ | 29,883 | |

| Over the Counter Credit Default Swaps | |

| - | | |

| 559,646 | | |

| - | | |

| 559,646 | |

| Total Return Swaps | |

| - | | |

| 99,118 | | |

| - | | |

| 99,118 | |

| Total Assets | |

$ | - | | |

$ | 688,647 | | |

$ | - | | |

$ | 688,647 | |

| | |

| | | |

| | | |

| | | |

| | |

| Liabilities | |

| | | |

| | | |

| | | |

| | |

| Forward foreign currency contracts | |

$ | - | | |

$ | 10,555 | | |

$ | - | | |

$ | 10,555 | |

| Futures Contracts | |

| 3,612 | | |

| - | | |

| - | | |

| 3,612 | |

| Centrally Cleared Credit Default Swaps | |

| - | | |

| 5,210,346 | | |

| - | | |

| 5,210,346 | |

| Total Return Swaps | |

| - | | |

| 90,339 | | |

| - | | |

| 90,339 | |

| Total Assets | |

$ | 3,612 | | |

$ | 5,311,240 | | |

$ | - | | |

$ | 5,314,852 | |

| * | In

accordance with ASC 820-10, investments that are measured at fair value using the NAV per

share (or its equivalent) practical expedient have not been classified in the fair value

hierarchy. The fair value amounts presented in this table are intended to permit reconciliation

of the fair value hierarchy to the amounts presented in the Consolidated Schedule of Investments

and Consolidated Statement of Assets and Liabilities. |

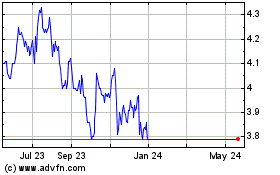

Templeton Global Income (NYSE:GIM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Templeton Global Income (NYSE:GIM)

Historical Stock Chart

From Dec 2023 to Dec 2024